Photovoltaic Welding Strip Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436603 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Photovoltaic Welding Strip Market Size

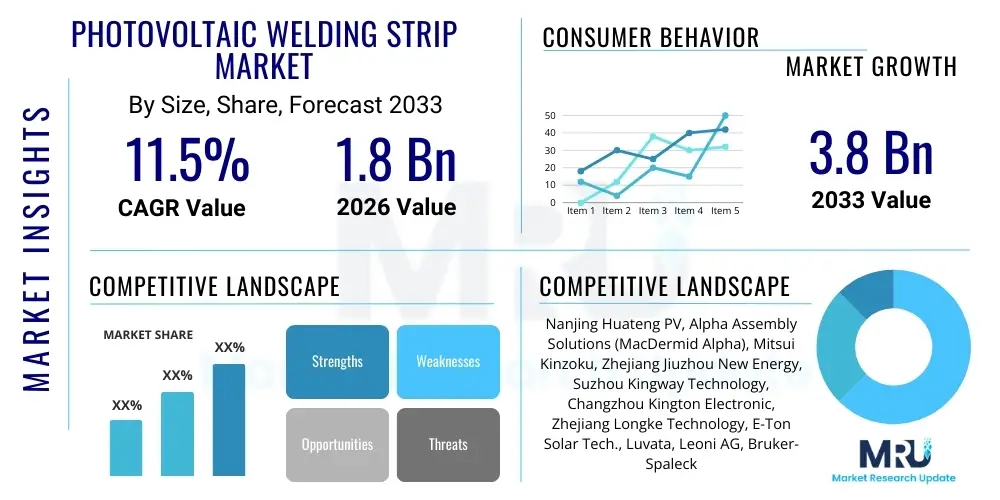

The Photovoltaic Welding Strip Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

Photovoltaic Welding Strip Market introduction

The Photovoltaic (PV) Welding Strip Market encompasses specialized conductive materials, primarily flat copper ribbons or wires, crucial for interconnecting individual solar cells within a PV module to form functional circuits. These strips, often referred to as tabbing and bussing ribbons, must possess high conductivity, optimal solderability, and mechanical stability to withstand thermal cycling and external environmental stresses over the module's lifespan. The integrity and efficiency of the entire solar panel are directly dependent on the quality and performance of these welding strips, making them a vital component in the balance of system (BOS) materials.

The primary application of these strips is in crystalline silicon PV module manufacturing, where tabbing strips are soldered directly to the front and back contacts of solar cells, facilitating current collection. Bussing strips then collect the power from the interconnected strings of cells and route it to the junction box. Technological advancements, such as the transition to multi-busbar (MBB) and half-cut cell configurations, necessitate thinner, more resilient, and sometimes coated strips to minimize shading losses and improve module efficiency. Benefits include optimized current flow, reduced resistive losses, and enhanced long-term module reliability under various climatic conditions.

Driving factors propelling market growth include aggressive global renewable energy targets, significant governmental subsidies and supportive policies encouraging solar adoption, and continuous reductions in the levelized cost of electricity (LCOE) derived from solar power. Furthermore, the relentless pursuit of higher module efficiency by major PV manufacturers, demanding high-performance materials like low-resistance tabbing ribbons and innovative encapsulation materials, sustains the demand trajectory. The increasing deployment of utility-scale solar farms and the expansion of distributed generation across residential and commercial sectors globally are foundational drivers supporting the sustained expansion of the Photovoltaic Welding Strip Market.

Photovoltaic Welding Strip Market Executive Summary

The Photovoltaic Welding Strip Market is characterized by intense innovation centered on improving conductivity and reducing material usage, driven primarily by the global imperative for decarbonization and energy transition. Business trends highlight the consolidation among key material suppliers capable of meeting stringent quality standards required for advanced module technologies like heterojunction (HJT) and TOPCon. Manufacturers are increasingly focusing on specialized coatings, such as tin/lead or lead-free alloys, and developing ultra-thin ribbon solutions to support multi-busbar architectures, thereby minimizing silver consumption on the cell surface and reducing shading effects, directly addressing cost pressures and efficiency demands within the competitive PV manufacturing sector.

Regional trends indicate that the Asia Pacific region, led by China, dominates both the production and consumption of welding strips due to the colossal scale of its integrated PV supply chain. Southeast Asian countries are emerging as significant secondary manufacturing hubs, attracting investment due to favorable trade conditions and lower operating costs, influencing global material flow. Europe and North America exhibit stable demand, characterized by a preference for high-quality, high-performance strips compatible with premium modules and adhering to strict regulatory requirements concerning material traceability and sustainability, including the push towards lead-free soldering solutions.

Segment trends reveal a rapid shift towards Tabbing Wire designed for Multi-Busbar (MBB) and highly automated production lines, offering superior flexibility and reduced thermal stress compared to conventional flat ribbon designs. The Copper material segment retains dominance due to its intrinsic high conductivity and cost-effectiveness. The Monocrystalline PV Modules application segment holds the largest share, aligning with the current dominant technology in large-scale solar deployment, while demand for strips optimized for Thin-Film PV Modules, though smaller, is showing growth driven by niche building-integrated photovoltaic (BIPV) applications requiring specialized connectivity solutions.

AI Impact Analysis on Photovoltaic Welding Strip Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can enhance the manufacturing precision, quality control, and supply chain efficiency of photovoltaic welding strips. Key concerns revolve around automating defect detection in ribbon coating and dimensioning, optimizing the soldering process parameters for different cell metallization schemes, and using predictive analytics to manage raw material (copper/tin) volatility. Users expect AI to reduce production waste, minimize variability in strip characteristics (critical for high-speed module assembly), and improve traceability throughout the value chain, ensuring that material performance precisely matches the specifications required for high-efficiency solar cells. The summarized theme points toward AI being a critical tool for achieving 'zero-defect' manufacturing and optimizing material utilization in a cost-sensitive market.

- AI-powered visual inspection systems enhance defect detection (e.g., coating inconsistencies, dimensional variances) on welding strips during high-speed production, significantly improving material quality assurance.

- Machine learning algorithms optimize the soldering temperature and pressure profiles in automated cell stringing processes, ensuring robust interconnectivity and minimizing thermal stress on advanced PV cells.

- Predictive analytics utilizing historical copper pricing, logistics data, and demand forecasts aid strip manufacturers in optimizing inventory levels and mitigating supply chain risks associated with volatile raw material costs.

- AI-driven simulation tools assist in designing new welding strip geometries (e.g., thinner, rounder profiles) that minimize shading losses and improve mechanical resilience under dynamic thermal load conditions.

- Implementation of smart manufacturing protocols allows for real-time monitoring and adjustment of plating thickness and alloy composition, leading to greater consistency and enhanced electrical performance of the final product.

DRO & Impact Forces Of Photovoltaic Welding Strip Market

The Photovoltaic Welding Strip Market dynamics are profoundly shaped by the synergistic impact of accelerating solar deployment (Driver) balanced against inherent raw material price volatility (Restraint). The core driver remains the immense global commitment to renewable energy targets, underpinned by technological advancements in solar cells requiring ever-higher precision in interconnection materials. However, the market faces significant restraint from the fluctuating price of copper, the primary raw material, and the intense cost pressure imposed by PV module manufacturers who operate on extremely thin margins, continuously demanding cheaper components. Opportunities arise from developing specialized, high-performance strips compatible with next-generation PV architectures like HJT and perovskites, which require non-standard soldering or bonding materials, and the growing demand for sustainable, lead-free products in regulated markets. These forces combine to push manufacturers towards high-volume, high-precision automated production systems to maintain competitiveness and profitability.

Drivers primarily revolve around systemic industry growth and technological progress. The decreasing cost of PV installations globally makes solar energy increasingly competitive, boosting module production volumes and, consequently, demand for welding strips. Furthermore, the shift towards Multi-Busbar (MBB) and large-format wafers necessitates optimized strip geometry and performance, creating niche high-value opportunities for innovative suppliers. Supportive policy frameworks, such as feed-in tariffs, net metering, and renewable portfolio standards across major economies like the U.S., E.U., and India, ensure a predictable, high-growth environment for solar component suppliers, reinforcing investment in production capacity and research focusing on enhanced material properties.

Restraints include the technological hurdle of maintaining high performance while transitioning to lead-free soldering, which can increase manufacturing complexity and cost. Additionally, the supply chain is highly sensitive to geopolitical tensions affecting copper sourcing and refining capacity, potentially leading to supply disruptions and cost surges. Market saturation in standard welding strip technologies further heightens competition, pressuring smaller manufacturers. Opportunities are realized through material diversification, exploring alternatives to pure copper or implementing proprietary coating techniques that improve long-term reliability. The focus on developing strips that integrate seamlessly with module assembly automation equipment represents a significant avenue for growth, particularly as production scales across Asia, facilitating high throughput and minimizing labor costs.

Impact forces are heavily skewed toward cost reduction and technological adaptation. The rapid iteration cycle in solar cell technology—moving from standard P-type cells to N-type technologies—forces strip manufacturers to constantly re-engineer their products to match new metallization schemes and cell layouts. The competitive rivalry within the PV supply chain dictates that cost efficiency is paramount; therefore, any innovation that reduces material consumption (e.g., thinner strips) or improves manufacturing yield provides a decisive market advantage. The environmental and regulatory impact forces are intensifying, particularly in Western markets, demanding environmentally compliant, recyclable, and low-toxicity materials, creating pressure to accelerate the transition away from conventional lead-based solder coatings.

- Drivers:

- Aggressive global solar capacity deployment and favorable governmental renewable energy policies.

- Technological shift towards high-efficiency PV modules (e.g., MBB, half-cut, TOPCon, HJT) requiring specialized interconnects.

- Continuous reduction in LCOE for solar power, driving up overall module manufacturing volumes.

- Restraints:

- Volatile global copper prices and sensitivity of raw material costs.

- Intense price competition and margin compression exerted by large PV manufacturers.

- Technical challenges associated with achieving high solderability and reliability using lead-free soldering alloys.

- Opportunity:

- Development and commercialization of ultra-thin, high-conductivity strips optimized for next-generation PV cell architectures.

- Expansion into emerging solar markets in Latin America, MEA, and Southeast Asia.

- Focus on sustainable and recyclable strip materials to meet stringent European regulatory standards.

Segmentation Analysis

The Photovoltaic Welding Strip Market is segmented based on product type, material composition, and the specific application within the solar module. This segmentation is crucial for understanding the market's technological evolution and commercial dynamics, as different module technologies demand specific strip characteristics. The segmentation reveals that the market is rapidly diversifying away from standard flat tabbing ribbons towards advanced wire-based solutions designed for multi-busbar technology, which offers enhanced current collection efficiency and superior aesthetics by reducing shadowing. Material composition largely remains dominated by high-purity copper, but innovative coating alloys are continually being introduced to improve cell contact and long-term durability, especially under high-temperature conditions.

By product type, the market is primarily divided into Tabbing Wire, Tabbing Ribbon (or Strip), and Bussing Wire/Ribbon. Tabbing strips are the core component, connecting cells in series, while bussing strips link cell strings to the junction box. The fastest-growing segment is the Tabbing Wire used in MBB modules, characterized by its circular or fine rectangular cross-section, enabling higher light capture and reducing localized stress points. The material segmentation focuses primarily on the conductivity and purity of the core metal, with copper being overwhelmingly preferred due to its superior electrical properties and established processing infrastructure, although copper alloys are utilized for enhanced mechanical strength or specific thermal requirements.

Application segmentation reflects the dominant technologies in PV manufacturing. Monocrystalline PV Modules currently represent the largest application area globally due to their high efficiency and widespread adoption in utility-scale projects and high-performance rooftop installations. While Polycrystalline PV Modules demand is slowing down due to cost-efficiency improvements in mono-Si, they still represent a significant installed base requiring replacement and repair components. The Thin-Film PV Module segment, though smaller, requires specialized, often wider, welding strips or foils to manage lower current density and integrate into novel flexible or specialized BIPV structures, presenting unique material handling and interconnection challenges for suppliers.

- By Product Type:

- Tabbing Wire (MBB, Thin Wire)

- Tabbing Ribbon (Conventional Flat Strip)

- Bussing Wire/Ribbon

- Plated Strip (Specialized Coatings)

- By Material:

- Copper (C11000 Grade, Oxygen-free Copper)

- Copper Alloy (For specific strength requirements)

- Aluminum (Niche applications in thin-film)

- By Application:

- Monocrystalline PV Modules (Dominant Segment)

- Polycrystalline PV Modules

- Thin-Film PV Modules

Value Chain Analysis For Photovoltaic Welding Strip Market

The value chain for the Photovoltaic Welding Strip Market begins upstream with the raw material extraction and processing, predominantly high-purity copper cathodes, followed by specialized tin and solder alloy manufacturing. The upstream segment is characterized by large global commodity markets and involves energy-intensive refining processes. Price volatility in copper profoundly influences the downstream cost structure. Key activities at this stage include wire rod drawing and specialized plating or coating formulation. Effective management of raw material procurement and hedging strategies is crucial for maintaining competitive pricing and ensuring supply stability across the chain.

The midstream phase involves the core manufacturing of the welding strip itself, where copper wire is precision-rolled or drawn into the required flat ribbons or fine wires, followed by sophisticated surface plating (typically tin or tin-silver alloys). This manufacturing stage is highly automated and precision-dependent, requiring stringent quality control to meet tight dimensional tolerances and coating uniformity critical for high-speed soldering processes at the module assembly stage. Manufacturers of PV welding strips often employ proprietary annealing processes and coating technologies to enhance conductivity, solderability, and resistance to environmental degradation, serving as the primary value-add link in the chain.

Downstream activities include the distribution channel, which utilizes both direct sales models and specialized third-party distributors. Direct sales are prevalent for supplying high-volume, tier-one PV module manufacturers who prefer direct contractual relationships to ensure material traceability and just-in-time delivery. Indirect channels involve regional distributors who cater to smaller module assemblers, repair services, and specialized BIPV integrators. The final consumers are the PV Module Manufacturers (the immediate buyers) and ultimately the EPC contractors and solar project developers who deploy the finished PV systems. Efficiency and reliability of the strips are tested and validated at the module manufacturing stage, forming a feedback loop critical for product continuous improvement.

Photovoltaic Welding Strip Market Potential Customers

The primary and immediate potential customers for photovoltaic welding strips are the integrated PV Module Manufacturers globally, ranging from Tier 1 giants like Jinko Solar, LONGi Green Energy, and Trina Solar, who consume massive volumes, to smaller, regional assembly houses. These customers are defined by their stringent quality requirements, high automation levels, and continuous pressure to reduce component costs while boosting efficiency. Suppliers must align their product development with the customer's cell technology roadmap (e.g., transition from PERC to TOPCon and HJT) to remain relevant, focusing on strips optimized for high throughput automated stringing machines and multi-busbar configurations.

A secondary, yet crucial, customer segment includes specialized PV repair and maintenance companies and independent module assemblers focused on niche markets (e.g., customized BIPV, flexible modules, or off-grid systems). These entities typically purchase smaller volumes through distribution networks and require a broader range of strip specifications, including traditional flat ribbons for legacy module repairs or specialized, custom-plated strips. This segment values rapid fulfillment, technical support, and product variety rather than sheer volume pricing, contrasting with the primary customer base.

Geographically, potential customers are highly concentrated in Asia Pacific, particularly China, which dominates the global PV manufacturing capacity. However, the resurgence of localized manufacturing initiatives in North America and Europe, driven by energy security and trade policies, presents highly attractive, albeit potentially smaller, customer segments willing to pay a premium for high-quality, locally sourced, or specialized low-carbon footprint materials, opening avenues for differentiated product offerings based on sustainability criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nanjing Huateng PV, Alpha Assembly Solutions (MacDermid Alpha), Mitsui Kinzoku, Zhejiang Jiuzhou New Energy, Suzhou Kingway Technology, Changzhou Kington Electronic, Zhejiang Longke Technology, E-Ton Solar Tech., Luvata, Leoni AG, Bruker-Spaleck GmbH, Solbond, Ulbrich Solar, G&S Technologies, Wuxi Suntech Power Co., Sanwa Material, Sumitomo Electric Industries, Heraeus Group, Wieland-Werke AG, Miasole. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photovoltaic Welding Strip Market Key Technology Landscape

The technological landscape of the Photovoltaic Welding Strip market is defined by continuous material science innovation aimed at maximizing current collection and minimizing optical losses. The shift from standard flat ribbons (with three or four busbars) to Multi-Busbar (MBB) wire technology is the most significant recent development. MBB utilizes nine, twelve, or even sixteen thinner, rounder wires, which reduces the path length for electrons, lowers resistive losses, and significantly enhances light utilization by minimizing shading effects compared to traditional wider strips. This evolution necessitates ultra-fine wire drawing and highly precise tin-plating processes that ensure robust and reliable connections adaptable to fully automated assembly lines without compromising cell integrity during soldering.

Another crucial technological focus is the development of optimized coatings and alloys. Traditional tin/lead solder coatings are facing phasedown mandates in various regions, driving the development of lead-free solutions, typically utilizing tin-silver-copper alloys or specialized low-melting-point solder pastes. These lead-free options must match or exceed the durability and wetting characteristics of conventional solders, posing a technical challenge due to higher processing temperatures or specific material compatibility issues with advanced cell metallization, such as those used in Heterojunction (HJT) technology. Welding strip manufacturers are investing heavily in R&D to tailor the coating composition and thickness specifically for N-type cells and half-cut module designs.

Advanced manufacturing techniques, including continuous casting, precision rolling, and highly controlled electrolytic or chemical plating, are central to the key technology landscape. Surface modification techniques, such as texturing the strip surface, are being explored to improve light trapping and further minimize reflection. Furthermore, technology convergence with smart factory solutions, including inline sensors and sophisticated process monitoring systems (often AI-enhanced), ensures that the produced strips consistently meet the extremely tight tolerances required for modern high-speed cell stringers, thereby guaranteeing the quality and lifespan of the resulting high-efficiency PV modules.

Regional Highlights

The regional analysis of the Photovoltaic Welding Strip Market reveals distinct consumption patterns and manufacturing dominance across key geographical areas, fundamentally driven by localized solar installation rates and the presence of major PV manufacturing clusters.

- Asia Pacific (APAC): APAC is the unquestioned global hub for both production and consumption, primarily driven by China, which houses the vast majority of the world's PV cell and module production capacity. High domestic solar installations in China and India, coupled with massive export volumes from Southeast Asia (Vietnam, Thailand, Malaysia), solidify APAC’s dominance. The region is characterized by high volume, aggressive pricing, and rapid adoption of the latest PV technology standards, such as MBB and N-type cell integration.

- Europe: Europe represents a high-value market segment emphasizing regulatory compliance and quality. While manufacturing capacity is smaller compared to APAC, demand is strong due to robust solar deployment policies and a clear preference for environmentally friendly materials, notably driving the demand for lead-free welding strips and materials with verifiable sustainable sourcing. Germany, Spain, and the Netherlands are key consumers, supporting both utility-scale and prosumer rooftop markets.

- North America: The market is influenced by trade policies, local content requirements (LCRs), and significant utility-scale project pipelines. Demand for welding strips is steadily increasing, fueled by renewable energy targets and the supportive investment framework provided by national legislation. Local manufacturing initiatives are leading to investments in North American strip production facilities, focusing on high-specification materials to serve the growing domestic module assembly base.

- Latin America: This region is an emerging high-growth consumer market, driven by favorable solar irradiation conditions and rapidly industrializing economies like Brazil, Mexico, and Chile. Consumption of PV modules, and thus welding strips, is growing rapidly due to the development of large utility-scale projects, although the region typically relies heavily on imported modules and components from APAC.

- Middle East and Africa (MEA): Growth is primarily concentrated in large, government-backed solar projects (e.g., in the UAE and Saudi Arabia). The extreme environmental conditions (high temperature, high dust) in this region necessitate strips with exceptional durability and corrosion resistance, pushing demand for highly reliable and specialized coated products suitable for desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photovoltaic Welding Strip Market.- Nanjing Huateng PV

- Alpha Assembly Solutions (MacDermid Alpha)

- Mitsui Kinzoku

- Zhejiang Jiuzhou New Energy

- Suzhou Kingway Technology

- Changzhou Kington Electronic

- Zhejiang Longke Technology

- E-Ton Solar Tech.

- Luvata

- Leoni AG

- Bruker-Spaleck GmbH

- Solbond

- Ulbrich Solar

- G&S Technologies

- Wuxi Suntech Power Co.

- Sanwa Material

- Sumitomo Electric Industries

- Heraeus Group

- Wieland-Werke AG

- Miasole

Frequently Asked Questions

Analyze common user questions about the Photovoltaic Welding Strip market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a photovoltaic welding strip in a solar panel?

The primary function of a PV welding strip (tabbing and bussing ribbon) is to electrically connect individual solar cells in series and parallel within a module, effectively collecting the generated current and routing it to the junction box with minimal resistive loss. They ensure mechanical stability and conductivity throughout the module’s operational lifespan.

How is the market influenced by the shift to Multi-Busbar (MBB) technology?

The shift to MBB technology significantly increases demand for thinner, often circular or fine rectangular, Tabbing Wires instead of traditional flat ribbons. This change improves module efficiency by reducing shading and lowering resistive losses, forcing manufacturers to adopt specialized, high-precision wire drawing and coating processes.

What are the key material trends concerning welding strips?

The key material trend involves maintaining high-purity copper cores while transitioning away from lead-based solder coatings to lead-free alternatives (typically SnAgCu alloys) to comply with environmental regulations, particularly in European and North American markets. There is also increased focus on developing specialized coatings for compatibility with advanced N-type solar cells.

Which geographical region dominates the consumption and production of PV welding strips?

The Asia Pacific (APAC) region, driven primarily by integrated PV manufacturing capacities in China and export hubs in Southeast Asia, dominates both the global production and consumption of photovoltaic welding strips due to its immense scale and cost competitiveness in the solar industry supply chain.

What factors determine the quality and performance of a welding strip?

Quality and performance are determined by material conductivity (low resistance), solderability (ability to form a strong, low-resistance bond with the cell), dimensional accuracy (critical for automation), and long-term durability against thermal cycling and moisture, which prevents degradation or cracking over 25 years.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager