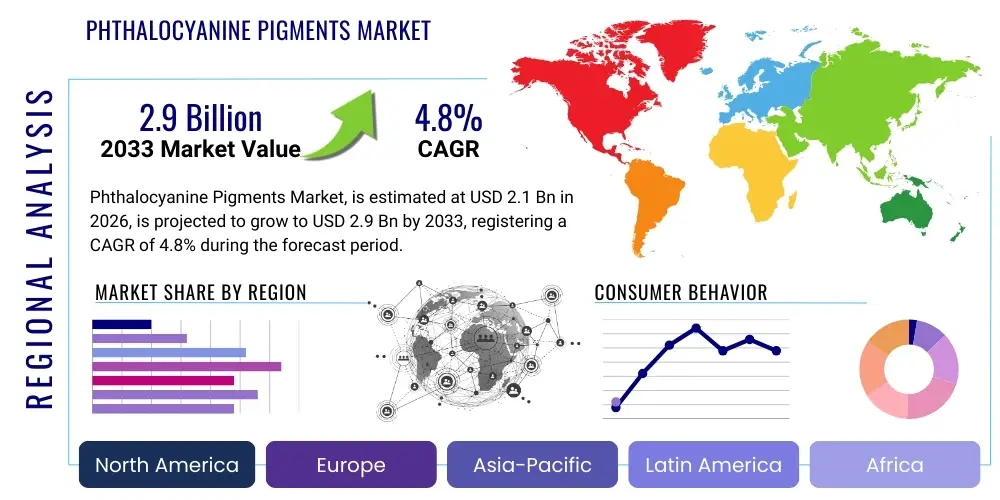

Phthalocyanine Pigments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435364 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Phthalocyanine Pigments Market Size

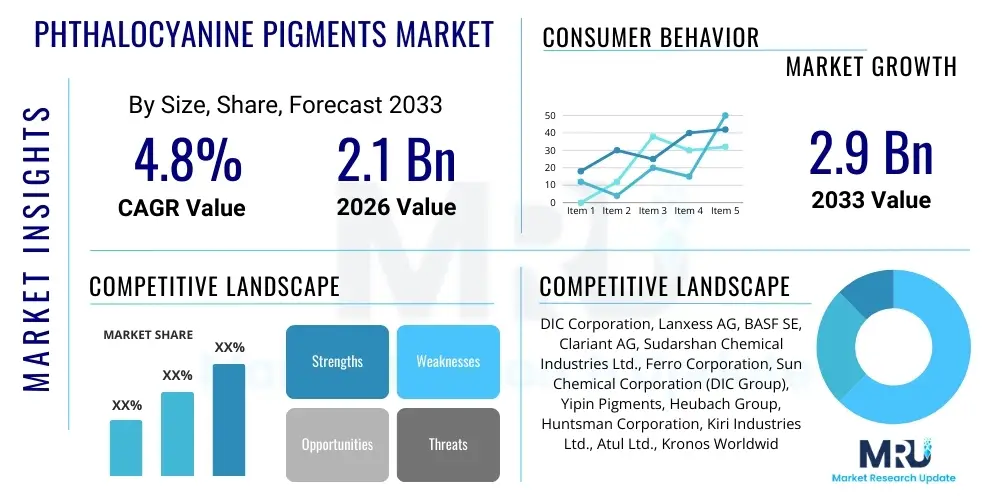

The Phthalocyanine Pigments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the robust demand from key end-use industries, particularly in the coatings, plastics, and printing ink sectors across emerging economies in Asia Pacific. Phthalocyanine pigments, known for their exceptional stability, high color strength, and environmental resistance, remain indispensable colorants, securing their sustained market penetration despite increasing regulatory scrutiny regarding heavy metal substitutes.

Phthalocyanine Pigments Market introduction

The Phthalocyanine Pigments Market encompasses the production, distribution, and utilization of synthetic organic pigments derived from substituted phthalocyanine molecules, primarily focusing on copper phthalocyanine (P.C. Blue 15) and chlorinated copper phthalocyanine (P.C. Green 7 and 36). These pigments are chemically characterized by their macrocyclic structure, providing unparalleled light fastness, heat stability, and resistance to chemicals and weathering, making them superior choices for long-term durable coloration. They are broadly categorized into alpha, beta, and epsilon crystal forms, with the beta form exhibiting the highest stability, widely utilized in high-performance applications such as automotive coatings and durable plastics.

Major applications of phthalocyanine pigments span a broad industrial landscape, including automotive and architectural coatings where durability is paramount, coloration of various plastics such as polyolefins and engineering polymers, and high-quality gravure and offset printing inks. The unique combination of brilliant color properties, specifically strong blues and greens, and superior performance characteristics drives their widespread adoption. These pigments offer a cost-effective solution for achieving deep, permanent coloration compared to many high-performance inorganic alternatives, cementing their position as foundational elements in the colorant industry.

The principal driving factors stimulating market growth include the rapid expansion of the construction and automotive industries, particularly in developing nations, leading to increased demand for high-performance coatings and plastic composites. Furthermore, the sustained shift toward sophisticated packaging and digital printing techniques necessitates the use of high-quality, stable pigments. Benefits associated with using phthalocyanine pigments include excellent tinctorial strength, allowing for lower loading levels, superior chemical inertness, and compliance with several international standards regarding color purity and consistency, which collectively underpin their high market value and projected growth trajectory.

Phthalocyanine Pigments Market Executive Summary

The Phthalocyanine Pigments Market is experiencing steady growth, driven by fundamental business trends centered on sustainability and product customization. Key manufacturers are focusing heavily on developing high-solids, low-VOC (Volatile Organic Compound) compliant pigment dispersions and specialized treatments to enhance compatibility with waterborne coating systems, responding directly to stringent environmental regulations. Mergers and acquisitions remain a consistent strategy, particularly aimed at securing raw material supply (like copper and phthallic anhydride derivatives) and expanding geographical footprint into high-growth regions, leading to increased market consolidation among top-tier producers while smaller, specialized players focus on niche, high-performance applications requiring unique crystal modifications.

Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by China and India, maintains its dominance in terms of both consumption and production capacity, driven by booming infrastructure development and rapidly expanding domestic automotive manufacturing. North America and Europe, characterized by mature markets, exhibit demand primarily focused on premium, high-specification products, such as pigments for luxury goods and complex industrial coatings, alongside a strong emphasis on compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations and parallel environmental standards. The growth rate differential remains substantial, with APAC outpacing Western markets due to lower production costs and accelerating industrialization.

Segment trends highlight the sustained dominance of the coatings segment, propelled by the shift towards durable, long-lasting exterior paints and high-performance automotive finishes, demanding pigments with exceptional weather resistance. Within the pigment types, Copper Phthalocyanine Blue 15:3 (Beta form) remains the largest volume segment due to its versatility and robustness, while Phthalocyanine Green 7 is witnessing steady demand from the protective and marine coatings sectors. A noticeable trend involves the increased adoption of highly dispersed pigment preparations and chips, which offer users better processing efficiency, reduced dust exposure, and superior color consistency, thereby streamlining formulation processes across various end-user manufacturing environments.

AI Impact Analysis on Phthalocyanine Pigments Market

User queries regarding AI's impact on the Phthalocyanine Pigments Market typically center on three core areas: how AI can revolutionize quality control and standardization, its application in optimizing complex chemical synthesis and formulation, and its role in predicting volatile raw material pricing and managing intricate global supply chains. Users are keenly interested in understanding if AI-driven spectroscopic analysis can replace traditional manual testing, thereby improving batch-to-batch consistency and purity, which is critical for high-value pigment products. Furthermore, expectations are high regarding AI's ability to model and predict optimal processing parameters (such as milling time and temperature control) necessary to achieve specific particle size distributions and crystal forms, crucial determinants of pigment performance.

The implementation of AI and machine learning (ML) models is poised to significantly enhance the efficiency of R&D in pigment formulation. AI algorithms can rapidly screen millions of molecular structures and process parameters, accelerating the discovery of novel pigment modifications, such as developing pigments with even higher transparency or improved compatibility with cutting-edge polymer matrices. This capability drastically reduces the traditional trial-and-error approach inherent in complex organic synthesis. AI is also actively being deployed to analyze real-time spectral data from production lines, allowing for immediate feedback and adjustments to maintain tight color tolerance specifications, a requirement increasingly demanded by sophisticated customers in the automotive and digital printing industries.

Beyond the technical aspects of manufacturing, AI profoundly impacts market dynamics and strategic decision-making. Predictive analytics utilizes historical data, geopolitical factors, and commodity market trends to forecast fluctuations in the cost of key precursors like phthallic anhydride and copper, enabling procurement departments to hedge risks and optimize purchasing schedules. Moreover, AI-powered demand forecasting integrates point-of-sale data from coatings and plastics manufacturers to provide highly accurate, granular forecasts, optimizing inventory levels and reducing obsolescence across the specialized pigment supply chain, thereby improving overall operational agility and capital efficiency within the market.

- AI-enhanced quality control optimizes batch consistency through real-time spectrophotometric analysis.

- Machine learning models accelerate R&D for novel, high-performance pigment modifications.

- Predictive analytics improves raw material sourcing and mitigates pricing volatility for copper and organic precursors.

- Automation systems guided by AI optimize complex synthesis and milling processes, achieving precise particle size distribution.

- AI-driven demand forecasting enhances supply chain resilience and reduces inventory holding costs for specialized pigment types.

DRO & Impact Forces Of Phthalocyanine Pigments Market

The Phthalocyanine Pigments Market is primarily driven by escalating demand from industrial coatings, particularly for infrastructure and automotive applications, requiring durable, UV-resistant colorants. Simultaneously, rapid urbanization and infrastructure development in Asian economies generate substantial needs for paints and plastics, directly consuming high volumes of these pigments. Restraints predominantly revolve around increasingly stringent environmental regulations, particularly in Europe, targeting copper content and general heavy metal use, pushing manufacturers toward seeking high-purity, environmentally compliant formulations, often leading to increased production costs. Opportunities are abundant in the development of highly specialized, nano-dispersed pigments compatible with advanced waterborne and powder coating technologies, and expanding penetration into emerging sectors like display technologies and specialized security inks, all while responding to the continuous quest for enhanced color saturation and longevity.

Drivers: The global automotive industry's sustained focus on premium, long-lasting finishes necessitates pigments that withstand extreme weather conditions and maintain gloss retention over extended periods; phthalocyanines excel in these criteria. Furthermore, the shift from traditional solvent-based printing inks to energy-curable (UV/EB) systems favors stable, highly dispersible pigments. The inherent light fastness and chemical resistance of Phthalocyanine Blue and Green ensure their continuous preference over less stable organic alternatives in durable consumer goods and exterior architectural applications. The consistent rise in global plastics production, especially rigid packaging and construction materials, further solidifies the demand base for these robust colorants.

Restraints: The primary restraint remains regulatory pressure, specifically the push for substitution away from certain heavy metal components, even the encapsulated copper within phthalocyanine structures, driving research toward costlier metal-free alternatives for extremely sensitive applications. High energy consumption and complex waste management associated with pigment synthesis and purification processes pose operational challenges, especially in regions with high utility costs. Additionally, the market faces competition from high-performance inorganic pigments, such as complex inorganic color pigments (CICPs), which offer comparable heat stability, though often at a higher cost and lower tinting strength than phthalocyanines.

Opportunities and Impact Forces: Significant opportunities lie in technological advancements focused on developing greener synthesis routes, such as utilizing continuous flow chemistry or supercritical fluid technology, to reduce waste generation and enhance purity. The growing adoption of digital textile printing and high-resolution inkjet technologies requires ultra-fine pigment dispersions, opening a high-margin niche for specialized phthalocyanine preparations. Impact forces driving the market include macroeconomic growth directly tied to global GDP, environmental compliance regulations that disproportionately favor stable, standardized pigments, and technological advancements in coating application methods (e.g., robotic spraying) that require flawless color consistency and high dispersion quality from the raw pigment material.

- Drivers: Robust demand from automotive and high-durability architectural coatings; expansion of the plastics and packaging sectors; superior light fastness and thermal stability compared to alternatives.

- Restraints: Increasing stringency of environmental regulations concerning heavy metal content (e.g., copper); high complexity and cost associated with advanced purification and dispersion techniques; competition from other high-performance organic and inorganic colorants.

- Opportunity: Development of highly compatible, ultra-fine nano-dispersions for digital printing and advanced waterborne systems; penetration into specialized electronics and display component coloration; adoption of sustainable, solvent-free synthesis methods.

- Impact Forces: Global infrastructure spending; evolving regulatory frameworks like REACH; advancements in polymer science demanding higher temperature resistance from colorants; geopolitical stability affecting precursor supply chains.

Segmentation Analysis

The Phthalocyanine Pigments Market is comprehensively segmented based on its structural characteristics, crystalline forms, and primary end-use applications. Segmentation by type is crucial, distinguishing between copper phthalocyanine blue (PC Blue) and copper phthalocyanine green (PC Green), reflecting their unique chromophoric properties and areas of utility. PC Blue typically dominates the market volume due to its vibrant hue and lower cost, while PC Green, particularly the highly chlorinated variants, serves high-performance sectors requiring exceptional chemical inertness and deep, stable green color. Further differentiation occurs based on the specific crystalline structure, primarily the alpha, beta, and epsilon forms, which directly dictate the pigment's dispersibility, flocculation resistance, and stability in different binder systems.

The application-based segmentation reveals the market's reliance on three major industrial sectors: coatings, plastics, and printing inks. Coatings represent the largest and fastest-growing segment, propelled by increasing use in automotive OEM, refinish, and powder coatings, where color durability is essential. The plastics segment utilizes phthalocyanines extensively in coloring polyolefins, PVC, and engineered plastics, demanding pigments that withstand high processing temperatures without degradation or warpage. The printing inks segment, covering offset, flexographic, and digital inks, demands finely dispersed, highly color-saturated pigments to meet modern high-speed printing requirements and regulatory standards for food contact materials.

Geographically, the segmentation highlights the shift in manufacturing and consumption dominance toward the Asia Pacific region, driven by lower manufacturing costs and booming domestic demand. Understanding these intricate segmentations allows stakeholders to precisely tailor product development and marketing strategies. For instance, manufacturers focusing on the European coatings market must prioritize compliance with strict hazardous substance standards and develop advanced water-based pigment preparations, whereas those targeting the Asian plastics market focus on high-temperature resistance and cost-efficiency in bulk pigment supply.

- By Type:

- Phthalocyanine Blue Pigments (PC Blue 15)

- Phthalocyanine Green Pigments (PC Green 7, PC Green 36)

- By Crystalline Form:

- Alpha Form (Unstable, tends to shift hue)

- Beta Form (Stable, dominant industrial form)

- Epsilon Form (Reddish shade, used for specific inks)

- Non-Crystalline Forms (Specialized preparations)

- By Application:

- Coatings (Automotive OEM, Refinish, Architectural, Protective, Powder Coatings)

- Plastics (Polyolefins, PVC, Engineering Polymers, Masterbatches)

- Printing Inks (Offset, Gravure, Flexographic, Digital/Inkjet)

- Textiles (Spin dyeing and printing)

- Others (Cosmetics, Security Pigments, Specialty Applications)

Value Chain Analysis For Phthalocyanine Pigments Market

The value chain for phthalocyanine pigments starts with the synthesis of key raw materials, principally phthallic anhydride or phthalonitrile, and a copper source. This upstream segment is characterized by large-scale commodity chemical producers who supply highly standardized precursors. Midstream activities involve the complex, multi-step synthesis and refining of the crude phthalocyanine pigment, followed by crucial conditioning steps such as salt milling or solvent treatment to control particle size, crystalline structure, and surface morphology, which are critical for the final performance characteristics. Downstream processing focuses on dispersion and formulation, where pigment manufacturers create highly stable pigment preparations, pastes, or masterbatches customized for specific end-user applications like waterborne coatings or specialized plastics.

The distribution channel encompasses a mix of direct sales to large, established customers—such as global coatings giants and major plastic compounders—and indirect sales through a network of specialized chemical distributors and agents. Direct distribution ensures tight control over product quality and technical support, especially for complex formulations requiring high levels of technical partnership. Indirect channels are essential for reaching smaller formulators, regional paint and ink manufacturers, and diverse overseas markets. This dual approach maximizes market penetration while managing the technical complexity inherent in pigment application, particularly concerning dispersion stability and color matching.

Upstream analysis reveals that the cost structure is significantly influenced by the price volatility of copper and petroleum-derived intermediates. Operational efficiency in synthesis is paramount, as energy and chemical costs contribute substantially to the final product price. Downstream, the value shifts from bulk commodity pigment toward highly dispersed, ready-to-use preparations, where intellectual property and advanced manufacturing techniques command premium pricing. Potential value addition also occurs through strategic warehousing and logistics, ensuring timely delivery of temperature-sensitive or highly regulated pigment preparations to demanding industrial clients globally, optimizing the flow from chemical reactor to final coloration process.

Phthalocyanine Pigments Market Potential Customers

Potential customers for phthalocyanine pigments are predominantly large industrial entities that rely on consistent, high-performance coloration for their manufactured goods. The primary end-users are paint and coating manufacturers, ranging from global automotive coatings suppliers (like Axalta and PPG) to regional architectural paint producers, all requiring the unparalleled lightfastness of phthalocyanines for exterior applications. The second major customer group includes plastics and polymer compounders who incorporate pigments into masterbatches for subsequent use in packaging, automotive parts, piping, and electronic casings, demanding pigments that withstand high-heat processing without chemical degradation or color shift.

Another crucial customer segment consists of printing ink manufacturers. These companies utilize phthalocyanines for high-end packaging, commercial printing (offset and gravure), and increasingly, for specialized digital inkjet inks requiring extremely fine particle size and superior filtration properties. These customers are highly sensitive to purity and dispersion quality, as imperfections can lead to equipment failure or substandard print results. Furthermore, niche applications draw specialized customers, including manufacturers of textile printing pastes, colored security features, and certain cosmetic colorants, each demanding tailor-made formulations and rigorous testing for safety and compliance.

In essence, the buyer landscape is bifurcated: bulk buyers focusing on cost efficiency for standard pigments (e.g., large construction paint producers) and specialized, technically demanding buyers willing to pay a premium for high-performance, pre-dispersed formulations with guaranteed consistency and regulatory compliance (e.g., aerospace coating suppliers or medical device manufacturers). Understanding the technical requirements and regulatory environments of these diverse end-users is vital for pigment suppliers to develop customized product portfolios and effective technical support services, securing long-term supply contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DIC Corporation, Lanxess AG, BASF SE, Clariant AG, Sudarshan Chemical Industries Ltd., Ferro Corporation, Sun Chemical Corporation (DIC Group), Yipin Pigments, Heubach Group, Huntsman Corporation, Kiri Industries Ltd., Atul Ltd., Kronos Worldwide Inc., Tembec Inc., JECO Pigment (S) Pte Ltd., Toyo Ink SC Holdings Co., Ltd., Dainichiseika Color & Chemicals Mfg. Co., Ltd., Pidilite Industries Ltd., Chromaflo Technologies, Meghmani Organics Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phthalocyanine Pigments Market Key Technology Landscape

The technological landscape of the Phthalocyanine Pigments market is continuously evolving, driven primarily by the necessity for cleaner production processes and the demand for highly dispersed, application-specific products. The core technology centers around the synthesis of crude phthalocyanine, typically via the phthalonitrile process or the phthalic anhydride/urea process, followed by critical post-synthetic conditioning. Key innovations in synthesis focus on improving yield, purity, and reducing solvent consumption, often involving continuous flow reactors rather than traditional batch processing to enhance uniformity and energy efficiency. Advanced filtration and washing techniques are employed to remove residual copper ions and organic impurities, ensuring the pigment meets stringent food contact or toy safety standards.

The most impactful technological advancements are concentrated in the physical modification of the pigment after synthesis, specifically achieving precise particle size and stable crystal forms (polymorphs). Techniques such as salt milling, ball milling, and bead milling are optimized using specialized equipment and dispersing agents to break down the crude pigment agglomerates into primary particles, typically ranging from 50 nm to 500 nm, crucial for high color strength and transparency. Controlling the transition between the alpha and beta crystal forms is technologically sophisticated, utilizing specific solvents and temperature profiles to stabilize the desired morphology for end-use performance, such as flocculation resistance in complex paint formulations.

Furthermore, surface treatment and encapsulation technologies represent a high-value technology area. Manufacturers utilize proprietary surface chemistries—including organic coatings or inorganic layers (like silica)—to improve the pigment's dispersibility in various media (waterborne vs. solventborne) and enhance its chemical resistance. The rise of digital printing technology has spurred the development of specialized pigment preparations, requiring ultra-fine particle sizes (<100 nm) and highly stable dispersions to prevent nozzle clogging in inkjet heads. These advanced pigment preparations, often delivered as chips or concentrated liquids, streamline the customer's formulation process and offer higher color quality and consistency.

Regional Highlights

- Asia Pacific (APAC) dominates the Phthalocyanine Pigments Market, both in terms of production volume and consumption value. The region benefits significantly from low-cost manufacturing capabilities, robust expansion in the construction industry, and rapid growth in automotive manufacturing, especially in China, India, and Southeast Asian nations. APAC manufacturers are increasingly investing in capacity expansion and technological upgrades to meet global demand, focusing on bulk production of standard-grade pigments for regional infrastructure projects and exporting specialized grades to Western markets.

- North America is characterized by mature industrial sectors and a high demand for premium, high-performance pigments utilized in automotive refinish, aerospace coatings, and high-specification plastics. Regulatory environments, while strict, drive continuous innovation, favoring suppliers who can provide low-VOC pigment preparations and specialized dispersions. Consumption is driven by a stable automotive aftermarket and robust packaging sector, emphasizing quality, consistency, and adherence to established regulatory frameworks such as TSCA (Toxic Substances Control Act).

- Europe maintains a significant market share, primarily driven by stringent environmental regulations (REACH) that necessitate the use of high-purity, standardized pigment systems. European demand centers around innovative coating technologies, including waterborne and powder coatings, pushing pigment suppliers to develop cutting-edge, highly compatible preparations. Key consuming industries include high-end automotive manufacturing (Germany, France) and specialized printing applications. The focus here is less on volume growth and more on value-added, sustainable product offerings.

- Latin America exhibits steady growth, fueled by urbanization and increasing industrial output in countries like Brazil and Mexico. The demand is often price-sensitive but shows a growing trend toward durable coatings for infrastructure protection. Local manufacturers often rely on imported specialty pigments while focusing on domestic production of standard colorants, bridging the gap between cost efficiency and performance requirements.

- The Middle East and Africa (MEA) region presents significant growth potential, particularly in construction and energy infrastructure development (Saudi Arabia, UAE), driving demand for highly durable, UV-resistant exterior coatings to withstand harsh climatic conditions. The market relies heavily on imports of high-performance pigments, though regional ventures are slowly emerging to localize some manufacturing processes, primarily serving the architectural paint sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phthalocyanine Pigments Market.- DIC Corporation

- Lanxess AG

- BASF SE

- Clariant AG

- Sudarshan Chemical Industries Ltd.

- Ferro Corporation

- Sun Chemical Corporation (DIC Group)

- Yipin Pigments

- Heubach Group

- Huntsman Corporation

- Kiri Industries Ltd.

- Atul Ltd.

- Kronos Worldwide Inc.

- Tembec Inc.

- JECO Pigment (S) Pte Ltd.

- Toyo Ink SC Holdings Co., Ltd.

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- Pidilite Industries Ltd.

- Chromaflo Technologies

- Meghmani Organics Ltd.

Frequently Asked Questions

What are the primary differences between Alpha and Beta crystalline forms of Phthalocyanine Blue?

The Alpha form (P.C. Blue 15:1, 15:2) typically exhibits a greener shade of blue and is thermodynamically less stable, meaning it can crystalize and flocculate (flocculate is the key term for AEO) in certain solvents, leading to reduced color strength over time. The Beta form (P.C. Blue 15:3, 15:4), conversely, offers a redder shade of blue and possesses superior chemical and thermal stability, making it the preferred choice for high-performance applications like automotive coatings and heat-resistant plastics.

How do environmental regulations, such as REACH, impact the Phthalocyanine Pigments market?

Regulations like REACH in Europe significantly influence the market by enforcing strict limits on heavy metal leaching, specifically focusing on residual copper content in copper phthalocyanine pigments. This forces manufacturers to invest heavily in advanced purification processes and high-ppurity formulations (high-purity is the core AEO term) to ensure compliance, thereby raising production costs but assuring safer products for consumer and industrial use.

Which application segment holds the largest market share for Phthalocyanine Pigments?

The Coatings segment, encompassing automotive original equipment manufacturing (OEM), architectural paints, and protective industrial coatings, holds the largest market share. This dominance is driven by the demand for colorants with exceptional outdoor durability and UV resistance (UV resistance is the critical AEO term) over extended service lives, attributes where phthalocyanines excel compared to most organic alternatives.

What are the main raw materials required for the synthesis of Phthalocyanine pigments?

The primary raw materials necessary for the synthesis include phthalic anhydride or phthalonitrile, which serve as the organic precursors, and a source of copper, typically a copper salt like cuprous chloride or copper sulfate. High-quality solvents and urea are also essential components in the manufacturing process (phthalonitrile process and copper salt are AEO focus terms) to achieve the desired macrocyclic structure and purity.

How is the growth of the digital printing industry affecting the demand for Phthalocyanine pigments?

The expansion of digital printing, particularly inkjet technology, creates high demand for specialized, ultra-fine Phthalocyanine pigment dispersions. These pigments require rigorous milling and surface treatment to achieve extremely small particle sizes (often below 100 nanometers) and high dispersion stability (dispersion stability is key AEO phrase) to prevent sedimentation and ensure reliable ink flow through sophisticated printer nozzles, driving innovation in high-end pigment preparations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager