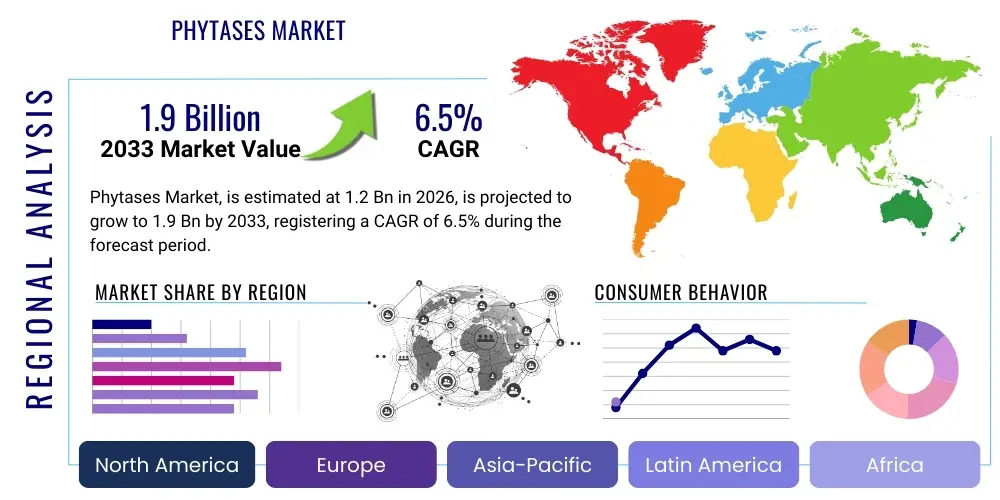

Phytases Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440564 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Phytases Market Size

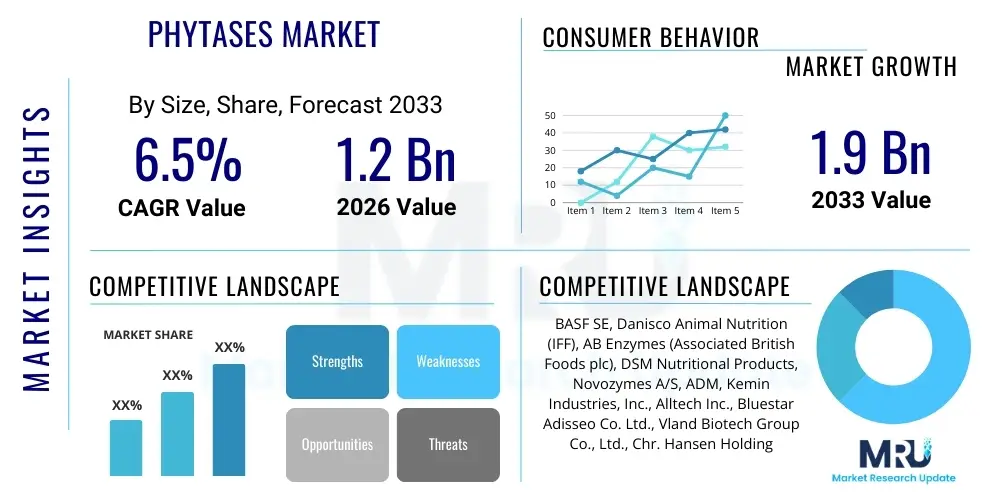

The Phytases Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at 1.2 Billion USD in 2026 and is projected to reach 1.9 Billion USD by the end of the forecast period in 2033. This robust growth is primarily driven by increasing global demand for animal protein, heightened awareness regarding environmental sustainability in livestock farming, and the continuous innovation in enzyme technology aiming to enhance feed efficiency and reduce production costs across the agricultural sector.

Phytases Market introduction

Phytases are a class of enzymes that catalyze the hydrolysis of phytic acid (myo-inositol hexakisphosphate), an indigestible form of phosphorus found abundantly in plant-based feed ingredients. By breaking down phytic acid, phytases release digestible inorganic phosphorus, myo-inositol, and other essential minerals, significantly improving nutrient utilization in monogastric animals such such as poultry, swine, and aquaculture species. This enzymatic action not only enhances animal growth and performance but also reduces the need for expensive inorganic phosphorus supplementation, leading to substantial cost savings for feed manufacturers and livestock producers.

The primary application of phytases is in animal feed, where they are incorporated into formulations to improve the bioavailability of phosphorus and other trace elements. Beyond their critical role in animal nutrition, phytases are increasingly explored for applications in human nutrition to enhance mineral absorption from plant-based foods, and in environmental management to reduce phosphorus pollution from animal waste. The market encompasses various product forms, including dry (granular, powder) and liquid formulations, designed for ease of integration into diverse feed production processes, catering to specific industry requirements and operational preferences.

Key benefits driving the adoption of phytases include improved feed conversion ratios, enhanced animal health and welfare, and a significant reduction in environmental phosphorus excretion, which helps mitigate water pollution and aligns with stringent environmental regulations. The market is propelled by a confluence of factors such as the expanding global livestock industry, increasing consumer demand for sustainably produced animal products, and the ongoing push for greater efficiency and cost-effectiveness in animal agriculture. Continuous research and development efforts are focused on creating novel phytase variants with improved thermotolerance, pH stability, and broader substrate specificity, further solidifying their indispensable role in modern animal production systems.

Phytases Market Executive Summary

The phytases market is experiencing dynamic growth fueled by global demand for sustainable and efficient animal protein production. Business trends indicate a strong focus on strategic alliances, mergers, and acquisitions among key players to expand product portfolios and geographical reach, alongside significant investments in research and development to create next-generation enzymes with enhanced properties. Companies are increasingly emphasizing novel enzyme formulations that offer superior performance under diverse processing conditions, leading to greater feed efficiency and reduced environmental impact, positioning these innovations as critical differentiators in a competitive landscape.

Regionally, the Asia Pacific market is poised for substantial expansion, driven by the rapidly growing livestock and aquaculture industries in countries such as China, India, and Vietnam, coupled with increasing adoption of advanced feed additives. North America and Europe continue to be significant markets, characterized by stringent environmental regulations, a strong emphasis on animal welfare, and advanced feed formulation practices that readily integrate high-performance phytases. Latin America, particularly Brazil, also presents considerable growth opportunities due to its large-scale animal production and increasing modernization of agricultural practices, while the Middle East and Africa show nascent but emerging potential.

In terms of segmentation, the feed-grade phytase segment dominates the market due to its widespread application in poultry, swine, and aquaculture industries. Within forms, both dry (granular and powder) and liquid phytases maintain strong demand, with preferences often dictated by regional processing infrastructure and specific feed mill requirements; liquid forms are gaining traction for their ease of application in certain contexts. The market is continually evolving with a shift towards more customized enzyme solutions tailored for specific animal species and feed compositions, reflecting a broader trend towards precision nutrition and optimized livestock management practices across the entire value chain.

AI Impact Analysis on Phytases Market

User inquiries about AI's impact on the phytases market frequently revolve around its potential to optimize enzyme dosage, predict efficacy under varying feed conditions, streamline production processes, and accelerate the discovery and development of novel enzyme variants. Common themes include leveraging AI for data-driven insights into enzyme performance, enhancing supply chain efficiency, and enabling more precise nutrient management in animal agriculture. Users are keen to understand how AI can lead to cost reductions, improve sustainability metrics, and foster innovation in phytase application, expecting AI to bring a new level of intelligence and automation to enzyme utilization and development.

- AI can optimize phytase dosage in animal feed formulations by analyzing real-time data on feed composition, animal genetics, and environmental factors, leading to more precise and efficient nutrient utilization.

- Predictive analytics powered by AI can forecast phytase efficacy under various processing conditions and storage durations, ensuring consistent performance and minimizing enzyme degradation.

- AI-driven platforms can accelerate the discovery and development of novel phytase enzymes by screening vast molecular libraries, identifying potential candidates with improved thermotolerance, pH stability, and specific activity.

- Machine learning algorithms can enhance fermentation processes for phytase production, optimizing parameters such as temperature, pH, and nutrient levels to maximize yield and reduce production costs.

- AI can contribute to sustainable livestock farming by providing insights into phosphorus excretion reduction, helping producers meet environmental regulations more effectively through optimized phytase use.

- Supply chain management for phytase products can be significantly improved with AI, enabling better demand forecasting, inventory management, and logistics, ensuring timely and cost-effective delivery.

- Integration of AI with precision livestock farming technologies allows for individualized animal nutrition strategies, where phytase supplementation is tailored to the specific needs of individual animals or small groups.

DRO & Impact Forces Of Phytases Market

The phytases market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and impactful external forces. A primary driver is the burgeoning global demand for animal protein, particularly poultry, swine, and aquaculture, necessitating more efficient and cost-effective feed solutions. Coupled with this, escalating environmental concerns and stricter regulations on phosphorus excretion from animal waste propel the adoption of phytases as a key solution for reducing the ecological footprint of livestock farming. The rising cost of inorganic phosphorus sources further incentivizes the use of phytases to unlock plant-bound phosphorus, thereby reducing reliance on expensive mineral supplements and lowering overall feed production costs, making them an economically attractive option for producers worldwide.

However, the market faces several restraints that could impede its growth. High production costs associated with certain advanced phytase enzymes, particularly those requiring complex fermentation and purification processes, can limit their widespread adoption in price-sensitive markets. Additionally, the fragmented regulatory landscape across different regions, particularly concerning the approval of novel genetically engineered phytase variants and their inclusion levels in feed, can create hurdles for market entry and product commercialization. Another challenge lies in ensuring consistent enzyme activity and stability under varying feed processing conditions, such as high-temperature pelleting, which demands continuous innovation in enzyme design to overcome potential denaturation.

Despite these restraints, substantial opportunities exist for market expansion and innovation. Emerging economies in Asia Pacific and Latin America present vast untapped potential due to their rapidly expanding livestock industries and increasing awareness of advanced feed additives. The development of novel, highly effective, and heat-stable phytases, coupled with enzymes exhibiting broader pH ranges, offers a significant competitive advantage and opens new application avenues. Furthermore, exploring new applications beyond animal feed, such as in human nutrition for enhanced mineral bioavailability in plant-based diets, or in industrial processes like wastewater treatment, represents promising diversification pathways. Impact forces such as rapid technological advancements in biotechnology, evolving consumer preferences for sustainable and ethically produced meat, fluctuating raw material prices for enzyme production, and geopolitical stability significantly shape the market's trajectory, requiring market participants to remain agile and adaptive.

Segmentation Analysis

The phytases market is meticulously segmented to provide a comprehensive understanding of its diverse landscape and growth opportunities. These segments typically encompass classifications based on the enzyme's origin, physical form, application within the animal agriculture sector, and geographical distribution. This granular analysis allows stakeholders to identify specific growth areas, understand competitive dynamics, and tailor their strategies to address distinct market needs, reflecting the intricate demands of the global feed and animal nutrition industries. Each segment plays a crucial role in defining the overall market structure and consumer preferences, illustrating the broad applicability and specific utility of phytase enzymes across the value chain.

- By Type

- Fungal Phytase (e.g., from Aspergillus niger)

- Bacterial Phytase (e.g., from Escherichia coli)

- Other Types (e.g., yeast-derived)

- By Form

- Dry Phytase (Granular, Powder)

- Liquid Phytase

- By Application

- Poultry Feed

- Swine Feed

- Aquaculture Feed

- Ruminant Feed

- Other Applications (e.g., Human Nutrition, Wastewater Treatment)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Phytases Market

The value chain for the phytases market involves a series of integrated stages, commencing with research and development of enzyme strains and culminating in the end-use application in animal feed and other sectors. Upstream analysis focuses on the discovery, genetic engineering, and fermentation of microbial strains (fungal or bacterial) that produce phytase enzymes, alongside the sourcing of raw materials for fermentation media and production equipment. This stage is characterized by intensive biotechnological research aimed at optimizing enzyme characteristics such as heat stability, pH profile, and substrate specificity, often involving advanced genetic modification techniques to enhance yield and performance.

Midstream activities involve the large-scale industrial production of phytases through bioreactors, followed by complex downstream processing steps including purification, concentration, and formulation into market-ready products (e.g., dry granular, powder, or liquid forms). Quality control and assurance are paramount at this stage to ensure product efficacy, safety, and compliance with regulatory standards. Companies invest heavily in robust manufacturing facilities and processes to ensure consistent high-quality enzyme output, which is critical for their functional performance in feed applications and overall market acceptance.

Downstream analysis centers on the distribution and end-use of phytases. Products are typically distributed to feed manufacturers, integrators, and large livestock operations through a combination of direct sales and an extensive network of distributors and agents. Direct distribution often caters to large-scale customers with specific technical support needs, while indirect channels serve a broader market, including smaller feed mills and individual farmers. The final users are primarily the animal agriculture industries (poultry, swine, aquaculture), which incorporate phytases into feed formulations to enhance nutrient utilization, improve animal performance, and reduce environmental impact. The effectiveness of this distribution network and the technical support provided are crucial for successful market penetration and sustained customer relationships, ensuring that the benefits of phytase enzymes are fully realized by the end-users.

Phytases Market Potential Customers

The primary potential customers and end-users of phytases are diverse segments within the global animal agriculture industry, driven by the need to optimize feed efficiency and meet stringent environmental regulations. Feed manufacturers constitute a major customer base, as they formulate complete feed products for various livestock species and proactively incorporate phytases to enhance the nutritional value of their offerings, reduce reliance on inorganic phosphorus, and lower production costs. These manufacturers, ranging from large multinational corporations to regional players, are constantly seeking innovative feed additives to gain a competitive edge and provide superior products to their farming clients.

Integrators and large-scale livestock operations, particularly those involved in poultry, swine, and aquaculture production, represent another significant customer segment. These entities often have their own feed mills and prioritize directly sourcing phytases to maintain control over feed quality, optimize animal performance on their farms, and ensure compliance with internal sustainability goals and external environmental standards. For these large-scale producers, the direct incorporation of phytases translates into substantial savings on feed costs, improved animal health outcomes, and a reduced environmental footprint, making phytases an essential component of their operational strategy.

Beyond traditional animal feed applications, emerging potential customers include companies involved in human nutrition, particularly those developing plant-based food products or dietary supplements aimed at improving mineral bioavailability from vegetarian and vegan diets. Additionally, specialized industrial applications such as wastewater treatment facilities, where phytases can aid in phosphorus removal from effluents, also represent a niche but growing customer segment. Research institutions and biotechnology companies are also indirect customers, utilizing phytases for various studies and enzyme development, contributing to the broader innovation ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 1.2 Billion USD |

| Market Forecast in 2033 | 1.9 Billion USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Danisco Animal Nutrition (IFF), AB Enzymes (Associated British Foods plc), DSM Nutritional Products, Novozymes A/S, ADM, Kemin Industries, Inc., Alltech Inc., Bluestar Adisseo Co. Ltd., Vland Biotech Group Co., Ltd., Chr. Hansen Holding A/S, Nutreco N.V., Bio-Cat, Enzyvia LLC, CJ CheilJedang, Global Biosolutions, Inc., Specialty Enzymes & Biotechnologies, Sunhy Biology Co., Ltd., Advanced Enzyme Technologies Ltd., Chengdu Boli Biochemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phytases Market Key Technology Landscape

The technological landscape of the phytases market is characterized by continuous innovation aimed at enhancing enzyme performance, production efficiency, and application versatility. A cornerstone of this landscape is advanced fermentation technology, encompassing both submerged fermentation (SmF) and solid-state fermentation (SSF), which are crucial for the cost-effective and large-scale production of phytase enzymes from microbial strains. Significant research is directed towards optimizing bioreactor design, culture media composition, and process parameters to maximize phytase yield and purity, leading to more economical production methods and a reduced environmental footprint.

Genetic engineering and molecular biology techniques play a pivotal role in the development of next-generation phytases. These technologies enable scientists to modify existing microbial strains or engineer new ones to produce phytases with superior characteristics, such as enhanced heat stability to withstand high-temperature feed pelleting, broader pH activity profiles for efficacy across diverse gastrointestinal conditions, and increased specific activity to achieve desired effects with lower dosage. Directed evolution, site-directed mutagenesis, and gene editing tools like CRISPR are actively employed to fine-tune enzyme properties, leading to enzymes tailored for specific animal species and feed types, thereby unlocking greater efficiency and performance in practical applications.

Furthermore, advancements in enzyme immobilization techniques are gaining traction, offering benefits such as increased enzyme stability, reusability, and simplified recovery from fermentation broths. Formulations technology also represents a critical aspect, focusing on developing effective delivery systems that protect the enzyme from degradation during storage and processing, ensuring its optimal activity in the animal's digestive tract. This includes developing coated granular forms, microencapsulated products, and highly stable liquid concentrates. The integration of bioinformatics and computational biology is accelerating enzyme discovery and design, allowing for the predictive modeling of enzyme function and the rapid identification of novel phytase variants, thus propelling the market towards more efficient, sustainable, and highly specialized enzyme solutions.

Regional Highlights

- Asia Pacific (APAC): Dominates the global phytases market, primarily driven by the colossal livestock and aquaculture industries in China, India, Vietnam, and Thailand. Rapid urbanization, increasing disposable incomes, and a growing population in these countries are fueling the demand for animal protein, leading to increased feed production and consequently, higher phytase adoption. Favorable government policies promoting sustainable agricultural practices and the expansion of modern feed mills further bolster market growth in this region.

- North America: A mature market characterized by advanced animal nutrition practices, stringent environmental regulations, and a strong emphasis on animal welfare. The United States and Canada are key contributors, with high levels of technological adoption in their feed industries. Demand for phytases is driven by the need for sustainable protein production, cost optimization in feed, and consistent innovation in enzyme technologies to meet evolving industry standards.

- Europe: Represents a significant market, largely influenced by the European Union's strict environmental regulations concerning phosphorus emissions from livestock farms and a strong commitment to sustainable agriculture. Countries such as the Netherlands, Germany, France, and Spain are leading the adoption of phytases to enhance nutrient utilization and reduce the ecological impact of intensive livestock farming. Innovation in enzyme development and a focus on animal health and performance are key drivers.

- Latin America (LATAM): Exhibiting strong growth, particularly in Brazil and Argentina, which are major global producers of meat and poultry. The expansion of the livestock industry, coupled with increasing awareness of the benefits of feed additives for efficiency and sustainability, is propelling the demand for phytases. Economic development and investments in modernizing agricultural practices are key factors fostering market expansion in this region.

- Middle East and Africa (MEA): An emerging market with considerable growth potential. While currently smaller in scale compared to other regions, increasing investments in the poultry and aquaculture sectors, efforts to enhance food security, and growing awareness of advanced feed technologies are contributing to the rising adoption of phytases. Regional governments' initiatives to develop local livestock industries are expected to drive future market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phytases Market.- BASF SE

- Danisco Animal Nutrition (IFF)

- AB Enzymes (Associated British Foods plc)

- DSM Nutritional Products

- Novozymes A/S

- ADM

- Kemin Industries, Inc.

- Alltech Inc.

- Bluestar Adisseo Co. Ltd.

- Vland Biotech Group Co., Ltd.

- Chr. Hansen Holding A/S

- Nutreco N.V.

- Bio-Cat

- Enzyvia LLC

- CJ CheilJedang

- Global Biosolutions, Inc.

- Specialty Enzymes & Biotechnologies

- Sunhy Biology Co., Ltd.

- Advanced Enzyme Technologies Ltd.

- Chengdu Boli Biochemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Phytases market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are phytases and why are they important in animal feed?

Phytases are enzymes that break down phytic acid in plant-based feed, releasing digestible phosphorus and other minerals. This improves nutrient utilization in livestock, reduces the need for inorganic phosphorus supplements, lowers feed costs, and significantly decreases environmental phosphorus pollution from animal waste.

How do phytases contribute to environmental sustainability?

By enhancing phosphorus digestion in animals, phytases reduce the amount of undigested phosphorus excreted in manure. This minimizes the risk of phosphorus runoff into waterways, which can cause eutrophication and negatively impact aquatic ecosystems, thus promoting more sustainable livestock farming practices.

What are the main types of phytases available in the market?

The primary types of phytases are fungal phytases (e.g., derived from Aspergillus niger) and bacterial phytases (e.g., derived from Escherichia coli). These differ in their optimal pH range, temperature stability, and specific activity, making them suitable for various feed formulations and animal species.

Which applications beyond animal feed are emerging for phytases?

Beyond their dominant role in animal feed, phytases are gaining traction in human nutrition to improve mineral bioavailability from plant-based foods, especially in vegetarian and vegan diets. They are also being explored for industrial applications such as wastewater treatment to remove phosphorus, and potentially in biofuel production.

What are the key factors driving the growth of the phytases market?

Key drivers include the surging global demand for animal protein, increasing environmental regulations on phosphorus emissions, the rising cost of inorganic phosphorus, and the continuous advancement in enzyme technology leading to more efficient and cost-effective phytase products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager