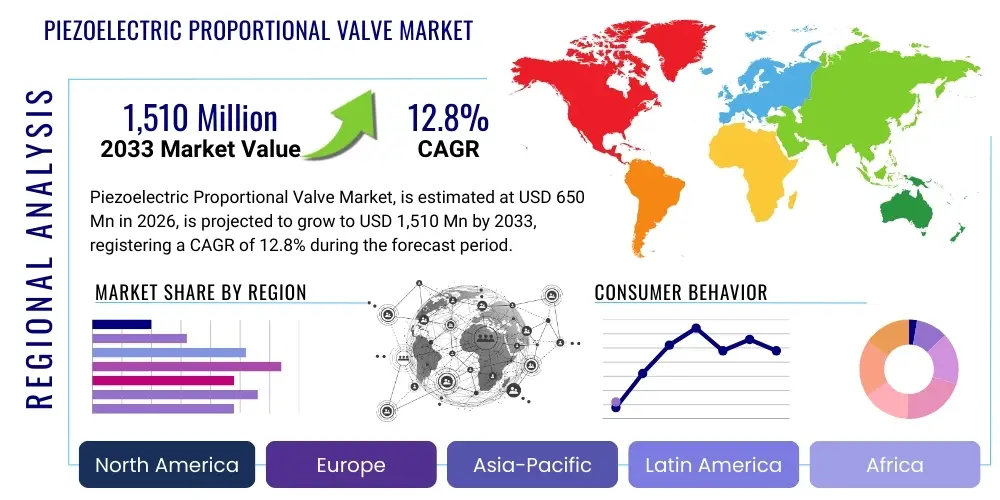

Piezoelectric Proportional Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438848 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Piezoelectric Proportional Valve Market Size

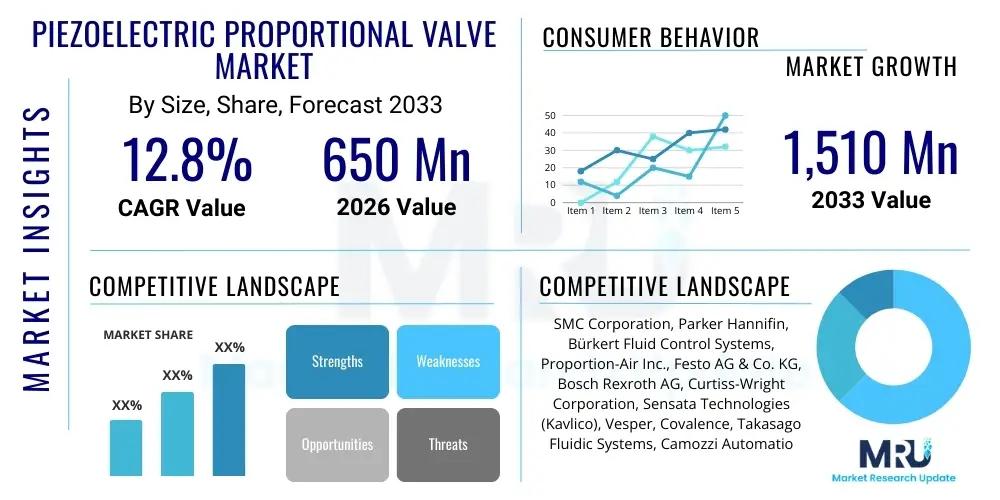

The Piezoelectric Proportional Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,510 Million by the end of the forecast period in 2033.

Piezoelectric Proportional Valve Market introduction

The Piezoelectric Proportional Valve Market encompasses specialized fluid control devices that utilize the inverse piezoelectric effect for precise and rapid modulation of gas or liquid flow rates. These valves convert electrical energy into mechanical displacement using ceramic materials, allowing for extremely fine resolution and repeatable positioning without the typical friction or hysteresis associated with traditional solenoid or motor-driven valves. This technology is critical in applications demanding high accuracy, low power consumption, minimal heat generation, and fast response times, distinguishing them from conventional pneumatic components. The core innovation lies in replacing electromagnetic actuation with solid-state piezo stacks or benders, resulting in non-wearing components and exceptional longevity, which is highly valued in sensitive industries.

The fundamental product description centers on miniaturized valves, often categorized by their maximum flow rate, pressure handling capabilities, and control resolution (the minimum discernible change in flow). These valves are typically used in closed-loop systems, where a sensor monitors the controlled variable (pressure or flow) and feeds back data to the controller, which adjusts the piezoelectric element accordingly. Major applications span several high-technology sectors, including advanced medical ventilation systems, precision gas mixing for analytical instrumentation (e.g., mass spectrometry, chromatography), semiconductor manufacturing processes requiring ultra-pure gas delivery, and microfluidic control in laboratory automation. The inherent lack of friction and silent operation further enhances their suitability for noise-sensitive and clean environments.

Driving factors for market growth include the accelerating trend toward miniaturization in medical devices and laboratory equipment, the increasing demand for energy-efficient components in industrial automation, and stringent regulatory requirements for control accuracy in clinical settings. The key benefits offered by piezoelectric technology—ultra-low power consumption, high durability, superior linearity, and maintenance-free operation—make them the preferred choice over standard solenoids, especially where the cost of system downtime or the precision of dosage is critical. Furthermore, the integration of smart electronics and communication protocols (like IO-Link) into these valves is enhancing their appeal for Industry 4.0 applications, facilitating predictive maintenance and optimized process control.

Piezoelectric Proportional Valve Market Executive Summary

The Piezoelectric Proportional Valve Market is undergoing robust expansion, driven primarily by technological advancements in micro-dosing and high-precision fluid management across the healthcare and industrial sectors. Business trends indicate a strong move towards strategic partnerships between component manufacturers and system integrators, particularly in North America and Europe, to co-develop custom valve solutions tailored for complex analytical instruments. Key competitive strategies involve continuous innovation to increase the pressure rating and flow capacity of piezoelectric valves while maintaining miniature footprints, thereby addressing the persistent gap between conventional valve throughput and piezo precision. Furthermore, sustainable manufacturing practices and the pursuit of ISO certifications for medical-grade components are shaping market entry barriers and influencing procurement decisions by major original equipment manufacturers (OEMs).

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive investments in domestic semiconductor fabrication facilities (Fabs) and the rapid expansion of healthcare infrastructure in countries like China and India. North America remains the leading region in terms of market value, commanding the highest adoption rate due to a concentration of cutting-edge medical device manufacturers and biotechnology firms. Europe demonstrates stable growth, characterized by strong demand from sophisticated industrial automation and automotive research & development sectors focused on advanced materials processing and fuel cell technology development. Localized supply chain resilience and proximity to key end-users are becoming increasingly important regional competitive differentiators.

Segmentation trends reveal that the medical and life sciences segment dominates the application landscape, attributed to the critical role of these valves in portable oxygen concentrators, ventilators, and infusion pumps where power efficiency and accuracy are non-negotiable. Technology-wise, the consumption of proportional valves designed for gas handling significantly outweighs those for liquid handling, though the liquid handling segment is projected to exhibit the highest CAGR due to burgeoning demand in microfluidics and point-of-care diagnostics. In terms of size, miniaturized valves (less than 10 mm width) are gaining traction, reflecting the broader market push towards portable and embedded system architectures. Pricing strategies are converging, moving away from purely premium pricing to value-based models, especially in high-volume industrial applications.

AI Impact Analysis on Piezoelectric Proportional Valve Market

User queries regarding AI's impact on piezoelectric valves frequently center on three main areas: predictive maintenance, optimization of closed-loop control systems, and integration with autonomous manufacturing processes. Users are concerned about whether AI algorithms can enhance the intrinsic precision of the valve beyond its mechanical limits and how machine learning (ML) can improve calibration and diagnostics remotely. Specifically, common questions revolve around utilizing AI to compensate for environmental variables (temperature, humidity, pressure drift) that might subtly affect piezo performance, and how data collected from arrays of smart proportional valves can inform process optimization across an entire production line. The underlying expectation is that AI integration will transform these highly precise components into truly intelligent edge devices, capable of self-diagnosis and instantaneous optimization, thereby significantly reducing operational expenditure and increasing throughput in critical applications.

The integration of Artificial Intelligence and Machine Learning into the Piezoelectric Proportional Valve ecosystem primarily manifests in enhancing system intelligence and reliability. AI algorithms are deployed to analyze the real-time performance data—including voltage, displacement, flow rate feedback, and temperature—to predict potential component drift or failure well before it occurs. This predictive maintenance capability dramatically improves system uptime, especially crucial in semiconductor manufacturing or clinical ventilation where failure is costly or life-threatening. Furthermore, ML models are used to train the proportional integral derivative (PID) control loops, enabling self-tuning capabilities that allow the valves to achieve target flow rates faster and with less overshoot than traditionally tuned controllers, effectively maximizing the response time and linearity of the fluidic system.

Beyond diagnostics and control optimization, AI is influencing the design and deployment stages of proportional valve systems. Generative design techniques, powered by AI, are being utilized to optimize the mechanical geometry of the valve components (e.g., diaphragms, nozzles) to improve flow characteristics and minimize turbulence, directly impacting the precision achievable. In autonomous manufacturing environments, AI acts as the supervisory controller, managing complex arrays of these valves to ensure perfect synchronization for intricate tasks like multi-gas blending or high-speed sorting, thereby enabling fully automated, lights-out operations. This synergy between the ultra-precise mechanical control offered by piezo technology and the cognitive optimization provided by AI establishes a new paradigm for advanced fluid handling systems.

- AI algorithms enable highly accurate predictive maintenance by analyzing voltage and performance signatures.

- Machine learning optimizes PID controllers for faster response times and improved control linearity in closed-loop systems.

- AI-driven generative design aids in optimizing valve geometry for superior flow characteristics.

- Integration with autonomous systems allows for real-time synchronization and management of complex valve arrays.

- Data analytics derived from smart piezo valves inform broader process optimization and efficiency improvements across entire factories.

DRO & Impact Forces Of Piezoelectric Proportional Valve Market

The Piezoelectric Proportional Valve Market is primarily driven by the imperative for precision and efficiency in critical applications, constrained by high initial costs and complexity, and opened up by opportunities in emerging medical technologies and industrial automation standards. The dominant driver is the growing adoption of portable and compact medical devices, which necessitate components offering high control resolution, minimal heat signature, and exceptional power efficiency—attributes perfectly met by piezoelectric technology. Restraints include the high manufacturing complexity of piezo stacks, leading to a premium price point compared to solenoid valves, and the inherent sensitivity of piezo ceramics to extreme humidity and mechanical shock. Opportunities lie in the rapidly expanding fields of personalized medicine, point-of-care diagnostics, and hydrogen fuel cell technology, all requiring ultra-precise micro-dosing and flow control. These forces collectively dictate the market trajectory, favoring suppliers capable of balancing performance, cost, and miniaturization.

Key drivers center around the technological shift towards microfluidics and the demands of Industry 4.0. The miniaturization trend across all high-tech sectors, particularly in diagnostic instruments and laboratory-on-a-chip devices, mandates the use of non-magnetic, low-power control elements. Furthermore, the stringent quality control requirements in semiconductor and pharmaceutical manufacturing necessitate the exceptional repeatability and long-term stability that piezo valves inherently offer. These valves eliminate the mechanical wear associated with moving parts, significantly reducing maintenance costs and ensuring consistent performance over millions of cycles, which is a major draw for high-volume production facilities.

Major restraints include the technical limitations regarding handling high flow rates and high pressures, which traditionally favor robust mechanical valves. While research is ongoing, the scalability of piezoelectric actuation for very large flow applications remains challenging and costly. Additionally, the complex drive electronics required to precisely control the voltage applied to the piezo element often add to the system cost and complexity, requiring specialized engineering expertise for integration. Opportunities, however, abound in emerging markets and new application areas. For instance, the transition to precision pneumatic control in advanced robotics and the necessity for accurate gas mixing in burgeoning fields like Controlled Atmosphere Storage (CAS) present significant avenues for market penetration. The continuous development of novel piezoelectric materials with enhanced stability and performance characteristics will further mitigate current technical restraints, fueling market acceleration.

Segmentation Analysis

The Piezoelectric Proportional Valve Market segmentation provides a granular view of demand across various product types, control mediums, valve sizes, and end-use applications, allowing for precise market targeting and strategic resource allocation. The market is primarily categorized based on the type of media controlled (gas vs. liquid), the structural design (e.g., beam-type, stack-type, or bending actuator), and crucially, the specific end-user industry, which dictates the performance requirements such as flow range and response time. The gas segment currently holds the dominant share, largely due to widespread usage in medical respiratory equipment and industrial mass flow controllers. However, the liquid segment is poised for rapid growth driven by specialized microfluidic dispensing and pharmaceutical sampling systems where volumetric accuracy is paramount.

Further analysis of the segmentation by application reveals a strong concentration of demand within the healthcare and life sciences sector, encompassing everything from high-fidelity ventilators to complex laboratory analytical instruments like High-Performance Liquid Chromatography (HPLC) systems. The industrial automation segment, including robotics and printing technology, forms the second largest consumer base, valuing the valve's speed and durability. Geographically, segmentation underscores the maturity and high-value consumption in North America and Europe, contrasting with the fast-paced capacity expansion and technology adoption characterizing the APAC region, specifically targeting local manufacturing needs in electronics and specialized chemicals.

From a product perspective, the market is segmented by control mechanism complexity—ranging from simple on/off switching piezo valves to complex true proportional valves capable of linear output across a wide dynamic range. The emphasis on miniaturization defines another crucial segmentation axis, with valves categorized into micro-valves (sub-millimeter flow channels) and standard compact valves. Understanding these detailed segmentations is essential for manufacturers to align their R&D efforts—for example, focusing on high-stability materials for medical devices or high-throughput designs for industrial robotics—to capture the most lucrative portions of the global market.

- By Medium:

- Gas Piezoelectric Proportional Valves

- Liquid Piezoelectric Proportional Valves

- By Application:

- Medical & Life Sciences (Ventilation, Oxygen Therapy, Drug Delivery)

- Industrial Automation (Robotics, Dispensing, Printing)

- Semiconductor & Electronics Manufacturing (Gas Delivery Systems)

- Analytical & Laboratory Instrumentation (Chromatography, Spectrometry)

- Others (Aerospace, Automotive Research, Fuel Cells)

- By Flow Range:

- Low Flow (Microfluidic applications)

- Medium Flow

- High Flow (Emerging industrial applications)

- By Actuator Type:

- Stack Actuator Based

- Bending Actuator Based (Bimorph/Multilayer)

Value Chain Analysis For Piezoelectric Proportional Valve Market

The value chain for the Piezoelectric Proportional Valve Market begins with the upstream sourcing and processing of specialized materials, primarily PZT (Lead Zirconate Titanate) ceramics and accompanying exotic metals necessary for construction. Upstream activities involve material preparation, precise sintering, and assembly of the piezoelectric actuators themselves—a highly technical and proprietary step often dominated by specialized ceramics firms or the valve manufacturers themselves if vertically integrated. Quality control at this stage is crucial as the performance and longevity of the final product depend entirely on the consistency and purity of the piezo material. The high capital expenditure required for sophisticated PZT material fabrication acts as a significant entry barrier to the upstream segment.

The middle segment of the value chain involves the design, manufacturing, and assembly of the complete proportional valve, including the mechanical housing, diaphragms, sealing materials, and the integration of control electronics (driver boards and feedback sensors). Manufacturing utilizes highly precise machining and cleanroom assembly techniques to ensure optimal performance, linearity, and freedom from contamination. Distribution channels are bifurcated into direct sales to large OEMs, particularly in the medical and semiconductor industries where customization and technical support are mandatory, and indirect distribution through specialized industrial fluid control distributors and integrators who cater to smaller industrial automation projects and regional customers. The complexity of the product means technical expertise is a necessity at every level of the distribution process.

Downstream analysis focuses on installation, calibration, and maintenance services provided to the end-users. The performance of these proportional valves is often critical to the final system's efficacy, requiring specialized training for installation and periodic recalibration, particularly in regulated environments like healthcare. The aftermarket segment, although small compared to the initial sales, is growing, driven by the need for replacement parts (diaphragms, seals) and advanced diagnostics services, often incorporating remote monitoring features. Direct engagement with end-users allows manufacturers to gather crucial performance data, feeding back into R&D for next-generation products, thereby closing the loop in a highly specialized, knowledge-intensive value chain.

Piezoelectric Proportional Valve Market Potential Customers

The primary consumers and end-users of Piezoelectric Proportional Valves are large-scale Original Equipment Manufacturers (OEMs) operating within highly regulated and precision-intensive industries. These customers are seeking solutions that offer superior control resolution, extremely fast response times (measured in milliseconds), and the highest level of reliability and lifetime expected in critical fluidic systems. The largest cohort of potential buyers includes manufacturers of life support equipment, such as advanced mechanical ventilators, anesthesia delivery systems, and portable oxygen conservation devices, where the flow of medical gases must be controlled with unwavering accuracy to ensure patient safety and therapeutic efficacy. These buyers prioritize quality certifications (e.g., ISO 13485) and documented stability over cost, creating a preference for established, high-quality component suppliers.

A secondary, yet rapidly expanding, group of potential customers comprises companies in the analytical sciences and laboratory automation sector. This includes manufacturers of high-end analytical instrumentation such as gas chromatographs (GC), liquid chromatographs (LC), mass spectrometers, and automated robotic sample handlers. For these systems, piezoelectric valves are critical for micro-dosing reagents, precisely controlling carrier gas flows, and managing solvent switching in microfluidic channels. These end-users value the minimal dead volume, chemical inertness of wetted materials, and high operational cycles offered by piezo technology, as system accuracy directly translates into the quality and validity of scientific results.

Furthermore, significant opportunities exist within the industrial sector, notably semiconductor fabrication and advanced additive manufacturing (3D printing). Semiconductor equipment manufacturers are essential buyers, utilizing these valves for the ultra-precise control of specialty and corrosive gases used in deposition and etching processes, where even minor flow fluctuations can ruin an entire wafer batch. In advanced manufacturing, potential customers include developers of high-precision dispensing equipment for specialized adhesives, coatings, and inkjet printing heads, who demand rapid, repeatable, and non-contact fluid control. The common denominator among all these potential buyers is a non-negotiable requirement for precision that exceeds the capabilities of standard electromagnetic valves.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,510 Million |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SMC Corporation, Parker Hannifin, Bürkert Fluid Control Systems, Proportion-Air Inc., Festo AG & Co. KG, Bosch Rexroth AG, Curtiss-Wright Corporation, Sensata Technologies (Kavlico), Vesper, Covalence, Takasago Fluidic Systems, Camozzi Automation, Vögtlin Instruments GmbH, Clippard Instrument Laboratory, MKS Instruments, Inc., Advanced Valve Technologies, Valcor Engineering Corporation, Rotarex S.A., Norgren (IMI Precision Engineering), EMERSON. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Piezoelectric Proportional Valve Market Key Technology Landscape

The technological core of the Piezoelectric Proportional Valve Market revolves around advanced materials science and sophisticated electronic control systems. The foundation is the piezoelectric transducer, primarily constructed from multilayer ceramic actuators (MLAs) utilizing PZT, which exhibits a strong inverse piezoelectric effect—deforming precisely and rapidly when an electric field is applied. Current technological advancements focus on enhancing the displacement output per unit of applied voltage and improving the mechanical coupling efficiency, allowing for greater flow control using smaller actuators. Furthermore, research into lead-free piezo materials is gaining traction, driven by environmental regulations (e.g., RoHS), though PZT derivatives still dominate due to their superior performance characteristics and reliability in high-cycle applications. The robustness of the flexure mechanisms that translate the minute piezo displacement into valve opening/closing motion is crucial, minimizing hysteresis and maximizing control linearity.

A critical technology component is the specialized drive electronics required to manage the high voltage, low current signals necessary to operate the piezo elements. These driver circuits must provide extremely stable, noise-free, and high-resolution voltage signals to ensure proportional control, often integrating high-speed digital signal processors (DSPs) or microcontrollers for complex waveform generation and real-time compensation for thermal drift or minor material aging. The integration of closed-loop feedback mechanisms, usually involving miniature pressure or flow sensors (Micro-Electro-Mechanical Systems or MEMS), is standard practice, enabling the system to instantaneously adjust the piezo voltage to maintain the target flow rate irrespective of external disturbances. This tight integration of sensing, actuation, and computational control defines the current state-of-the-art in proportional valve technology.

Emerging technologies focus on expanding the utility and simplifying the integration of these valves. This includes the development of 'smart valves' with integrated connectivity, utilizing protocols like IO-Link, Ethernet/IP, or proprietary wireless mesh networks for centralized control, diagnostics, and data collection relevant to Industry 4.0 environments. Another key area is the refinement of microfluidic valve arrays, where multiple tiny piezoelectric valves are integrated onto a single substrate to manage complex fluidic logic on a chip. Furthermore, innovations in packaging and sealing materials (e.g., highly flexible and chemically inert elastomers) are expanding the operational envelopes of these valves, enabling them to handle aggressive media and maintain performance integrity under extreme temperatures and pressures, further broadening their appeal in demanding industrial and analytical environments.

Regional Highlights

- North America: This region holds the largest market share in terms of value, primarily driven by the robust presence of leading medical device manufacturers and biotechnology firms in the United States and Canada. The stringent regulatory environment in the healthcare sector mandates the use of highly reliable, high-precision components like piezoelectric proportional valves for patient safety and efficacy. Furthermore, significant research and development spending in aerospace and defense, particularly concerning advanced fluid and gas handling systems, contributes substantially to the demand for premium, customized piezo solutions. The region acts as an early adopter of advanced valve technologies, setting market trends for high-resolution control systems and integrated smart diagnostics.

- Europe: Europe represents a mature market characterized by strong demand from advanced industrial automation and automotive sectors, particularly Germany and Switzerland. European manufacturers are focused on optimizing production lines for maximum efficiency and energy savings, driving the adoption of low-power, high-durability piezoelectric valves in robotics and precision assembly. The region is also a key center for analytical instrumentation manufacturing, requiring ultra-precise gas and liquid handling for laboratory equipment. Regulatory pressures, especially those related to energy consumption and environmental controls, further propel the transition from older, less efficient valve technologies to modern piezo solutions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, largely attributable to massive governmental and private investments in semiconductor manufacturing capacity (particularly in China, Taiwan, and South Korea) and rapidly expanding healthcare infrastructure. The demand for ultra-pure gas delivery systems in Fabs and the need for high-quality, domestically manufactured medical ventilators and diagnostic kits fuel the need for piezoelectric precision. While historically focused on cost-effective manufacturing, the region is quickly moving up the value chain, prioritizing technological capability and quality, leading to rapid market penetration for high-end proportional valve suppliers.

- Latin America (LATAM): The LATAM market, while smaller, exhibits steady growth primarily driven by modernization efforts in industrial plants, particularly in Brazil and Mexico, focusing on optimizing efficiency in processes like petrochemical refinement and food/beverage processing. Healthcare infrastructure improvements are also a growing factor, leading to increased demand for essential medical devices, including respiratory care equipment, where precision flow control is critical. Market dynamics are highly influenced by imports, making local distribution and technical support capabilities key competitive advantages.

- Middle East and Africa (MEA): The MEA market is currently characterized by niche demand, mainly concentrated in energy sector applications (oil and gas sampling and analysis) and infrastructure projects. Investments in specialized healthcare facilities, particularly in Gulf Cooperation Council (GCC) countries, are beginning to generate targeted demand for advanced medical technologies. Growth is moderate and segmented, with high-end demand in specialized industrial applications and low-end demand for general pneumatics, necessitating a focused sales strategy targeting high-value infrastructure projects and advanced diagnostic centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Piezoelectric Proportional Valve Market.- SMC Corporation

- Parker Hannifin

- Bürkert Fluid Control Systems

- Proportion-Air Inc.

- Festo AG & Co. KG

- Bosch Rexroth AG

- Curtiss-Wright Corporation

- Sensata Technologies (Kavlico)

- Vesper

- Covalence

- Takasago Fluidic Systems

- Camozzi Automation

- Vögtlin Instruments GmbH

- Clippard Instrument Laboratory

- MKS Instruments, Inc.

- Advanced Valve Technologies

- Valcor Engineering Corporation

- Rotarex S.A.

- Norgren (IMI Precision Engineering)

- EMERSON

Frequently Asked Questions

What are the primary benefits of piezoelectric proportional valves over traditional solenoid valves?

Piezoelectric proportional valves offer superior performance in terms of energy efficiency (ultra-low power consumption), control resolution (sub-millisecond response and fine linearity), and lifetime reliability (due to non-wearing solid-state actuation), making them ideal for battery-powered or high-cycle precision applications like medical ventilators.

Which industries are the major end-users driving the growth of the Piezoelectric Proportional Valve Market?

The Medical and Life Sciences sector is the leading driver, utilizing these valves in portable respiratory equipment, drug delivery systems, and sophisticated analytical instruments. The Semiconductor and Industrial Automation sectors are also critical consumers, requiring highly accurate gas and fluid control for fabrication and robotics.

What technological factors restrict the adoption of piezoelectric proportional valves in high-flow systems?

Piezoelectric proportional valves face restrictions in very high-flow or high-pressure applications because scaling the ceramic actuators sufficiently to generate the necessary closing or opening force becomes mechanically complex and highly expensive compared to traditional valve designs. They excel primarily in microfluidic and low-to-medium flow systems.

How does the integration of AI impact the performance and maintenance of piezoelectric valves?

AI significantly impacts performance by enabling self-tuning PID control loops for faster and more precise flow regulation. For maintenance, AI-driven predictive analytics monitor real-time performance data to forecast potential component drift or failure, drastically improving system uptime and reducing unscheduled maintenance costs.

Which geographic region demonstrates the fastest growth rate for piezoelectric proportional valve consumption?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to massive investments in regional semiconductor manufacturing expansion and substantial growth in high-technology medical device production, particularly in China and South Korea, driving demand for precision fluidic components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager