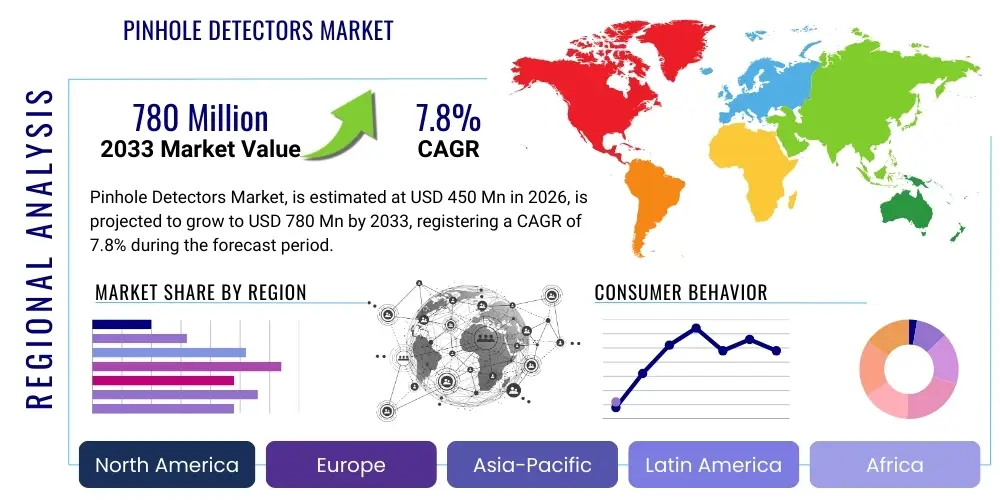

Pinhole Detectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437635 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Pinhole Detectors Market Size

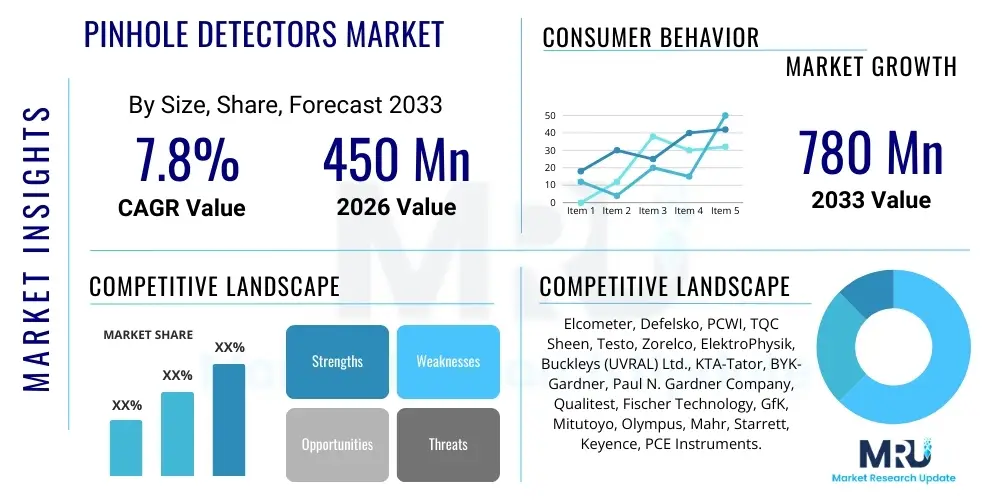

The Pinhole Detectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 780 Million by the end of the forecast period in 2033.

Pinhole Detectors Market introduction

The Pinhole Detectors Market encompasses specialized non-destructive testing (NDT) equipment designed to identify microscopic flaws, holidays, or discontinuities (pinholes) in non-conductive coatings applied over conductive substrates. These coatings are essential barriers against corrosion, abrasion, and contamination, primarily utilized across industries requiring high levels of material integrity, such as oil and gas, infrastructure, marine, and aerospace. The fundamental principle of these devices relies on electrical testing methods, utilizing either low-voltage (wet sponge) or high-voltage (spark) techniques to detect areas where the protective layer is compromised, allowing current to pass through to the underlying substrate.

Pinhole detection technology is crucial for quality assurance and regulatory compliance, particularly in environments where coating failure can lead to catastrophic structural degradation or safety hazards. The primary products include high-voltage spark testers, suitable for thicker coatings (typically above 500 microns or 20 mils), and low-voltage wet sponge detectors, ideal for thin coatings (up to 500 microns). These instruments are highly portable, ensuring suitability for both laboratory quality control and on-site inspection of large structures like pipelines, storage tanks, and ship hulls.

Major applications driving the adoption of pinhole detectors include corrosion protection in petrochemical infrastructure, sealing integrity testing in packaging materials, and quality control in automotive body painting and composite manufacturing. The benefits derived from using these detectors are substantial, primarily preventing costly material failures, extending the operational lifespan of coated assets, and ensuring adherence to international standards such as ASTM G62, ASTM D5162, and NACE SP0188. Key driving factors include increasing global infrastructure spending, stricter governmental regulations concerning asset integrity, and the continuous demand for superior corrosion protection solutions across developing and mature industrial economies.

Pinhole Detectors Market Executive Summary

The Pinhole Detectors Market is experiencing robust growth driven by accelerating industrialization and an increasing focus on preventative maintenance and asset longevity across critical sectors. Business trends indicate a strong shift toward digitalization and automation, with manufacturers integrating wireless connectivity, data logging capabilities, and intuitive user interfaces into detector units to streamline inspection processes and improve data traceability. This technological evolution enhances operational efficiency and supports complex quality management systems required by high-stakes industries like aerospace and nuclear power. Furthermore, there is a distinct market preference for devices offering multi-functional capabilities, such as integrated thickness measurement alongside flaw detection, reducing the need for multiple instruments and minimizing inspection time.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, largely due to extensive infrastructural development, massive investment in new manufacturing facilities, and the rapid expansion of the oil and gas pipeline network, particularly in China and India. North America and Europe, characterized by mature industrial bases and stringent regulatory landscapes, maintain high demand for advanced, highly accurate, and certified detection equipment for long-term maintenance of existing assets. The Middle East and Africa (MEA) are also showing significant upward trajectory, primarily driven by massive investments in crude oil infrastructure, demanding high-specification coating integrity testing to withstand severe operating environments.

Segment trends underscore the dominance of the High-Voltage Detector segment, especially for heavy-duty applications like lining inspection in chemical plants and large-diameter pipelines, owing to their ability to test much thicker coatings efficiently. However, the Low-Voltage (Wet Sponge) segment is maintaining steady growth, favored in quality control for thinner protective layers, such as specialized aerospace finishes or consumer product coatings, where high-voltage testing could potentially damage the substrate. End-use segmentation reveals the Oil & Gas and Marine sectors as the primary consumers, although the Packaging and Water Treatment industries are emerging as crucial segments requiring precise detection of microscopic defects to ensure product safety and containment integrity.

AI Impact Analysis on Pinhole Detectors Market

The impact of Artificial Intelligence (AI) on the Pinhole Detectors Market primarily revolves around enhancing inspection efficiency, standardizing defect analysis, and integrating predictive maintenance frameworks. Users frequently inquire about AI's ability to minimize human error during visual confirmation of pinhole locations and how machine learning algorithms can classify the severity and type of coating defect automatically. Common concerns also center on the feasibility of integrating AI with existing NDT hardware, particularly in highly dynamic or remote industrial settings, and the reliability of AI-driven data interpretation compared to established manual protocols. The overall expectation is that AI will transform pinhole detection from a reactive measurement process into a proactive, analytical quality control discipline.

AI facilitates the development of smart inspection systems that utilize data captured by advanced detectors (such as digitized high-voltage data or complex wet sponge conductivity maps) to create detailed predictive models of coating failure over time. For instance, AI algorithms can analyze trends in detected pinhole density relative to environmental variables (temperature, humidity, chemical exposure) recorded simultaneously, providing insights into optimal recoating schedules. This transition towards data-driven quality control elevates the role of pinhole detection beyond simple compliance, positioning it as an integral component of asset life cycle management and risk minimization strategies.

Furthermore, machine learning enables the automation of calibration verification and fault diagnostics within the detectors themselves, ensuring maximum measurement accuracy and reducing instrument downtime. By analyzing vast datasets of successful and failed coating inspections, AI can refine sensitivity settings and filtering criteria, thereby reducing false positives that often plague manual inspection methods, especially in noisy electrical environments. This ensures inspection campaigns are faster, more reliable, and require less highly specialized technical expertise on the ground, democratizing access to high-quality coating analysis.

- Automated defect classification and mapping using image recognition integrated with sensor data.

- Predictive modeling of coating degradation based on pinhole density and environmental stressors.

- Real-time optimization of detector sensitivity settings to minimize false positives.

- Integration with robotic and drone inspection systems for autonomous large-scale surveys.

- Enhanced data logging and reporting capabilities, complying with industrial IoT standards.

DRO & Impact Forces Of Pinhole Detectors Market

The Pinhole Detectors Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, resulting in a distinct set of Impact Forces shaping its evolution. Key drivers propelling the market include the global imperative for corrosion prevention across critical infrastructure (oil and gas pipelines, bridges, water treatment facilities) and the increasingly rigorous regulatory environment mandating non-destructive testing for coating certification. These regulations, often enshrined in international standards like ISO and NACE, necessitate reliable, traceable, and repeatable pinhole detection, thereby boosting demand for high-end digital equipment capable of generating comprehensive audit trails.

Conversely, the market faces significant restraints, primarily centered around the high initial capital expenditure required for advanced, automated detection systems and the persistent need for highly trained personnel capable of operating and interpreting results from complex high-voltage testers, particularly in adverse field conditions. Furthermore, the inherent limitations of electrical testing methods, such as the inability to test coatings on non-conductive substrates or the risk of spark damage to certain sensitive thin-film materials, also curb their universal adoption. These restraints necessitate ongoing manufacturer investment in user training and the development of safer, lower-energy testing alternatives.

Opportunities for growth are abundant, notably in the emerging fields of advanced materials and composite manufacturing, where pinhole detection is crucial for quality control in composite panels and specialized linings used in electric vehicles and renewable energy infrastructure (wind turbine blades). The development of integrated inspection software that seamlessly connects pinhole detection data with enterprise resource planning (ERP) systems and building information modeling (BIM) offers substantial commercial potential. The most significant impact forces acting on the market are the accelerating digital transformation within NDT, pushing for fully integrated, cloud-connected devices, and the continuous geopolitical drive for energy infrastructure security, which mandates zero tolerance for coating defects.

Segmentation Analysis

The Pinhole Detectors Market is broadly segmented based on product type, the nature of the application, and the end-user industry, reflecting the diverse technical requirements across different sectors. This segmentation is crucial for manufacturers to tailor their detector specifications, focusing on parameters such as voltage range, portability, data logging capacity, and coating thickness compatibility. The core differentiation remains between the low-voltage and high-voltage segments, each catering to specific thickness and material sensitivity needs, allowing users to select the optimal method based on coating specifications and substrate material.

Further granularity in segmentation involves distinguishing between handheld, portable devices used predominantly for field inspections (e.g., pipelines and bridges) and automated, in-line systems integrated into manufacturing processes (e.g., sheet metal coating lines). The evolution of sophisticated software and sensor technology is blurring traditional lines, as modern portable devices now offer precision previously restricted to laboratory-grade equipment. Understanding these nuances aids in accurate market sizing and strategic targeting, ensuring manufacturers address specific pain points within each segment, such as the need for explosion-proof certification in the oil and gas sector or ultra-high precision in the aerospace sector.

The market analysis reveals that application-based segmentation, particularly the distinction between anticorrosion coatings, linings, and thin films, heavily dictates the choice of detector technology. Anticorrosion coatings on large steel structures usually require high-voltage spark testing, while thin films used in critical electronic components or consumer packaging often rely on highly sensitive low-voltage methods. This structured segmentation provides a clear framework for analyzing market dynamics, competitive positioning, and future technological investment areas, ensuring market offerings align closely with prevailing industry standards and operational demands.

- Product Type:

- High Voltage Detectors (Spark Testing)

- Low Voltage Detectors (Wet Sponge Testing)

- Application:

- Anti-Corrosion Coatings

- Lining Integrity Testing

- Film and Foil Inspection

- Powder Coatings

- End-User Industry:

- Oil & Gas and Petrochemical

- Marine and Shipping

- Construction and Infrastructure

- Water and Wastewater Treatment

- Automotive and Aerospace

- Packaging and Consumer Goods

Value Chain Analysis For Pinhole Detectors Market

The value chain for the Pinhole Detectors Market begins with upstream activities, involving the sourcing of specialized electronic components, sensor technology, and high-performance battery systems critical for portable NDT equipment. Key upstream suppliers include manufacturers of precision circuitry, microprocessors, and proprietary data logging modules. Successful upstream management is characterized by rigorous quality control over sensor sensitivity and calibration standards, as the accuracy and reliability of the final detector instrument directly depend on the quality of these foundational components. Strategic partnerships with reliable component suppliers are vital for maintaining competitive pricing and ensuring rapid integration of new technological advancements, such as enhanced digital signal processing units.

The midstream phase focuses on manufacturing, assembly, and integration, where original equipment manufacturers (OEMs) design the ergonomic form factors, integrate proprietary software for data analysis and reporting, and perform essential calibration and certification processes. This stage is highly proprietary, requiring significant investment in research and development to comply with stringent industry standards (e.g., IP ratings, explosion-proof standards like ATEX/IECEx). Efficiency in the midstream production cycle, particularly in modular design and software scalability, dictates the time-to-market for new models incorporating features like cloud connectivity and AI-driven diagnostics.

Downstream activities include distribution, sales, and comprehensive post-sales support. Distribution channels are typically a mix of direct sales to large institutional end-users (like major energy companies or governmental inspection agencies) and indirect sales through specialized NDT equipment distributors and calibration service providers. Direct channels offer greater control over pricing and customer feedback, while indirect channels provide extensive geographic reach, particularly in emerging markets. Crucial aspects of downstream service include mandatory annual calibration, certified repair services, and advanced training programs for end-users, ensuring prolonged instrument life and accurate operation in compliance with industrial mandates.

Pinhole Detectors Market Potential Customers

Potential customers, or the end-users/buyers of pinhole detector products, are diverse and span numerous capital-intensive industries where coating integrity is paramount to operational safety and financial viability. The largest consumers are typically large enterprises and government agencies involved in maintaining extensive infrastructure networks, such as oil and gas pipeline operators, naval shipyards, and municipal water treatment authorities. These buyers prioritize robust, durable equipment capable of enduring harsh operational environments and generating detailed, auditable reports to meet internal and external regulatory requirements. Procurement decisions are heavily influenced by device certification (e.g., ISO, NACE), reliability, and integrated data management features.

A second major category includes specialized NDT service companies and industrial painting contractors who use these detectors as essential tools for contract fulfillment and quality verification for their clients. For these users, portability, speed of measurement, and user-friendliness are critical, as they often deploy the equipment across multiple sites daily. Their purchasing patterns favor versatile instruments that can handle a range of coating thicknesses and substrate types, maximizing the utility of their equipment fleet. The relationship between manufacturers and NDT service providers often involves bulk purchasing and long-term calibration service agreements.

Emerging potential customers include manufacturers in the renewable energy sector, particularly wind turbine blade producers and solar panel manufacturers, requiring highly precise inspection of protective coatings used to ensure longevity against environmental exposure. Similarly, the packaging industry (food, pharmaceutical) requires pinhole detectors to ensure the barrier function of films and foils, preventing contamination. These emerging segments are driving demand for highly sensitive, often automated, in-line detection systems that can integrate seamlessly into high-speed production lines, emphasizing precision over sheer voltage power, thereby diversifying the market customer base considerably.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 780 Million |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Elcometer, Defelsko, PCWI, TQC Sheen, Testo, Zorelco, ElektroPhysik, Buckleys (UVRAL) Ltd., KTA-Tator, BYK-Gardner, Paul N. Gardner Company, Qualitest, Fischer Technology, GfK, Mitutoyo, Olympus, Mahr, Starrett, Keyence, PCE Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pinhole Detectors Market Key Technology Landscape

The technology landscape of the Pinhole Detectors Market is characterized by a continuous drive toward enhanced precision, digitalization, and integration with other measurement technologies. Historically dominated by rudimentary analog high-voltage DC spark testers, the market has rapidly transitioned to advanced pulsed DC and AC high-voltage systems. Pulsed DC technology is gaining traction as it minimizes the risk of burning or damaging the protective coating during testing, offering a safer and more precise method for thicker films, thereby meeting stricter industry specifications for non-destructive inspection. The integration of microprocessor control allows for automated voltage calibration based on predefined coating thickness, significantly reducing operator errors and ensuring compliance with multiple testing standards instantly.

Digitalization forms the backbone of modern pinhole detection technology. Contemporary devices feature high-resolution liquid crystal displays (LCDs) capable of displaying real-time data, trend analysis, and integrated user manuals. Furthermore, almost all premium pinhole detectors now include extensive onboard memory for data logging, wireless connectivity (Bluetooth or Wi-Fi), and dedicated mobile or desktop applications. This technological shift enables seamless transfer of inspection data to cloud-based platforms for centralized analysis, storage, and immediate report generation, which is crucial for large-scale projects requiring real-time accountability and traceability across vast geographies. The emphasis is on creating a comprehensive digital audit trail that links the pinhole location (often geo-tagged via integrated GPS) directly to the specific asset.

Advanced sensor technology also plays a crucial role, particularly in low-voltage wet sponge detectors. Modern iterations utilize smart wet sponge probes that automatically regulate the flow of the wetting agent, ensuring consistent conductivity across the surface area being tested, thus eliminating variability associated with manual sponge saturation. Furthermore, there is growing research into non-contact pinhole detection methods, potentially utilizing capacitance or electromagnetic principles, which could revolutionize testing on substrates where traditional electrical contact methods are unsuitable or impossible. However, high-voltage spark testing remains the gold standard for heavy-duty industrial coatings due to its reliability and compliance with established NACE and ASTM protocols for extreme thickness applications.

Regional Highlights

Regional dynamics significantly influence the demand and adoption rates of Pinhole Detectors, driven by differing infrastructure development cycles, regulatory strictness, and industrial concentration. North America stands as a mature market segment, characterized by high adoption rates of premium, automated detection equipment. The demand here is primarily fueled by the rigorous maintenance requirements of aging oil and gas infrastructure (pipelines, refineries) and the stringent quality standards within the aerospace and automotive manufacturing sectors. Regulatory bodies like the Department of Transportation (DOT) mandate specific NDT procedures for pipeline integrity, ensuring continuous high demand for certified, data-logging pinhole detectors. Manufacturers focus on providing sophisticated user interfaces and seamless integration with existing asset management systems prevalent in the region.

The Asia Pacific (APAC) region represents the fastest-growing market globally, driven by massive investments in new infrastructure projects, particularly in China, India, and Southeast Asian nations. The rapid expansion of shipbuilding, automotive manufacturing capacity, and the establishment of extensive petrochemical facilities necessitate continuous coating quality verification. APAC demand often focuses on affordable yet reliable devices, although the emerging economies are quickly adopting advanced high-voltage systems as local regulatory standards mature and global export requirements enforce higher quality control measures. The competitive landscape in APAC is intensifying, with both global players and strong regional manufacturers vying for dominance through cost-effective and localized product offerings.

Europe maintains a strong position, driven by environmental and safety regulations requiring meticulous corrosion protection in marine, energy, and renewable sectors. European users exhibit a high preference for technologically advanced devices that offer maximum operational safety and detailed data export features compliant with EU industrial directives. The Middle East and Africa (MEA) region shows accelerating growth, intrinsically linked to the monumental scale of oil and gas production and export infrastructure. The extreme operational conditions (high temperatures, high salinity) mandate the highest level of coating integrity, pushing MEA companies to invest heavily in robust, high-specification pinhole detectors that can perform reliably in desert and offshore environments, often requiring ATEX/IECEx certification for use in explosive atmospheres.

- North America: Focus on pipeline integrity management and aerospace NDT compliance, demanding advanced, certified equipment with extensive data logging capabilities.

- Asia Pacific (APAC): Rapid market expansion due to massive infrastructure development (e.g., ports, chemical plants) and booming manufacturing industries (automotive, electronics).

- Europe: Driven by strict environmental regulations, high safety standards, and emphasis on precision technology in the marine and offshore wind energy sectors.

- Middle East & Africa (MEA): High demand fueled by large-scale oil and gas projects requiring explosion-proof (ATEX/IECEx certified) high-voltage detection for specialized lining applications.

- Latin America: Growing market uptake linked to investment in mining, petrochemical processing, and essential municipal water infrastructure maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pinhole Detectors Market.- Elcometer

- Defelsko

- PCWI

- TQC Sheen

- Testo

- Zorelco

- ElektroPhysik

- Buckleys (UVRAL) Ltd.

- KTA-Tator

- BYK-Gardner

- Paul N. Gardner Company

- Qualitest

- Fischer Technology

- GfK

- Mitutoyo

- Olympus

- Mahr

- Starrett

- Keyence

- PCE Instruments

Frequently Asked Questions

Analyze common user questions about the Pinhole Detectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between high-voltage and low-voltage pinhole detection methods?

High-voltage (spark testing) detectors are used for non-conductive coatings typically thicker than 500 microns (20 mils), generating a high-voltage spark to find flaws. Low-voltage (wet sponge) detectors are used for thinner coatings (up to 500 microns), utilizing a wet, conductive sponge and lower voltage to detect current flow through a pinhole, offering a non-damaging inspection method for sensitive surfaces.

Which industry standards govern the use of pinhole detectors?

The operation and certification of pinhole detectors are primarily governed by international standards such as ASTM D5162 (Wet Sponge), ASTM G62 (High Voltage), and NACE SP0188. Compliance with these standards ensures repeatable, reliable testing procedures necessary for quality assurance and regulatory audits across industries like oil and gas, marine, and construction.

Can pinhole detectors be used on coatings applied over non-metallic or composite substrates?

No, standard electrical pinhole detectors (both high and low voltage) require the coating to be non-conductive and the substrate underneath to be conductive (usually metal or carbon fiber) to complete the electrical circuit and identify a flaw. Specialized non-contact methods are being developed, but traditional detectors are limited to conductive substrates.

What role does digitalization play in modern pinhole detection equipment?

Digitalization enhances pinhole detection by integrating features like microprocessors for automated voltage calibration, large internal memory for geo-tagged data logging, and wireless connectivity (Bluetooth/Wi-Fi). This enables automated report generation, cloud storage of inspection records, and compliance with modern traceability requirements, moving away from manual data recording.

What are the key drivers for market growth in the Asia Pacific region?

The primary drivers for market growth in APAC are massive government investments in infrastructure (e.g., pipeline networks, bridges, manufacturing plants), rapid industrial expansion, and the increasing adoption of stringent international coating standards by local industries aiming for global export quality, thereby necessitating reliable NDT equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager