Photovoltaic (PV) Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436001 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Photovoltaic (PV) Equipment Market Size

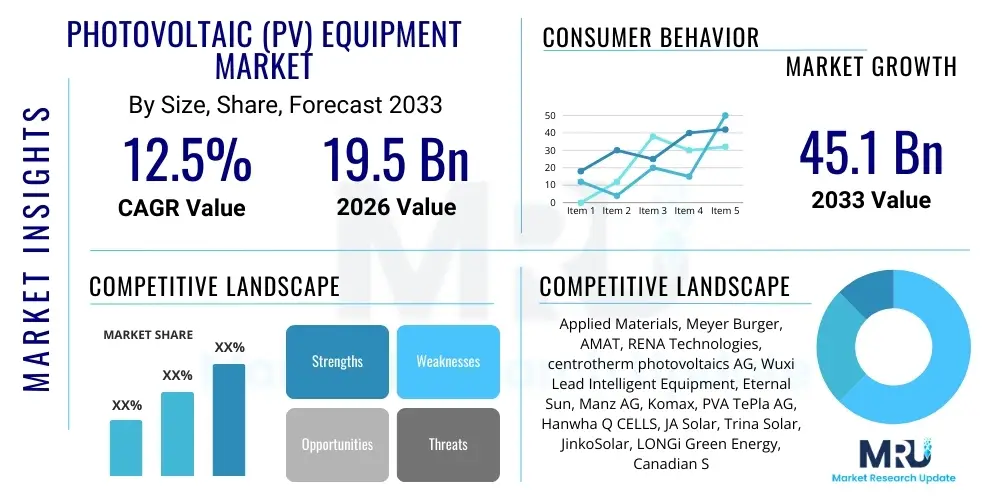

The Photovoltaic (PV) Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 45.1 Billion by the end of the forecast period in 2033.

Photovoltaic (PV) Equipment Market introduction

The Photovoltaic (PV) Equipment Market encompasses the specialized machinery, tools, and systems required for the production of solar cells and modules across the entire supply chain, ranging from ingot slicing and wafer production to cell processing and final module assembly. This sophisticated industrial sector provides the backbone technology enabling the global transition towards renewable energy, ensuring high-efficiency conversion of sunlight into electricity. Key products include furnaces for polysilicon purification, wire saws for wafer cutting, deposition systems (e.g., PECVD, PVD), etching equipment, and laminators. The continuous need for improved cell efficiency (e.g., shift towards TOPCon and HJT technologies) and lower manufacturing costs drives innovation and capital expenditure within this equipment market.

Major applications for the output of PV equipment include utility-scale solar farms, commercial rooftop installations, and residential solar solutions. Utility-scale projects demand high throughput and robust equipment capable of manufacturing large volumes of standardized, high-power modules, emphasizing cost-efficiency and durability. Conversely, specialized equipment may cater to niche markets requiring flexible or high-efficiency cells for building-integrated photovoltaics (BIPV) or portable electronics. The inherent benefits of this equipment market include facilitating capacity expansion, enhancing operational efficiency through automation, reducing material waste, and driving down the Levelized Cost of Electricity (LCOE) for solar power generation globally.

The primary driving forces behind the vigorous expansion of the PV equipment market are global climate change mitigation goals, aggressive governmental mandates and incentives (such as feed-in tariffs and tax credits), and the falling cost competitiveness of solar energy compared to fossil fuels. Furthermore, the relentless technological race among manufacturers to produce cells with higher conversion efficiencies, spurred by breakthroughs in doping techniques and passivation layers (like PERC and its successors), necessitates frequent equipment upgrades and capital investment. This cycle of technological obsolescence and renewal ensures a steady demand flow for highly advanced, precise manufacturing machinery. Infrastructure development initiatives in emerging economies further solidify market growth potential.

Photovoltaic (PV) Equipment Market Executive Summary

The Photovoltaic (PV) Equipment Market is characterized by robust capital expenditure driven by massive global capacity expansion, particularly across Asia Pacific, where integrated manufacturing hubs dominate. Business trends indicate a pronounced shift towards equipment supporting n-type cell architectures (TOPCon and HJT), replacing legacy p-type production lines. This transition demands high precision deposition, doping, and etching tools, favoring vendors that can deliver highly integrated, turnkey solutions. Furthermore, increasing automation and the adoption of Industry 4.0 principles, including predictive maintenance and real-time monitoring, are critical for minimizing downtime and maximizing output yield in modern PV manufacturing facilities.

Regionally, Asia Pacific, led by China, remains the undisputed epicenter of both PV manufacturing and equipment demand, commanding over 80% of global capacity. However, geopolitical pressures and supply chain resilience concerns are spurring significant investment in localized manufacturing capacity in North America and Europe, supported by policies like the US Inflation Reduction Act (IRA) and European Green Deal initiatives. This geographical diversification is creating lucrative opportunities for equipment suppliers capable of establishing localized service and support networks, mitigating dependence on single-source regions and addressing varied regional regulatory requirements, particularly concerning environmental, social, and governance (ESG) standards.

Segment-wise, the Cell Production Equipment segment is experiencing the fastest growth, primarily due to the rapid technological evolution requiring new generations of deposition and metallization equipment. Within the application landscape, the Utility Scale segment continues to represent the largest share of equipment usage, driven by large-scale government auctions and energy transition targets. A major trend influencing all segments is the increasing standardization of large-format wafers (e.g., 182mm and 210mm), which necessitates the replacement or modification of existing slicing, handling, and module assembly equipment to accommodate larger sizes and higher throughput rates, ensuring economies of scale are fully realized.

AI Impact Analysis on Photovoltaic (PV) Equipment Market

Common user questions regarding AI's impact on PV equipment center around how Artificial Intelligence can enhance manufacturing efficiency, reduce defects, and accelerate R&D for next-generation cells. Users frequently inquire about the integration of machine learning algorithms for predictive maintenance—specifically, how AI can forecast equipment failure based on sensor data to minimize costly downtime, a critical concern given the high capital intensity of PV production lines. Another major theme involves yield optimization: how deep learning models can analyze complex process parameters (such as temperature, gas flow rates, and plasma consistency) in real-time within highly sensitive processes like PECVD or firing, allowing for dynamic adjustments to maintain peak production yield and consistency across diverse wafer batches. Furthermore, there is significant interest in AI's role in automated visual inspection (AVI) systems, replacing traditional, slower manual checks to identify microcracks, contamination, and cell defects instantaneously.

The integration of AI and Machine Learning (ML) into PV equipment is evolving from basic data logging to sophisticated, closed-loop control systems. AI algorithms are essential for managing the complexity arising from the transition to multi-junction and advanced heterojunction (HJT) cells, where process windows are extremely narrow. By deploying digital twins of manufacturing lines, equipment providers can simulate process variations and optimize recipes before physical implementation, significantly cutting down commissioning time and material wastage. This enhanced control allows manufacturers to push the boundaries of efficiency without compromising reliability, creating a competitive advantage for equipment suppliers offering embedded AI capabilities.

AI is transforming the lifecycle management of PV equipment, extending far beyond the initial manufacturing phase and into operational efficiency and predictive troubleshooting. Analyzing vast datasets generated by numerous sensors on deposition, etching, and sorting machines, AI models can detect subtle deviations indicative of potential process drift or mechanical wear before quality control metrics drop below acceptable thresholds. This proactive approach not only saves costs associated with scrapped modules but also maximizes the utilization rate of expensive capital assets. Consequently, PV equipment manufacturers are increasingly shifting their business models to offer comprehensive software and service packages built around intelligent, AI-powered equipment diagnostics.

- AI-driven Predictive Maintenance: Minimizing unplanned downtime by forecasting component failure based on real-time operational data.

- Real-Time Yield Optimization: Using machine learning to dynamically adjust process parameters (temperature, pressure, flow) within deposition and etching stages for maximum cell efficiency.

- Automated Visual Inspection (AVI): Employing deep learning for rapid and highly accurate defect detection (microcracks, impurities) in wafers and cells, surpassing human capability.

- Digital Twin Simulation: Creating virtual representations of production lines to optimize equipment layouts and process recipes before physical deployment.

- Supply Chain Forecasting: Utilizing AI to predict demand fluctuations and optimize inventory management for critical raw materials and spare parts, improving operational agility.

DRO & Impact Forces Of Photovoltaic (PV) Equipment Market

The Photovoltaic (PV) Equipment Market dynamics are dictated by a powerful interplay of drivers, restraints, and opportunities. The core driver is the sustained decline in the LCOE of solar power, making it economically attractive even without substantial subsidies in many regions. Restraints primarily involve the high initial capital investment required for establishing or upgrading production facilities, coupled with the inherent technological risk associated with rapid shifts (e.g., the quick obsolescence of PERC equipment in favor of TOPCon). Opportunities abound in supplying specialized equipment for emerging, high-efficiency technologies like tandem cells and perovskites, and catering to the expanding localized manufacturing efforts in North America and Europe aiming for supply chain security.

Driving forces are heavily influenced by governmental climate targets, particularly the net-zero pledges made by major economies, which translate directly into massive renewable energy deployment quotas, thus necessitating continuous PV manufacturing capacity expansion. This capacity increase directly fuels demand for highly efficient, automated equipment. Moreover, industry standardization efforts, such as the adoption of larger wafer sizes (M10, G12), drive widespread retooling and replacement cycles for existing machinery globally. The focus on energy independence, especially in Europe following geopolitical events, has reinforced the imperative to build domestic PV supply chains, creating immediate demand for complete manufacturing lines.

The main restraining factor, besides high capital expenditure, is the cyclical nature of the solar industry, where periods of oversupply can lead to significant price erosion for PV modules, causing manufacturers to postpone equipment investment. Furthermore, intellectual property rights and the complexity of integrating highly specialized process equipment from different global vendors pose significant integration challenges. However, the opportunity landscape is exceptionally strong, centered on next-generation manufacturing technology, including thin-film deposition tools for CIGS and CdTe, and advanced etching solutions crucial for producing high-performance heterojunction cells. Suppliers who can offer modular, scalable equipment platforms designed for flexibility in handling multiple cell architectures are best positioned to capitalize on future market needs. The imperative for 'green manufacturing,' reducing the energy and resource consumption of the equipment itself, also presents a substantial innovation opportunity.

Segmentation Analysis

The Photovoltaic (PV) Equipment Market is comprehensively segmented based on the product type of the equipment used across the manufacturing process, the specific PV cell technology employed, and the end-use application of the manufactured modules. Understanding these segments is crucial as capital expenditure decisions vary significantly depending on the desired throughput, efficiency targets, and scale of the operation. The market is primarily categorized into equipment used for Polysilicon Production, Wafer Production, Cell Production, and Module Production, reflecting the sequential stages of the PV value chain, with Cell Production equipment often seeing the highest rate of innovation and capital infusion due to continuous cell efficiency advancements.

Technologically, the market is segmented into Crystalline Silicon PV (c-Si) equipment and Thin-Film PV equipment. Crystalline silicon dominates the market, driving demand for furnaces, wire saws, and advanced cell processing tools for PERC, TOPCon, and HJT architectures. Thin-Film technology, including amorphous silicon (a-Si), Cadmium Telluride (CdTe), and Copper Indium Gallium Selenide (CIGS), requires distinct equipment such as PVD, CVD, and specialized laser scribing systems. While c-Si holds the majority share, thin-film continues to find stable demand in niche applications like BIPV and large-scale utility projects where specific performance characteristics (e.g., shading tolerance) are prioritized.

Finally, application segmentation divides demand into Utility Scale, Commercial, and Residential sectors. Utility-scale projects are responsible for the highest volume demand, driving the need for extremely high-throughput, standardized module assembly and cell equipment. The commercial and residential segments, while smaller in volume, often necessitate equipment capable of handling diverse module sizes and specifications, including aesthetic modules and specialized smaller batch requirements. The global push for distributed energy resources (DER) is expected to significantly bolster the commercial and residential segments, requiring manufacturers to maintain flexible, multi-purpose equipment lines.

- By Product Type:

- Polysilicon Production Equipment

- Wafer Production Equipment (Slicing, Grinding)

- Cell Production Equipment (PECVD, Diffusion, Etching, Metallization)

- Module Production Equipment (Laminators, Framing, Testing)

- By Technology:

- Crystalline Silicon PV (c-Si)

- Thin-Film PV (a-Si, CdTe, CIGS)

- By Application:

- Utility Scale

- Commercial

- Residential

Value Chain Analysis For Photovoltaic (PV) Equipment Market

The value chain of the PV Equipment Market is intrinsically linked to the solar manufacturing supply chain, beginning with upstream activities focused on raw material procurement and the fabrication of specialized components used within the equipment itself. Upstream analysis involves suppliers of high-purity quartzware, specialized gases, high-tolerance mechanical components (e.g., robotics, precision drives), and advanced optical systems necessary for machine functioning. Key equipment manufacturers rely heavily on a specialized pool of subcontractors for these components, ensuring the highest level of precision required for modern nanometer-scale solar cell processes. Managing the quality and timely delivery of these specialized parts is crucial for equipment manufacturers to meet their ambitious installation and commissioning timelines for PV producers globally.

The midstream is dominated by the Original Equipment Manufacturers (OEMs) who design, assemble, and integrate the complex machinery, such as PECVD reactors, diffusion furnaces, screen printers, and laminators. These OEMs focus intensely on research and development to improve throughput, reduce footprint, and enhance the process capability of their equipment to support new cell architectures like HJT and tandem cells. Distribution channels for this capital-intensive equipment are highly specialized, often involving direct sales models supplemented by exclusive regional agents or service partners due to the high complexity and the necessity for extensive after-sales support, installation, and process ramp-up assistance.

Downstream analysis involves the direct customers: the PV module and cell manufacturers. These manufacturers utilize the equipment to produce the finished solar products. The efficiency and reliability of the OEM equipment directly impact the downstream manufacturer's ability to compete on cost (LCOE) and quality. The distribution of the equipment itself (direct vs. indirect) typically favors direct distribution for major, highly customized production lines, ensuring tighter control over intellectual property and integration. However, indirect channels often handle smaller spare parts, consumables, and routine maintenance contracts, enabling broader geographical service coverage. The entire chain is characterized by long sales cycles and high switching costs once equipment is installed.

Photovoltaic (PV) Equipment Market Potential Customers

The primary customers and end-users of the Photovoltaic (PV) Equipment Market are large-scale, integrated solar cell and module manufacturers globally. These entities, spanning established industry giants and emerging players backed by national industrial policies, require specialized machinery to set up new production capacities or upgrade existing lines to accommodate higher efficiency standards. Customers include firms focused solely on ingot and wafer production (slicing equipment), dedicated cell manufacturers (deposition and etching equipment), and fully integrated module assemblers (laminators, framing systems).

In addition to traditional PV manufacturing firms, government-backed research institutes and national laboratories constitute a significant, though smaller, customer base. These organizations purchase specialized, often pilot-scale, R&D equipment to explore next-generation technologies like perovskites, multi-junction devices, and flexible solar films. Furthermore, independent service providers and large energy companies that invest in captive manufacturing facilities to secure their own supply chain are increasingly becoming major purchasers of PV equipment, especially in regions pursuing energy sovereignty, driving demand for turnkey factory solutions delivered by equipment vendors.

A crucial customer segment is the existing base of PV manufacturers who are undergoing technology transitions. As the industry pivots from standard p-type PERC cells to n-type structures like TOPCon and HJT, these existing facilities must purchase complex add-on equipment or entirely new production lines to remain competitive. Equipment obsolescence driven by rapid technological change ensures a continuous, high-value replacement market, even when physical capacity expansion temporarily slows down. These modernization projects constitute a highly valuable revenue stream for sophisticated equipment suppliers capable of managing complex integration projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 45.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Meyer Burger, AMAT, RENA Technologies, centrotherm photovoltaics AG, Wuxi Lead Intelligent Equipment, Eternal Sun, Manz AG, Komax, PVA TePla AG, Hanwha Q CELLS, JA Solar, Trina Solar, JinkoSolar, LONGi Green Energy, Canadian Solar, First Solar, Ascent Solar Technologies, SunPower, SolarEdge |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photovoltaic (PV) Equipment Market Key Technology Landscape

The Photovoltaic (PV) Equipment market is defined by several highly specialized and constantly evolving technological processes essential for increasing cell efficiency and decreasing manufacturing costs. A dominant technological trend is the rapid expansion of equipment designed for n-type cell architectures, specifically Tunnel Oxide Passivated Contact (TOPCon) and Heterojunction Technology (HJT). TOPCon requires sophisticated low-pressure chemical vapor deposition (LPCVD) or plasma-enhanced chemical vapor deposition (PECVD) tools for depositing the ultra-thin tunnel oxide and polysilicon layers. HJT, known for its high efficiency and low-temperature processing, demands specific PECVD equipment for amorphous silicon passivation layers and high-precision physical vapor deposition (PVD) or screen printing for metallization, differentiating the equipment needs substantially from legacy technologies.

Beyond core cell processing, key technologies include advanced wafer slicing equipment utilizing diamond wire technology, which has dramatically reduced kerf loss and wafer thickness while increasing slicing speed, driving down material costs. Furthermore, high-throughput automation and handling systems are critical, featuring robotic arms and vision systems capable of handling brittle, large-format wafers (M10 and G12) without breakage, maximizing yield in high-volume production lines. The industry is also witnessing innovation in non-contact metrology and inspection systems, often incorporating AI for real-time quality control, ensuring uniformity across large batches of cells and modules.

Looking ahead, the technological landscape is focused on equipment supporting tandem solar cells, particularly Silicon/Perovskite tandems, which promise efficiencies exceeding 30%. This requires equipment capable of depositing highly stable and uniform perovskite layers, potentially using advanced solution processing techniques like slot-die coating or specialized vacuum deposition methods. Equipment manufacturers are heavily investing in R&D to provide commercially viable tools for these frontier technologies. Moreover, the push for manufacturing sustainability is driving demand for equipment that operates at lower temperatures and consumes fewer harmful chemicals, aligning the equipment manufacturing process with broader environmental compliance goals and enhancing the overall green profile of solar energy production.

Regional Highlights

The global PV Equipment Market exhibits significant regional disparities in demand, primarily influenced by local government subsidies, energy policy stability, and existing manufacturing infrastructure. Asia Pacific (APAC), particularly China, dominates the global market landscape, both as the largest consumer of PV equipment due to massive, state-supported capacity expansion projects and as a major supplier of this machinery. China’s centralized manufacturing ecosystem allows for rapid scalability and competitive pricing, making it the primary hub for crystalline silicon equipment demand and supply. Other APAC countries like Vietnam, Thailand, and India are also expanding their PV manufacturing capabilities, spurred by national renewable targets and foreign investment seeking diversified supply chains, generating secondary hotspots for equipment procurement.

Europe represents a crucial growth region driven by the necessity for strategic autonomy and reducing reliance on foreign supply chains, underscored by initiatives such as the European Solar Initiative. While Europe has historically lagged in manufacturing capacity compared to Asia, recent policy support and funding mechanisms are encouraging the establishment of gigawatt-scale, high-efficiency production lines (often focusing on HJT and next-generation technologies). This region demands highly specialized, technologically advanced equipment that adheres to stringent European manufacturing standards and emphasizes sustainable operational practices. Germany, France, and Poland are key markets witnessing renewed investment in both wafer and cell production equipment.

North America, led by the United States, is experiencing a transformative phase fueled by significant policy interventions like the Inflation Reduction Act (IRA), which provides robust manufacturing tax credits across the entire PV supply chain—from polysilicon to module assembly. This has spurred major announcements for new domestic manufacturing facilities, creating unprecedented, immediate demand for all categories of PV equipment. Manufacturers are prioritizing equipment vendors who can guarantee rapid installation and compliance with U.S. domestic content requirements. Latin America and the Middle East and Africa (MEA) currently represent smaller, but rapidly emerging markets. MEA countries, particularly those in the GCC region, are investing heavily in large utility-scale projects and are beginning to establish localized module assembly, creating a stable but incremental demand for associated module production equipment.

- Asia Pacific (APAC): Market epicenter driven by China's dominant manufacturing capacity; focus on high-volume, cost-efficient c-Si equipment; substantial growth in India and Southeast Asia seeking capacity diversification.

- North America: Experiencing explosive growth in domestic manufacturing demand, directly stimulated by the US Inflation Reduction Act (IRA) tax credits; strong emphasis on equipment for high-efficiency cells (TOPCon, HJT).

- Europe: Strategic localization of supply chains, driven by energy sovereignty goals and Green Deal policies; demand concentrated on premium, technologically advanced, and highly automated HJT and tandem cell manufacturing equipment.

- Latin America: Emerging market focused primarily on utility-scale projects; stable demand for standardized module assembly equipment and basic cell production components.

- Middle East and Africa (MEA): Growth tied to large-scale solar project implementation (especially in Saudi Arabia and UAE); nascent but growing investment in localized module assembly and solar component production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photovoltaic (PV) Equipment Market.- Applied Materials

- Meyer Burger

- AMAT

- RENA Technologies

- centrotherm photovoltaics AG

- Wuxi Lead Intelligent Equipment

- Eternal Sun

- Manz AG

- Komax

- PVA TePla AG

- Hanwha Q CELLS

- JA Solar

- Trina Solar

- JinkoSolar

- LONGi Green Energy

- Canadian Solar

- First Solar

- Ascent Solar Technologies

- SunPower

- SolarEdge

- Maxwell Technologies (Zhonghuan Semiconductor)

- Von Ardenne

- Lead China

- ADAM Equipment Co. Ltd.

- Kojima Electric Mfg. Co., Ltd.

- Inteva

- Eurotron S.p.A.

- Wuxi Haiyuan

- J.v.G. Thoma GmbH

- DEK Solar

- CETC Solar Energy Holdings Co., Ltd.

- Shibaura Mechatronics

- Toyo Aluminium K.K.

- ISC Konstanz

- SolayTec

- Spire Corporation

Frequently Asked Questions

Analyze common user questions about the Photovoltaic (PV) Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the massive current capacity expansion in the PV Equipment market?

The expansion is primarily driven by global governmental mandates, notably net-zero emissions targets, which require vast increases in solar deployment. This is reinforced by the favorable economics of solar power (declining LCOE) and substantial policy support, such as the U.S. IRA and European initiatives aimed at establishing regional supply chain resilience against geopolitical risks.

Which cell technology shift is demanding the most significant equipment investment?

The transition from traditional p-type PERC cells to high-efficiency n-type architectures, specifically TOPCon (Tunnel Oxide Passivated Contact) and HJT (Heterojunction Technology), is driving the highest capital expenditure. This requires highly specialized equipment for ultra-thin layer deposition (LPCVD/PECVD) and advanced metallization processes.

How is AI and automation fundamentally changing PV equipment manufacturing processes?

AI is transforming PV manufacturing by enabling predictive maintenance, optimizing complex process parameters in real-time to maximize yield, and accelerating quality control through high-precision automated visual inspection (AVI). Automation is crucial for handling fragile, large-format wafers (M10/G12) efficiently and safely, minimizing breakage and maximizing throughput.

Which region dominates the PV Equipment market both in terms of consumption and supply?

Asia Pacific, particularly China, is the dominant region. China controls the largest share of global PV manufacturing capacity, making it the primary consumer of advanced equipment, while also housing the majority of the world's leading PV equipment suppliers due to robust industrial policies and scale advantages.

What are the key technological challenges facing PV equipment suppliers in the next five years?

Key challenges include developing commercially scalable equipment for next-generation tandem solar cells (Perovskite/Silicon), ensuring process stability for highly sensitive HJT production, and integrating sustainability features into equipment design to reduce energy consumption and chemical usage during cell manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager