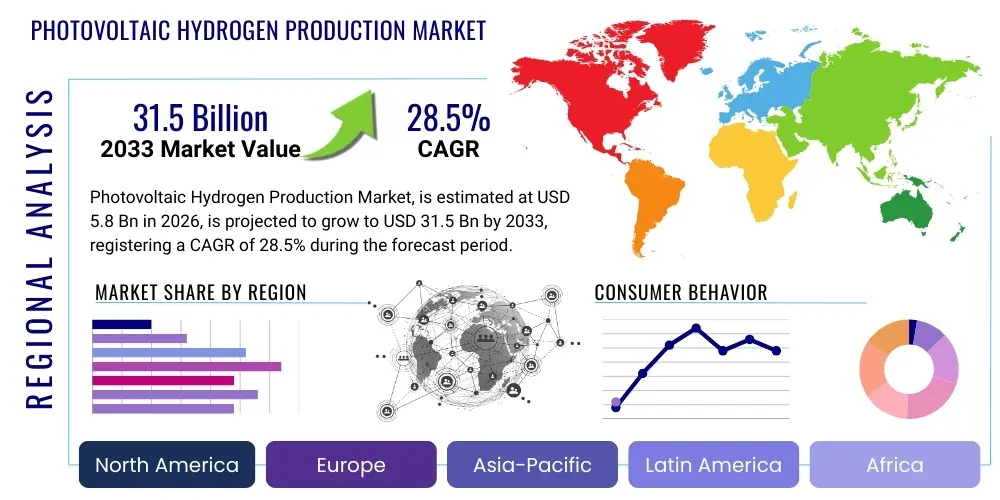

Photovoltaic Hydrogen Production Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437276 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Photovoltaic Hydrogen Production Market Size

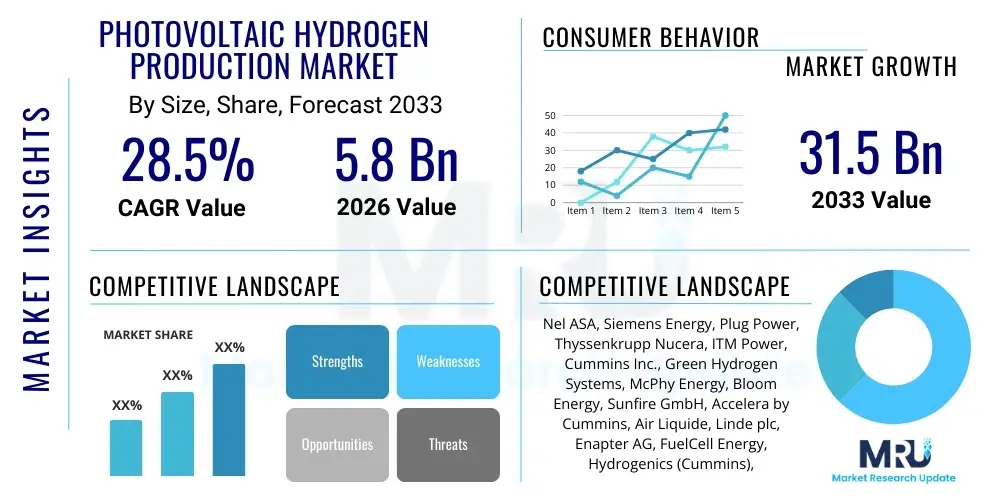

The Photovoltaic Hydrogen Production Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $31.5 Billion by the end of the forecast period in 2033. This substantial expansion is driven primarily by the global imperative for decarbonization, coupled with rapidly decreasing photovoltaic (PV) hardware costs and significant governmental investment in large-scale green hydrogen projects. The shift toward sustainable energy sources places PV-derived hydrogen at the forefront of the energy transition, positioning it as a critical vector for industrial processes and heavy transport sectors previously reliant on fossil fuels.

Photovoltaic Hydrogen Production Market introduction

The Photovoltaic Hydrogen Production Market encompasses the design, manufacture, and deployment of integrated systems that utilize solar energy (photovoltaics) to power water electrolysis, producing hydrogen gas without net carbon emissions. This process, known as green hydrogen production, relies on the synergy between highly efficient solar farms and various electrolyzer technologies, primarily Polymer Electrolyte Membrane (PEM) and Alkaline electrolyzers. Key market players are focused on improving system integration efficiency, reducing the Levelized Cost of Hydrogen (LCOH), and developing advanced materials to enhance catalyst durability and stack lifespan. Major applications span critical sectors, including industrial feedstock (e.g., ammonia production, steel manufacturing), energy storage, and fueling infrastructure for hydrogen fuel cell vehicles.

The primary benefits of photovoltaic hydrogen production are its sustainability, zero greenhouse gas emissions during operation, and its potential to decouple hydrogen production from fossil fuel dependency. Green hydrogen acts as a versatile energy carrier, enabling long-duration energy storage and facilitating the decarbonization of hard-to-abate sectors. Driving factors include aggressive national hydrogen strategies (such as those implemented in the EU, China, and the US), escalating carbon pricing mechanisms, and continuous technological breakthroughs that reduce both the capital expenditure (CAPEX) and operational expenditure (OPEX) associated with large-scale solar and electrolysis facilities. Standardization and regulatory clarity are also emerging as crucial elements supporting market acceleration.

Photovoltaic Hydrogen Production Market Executive Summary

The Photovoltaic Hydrogen Production Market is characterized by intense innovation, rapidly scaling deployment capacity, and increasing cross-sector partnerships between solar developers, electrolyzer manufacturers, and industrial end-users. Current business trends indicate a strong move toward gigawatt-scale projects, benefiting from economies of scale and sophisticated power purchase agreements (PPAs) that stabilize electricity supply to the electrolyzers. Furthermore, advancements in hybrid renewable energy systems, combining solar PV with battery storage, are mitigating the intermittency inherent to solar energy, thereby improving the capacity utilization factor of electrolysis plants and driving down the final cost of green hydrogen, positioning it competitively against grey hydrogen in specific regions by the end of the forecast period.

Regionally, Asia Pacific (APAC), particularly China and Australia, leads the market in terms of planned project pipeline and established supply chain infrastructure, leveraging vast solar resources and strong governmental backing for heavy industry decarbonization. Europe, driven by the REPowerEU plan and comprehensive regulatory frameworks defining "green" hydrogen, focuses heavily on developing hydrogen backbone infrastructure and importing renewable hydrogen via dedicated corridors. Segment trends show a clear dominance of Alkaline electrolyzers in current large-scale deployments due to their robustness and lower initial cost, though PEM technology is gaining traction due to its flexibility and fast response time, critical for coupling directly with the fluctuating output of PV systems. The emergence of Solid Oxide Electrolyzer Cells (SOEC) promises higher efficiency, especially when waste heat is available, creating significant potential in industrial co-location scenarios.

AI Impact Analysis on Photovoltaic Hydrogen Production Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can overcome the primary technological challenges facing PV hydrogen production, specifically focusing on managing PV intermittency, optimizing system efficiency, and accelerating material science breakthroughs. The central themes revolve around predictive operational stability, dynamic energy management, and cost reduction. Stakeholders are particularly interested in AI's capability to forecast solar irradiance accurately, allowing electrolyzers to adjust their load optimally, minimize degradation, and maximize the efficiency of the overall Power-to-X conversion process. Concerns often include data security and the integration complexity of advanced AI algorithms into existing operational technology (OT) infrastructure.

AI’s influence is profound, extending from optimizing the physical placement of PV farms to managing the complex electrochemistry of the electrolyzer stack. AI-driven predictive maintenance utilizes sensor data to anticipate component failure, reducing downtime and extending asset life, which is critical given the high capital expenditure of electrolysis equipment. Furthermore, AI algorithms are vital for designing novel catalyst materials and membranes—processes that traditionally rely on slow, expensive physical experimentation. ML accelerates the discovery phase by simulating molecular interactions and predicting performance under varied operating conditions, significantly speeding up the development of cheaper, more durable components essential for achieving widespread cost parity.

The immediate impact of AI is most notable in the development of sophisticated Energy Management Systems (EMS) that ensure seamless integration between the variable PV power source and the rigid demands of the grid or industrial consumers. These smart EMS utilize real-time market data, weather forecasts, and historical operational performance to execute dynamic load shaping, ensuring the hydrogen produced meets specific purity and volume requirements while minimizing the Levelized Cost of Hydrogen (LCOH). This intelligent optimization minimizes curtailment of renewable power and maximizes the capacity factor of the expensive electrolysis assets, thereby providing significant competitive advantage to early adopters of AI-enhanced operations.

- AI optimizes PV farm location and orientation based on long-term solar data and topographical analysis.

- Machine Learning models provide highly accurate short-term solar irradiance forecasting, enabling dynamic load adjustment of electrolyzers.

- Predictive maintenance algorithms reduce operational downtime and extend the lifespan of critical electrolyzer components.

- AI accelerates the discovery and testing of advanced catalysts and membrane materials, lowering material costs and increasing efficiency.

- Smart Energy Management Systems (EMS) use AI for real-time load balancing, minimizing electricity costs and maximizing system utilization factor.

DRO & Impact Forces Of Photovoltaic Hydrogen Production Market

The market trajectory is shaped by powerful Drivers, inherent Restraints, and substantial Opportunities, collectively constituting the Impact Forces driving strategic decision-making and investment. The overarching force is the global commitment to achieving net-zero emissions, making green hydrogen a crucial instrument for industrial deep decarbonization. While technological maturity and scaling have propelled growth, high initial capital expenditure and the challenge of solar intermittency remain significant limiting factors. However, the emerging opportunity in providing flexibility and storage to power grids, alongside the creation of global hydrogen trading networks, presents a compelling future growth scenario.

Drivers: The fundamental market driver is the sustained decline in the Levelized Cost of Electricity (LCOE) derived from solar PV, making the primary input for green hydrogen increasingly affordable. This is coupled with robust policy support, including subsidies, tax credits (like the U.S. Production Tax Credit), and mandated blending targets in pipeline infrastructure. Furthermore, the increasing corporate demand for sustainable industrial inputs and the push to replace carbon-intensive grey hydrogen, which currently dominates production, is creating a massive market pull. The capability of green hydrogen to act as a crucial energy storage mechanism also drives demand, providing grid stability and mitigating the variability of other renewable sources.

Restraints: Significant restraints include the high Capital Expenditure (CAPEX) required for integrated PV-electrolysis plants, particularly involving specialized equipment like PEM electrolyzers. The inherent intermittency of solar power necessitates either large battery storage systems or oversized electrolyzers to maintain continuous output, adding to the system complexity and cost. Furthermore, the lack of extensive, dedicated hydrogen transmission and distribution infrastructure presents a logistics bottleneck, particularly in connecting production hubs to consumption centers. Safety concerns related to hydrogen handling and storage, though manageable with modern technology, also require significant public and industrial acceptance efforts.

Opportunities: Key opportunities lie in the utilization of green hydrogen derivatives (e.g., green ammonia and synthetic fuels) for international shipping and aviation, sectors difficult to electrify directly. Developing cost-effective, decentralized production units suitable for commercial and small industrial applications offers another lucrative avenue. Crucially, the coupling of PV hydrogen production with industrial facilities (e.g., steel mills or fertilizer plants) to utilize existing infrastructure and waste heat streams significantly improves overall system economics and efficiency. Breakthroughs in direct solar hydrogen production technologies, such as photocatalytic water splitting, could revolutionize the cost structure entirely in the long term.

Segmentation Analysis

The Photovoltaic Hydrogen Production Market is segmented primarily based on the type of electrolyzer technology employed, the scale of production capacity, and the end-use application. Understanding these segments is crucial for strategic market positioning, as each technology offers distinct advantages regarding efficiency, cost, and operational flexibility. The selection of the optimal electrolyzer technology is heavily influenced by the specific characteristics of the solar energy input (e.g., variability) and the required hydrogen purity level for the end application. Geographic considerations also play a vital role, with regions prioritizing different technologies based on local industrial requirements and available investment capital.

The segmentation by capacity (small, medium, large) reflects the transition of the industry from pilot projects to utility-scale commercial installations, with the 'large' segment (multi-MW to GW scale) projected to exhibit the highest growth rate due to economies of scale and governmental emphasis on large hydrogen hubs. Meanwhile, the segmentation by application highlights the shift away from niche markets towards mainstream industrial decarbonization. As technology matures and the LCOH falls, the mobility segment (fuel cell vehicles) and the power generation segment (gas turbines/fuel cells for grid support) are expected to see accelerated adoption, leveraging the dense energy storage capability of hydrogen.

- By Electrolyzer Type:

- Alkaline Electrolyzer

- Polymer Electrolyte Membrane (PEM) Electrolyzer

- Solid Oxide Electrolyzer Cell (SOEC)

- Anion Exchange Membrane (AEM) Electrolyzer

- By Capacity:

- Small-Scale (Below 1 MW)

- Medium-Scale (1 MW - 20 MW)

- Large-Scale (Above 20 MW)

- By Application:

- Industrial Feedstock (Refining, Ammonia, Methanol, Steel)

- Mobility (Fuel Cell Electric Vehicles, Rail, Marine)

- Power Generation & Grid Injection

- Building Heat and Power

Value Chain Analysis For Photovoltaic Hydrogen Production Market

The value chain for photovoltaic hydrogen production is intricate, integrating the renewable energy sector with the electrochemical industry. It begins with the upstream segment encompassing the sourcing of materials for PV module manufacturing (silicon, glass) and electrolyzer components (catalysts, membranes, stacks, power electronics). Key upstream activities focus heavily on optimizing the supply chain for critical raw materials such as platinum group metals (PGMs) used in PEM catalysts and sourcing sufficient quantities of nickel and steel for Alkaline systems. Efficiency gains and cost reductions in this segment are directly correlated with the final LCOH, making supply chain resilience a crucial strategic concern for major players.

The midstream segment involves the core integration—the construction and operation of the coupled PV solar farm and the electrolysis plant. Distribution channels in the midstream include both direct pathways (piping hydrogen immediately to an adjacent industrial user) and indirect pathways (liquefaction or compression for road transport or injection into natural gas grids). Direct distribution is currently the most cost-effective method for large volumes, while indirect distribution relies on developing robust storage and transportation infrastructure, including specialized cryogenic tanks and high-pressure trailers. Significant investments are being channeled into developing dedicated hydrogen pipelines to facilitate long-distance, high-volume transport.

The downstream analysis focuses on the end-users and the monetization of the hydrogen product. Direct customers include large industrial complexes (chemical manufacturing, steel producers) requiring high-purity hydrogen feedstock. Indirect distribution targets the mobility sector through refueling stations and the energy sector through blending or use in dedicated power generation units. The complexity of the downstream segment lies in tailoring the hydrogen output (pressure, purity) to the specific requirements of disparate customer applications, often requiring specialized purification and compression equipment located at the production or dispensing site. The viability of the entire chain hinges on establishing stable off-take agreements with reliable, high-volume customers.

Photovoltaic Hydrogen Production Market Potential Customers

Potential customers for photovoltaic hydrogen production span across heavy industry, transportation, and utilities sectors, driven by regulatory mandates and economic incentives favoring decarbonization. The largest current customers are heavy industrial end-users, particularly those involved in petroleum refining, ammonia production for fertilizers, and chemical manufacturing, which currently consume vast quantities of grey hydrogen. These sectors are transitioning rapidly due to increased environmental, social, and governance (ESG) pressures and the rising cost of carbon emissions, making green hydrogen a compelling substitution option to maintain competitiveness and comply with global sustainability standards.

The mobility sector represents another critical customer base, particularly for heavy-duty transportation like trucking, rail, and maritime shipping, where battery electric solutions face limitations due to weight and charging time. Fleet operators and public transport authorities are increasingly investing in fuel cell electric vehicles (FCEVs) and the associated hydrogen refueling infrastructure. Utilities and independent power producers (IPPs) are emerging as high-volume customers, utilizing hydrogen for long-duration energy storage, blending it into existing natural gas grids (up to certain limits), or using it to fuel hydrogen-ready gas turbines to provide flexible, low-carbon power generation when renewable output is low.

Furthermore, new customers are emerging from the sustainable fuel production segment, specifically those involved in Power-to-Liquids (PtL) and production of Sustainable Aviation Fuel (SAF). These processes rely on green hydrogen combined with captured carbon dioxide to produce synthetic hydrocarbons. The demand for green hydrogen from these synthetic fuel producers is anticipated to grow exponentially as regulatory requirements for sustainable fuel uptake in aviation and shipping become more stringent, positioning them as significant future off-takers of large-scale PV hydrogen projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $31.5 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nel ASA, Siemens Energy, Plug Power, Thyssenkrupp Nucera, ITM Power, Cummins Inc., Green Hydrogen Systems, McPhy Energy, Bloom Energy, Sunfire GmbH, Accelera by Cummins, Air Liquide, Linde plc, Enapter AG, FuelCell Energy, Hydrogenics (Cummins), Hystar AS, Ohmium International, Tianjin Mainland Hydrogen Equipment, Giner ELX |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photovoltaic Hydrogen Production Market Key Technology Landscape

The Photovoltaic Hydrogen Production market relies on the convergence of two mature technologies: high-efficiency solar photovoltaic modules and various electrolysis processes. In the PV segment, the shift toward bifacial solar modules and higher-wattage panels is maximizing electricity yield per square meter, optimizing the energy input for electrolysis. Concurrently, advanced power electronics and Maximum Power Point Tracking (MPPT) systems are becoming essential to efficiently manage the variable DC output from the PV array and deliver stable power to the electrolyzer stack. This dynamic coupling is fundamental to maximizing overall system efficiency and reducing the cost per kilogram of hydrogen produced.

Within electrolysis, Polymer Electrolyte Membrane (PEM) technology is gaining prominence for PV coupling due to its ability to handle highly fluctuating power inputs, rapid start-up times, and high current density, making it ideally suited for direct operation with intermittent solar power. However, Alkaline Electrolyzers (AEL) still dominate the market share in terms of installed capacity, particularly in large-scale, centrally located projects where stable, low-cost electricity can be secured, often relying on grid balancing rather than direct PV coupling variability management. Research efforts are heavily focused on reducing or eliminating the need for expensive noble metal catalysts in both PEM and the emerging Anion Exchange Membrane (AEM) technologies.

A significant long-term technological trend involves Solid Oxide Electrolyzer Cells (SOEC), which operate at high temperatures (700°C–1000°C) and offer significantly higher electrical efficiency compared to AEL and PEM technologies. While SOEC requires an external heat source, its integration potential with industrial waste heat streams—such as those available at steel mills or chemical plants—makes it highly attractive for co-location projects. Furthermore, early-stage research into direct solar-to-hydrogen conversion methods, like photocatalytic water splitting and photoelectrochemical (PEC) cells, promises a potential paradigm shift by eliminating the need for an external electrical grid and separate PV modules, though these technologies are not yet commercially viable at scale.

Regional Highlights

The global market exhibits distinct regional dynamics driven by varying levels of solar irradiation, regulatory environments, industrial demand structures, and strategic geopolitical interests in energy independence. Asia Pacific (APAC) stands as the largest and fastest-growing market, largely spearheaded by China's aggressive national hydrogen deployment goals and massive investments in both PV and electrolyzer manufacturing capacities, enabling them to capture significant economies of scale. Australia is also a key player, utilizing its vast solar resources for large-scale export-oriented green hydrogen and green ammonia projects, leveraging existing shipping routes and expertise in energy commodity trade. The regional focus is characterized by rapid scale-up and supply chain domination.

Europe represents a major demand center, driven by the ambitious goals outlined in the European Green Deal and the REPowerEU initiatives aimed at energy security and decarbonization. Countries like Germany, the Netherlands, and Spain are investing heavily in establishing hydrogen valleys and pipeline infrastructure. Europe's strategic focus is less on PV production dominance and more on developing the consumption and transportation infrastructure, supporting both domestic green hydrogen production (often in Southern Europe/Iberia) and facilitating substantial imports from regions with abundant renewable resources, such as North Africa and the Middle East.

North America, led by the United States, is experiencing accelerated market growth, primarily fueled by supportive federal policies such as the Inflation Reduction Act (IRA), which provides lucrative production tax credits for green hydrogen. This has incentivized numerous multi-gigawatt project announcements across the Sun Belt states. The regional strategy emphasizes large-scale hydrogen hubs designed to serve specific industrial clusters (e.g., Gulf Coast refining and petrochemicals) and support the decarbonization of long-haul trucking, utilizing domestic renewable energy resources and fostering job creation within the hydrogen value chain.

The Middle East and Africa (MEA) region is rapidly emerging as a global powerhouse for green hydrogen exports. Countries like Saudi Arabia (NEOM project) and the UAE are leveraging their low-cost, high-intensity solar resources and strategic port locations to develop some of the world's largest PV hydrogen and ammonia production facilities. These mega-projects are fundamentally aimed at establishing the MEA region as a low-cost exporter to energy-hungry markets in Europe and Asia. Latin America, particularly Chile (Patagonia) and Brazil, also holds significant potential, possessing some of the world's best combined solar and wind resources, attracting international investment for potential export capacity.

- Asia Pacific (APAC): Leads in installed capacity and manufacturing; driven by China, Australia, and South Korea, focusing on industrial use and exports.

- Europe: High demand driven by EU mandates (REPowerEU); strong focus on infrastructure development, blending, and strategic imports from neighboring regions.

- North America: Rapid growth fueled by the U.S. Inflation Reduction Act (IRA) tax credits; development centered around regional hydrogen hubs for industrial and mobility applications.

- Middle East & Africa (MEA): Emergent global export hub leveraging superior solar resources for ultra-low-cost production, exemplified by mega-projects like NEOM in Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photovoltaic Hydrogen Production Market.- Nel ASA

- Siemens Energy

- Plug Power

- Thyssenkrupp Nucera

- ITM Power

- Cummins Inc.

- Green Hydrogen Systems

- McPhy Energy

- Bloom Energy

- Sunfire GmbH

- Accelera by Cummins

- Air Liquide

- Linde plc

- Enapter AG

- FuelCell Energy

- Hydrogenics (Cummins)

- Hystar AS

- Ohmium International

- Tianjin Mainland Hydrogen Equipment

- Hitachi Zosen Corporation

Frequently Asked Questions

Analyze common user questions about the Photovoltaic Hydrogen Production market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current Levelized Cost of Hydrogen (LCOH) for PV production?

The LCOH for PV hydrogen varies significantly by region, but it generally ranges from $3.00/kg to $8.00/kg, depending on local solar irradiation, CAPEX, and the price of financing. The industry is rapidly moving toward the target of $2.00/kg, a crucial benchmark for achieving cost parity with conventional fossil-fuel hydrogen production.

How does solar intermittency affect the efficiency of electrolysis?

Solar intermittency leads to fluctuating power input, which can stress the electrolyzer stack, reducing lifespan and efficiency. PEM electrolyzers are better equipped to handle variability due to faster response times, while advanced AI-driven Energy Management Systems (EMS) and co-location with battery storage are critical strategies used to stabilize power supply and optimize operational efficiency.

Which electrolyzer technology is dominant in the PV hydrogen market?

While Alkaline Electrolyzers currently hold the largest installed capacity due to lower initial cost, Polymer Electrolyte Membrane (PEM) electrolyzers are rapidly gaining market share, particularly for direct coupling with PV systems, owing to their superior dynamic response capabilities and higher current density.

What major government policies are accelerating the PV hydrogen market growth?

Key policies include the U.S. Inflation Reduction Act (IRA), which provides substantial production tax credits (up to $3/kg), and the European Union’s REPowerEU initiative, which sets ambitious domestic production and import targets, creating high market certainty and incentivizing gigawatt-scale project development globally.

What is the potential role of green hydrogen in industrial decarbonization?

Green hydrogen is essential for decarbonizing "hard-to-abate" sectors like steel production, cement manufacturing, and chemical refining, which require high-temperature heat or chemical feedstocks. It serves as a direct, zero-emission replacement for fossil fuels and grey hydrogen in these processes, enabling substantial emissions reductions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager