Physical Examination Center Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433689 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Physical Examination Center Market Size

The Physical Examination Center Market is experiencing robust expansion, fundamentally driven by the global paradigm shift towards preventive healthcare and early disease detection. Increased public awareness regarding lifestyle diseases, coupled with growing disposable incomes in emerging economies, has catalyzed the demand for routine comprehensive health checks. These centers are evolving from simple diagnostic facilities into comprehensive wellness management hubs, integrating advanced imaging techniques and personalized risk assessment tools. Regulatory mandates, particularly those related to corporate health benefits and occupational safety, further underpin the foundational growth of this market segment.

The market trajectory is significantly influenced by technological advancements, including the adoption of high-throughput testing platforms, digitized patient records (EMR/EHR integration), and streamlined appointment scheduling systems. Independent diagnostic centers, characterized by their efficiency and patient-centric services, are successfully competing with traditional hospital-based services by offering specialized, often more affordable, check-up packages. This competitive landscape drives continuous innovation in service delivery and geographical expansion into previously underserved urban and semi-urban areas.

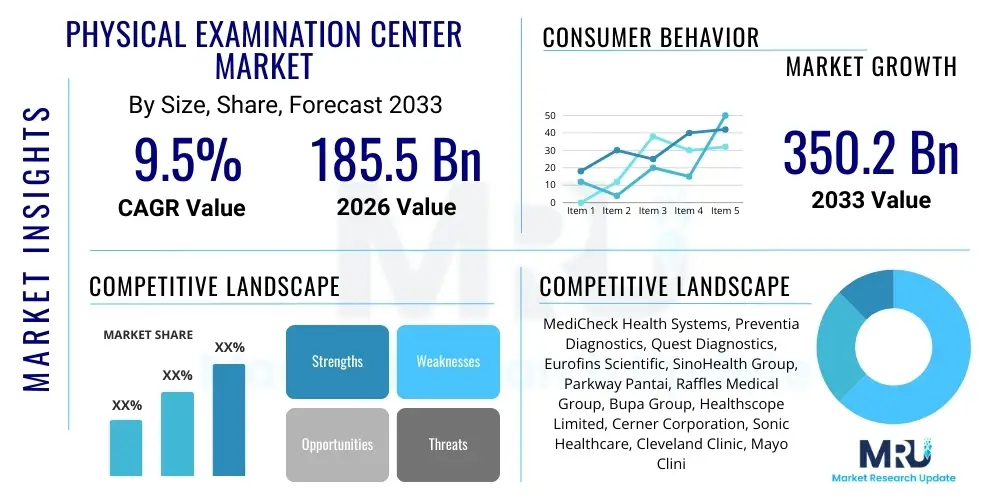

The Physical Examination Center Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $185.5 Billion USD in 2026 and is projected to reach $350.2 Billion USD by the end of the forecast period in 2033. This growth highlights the sustained investment by private equity firms and healthcare conglomerates seeking to capitalize on the stable, recurring revenue streams generated by corporate contracts and aging population needs.

Physical Examination Center Market introduction

The Physical Examination Center Market encompasses dedicated facilities and outsourced service providers offering comprehensive health assessments, including diagnostic testing, medical imaging, and preventative counseling. These centers provide structured check-ups ranging from basic routine screenings to highly specialized examinations targeting specific disease risks, such as cardiovascular or oncological conditions. Key product offerings include blood chemistry analysis, physiological measurements, urinalysis, radiological assessments, and consultations with general practitioners or specialists. The market is primarily application-driven, catering to mandatory annual corporate health programs, individual voluntary wellness checks, pre-employment screenings, and specialized disease monitoring programs designed for high-risk demographics.

Major applications of these services revolve around risk stratification and chronic disease management. By establishing baseline health parameters and identifying risk factors early, these centers play a critical role in reducing the burden of later-stage healthcare intervention. The benefits extend beyond individual health, contributing to decreased corporate absenteeism, lower overall healthcare expenditure for insurers, and improved public health outcomes. Driving factors include the escalating prevalence of non-communicable diseases (NCDs) like diabetes and hypertension, increased government expenditure on public health initiatives, and consumer preference for convenient, centralized diagnostic services separate from acute hospital settings.

The core business model of a modern Physical Examination Center (PEC) is built on efficiency, accuracy, and patient experience. Integration with digital platforms is crucial, allowing patients to schedule appointments, receive results securely, and access personalized health recommendations. The evolution of PECs reflects a broader societal movement toward proactive health management, positioning these services as indispensable tools in maintaining workforce productivity and improving longevity in an increasingly aging global population.

Physical Examination Center Market Executive Summary

The Physical Examination Center Market is defined by strong business trends centered on consolidation, digitalization, and specialization. Leading healthcare providers are actively acquiring independent centers to expand geographic reach and capture economies of scale, leading to heightened competition focused on standardized quality and technological superiority. A significant business trend involves the shift towards subscription-based wellness models, encouraging annual recurring revenue from loyal corporate clients and high-net-worth individuals. Digitalization efforts are prioritizing Artificial Intelligence (AI) integration in diagnostic interpretation and patient flow management, optimizing operational costs and enhancing diagnostic accuracy across high-volume facilities.

Regional trends indicate that the Asia Pacific (APAC) region is experiencing the most rapid market growth, fueled by massive urbanization, a booming middle class prioritizing health, and government policies (especially in China and India) supporting health tourism and preventative screening. North America and Europe, while mature, exhibit trends towards specialized precision medicine check-ups, focusing on genetic risk assessment and highly detailed imaging techniques, often through premium-priced services. Latin America and MEA are seeing substantial investment in infrastructure, driven by multinational corporations establishing regional offices requiring robust employee health programs, thereby expanding the regional service base.

Segment trends confirm that independent Physical Examination Centers (IPECs) hold a substantial market share due to their flexibility and ability to offer highly customized packages, contrasting with the more generalized offerings of hospital-affiliated units. Disease screening remains the dominant application segment, particularly for cardiovascular and metabolic disorders. Furthermore, the corporate wellness segment is witnessing significant growth, as employers increasingly view preventative check-ups not as an expense, but as a critical investment in human capital retention and productivity maintenance, driving demand for tailored, on-site, or mobile examination services.

AI Impact Analysis on Physical Examination Center Market

User inquiries regarding AI's influence in the Physical Examination Center Market frequently center on themes of diagnostic reliability, data privacy, and the future role of human physicians. Key concerns revolve around the accuracy of AI algorithms in interpreting complex medical images (like mammograms or CT scans) compared to specialists, and how integrated AI systems will handle massive volumes of sensitive patient data while ensuring compliance with regulations such as HIPAA or GDPR. Users also express high expectations for AI to deliver personalized health risk predictions derived from combining genetic, biometric, and lifestyle data, moving beyond standardized recommendations to truly customized preventative plans. Furthermore, there is significant interest in how AI can streamline the user experience, from intelligent scheduling and resource allocation within centers to instant result delivery and automated follow-up scheduling, reducing wait times and administrative bottlenecks.

The primary impact of AI adoption is manifesting in enhanced diagnostic throughput and minimized human error in routine tasks. AI-powered image analysis tools can quickly flag anomalies in radiological scans (X-rays, MRIs), serving as a crucial second opinion for physicians and increasing the efficiency of report generation. This speeds up the examination process, allowing centers to handle larger patient volumes without compromising quality. Moreover, AI excels at identifying subtle patterns in laboratory data that might indicate early-stage disease markers, significantly improving the sensitivity and specificity of screening protocols, which is the core value proposition of PECs.

AI is also revolutionizing operational and patient engagement aspects. Predictive analytics are being deployed to forecast equipment maintenance needs, optimize staff scheduling based on anticipated patient flow, and manage inventory of consumables. From a patient perspective, sophisticated chatbots and virtual assistants, trained on large medical datasets, are providing instant, preliminary answers to common health queries and guiding patients through pre-exam preparation, thereby improving patient compliance and overall satisfaction with the service delivery ecosystem.

- Enhanced Diagnostic Accuracy: AI algorithms improve the interpretation of medical imaging and laboratory results, particularly for identifying subtle early-stage diseases.

- Operational Efficiency: Automated scheduling, resource allocation, and patient queue management reduce operational costs and patient wait times.

- Personalized Risk Assessment: Integration of AI models to correlate genetic data, lifestyle factors, and examination results for highly customized health recommendations.

- Data Integration and Management: AI facilitates the seamless handling and analysis of large datasets (EMR/EHR), improving health record integrity and accessibility.

- Predictive Maintenance: Use of machine learning to forecast equipment failures and optimize maintenance schedules, minimizing service disruption.

DRO & Impact Forces Of Physical Examination Center Market

The Physical Examination Center Market is significantly shaped by a powerful confluence of Driving forces (D), Restraints (R), and Opportunities (O), which collectively dictate market growth and evolution, forming the critical Impact Forces. Key drivers include the massive global demographic shift toward an aging population, which inherently requires more frequent and comprehensive health screenings, and the rising global prevalence of chronic diseases demanding early intervention through routine check-ups. Further impetus comes from increasingly mandatory corporate wellness programs and strong government endorsement of preventative care policies intended to mitigate skyrocketing long-term healthcare costs. These drivers create a stable, increasing demand base for PEC services globally.

However, the market faces several significant Restraints. High capital expenditure required for acquiring advanced diagnostic equipment, such as MRI and CT scanners, poses a barrier to entry, particularly for smaller independent centers. Furthermore, the lack of standardized regulatory frameworks across different geographies regarding the scope and quality of comprehensive physical examinations leads to fragmentation and difficulties in ensuring consistent service delivery. The acute shortage of highly skilled healthcare professionals, including specialists and technicians capable of operating sophisticated equipment and interpreting complex results, represents a critical constraint on expansion velocity, especially in emerging markets.

Opportunities for growth are concentrated around leveraging digital transformation and expanding service scope. The integration of telehealth and remote monitoring services allows PECs to offer follow-up consultations and continuous data collection outside the physical center, enhancing patient lifetime value. Strategic opportunities lie in developing highly niche, specialized screening centers focused on specific high-risk groups (e.g., personalized cancer screening or executive wellness programs) and expanding into underserved rural areas through mobile examination units. The critical impact forces driving future success revolve around technology adoption—specifically, integrating AI and genomics into standard screening packages to offer a superior, predictive service model.

Segmentation Analysis

The Physical Examination Center Market is extensively segmented based on the service type, the type of provider delivering the service, and the primary application driving the consumer demand. Understanding these segments is crucial for market participants to tailor their offerings, optimize pricing strategies, and target specific consumer demographics effectively. The complexity of modern health checks necessitates distinct categories, moving beyond simple generalized examinations to highly personalized and specialized diagnostic pathways that cater to specific risk profiles and employer mandates. The segmentation highlights the market’s maturity and the intense competition among various provider models, from small, specialized labs to large, integrated hospital networks.

Service Type segmentation differentiates centers based on the breadth and depth of the tests offered, determining the technology level and staffing required. Provider segmentation indicates the ownership and operational structure, which significantly influences cost structure, perceived quality, and patient access channels. Finally, Application segmentation reflects the ultimate purpose of the examination, distinguishing between regulatory-driven checks (like pre-employment) and consumer-driven checks (like annual wellness), which informs marketing strategy and pricing tiers. This multi-dimensional analysis provides a clear map of consumer needs and structural market dynamics, aiding strategic investment decisions in equipment and geographic expansion.

- By Service Type:

- Routine (Basic Blood Work, Vitals, Standard Check-ups)

- Comprehensive (Advanced Imaging, Cardiovascular Screening, Tumor Markers)

- Specialized (Genetic Screening, Executive Health Programs, Travel Health)

- By Service Provider:

- Hospital-affiliated Centers

- Independent Physical Examination Centers (IPECs)

- Corporate Wellness Centers (On-site/Mobile Units)

- By Application:

- Annual Corporate Health Check-ups

- Disease Screening and Risk Assessment (e.g., Cancer, Cardiac, Diabetes)

- Pre-employment and Insurance Medicals

- Individualized Wellness Programs

Value Chain Analysis For Physical Examination Center Market

The value chain for the Physical Examination Center Market is structured into several critical phases, starting with the upstream supply of essential resources and culminating in the highly integrated service delivery to the end-consumer. The upstream segment involves the procurement of high-value capital equipment, including sophisticated diagnostic imaging machines (MRI, CT, Ultrasound) and laboratory testing systems (chemistry and hematology analyzers). Key suppliers here are global medical device manufacturers and specialized reagent/consumable providers. Strategic relationships at this stage are vital, focusing on quality, equipment maintenance contracts, and technological upgrades to ensure competitive service capability.

The core process segment involves the operational execution of the physical examination, including patient registration, sample collection, diagnostic analysis, physician interpretation, and the compilation of the final health report. Efficiency in this phase is paramount and heavily relies on robust IT infrastructure, primarily Electronic Health Records (EHR) systems, Laboratory Information Management Systems (LIMS), and efficient workflow protocols. Direct and indirect distribution channels dictate how the services reach the consumer. Direct channels involve self-referred individuals or walk-in patients, while indirect channels are dominated by significant B2B contracts with corporations, insurance providers, and government agencies, which funnel large volumes of patients to the centers.

The downstream segment focuses on the delivery of results and post-examination support, crucial for patient satisfaction and adherence to preventative measures. This includes secure online portals for result access, follow-up consultations (often via telehealth), and referral networks to specialized medical providers for identified issues. Patient data security and seamless integration with external healthcare systems are the dominant challenges in the downstream value chain. Success is measured not just by the quality of the diagnosis, but by the convenience and continuity of care provided to the end-user/buyer.

Physical Examination Center Market Potential Customers

The potential customer base for Physical Examination Centers is highly diverse, spanning both large institutional buyers and individual consumers seeking proactive health management. Institutional buyers, representing the largest volume drivers, primarily include large multinational corporations and small-to-medium enterprises (SMEs) that require mandatory annual health checks for their employees to comply with occupational safety laws and minimize health-related productivity losses. Government agencies and public sector organizations are also significant buyers, commissioning health screenings for civil servants and implementing large-scale public health campaigns focused on specific diseases, such as diabetes or hypertension.

Beyond the corporate sphere, major insurance providers and healthcare payers constitute a critical end-user group. These entities frequently partner with PECs to offer subsidized or mandated preventative screenings to their policyholders, recognizing that early detection significantly reduces the cost of expensive acute care later on. This relationship drives service standardization and volume scalability. Additionally, academic institutions, particularly those requiring health clearance for student admissions or research participation, represent a specialized segment of institutional demand.

Individual consumers form the third core segment, driven primarily by increasing health literacy and disposable income, particularly among affluent and middle-aged demographics globally. These consumers voluntarily seek comprehensive, specialized health packages (often termed 'executive physicals' or 'wellness screenings') focused on optimizing lifestyle and managing age-related health risks. They value convenience, privacy, and highly detailed diagnostic reports, often favoring independent centers that offer a premium, concierge-like experience over busy hospital settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Billion USD |

| Market Forecast in 2033 | $350.2 Billion USD |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MediCheck Health Systems, Preventia Diagnostics, Quest Diagnostics, Eurofins Scientific, SinoHealth Group, Parkway Pantai, Raffles Medical Group, Bupa Group, Healthscope Limited, Cerner Corporation, Sonic Healthcare, Cleveland Clinic, Mayo Clinic (Wellness Programs), LifePoint Health, CommonSpirit Health, DaVita Inc., RadNet, HCA Healthcare, Fresenius Medical Care, Labcorp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Physical Examination Center Market Key Technology Landscape

The technological landscape within the Physical Examination Center Market is characterized by a rapid integration of digital health solutions aimed at enhancing precision, speed, and patient comfort. Central to this evolution is the deployment of advanced Electronic Medical Records (EMR) and Electronic Health Records (EHR) systems, often integrated with specialized Laboratory Information Management Systems (LIMS). These integrated platforms ensure seamless data flow from the moment a sample is collected to the final report generation, drastically reducing administrative burden and minimizing errors associated with manual data entry. Furthermore, the adoption of Point-of-Care Testing (POCT) devices is increasing, allowing certain routine tests to be performed quickly on-site without relying on external centralized laboratories, thus speeding up the overall turnaround time for patients.

High-throughput screening technologies, including sophisticated automated immunoassay and clinical chemistry analyzers, form the backbone of diagnostic services, enabling centers to process massive volumes of blood and urine samples efficiently. Beyond laboratory equipment, advanced medical imaging technologies, particularly low-dose CT scanners and high-resolution ultrasound machines, are essential for specialized screenings. These devices require sophisticated software for image processing and often utilize cloud computing infrastructure for storage and remote consultation by specialized radiologists. The competitive advantage is increasingly shifting toward centers that adopt the latest generation of equipment, offering faster scan times and higher diagnostic accuracy.

The frontier of technology integration lies in personalized health monitoring and artificial intelligence. Wearable technology and digital biomarkers are being integrated into wellness packages, allowing centers to collect longitudinal data on patient activity, sleep, and physiological markers beyond the brief examination window. AI and machine learning tools are not only used for image analysis but also for generating personalized health reports and predicting future health risks by analyzing complex data sets from genomics, proteomics, and patient history. Centers that effectively leverage these predictive analytics capabilities are positioning themselves as leaders in preventative medicine, driving higher customer retention and attracting premium clientele.

Regional Highlights

- North America: This region is a mature market characterized by high consumer awareness, robust corporate wellness mandates, and a strong preference for specialized, premium executive health check-up services. Technological adoption is high, with rapid integration of AI for diagnostics and extensive utilization of EHR systems. The US dominates, driven by significant private sector investment and a high prevalence of lifestyle-related diseases requiring frequent screening.

- Europe: The market is stable, largely influenced by government-funded universal healthcare systems that promote standardized preventative screening protocols. Growth is concentrated in Western Europe (Germany, UK) due to the aging population and increasing expenditure on proactive health. The shift towards genetic testing and personalized preventative programs is a key growth driver, despite regulatory complexity across the European Union member states.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by expanding healthcare infrastructure, rising disposable incomes, and increasing health literacy in populous countries like China and India. The demand is massive, driven by both corporate necessity and the need to screen for diseases linked to rapid urbanization and environmental factors. Governments actively support the expansion of independent diagnostic centers to alleviate pressure on overburdened hospital systems.

- Latin America (LATAM): Market growth is steady, though fragmented, dependent heavily on regulatory shifts and economic stability within individual countries. Key drivers include the emergence of medical tourism hubs and growing awareness of preventative measures among the middle class. Investment is focused on establishing centralized, high-volume centers in major metropolitan areas to standardize care quality.

- Middle East and Africa (MEA): Growth is primarily concentrated in the GCC states (UAE, Saudi Arabia) due to high government investment in healthcare infrastructure and high rates of chronic metabolic diseases (e.g., diabetes). The market relies heavily on expatriate health insurance mandates and the establishment of international medical franchises that adhere to high global standards of care, driving demand for technologically advanced screening equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Physical Examination Center Market.- MediCheck Health Systems

- Preventia Diagnostics

- Quest Diagnostics

- Eurofins Scientific

- SinoHealth Group

- Parkway Pantai

- Raffles Medical Group

- Bupa Group

- Healthscope Limited

- Cerner Corporation

- Sonic Healthcare

- Cleveland Clinic (Wellness Programs)

- Mayo Clinic (Preventive Medicine)

- LifePoint Health

- CommonSpirit Health

- DaVita Inc.

- RadNet

- HCA Healthcare

- Fresenius Medical Care

- Labcorp

Frequently Asked Questions

Analyze common user questions about the Physical Examination Center market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Physical Examination Center Market?

The market is primarily driven by the increasing global shift toward preventative healthcare, mandated corporate wellness programs, and the rising prevalence of chronic lifestyle diseases requiring early detection and risk stratification.

How is technology impacting the efficiency of Physical Examination Centers?

Technology significantly boosts efficiency through AI-powered diagnostic image analysis, integrated EMR/LIMS systems for seamless data management, and automated patient scheduling, resulting in faster turnaround times and reduced operational costs.

Which segmentation dominates the Physical Examination Center Market?

By application, Disease Screening and Risk Assessment dominate, as these services directly address the high-value need for early detection of pervasive conditions like cardiovascular disease, cancer, and diabetes, crucial for cost savings in long-term care.

What are the main regulatory challenges faced by Physical Examination Centers?

The main challenges include the lack of consistent international standards for comprehensive physical examination protocols, coupled with stringent and evolving data privacy regulations (like GDPR and HIPAA) concerning the secure handling of sensitive patient health information.

Which geographic region presents the highest growth potential for PEC investments?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, offers the highest growth potential due to rapid urbanization, expanding middle-class spending power on health, and substantial governmental and private sector investments in preventative health infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager