Photovoltaic Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436184 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Photovoltaic Glass Market Size

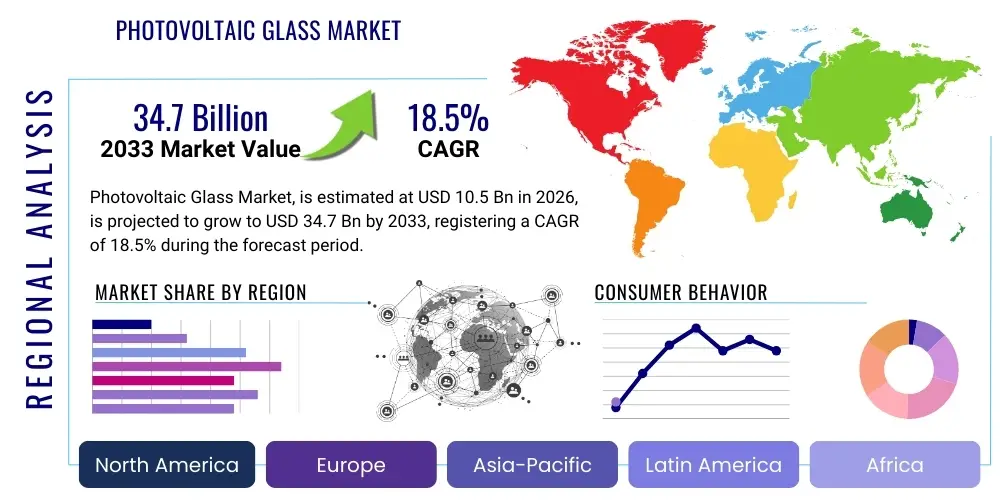

The Photovoltaic Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $10.5 Billion in 2026 and is projected to reach $34.7 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by global governmental policies promoting renewable energy infrastructure and the decreasing cost of solar panel installation, making PV technology increasingly competitive against conventional energy sources worldwide. The sustained demand from utility-scale solar farms and the growing integration of solar technology into commercial and residential buildings are key accelerators influencing this robust market valuation.

Photovoltaic Glass Market introduction

The Photovoltaic (PV) Glass Market encompasses specialized glass solutions engineered for use in solar energy capture devices, primarily solar modules and collectors. PV glass serves as the crucial front cover of a solar panel, offering mechanical stability, robust protection against environmental factors (such as humidity, UV radiation, and hail), and, most importantly, optimizing light transmittance to maximize electrical output. Key products include low-iron tempered glass and specialized anti-reflective (AR) coated glass, which enhance the efficiency of crystalline silicon and thin-film solar cells. Major applications span utility-scale power generation, commercial rooftop installations, and the rapidly expanding segment of Building Integrated Photovoltaics (BIPV), where the glass replaces conventional construction materials. The primary benefits of advanced PV glass are improved module efficiency, extended lifespan, and enhanced durability, all critical for lowering the Levelized Cost of Electricity (LCOE) generated by solar installations. The market is overwhelmingly driven by aggressive global decarbonization targets, technological advancements in cell efficiency requiring superior glass protection, and significant cost reductions achieved through economies of scale in PV module manufacturing.

Photovoltaic Glass Market Executive Summary

The global Photovoltaic Glass market is experiencing unprecedented growth, underpinned by favorable regulatory landscapes and surging investments in green energy infrastructure across major economies. Business trends highlight a strong shift toward high-efficiency products, particularly bifacial modules necessitating advanced double-glass structures, driving demand for thin, durable, and highly transparent glass variants. Manufacturers are focusing on process innovation, such as continuous rolling methods and automated coating application, to improve yield and reduce manufacturing costs, sustaining competitive pricing within the PV module supply chain. Regional trends indicate Asia Pacific, led by China and India, as the undisputed leader in production and deployment due to massive government support for utility-scale projects. Europe and North America are characterized by high value-added market growth, especially in the BIPV sector, focusing on aesthetic and functional integration into urban environments. Segment trends show that tempered glass remains dominant due to its strength and cost-effectiveness, but the market share of AR-coated glass is rising sharply as installers prioritize efficiency maximization. Furthermore, the increasing adoption of larger module formats (e.g., M10 and G12 wafer sizes) is placing new demands on glass manufacturers for larger, structurally sound components, ensuring continued market evolution and technological refinement.

AI Impact Analysis on Photovoltaic Glass Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Photovoltaic Glass market primarily revolve around operational efficiency, quality control, predictive maintenance, and optimizing the design process. Common questions analyze how AI-driven vision systems can enhance flaw detection during manufacturing, whether AI can optimize glass coating uniformity, and how machine learning might predict raw material pricing or demand fluctuations to streamline inventory management. The consensus theme centers on using AI not necessarily to invent new glass types, but to perfect the current manufacturing process, thereby reducing waste, increasing throughput, and ensuring superior long-term reliability of the glass components. Users expect AI to minimize human error in complex, high-volume production lines and facilitate data-driven decisions concerning temperature control, chemical composition, and furnace operation, leading directly to lower production costs and higher quality end-products crucial for high-performance solar arrays.

- AI-driven Quality Inspection: Utilizing deep learning models for high-speed, non-destructive detection of micro-cracks, bubbles, and stress points in glass sheets, far exceeding human capability and conventional sensors.

- Predictive Maintenance: AI algorithms analyze sensor data from furnaces, tempering lines, and coating machines to predict component failure, reducing unplanned downtime and optimizing equipment longevity.

- Supply Chain Optimization: Machine learning models forecast raw material demand (e.g., silica, soda ash) and pricing volatility, improving procurement strategies and reducing overall inventory risk.

- Process Parameter Optimization: AI controls and adjusts operational variables like furnace temperature, glass flow rate, and coating thickness in real-time, ensuring maximum energy efficiency during production and consistent product quality.

- Yield Improvement: Analysis of historical production data by AI identifies bottlenecks and inefficient steps in the manufacturing process, leading to incremental improvements in yield rates.

- Custom Glass Design: Utilizing generative design and simulation tools powered by AI to model new glass compositions or coating architectures that maximize light harvesting capabilities for specific geographic locations or module types.

DRO & Impact Forces Of Photovoltaic Glass Market

The Photovoltaic Glass Market is powerfully shaped by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively constitute the Impact Forces influencing long-term strategic direction. The primary drivers include favorable governmental policies, such as Renewable Portfolio Standards (RPS) and tax credits, coupled with the critical global necessity to transition away from fossil fuels, maintaining high deployment rates for solar energy. Restraints largely center on the cyclical volatility of raw material costs (especially soda ash and specialized coatings), the substantial initial capital investment required for establishing large-scale float glass production facilities, and stringent quality requirements necessary to ensure a 25-year operational lifespan for solar modules. Opportunities are predominantly found in technological innovation, such as the commercialization of ultra-thin, lightweight glass for flexible applications, the development of specialized coatings for low-light environments, and the expansive potential offered by the BIPV sector, which integrates aesthetically pleasing solar glass directly into building facades and windows. The resultant impact forces strongly favor market expansion, pushing manufacturers toward efficiency and material science innovation to overcome cost barriers and capitalize on the accelerating energy transition momentum.

Segmentation Analysis

The Photovoltaic Glass market is structurally segmented across various dimensions, including type, application, and end-use, allowing for detailed market analysis and strategic targeting. Segmentation by type focuses on the physical and chemical characteristics of the glass, differentiating based on structural integrity and optical properties crucial for performance. Application segmentation highlights the different technological platforms where the glass is utilized, ranging from standard modules to highly specialized concentrating systems. Finally, end-use segmentation categorizes deployment based on the scale and nature of the consumer, providing insight into demand patterns across residential, commercial, and utility-scale projects.

- By Type:

- Tempered Glass (Heat Strengthened)

- Anti-Reflective (AR) Coated Glass

- High Transmittance/Low-Iron Glass

- TCO (Transparent Conductive Oxide) Glass (for Thin Film PV)

- Coated Glass (Self-Cleaning, Anti-Soiling)

- By Application:

- Crystalline Silicon PV Modules (Monofacial and Bifacial)

- Thin Film PV Modules (CdTe, CIGS)

- Building Integrated Photovoltaics (BIPV)

- Concentrating Solar Power (CSP)

- By End-Use:

- Residential

- Commercial and Industrial (C&I)

- Utility-Scale Solar Farms

Value Chain Analysis For Photovoltaic Glass Market

The value chain for the Photovoltaic Glass market is intricate, beginning with the highly capital-intensive upstream sector and culminating in the complex downstream installation and maintenance services. Upstream analysis focuses on the acquisition and processing of raw materials, primarily high-purity silica sand, limestone, and soda ash, which are essential components for manufacturing low-iron glass. Key activities at this stage include refining, melting in large-scale float furnaces, and forming the base glass substrate. The crucial midstream processes involve specialized treatment, such as thermal tempering to enhance strength, and the application of sophisticated anti-reflective (AR) coatings, which are proprietary technologies vital for maximizing module efficiency. This stage also includes cutting, edging, and quality inspection before the glass is supplied to PV module assemblers.

Downstream analysis centers on the integration of the glass into the final solar module structure, where it is laminated with the solar cells (wafers) and encapsulants (e.g., EVA or POE) and framed. These modules are then distributed through complex channels. Direct distribution involves major glass manufacturers supplying large, Tier 1 solar module producers under long-term contracts, fostering streamlined logistics and material optimization. Indirect distribution utilizes specialized component distributors or wholesalers who supply smaller module assemblers or BIPV specialists, often requiring smaller, custom-sized batches.

The efficiency of the distribution channel is critical, given the fragility and size of PV glass panels. Logistics must be highly optimized to minimize breakage and transportation costs. Direct channels offer greater control over quality and delivery schedules, especially for utility-scale projects demanding massive volumes. The strong consolidation among leading PV glass manufacturers and the increasing vertical integration by large solar companies, who sometimes establish in-house glass production capabilities, significantly influences channel dynamics, seeking cost synergy and supply security in a rapidly expanding global market.

Photovoltaic Glass Market Potential Customers

The primary potential customers and end-users of Photovoltaic Glass are highly diversified, ranging from multinational PV module manufacturers to specialized architectural firms focused on sustainable building designs. The largest volume buyers are utility-scale solar project developers and the Tier 1 module manufacturers (e.g., JinkoSolar, Trina Solar, LONGi Solar) who require vast quantities of standardized, high-quality tempered glass for their high-power conventional and bifacial crystalline silicon modules. These customers prioritize consistency, structural integrity, and competitive pricing, as glass constitutes a significant component cost of the overall module bill of materials (BOM). Procurement decisions in this segment are typically based on rigorous long-term supply agreements and stringent performance guarantees over the module lifetime.

A second crucial segment includes specialized thin-film solar producers (e.g., First Solar), who require TCO-coated glass substrates that function as both the protective cover and a necessary electrical contact layer. The specifications for TCO glass are highly technical, focusing on sheet resistance and high transparency, demanding specialized manufacturing expertise from glass suppliers. Furthermore, this segment often requires smaller volumes of highly customized glass products compared to the crystalline module segment, driven by proprietary thin-film deposition processes and module sizes, making them a high-value customer group focused on technological partnership.

Finally, the growing niche of the Building Integrated Photovoltaics (BIPV) market represents a high-growth, high-margin customer base. These customers include architects, construction companies, façade specialists, and building material suppliers. BIPV customers prioritize aesthetic integration, color uniformity, custom shaping, and enhanced functionality (e.g., smart shading, insulation properties) alongside energy generation. For BIPV applications, the glass often replaces traditional roofing or façade materials, meaning the buyers are highly sensitive to architectural requirements, building codes, and certification standards, favoring suppliers who can provide highly customized, multi-functional PV glass solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion |

| Market Forecast in 2033 | $34.7 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGC Inc., Saint-Gobain, Xinyi Solar Holdings Limited, Flat Glass Group Co., Ltd., Taiwan Glass Industry Corporation, China Glass Holdings Limited, Nippon Sheet Glass Co., Ltd., Guardian Glass, Borosil Renewables Ltd., SCHOTT AG, Sisecam, Euroglas GmbH, EVG, Vitro, Inc., Jinmao Glass, Hanwha Q CELLS, ReneSola, JinkoSolar, Trina Solar, JA Solar |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photovoltaic Glass Market Key Technology Landscape

The technological landscape of the Photovoltaic Glass market is defined by continuous innovation focused on optimizing light transmission, enhancing mechanical durability, and reducing material weight and thickness. The core technology remains the production of low-iron ultra-clear glass, essential for maximizing solar light absorption by minimizing the optical absorption caused by iron oxide impurities found in standard float glass. Modern manufacturing utilizes highly specialized glass compositions and precise furnace control to achieve iron content often below 0.01%, resulting in light transmittance exceeding 91.5%. Advances in thermal tempering technology are also crucial, allowing manufacturers to produce thinner glass (down to 2.0 mm or even 1.6 mm) that meets stringent safety standards (e.g., IEC 61215), reducing the weight and material consumption of the finished solar module without compromising resistance to external loads or thermal shock.

The most significant innovation driving performance is the development and application of advanced Anti-Reflective (AR) coatings. These coatings, often applied using wet chemistry (sol-gel process) or vacuum deposition, are designed to create a nano-structured surface that minimizes the reflection of sunlight, particularly at non-perpendicular angles, thereby boosting module efficiency by 2% to 4%. The latest generation of AR coatings also incorporates anti-soiling or self-cleaning properties (hydrophobic or hydrophilic surfaces), which help maintain panel efficiency in dusty or polluted environments by allowing dust and grime to be washed away more easily by rain or manual cleaning, minimizing performance degradation over time (Potential Induced Degradation mitigation is also a factor). The sophistication of these coatings, which must be extremely durable and resistant to UV exposure for decades, requires specialized and highly controlled production environments.

Furthermore, the rise of bifacial solar technology has necessitated the adoption of double-glass modules, requiring two sheets of PV glass instead of one glass front and a polymer back sheet. This technology demands high-strength, thin glass for the back side, often tempered or heat-strengthened, to protect the cells and endure harsher environmental conditions, leading to greater demand for thin, double-sided glass solutions. In the BIPV sector, the technology focus shifts toward aesthetic and multifunctional integration, including colored PV glass (achieved through selective absorption coatings or tinted encapsulation) and specialized patterned glass designs, balancing energy generation performance with architectural appeal and thermal insulation properties essential for modern, energy-efficient building envelopes. These diverse technological demands ensure continuous R&D investment in glass material science and processing techniques.

Regional Highlights

Regional dynamics heavily influence the Photovoltaic Glass market, dictated by government incentives, local manufacturing capacities, and the pace of renewable energy adoption.

- Asia Pacific (APAC): APAC dominates both the production and consumption of PV glass globally. China is the powerhouse, hosting the majority of the world's float glass capacity dedicated to solar applications, benefiting from state subsidies, low labor costs, and a comprehensive solar supply chain infrastructure. India and Southeast Asian nations are rapidly expanding their PV installation bases, driven by national targets (e.g., India's ambitious solar goals), ensuring continued high regional demand. This region is critical for large-volume, utility-scale projects, emphasizing cost-efficiency and high throughput.

- Europe: Europe is characterized by a mature market with a strong emphasis on high-quality, specialized products, particularly in the BIPV sector. Countries like Germany, Italy, and the Netherlands lead in adopting aesthetically integrated solar solutions for urban environments. While manufacturing capacity is lower compared to APAC, the demand is focused on high-margin products like customized BIPV glass and advanced, long-warranty products, fueled by strict building efficiency regulations and strong environmental consciousness.

- North America: The North American market, centered in the US, is a high-growth region driven by substantial government policies (e.g., Inflation Reduction Act - IRA) encouraging domestic manufacturing and large-scale utility projects. Demand is high for both standard utility-grade glass and specialized AR-coated glass designed to maximize output in diverse climatic zones. The focus is on supply chain resilience and reducing dependence on foreign suppliers, leading to significant planned investments in localized PV glass production capacity.

- Latin America: This region, particularly Brazil and Mexico, is expanding rapidly due to abundant solar resources and significant foreign investment in large solar farms. The market prioritizes robust, durable glass capable of withstanding extreme weather conditions (high temperatures, strong UV exposure). Market growth is currently driven primarily by utility-scale installations, making it a volume-sensitive market focusing on competitive pricing.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the GCC states (Saudi Arabia, UAE) and South Africa, driven by mega-project developments aiming for energy diversification. The key market requirement here is superior anti-soiling and anti-dust coating technology, given the prevalent sandy and arid conditions, which are highly detrimental to conventional PV module performance. Suppliers offering advanced surface modification technologies hold a competitive edge in this challenging operating environment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photovoltaic Glass Market.- Flat Glass Group Co., Ltd.

- Xinyi Solar Holdings Limited

- AGC Inc.

- Saint-Gobain

- Nippon Sheet Glass Co., Ltd. (NSG)

- SCHOTT AG

- Guardian Glass

- Borosil Renewables Ltd.

- Taiwan Glass Industry Corporation

- China Glass Holdings Limited

- Sisecam

- Euroglas GmbH

- Vitro, Inc.

- Jinmao Glass

- EVG (Engineering and Vacuum)

- Hanwha Q CELLS (Vertical Integration)

- JinkoSolar (Strategic partnerships/Vertical Integration)

- Trina Solar (Strategic partnerships)

- JA Solar (Strategic partnerships)

- ReneSola (Supply chain optimization focus)

Frequently Asked Questions

Analyze common user questions about the Photovoltaic Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Photovoltaic Glass Market?

The primary drivers are aggressive global renewable energy targets set by governments, significant reductions in the Levelized Cost of Electricity (LCOE) for solar power, and rising demand for high-efficiency solar modules, especially bifacial panels which require advanced double-glass structures. Favorable policies, subsidies, and the necessity for global decarbonization are fundamentally accelerating market expansion.

How does Anti-Reflective (AR) Coating technology enhance solar panel efficiency?

AR coating technology utilizes a thin, typically nano-structured layer applied to the outer glass surface. This coating minimizes the reflection of incoming sunlight, particularly during early morning or late afternoon when the sun angle is shallow. By reducing light loss due to reflection, the AR coating increases the amount of light reaching the solar cells, often boosting electrical output efficiency by 2% to 4%, maximizing energy harvest over the module's lifespan.

What is Building Integrated Photovoltaics (BIPV) and its role in PV Glass demand?

BIPV involves integrating photovoltaic materials directly into the building envelope (e.g., facades, roofs, skylights) to serve as both the protective material and an energy generator. BIPV applications demand customized PV glass solutions focusing on aesthetics, specific colors, and unique sizing, driving higher-margin demand for specialized, highly durable, and multi-functional glass products beyond standard utility-scale requirements.

What role does Low-Iron Glass play in improving solar module performance?

Low-Iron Glass is the standard for PV applications because it significantly enhances light transmission compared to regular glass. Standard glass contains higher levels of iron oxides, which absorb sunlight, reducing efficiency. By minimizing iron content (often below 0.01%), low-iron glass achieves ultra-high transparency (over 91%), ensuring that the maximum amount of incident light reaches the underlying solar cells, thereby boosting the panel’s power generation capability.

Which geographical region dominates the production capacity and consumption of Photovoltaic Glass?

The Asia Pacific (APAC) region, specifically China, dominates the global Photovoltaic Glass market. China commands the largest manufacturing capacity for ultra-clear float glass and specialized solar coatings due to massive governmental support, economies of scale, and the clustering of the entire solar module manufacturing supply chain within the region. This centralized production capacity serves both internal demand and global export markets, cementing APAC's leadership position.

What are the key technical specifications required for PV glass used in bifacial modules?

Bifacial modules require two sheets of PV glass (front and back), demanding lightweight, high-strength characteristics for both sides. Key technical specifications include extreme clarity (low-iron content) for the back glass to maximize light capture from reflected sources (albedo effect), superior mechanical strength (often heat-strengthened or tempered thin glass, 1.6 mm to 2.5 mm), and excellent resistance to Potential Induced Degradation (PID) to ensure long-term reliability and structural integrity.

How are advancements in glass thinning technology affecting market dynamics?

Advancements in glass thinning technology allow manufacturers to produce PV glass down to 2.0 mm or even 1.6 mm thickness while maintaining structural integrity through enhanced tempering processes. This reduction in thickness significantly lowers the overall weight of solar modules, reducing transportation costs, easing installation, and conserving raw materials, directly contributing to a reduction in the module's manufacturing cost and expanding applications in weight-sensitive markets like residential roofing.

What are the primary raw material constraints impacting PV glass manufacturing?

The primary raw material constraints involve the reliable sourcing and price stability of high-purity silica sand, soda ash, and specialized chemical precursors for anti-reflective and TCO coatings. Energy costs for running large float furnaces are also a significant constraint. Volatility in the global pricing and supply chain logistics of soda ash and the need for consistently high-quality, low-iron silica feedstock often influence production costs and strategic inventory management for glass manufacturers.

How is AI specifically being utilized in the quality control of PV glass production?

AI is employed in quality control through advanced machine vision systems integrated into the production line. These systems use deep learning algorithms trained on millions of images to instantly detect microscopic flaws, such as subtle inclusions, stress fractures, air bubbles, and coating inconsistencies, which are often invisible or difficult for human inspectors to spot. This results in significantly higher defect detection rates and real-time process adjustments, ensuring superior finished product quality and adherence to strict industry standards.

Why is durability and longevity a crucial factor in the Photovoltaic Glass selection process?

Durability and longevity are crucial because solar modules are typically guaranteed for 25 to 30 years of operational life in harsh outdoor environments. The PV glass must withstand extreme temperature fluctuations, hail impact, wind loads, chemical corrosion, and UV radiation over this entire period without delamination or significant degradation. Poor glass quality can lead to premature module failure, voiding warranties and severely impacting the financial viability of solar projects, making material reliability paramount for utility-scale buyers.

What is TCO Glass and where is it predominantly used in the solar industry?

TCO (Transparent Conductive Oxide) Glass is specialized PV glass coated with a transparent electrically conductive film (typically Fluorine-doped Tin Oxide or Indium Tin Oxide). This glass serves dual functions: protection and acting as the front electrical contact for thin-film solar technologies, such as Cadmium Telluride (CdTe) and Copper Indium Gallium Selenide (CIGS) modules. It is predominantly used by thin-film manufacturers who require this specific electrical and optical characteristic for their cell structure.

How does the demand for utility-scale solar farms influence PV glass standardization?

Utility-scale solar farms demand massive volumes of modules, favoring large, standardized formats (e.g., M10, G12) and cost-optimized glass sheets. This high-volume demand encourages PV glass manufacturers to standardize their production processes, focusing on maximizing throughput, ensuring uniform thickness (e.g., 3.2 mm or 2.8 mm), and reducing variation to minimize costs, leading to major global standardization in product dimensions and quality specifications for high-volume orders.

What are the main distribution channels for Photovoltaic Glass?

The main distribution channels include direct sales from large glass manufacturers to Tier 1 PV module assemblers via long-term supply contracts, providing stable volume and pricing. Indirect channels involve specialized component distributors or wholesalers who serve smaller regional module manufacturers, BIPV specialists, and custom system integrators, handling fragmented logistics and smaller, bespoke order quantities efficiently.

What technological advancements are helping mitigate Potential Induced Degradation (PID) related to PV glass?

PID is a power loss phenomenon often exacerbated by electrical stress, temperature, and moisture. Advancements in PV glass mitigation include specialized glass compositions with reduced alkali metal content (sodium and potassium), and the use of optimized encapsulation materials (POE instead of EVA) which better insulate the solar cells. These materials reduce the potential for ion migration under high voltage, thereby protecting the solar cell from performance loss over time.

How does the shift towards larger wafer sizes (M10, G12) affect PV glass production requirements?

The shift towards larger wafer sizes necessitates the production of significantly larger PV glass sheets (e.g., up to 2.3 meters in length) to accommodate the increased module area. This requires glass manufacturers to upgrade their cutting, tempering, and handling equipment to manage these larger dimensions while maintaining stringent tolerances, increasing the engineering complexity and capital expenditure required in the production phase.

What are the environmental sustainability trends influencing PV glass manufacturing?

Sustainability trends include increasing the use of recycled content (cullet) in glass production to reduce the reliance on virgin raw materials, optimizing furnace efficiency to reduce energy consumption (a major cost and carbon emission source), and minimizing hazardous waste from chemical processes like AR coating application. Manufacturers are increasingly seeking green certifications and transparent reporting on embodied carbon to meet stringent European market requirements.

In the Value Chain, why is the midstream processing (coating and tempering) considered critical?

Midstream processing is critical because it transforms the basic float glass into a high-performance PV component. Tempering provides the necessary mechanical strength and safety features, ensuring survivability in the field. Applying proprietary Anti-Reflective (AR) coatings, a key midstream step, determines the final optical efficiency of the module. Quality failures at this stage directly impact module power output, warranty validity, and the overall competitiveness of the final solar product.

What is the primary constraint on new market entrants in PV glass manufacturing?

The primary constraint is the exceptionally high capital expenditure required to establish and operate a dedicated, large-scale float glass production line optimized for low-iron ultra-clear glass. The lead time for construction and commissioning is long, and the manufacturing process demands complex technical expertise and massive energy inputs, creating significant barriers to entry for new competitors who cannot achieve immediate economies of scale.

How do varying climatic conditions influence the selection of PV glass types globally?

Climatic conditions heavily dictate glass selection. In arid, dusty regions (like MEA), anti-soiling coatings are prioritized to maintain performance. Regions with high levels of sunshine and high temperatures benefit most from high-transmittance, low-iron glass and robust tempering. Regions prone to snow and heavy loads require thicker, structurally superior glass. Coastal regions demand glass and coatings resistant to salt mist corrosion, ensuring material longevity in harsh coastal environments.

What is the expected long-term impact of new materials like perovskite on the PV glass market?

Perovskite technology is expected to drive demand for specialized, highly customized encapsulation glass, particularly ultra-thin glass or flexible substrates, as perovskite cells often require different levels of protection against moisture and environmental degradation compared to silicon cells. While potentially disruptive to cell technology, it is anticipated to increase overall glass demand, shifting the focus towards specialized coating and encapsulation solutions rather than standard tempered glass.

How does the demand for residential solar differ from utility-scale demand in terms of PV glass requirements?

Residential demand (rooftop solar) often prioritizes aesthetic appeal, module size constraints, and lower overall weight for ease of installation, sometimes favoring thinner glass or colored/patterned BIPV-style modules. Utility-scale demand focuses purely on maximizing power output per square meter and minimizing costs, leading to high-volume procurement of standardized, rugged, high-efficiency AR-coated glass.

What are the major challenges in transporting large PV glass sheets internationally?

Major challenges include the fragility of the glass sheets, necessitating specialized packaging (A-frames or customized crates) and careful handling to prevent breakage, particularly micro-cracks during transit. The sheer size and weight of mass shipments require optimized logistics chains, and the long distances involved in international shipping increase insurance costs and geopolitical risk, compelling manufacturers to invest heavily in secure, containerized transport methods.

What is the role of certification standards (e.g., IEC) in the PV glass market?

Certification standards like those established by the International Electrotechnical Commission (IEC) are crucial as they define the minimum performance, safety, and durability criteria that PV modules, including the glass component, must meet. Compliance with standards such as IEC 61215 (performance) and IEC 61730 (safety) ensures that the glass possesses the required mechanical strength, thermal endurance, and resistance to environmental stress, providing essential quality assurance for project developers and insurers.

How is the market addressing the growing need for fire safety in BIPV and rooftop installations?

The market is addressing fire safety by developing non-combustible PV glass modules and incorporating advanced thermal tempering processes that prevent shattering or release of flammable components during high-heat events. Furthermore, specialized BIPV products are designed to integrate seamlessly with existing fire-rated building structures and adhere to stricter building codes, ensuring that the solar component does not compromise the fire integrity of the structure.

What strategic shift is observed among major PV glass manufacturers regarding vertical integration?

A strategic shift is observed where some large PV glass manufacturers are integrating forward into module assembly, while major solar cell manufacturers are integrating backward into glass production. This vertical integration strategy is aimed at securing consistent, high-quality material supply, achieving tighter control over production costs, mitigating supply chain bottlenecks, and optimizing the interface between the glass and the solar cell for maximum efficiency gains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager