Pilot Glasses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431821 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pilot Glasses Market Size

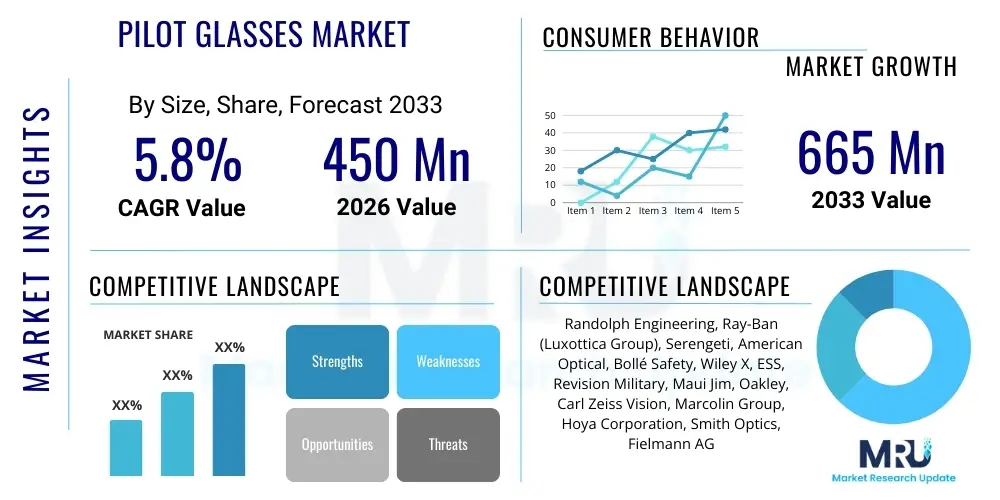

The Pilot Glasses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 665 Million by the end of the forecast period in 2033.

Pilot Glasses Market introduction

The Pilot Glasses Market encompasses specialized eyewear designed to meet the rigorous visual and safety demands of professional and recreational pilots. These products are crucial for enhancing visual clarity, reducing glare, filtering harmful UV radiation, and ensuring optimal situational awareness during flight operations. Key product characteristics include lightweight construction, high optical quality, compatibility with aviation headsets and helmets, and often, non-polarized lenses, which is a critical specification to prevent distortion when viewing cockpit instrumentation, particularly liquid-crystal displays (LCDs) or electronic flight bags (EFBs).

Major applications of pilot glasses span across military, commercial, and private aviation sectors. In commercial aviation, standardized high-quality eyewear is necessary for fatigue reduction during long-haul flights and maintaining compliance with aviation health standards. Military applications demand highly durable, impact-resistant glasses that often comply with stringent ballistic standards for enhanced protection in combat or training environments. The core benefit of these specialized glasses is the provision of superior contrast and depth perception under variable atmospheric and light conditions, ranging from bright sunshine at high altitudes to challenging low-light landings.

Driving factors for market expansion include the consistent growth of the global commercial aircraft fleet, the rising number of licensed pilots globally, and continuous technological advancements in lens and frame materials that offer improved performance and comfort. Additionally, increasing awareness regarding the long-term effects of UV and blue light exposure on pilots’ vision is prompting higher adoption rates of premium, protective eyewear. Regulatory bodies, such as the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA), emphasize visual acuity standards, further cementing the necessity of high-performance pilot glasses.

Pilot Glasses Market Executive Summary

The Pilot Glasses Market is characterized by robust growth driven primarily by escalating air travel demand and the modernization of global military aviation forces requiring advanced protective gear. Key business trends indicate a strong move toward customization and the incorporation of sophisticated lens technologies, such as photochromic and high-definition optics, designed to adapt automatically to changing cockpit lighting conditions. Market leaders are focusing on strategic partnerships with large commercial airlines and defense procurement agencies to secure long-term contracts, emphasizing compliance with strict military and civil aviation specifications.

Regionally, North America maintains market dominance due to the high concentration of major defense contractors, significant commercial air traffic volume, and the presence of leading eyewear manufacturers specialized in aerospace applications. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, fueled by rapid expansion of low-cost carriers, substantial investment in new airport infrastructure, and the continuous growth of both commercial and general aviation sectors, particularly in China and India. Europe also represents a mature market, driven by stringent safety regulations and the established presence of high-end optical brands focused on professional ergonomics and style.

Segmentation trends highlight the increasing demand for high-end, non-polarized, prescription pilot glasses, reflecting the aging demographic of the pilot population and the personalized visual needs of professional aviators. While the aviator style remains iconic and popular across all segments, the demand for wrap-around, protective styles is rising, particularly in military and private recreational flying, where peripheral vision and wind protection are paramount. Distribution channels are shifting, with dedicated specialty optical stores and direct-to-consumer online platforms gaining traction, allowing manufacturers to offer specialized fittings and technical support directly to the end-users.

AI Impact Analysis on Pilot Glasses Market

User inquiries concerning the influence of Artificial Intelligence (AI) on the Pilot Glasses Market often center on how AI-driven cockpit augmentation might change visual requirements, whether AI can integrate diagnostic capabilities into eyewear, and the potential for AI algorithms to personalize lens performance in real-time. Analysis reveals that key themes revolve around the integration of augmented reality (AR) displays powered by AI to overlay crucial flight data onto the pilot's field of view, minimizing head-down time. Users also express interest in AI's role in optimizing lens tint and clarity based on predictive weather models and dynamic light conditions, effectively creating a "smart" pilot glass system that preempts visual stressors.

The core expectation is that AI will transform pilot glasses from passive protective equipment into active, data-interacting visual tools. Concerns exist regarding the balance between functionality and clutter—ensuring AR overlays are intuitive and non-distracting during critical phases of flight. Manufacturers are exploring micro-display technology and AI-based image processing to ensure seamless data presentation without compromising optical clarity or regulatory compliance. Although fully autonomous flight reduces the direct need for pilot input, the transitional period involves heavy reliance on human monitoring, where AI-enhanced visual aids become indispensable tools for supervising automated systems and handling complex deviations.

- AI integration enables sophisticated augmented reality (AR) overlays for displaying navigational data and hazard warnings directly onto the lens surface.

- Predictive AI algorithms can optimize photochromic lens adjustments based on flight phase, altitude, and instantaneous light measurements, ensuring optimal vision clarity.

- AI-powered monitoring systems embedded in the glasses can track pilot fatigue, pupil dilation, and attention focus, offering real-time alerts or recommendations.

- Advanced manufacturing techniques utilizing AI optimize material stress analysis and ergonomic design, leading to lighter, more durable, and custom-fit frames.

- Machine learning enhances quality control processes during lens production, ensuring minimal optical aberration and superior performance compliance.

DRO & Impact Forces Of Pilot Glasses Market

The Pilot Glasses Market is significantly influenced by a confluence of accelerating drivers, stringent restraints, and lucrative opportunities, collectively forming the dynamic impact forces shaping its trajectory. The primary drivers include the mandatory requirement for high-quality protective eyewear in regulated aviation environments, coupled with the global growth in air traffic and the corresponding increase in commercial pilot training. Restraints largely stem from the high cost associated with manufacturing precision, custom-made lenses, particularly those incorporating advanced materials and coatings, as well as the inherent reluctance within the aviation community to adopt polarized lenses due to compatibility issues with cockpit instrumentation, which limits market expansion for certain popular lens types.

Opportunities for growth are vast, particularly in the emerging markets of Asia Pacific where pilot training schools are proliferating rapidly, creating a growing base of entry-level professional customers. The expansion into smart eyewear, integrating technologies like AR and biometric monitoring, represents a significant avenue for value addition and premium pricing. Furthermore, the ongoing push towards lightweight, sustainable materials and hypoallergenic frame designs offers differentiation in a highly specialized market. The core impact forces therefore necessitate continuous innovation in lens chemistry and frame ergonomics to balance strict regulatory requirements with enhanced user comfort and functional performance.

The market faces impact from several critical factors: Regulatory Impact dictates mandatory specifications for impact resistance and optical quality, driving compliance costs and specialized material use. Technological Impact pushes for integration of digital features and high-definition optics. Economic Impact influences procurement decisions, especially within defense budgets and large commercial fleet purchases. Finally, the Safety Impact, which is paramount in aviation, ensures that performance criteria (such as non-polarization compatibility and UV blocking) take precedence over purely aesthetic considerations, maintaining a premium value proposition for truly specialized pilot eyewear.

Segmentation Analysis

The Pilot Glasses Market segmentation provides a granular view of demand distribution across various product specifications, materials, end-user applications, and distribution methodologies. Understanding these segments is crucial for manufacturers to tailor their R&D and marketing efforts, ensuring products meet the distinct requirements of commercial aviators versus military personnel or general aviation enthusiasts. The segmentation highlights premiumization trends in lens technology and material science, driven by the requirement for optimized visual performance under highly stressful and variable conditions inherent to flying.

Key segmentation reveals that while aviator style glasses dominate historical sales due to tradition and form factor, the functional segments related to lens material (e.g., impact-resistant polycarbonate) and application (e.g., military contracts) drive the highest revenue growth. The B2B nature of large commercial and military procurement contrasts sharply with the B2C segment targeting private pilots, requiring distinct sales and technical support strategies. This comprehensive segmentation allows stakeholders to identify niche high-growth areas, such as the market for custom prescription pilot eyewear, which commands substantial profit margins due to its specificity.

- By Product Type:

- Aviator Style

- Wrap-around Style

- Sports/Tactical Design

- By Lens Type:

- Non-polarized

- Photochromic (Light Adjusting)

- High-Definition (HD) Optics

- Prescription

- By Lens Material:

- Polycarbonate

- Glass (Mineral)

- Trivex/NXT

- CR-39

- By Application:

- Commercial Aviation (Airline Pilots)

- Military Aviation (Fighter/Transport Pilots)

- General/Recreational Aviation

- Flight Training Academies

- By Distribution Channel:

- Offline Retail (Specialty Optical Stores, Department Stores)

- Online Retail (E-commerce Platforms, Brand Websites)

- Direct Procurement (Military/Aviation Operators)

Value Chain Analysis For Pilot Glasses Market

The value chain for the Pilot Glasses Market begins with upstream activities focused on raw material sourcing and precision component manufacturing. This involves procuring specialized optical polymers (like high-grade polycarbonate or NXT material) and metals (like titanium or high-tensile stainless steel) necessary for creating lightweight, durable, and hypo-allergenic frames. The specialized nature of the lenses, which must pass rigorous optical and impact testing (e.g., ANSI Z87.1 or military standard MIL-PRF-31013), places a heavy emphasis on R&D and advanced coating application during the manufacturing stage. Expertise in non-polarization techniques and anti-reflective coatings is a prerequisite for entry at this stage, driving costs and limiting the pool of qualified suppliers.

Midstream activities involve the assembly, customization, and branding of the finished products. Due to the professional nature of the end-user, rigorous quality assurance and certification processes are integral, ensuring compliance with global aviation safety standards such as FAA or EASA requirements. The distribution channel is bifurcated: direct channels often handle large volume military or commercial airline contracts, demanding logistical efficiency and specialized documentation. Indirect channels, serving general aviation and recreational pilots, rely heavily on specialty optical retailers who can provide expert fitting and prescription integration services, acting as crucial technical intermediaries between the manufacturer and the discerning pilot consumer.

Downstream activities focus on sales, marketing, and post-sale support. Direct and online retail channels allow manufacturers to control the brand message and engage directly with the professional aviation community, offering highly technical product information. The increasing use of e-commerce platforms requires sophisticated logistical support for global delivery and managing customized orders. Crucially, the long operational life of high-quality pilot glasses necessitates robust warranty and repair services, especially for high-value military-grade or complex prescription items, reinforcing customer loyalty and trust within this specialized market niche.

Pilot Glasses Market Potential Customers

Potential customers for pilot glasses are highly segmented yet uniformly require performance and reliability above standard consumer eyewear. The largest and most lucrative customer segment comprises professional aviators employed by major commercial airlines, including regional, national, and international carriers. These buyers prioritize non-polarized lenses, ergonomic comfort for extended wear, and frames that seamlessly integrate with standard cockpit environments and communication equipment. Purchasing decisions in this segment are often influenced by recommendations from flight safety officers and institutional procurement guidelines rather than individual aesthetics.

The second critical segment is military and defense aviation personnel, encompassing fighter pilots, transport pilots, and helicopter crews. This customer base demands glasses that meet stringent ballistic fragmentation protection standards, exceptional durability, and specific anti-glare properties for high-G maneuvers or night-vision compatibility. Procurement here is driven by government tenders and defense contracts, focusing heavily on technical specifications, operational testing results, and long-term logistical support capabilities of the supplier. This B2G (Business-to-Government) relationship is characterized by complex regulatory and technical barriers to entry.

Finally, the general and private aviation segment, including flight students, recreational pilots, and general aviation aircraft owners, forms a significant volume component. These customers seek a blend of professional-grade functionality and personal style. While prioritizing safety features like high UV protection, they are more susceptible to brand loyalty and market aesthetics compared to commercial pilots. Flight training academies represent an important sub-segment, requiring durable, entry-level glasses for trainees who need to adapt quickly to diverse visual conditions during the learning phase.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Randolph Engineering, Ray-Ban (Luxottica Group), Serengeti, American Optical, Bollé Safety, Wiley X, ESS, Revision Military, Maui Jim, Oakley, Carl Zeiss Vision, Marcolin Group, Hoya Corporation, Smith Optics, Fielmann AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pilot Glasses Market Key Technology Landscape

The technology landscape of the Pilot Glasses Market is defined by innovation in lens optics, material science, and digital integration, aiming to maximize visual comfort and operational safety. A critical technology is the development of highly stable, non-polarized lens coatings that effectively manage glare and ambient light without causing interference patterns (known as the "blackout" effect) when viewing LCD or OLED cockpit displays, head-up displays (HUDs), and flight management systems. This necessitates precise control over molecular layering during the deposition process to achieve superior light transmission curves. Photochromic technology is also advancing rapidly, offering faster reaction times and a wider dynamic range, enabling lenses to shift clarity almost instantaneously between bright sunlight and cloud penetration, minimizing eye strain during rapid transitions in light intensity.

Material science innovation centers on creating ultra-lightweight, high-impact resistant frames and lenses. Frames often utilize aerospace-grade titanium or specialized polymer composites (like Grilamid TR90) to ensure durability and comfort under high temperatures and prolonged use, while remaining compatible with noise-cancelling aviation headsets. Lens materials, such as Trivex or high-grade polycarbonate, are preferred for their superior impact resistance, crucial for military applications and protection against debris. Furthermore, high-definition or 'chromatic filtering' optics are employed to selectively filter out specific wavelengths of light (like excess blue light), enhancing contrast and improving depth perception, which is vital during complex approach and landing maneuvers.

Looking forward, the technology landscape is increasingly incorporating micro-electronics and digital connectivity. Research is concentrated on developing seamless Augmented Reality (AR) integration into the eyewear itself, moving beyond bulky helmet-mounted displays. This involves projecting critical flight data via miniature optical engines housed within the frame, ensuring the data remains clear and non-obtrusive to the natural field of view. These smart glasses may also feature embedded sensors for biometric monitoring (e.g., eye tracking, heart rate variability), powered by miniaturized, long-lasting battery solutions compatible with long-haul flight requirements, thus enhancing pilot health and operational safety analysis.

Regional Highlights

- North America: This region holds the largest market share, driven by the strong presence of major defense contractors and the highest volume of general and commercial aviation traffic globally. The U.S. market specifically benefits from stringent FAA regulations demanding certified eyewear and substantial procurement budgets allocated by the Department of Defense for advanced military-grade pilot glasses. Innovation in AR-enabled flight technology also originates primarily from this region.

- Europe: Characterized by a mature aviation sector and high disposable income, Europe exhibits strong demand for high-end, aesthetically designed pilot glasses that meet strict EASA safety standards. Countries like Germany and France are key centers for precision optics manufacturing, focusing on ergonomic design and premium materials. The market is moderately saturated, requiring manufacturers to emphasize brand heritage and superior optical performance for differentiation.

- Asia Pacific (APAC): APAC is the fastest-growing market, fueled by explosive growth in commercial aviation, massive investment in new airport infrastructure, and the subsequent rapid expansion of regional flight training academies, particularly in China, India, and Southeast Asia. The focus is shifting from basic protection toward adopting modern, technical eyewear to meet the standards of rapidly modernizing regional carriers and air forces.

- Latin America: This region presents moderate growth, primarily driven by expanding general aviation operations and the need for standardized equipment in emerging regional airlines. Price sensitivity remains a factor, driving demand toward cost-effective yet reliable solutions that still adhere to basic international safety requirements.

- Middle East and Africa (MEA): Growth is stable, propelled by significant investment in defense aviation technology, especially in the Gulf Cooperation Council (GCC) countries. Commercial airline expansion, particularly among large flag carriers, drives demand for high-specification eyewear suitable for extreme heat and high UV environments. Direct government procurement is a key sales channel in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pilot Glasses Market.- Randolph Engineering

- Ray-Ban (Luxottica Group)

- Serengeti Eyewear

- American Optical (AO Eyewear)

- Bollé Safety

- Wiley X Inc.

- ESS (Eye Safety Systems)

- Revision Military

- Maui Jim (Kering Eyewear)

- Oakley (Luxottica Group)

- Carl Zeiss Vision International GmbH

- Marcolin Group

- Hoya Corporation

- Smith Optics (Safilo Group)

- Fielmann AG

- Gatorz Eyewear

- Rudy Project

- Silhouette International

- 3M Company (Safety Division)

Frequently Asked Questions

Analyze common user questions about the Pilot Glasses market and generate a concise list of summarized FAQs reflecting key topics and concerns.Why are non-polarized lenses often mandatory for professional pilots?

Non-polarized lenses are essential because polarization filters can interfere with the visibility of critical liquid-crystal displays (LCDs), electronic flight bags, and instruments in the cockpit, leading to partial or complete visual blackout when viewed at certain angles, compromising safety.

What is the primary factor driving the demand for specialized prescription pilot glasses?

The increasing average age of professional pilots globally is the primary driver. As pilots require visual correction, specialized prescription lenses must be integrated with the non-polarized, high-definition optical standards required for aviation safety and performance.

How does the military aviation segment differ from commercial aviation demand?

Military aviation requires higher impact resistance (ballistic standards), specific compatibility with helmets and oxygen masks, and often demands specialized lens tints for tactical environments, whereas commercial aviation focuses more on ergonomic comfort for extended wear and non-interference with modern digital cockpit screens.

What role does photochromic technology play in modern pilot eyewear?

Photochromic technology allows lenses to automatically adjust their tint based on UV exposure, ensuring optimal light management during rapid transitions, such as flying into or out of clouds, thereby reducing eye fatigue and improving visual acuity without manual lens changes.

Which geographical region exhibits the highest growth potential in the Pilot Glasses Market?

The Asia Pacific (APAC) region is projected to demonstrate the highest growth rate, driven by significant investments in commercial airline fleet expansion, the establishment of numerous new flight training academies, and rapid modernization across regional military aviation sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager