Photostimulable Phosphor (PSP) Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432699 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Photostimulable Phosphor (PSP) Systems Market Size

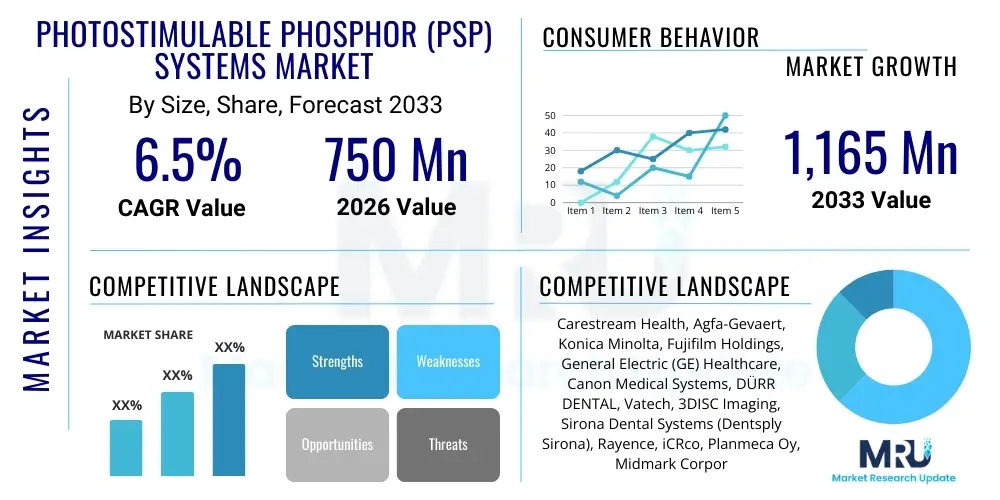

The Photostimulable Phosphor (PSP) Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,165 Million by the end of the forecast period in 2033.

Photostimulable Phosphor (PSP) Systems Market introduction

The Photostimulable Phosphor (PSP) Systems Market encompasses the technologies and components used for capturing radiographic images through the storage and subsequent release of energy in a specialized phosphor material. PSP systems, often referred to as Computed Radiography (CR), act as an important bridge between conventional film-based radiography and modern Direct Radiography (DR) systems. These systems utilize flexible imaging plates coated with barium fluorohalide phosphors doped with europium, which trap the energy of incident X-rays. This trapped energy forms a latent image that is then read by a high-intensity laser scanner, converting the stored energy into visible light, which is subsequently captured by a photomultiplier tube and digitized. The primary appeal of PSP technology lies in its ability to integrate into existing X-ray equipment infrastructure seamlessly, offering a cost-effective pathway to digital imaging across various healthcare settings globally.

The core functionality of PSP systems revolves around the scanning process and the workflow efficiency they enable. Once the exposure is complete, the PSP plate must be physically transferred to a dedicated reader unit, which scans the plate pixel by pixel. This process, while slower than instantaneous DR imaging, provides high-resolution digital data suitable for diagnostic interpretation and long-term storage within Picture Archiving and Communication Systems (PACS). Major applications span general radiology, mammography, and, critically, dental imaging, where the small, flexible PSP plates are exceptionally convenient for intraoral examinations. The flexibility and durability of the imaging plates, coupled with the relatively low capital investment compared to flat panel detectors (FPDs), solidify the market position of PSP technology, particularly in resource-constrained environments or high-volume settings requiring backup digital solutions.

Key benefits driving the adoption of PSP systems include superior image latitude, which allows for better detection across a wider range of exposure settings, thereby reducing the need for repeat examinations. Furthermore, the inherent simplicity and ruggedness of the plate technology contribute to lower maintenance costs over the system’s lifecycle. The driving factors influencing the market trajectory include the continuous demand for digital imaging solutions globally, particularly the need to replace outdated film processes in emerging economies, and the sustained requirement for high-quality, cost-efficient intraoral imaging in the expanding dental care sector. Although faced with competition from rapidly advancing DR technology, the operational advantages and economic viability ensure PSP systems maintain a critical niche within the broader medical imaging ecosystem, supporting both primary diagnostic functions and versatile field applications.

Photostimulable Phosphor (PSP) Systems Market Executive Summary

The Photostimulable Phosphor (PSP) Systems Market is characterized by a mature technology base undergoing subtle advancements focused primarily on improving plate reading speed, enhancing image resolution, and optimizing integration software. Current business trends indicate a stabilization of demand in developed markets, where PSP systems are primarily sought for dental applications or as backup/portable solutions in large hospitals, while significant growth acceleration is observed in developing nations. The primary business shift involves manufacturers focusing on offering integrated solutions that link PSP readers directly into existing hospital IT infrastructure (HIS/RIS/PACS), ensuring seamless digital workflow management. Furthermore, pricing strategy remains a crucial element, as PSP systems compete intensely on cost against high-initial-investment DR technology, cementing their role as the preferred digital entry point for small to mid-sized clinics and outpatient centers globally.

Regionally, the market dynamics exhibit noticeable variation. North America and Europe maintain high penetration rates, but the growth here is predominantly replacement-driven, focusing on upgrades to faster reader models or systems with specialized applications like pediatrics or equine diagnostics. Conversely, the Asia Pacific (APAC) region, spearheaded by countries like China and India, presents the highest growth opportunities. This exponential regional expansion is fueled by rising healthcare expenditures, increasing accessibility to basic diagnostic services, and large-scale government initiatives promoting digitalization in public health facilities. Latin America and the Middle East & Africa (MEA) are also emerging as vital markets, driven by the strong value proposition of PSP systems—offering digital quality imaging without the massive financial outlay required for modern flat panel detectors, thereby democratizing access to essential diagnostic technologies.

Segment trends highlight the persistent dominance of the dental segment, both in terms of unit sales and revenue, attributable to the specific suitability of small PSP plates for intraoral use and the large global volume of dental practitioners seeking digital transition. In the medical segment, general radiology applications remain crucial, though competition from DR is more pronounced. Technology segments are evolving towards compact, desktop-sized PSP readers that offer faster throughput and minimize footprint, catering specifically to clinic and decentralized care settings. Furthermore, there is an increasing trend in end-user preference for combined diagnostic systems that can handle multiple plate sizes and integrate seamlessly with various legacy X-ray generators, emphasizing flexibility and comprehensive capability as key purchase criteria across all market verticals.

AI Impact Analysis on Photostimulable Phosphor (PSP) Systems Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Photostimulable Phosphor (PSP) workflow often center on whether AI can extend the lifespan and diagnostic utility of these established systems, especially in the face of competition from Direct Radiography (DR). Key concerns revolve around AI's ability to compensate for potential image quality limitations inherent to the PSP process, such as light scatter or sensitivity to reader maintenance issues. The overwhelming expectation is that AI algorithms will primarily focus on image enhancement, noise reduction specific to the scanning process, and advanced post-processing to standardize image output regardless of exposure variation. Users anticipate AI tools will improve diagnostic accuracy, flag critical findings (CADe/CADx), and streamline the radiologist's workflow by prioritizing studies derived even from less advanced digital sources like PSP, thereby ensuring the continued relevance and enhanced performance of PSP systems in digital diagnostic environments.

- AI-driven image enhancement: Utilizing deep learning models to reduce phosphor plate noise and artifacts inherent to the scanning process, thereby improving the perceived resolution and diagnostic quality of PSP images.

- Dose optimization assistance: AI algorithms analyze exposure indices from PSP scans to provide real-time feedback, helping technicians maintain As Low As Reasonably Achievable (ALARA) principles, crucial for patient safety.

- Workflow prioritization and triage: AI tools analyze digitized PSP images to identify and flag critical pathologies (e.g., pneumothorax, fractures), automatically prioritizing those studies within the PACS workflow, improving response times.

- Automated quality control (QC): AI monitors the plate reading cycle, detecting potential scanner calibration drift or plate degradation (scratches, wear) and alerting maintenance staff, extending the effective lifespan of the PSP system.

- Computer-Aided Detection (CAD) implementation: Deploying CAD solutions trained on digital radiography images to assist in detecting subtle findings in complex PSP scans, increasing diagnostic sensitivity across general and specialized applications (e.g., mammography screening).

DRO & Impact Forces Of Photostimulable Phosphor (PSP) Systems Market

The Photostimulable Phosphor (PSP) Systems Market is governed by a dynamic interplay of factors primarily related to cost efficiency, technological evolution, and regulatory adherence. The principal driving force remains the significant cost advantage PSP systems hold over Direct Radiography (DR) flat panel detectors, making them highly accessible for facilities operating under strict budget constraints, particularly in developing economies and non-hospital settings like small clinics and veterinary practices. Restraints primarily stem from the inherent workflow inefficiency of PSP, requiring manual plate handling and a longer processing time compared to instantaneous DR imaging, which can limit high-volume throughput. Opportunities are abundant in the form of technological innovation focused on high-speed scanning technologies and improved phosphor chemistry to enhance image quality and reduce readout time. The market is also heavily impacted by evolving global standards for digital image quality and archiving, pushing all manufacturers to continuously upgrade system compatibility and resolution standards.

Key drivers further include the immense installed base of existing analog X-ray generators globally. PSP systems offer the simplest and most cost-effective method for converting these legacy analog systems into digital capabilities without requiring complete replacement of the core X-ray apparatus, maximizing returns on previous capital investments. Furthermore, the robust nature and portability of PSP plates make them ideal for mobile and field applications, such as military medicine, disaster relief efforts, and outreach programs in remote areas, where the delicate electronics of DR systems might be unsuitable or prone to damage. The continued replacement cycle of aging CR units, which typically have a useful life of 7-10 years before the reader needs replacement or major overhaul, provides a consistent, albeit measured, revenue stream for key market participants, stabilizing market growth despite the disruptive presence of advanced digital technologies.

However, significant impact forces are exerting pressure on the market structure. The decreasing cost and increasing adoption of entry-level DR systems, particularly tethered detectors, are eroding the competitive advantage of PSP systems, especially in mid-tier clinics. Regulatory bodies, especially in highly regulated markets like North America and Western Europe, are gradually favoring faster, lower-dose technologies, which often pushes procurement decisions towards DR. This necessitates PSP manufacturers to invest heavily in optimization techniques, such as higher sensitivity phosphors (like Cesium Bromide-based plates) and faster laser scanning mechanisms, to narrow the performance gap. The overall impact forces suggest a market segment that is consolidating and specializing, focusing on niche markets (like dental and portable applications) where the workflow limitations are outweighed by the benefits of cost and robustness, ensuring its persistence rather than rapid obsolescence.

| Force Category | Specific Market Impact |

|---|---|

| Drivers (D) | Cost-effectiveness, ease of integration with existing analog infrastructure, high portability and robustness for field use, sustained demand in the dental imaging sector. |

| Restraints (R) | Slower workflow (manual plate handling), increasing competition from lower-cost Direct Radiography (DR) systems, potential for image artifacts (scratches, dust) inherent to plate reuse, need for frequent reader calibration. |

| Opportunities (O) | Expansion into emerging economies (APAC, LATAM), development of high-speed/high-resolution phosphors (e.g., CsBr plates), demand for hybrid imaging solutions, optimization via AI post-processing tools. |

| Impact Forces | Technological substitution pressure from DR, strict regulatory requirements for image quality and dose reduction, healthcare digitalization initiatives driving PACS integration, and global focus on affordable healthcare delivery models. |

Segmentation Analysis

The Photostimulable Phosphor (PSP) Systems Market is systematically analyzed based on key segmentations including components, application areas, and the type of end-user facility. Component segmentation typically differentiates between the imaging plates themselves (which represent a recurring consumable revenue stream) and the reader/scanner units (the primary capital equipment). Application segmentation is crucial, as the performance requirements and plate sizes differ significantly between general medical radiography (chest, extremities) and specialized areas like high-resolution dental imaging, which dominates specific sub-segments. End-user categorization reflects procurement patterns and scale, distinguishing large hospitals and integrated delivery networks (IDNs) from smaller, budget-conscious clinics and specialized diagnostic centers. Understanding these segments is vital for manufacturers to tailor their product offerings, whether focusing on high-volume, floor-standing readers for hospitals or compact, cost-optimized desktop units for dental practices.

- By Component:

- PSP Imaging Plates (Consumables)

- PSP Reader Systems (Scanners)

- Single-Plate Readers

- Multi-Plate/High-Throughput Readers

- Software and Workstations

- By Application:

- Dental Radiography

- Intraoral Imaging

- Extraoral/Panoramic Imaging

- Medical Radiography

- General Radiology (Chest, Abdomen, Extremities)

- Pediatric Imaging

- Mammography (Specialized Readers)

- Veterinary Radiography

- Industrial Nondestructive Testing (NDT)

- By End-User:

- Hospitals and Trauma Centers

- Diagnostic Imaging Centers

- Dental Clinics and Laboratories

- Ambulatory Surgical Centers (ASCs)

- Military and Field Operations

Value Chain Analysis For Photostimulable Phosphor (PSP) Systems Market

The value chain for the Photostimulable Phosphor (PSP) Systems Market begins with the highly specialized upstream analysis involving the sourcing and refinement of rare earth elements, particularly Barium and Europium, crucial for synthesizing the photostimulable phosphors (e.g., BaFBr:Eu²⁺) used in the imaging plates. This upstream segment is characterized by high technical expertise and reliance on a few specialized chemical manufacturers. The manufacturing stage involves synthesizing the phosphor material, coating it uniformly onto flexible plate substrates, and assembling the electromechanical reader units, including precision lasers, optics, and photomultiplier tubes. Efficiency in manufacturing and rigorous quality control during the coating process are paramount, as the uniformity of the phosphor layer directly impacts image quality and system lifespan. The complexity of integrating precision engineering (reader hardware) with materials science (plate manufacturing) defines the midstream value addition.

The downstream analysis focuses heavily on market penetration, distribution, and post-sales support, which is critical due to the technical nature of the equipment and the need for frequent reader calibration and plate replacement. Distribution channels are typically bifurcated into direct sales models, often employed by major multinational corporations for large hospital systems and government contracts, and indirect distribution through a robust network of specialized medical equipment distributors and regional resellers. Indirect channels are particularly effective for reaching smaller dental clinics and veterinary practices globally. These distributors not only handle logistics and installation but also provide localized technical support and training, which is a major factor in purchasing decisions, especially in emerging markets where direct manufacturer presence is limited.

The distribution network relies on both direct sales teams offering customized service packages and indirect sales partners who provide accessibility and localized maintenance. After-sales service is a key competitive differentiator; companies that offer rapid response times for reader repairs and readily available plate replacements often gain market share. The revenue streams are dual: large upfront capital expenditures for the reader units and consistent recurring revenue from the sale of consumable PSP plates. The efficiency of the distribution channel—getting the sensitive plates and complex readers to the end-users swiftly and supporting them effectively—is crucial for maintaining high customer satisfaction and maximizing the system's operational uptime in demanding clinical environments.

Photostimulable Phosphor (PSP) Systems Market Potential Customers

The potential customer base for Photostimulable Phosphor (PSP) Systems is diverse, primarily spanning healthcare providers that require high-quality digital radiography while adhering to strict budgetary constraints or requiring extreme system portability. The largest segment of buyers includes small to medium-sized hospitals and clinics, especially those transitioning away from analog film-based systems, for whom the initial capital expenditure of Direct Radiography (DR) flat panels is prohibitive. These institutions value the system's ability to digitize images using existing X-ray equipment. Furthermore, public sector hospitals in developing nations, driven by governmental mandates for healthcare modernization and low-cost diagnostics, represent significant volume buyers who often rely on the durability and affordability of PSP technology to serve large, diverse patient populations across centralized and decentralized care settings.

Another critical customer segment is the expansive global network of private dental practices and specialized dental imaging centers. PSP technology is particularly well-suited for intraoral dental imaging due to the small, flexible, and easily manageable size of the plates, offering a superior patient comfort level compared to rigid DR sensors, while still providing diagnostic-quality digital images. Dental practitioners value the similarity in workflow to traditional film, easing the learning curve for staff, combined with the longevity and flexibility of the plates. This niche dominance ensures sustained demand from the dental sector, making individual dental practitioners and large dental clinic chains key targets for market players specializing in compact, dedicated PSP readers and specialized intraoral plates.

Finally, a robust and growing customer segment includes specialized non-hospital entities such as veterinary clinics, mobile imaging services, military field hospitals, and non-destructive testing (NDT) facilities in industrial sectors. Veterinary medicine often requires rugged, portable imaging solutions capable of handling large animals and diverse environments, where PSP plates excel due to their resilience. Mobile imaging units that serve nursing homes or rural populations rely on the light weight and reliability of PSP systems. These niche end-users prioritize flexibility, system robustness, and low operational cost per image, confirming PSP's value proposition extends beyond traditional human medical radiology into various specialized and highly demanding operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,165 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carestream Health, Agfa-Gevaert, Konica Minolta, Fujifilm Holdings, General Electric (GE) Healthcare, Canon Medical Systems, DÜRR DENTAL, Vatech, 3DISC Imaging, Sirona Dental Systems (Dentsply Sirona), Rayence, iCRco, Planmeca Oy, Midmark Corporation, Swissray, Teledyne DALSA, Image Information Systems, J. Morita USA, FONA Dental, Runyes Medical Instrument. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photostimulable Phosphor (PSP) Systems Market Key Technology Landscape

The technological evolution within the Photostimulable Phosphor (PSP) Systems Market is primarily centered on enhancing image quality, increasing throughput speed, and improving system durability, aiming to minimize the competitive lag against Direct Radiography (DR). Significant advancements have been made in phosphor material science, moving beyond basic Barium Fluorohalide compounds to higher-performance materials such as Cesium Bromide (CsBr) based phosphors. These newer phosphors exhibit greater sensitivity to X-ray exposure, allowing for lower radiation doses to the patient while maintaining superior image quality and spatial resolution. The technological focus is on optimizing the crystal structure and doping concentration to maximize light emission during the stimulation phase, ensuring higher signal-to-noise ratio and greater dynamic range, crucial for diagnostic accuracy in diverse clinical scenarios.

A second major technological area is the development of faster and more precise reader mechanics. Early PSP readers were bulky and slow, significantly bottlenecking the imaging workflow. Modern reader systems incorporate advanced optics, high-speed, line-scanning lasers, and sophisticated analog-to-digital converters (ADCs) that drastically reduce the time required to read and erase a plate—often achieving throughput rates competitive with entry-level DR systems for certain applications. Miniaturization has also been key, with the shift towards compact, desktop-sized readers specifically designed for decentralized care settings like dental offices or satellite clinics. These readers often feature automated plate feeding mechanisms and integrated quality control checks, reducing operator error and increasing overall system reliability over long operational periods.

Furthermore, technology integration and software optimization are increasingly important. Modern PSP systems are designed with advanced connectivity protocols, ensuring immediate, seamless integration with Hospital Information Systems (HIS), Radiology Information Systems (RIS), and Picture Archiving and Communication Systems (PACS). The accompanying proprietary software incorporates sophisticated algorithms for image post-processing, including artifact suppression, contrast enhancement, and automatic exposure compensation (AEC) tools tailored specifically to the characteristics of PSP generated images. This software layer is critical for standardizing the diagnostic output across different reader models and minimizing the variability introduced by manual plate handling, thereby ensuring the digital output meets rigorous industry standards for diagnostic imaging.

Regional Highlights

- North America (United States, Canada): This region represents a mature and highly penetrated market where PSP adoption is specialized. While general medical facilities have largely transitioned to Direct Radiography (DR), PSP systems maintain strong relevance in dental imaging due to cost-effectiveness and plate flexibility, as well as in specialized portable and veterinary applications. Market growth is primarily driven by system replacement cycles, technological upgrades (faster readers), and sustained high demand from the massive network of independent dental practices. Regulatory standards for digital imaging quality are exceptionally high, pushing manufacturers to continuously improve phosphor technology and scanning resolution.

- Europe (Germany, UK, France, Italy): The European market shows steady, moderate growth, influenced by stringent regulations (e.g., EU Medical Device Regulation) and centralized healthcare procurement policies, favoring products with robust quality assurances and long service lifetimes. PSP systems are predominantly utilized in public health systems in Eastern and Southern Europe due to budgetary constraints, and they serve as reliable backup systems in Western European hospitals. The dental segment remains highly significant, mirroring trends in North America, with a focus on integrating PSP data seamlessly into regional digital health infrastructures.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is the fastest-growing market globally for PSP systems. The rapid expansion is fueled by increasing government investment in primary healthcare infrastructure, rising awareness of digital imaging benefits, and the sheer scale of the patient population requiring cost-effective diagnostic access. China and India are major demand centers, often selecting PSP as the foundational digital imaging technology due to its compatibility with existing X-ray machines and lower initial investment costs compared to DR. Japan and South Korea, while technologically advanced, continue to utilize PSP in specialized mobile units and dental clinics.

- Latin America (Brazil, Mexico, Argentina): This region demonstrates a robust demand for PSP systems driven largely by the need for affordable diagnostic tools and efforts to modernize outdated film-based systems across public and private clinics. Economic volatility often necessitates the selection of lower-cost capital equipment, positioning PSP as the preferred digital radiography entry point. Market activity is concentrated on establishing distribution networks and providing localized technical support, essential for maintaining long-term customer relationships and market penetration.

- Middle East and Africa (MEA): Growth in MEA is highly variable, concentrated in Gulf Cooperation Council (GCC) countries which invest heavily in high-end medical technologies, using PSP as a robust portable or backup solution. In Africa, PSP systems are vital for regional clinics and non-governmental organization (NGO) supported medical initiatives, valued for their durability, simple operation, and suitability for environments with unreliable infrastructure. The market is highly sensitive to external funding and government healthcare budgeting cycles, emphasizing the product’s low total cost of ownership (TCO).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photostimulable Phosphor (PSP) Systems Market.- Carestream Health

- Agfa-Gevaert

- Konica Minolta

- Fujifilm Holdings

- General Electric (GE) Healthcare

- Canon Medical Systems

- DÜRR DENTAL

- Vatech

- 3DISC Imaging

- Sirona Dental Systems (Dentsply Sirona)

- Rayence

- iCRco

- Planmeca Oy

- Midmark Corporation

- Swissray

- Teledyne DALSA

- Image Information Systems

- J. Morita USA

- FONA Dental

- Runyes Medical Instrument

Frequently Asked Questions

Analyze common user questions about the Photostimulable Phosphor (PSP) Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of PSP systems over traditional film radiography?

The primary advantage of PSP systems is the conversion of analog X-ray information into a digital format, eliminating the need for darkrooms and wet chemical processing, while allowing for digital image enhancement, efficient storage in PACS, and easy sharing.

How do PSP systems compare to Direct Radiography (DR) systems in terms of cost and workflow?

PSP systems have a significantly lower initial capital cost than DR systems, making them budget-friendly. However, DR offers instantaneous image acquisition and superior workflow efficiency, whereas PSP requires an intermediate step of manually scanning the plate, resulting in a slower process.

In which medical application does PSP technology currently hold the strongest market share?

PSP technology holds the strongest market share in the dental radiography segment, particularly for intraoral imaging, due to the flexibility, comfort, and ease of use of small PSP plates compared to rigid digital sensors.

What technological advancements are extending the relevance of PSP systems?

Key advancements include the use of higher-sensitivity phosphors (e.g., Cesium Bromide) for reduced patient dose, increased reader speed and automation (higher throughput), and advanced software for AI-driven image processing and artifact reduction.

What is the expected lifespan of a PSP imaging plate, and when should it be replaced?

A PSP imaging plate typically has a functional lifespan spanning several thousand uses (often 10,000+ cycles) before physical wear (scratches, scuffs) or reduction in signal uniformity necessitates replacement to maintain diagnostic image quality standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager