Photovoltaic Packaging EVA Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440165 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Photovoltaic Packaging EVA Film Market Size

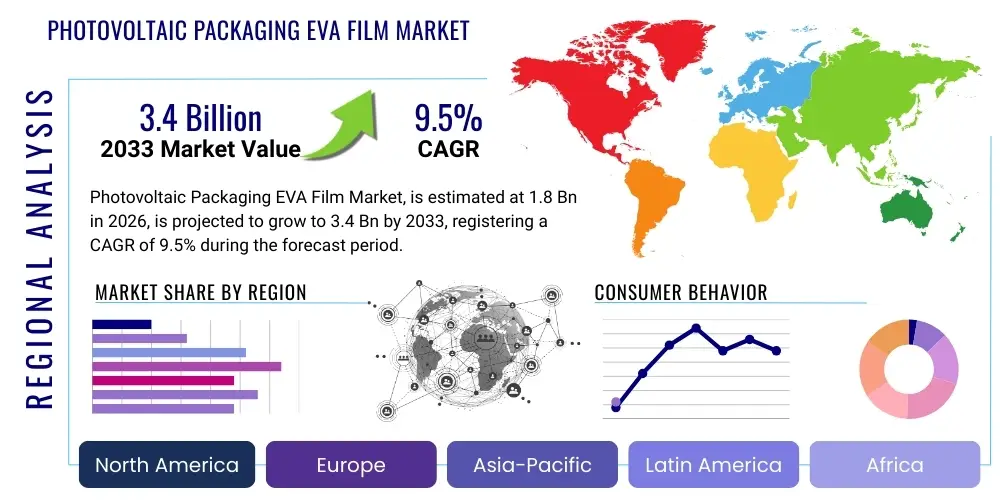

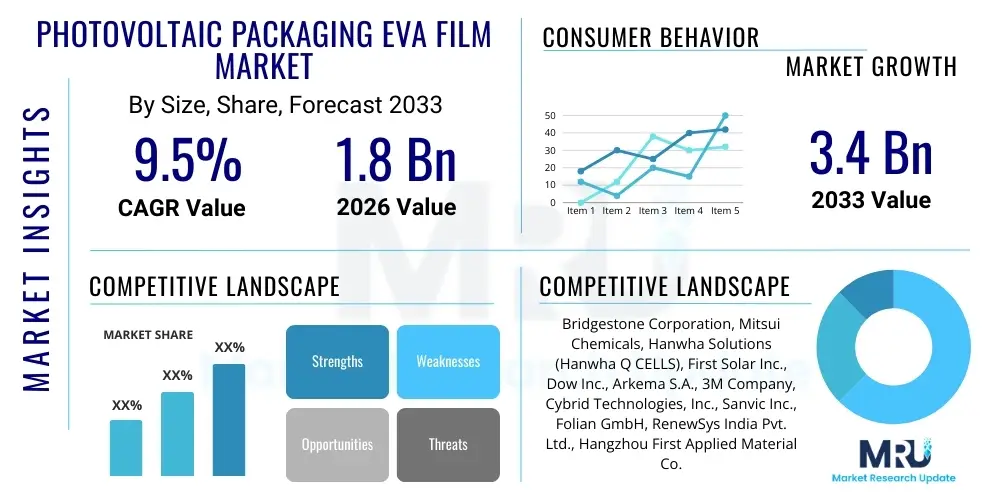

The Photovoltaic Packaging EVA Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

Photovoltaic Packaging EVA Film Market introduction

The Photovoltaic (PV) Packaging Ethylene Vinyl Acetate (EVA) film market is a critical component within the rapidly expanding solar energy industry. EVA film serves as an encapsulant, forming a protective layer over the delicate photovoltaic cells within solar modules. This transparent, adhesive polymer film plays an indispensable role in safeguarding solar cells from environmental degradation, ensuring their long-term performance and reliability. It effectively encapsulates the solar cells, providing excellent light transmittance, superior adhesion to glass and backsheets, and crucial resistance to UV radiation, moisture, and extreme temperatures, thereby preventing delamination and power loss.

Major applications of EVA film are predominantly found in the manufacturing of both crystalline silicon (c-Si) and thin-film solar modules, which are the two primary types of PV technologies. The film ensures robust mechanical protection, electrical insulation, and optical transparency, which are fundamental for efficient energy conversion and module longevity. The benefits of using EVA film include enhanced module durability, improved power output stability, and resistance against potential-induced degradation (PID). These advantages directly contribute to the overall efficiency and lifespan of solar panels, making them more cost-effective and reliable for consumers and utility-scale projects alike.

The market is primarily driven by the escalating global demand for renewable energy sources, particularly solar power, which continues to grow due to increasing environmental concerns, supportive government policies, and declining costs of solar electricity generation. Continuous advancements in solar technology, coupled with the rising adoption of solar energy across residential, commercial, and utility-scale sectors, further fuel the demand for high-performance PV encapsulants like EVA film. Furthermore, the growing trend towards bifacial modules and floating solar installations presents new avenues for market expansion, requiring advanced encapsulant solutions to withstand varied environmental conditions.

Photovoltaic Packaging EVA Film Market Executive Summary

The Photovoltaic Packaging EVA Film market is experiencing robust growth driven by the burgeoning global solar energy sector, with significant business trends focusing on innovation in material science and strategic partnerships. Companies are investing heavily in research and development to produce EVA films with enhanced properties such as improved UV resistance, lower acetic acid content, and better adhesion for next-generation solar cells, including those used in bifacial and flexible modules. Consolidation among manufacturers and suppliers is also a key business trend, aimed at achieving economies of scale and strengthening market positions. Supply chain resilience, particularly concerning raw material sourcing, has become a strategic priority for market players to mitigate price volatility and ensure consistent production.

Regionally, the Asia Pacific (APAC) continues to dominate the market, primarily owing to the massive solar manufacturing capabilities and aggressive solar energy deployment targets in countries like China, India, and Southeast Asian nations. This region acts as both a major producer and consumer of PV packaging EVA film. Europe and North America are also witnessing substantial growth, propelled by strong renewable energy policies, incentive programs, and increasing investments in utility-scale solar projects. Emerging markets in Latin America, the Middle East, and Africa are showing significant potential, driven by energy diversification efforts and improving grid infrastructure, albeit from a smaller base.

Segment-wise, the market is seeing a shift towards advanced EVA film types tailored for specific module technologies. Fast-cure EVA films are gaining traction due to their ability to speed up manufacturing processes, while UV-resistant and anti-PID formulations are becoming standard to enhance module longevity and performance, especially in harsh environmental conditions. The application segment for crystalline silicon modules remains the largest, but the thin-film segment is also expanding with specialized EVA films designed to meet their unique encapsulation requirements. Demand is observed across all end-use sectors—residential, commercial, industrial, and utility-scale—with utility-scale projects representing the largest volume consumer due to their vast power generation capacities.

AI Impact Analysis on Photovoltaic Packaging EVA Film Market

User inquiries about AI's impact on the Photovoltaic Packaging EVA Film Market frequently center on how artificial intelligence can optimize manufacturing processes, enhance material quality, and drive innovation within the industry. Key themes often include the potential for AI to streamline production, improve predictive maintenance of equipment, facilitate the discovery of new and more efficient encapsulant materials, and optimize supply chain logistics. Users are keen to understand if AI can lead to cost reductions, superior product performance, and faster development cycles for next-generation EVA films, ultimately contributing to more reliable and cost-effective solar energy solutions. The overall expectation is that AI will introduce unprecedented levels of precision, efficiency, and intelligence into the production and application of PV packaging EVA films, addressing current challenges and unlocking future opportunities for advanced material development and sustainable manufacturing practices.

- AI-driven optimization of manufacturing parameters, leading to reduced waste and improved film consistency.

- Predictive maintenance for production machinery, minimizing downtime and increasing operational efficiency.

- Accelerated R&D through AI-powered material design and simulation, identifying novel EVA formulations with enhanced properties.

- Improved quality control and defect detection using computer vision and machine learning algorithms during film production.

- Enhanced supply chain management and demand forecasting for raw materials, mitigating price volatility and ensuring stability.

- AI-enabled analysis of environmental data to tailor EVA film properties for specific regional climatic conditions.

- Development of smart encapsulants with self-healing or adaptive properties through AI-guided material engineering.

- Optimized inventory management and logistics, reducing storage costs and improving delivery efficiency.

DRO & Impact Forces Of Photovoltaic Packaging EVA Film Market

The Photovoltaic Packaging EVA Film market is primarily driven by the robust expansion of the global solar energy sector, fueled by increasing awareness of climate change, the imperative for energy security, and supportive governmental policies, including subsidies and renewable energy mandates. The continuous decline in the levelized cost of solar electricity, making it competitive with traditional energy sources, further accelerates solar panel adoption and, consequently, the demand for EVA film. Innovations in solar panel technology, such as the proliferation of bifacial modules and the development of floating solar arrays, necessitate high-performance encapsulants that offer superior durability and protection, thereby creating new market opportunities for advanced EVA film formulations. The growing emphasis on long-term module reliability and warranty periods also pushes manufacturers to invest in higher quality EVA films.

However, the market faces significant restraints, including the volatility of raw material prices, particularly ethylene and vinyl acetate, which are petroleum-derived and subject to geopolitical and economic fluctuations. This price instability can impact manufacturing costs and profit margins for EVA film producers. Another restraint is the potential for competition from alternative encapsulant materials like POE (Polyolefin Elastomer) and TPO (Thermoplastic Polyolefin), especially for specific applications that demand enhanced moisture resistance or higher module efficiency in extreme conditions. The high initial capital investment required for establishing or expanding EVA film manufacturing facilities can also be a barrier to entry for new players, potentially limiting market dynamism and innovation.

Despite these challenges, substantial opportunities exist for market expansion. The increasing focus on sustainable manufacturing practices and the development of recyclable EVA films present a promising avenue for growth and differentiation. Emerging markets in Africa, Latin America, and Southeast Asia are poised for significant solar energy infrastructure development, offering untapped potential for EVA film suppliers. Furthermore, advancements in film properties, such as enhanced UV stability, anti-PID capabilities, and films with reduced acetic acid output, are critical for improving module longevity and performance, driving demand for premium products. The ongoing global energy transition and the strong commitment of nations towards achieving net-zero emissions ensure a sustained growth trajectory for the solar industry and, by extension, the EVA film market.

Segmentation Analysis

The Photovoltaic Packaging EVA Film market is broadly segmented based on several critical factors including film type, application, and end-use, each reflecting distinct characteristics and market dynamics. Understanding these segments is crucial for market participants to tailor their product offerings, marketing strategies, and investment decisions. The segmentation highlights the diverse requirements within the solar industry, from specialized films for high-efficiency modules to cost-effective solutions for mass production, ensuring that a wide range of needs across different solar technologies and deployment scales can be met effectively. This granular view assists in identifying key growth areas and competitive landscapes within the broader market.

- Type

- Fast Cure EVA Film

- Normal Cure EVA Film

- UV Cure EVA Film

- Application

- Crystalline Silicon Solar Cells

- Thin-Film Solar Cells

- Bifacial Solar Modules

- Flexible Solar Modules

- End-Use

- Residential

- Commercial

- Industrial

- Utility-Scale

- Automotive

- Off-Grid Solutions

Value Chain Analysis For Photovoltaic Packaging EVA Film Market

The value chain for the Photovoltaic Packaging EVA Film market commences with the upstream segment, primarily involving the extraction and processing of raw materials. Key raw materials include ethylene and vinyl acetate monomer (VAM), which are derived from petrochemical feedstocks. These are then polymerized to produce ethylene vinyl acetate (EVA) resin by chemical manufacturers. The quality and purity of these raw materials directly influence the performance characteristics of the final EVA film, making supplier relationships and material consistency crucial. Upstream suppliers are typically large chemical companies that serve a wide array of industries beyond just PV, allowing for economies of scale but also exposing them to global commodity price fluctuations.

Moving downstream, the EVA resin is then processed into film by specialized manufacturers who apply various additives, cross-linking agents, and processing techniques to create the finished EVA film. This stage often involves sophisticated co-extrusion technologies to achieve desired thickness, clarity, adhesion, and curing properties. These EVA film manufacturers then supply their products directly to solar module manufacturers, who integrate the film into their solar panel assembly lines. The solar module manufacturers represent the primary direct customers in the value chain, as they are the direct end-users of the EVA film for encapsulating solar cells. The performance of the EVA film is critical for the long-term reliability and efficiency of the finished solar module.

The distribution channel primarily involves direct sales from EVA film manufacturers to solar module manufacturers, often facilitated by long-term supply agreements. Indirect channels may involve distributors or agents who handle logistics and provide localized support, particularly for smaller module manufacturers or in regions with less direct market access. Furthermore, the completed solar modules are then distributed to project developers, EPC (Engineering, Procurement, and Construction) companies, and installers, who deploy them in residential, commercial, industrial, and utility-scale solar projects. This intricate network of direct and indirect channels ensures that the EVA film, as a critical component, reaches its ultimate application within the broader solar energy ecosystem, driving demand through the success and expansion of solar power generation globally.

Photovoltaic Packaging EVA Film Market Potential Customers

The primary potential customers and end-users of photovoltaic packaging EVA film are predominantly companies involved in the manufacturing and assembly of solar photovoltaic modules. These include large-scale, vertically integrated solar panel manufacturers who produce cells, modules, and sometimes even ingots and wafers, as well as specialized module assemblers who source cells from third parties. These manufacturers require EVA film in significant volumes to encapsulate and protect their solar cells, ensuring the durability, weather resistance, and performance of the final solar panels. Their purchasing decisions are heavily influenced by factors such as film transparency, adhesion strength, UV resistance, anti-PID properties, and cost-effectiveness, alongside reliability of supply and technical support from EVA film suppliers.

Beyond direct module manufacturers, other indirect but significant customers include Engineering, Procurement, and Construction (EPC) companies involved in large-scale solar project development, and independent power producers (IPPs) or utility companies. While these entities do not directly purchase EVA film, their specifications and material requirements for solar modules profoundly impact the demand and selection criteria for EVA film. For instance, EPCs building solar farms in harsh environments will demand modules built with encapsulants offering superior resistance to moisture and extreme temperatures, thereby driving module manufacturers to procure high-performance EVA films. Therefore, understanding the evolving needs and quality benchmarks set by these downstream project developers is essential for EVA film producers to remain competitive and innovative.

Moreover, the growth of niche applications such as building-integrated photovoltaics (BIPV), automotive solar roofs, and flexible solar solutions also creates a new segment of potential customers requiring specialized EVA films. Manufacturers of these advanced solar products need films that offer specific characteristics like enhanced flexibility, lighter weight, or aesthetic integration properties. As the solar industry diversifies, the customer base for EVA film is expanding beyond traditional rigid module production to encompass a broader range of innovative solar product developers. This diversification requires EVA film suppliers to offer a more varied portfolio of products tailored to these unique requirements, highlighting the dynamic nature of the customer landscape within the photovoltaic market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, Mitsui Chemicals, Hanwha Solutions (Hanwha Q CELLS), First Solar Inc., Dow Inc., Arkema S.A., 3M Company, Cybrid Technologies, Inc., Sanvic Inc., Folian GmbH, RenewSys India Pvt. Ltd., Hangzhou First Applied Material Co. Ltd., STR Holdings, Inc., Kuraray Co. Ltd., HiUV New Materials Co. Ltd., Shanghai HIUV New Materials Co., Ltd., Changzhou Sveck PV New Material Co., Ltd., Jolywood (Suzhou) Sunwatt Co., Ltd., Wuxi Suntech Power Co., Ltd., Huaxia Glass Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photovoltaic Packaging EVA Film Market Key Technology Landscape

The Photovoltaic Packaging EVA Film market is continuously evolving with significant technological advancements aimed at enhancing solar module performance, longevity, and manufacturing efficiency. A key technology involves the development of advanced EVA formulations that offer superior UV resistance and improved adhesion to various module components, including glass, backsheets, and solar cells. This is crucial for preventing delamination and ensuring the long-term integrity of solar panels, particularly in harsh outdoor environments. Innovations also include EVA films with reduced acetic acid content, which minimizes potential corrosion of sensitive cell components and enhances overall module reliability by mitigating Potential-Induced Degradation (PID) effects, a common issue impacting module power output over time.

Another prominent technological trend is the development of fast-cure and low-temperature cure EVA films. Fast-cure films significantly reduce the lamination time in the manufacturing process, thereby increasing production throughput and lowering operational costs for module manufacturers. Low-temperature cure films are particularly beneficial for sensitive cell technologies that cannot withstand high processing temperatures, expanding the applicability of EVA encapsulants across a broader range of advanced solar cell architectures. Furthermore, the advent of multi-layer co-extrusion technologies allows for the creation of sophisticated film structures, where different layers can be engineered to provide specific functionalities, such as enhanced moisture barrier properties or improved electrical insulation, without compromising on other critical characteristics.

The integration of specialized additives also represents a crucial aspect of the technological landscape. These additives can impart properties like anti-soiling, anti-reflection, or improved thermal stability, contributing to higher energy yield and longer module lifespan. For example, some films incorporate light-converting additives to optimize the light spectrum reaching the solar cells, potentially boosting efficiency. As the industry moves towards bifacial and transparent backsheet modules, new demands arise for EVA films that maintain clarity and performance on both sides, leading to innovations in optical properties and durability. These technological advancements collectively aim to make solar energy more efficient, reliable, and cost-effective, driving the continuous evolution of PV packaging EVA film materials.

Regional Highlights

- Asia Pacific (APAC): The largest and fastest-growing market, primarily driven by massive solar panel manufacturing capacities and robust government support for solar energy deployment in China, India, Japan, and Southeast Asian countries. High demand for both residential and utility-scale projects, coupled with lower production costs, cements its dominant position.

- Europe: A mature market with significant emphasis on renewable energy targets and sustainable practices. Countries like Germany, Spain, Italy, and France are leading the adoption of advanced solar technologies, driving demand for high-performance EVA films. Strict environmental regulations also encourage innovation in eco-friendly encapsulant solutions.

- North America: Experiencing substantial growth fueled by increasing investments in solar infrastructure, federal tax credits, and state-level renewable energy mandates, especially in the United States. Growing concerns about energy independence and grid reliability are accelerating utility-scale and distributed generation projects, pushing demand for PV EVA films.

- Latin America: An emerging market with considerable potential, driven by vast solar resources and government initiatives to diversify energy mixes. Countries like Brazil, Chile, and Mexico are investing in large-scale solar farms, creating a burgeoning market for PV components including EVA films. Economic development and electrification efforts also contribute to market expansion.

- Middle East and Africa (MEA): Showing promising growth, particularly in the Middle East with ambitious renewable energy targets in countries such as UAE and Saudi Arabia, alongside significant solar project developments in South Africa and other African nations. Abundant solar irradiation and the need for reliable power sources are key drivers, though initial infrastructure investments remain a challenge.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photovoltaic Packaging EVA Film Market.- Bridgestone Corporation

- Mitsui Chemicals

- Hanwha Solutions (Hanwha Q CELLS)

- First Solar Inc.

- Dow Inc.

- Arkema S.A.

- 3M Company

- Cybrid Technologies, Inc.

- Sanvic Inc.

- Folian GmbH

- RenewSys India Pvt. Ltd.

- Hangzhou First Applied Material Co. Ltd.

- STR Holdings, Inc.

- Kuraray Co. Ltd.

- HiUV New Materials Co. Ltd.

- Shanghai HIUV New Materials Co., Ltd.

- Changzhou Sveck PV New Material Co., Ltd.

- Jolywood (Suzhou) Sunwatt Co., Ltd.

- Wuxi Suntech Power Co., Ltd.

- Huaxia Glass Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Photovoltaic Packaging EVA Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Photovoltaic Packaging EVA Film?

Photovoltaic (PV) Packaging EVA (Ethylene Vinyl Acetate) film is a transparent, adhesive polymer film used as an encapsulant in solar modules. It protects delicate solar cells from environmental factors like moisture, UV radiation, and temperature fluctuations, ensuring long-term performance and durability of solar panels.

Why is EVA film crucial for solar panel longevity and efficiency?

EVA film is crucial because it provides mechanical protection, electrical insulation, and superior adhesion to the various layers of a solar module. Its high light transmittance maximizes solar cell efficiency, while its resistance to degradation extends the operational lifespan of solar panels by preventing delamination and protecting against harsh weather conditions.

What key factors are driving the growth of the EVA film market?

The market's growth is primarily driven by the escalating global demand for solar energy, favorable government policies and incentives for renewable energy, the decreasing cost of solar electricity, and continuous technological advancements in solar module design, including bifacial and flexible solar technologies.

What are the main challenges faced by the Photovoltaic Packaging EVA Film market?

Key challenges include the volatility of raw material prices (ethylene and vinyl acetate), intense competition from alternative encapsulant materials like POE, and the high initial capital investment required for manufacturing facilities. Maintaining consistent quality across diverse environmental conditions also presents an ongoing challenge for manufacturers.

How does AI impact the development and manufacturing of PV EVA film?

AI significantly impacts the PV EVA film market by optimizing manufacturing processes for efficiency and quality control, accelerating research and development of new material formulations, and enhancing supply chain management. AI-driven simulations can predict material performance, while machine learning can detect defects and refine production parameters, leading to superior and more cost-effective films.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager