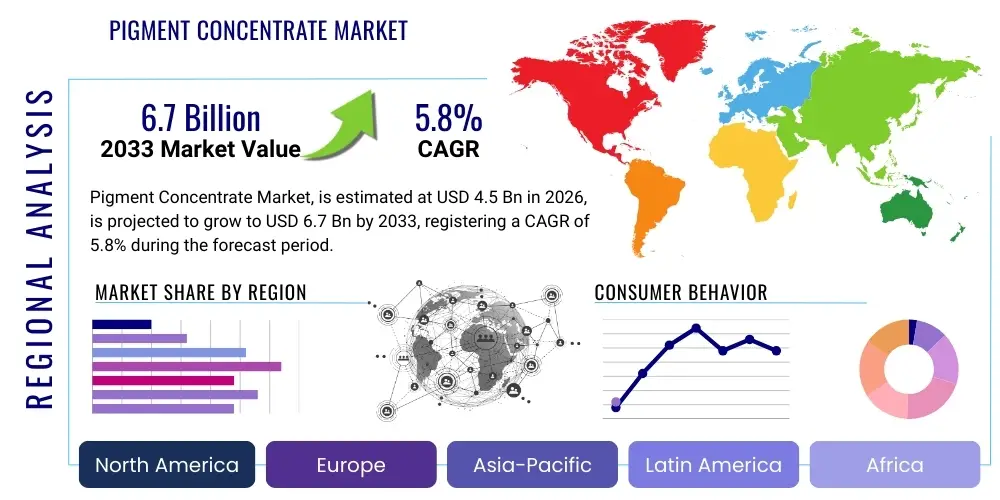

Pigment Concentrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437312 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Pigment Concentrate Market Size

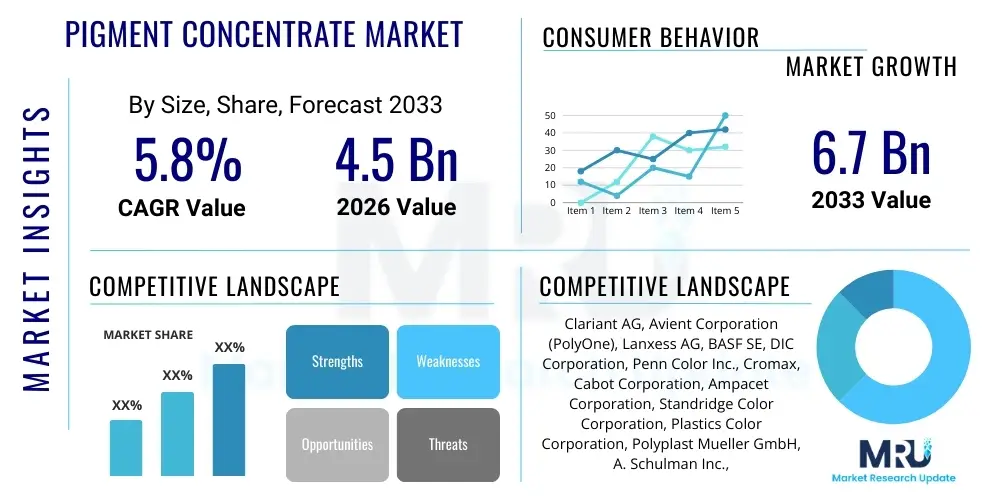

The Pigment Concentrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

The trajectory of growth in the pigment concentrate sector is primarily driven by the escalating demand from high-volume end-use industries, particularly packaging, construction, and automotive manufacturing. Pigment concentrates, valued for their superior dispersion properties, color consistency, and cost-effectiveness compared to neat pigments, are becoming the preferred coloring solution across polymers and coatings. Furthermore, the stringent regulatory environment pushing for the reduction of volatile organic compounds (VOCs) and hazardous substances is driving innovation toward solvent-free and water-based concentrate formulations, significantly impacting market valuation.

The market expansion is not uniform, showing particular acceleration in developing economies across the Asia Pacific (APAC) region, fueled by massive infrastructure projects and rapid expansion of the consumer goods sector. The technological advancements related to nano-pigments and high-performance concentrates designed for demanding applications, such as high-temperature engineering plastics and specialized textile fibers, contribute significantly to the overall market size increment. Industry stakeholders are heavily investing in capacity expansion and backward integration to secure raw material supply, anticipating sustained growth throughout the forecast period due to the indispensable nature of these concentrates in modern manufacturing processes requiring precise color control and enhanced product aesthetics.

Pigment Concentrate Market introduction

The Pigment Concentrate Market encompasses the production and distribution of highly loaded pigment preparations dispersed uniformly in a carrier medium, typically a polymer resin, plasticizer, or liquid solvent/water. These concentrates, often referred to as masterbatches in plastic applications, offer concentrated color solutions used to impart color, opacity, or other functional properties (like UV stabilization or antistatic behavior) to various materials, primarily plastics, coatings, inks, and fibers. Their precise formulation allows end-users to achieve consistent coloration with minimal dosing, simplifying the manufacturing process and reducing the potential for batch-to-batch color variation, which is critical in industries requiring stringent quality control such as automotive and medical devices.

Major applications of pigment concentrates span across diverse sectors, including flexible and rigid packaging (bottles, films, containers), automotive components (interiors, exteriors), construction materials (piping, profiles, roofing), consumer electronics, and specialized industrial coatings. The inherent benefits of using concentrates, such as dust-free handling, enhanced processing efficiency, better color saturation, and improved pigment utilization, make them economically and operationally superior to using raw pigments directly. The demand for vibrant colors, coupled with the need for high-throughput manufacturing processes, firmly establishes pigment concentrates as essential intermediates in the global manufacturing supply chain. Furthermore, the ability to customize formulations to meet specific regulatory standards, such as food contact compliance or toy safety requirements, enhances their attractiveness to global manufacturers.

The primary driving factors for this market include the global expansion of the plastics industry, the continuous evolution of packaging aesthetics and functionality, and the increasing consumption of durable goods in emerging economies. Additionally, ongoing R&D efforts focusing on developing sustainable, biodegradable carrier systems and high-chroma, easy-to-disperse concentrates for digital printing and advanced coating technologies are providing significant momentum. The shift from solvent-based to water-based liquid concentrates, driven by environmental mandates, is particularly strong in the inks and coatings segments, offering new avenues for market growth and technological differentiation.

Pigment Concentrate Market Executive Summary

The Pigment Concentrate Market is poised for stable and robust growth, underpinned by fundamental demand drivers in packaging and construction, coupled with technological shifts favoring high-performance and environmentally compliant formulations. Key business trends indicate a strong focus on consolidation among major players seeking economies of scale and control over specialized raw material supply chains, particularly high-performance organic pigments and effect pigments. The market is witnessing increased collaboration between pigment concentrate producers and polymer manufacturers to develop tailor-made solutions that optimize processing parameters for specific end applications, such as bio-plastics and advanced composites, thereby securing long-term supply contracts and market share.

Regionally, the Asia Pacific (APAC) remains the dominant and fastest-growing market, primarily due to large-scale plastic processing and robust manufacturing bases in China, India, and Southeast Asia. North America and Europe, while mature, are characterized by high demand for specialized, high-value concentrates, driven by stringent regulatory requirements (e.g., REACH in Europe) and a consumer preference for sustainable products. These mature regions lead in the adoption of advanced liquid concentrates and concentrates based on recycled or bio-based polymers. Segment-wise, the plastics segment, particularly polyolefins and engineering plastics, retains the largest market share owing to its widespread use in consumer goods and industrial applications. However, the coatings and inks segments are exhibiting higher growth rates, propelled by the transition to waterborne and UV-curable systems where pre-dispersed concentrates offer significant advantages in stability and application performance.

The overarching strategic narrative across the industry revolves around sustainability and digitalization. Companies are prioritizing the development of concentrates that facilitate the recycling of plastics (e.g., concentrates that do not interfere with near-infrared sorting processes) and those utilizing recycled polymer carriers. Furthermore, the integration of data analytics and supply chain digitalization is becoming crucial for optimizing inventory management, enhancing color matching accuracy, and responding rapidly to volatile raw material costs and fluctuating customer demands, ensuring operational resilience and competitive advantage in a complex global market landscape.

AI Impact Analysis on Pigment Concentrate Market

Analysis of common user inquiries reveals that key stakeholders are intensely interested in how Artificial Intelligence (AI) can revolutionize the traditionally experience-driven processes of color matching, quality control, and formulation optimization within the pigment concentrate market. Users frequently ask about the feasibility of AI-driven predictive modeling for raw material price fluctuations, the accuracy of AI algorithms in compensating for color shifts during high-temperature processing, and the potential for fully automated, closed-loop color correction systems integrated directly into production lines. The overarching themes reflect a desire to mitigate human error, reduce formulation time (which can take days or weeks through traditional empirical methods), and enhance supply chain predictability, particularly regarding managing the complex interactions between different pigments and carrier resins under various manufacturing conditions. Expectations are high regarding AI’s ability to drive ‘right-first-time’ production, thereby minimizing waste and operational costs, which are critical metrics in this margin-sensitive industry.

- AI-powered predictive modeling for optimizing pigment dispersion parameters, minimizing agglomeration, and ensuring maximized color strength and consistency.

- Implementation of machine learning algorithms for rapid color matching (spectrophotometric data analysis combined with historical production knowledge) significantly reducing R&D cycle times.

- AI-driven supply chain resilience through predictive analytics anticipating shortages or price volatility in key raw materials like titanium dioxide or specialized organic dyes.

- Automated, real-time quality control systems utilizing computer vision and spectral analysis to detect minute color variations or processing defects during concentrate manufacturing.

- Optimization of production schedules and energy consumption in extrusion or blending processes using AI to manage complex interactions between batch sizes and machine parameters.

- Development of "smart" concentrates where embedded data tags are analyzed by AI systems to provide end-users with optimized processing guidelines, ensuring efficient use.

- Enhanced regulatory compliance checks and safety data sheet generation through AI parsing of global chemical inventory regulations.

DRO & Impact Forces Of Pigment Concentrate Market

The dynamics of the Pigment Concentrate Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, shaping the overall Impact Forces on market growth and profitability. The primary drivers include the burgeoning global demand for plastics, especially in high-growth packaging and infrastructure sectors, necessitating high-quality, standardized coloring solutions. Coupled with this is the continuous need for aesthetic enhancement and product differentiation across consumer goods, pushing manufacturers towards specialized and effect concentrates. The robust adoption of highly concentrated formulations, reducing logistical costs and material wastage for end-users, further accelerates market penetration globally, establishing these products as superior alternatives to powder pigments.

However, significant restraints temper the potential growth rate. High volatility in the prices of key raw materials, particularly crude oil derivatives (for carrier polymers) and critical inorganic pigments (like iron oxides and TiO2), poses persistent challenges to profitability and necessitates advanced hedging strategies. Additionally, the increasing regulatory scrutiny, especially in developed economies concerning heavy metal content and microplastic release (relevant to masterbatch handling), demands substantial investment in R&D for compliance and the transition to safer alternatives. The complexity of formulation, requiring specialized technical expertise and high capital expenditure for dispersion equipment, also acts as a barrier to entry for smaller players.

Opportunities for expansion are primarily concentrated around sustainable innovation, including the development and marketing of concentrates specifically designed for bio-plastics and recycled content, aligning with circular economy initiatives. The growth of additive manufacturing (3D printing) presents a niche but rapidly expanding application area for highly customized concentrates. Furthermore, geographical expansion into underserved markets in Africa and specific parts of Latin America, where plastic conversion rates are rising rapidly, provides long-term revenue potential. The combined impact forces suggest moderate to high growth, sustained by essential industrial demand but challenged by raw material cost pressures and evolving environmental legislation, driving innovation toward specialized, high-value, and compliant products.

Segmentation Analysis

The Pigment Concentrate Market is meticulously segmented based on product type, carrier type, application, and end-use industry, reflecting the diverse technical requirements across the value chain. Segmentation allows market participants to tailor their product offerings and strategic focus, ranging from high-volume, commodity-grade masterbatches (typically based on Polyethylene) used in general packaging to highly specialized, low-volume liquid concentrates engineered for automotive coatings requiring exceptional color fastness and chemical resistance. Understanding these segments is crucial for predicting localized demand shifts, technological investment areas, and competitive intensity.

The structure of the segmentation reflects the material science underlying the concentrates, with the carrier medium being the most defining characteristic, determining compatibility with the end application material. Liquid concentrates, for instance, are gaining traction in inks and coatings due to their ease of incorporation and superior wetting properties, whereas solid masterbatches remain dominant in the plastics processing industry due to their handling convenience and excellent thermal stability. The end-use segmentation highlights the sector-specific drivers, with packaging driving volume, and automotive/electronics driving value and technological complexity. This granular view is essential for developing AEO-optimized content targeting specific industry buyers seeking solutions for precise applications.

- By Product Type:

- Solid Concentrates (Masterbatches)

- Liquid Concentrates (Dispersions)

- Paste Concentrates

- By Carrier Type:

- Polyethylene (PE)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Engineering Plastics (e.g., ABS, PET, PC)

- Universal/Other Carriers (e.g., Plasticizers, Waterborne Systems)

- By Application:

- Plastics (Injection Molding, Extrusion, Blow Molding)

- Coatings (Industrial, Architectural, Automotive)

- Inks (Packaging Inks, Digital Inks)

- Fibers and Textiles

- By End-Use Industry:

- Packaging (Flexible and Rigid)

- Building & Construction

- Automotive

- Consumer Goods

- Electronics

- Textiles

- Others (Agriculture, Medical)

Value Chain Analysis For Pigment Concentrate Market

The value chain of the Pigment Concentrate Market begins with the highly specialized upstream analysis involving the sourcing and refining of raw materials. This stage includes procurement of high-performance organic and inorganic pigments (e.g., complex metal oxides, high-quality carbon black, and advanced TiO2), as well as the acquisition of carrier resins (polymers like PE, PP, or specialized engineering plastics) and critical additives such as dispersants, stabilizers, and processing aids. The profitability and stability of the entire chain are heavily dependent on the efficiency of this upstream segment, as fluctuations in commodity prices and supply disruptions for key pigments can severely impact manufacturing costs and product delivery timelines. Suppliers often operate globally, leading to complex logistics and the need for robust risk management strategies to ensure consistent material quality and availability for concentrate production.

The midstream segment involves the core manufacturing process of the concentrate producer, which includes compounding, kneading, extrusion, and dispersion technologies. This critical stage demands significant technical expertise and specialized equipment (twin-screw extruders, high-speed mixers, or bead mills for liquid systems) to ensure optimal pigment wetting, deagglomeration, and uniform distribution within the carrier medium. Direct distribution channels are often favored for large-volume industrial clients, such such as major automotive tier-one suppliers or large packaging converters, enabling close collaboration on color customization and technical support. Conversely, indirect distribution, utilizing regional distributors, agents, and specialized compounding houses, is prevalent for reaching small-to-medium enterprises (SMEs) and servicing fragmented markets, particularly in emerging economies where localized inventory and technical service are crucial competitive advantages.

The downstream analysis focuses on the conversion industries—plastics processors, coating manufacturers, and ink producers—who incorporate the concentrates into their final products. The performance of the concentrate is ultimately judged at this stage, based on ease of processing, color accuracy under specific production conditions, and the resultant quality of the final consumer or industrial good. Strong collaboration between the concentrate producer and the end-user is essential, moving beyond a simple transactional relationship to a partnership focused on problem-solving, such as addressing plate-out in extrusion or ensuring UV stability in exterior applications. This collaborative model, often facilitated by direct sales and technical service teams, drives product innovation and secures long-term market loyalty.

Pigment Concentrate Market Potential Customers

The potential customer base for the Pigment Concentrate Market is highly diversified, spanning multiple industries that rely on precise and efficient coloration, primarily categorized as end-users or buyers who integrate the concentrates into their manufacturing processes. The largest volume consumers are plastics processors, including injection molders, blow molders, and film extruders, specializing in high-throughput production of packaging components, automotive interiors and exteriors, household goods, and consumer electronics casings. These buyers prioritize concentrates that offer excellent heat stability, low migration rates, and superior dispersion quality to minimize scrap rates and ensure regulatory compliance, particularly for food-contact materials and medical device applications.

A second crucial segment consists of coatings and inks manufacturers. Architectural and industrial coatings companies utilize liquid pigment concentrates (dispersions) for tinting systems, demanding highly stable and compatible products that can be accurately dispensed to achieve consistent color across different batches and substrates. In the printing industry, especially in the flexible packaging and digital printing sectors, potential buyers seek concentrates that enhance color gamut, improve printability, and comply with strict solvent emission standards, driving the demand for water-based or UV-curable dispersions. These customers require extensive technical support to match concentrates with complex resin systems and application technologies, emphasizing specialized customer service and rapid formulation turnaround times.

Furthermore, specialized industrial sectors constitute significant potential buyers. The construction industry utilizes concentrates for coloring PVC profiles, piping, and composite decking, prioritizing weatherfastness and durability. The textile and fiber industry, including manufacturers of synthetic fibers like polyester and nylon, requires concentrates (often in chip form) that withstand the high temperatures of melt spinning processes while ensuring uniform color penetration and lightfastness. In these diverse sectors, the purchasing decision is heavily influenced not just by price, but by the concentrate producer's ability to provide customized solutions that meet stringent performance specifications and specific industry certifications, making technical capability a primary purchasing criterion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Clariant AG, Avient Corporation (PolyOne), Lanxess AG, BASF SE, DIC Corporation, Penn Color Inc., Cromax, Cabot Corporation, Ampacet Corporation, Standridge Color Corporation, Plastics Color Corporation, Polyplast Mueller GmbH, A. Schulman Inc., Gabriel-Chemie Group, Dainichiseika Color & Chemicals Mfg. Co., Ltd., Ferro Corporation, Milliken & Company, GCR Group, Americhem Inc., PolyOne Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pigment Concentrate Market Key Technology Landscape

The technological landscape of the Pigment Concentrate Market is defined by continuous innovation aimed at achieving better dispersion, higher loading levels, and enhanced sustainability, primarily focusing on improving the efficiency and quality of the compounding process. Key technological advancements center around high-shear mixing equipment, such as advanced twin-screw extruders and continuous kneaders, which are designed to apply precisely controlled energy to break down pigment agglomerates and ensure uniform wetting by the carrier polymer or liquid medium. The precision offered by these advanced compounding techniques is crucial for high-performance applications where even minor variations in particle size distribution can drastically affect color strength, filtration performance, and mechanical properties of the final product. Furthermore, sophisticated process control systems incorporating sensors and real-time rheological analysis are being integrated to monitor and adjust compounding parameters dynamically, leading to significant reductions in batch-to-batch variability and material waste.

Another pivotal technological area involves the development of specialized dispersants and wetting agents, which are chemical additives critical for stabilizing the pigment particles within the carrier. Recent innovations include polymeric dispersants tailored specifically for challenging pigment chemistries, such as highly transparent organic pigments or nano-sized inorganic materials, ensuring long-term shelf stability in liquid concentrates and preventing flocculation or settlement. For solid masterbatches, the focus is on developing low-VOC, high-efficiency carrier systems, including concentrates based on bio-polymers (like PLA or PHAs) and recycled plastic content (PCR-based masterbatches), requiring complex stabilization technologies to maintain color integrity despite the variability inherent in recycled feedstocks. This technical shift aligns with global regulatory pressures favoring environmentally friendly material solutions and requires deep material science expertise.

Furthermore, the integration of advanced color measurement and quality assurance technology is rapidly becoming standard. High-speed spectrophotometers and color quality software linked to centralized databases are essential for achieving consistent global color standards. The emerging trend involves integrating these measurement systems with machine learning models—a direct link to the AI impact discussed earlier—to predict and compensate for color drift caused by thermal degradation or shear stress during downstream processing. This digital transformation of quality control ensures that the pigment concentrate delivered is not only physically dispersed well but also guarantees predictable color performance across diverse manufacturing environments globally, representing a shift toward performance-guaranteed formulations rather than just material supply.

Regional Highlights

The global Pigment Concentrate Market exhibits distinct regional characteristics influenced by manufacturing trends, regulatory frameworks, and economic maturity.

- Asia Pacific (APAC): Dominates the market both in volume and growth rate, propelled by the unparalleled scale of the manufacturing sector, particularly in packaging, construction, and textiles across China, India, and Southeast Asian nations. Low-cost production bases and burgeoning domestic consumption drive high demand for commodity and specialty masterbatches.

- North America: Characterized by high technological adoption and a focus on premium, high-performance concentrates, particularly in the automotive, medical, and aerospace sectors. Strict safety and material standards necessitate high-value, compliant formulations, favoring robust R&D investment and specialized suppliers.

- Europe: A mature market defined by stringent environmental regulations, notably REACH, driving the rapid adoption of sustainable solutions, including non-heavy metal pigments, solvent-free liquid concentrates, and bio-based carriers. Innovation in recycling and circular economy initiatives strongly influences market demand and product development strategies.

- Latin America (LATAM): Exhibits strong growth potential, primarily driven by expanding urbanization, infrastructure development, and growing local plastics processing industries, particularly in Brazil and Mexico. The market is increasingly shifting from imported finished goods to local manufacturing, increasing the requirement for local concentrate supply chains.

- Middle East and Africa (MEA): Growth is tied to investments in petrochemical processing capacity (especially in the GCC countries) and developing infrastructure projects. Demand is rising for standard-grade masterbatches for construction materials and basic packaging, although specialized oil and gas sector requirements also create niche high-performance opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pigment Concentrate Market.- Clariant AG

- Avient Corporation (PolyOne)

- Lanxess AG

- BASF SE

- DIC Corporation

- Penn Color Inc.

- Cabot Corporation

- Ampacet Corporation

- Standridge Color Corporation

- Plastics Color Corporation

- Polyplast Mueller GmbH

- Gabriel-Chemie Group

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- Ferro Corporation

- Milliken & Company

- GCR Group

- Americhem Inc.

- PolyOne Corporation

- Cromax (Axalta Coating Systems)

- Sudarshan Chemical Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the Pigment Concentrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between pigment concentrates and raw pigments?

Pigment concentrates are highly loaded, pre-dispersed pigment preparations embedded in a compatible carrier (polymer or liquid), offering superior handling, dust reduction, and exceptional color consistency compared to raw powder pigments, which require complex in-house dispersion and are prone to handling difficulties and poor quality control if not processed correctly.

How do stringent environmental regulations, such as REACH, affect the concentrate market?

Regulations like REACH force manufacturers to eliminate hazardous substances (e.g., heavy metals) and promote the shift toward safer, compliant, and sustainable formulations, accelerating the adoption of high-performance organic pigments and water-based or solvent-free liquid concentrates in European and associated global markets.

Which end-use industry drives the highest demand volume for pigment concentrates?

The Packaging industry, encompassing both flexible and rigid plastic packaging, is the largest volume consumer globally. This is driven by high production rates for consumer goods, food and beverage containers, and increasing focus on visual branding and product differentiation requiring precise color matching.

What role does dispersion quality play in the overall performance of a concentrate?

Dispersion quality is critical; poor dispersion leads to pigment agglomeration, resulting in reduced color strength, inconsistent shade, processing defects (like filter blocking or plate-out), and compromised mechanical properties in the final product. High-quality concentrates ensure maximized color efficiency and optimal end-product performance.

Are liquid pigment concentrates replacing solid masterbatches in certain applications?

Yes, liquid concentrates are increasingly replacing solid masterbatches, particularly in the coatings and printing ink sectors, as well as in certain polyurethane applications. They offer superior flow properties, ease of metering, and faster, more complete wetting of the pigment surface, leading to enhanced color brilliance and higher gloss finishes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager