Pipe Hangers & Supports Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437398 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Pipe Hangers & Supports Market Size

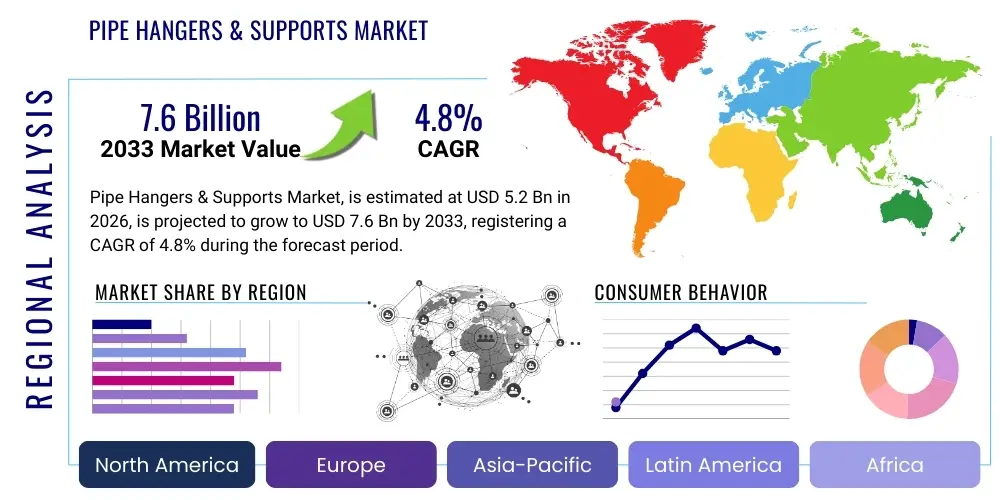

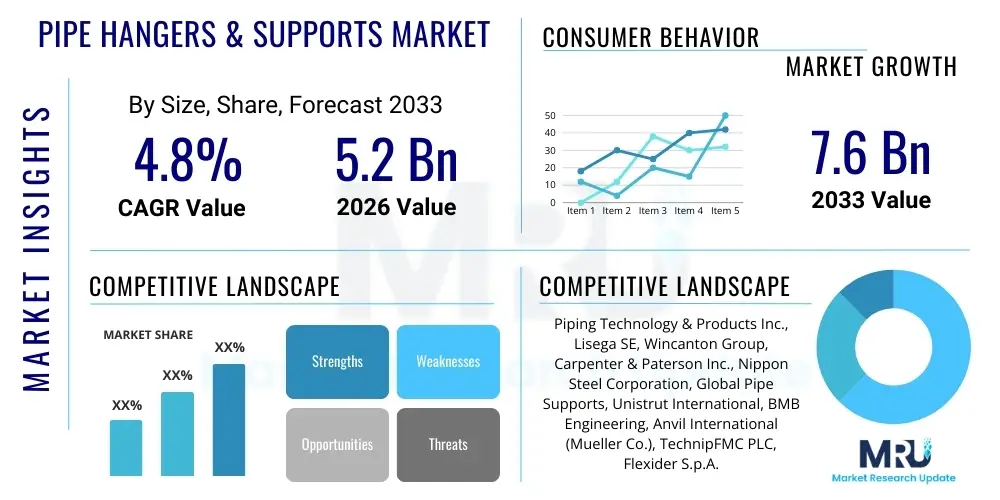

The Pipe Hangers & Supports Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.6 Billion by the end of the forecast period in 2033.

Pipe Hangers & Supports Market introduction

The Pipe Hangers & Supports Market encompasses the manufacturing, distribution, and installation of components designed to mechanically support piping systems, manage movement, absorb shock, and withstand thermal expansion or seismic events within industrial, commercial, and utility applications. These systems are critical infrastructure components, ensuring the structural integrity and operational safety of fluid and gas transport networks across diverse sectors. Products range from rigid supports, such as clamps and clevis hangers, to dynamic supports, including spring hangers, snubbers, and sway braces, tailored to specific load requirements and environmental conditions. The primary function is to transfer the operating and non-operating loads of the pipe, fluid, and insulation to the building structure or foundation, preventing stress concentrations that could lead to system failure or premature wear. The increasing complexity of modern industrial facilities, particularly those handling high-pressure and high-temperature media, necessitates highly engineered support solutions, thereby driving specialized product demand across key verticals.

Major applications of pipe hangers and supports span infrastructure essential to modern economies, including petrochemical processing plants, nuclear and fossil fuel power generation facilities, sophisticated commercial HVAC systems, marine engineering, and advanced pharmaceutical manufacturing units. The performance of these support structures directly influences system uptime, energy efficiency, and compliance with stringent safety regulations such as ASME B31.1 and B31.3 codes. As global urbanization and industrialization accelerate, particularly in emerging economies, the need for robust and reliable fluid transport infrastructure intensifies, positioning the market for steady growth. The benefits derived from utilizing high-quality pipe support systems include enhanced safety through load distribution, extended pipe lifespan due to reduced stress, optimization of flow efficiency by maintaining correct pipe alignment, and crucial protection against dynamic loads such as water hammer or seismic activity, making them indispensable elements of engineering design.

The driving factors for market expansion are multifaceted, anchored by significant global investment in energy infrastructure modernization, the burgeoning demand for specialized supports in liquefied natural gas (LNG) and hydrogen transportation projects, and mandatory replacement cycles for aging infrastructure in developed nations. Furthermore, the push towards adopting modular construction techniques in industrial sectors favors pre-engineered and easily deployable pipe support solutions, streamlining construction schedules and reducing field labor costs. The continuous evolution of material science, leading to the development of corrosion-resistant coatings and advanced composite materials, also plays a pivotal role, allowing pipe supports to operate effectively in increasingly harsh and corrosive operational environments. Regulatory mandates requiring stricter adherence to vibration control and seismic resilience further solidify the necessity for advanced pipe hanger technologies, providing a persistent growth momentum for the sector.

Pipe Hangers & Supports Market Executive Summary

The Pipe Hangers & Supports Market is characterized by moderate but consistent growth, underpinned by robust global construction activities in the energy, petrochemical, and commercial sectors. Current business trends indicate a strong move towards standardization and modularization of support systems to improve installation efficiency and reduce project timelines, particularly benefiting large-scale industrial constructors seeking reliable supply chains and consistent product quality. There is a notable technological shift focusing on materials science, with an increasing adoption of specialized materials, such as fiberglass reinforced plastics (FRP) and various stainless steel alloys, offering superior resistance to corrosion and high temperatures, thus extending the mean time between failures (MTBF) in critical applications. Furthermore, suppliers are increasingly integrating digital tools, including Building Information Modeling (BIM) compatibility and advanced calculation software, into their product offerings, enhancing collaboration between manufacturers and engineering procurement construction (EPC) firms, facilitating precise load calculations and optimized system design, which is paramount for competitive differentiation.

Regionally, the Asia Pacific (APAC) market is the undeniable engine of current growth, fueled by massive infrastructure projects, rapid industrial expansion in China and India, and significant investments in power generation capacity, including both conventional and renewable energy plants. North America and Europe, while being mature markets, exhibit stable demand driven primarily by replacement and maintenance activities (MRO), compliance-driven upgrades (especially seismic bracing), and the substantial revival of the oil and gas sector, specifically in midstream pipeline infrastructure and LNG export terminals. The Middle East and Africa (MEA) region shows strong potential due to mega-projects in the petrochemical sector and ongoing diversification of energy portfolios, requiring complex and highly specified support systems capable of handling extreme climate variability. Understanding the distinct regulatory landscapes across these regions is crucial, as compliance requirements often dictate material selection and design specifications, significantly impacting regional product mix and pricing dynamics.

In terms of segment trends, the rigid supports segment, historically dominant, is experiencing increased competition from dynamic supports, particularly hydraulic and mechanical snubbers, which are witnessing elevated demand due to stricter requirements for seismic protection and transient load management in critical facilities like nuclear power plants and large refinery complexes. By material, the pre-fabricated metal segment, dominated by carbon and galvanized steel, maintains the highest market share due to cost-effectiveness and versatility, but specialized non-metallic materials are making inroads in environments demanding chemical inertness. Application-wise, the Power Generation and Oil & Gas sectors remain the core revenue drivers, though the commercial HVAC and fire protection segments are demonstrating above-average growth rates, driven by stringent building codes and increased commercial real estate development in densely populated urban centers globally. These segment shifts necessitate that manufacturers diversify their product portfolios and strategically align production capabilities with high-growth, specialized sub-segments such as cryogenic supports for LNG applications.

AI Impact Analysis on Pipe Hangers & Supports Market

Common user questions regarding AI's impact on the Pipe Hangers & Supports Market generally revolve around how intelligent systems can optimize design and deployment processes, improve predictive maintenance schedules, and enhance regulatory compliance. Users frequently inquire about the integration of machine learning algorithms for calculating stress tolerances under highly variable operating conditions, seeking automated solutions that surpass traditional finite element analysis (FEA) models in speed and accuracy. Another major concern centers on the potential for AI to streamline supply chain logistics, predict material price fluctuations, and optimize inventory management for highly customized components. Furthermore, significant interest exists in using AI-driven image recognition and sensor data analysis to monitor installed supports in real-time, detecting early signs of fatigue, corrosion, or misalignment, thereby transitioning maintenance regimes from reactive to truly predictive, minimizing the substantial costs associated with unexpected infrastructure failures in critical environments.

The integration of Artificial Intelligence and advanced computational models is poised to revolutionize the engineering and lifecycle management phases of pipe support systems. AI algorithms can process vast datasets related to material performance, operational vibrations, thermal cycles, and environmental factors simultaneously, allowing for the generation of optimized support configurations that traditional engineering methods might overlook. This optimization extends beyond static load bearing to dynamic analysis, where machine learning models can accurately predict system responses to transient events like water hammer or sudden pressure changes, leading to the design of more robust and appropriately sized snubbers and dampening devices. This capability significantly reduces over-engineering, lowering material costs while simultaneously enhancing safety margins and ensuring compliance with the increasingly complex requirements dictated by international safety standards organizations, transforming the design workflow into a highly iterative, data-driven process.

Moreover, AI implementation is extending into the manufacturing and field service domains, impacting quality control and preventative maintenance. In manufacturing, AI-powered vision systems are being deployed for high-throughput quality checks, verifying weld integrity and coating thickness, ensuring every component meets exacting specifications before shipment. For installed infrastructure, the convergence of the Industrial Internet of Things (IIoT) sensors—monitoring parameters such as load displacement and temperature—with AI-powered diagnostic platforms allows facility operators to achieve unprecedented levels of oversight. These systems can autonomously analyze sensor telemetry against established baseline models, issuing alerts only when performance deviates significantly, enabling highly targeted and efficient maintenance interventions. This predictive capability translates directly into reduced downtime and extended operational life for aging assets, fundamentally changing the service model offered by pipe support providers, moving toward data-as-a-service offerings.

- AI-Driven Design Optimization: Machine learning algorithms enhance structural integrity design, optimizing placement and selection of supports based on complex stress simulations.

- Predictive Maintenance: Integration of IIoT sensors and AI analytics forecasts failure points due to fatigue or corrosion, ensuring proactive replacement schedules.

- Supply Chain Efficiency: AI models predict demand fluctuations for specialized components and optimize material sourcing, mitigating cost volatility.

- Automated Quality Control: Vision systems and AI streamline manufacturing quality inspection for welds, coatings, and dimensional accuracy.

- BIM Integration Enhancement: AI tools accelerate the generation and validation of pipe support models within Building Information Modeling (BIM) environments, improving collaboration.

- Seismic Response Modeling: Advanced AI simulation predicts dynamic system responses to seismic events more accurately than traditional linear models, optimizing snubber deployment.

- Material Performance Prediction: Machine learning assesses long-term degradation of materials under specific operational stresses and environmental exposures.

DRO & Impact Forces Of Pipe Hangers & Supports Market

The market dynamics are primarily shaped by robust industrial investment and stringent regulatory frameworks, which together serve as significant drivers (D). The primary drivers include the global energy transition, which necessitates complex, highly specified supports for new infrastructure like LNG terminals and hydrogen pipelines, and the extensive maintenance, repair, and overhaul (MRO) activities required for aging petrochemical and utility assets in mature markets. Furthermore, increased global focus on infrastructure resilience against natural hazards mandates the adoption of advanced seismic and vibration control technologies, specifically hydraulic snubbers and engineered damping systems, providing continuous demand for high-value components. Global urbanization and subsequent growth in commercial and residential construction also fuel the demand for standard supports utilized in large-scale HVAC and fire protection systems, creating a broad base of consistent revenue streams.

Despite these growth drivers, the market faces notable restraints (R), chiefly driven by the volatility of raw material prices, particularly steel and specialized alloys, which directly impacts manufacturing costs and profit margins across the supply chain. The customization required for high-specification projects often leads to lengthy lead times and design complexities, posing logistical challenges for large EPC contractors and potentially slowing project execution. Moreover, the lack of standardized installation procedures and the shortage of skilled labor capable of properly installing and maintaining complex dynamic supports, especially in emerging markets, present operational bottlenecks. Regulatory hurdles, although often driving demand for new products, can also restrain growth by imposing costly and time-consuming certification processes, particularly for safety-critical components used in nuclear or aerospace applications, limiting smaller players' ability to enter specialized segments.

Opportunities (O) abound, centered around technological innovation and geographic expansion. The increasing adoption of prefabricated and modular piping systems presents a significant opportunity for manufacturers to supply integrated, ready-to-install support modules, drastically reducing site work and improving quality consistency. The global transition toward renewable energy sources, such as offshore wind farms and geothermal plants, requires highly specialized support systems resistant to marine environments and high-stress conditions. Furthermore, the burgeoning demand for IIoT-enabled smart supports equipped with embedded sensors for real-time load monitoring and predictive diagnostics opens new revenue streams related to data services and maintenance contracts. These technological advancements, coupled with strategic expansion into high-growth regions like Southeast Asia and specialized markets such as semiconductor manufacturing facilities, define the forward trajectory of market potential.

The overall impact forces are high, largely driven by the inelastic demand for safety-critical infrastructure components. Economic growth (Impact Force 1) directly correlates with industrial and construction spending, ensuring that as global GDP expands, so too does the demand for pipe supports, making the market highly sensitive to macroeconomic cycles, although essential MRO work provides a counter-cyclical buffer. Technological disruption (Impact Force 2), particularly the movement towards digital engineering and specialized materials, reshapes the competitive landscape, favoring firms capable of sophisticated R&D and advanced manufacturing techniques. Lastly, regulatory compliance (Impact Force 3) acts as a non-negotiable demand driver; adherence to seismic, pressure, and safety standards mandates continuous purchasing and upgrading cycles, ensuring a persistent market floor regardless of temporary economic slowdowns, cementing the critical role of these components in maintaining operational integrity across all end-use sectors.

Segmentation Analysis

The Pipe Hangers & Supports Market is comprehensively segmented based on Type, Material, Application, and End-User Industry, reflecting the diversity of engineering requirements across global infrastructure. The segmentation highlights the critical distinction between rigid supports, which primarily resist movement in all three translational directions and manage static loads, and dynamic supports, which are essential for controlling transient loads, thermal expansion, and vibration across systems operating under varying stress conditions. This differentiation is fundamental because it dictates the complexity of manufacturing and the overall pricing structure, with dynamic supports typically commanding a significantly higher per-unit price due to their engineered complexity and requirement for precision calibration. Understanding the interplay between these segments is vital for stakeholders to allocate resources effectively, particularly as high-specification projects increasingly demand bespoke, dynamic solutions tailored to unique operational environments and regulatory mandates.

Segmentation by material reveals the dominance of metal-based solutions, mainly carbon and stainless steel, owing to their proven mechanical strength, durability, and cost-effectiveness in standard industrial settings. However, specialty alloys and non-metallic alternatives, such as polymer and composite supports, are gaining traction in niche segments where chemical corrosion resistance, weight reduction, or electrical isolation are paramount, such as in ultra-pure water systems or marine applications. Furthermore, the application segmentation, dividing the market into load-bearing components like pipe shoes and anchors versus transient control elements like shock absorbers and sway struts, allows manufacturers to focus on specific functional requirements. The End-User Industry segmentation, spanning utilities, oil & gas, chemicals, and commercial sectors, further elucidates market drivers, as each sector adheres to different safety standards, temperature ranges, and installation methodologies, requiring specialized product portfolios and targeted marketing strategies for market penetration and sustained revenue growth.

The detailed analysis of these segments is crucial for strategic market positioning. For instance, the demand profile in the Power Generation sector is heavily weighted toward high-temperature, high-pressure supports and advanced snubbers, while the commercial HVAC segment relies mostly on standard, cost-effective galvanized supports. The regional distribution of these industries, such as the concentration of petrochemical facilities in the Middle East or advanced pharmaceutical manufacturing in Europe and North America, directly influences segment growth rates and the required level of product customization. Successful market participants leverage granular segmentation data to optimize their R&D investments, ensuring they meet the evolving compliance and performance needs of the most lucrative and technically demanding segments, thereby securing long-term contracts and strengthening their competitive advantage against broad-based commodity suppliers.

- By Type:

- Rigid Pipe Supports (e.g., Clamps, Hangers, Anchors, Guides, Saddles)

- Dynamic Pipe Supports (e.g., Spring Hangers, Snubbers, Dampers, Sway Braces)

- Specialty Supports (e.g., Cryogenic Supports, Insulated Supports, Seismic Restraints)

- By Material:

- Metallic (e.g., Carbon Steel, Stainless Steel, Galvanized Steel, Alloy Steel)

- Non-Metallic (e.g., Fiberglass, Polypropylene, Composites)

- By Application:

- Load Support and Weight Management

- Vibration and Shock Control

- Thermal Expansion and Movement Compensation

- Friction Reduction and Abrasion Protection

- By End-User Industry:

- Oil & Gas (Upstream, Midstream, Downstream/Refineries)

- Power Generation (Fossil Fuel, Nuclear, Renewables)

- Chemical and Petrochemical Processing

- Commercial and Infrastructure (HVAC, Fire Protection)

- Pharmaceutical and Food & Beverage

- Marine and Shipbuilding

Value Chain Analysis For Pipe Hangers & Supports Market

The value chain for the Pipe Hangers & Supports Market commences with the upstream segment, dominated by raw material procurement, primarily high-grade steel (carbon, galvanized, and stainless), specialized alloys for high-temperature applications, and increasingly, engineering plastics and composites. Key challenges in this upstream phase include managing commodity price volatility and ensuring consistent quality and availability of materials certified for critical pressure vessel and piping applications. Manufacturers often engage in long-term supply agreements with major steel mills to mitigate price risk and secure steady supply. The efficiency of the upstream segment directly dictates the final cost and delivery timelines of the finished supports, highlighting the importance of strategic sourcing and vertical integration, particularly for high-volume standard product lines or highly customized components requiring specific alloy compositions for corrosion resistance in extreme environments.

The midstream phase involves manufacturing and fabrication, where raw materials are processed through casting, forging, welding, and precise machining to produce the final hanger components, followed by finishing processes such as galvanization, specialized coatings, or insulation application. This phase requires significant capital investment in advanced machinery, quality control mechanisms, and certified labor, especially for complex dynamic supports like spring hangers and hydraulic snubbers which must adhere to strict performance tolerances and regulatory standards (e.g., ASME, MSS SP). Distribution channels are bifurcated into direct sales for large, complex, and customized industrial projects, typically handled by manufacturer sales teams engaging directly with EPC firms, and indirect sales for standard, high-volume products, where a robust network of specialized industrial distributors and wholesalers plays a crucial role in inventory management and local market delivery, providing essential value-added services such as technical support and light fabrication.

The downstream segment encompasses the installation, maintenance, and end-use application of the pipe supports. End-users, who are primarily the owners and operators of industrial and commercial facilities, rely heavily on specialized contractors for correct system installation, which is critical to realizing the intended performance and lifespan of the piping network. The aftermarket service segment, including routine inspection, recalibration of spring cans, and replacement of snubbers, constitutes a significant portion of the total market revenue and often represents a lucrative, recurring stream for manufacturers who offer proprietary maintenance services or specialized replacement parts. This full lifecycle support—from initial design specification through decades of operational maintenance—reinforces the market’s stability and its reliance on established, certified players capable of delivering not just the product, but also comprehensive engineering support and long-term service agreements, thereby maintaining high barriers to entry for new competitors.

Pipe Hangers & Supports Market Potential Customers

The primary potential customers and end-users of pipe hangers and supports are large-scale industrial operators and commercial developers whose operations critically depend on the safe and reliable transport of fluids and gases. These buyers, fundamentally classified as Engineering Procurement Construction (EPC) companies, facility owners, and specialized maintenance service providers, procure these components based not only on cost but predominantly on adherence to strict technical specifications, regulatory compliance, and proven reliability under extreme operating conditions. For the Oil & Gas sector, customers include national oil companies (NOCs), independent exploration and production (E&P) firms, and midstream pipeline operators requiring supports capable of handling cryogenic temperatures (LNG), high pressures, and corrosive environments inherent to hydrocarbon processing. Their purchasing decisions are driven by minimizing operational risk and ensuring compliance with API and ASME standards, making performance assurance and documentation paramount over simple cost savings.

In the Power Generation segment, customers range from operators of conventional thermal and nuclear power plants to developers of renewable energy projects. Nuclear facilities represent the highest specification demand, requiring meticulously traceable materials and seismic-certified snubbers and supports, where the purchasing criteria prioritize safety-related quality assurance (QA) above all else. Thermal plants require supports robust enough for high-temperature steam applications, while renewable projects, such as large solar farms or geothermal plants, demand specialized, often composite or non-metallic, solutions to withstand unique environmental stresses. These customers engage in large, multi-year procurement contracts often bundled with engineering consultation services, seeking vendors who can provide integrated solutions across their entire portfolio of assets, demonstrating the importance of vendor capability and technological breadth in securing high-value contracts.

The commercial and institutional sector, encompassing large data centers, hospitals, universities, and high-rise commercial buildings, represents a significant volume purchaser of standard pipe supports, primarily for HVAC systems, plumbing, and fire suppression systems. These buyers are typically construction managers or mechanical contractors prioritizing ease of installation, compliance with local building codes, and competitive pricing for bulk orders. While customization is less frequent than in the industrial sector, reliability and standardization are still key factors influencing purchasing decisions, with a preference for vendors offering pre-assembled or quick-install components to streamline construction timelines. The pharmaceutical and specialized manufacturing sectors, requiring ultra-pure environments, constitute a specialized customer base demanding non-metallic or electropolished stainless steel supports to prevent contamination and maintain strict hygienic standards, where material traceability and surface finish are crucial procurement criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.6 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Piping Technology & Products Inc., Lisega SE, Wincanton Group, Carpenter & Paterson Inc., Nippon Steel Corporation, Global Pipe Supports, Unistrut International, BMB Engineering, Anvil International (Mueller Co.), TechnipFMC PLC, Flexider S.p.A., Hilti Corporation, Asco Engineering, ZAT PVS, Shaw Group, Fronek Anchor & Support Inc., Power Pipe Supports, Core Pipe International, Reliance Worldwide Corporation, Nucor Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pipe Hangers & Supports Market Key Technology Landscape

The key technology landscape in the Pipe Hangers & Supports Market is increasingly focused on improving resilience, extending operational life, and enhancing installation efficiency through material science and digital integration. A significant technological focus is placed on advanced vibration and seismic control through sophisticated dynamic supports. Modern hydraulic and mechanical snubbers utilize highly engineered mechanisms and materials to lock up rapidly under sudden transient loads (like earthquakes or water hammer) while allowing slow, continuous movement required for thermal expansion during normal operation. Furthermore, advanced shock absorber and dampener designs are critical in environments such as nuclear facilities and offshore platforms, utilizing viscoelastic materials or sophisticated fluid dynamics to dissipate damaging energy effectively, representing a crucial technological differentiation point in high-stress applications.

Material innovation is driving the capability of pipe supports to operate in increasingly demanding environments. This includes the development of high-performance, corrosion-resistant coatings (e.g., specialized epoxy, zinc-aluminum alloys) that significantly extend the component lifespan in marine or highly acidic petrochemical environments, reducing maintenance frequency. Furthermore, the use of specialized cryogenic insulation materials integrated directly into supports (pipe shoes) for LNG and hydrogen facilities is crucial, preventing heat transfer and resultant thermal damage to the surrounding structure while maintaining the integrity of the supported pipe at temperatures often below -160°C. The focus here is on achieving high compressive strength with minimal thermal conductivity, requiring significant R&D investment in polyurethane and polyisocyanurate formulations and their mechanical integration into metallic supports.

Digitalization and modularization represent the future of installation technology. The adoption of pre-engineered, modular support systems allows for rapid, tool-less assembly on-site, significantly cutting down labor time and ensuring quality consistency, which is vital for large, repeatable industrial projects. Concurrently, the rise of "Smart Supports" equipped with embedded micro-sensors (IIoT) is transforming asset management. These sensors continuously monitor parameters like displacement, load bearing, and corrosion levels, transmitting data wirelessly to cloud-based platforms. This allows for real-time diagnostics and the implementation of true predictive maintenance strategies, alerting operators to potential issues before they become catastrophic failures. These technologies facilitate compliance reporting and optimize operational expenditure (OPEX) by minimizing unnecessary inspections and maximizing asset uptime, offering substantial long-term value to end-users.

Regional Highlights

The geographic distribution of the Pipe Hangers & Supports Market reflects global infrastructure development cycles, regulatory environments, and industrial capacity. The Asia Pacific (APAC) region stands out as the highest growth market globally, primarily driven by massive government and private sector investment in industrialization, urbanization, and energy infrastructure expansion, particularly in China, India, and Southeast Asian nations. The rapid construction of coal and gas power plants, expansion of petrochemical refining capabilities, and widespread commercial development necessitate vast quantities of standard and specialized pipe supports. The region's reliance on large-scale infrastructure projects ensures continued high demand, although competition is intense, often focusing on volume production and competitive pricing, balanced by increasingly stringent local safety codes adapted from international standards, particularly in new LNG projects and nuclear ventures in countries like South Korea and India.

North America (NA) represents a mature, high-value market characterized by stringent regulatory oversight, particularly regarding seismic safety and environmental protection. Demand is bifurcated: stable, continuous demand from essential Maintenance, Repair, and Overhaul (MRO) activities required for aging oil & gas pipelines, utility grids, and refinery assets, coupled with specialized demand driven by high-specification projects. The growth of the LNG export terminals and the resurgence of chemical manufacturing tied to cheap shale gas feedstocks specifically drive the need for complex, engineered supports, including cryogenic and high-load dynamic snubbers. High labor costs necessitate a strong preference for pre-fabricated, modular solutions that minimize on-site installation time, giving technological leaders an edge in providing integrated, value-added engineering services alongside product supply.

Europe exhibits steady, compliance-driven growth, heavily influenced by strict European Union directives concerning industrial safety, environmental standards, and carbon neutrality goals. The region’s market is dominated by replacement cycles and modernization projects within the substantial existing chemical, pharmaceutical, and power infrastructure, particularly the decommissioning and life extension of nuclear and thermal plants. Demand is concentrated in highly specialized supports and advanced materials that offer superior life cycles and energy efficiency, aligning with EU sustainability mandates. The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) states, presents high potential growth centered on mega-projects in the petrochemical, water desalination, and oil infrastructure sectors. These projects require supports capable of withstanding extreme heat, sand erosion, and high salinity/corrosion, driving demand for specialized coatings and high-grade stainless steel products, with procurement largely concentrated through major international EPC contractors.

- Asia Pacific (APAC): Highest growth region driven by rapid industrialization in China and India, massive investments in power generation capacity, and large-scale infrastructure development.

- North America: Mature market focused on MRO of aging infrastructure, significant demand for high-specification supports (seismic, cryogenic) driven by LNG and pipeline modernization projects.

- Europe: Stable market growth dictated by strict EU safety and environmental regulations; strong demand in pharmaceutical, chemical, and nuclear plant maintenance and upgrades.

- Middle East & Africa (MEA): High growth potential fueled by mega-projects in oil & gas, petrochemicals, and desalination facilities; focus on products suitable for extreme heat and corrosive environments.

- Latin America: Emerging market with growth tied to commodity prices, driving investment in mining, oil & gas exploration, and necessary infrastructure upgrades, requiring robust and cost-effective solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pipe Hangers & Supports Market.- Piping Technology & Products Inc.

- Lisega SE

- Wincanton Group

- Carpenter & Paterson Inc.

- Nippon Steel Corporation

- Global Pipe Supports

- Unistrut International

- BMB Engineering

- Anvil International (Mueller Co.)

- TechnipFMC PLC

- Flexider S.p.A.

- Hilti Corporation

- Asco Engineering

- ZAT PVS

- Shaw Group

- Fronek Anchor & Support Inc.

- Power Pipe Supports

- Core Pipe International

- Reliance Worldwide Corporation

- Nucor Corporation

Frequently Asked Questions

Analyze common user questions about the Pipe Hangers & Supports market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for dynamic pipe supports?

The primary driver for dynamic pipe supports, such as snubbers and sway braces, is the increasing global regulatory requirement for seismic resilience and the need to manage severe transient loads (like water hammer) in high-risk industrial facilities, ensuring operational safety and structural integrity under dynamic stress conditions.

How does the Oil & Gas sector influence the pipe support market?

The Oil & Gas sector is a major revenue driver, particularly demanding high-specification, customized supports for extreme conditions, including cryogenic supports for LNG terminals, high-temperature supports for refineries, and corrosion-resistant materials for offshore and midstream pipeline infrastructure maintenance.

What role does material choice play in the longevity of pipe hanger systems?

Material choice is crucial for longevity, with standard carbon steel being cost-effective for general use, while stainless steel and specialized alloys, often coupled with advanced anti-corrosion coatings, are necessary for chemical plants and marine environments to prevent premature failure and comply with regulatory operational life expectations.

Is the integration of IIoT technology impacting traditional pipe supports?

Yes, the integration of IIoT technology is leading to the development of 'Smart Supports' with embedded sensors that monitor load, displacement, and temperature in real-time. This transition enables facility operators to shift from time-based maintenance to highly accurate predictive maintenance, significantly reducing downtime and operational costs.

Which geographic region is expected to demonstrate the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by substantial government investment in energy infrastructure, rapid industrial expansion, and large-scale urbanization projects across countries like China, India, and other Southeast Asian nations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager