Physician Dispensed Cosmeceuticals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435942 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Physician Dispensed Cosmeceuticals Market Size

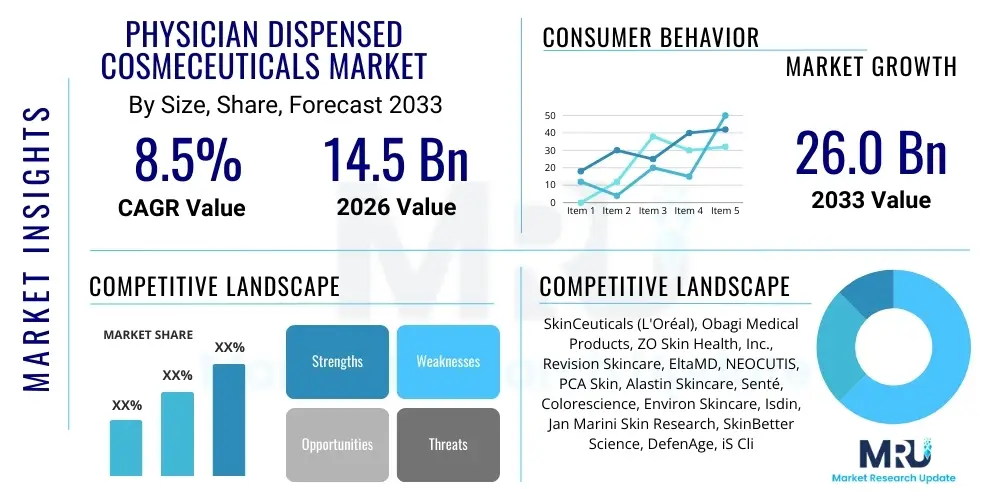

The Physician Dispensed Cosmeceuticals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 14.5 billion in 2026 and is projected to reach USD 26.0 billion by the end of the forecast period in 2033.

Physician Dispensed Cosmeceuticals Market introduction

The Physician Dispensed Cosmeceuticals Market encompasses professional-grade skincare and hair care products that are exclusively sold or recommended through licensed dermatologists, plastic surgeons, medical spas, and other licensed medical professionals. Unlike over-the-counter (OTC) or department store cosmetics, these products contain higher concentrations of active ingredients, often supported by clinical research, such as growth factors, advanced antioxidants, retinoids, and peptides. These formulations are specifically designed to address complex skin concerns—including aging, hyperpigmentation, acne, and photodamage—and complement professional procedures like chemical peels, laser treatments, and microneedling, ensuring optimal patient outcomes and maintenance of clinical results.

The core benefit of these products lies in the personalized recommendation and oversight provided by a healthcare professional, ensuring that the patient receives a regimen tailored to their specific skin type and therapeutic needs, minimizing potential irritation or adverse reactions associated with high-potency ingredients. Major applications include anti-aging treatments (wrinkle reduction, firmness improvement), skin brightening, acne management, and post-procedure recovery. The primary driving factor is the increasing consumer awareness regarding the efficacy of science-backed skincare, coupled with the rising global expenditure on aesthetic procedures and the expanding role of cosmetic dermatology in mainstream healthcare.

Furthermore, the perceived trustworthiness and clinical validation associated with products dispensed directly by physicians significantly boost consumer confidence and willingness to invest in higher-priced solutions. The shift towards non-invasive aesthetic procedures creates a sustained demand for potent ancillary products that prolong and enhance the effects of clinical interventions. Product descriptions typically highlight pharmaceutical-grade ingredients, proprietary delivery systems (like liposomal encapsulation), and evidence-based efficacy data, positioning these cosmeceuticals as a bridge between conventional cosmetics and prescription medications.

Physician Dispensed Cosmeceuticals Market Executive Summary

The Physician Dispensed Cosmeceuticals Market is experiencing robust growth, primarily driven by strong business trends focusing on vertical integration and direct-to-consumer models facilitated by medical professionals. Key business trends include pharmaceutical companies and traditional cosmetic manufacturers acquiring smaller, specialty cosmeceutical brands to gain immediate access to professional distribution channels, ensuring market penetration among high-value patient populations. The COVID-19 pandemic accelerated the adoption of telemedicine and online consultations, allowing physicians to maintain product recommendations and sales through e-commerce platforms linked directly to their practices, optimizing inventory management and enhancing patient convenience. Innovation in ingredient technology, particularly around microbiome science and regenerative ingredients like exosomes, is creating premium pricing opportunities and differentiating professional products from mass-market offerings.

Regionally, North America remains the dominant market, characterized by high consumer spending power, strong acceptance of cosmetic procedures, and a highly established network of dermatologists and plastic surgeons. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by increasing disposable incomes, a burgeoning middle class prioritizing aesthetic health in countries like China and South Korea, and the rapid expansion of medical aesthetic clinics. European markets exhibit maturity but are characterized by strict regulatory standards (e.g., EU cosmetic regulations), which favor clinically proven and physician-validated product lines, maintaining steady demand within the professional channel. Latin America is also emerging due to increasing access to specialized medical aesthetics services.

Segment trends highlight the dominance of the skincare segment, specifically anti-aging products and sun protection (broad-spectrum SPF formulations), as fundamental components of any physician-recommended regimen. Serums and creams are the most frequently dispensed product forms due to their high concentration capabilities and ease of incorporation into daily routines. Furthermore, the acne treatment segment is experiencing significant innovation, moving beyond traditional salicylic acid and benzoyl peroxide to incorporate advanced anti-inflammatory and barrier-repair ingredients, catering to adult acne sufferers seeking gentle yet effective solutions. The rising demand for specialized treatments for sensitive or post-procedural skin is also a notable segment growth driver.

AI Impact Analysis on Physician Dispensed Cosmeceuticals Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Physician Dispensed Cosmeceuticals Market frequently revolve around personalization, clinical validation, and supply chain efficiency. Users are keenly interested in how AI algorithms can analyze patient data—including genetic predispositions, lifestyle factors, and real-time skin metrics (via specialized imaging devices)—to formulate highly customized, or even 3D-printed, cosmeceutical products dispensed by the physician. Concerns often focus on data privacy when utilizing deep learning for skin analysis and the ethical considerations of algorithmic product recommendations. Expectations are high concerning AI's ability to streamline inventory management for medical practices, predict patient compliance, and assist in identifying which ingredients offer the maximum therapeutic benefit for a specific individual, thereby justifying the high price point of professional products and enhancing consumer trust in the diagnostic process.

- AI-driven Personalized Diagnostics: Utilization of machine learning to analyze high-resolution facial images and patient health records for precise skin condition mapping and personalized regimen creation.

- Predictive Inventory Management: AI algorithms optimizing stock levels in physician offices by forecasting patient demand based on procedure schedules and seasonal trends, minimizing waste and ensuring product availability.

- Enhanced R&D Efficiency: AI accelerating the discovery of novel bioactive ingredients and predicting their efficacy and safety profiles through virtual screening and simulation, speeding up clinical validation processes.

- Custom Formulation Platforms: Enabling physicians to utilize generative AI interfaces to create unique, patient-specific compound formulations on demand, moving beyond standard product lines.

- Improved Patient Compliance Monitoring: AI-powered applications tracking patient usage patterns and providing personalized reminders or educational content, increasing adherence to the prescribed cosmeceutical routine.

DRO & Impact Forces Of Physician Dispensed Cosmeceuticals Market

The market is dynamically shaped by potent drivers, strict restraints, and substantial opportunities, all of which are managed through interconnected impact forces. The primary driver is the accelerating consumer preference for high-efficacy, science-backed skincare solutions, moving away from purely aesthetic products towards therapeutic cosmeceuticals recommended by trusted medical authority figures. This is strongly supported by the increasing number of minimally invasive aesthetic procedures globally, where physician-dispensed products are essential for both pre-conditioning and post-procedure maintenance, maximizing the investment in clinical treatments. Opportunity lies significantly in penetrating emerging economies, particularly in Asia, where rising disposable incomes coupled with increasing skin health consciousness are unlocking vast untapped patient populations, demanding sophisticated and clinically proven products.

However, significant restraints temper the market’s exponential potential. The primary restraint is the high cost of physician-dispensed products compared to mass-market or high-end retail cosmetics, which limits accessibility for budget-conscious consumers. Furthermore, the regulatory landscape is fragmented; cosmeceuticals often occupy a gray area between cosmetics and pharmaceuticals, leading to complexities in marketing claims, clinical substantiation requirements, and international trade. This ambiguity necessitates rigorous internal testing and compliance protocols for manufacturers seeking global distribution.

The collective impact forces—comprising market saturation in developed urban centers, intense competitive pressure from premium direct-to-consumer brands that mimic medical claims, and shifts in consumer confidence based on economic stability—dictate market momentum. Technology serves as a fundamental impact force, driving innovation in delivery systems (e.g., nanotechnology, microencapsulation) that enhance ingredient penetration and stability, ensuring the superiority of professional formulations over retail alternatives. The perceived impact force of professional endorsement remains paramount; maintaining the exclusivity and clinical focus of distribution channels is critical to reinforcing the premium positioning and justifying the higher average selling price.

Segmentation Analysis

The Physician Dispensed Cosmeceuticals Market is strategically segmented based on product type, formulation, end-user, and distribution channel, providing granular insights into consumer preferences and medical practice procurement patterns. The segmentation by product type reveals that skincare dominates, reflecting the fundamental role of dermatologists and plastic surgeons in managing topical skin health. Within skincare, anti-aging and sun protection products are perennial leaders due to universal applicability and the need for daily maintenance against extrinsic factors. Formulation-wise, high-potency products like serums and concentrates, which are best suited for deep delivery of active ingredients, command the largest market share, indicating consumer willingness to pay a premium for perceived efficacy.

Segmentation by end-user differentiates between products used for professional procedures (clinical use) versus those prescribed for home care (patient use), with home care constituting the vast majority of dispensed revenue. The primary distribution channel remains the professional channel, specifically medical spas and standalone dermatology/plastic surgery clinics, highlighting the crucial gatekeeping role physicians play in product access. Analyzing these segments is essential for manufacturers to tailor their R&D investments, focus marketing efforts toward specific professional communities, and optimize supply chain logistics to meet the unique needs of medical practices.

- By Product Type:

- Skincare (Anti-aging, Acne Treatment, Sun Protection, Skin Brightening, Moisturizers)

- Haircare (Hair Growth Serums, Scalp Treatments)

- Body Care

- By Formulation:

- Serums and Concentrates

- Creams and Lotions

- Gels and Cleansers

- Toner and Mists

- By End User:

- Dermatology Clinics

- Plastic Surgery Clinics

- Medical Spas and Aesthetic Centers

- Hospitals

- By Distribution Channel:

- Physician Offices/Clinics (Direct Sales)

- Medical Spas

- E-commerce Platforms (Affiliated with Clinics)

Value Chain Analysis For Physician Dispensed Cosmeceuticals Market

The value chain for physician-dispensed cosmeceuticals is highly structured, emphasizing rigorous research and a tightly controlled downstream distribution network. The upstream segment is defined by specialized raw material procurement, focusing on pharmaceutical-grade ingredients, proprietary biotechnology assets (like advanced peptides or growth factors), and complex delivery system components (e.g., specialized liposomes or microcapsules). Manufacturers invest heavily in clinical trials and in-house laboratories to substantiate efficacy claims, differentiating their products from general cosmetics. This specialized sourcing and manufacturing process establishes a high barrier to entry and justifies premium pricing.

The downstream analysis is centered on the exclusive distribution channel, where the products move directly from manufacturers or authorized distributors to the medical professional (dermatologist, plastic surgeon). This direct channel ensures product integrity, limits counterfeiting, and allows for continuous professional education regarding product use and patient selection. Direct distribution is crucial because the physician acts as both the point of sale and the critical educator, providing customized advice that reinforces product value and usage protocols, which is not possible in retail settings.

The distribution channels are predominantly direct (manufacturer to physician) or through specialized medical distributors who strictly service the professional aesthetic market. Indirect distribution through affiliated e-commerce platforms managed by the clinic is increasingly common, allowing patients to conveniently reorder prescribed products while maintaining the physician's oversight. Potential customers, the end-users, are typically high-income individuals, patients undergoing or maintaining aesthetic procedures, and consumers who prioritize science-backed solutions over traditional beauty products, recognizing the efficacy superiority associated with the professional channel.

Physician Dispensed Cosmeceuticals Market Potential Customers

The primary customers for physician-dispensed cosmeceuticals are patients already engaged in or considering medical aesthetic treatments, recognizing that topical treatments are integral to achieving and maintaining optimal results. These customers typically demonstrate high disposable income, an active interest in advanced skincare technology, and a strong preference for product recommendations validated by medical expertise rather than celebrity endorsements or retail advertising. The demographic skews towards adults aged 35 and above, highly concerned with intrinsic and extrinsic aging signs, hyperpigmentation, and texture irregularities. A critical segment includes individuals with sensitive or compromised skin conditions, such as severe rosacea, persistent acne, or those requiring intensive post-procedure wound healing and barrier repair, where OTC products are deemed insufficient or potentially irritating.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 26.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SkinCeuticals (L'Oréal), Obagi Medical Products, ZO Skin Health, Inc., Revision Skincare, EltaMD, NEOCUTIS, PCA Skin, Alastin Skincare, Senté, Colorescience, Environ Skincare, Isdin, Jan Marini Skin Research, SkinBetter Science, DefenAge, iS Clinical, Epionce, VI Aesthetics, Rodan + Fields (Professional Line), Glytone |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Physician Dispensed Cosmeceuticals Market Key Technology Landscape

The Physician Dispensed Cosmeceuticals Market is continually defined by technological innovation focused on enhancing ingredient bioavailability, stability, and targeted delivery deep into the skin's layers. A critical technological advancement is the widespread adoption of advanced delivery systems, such as proprietary liposomal and microsphere encapsulation technologies. These systems protect highly volatile active ingredients, like Vitamin C or retinol, from degradation and ensure their controlled, sustained release precisely where they are needed, minimizing systemic absorption and reducing the irritation potential often associated with high concentrations. This technology is foundational for justifying the efficacy claims of professional products.

Furthermore, biotechnology plays a significant role, particularly in the development and synthesis of novel growth factors, specialized peptides, and recombinant proteins (e.g., human epidermal growth factor) that mimic the body's natural signaling processes to stimulate collagen production and cellular repair. Research into exosome technology is currently a frontier, offering ultra-potent, non-cellular communication vesicles that promise superior regenerative and anti-inflammatory effects. Nanotechnology is also leveraged to micronize ingredients, facilitating better absorption without occlusive residues, particularly in specialized sunscreens utilizing mineral blockers.

Finally, the integration of diagnostics with technology—such as high-resolution imaging devices used in-clinic to assess skin barrier function, hydration levels, and subsurface pigmentation—is transforming product recommendation. These technologies provide quantifiable data, enabling physicians to select and dispense products with unparalleled precision, moving the consultation from subjective assessment to objective, data-driven prescription. This technological alignment between diagnostic tools and product formulation strengthens the clinical relevance of the physician-dispensed channel.

Regional Highlights

The global Physician Dispensed Cosmeceuticals Market exhibits distinct regional dynamics driven by economic prosperity, regulatory environments, and cultural attitudes toward aesthetic medicine. North America, particularly the United States, holds the largest market share globally due to a high density of aesthetic practitioners, permissive consumer attitudes toward medical intervention for cosmetic purposes, high healthcare spending, and sophisticated marketing by leading professional brands. This region dictates many of the global trends in ingredient technology and professional educational standards.

Europe represents a mature market characterized by stringent regulatory oversight that mandates strong clinical evidence for product claims. Countries like Germany, France, and the UK demonstrate steady demand, focusing heavily on anti-aging and preventative care. The emphasis here is often on natural, scientifically rigorous ingredients, aligning with a generally conservative, yet high-quality, aesthetic consumer base. European growth, while slower than APAC, is stable due to the deep integration of dermatologists into the general healthcare system.

Asia Pacific (APAC) is the fastest-growing market segment, primarily propelled by South Korea, China, and Japan. Factors driving this growth include rising middle-class disposable incomes, a strong cultural emphasis on flawless skin (especially in East Asia), and the rapid expansion of aesthetic clinics and medical spas. Unlike Western markets, APAC often shows higher demand for skin brightening, pigmentation correction, and post-laser recovery products. Latin America and the Middle East & Africa (MEA) are emerging regions, where market growth is accelerating due to the increasing westernization of beauty standards and expanding access to specialized medical aesthetic services in major urban centers, though regulatory hurdles and economic variability remain present.

- North America: Market dominance due to high adoption rates of cosmetic procedures, extensive clinical infrastructure, and consumer willingness to invest in premium, professional-grade products.

- Asia Pacific (APAC): Highest CAGR driven by booming aesthetic industries in China and South Korea, coupled with strong demand for skin tone correction and protective formulations.

- Europe: Stable growth underpinned by stringent clinical standards, focusing on established, evidence-based anti-aging and barrier-supportive cosmeceuticals.

- Latin America: Emerging growth potential fueled by rising economic stability and increasing popularity of aesthetic medical procedures, requiring professional maintenance products.

- Middle East & Africa (MEA): Growth concentrated in wealthy Gulf Cooperation Council (GCC) nations, driven by high aesthetic expenditure and demand for advanced sun protection and hyperpigmentation solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Physician Dispensed Cosmeceuticals Market.- SkinCeuticals (L'Oréal Group)

- Obagi Medical Products (Ortho Dermatologics/Bausch Health)

- ZO Skin Health, Inc.

- Revision Skincare

- Alastin Skincare (Galderma)

- EltaMD (Colgate-Palmolive)

- PCA Skin (Colgate-Palmolive)

- NEOCUTIS (Merz Aesthetics)

- SkinBetter Science

- DefenAge Skincare

- Environ Skincare (Environ Skin Care Ltd.)

- iS Clinical (Innovative Skincare)

- Jan Marini Skin Research

- Senté

- Colorescience

- Glytone (Pierre Fabre Dermo-Cosmétique)

- Epionce

- VI Aesthetics

- Rodan + Fields (Professional Line)

- Isdin

Frequently Asked Questions

Analyze common user questions about the Physician Dispensed Cosmeceuticals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes physician-dispensed cosmeceuticals from standard cosmetic products?

Physician-dispensed cosmeceuticals are differentiated by their significantly higher concentrations of pharmaceutical-grade active ingredients (such as retinoids, potent antioxidants, and specific growth factors), superior clinical validation through controlled studies, and distribution exclusivity through licensed medical professionals, ensuring expert guidance and suitability for therapeutic use.

Which product type holds the largest share in the Physician Dispensed Cosmeceuticals Market?

Skincare products, specifically those targeting anti-aging (wrinkle reduction and skin firming) and broad-spectrum sun protection, consistently account for the largest revenue share in the physician-dispensed market, as they form the foundation of both preventative and corrective professional regimens.

How is technological advancement influencing the efficacy of professional cosmeceuticals?

Technology, particularly advanced delivery systems like liposomal encapsulation and nanotechnology, enhances the efficacy of professional products by protecting active ingredients from degradation, ensuring deeper penetration into the dermis, and facilitating controlled, sustained release for maximum therapeutic benefit with reduced irritation.

What is the projected Compound Annual Growth Rate (CAGR) for this market between 2026 and 2033?

The Physician Dispensed Cosmeceuticals Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 8.5% throughout the forecast period from 2026 to 2033, driven by increasing consumer prioritization of clinical efficacy and aesthetic procedure maintenance.

Which region presents the highest growth opportunities for cosmeceutical manufacturers?

The Asia Pacific (APAC) region, led by rapidly expanding markets such as China and South Korea, offers the highest growth opportunities. This acceleration is due to rising disposable incomes, high societal value placed on skin health, and increasing infrastructure development within the medical aesthetic sector.

This report provides a granular analysis of the Physician Dispensed Cosmeceuticals Market, highlighting the critical intersection of clinical science, consumer demand, and professional distribution channels. The market's stability is reinforced by the necessity of high-potency topical solutions as an adjunct to invasive and non-invasive aesthetic procedures. Future growth will heavily rely on innovation in ingredient technology and successful navigation of global regulatory complexities. The premium positioning of these products is maintained through continuous investment in clinical trials and the invaluable endorsement provided by dermatologists and plastic surgeons, solidifying their competitive advantage over mass-market competitors. Strategic expansion into underserved regional markets, particularly in Asia, and the integration of personalized medicine technologies will be key determinants of market leadership and sustained revenue generation through 2033.

The emphasis on barrier function repair, reduction of chronic inflammation (inflammaging), and the utilization of biomimetic ingredients represents the forefront of R&D efforts. This shift reflects a move towards addressing the underlying biological causes of skin aging and pathology rather than merely treating superficial symptoms. Furthermore, successful market participants are leveraging digital platforms to support their professional partners, offering comprehensive training, inventory automation tools, and personalized patient recommendation software. This sophisticated ecosystem ensures that the physician-dispensed channel remains the gold standard for consumers seeking therapeutic-grade topical solutions, ensuring long-term profitability and market resilience. Regulatory efforts to standardize claims and ingredient quality across key geographies will further legitimize the category, providing clearer pathways for consumer adoption and mitigating risks associated with non-compliant product offerings from fringe competitors.

In terms of end-user dynamics, the growth of specialized medical spas and aesthetic centers, which often operate under the supervision of a licensed physician, has broadened the distribution reach beyond traditional private practices. These facilities cater to a wider demographic seeking accessible, high-quality treatments and associated home care products. The continuous training and certification of aestheticians within these facilities on the proper use of physician-dispensed lines are crucial for maintaining the brand integrity and clinical efficacy promise. This expansion necessitates streamlined logistics and educational support from manufacturers to ensure product consistency and professional representation across diverse point-of-sale environments. The integration of advanced diagnostics at the point of dispensing further reinforces the value proposition, providing patients with tangible evidence of product effectiveness and reinforcing the professional recommendation as a bespoke medical prescription rather than a mere retail purchase decision.

The competitive landscape is characterized by a mix of specialized boutique firms (known for specific, patented ingredients) and large pharmaceutical or cosmetic conglomerates that provide expansive product portfolios and global distribution networks. Merger and acquisition activities remain high, driven by the desire of major players to quickly capture innovative technologies and secure established relationships within the key professional dispensing communities. Differentiation hinges on clear clinical data, published peer-reviewed studies, and ingredient exclusivity, enabling brands to justify their premium positioning. Supply chain resilience, particularly for sensitive biotech ingredients that require careful handling and temperature control, is another critical factor influencing market competitiveness and operational efficiency. Sustainability and ethical sourcing are also emerging as influential purchasing factors, particularly among younger consumers who seek transparency in formulation and manufacturing processes, adding a layer of complexity to product development and marketing strategies within this high-end segment.

Future R&D is heavily concentrated on leveraging personalized medicine. Technologies such as genomics and proteomics analysis are being explored to identify individual biomarkers that influence skin health outcomes. This deep-dive biological data will eventually allow for the hyper-customization of cosmeceutical ingredients on a mass scale, moving beyond general skin types to specific cellular needs. While currently nascent, this shift toward truly individualized skin health solutions, delivered under physician supervision, promises to unlock a new tier of premium pricing and consumer loyalty. Furthermore, the development of non-invasive home-use devices that enhance the penetration of physician-dispensed topicals—such as microcurrent or LED masks—are creating synergistic product sales opportunities, integrating the product line seamlessly into the patient's daily routine and maximizing overall treatment effectiveness. This continuous innovation ensures the physician-dispensed channel remains at the leading edge of dermatological science and consumer satisfaction.

The regulatory trajectory for cosmeceuticals continues to evolve. While they are generally treated as cosmetics, increasing consumer expectations for efficacy often push marketing claims toward therapeutic territory, prompting closer scrutiny from agencies like the FDA in the US and equivalent bodies globally. Manufacturers must meticulously document all clinical evidence to support structure/function claims without crossing the line into drug claims, which would necessitate far more complex and costly approval processes. This regulatory tightrope necessitates close collaboration between legal and R&D teams, ensuring that product positioning maintains professional credibility while remaining compliant. The successful management of this regulatory landscape is pivotal for global brand scalability and minimizing exposure to potentially damaging class action lawsuits or product recalls, which could severely undermine the professional trust cultivated by dispensing physicians.

In summary, the Physician Dispensed Cosmeceuticals Market is a high-value, high-growth segment driven by consumer demand for medically validated results and supported by technological innovation in ingredient delivery. The market's future remains robust, dependent on the continued trust between patients and their aesthetic practitioners, effective segmentation strategies focusing on hyper-specialized needs (e.g., sensitive skin, post-procedure care), and strategic geographical expansion, particularly into the high-potential APAC region. Maintaining product exclusivity and professional endorsement will be central to defending the premium positioning of this unique intersection of health and beauty.

The digital transformation of the healthcare industry presents both opportunities and challenges. While e-commerce platforms affiliated with clinics facilitate convenience for reorders, manufacturers must invest in robust digital security to protect patient data and maintain the integrity of their proprietary distribution model. Tele-dermatology consultations are becoming increasingly sophisticated, incorporating AI-enabled skin analysis tools, which requires the cosmeceutical brands to provide comprehensive digital training modules for physicians to effectively recommend and dispense products remotely. This blending of physical consultation and digital sales channels is redefining the patient journey and necessitates a seamless, omnichannel approach to marketing and distribution, ensuring that the clinical recommendation remains central regardless of the final point of purchase.

The competitive intensity is also being influenced by increasing consumer skepticism regarding 'clean beauty' claims and a growing return to science-backed, results-oriented formulations. This trend favors physician-dispensed brands, which inherently emphasize clinical efficacy over ephemeral marketing buzzwords. Brands that transparently communicate their ingredient sourcing, manufacturing quality, and clinical trial results are gaining significant market traction. This focus on scientific honesty helps differentiate legitimate professional products from mass-market cosmetics that may use similar terminology without the corresponding ingredient concentration or delivery system sophistication. The convergence of consumer demand for both transparency and measurable results further strengthens the market position of physician-dispensed leaders who can substantiate their claims with rigorous data.

Finally, the long-term sustainability of the market is intrinsically linked to the successful training and engagement of the next generation of dermatologists and plastic surgeons. Manufacturers invest heavily in continuing medical education (CME) programs, sponsoring clinical research, and offering comprehensive product mentorship to ensure that new practitioners are fully equipped to incorporate cosmeceuticals into their treatment protocols. This strategic engagement maintains the essential link between product dispensing and professional authority, serving as a powerful, non-price competitive advantage. As aesthetic medicine becomes more globalized, standardizing these professional education initiatives will be key to ensuring consistent quality and brand recognition across diverse international markets, supporting the projected growth trajectory through 2033.

The shift towards minimally invasive procedures, such as injectables and advanced energy-based devices, intrinsically links their success to the use of highly specialized pre- and post-procedure cosmeceuticals. These products are formulated to reduce downtime, manage inflammation, and accelerate healing, maximizing patient satisfaction and treatment outcome. Manufacturers focusing on formulations specifically designed for peri-procedural care—featuring ingredients like arnica, copper peptides, and advanced humectants—are capturing a high-margin niche within the overall market. This co-dependency ensures that as the aesthetic procedure volume increases globally, the demand for physician-dispensed cosmeceuticals will follow suit, reinforcing the market’s stability and growth projections throughout the forecast period. The increasing awareness among consumers that the topical care regimen is just as crucial as the in-office procedure reinforces the professional recommendation and perceived value.

Furthermore, global macroeconomic conditions, particularly changes in discretionary consumer spending, directly influence the purchasing patterns of high-end cosmeceuticals. While the market segment generally targets affluent consumers who are less susceptible to short-term economic fluctuations, prolonged economic downturns can lead consumers to prioritize core products and postpone the purchase of specialized or supplementary items. However, the perceived investment value of maintaining skin health and procedure longevity often cushions this market from severe downturns compared to general luxury goods. Strategic pricing and loyalty programs offered through the physician’s office help maintain patient adherence even during periods of economic uncertainty. These factors necessitate a focused approach on demonstrating return on investment for the consumer through visible clinical results and physician testimonials.

The environmental sustainability movement is also impacting packaging and formulation choices. Consumers, even those in the premium segment, are increasingly looking for recyclable or bio-degradable packaging, reduced reliance on petrochemicals, and ethical sourcing of ingredients. While efficacy remains paramount, physician-dispensed brands are actively innovating to align their products with these environmental standards without compromising potency or stability. This includes utilizing anhydrous formulations, minimizing water use, and adopting responsible supply chain management practices. Brands that successfully merge high clinical efficacy with strong environmental and ethical governance stand to gain a competitive edge by appealing to the increasingly conscious consumer base in developed markets.

The specialized haircare segment, though smaller than skincare, is gaining momentum, particularly in products addressing hair thinning, scalp health, and post-transplant care. Physicians, especially dermatologists, are increasingly integrating prescription-strength topical solutions and growth factor serums into comprehensive treatment plans for alopecia and other scalp conditions. The clinical environment provides the ideal setting for diagnosing these complex issues and dispensing targeted, high-concentration products that are often ineffective when sold in general retail channels. This niche specialization within the physician-dispensed market represents a significant growth area, driven by advancements in understanding the hair follicle cycle and the development of novel peptide technologies tailored for scalp health, diversifying the market portfolio beyond traditional facial skincare.

Finally, the growing prevalence of skin sensitivities and inflammatory conditions globally necessitates sophisticated, gentle formulations. Physician-dispensed brands are responding by focusing heavily on barrier repair, microbiome balance, and formulations free from common irritants (parabens, fragrances, harsh surfactants). These specialized product lines cater to patients with conditions like eczema, rosacea, or extreme post-procedural sensitivity, where products must be simultaneously potent and non-reactive. The trust placed in the physician to recommend a safe and effective product for compromised skin significantly reinforces the entire distribution channel, providing a continuous flow of patients who cannot safely rely on general retail options.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager