Pipe Joints Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435712 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Pipe Joints Market Size

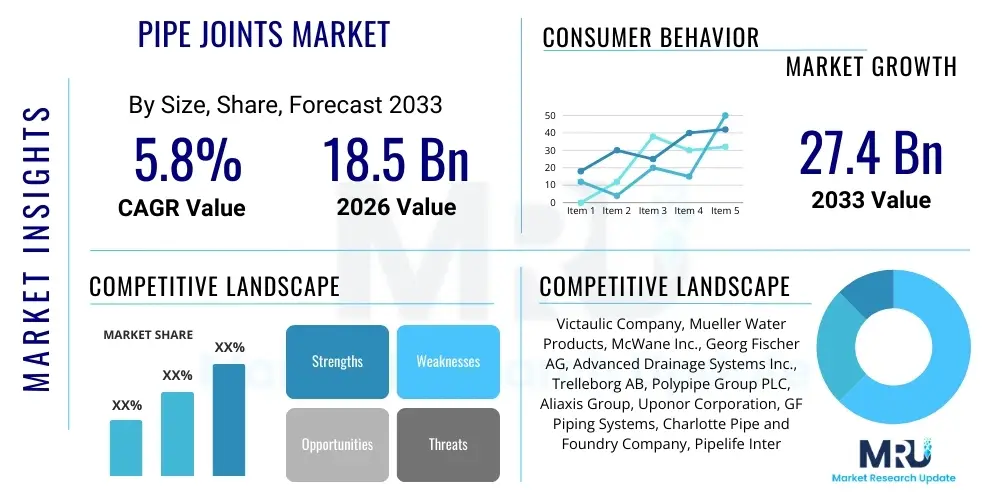

The Pipe Joints Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 27.4 Billion by the end of the forecast period in 2033.

Pipe Joints Market introduction

Pipe joints, crucial components in piping systems, are mechanisms used to connect two or more sections of pipes, enabling the safe and efficient transfer of fluids, gases, and slurries across various industrial and commercial landscapes. These joints ensure structural integrity, prevent leakage, and accommodate thermal expansion, vibration, and angular misalignment. The market encompasses a vast array of types, including threaded, welded, flanged, grooved, and mechanical joints, manufactured from materials such as steel alloys, cast iron, copper, and various polymers, tailored specifically for the demanding environments of their applications.

The major applications for pipe joints span across infrastructure development, industrial processing, and utilities. Key sectors driving demand include oil and gas, where high-pressure and high-temperature resistance is paramount; water and wastewater management, focusing on corrosion resistance and long-term durability; and construction, particularly in HVAC and plumbing systems. The functionality of these components is central to preventing system failures, minimizing downtime, and ensuring compliance with stringent safety and environmental regulations globally.

The market growth is fundamentally driven by accelerating urbanization, leading to extensive infrastructure projects such as new municipal water distribution networks and large-scale commercial building constructions. Furthermore, the global emphasis on energy transition necessitates significant investments in pipeline infrastructure for hydrogen, CO2 capture, and natural gas distribution, requiring advanced and durable pipe joint solutions. Technological advancements, particularly in quick-connect systems and specialty materials, offer enhanced installation efficiency and improved performance under extreme conditions, further fueling market expansion.

Pipe Joints Market Executive Summary

The Pipe Joints Market is experiencing robust growth driven primarily by expansive investments in energy infrastructure, particularly the rejuvenation of aging oil and gas pipelines and the establishment of new water utility networks in developing economies. Key business trends indicate a strong shift towards advanced materials such as high-performance plastics and corrosion-resistant alloys, alongside the integration of smart monitoring capabilities within joint systems to preemptively detect leaks and structural fatigue. Manufacturers are focusing on modular and easily installable joint technologies, reducing site labor time and overall project costs, thereby enhancing product competitiveness in fast-paced construction sectors.

Regionally, the Asia Pacific continues to dominate the market due to massive urbanization and the corresponding surge in construction and water infrastructure projects in countries like China and India. North America and Europe, characterized by stringent regulatory environments and a focus on pipeline integrity management, show high demand for premium, high-specification joints, including specialized welding techniques and mechanically reinforced couplings used for complex retrofitting operations. The Middle East remains a critical market driven by large-scale oil and gas extraction and transportation projects, necessitating extremely robust and temperature-resilient joint solutions.

Segmentation analysis highlights that the industrial application segment, particularly the chemical and power generation industries, maintains the largest market share owing to the critical nature and high throughput of their piping systems. Material-wise, steel and steel alloys remain the predominant choice due to their strength and versatility, although polymer joints are rapidly gaining traction in municipal and non-critical applications due to their superior corrosion resistance and lower installation weight. The mechanical joint type, favored for its ease of installation and maintenance compared to traditional welded joints, is projected to register the fastest growth rate throughout the forecast period.

AI Impact Analysis on Pipe Joints Market

User queries regarding the impact of Artificial Intelligence (AI) on the Pipe Joints Market primarily revolve around predictive maintenance, quality control automation, and supply chain optimization. Users seek confirmation on whether AI-driven inspection systems, utilizing computer vision and machine learning models, can significantly reduce the risk of joint failure by identifying microscopic defects during manufacturing and post-installation monitoring. Concerns are also raised about the integration challenges of embedding smart sensors (IoT) within joints and the subsequent AI analysis required to turn raw data into actionable insights for pipeline operators. The overall expectation is that AI will transition the industry from reactive maintenance to highly precise, predictive integrity management, drastically extending the service life of pipe networks.

AI's influence is transforming the entire lifecycle of pipe joints, starting from optimized design simulations where algorithms test various stress points and material combinations far faster than traditional methods. In the manufacturing phase, AI-powered visual inspection systems monitor welding quality and dimensional accuracy in real-time, ensuring zero-defect output and conforming to ISO standards with unparalleled precision. Furthermore, post-installation, AI analyzes sensor data (pressure, vibration, temperature) collected from smart joints to predict when a specific joint is likely to fail, enabling proactive repair or replacement schedules, thereby minimizing catastrophic failures and reducing regulatory fines associated with leaks.

- AI-driven Predictive Maintenance: Utilizing sensor data embedded in smart joints to forecast structural degradation and schedule preemptive repairs, drastically reducing downtime.

- Automated Quality Inspection: Deployment of machine learning algorithms for real-time visual inspection of welds and threading during manufacturing, ensuring consistency and adherence to strict tolerance limits.

- Optimized Design and Material Selection: AI simulates fluid dynamics and stress analysis to optimize joint geometry and material composition for specific application environments (e.g., highly corrosive media).

- Supply Chain and Inventory Management: Predictive algorithms forecast demand for specific joint types and sizes based on regional construction trends, optimizing manufacturing batches and reducing excess inventory.

- Enhanced Site Safety: AI monitors site conditions and welding procedures, providing real-time feedback to technicians to ensure compliance with safety protocols and proper installation techniques.

DRO & Impact Forces Of Pipe Joints Market

The Pipe Joints Market is propelled by the necessity of infrastructure upgrade cycles globally, especially the replacement of antiquated water and gas distribution networks that suffer from high leakage rates and material degradation. Robust restraints include the inherent complexity and high initial cost associated with specialized joints required for high-pressure or extreme temperature environments, coupled with the variability in global standardization which complicates international procurement and installation across different regulatory jurisdictions. Opportunities lie in the rapidly expanding market for sustainable infrastructure, particularly joints optimized for transporting alternative energy carriers like hydrogen, and the integration of IoT technology for leak detection and condition monitoring. These forces collectively shape the market's trajectory, emphasizing innovation in material science and installation efficiency as primary competitive differentiators.

Drivers:

The primary driver for the sustained expansion of the pipe joints market is the global surge in infrastructure expenditure, mandated by both demographic shifts and environmental necessities. Rapid urbanization, particularly across the Asia Pacific and Latin America, mandates continuous expansion and replacement of existing municipal water supply and sewerage systems. Additionally, regulatory pressure to reduce methane emissions and improve pipeline safety in the oil and gas sector compels operators to adopt advanced, highly reliable jointing technologies, often replacing traditional, less secure methods with modern mechanical or high-integrity welded joints. This focus on reliability necessitates investment in joints capable of withstanding seismic activity and significant thermal cycling.

Furthermore, the global energy transition is creating substantial new demand. The pivot toward liquefied natural gas (LNG) export and the nascent development of hydrogen pipeline networks require specialized joints designed for cryogenic temperatures or high-pressure gas containment, offering significant opportunities for manufacturers of precision-engineered components. Concurrently, the increasing demand for advanced manufacturing materials, such as fiberglass-reinforced plastics (FRP) and sophisticated polymer blends, is driving innovation, particularly in applications where corrosion resistance is paramount, such as in chemical processing plants and desalination facilities.

- Accelerated Global Infrastructure Development and Urbanization.

- Mandatory Replacement and Maintenance of Aging Pipeline Networks.

- Stringent Regulatory Standards Governing Leakage Prevention and Pipeline Safety.

- Growth in the Oil, Gas, and Chemical Processing Industries.

- Technological Advancements in Joint Materials and Installation Techniques.

Restraints:

A significant impediment to market growth is the volatility and high cost of raw materials, particularly steel, copper, and specialized alloys, which directly impacts manufacturing costs and profit margins. This price instability makes long-term project planning difficult for infrastructure developers. Furthermore, the reliance on highly skilled labor for complex joint installations, such as specialized welding processes required for high-pressure pipelines, poses a constraint, especially in regions facing skilled labor shortages. Incorrect installation due to lack of expertise often leads to premature failures, undermining confidence in certain advanced joint technologies.

Another major restraint is the inherently long service life of pipeline infrastructure, which translates to a slow replacement cycle, limiting continuous sales volume for replacement parts. While new infrastructure projects drive initial sales, the aftermarket replacement market is relatively stable and governed by failure rates rather than routine upgrades. Regulatory complexity, particularly across different continents where pipe size standards (e.g., imperial vs. metric) and pressure codes vary significantly, necessitates bespoke manufacturing, adding complexity and slowing market entry for standardized products.

- Volatility in Raw Material Prices (Steel, Polymers, Alloys).

- Requirement for Highly Skilled Labor for Installation and Maintenance.

- High Initial Capital Investment for Specialized, High-Pressure Joints.

- Slow Replacement Cycle Due to the Long Service Life of Existing Pipelines.

- Lack of Global Standardization in Pipe Dimensions and Connection Protocols.

Opportunities:

The emergence of smart piping systems presents a significant opportunity. Integrating IoT sensors and passive monitoring technologies directly into pipe joints allows for continuous, real-time integrity assessment, offering superior reliability and reduced lifecycle costs for operators. This move toward 'smart joints' provides manufacturers with a premium segment focused on data integration and predictive analytics, moving beyond simple connection components.

The massive global push toward sustainability and alternative energy sources, particularly hydrogen and Carbon Capture, Utilization, and Storage (CCUS) projects, opens new, highly specialized market niches. Hydrogen transportation requires joints capable of handling the gas's unique properties, including susceptibility to hydrogen embrittlement, demanding new material science approaches. Similarly, the growing adoption of trenchless technology and piping rehabilitation methods increases demand for flexible, high-performance mechanical and coupling joints suitable for non-disruptive installation environments.

- Development and Commercialization of Smart Joints (IoT Integration).

- Expansion of Hydrogen and CCUS Pipeline Infrastructure.

- Adoption of Advanced Corrosion-Resistant Polymer and Composite Joints.

- Growth in Trenchless Technology and Pipe Rehabilitation Projects.

- Increased Focus on Leak Detection and Water Loss Reduction Technologies in Municipal Networks.

Impact Forces:

The core impact forces shaping the pipe joints market are regulatory mandates and technological disruption. Regulatory bodies worldwide are continuously increasing pressure on pipeline operators to adhere to stricter environmental standards, particularly concerning minimizing leaks of natural gas and hazardous chemicals, directly stimulating demand for high-integrity, zero-leak joint technologies. Simultaneously, material science innovation, particularly the development of high-strength, lightweight composite materials, is disrupting traditional metallic joint dominance in certain applications, providing performance benefits like superior chemical resistance and easier handling.

Furthermore, globalization and geopolitical factors significantly influence procurement and pricing, particularly given the reliance on specific regions for primary raw material sourcing and specialized manufacturing expertise. The rapid pace of modular construction techniques also impacts demand, favoring manufacturers that can supply pre-fabricated joint assemblies or quick-fit connectors, shifting the value proposition from raw component supply to integrated system solutions and efficient installation methodologies.

- Regulatory Compliance and Environmental Standards (Leakage Reduction).

- Material Science Innovation (Composites and High-Performance Polymers).

- Geopolitical Stability Affecting Raw Material Supply Chains.

- Adoption of Modular and Pre-Fabricated Piping Systems in Construction.

- Fluctuations in Global Energy Prices Impacting Capital Expenditure in O&G.

Segmentation Analysis

The Pipe Joints Market is comprehensively segmented based on material, joint type, nominal pipe size, and end-use application. This multidimensional approach allows for a granular understanding of demand patterns across industrial sectors and geographical regions. Material segmentation is crucial as performance characteristics, such as pressure rating, corrosion resistance, and temperature tolerance, are inherently tied to the material composition, ranging from high-tensile steel to specialized thermoplastic compounds. Joint type segmentation reflects differing installation methods and functional requirements, distinguishing between permanent connections (welded, flanged) and temporary or flexible connections (mechanical, grooved).

The market volume is heavily influenced by the end-use application, with the oil and gas sector demanding the highest specification and largest diameter joints, while the municipal water and sewage sector relies on corrosion-resistant and cost-effective solutions. Nominal pipe size segregation further refines the market, as larger diameter joints (above 12 inches) command significantly higher prices and require more complex manufacturing processes compared to small-bore joints used in residential or commercial plumbing. Understanding these segments is key for manufacturers to align their production capabilities with sector-specific demands and technological evolution.

- By Material:

- Metallic (Steel, Stainless Steel, Carbon Steel, Cast Iron, Copper)

- Non-Metallic (PVC, CPVC, HDPE, Fiberglass Reinforced Plastic (FRP))

- Others (Composite Materials)

- By Joint Type:

- Welded Joints (Butt Weld, Socket Weld)

- Threaded Joints

- Flanged Joints

- Mechanical Joints (Couplings, Gaskets)

- Grooved Joints

- By Nominal Pipe Size:

- Small Bore (Up to 4 Inches)

- Medium Bore (4 to 12 Inches)

- Large Bore (Above 12 Inches)

- By End-Use Application:

- Oil and Gas (Upstream, Midstream, Downstream)

- Water and Wastewater Treatment

- Chemical and Petrochemical

- Construction (HVAC, Plumbing)

- Power Generation (Thermal, Nuclear)

- Mining

- Marine

Value Chain Analysis For Pipe Joints Market

The value chain for the Pipe Joints Market commences with the upstream extraction and processing of raw materials, primarily steel alloys (carbon steel, stainless steel) and specialized polymers (HDPE, PVC). This initial stage is highly dependent on global commodity markets and energy costs. Manufacturers then acquire these materials, subjecting them to processes like forging, casting, machining, and precision welding to form finished joint products, where intellectual property related to design and stress resistance adds substantial value. Efficiency in manufacturing, leveraging automation and standardized processes, is critical for cost management at this stage.

Downstream analysis focuses on distribution and installation. Distribution channels are bifurcated: direct sales channels cater primarily to large-scale, long-term infrastructure projects (oil pipelines, municipal utilities) where specialized technical support and customized specifications are required. Indirect channels, involving wholesalers, distributors, and plumbing supply houses, serve the fragmented construction and maintenance markets. The final stage involves professional installation, which, particularly for high-pressure or critical applications, requires certified technicians, and the quality of this service profoundly impacts the lifespan and integrity of the overall piping system.

The entire chain is increasingly digitized. Upstream suppliers are optimizing inventory through AI-driven forecasting, while midstream manufacturers are integrating IoT for quality control and process efficiency. Downstream, distributors are employing sophisticated logistics platforms to manage complex global inventories. The movement is toward vertical integration, where major piping system providers seek to control the entire process from material sourcing to complex installation, minimizing reliance on fragmented third-party services and enhancing overall product accountability.

Pipe Joints Market Potential Customers

Potential customers for pipe joints are diverse, spanning both private and public sectors globally, unified by the requirement to safely and reliably transport media. The largest segment of end-users comprises major engineering, procurement, and construction (EPC) firms responsible for executing large-scale industrial and infrastructure projects, such as building chemical processing plants, refineries, or water treatment facilities. These buyers prioritize product certifications, high flow capacity, pressure resistance, and reliable supply chain logistics, often procuring directly from manufacturers under long-term contracts.

Another crucial customer segment includes governmental and municipal bodies responsible for critical public infrastructure, such as water utilities, sewage systems, and municipal gas distribution networks. These entities prioritize longevity, corrosion resistance (especially for buried applications), ease of maintenance, and compliance with local health and environmental regulations. They typically procure through public tenders, where competitive pricing, coupled with proven product durability and warranty support, are key selection criteria.

Furthermore, specialized industrial customers, including power generation companies (nuclear and thermal), shipbuilding yards, and mining operations, represent a high-value niche. These buyers demand extreme performance characteristics, such as joints capable of handling superheated steam, aggressive slurries, or cryogenic fluids. For these critical applications, custom engineering, traceability of materials, and rigorous testing protocols become mandatory requirements for supplier selection, overriding simple cost considerations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Victaulic Company, Mueller Water Products, McWane Inc., Georg Fischer AG, Advanced Drainage Systems Inc., Trelleborg AB, Polypipe Group PLC, Aliaxis Group, Uponor Corporation, GF Piping Systems, Charlotte Pipe and Foundry Company, Pipelife International GmbH, Aalberts N.V., Zurn Industries, NIBCO Inc., Pentair plc, Etex Group, Kitz Corporation, Flowserve Corporation, Parker Hannifin Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pipe Joints Market Key Technology Landscape

The technology landscape of the Pipe Joints Market is marked by continuous efforts to enhance integrity, expedite installation, and improve material performance. Key advancements revolve around the evolution of mechanical coupling systems, which increasingly incorporate advanced elastomer seals and robust locking mechanisms, allowing for faster, flame-free installation compared to traditional welding. These grooved and mechanical joints are gaining favor in commercial construction and fire protection systems due to their efficiency and flexibility in accommodating minor pipe misalignment and seismic movement. Furthermore, manufacturers are employing sophisticated Finite Element Analysis (FEA) software to digitally prototype and stress-test new joint designs, ensuring compliance with extremely high-pressure specifications before physical production.

Material science innovation is a critical technological driver. There is a burgeoning trend in utilizing high-performance thermoplastic joints (e.g., specialized HDPE and PVC blends) that offer superior resistance to chemical attack and galvanic corrosion, which is essential in harsh industrial environments like mining and chemical processing. This is coupled with the development of fusion technology, particularly electrofusion and butt fusion for non-metallic pipes, which creates seamless, monolithic joints with high tensile strength and long-term sealing capabilities. These fusion methods minimize human error and dependency on external fasteners, leading to significantly higher system reliability.

The most transformative technology involves the integration of smart monitoring capabilities. This includes embedding passive or active sensors (IoT) within or adjacent to the joint structure. These smart joints utilize micro-electromechanical systems (MEMS) or specialized fiber optics to continuously monitor parameters such as pressure, temperature, strain, and acoustic emissions, allowing pipeline operators to utilize Artificial Intelligence (AI) platforms for predictive failure analysis. This technological shift is moving pipe joints from being static components to integral parts of a digitized pipeline integrity management system, significantly improving operational safety and compliance.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, driven primarily by unprecedented infrastructure development, large-scale urbanization, and expansive industrialization, particularly in China, India, and Southeast Asian nations. Substantial government investments in water supply systems, power generation facilities, and new oil and gas import terminals are fueling massive demand for all types of metallic and non-metallic joints. The region's focus on cost-effective, high-volume manufacturing makes it a global hub for standard pipe joint production.

- North America: This region is characterized by high adoption rates of specialized, high-integrity joints due to stringent regulatory standards and the critical need to refurbish vast, aging pipeline networks for gas transmission and water distribution. Demand is strong for grooved mechanical joints, advanced welding technologies, and smart joints equipped with leak detection capabilities. The booming energy sector, particularly unconventional oil and gas extraction (shale), drives substantial procurement of high-pressure, corrosion-resistant steel joints.

- Europe: Growth is primarily focused on replacing existing infrastructure and adapting to sustainability mandates. European markets exhibit high demand for non-metallic joints (PVC, HDPE) in municipal applications, driven by regulations promoting sustainable water management and reducing water loss. There is significant technological leadership in specialized welding automation and modular pipe systems used in densely populated urban renovation projects. Strict adherence to REACH regulations influences material choices.

- Middle East & Africa (MEA): Dominated by massive capital expenditure in the oil, gas, and petrochemical sectors. The market requires joints capable of handling extremely high temperatures and pressures, often in highly corrosive desert environments. Demand for large-bore, high-grade steel flanged and welded joints remains paramount for long-distance export pipelines and desalination plants. Infrastructure projects related to megacities (e.g., NEOM in Saudi Arabia) also contribute significantly to specialized joint demand.

- Latin America: The market exhibits moderate growth, stimulated by recovery in the construction sector and ongoing efforts to upgrade municipal services, particularly water and sanitation infrastructure, where leakage rates are often high. The region shows increasing adoption of cost-effective polymeric joints and standard metallic flanged joints, though economic volatility remains a key factor influencing the scale and timeline of large-scale pipeline projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pipe Joints Market.- Victaulic Company

- Mueller Water Products

- McWane Inc.

- Georg Fischer AG (GF Piping Systems)

- Advanced Drainage Systems Inc. (ADS)

- Trelleborg AB

- Polypipe Group PLC

- Aliaxis Group

- Uponor Corporation

- Charlotte Pipe and Foundry Company

- Pipelife International GmbH

- Aalberts N.V.

- Zurn Industries, LLC

- NIBCO Inc.

- Pentair plc

- Etex Group

- Kitz Corporation

- Flowserve Corporation

- Parker Hannifin Corporation

- Dixon Valve & Coupling Company

Frequently Asked Questions

Analyze common user questions about the Pipe Joints market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for pipe joints in the coming years?

The primary driver is global infrastructure spending, specifically the extensive replacement and modernization of aging water and wastewater pipeline networks and continued massive investments in energy transmission infrastructure, including natural gas and emerging hydrogen pipelines. Urbanization trends in APAC are a major catalyst for volume growth.

Which type of pipe joint is expected to exhibit the fastest growth rate?

Mechanical joints, particularly grooved couplings, are projected to experience the fastest growth. This is due to their inherent advantages in reducing installation time and labor costs, enhancing flexibility, and offering superior seismic resistance compared to traditional welded or threaded connections, making them highly favored in commercial and industrial construction.

How is technological innovation affecting the durability of pipe joints?

Technological innovation is enhancing durability through two main avenues: superior material science, leading to high-performance composite and polymer joints with improved corrosion and chemical resistance; and the integration of IoT and smart sensors, enabling real-time condition monitoring and predictive maintenance to prevent catastrophic failures before they occur.

Which regional market holds the largest share for pipe joints, and why?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is attributed to high population density, rapid industrial expansion, and massive governmental funding directed toward expanding and renovating essential public utilities and energy infrastructure across key developing economies such as China and India.

What are the main applications where non-metallic pipe joints are preferred over metallic joints?

Non-metallic joints (e.g., HDPE, PVC, FRP) are strongly preferred in applications requiring high chemical resistance, zero galvanic corrosion, and lightweight installation, such as municipal water distribution, sewage and drainage systems, and specialized chemical processing plants dealing with highly corrosive fluids.

What role does the oil and gas industry play in the high-pressure joint segment?

The oil and gas industry is the largest consumer of high-pressure, high-temperature joints. This sector necessitates specialized metallic joints (flanged, welded) made from high-grade steel alloys to ensure safe containment and transfer of hydrocarbons under extreme operating conditions, driving innovation in material traceability and structural integrity standards.

What major regulatory challenge impacts manufacturers in the European pipe joints market?

European manufacturers are heavily impacted by stringent environmental and chemical regulations, such as the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation. This mandates rigorous testing and material transparency, often restricting the use of certain traditional components and pushing manufacturers toward compliant, sustainable material alternatives.

How does AI contribute to quality control in pipe joint manufacturing?

AI utilizes advanced computer vision and machine learning algorithms to automate and enhance quality control during manufacturing. This involves real-time inspection of welding seams, dimensional analysis of threads and flanges, and defect detection at microscopic levels, ensuring products meet demanding industry specifications with high consistency and accuracy.

What is the significance of nominal pipe size segmentation in the market?

Nominal pipe size segmentation is significant because it dictates material volume, manufacturing complexity, and, consequently, unit cost. Large bore joints (above 12 inches) used for main transmission lines are highly specialized and command premium pricing, requiring different production capacities compared to mass-produced small bore joints for plumbing.

How is sustainability affecting material selection for pipe joints?

Sustainability concerns are accelerating the shift toward materials with lower embodied energy and longer service lives, such as certain recyclable polymers (HDPE) and corrosion-resistant materials that minimize the need for frequent replacement. Additionally, manufacturers are seeking ways to reduce waste generated during the joint installation process.

What are the typical risks associated with threaded pipe joints?

Threaded pipe joints, while easy to install, are susceptible to leakage if not properly sealed or subjected to high vibration. They can also create stress points, making them generally less suitable for high-pressure or critical applications compared to welded or flanged joints, which offer higher structural integrity and sealing reliability.

Describe the role of distributors in the pipe joints value chain.

Distributors play a critical role in the indirect sales channel, particularly servicing the fragmented construction and maintenance markets. They manage inventory, provide logistics support, and offer readily available product variety for smaller projects, bridging the gap between large manufacturers and local contractors.

Why are specialized joints required for hydrogen pipeline infrastructure?

Hydrogen molecules are significantly smaller than natural gas, increasing the risk of leakage, and hydrogen can cause hydrogen embrittlement in traditional steel. Therefore, specialized joints must employ high-integrity seals, non-reactive materials, and rigorous testing protocols to safely contain the gas under high pressure over long distances.

How does the mining sector influence demand for specific joint types?

The mining sector demands highly abrasive-resistant and corrosion-proof joints, primarily for slurry transportation. This drives demand for specialized lined metallic joints or robust non-metallic joints (like HDPE or fiberglass) that can withstand the severe wear and chemical aggressiveness of mineral slurries and corrosive mine water.

What is the primary advantage of mechanical couplings over welded joints?

The main advantage is the rapid, non-destructive installation process, eliminating the need for hot work (welding) permits, specialized welding labor, and extended curing times. Mechanical couplings allow for quicker system assembly, easy disassembly for maintenance, and inherent flexibility to absorb thermal stress.

What is driving the shift towards composite materials in pipe joints?

The shift towards composites (like FRP) is driven by their superior performance-to-weight ratio, excellent resistance to extreme chemical environments, and inherent inability to corrode, making them ideal for long-term applications in highly aggressive media where traditional steel would quickly degrade.

How significant is the replacement market for the overall market growth?

The replacement and refurbishment market is highly significant, particularly in mature economies (North America and Europe). While new construction drives initial market size, the cyclical necessity of replacing aging infrastructure, often mandated by safety and environmental regulations, provides a stable, long-term revenue stream for specialized retrofitting joints and components.

What technological advancement is crucial for optimizing joint geometry?

Finite Element Analysis (FEA) software is crucial for optimizing joint geometry. FEA allows engineers to digitally model and simulate stress distribution, pressure resistance, and thermal expansion effects on various joint designs, leading to highly optimized products that maximize material efficiency and structural integrity.

In the chemical processing industry, what is the key purchasing criterion for pipe joints?

The key purchasing criterion in the chemical processing industry is chemical compatibility and resistance to media corrosion, followed closely by pressure rating. Failure in this sector can lead to dangerous and costly chemical leaks, making material selection (often specialized alloys or high-performance plastics) paramount over cost efficiency.

How does urbanization specifically impact the demand for small and medium bore joints?

Urbanization directly increases the demand for small and medium bore joints (up to 12 inches) because these sizes are predominantly used in residential and commercial plumbing, HVAC systems, fire protection lines, and the final distribution networks within new urban developments and high-rise buildings.

What are the major challenges associated with specialized welding for high-pressure joints?

Challenges include the need for extremely skilled, certified welders, strict adherence to complex welding procedures (WPS), high cost of non-destructive testing (NDT), and susceptibility to defects from improper technique, which necessitates high-precision automation and stringent quality control protocols.

Which segment of the Oil and Gas industry is the most demanding in terms of joint performance?

The Upstream segment, including drilling and extraction, is the most demanding. Joints used here must withstand extreme pressures, sour gas (H2S), and high downhole temperatures, requiring highly specialized, corrosion-resistant metallic joints and premium sealing technologies.

What is AEO and how does it relate to information regarding pipe joints?

Answer Engine Optimization (AEO) involves structuring content (like FAQs and descriptive paragraphs) specifically so that search engines and AI assistants can extract direct, concise answers efficiently. In the context of pipe joints, this ensures key technical specifications and market trends are easily discoverable and synthesized by generative AI models.

How do geopolitical factors influence the pipe joints market?

Geopolitical stability directly influences the price and supply chain reliability of key raw materials like steel and specialty alloys, which are often globally sourced. Furthermore, tensions can affect capital expenditure decisions in large-scale energy projects, impacting demand for pipeline components, including specialized joints.

What is the current trend regarding the weight of pipe joint components?

There is a strong industry trend towards weight reduction. Lighter components, achieved through advanced materials (composites, thin-wall steel) or innovative design, reduce shipping costs, ease handling on construction sites, and simplify installation, especially beneficial in remote locations or high-rise construction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Pipe Joints Market Size Report By Type (Metal Pipe Joints, Plastic Pipe Joints, Other Pipe Joints), By Application (Construction Industry, Petrochemical Industry, Electronic and Electrical Industry, Water Treatment Industry, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pipe Joints Market Statistics 2025 Analysis By Application (Construction Industry, Petrochemical Industry, Electronic and Electrical Industry, Water Treatment Industry), By Type (Metal Pipe Joints, Plastic Pipe Joints, Other Pipe Joints), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Pipe Joints Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Metal Pipe Joints, Plastic Pipe Joints, Other Pipe Joints), By Application (Construction Industry, Petrochemical Industry, Electronic and Electrical Industry, Water Treatment Industry, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager