Pipelay Vessel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436936 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pipelay Vessel Market Size

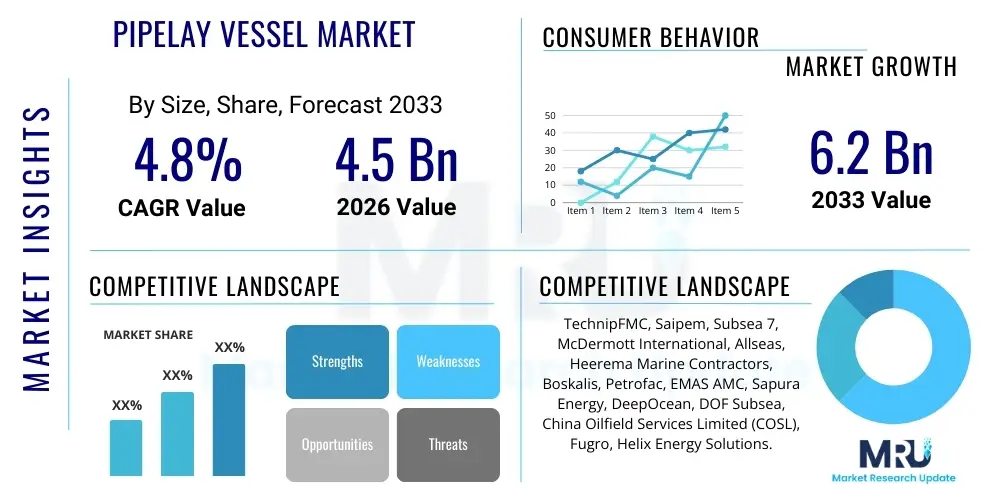

The Pipelay Vessel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.2 Billion by the end of the forecast period in 2033.

Pipelay Vessel Market introduction

The Pipelay Vessel Market is integral to the global offshore infrastructure sector, focusing on the specialized construction and installation of subsea pipelines essential for transporting hydrocarbons, utilities, and increasingly, facilitating offshore energy transition projects. Pipelay vessels are highly engineered marine assets designed to handle complex operations in varying sea conditions and water depths, ranging from shallow coastal areas to ultra-deep oceanic environments. These vessels utilize advanced laying techniques—primarily S-Lay, J-Lay, and Reel-Lay—each suited for different pipeline diameters, wall thicknesses, and depth requirements. The inherent durability and complexity of these operations necessitate massive capital investment and specialized expertise, positioning this market as a highly technical and cyclical component of the marine energy industry.

Major applications of pipelay vessels center around the conventional oil and gas industry, specifically in Exploration and Production (E&P) activities where they install flowlines, risers, and export pipelines connecting offshore platforms to onshore processing facilities or storage hubs. However, the market scope is rapidly broadening due to the global shift towards renewable energy. Pipelay vessels are increasingly essential for installing subsea cables and export lines associated with large-scale offshore wind farms, particularly in challenging deepwater locations. Furthermore, they play a crucial role in decommissioning projects, involving the safe removal or modification of aged subsea infrastructure, thereby ensuring environmental compliance and operational integrity.

The primary benefits driving the demand for advanced pipelay vessels include enhanced operational efficiency, reduced installation time, and the capability to operate safely in harsher environments. Modern vessels incorporate dynamic positioning (DP) systems, heavy-lift capabilities, and automated welding systems that significantly improve productivity and reliability. Driving factors for market expansion include sustained long-term demand for natural gas infrastructure, particularly in Asia Pacific and Africa, the increasing average depth of new offshore oil and gas developments, and, most critically, the global boom in large-scale offshore wind projects requiring robust subsea cable installation infrastructure. These combined drivers are compelling operators to invest in upgrading their fleets or commissioning new, versatile vessels capable of serving both hydrocarbon and renewable energy sectors.

Pipelay Vessel Market Executive Summary

The Pipelay Vessel Market is exhibiting a structural shift, moving beyond its historical dependence on deepwater oil developments toward embracing diversified energy infrastructure projects. Business trends are characterized by consolidation among major engineering, procurement, construction, and installation (EPCI) contractors, who are integrating pipelay capabilities with subsea tie-back and heavy-lift services to offer comprehensive, integrated solutions. This integration minimizes project risk and timeline complexity for operators. Furthermore, there is a strong capital expenditure focus on asset optimization, involving converting older assets for specialized decommissioning work or upgrading existing vessels with enhanced DP systems and larger crane capacities to handle the substantial components required for offshore wind foundation installations, reflecting a proactive adaptation to energy transition demands.

Regional trends indicate significant dynamism, with the highest growth potential residing in emerging offshore basins. While established regions like the Gulf of Mexico and the North Sea remain crucial for maintenance, inspection, and decommissioning work, regions such as the Asia Pacific (driven by robust natural gas projects in countries like Australia, Indonesia, and Malaysia) and West Africa (fueled by deepwater discoveries and sanctioned field development plans) are attracting substantial new pipelay commitments. The Middle East continues to provide stable, large-scale shallow-water pipeline opportunities, though the investment focus there often favors conventional S-Lay methods. Regulatory environments concerning carbon emissions and local content requirements are increasingly influencing vessel deployment decisions across these key geographical areas.

Segmentation trends reveal a clear preference for advanced laying techniques capable of operating efficiently in deep and ultra-deep waters. The J-Lay segment is experiencing rapid adoption, particularly for complex riser installations in depths exceeding 2,000 meters, owing to its superior control over pipeline stress and fatigue. Conversely, the Reel-Lay segment is valued for its speed and efficiency in smaller diameter pipeline and flowline installation, making it highly attractive for standardized deepwater tie-backs and renewable energy cable projects. The operation depth segment is leaning heavily towards Deepwater and Ultra-Deepwater classifications, reflecting the depletion of shallow water reserves and the pursuit of frontier offshore resources. End-Use segmentation shows the emergence of offshore renewables as a critical, high-growth revenue stream, providing a much-needed counterbalance to the cyclical nature of traditional Oil & Gas E&P expenditures.

AI Impact Analysis on Pipelay Vessel Market

Common user questions regarding AI’s impact on the Pipelay Vessel Market frequently revolve around how artificial intelligence can mitigate the high operational risks associated with subsea construction, enhance the precision of pipeline installation in challenging environments, and ultimately drive down installation costs. Users are particularly interested in the application of AI for predictive maintenance of complex onboard machinery, the optimization of vessel routes and dynamic positioning (DP) during weather-sensitive operations, and the integration of AI-driven sensor data for real-time monitoring of pipe stress and fatigue during the laying process. The key themes summarized from user queries highlight expectations for improved safety protocols, enhanced data utilization from subsea inspection assets (ROVs/AUVs), and the automation of repetitive welding and pipe handling tasks, leading to substantial increases in operational efficiency and reliability in mission-critical deepwater projects.

- Implementation of AI algorithms for predictive maintenance on welding equipment, tensioners, and DP thrusters, minimizing unplanned vessel downtime during critical offshore spreads.

- Integration of machine learning models for optimizing dynamic positioning systems, enhancing station-keeping accuracy in high currents and adverse weather conditions, thereby ensuring safe and precise pipe alignment.

- AI-enhanced sensor data processing from Subsea Survey and Inspection ROVs (Remotely Operated Vehicles) for faster anomaly detection and high-resolution pipeline health monitoring post-installation.

- Deployment of computer vision systems to automate quality control checks in the firing line, ensuring weld integrity and coating application compliance with minimal human intervention.

- Use of AI-driven simulation tools for optimizing lay procedures (S-Lay, J-Lay) and vessel heading, reducing pipe strain and maximizing lay rate efficiency based on real-time environmental data inputs.

- Development of autonomous or semi-autonomous pipelay operations, especially for dangerous or extremely deep environments, reducing human exposure to risk and potentially lowering crew costs in the long term.

DRO & Impact Forces Of Pipelay Vessel Market

The Pipelay Vessel Market is governed by a critical interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape investment decisions and operational strategies. The primary drivers stem from the global energy demand structure, including the ongoing development of large-scale deepwater hydrocarbon fields, the extensive requirement for pipeline infrastructure expansion to support global LNG and gas transportation, and the rapid, sustained proliferation of offshore wind energy projects, demanding new vessels optimized for complex subsea cable installation. Restraints largely involve the market's significant cyclical volatility, characterized by fluctuating oil prices which directly impact sanctioning rates for E&P projects, the extremely high capital expenditure required for new vessel construction or major upgrades, and stringent environmental regulations that increase operational complexity and compliance costs, particularly regarding noise pollution and emissions.

Opportunities in the market are compelling, centering on diversification and technological advancement. The most significant opportunity lies in pivoting specialized vessel capabilities toward the burgeoning offshore renewables sector, requiring high-capacity installation vessels for export cables, inter-array cables, and associated infrastructure. Furthermore, the growing global need for decommissioning aging oil and gas infrastructure presents a specialized, long-term opportunity for vessel modifications and dedicated services. Technological innovation, specifically the implementation of advanced automation, remote operation capabilities, and cleaner fuel technologies (e.g., LNG or methanol propulsion), offers a route to competitive differentiation and reduced environmental impact, attracting sustainability-focused clients.

The impact forces influencing the market are multifaceted, encompassing macroeconomic instability, regulatory shifts, and technological disruption. Geopolitical tensions in key supply regions exert high impact by influencing oil and gas pricing and project security, directly affecting pipeline investment decisions. Environmental regulations, such as mandatory carbon reduction targets and restrictions on deep-sea dredging, act as powerful external forces demanding operational adjustments and investment in green technologies. Internally, the increasing demand for high-specification, multi-functional vessels puts intense pressure on shipyards and vessel owners to rapidly innovate. The overall impact results in heightened market segmentation, where specialized deepwater or renewable-focused vessels command premium day rates, while older, less capable vessels face significant utilization pressure.

Segmentation Analysis

The Pipelay Vessel Market segmentation provides a critical view of operational capabilities and targeted end-use sectors, helping stakeholders understand where capital investment and technological development are most concentrated. The market is primarily segmented based on the type of laying mechanism employed (S-Lay, J-Lay, Reel-Lay), the operational depth of the activity (Shallow Water, Deepwater, Ultra-Deepwater), and the end-use application (Oil & Gas E&P, Offshore Wind/Renewables, Decommissioning). Each segment reflects distinct technical challenges and market demand drivers. The dominance of the Oil & Gas sector is gradually being challenged by the rapid scaling of the Offshore Wind segment, driving demand for versatile vessels that can efficiently transition between heavy pipeline installation and complex cable laying tasks.

- By Vessel Type:

- S-Lay Vessels (Suitable for shallow to intermediate depths, high speed, high volume)

- J-Lay Vessels (Ideal for deepwater and ultra-deepwater, minimizes pipe bending stress)

- Reel-Lay Vessels (Highly efficient for small to medium diameter pipelines, rapid deployment)

- Other Types (e.g., Modular Pipelay Systems, Flex-Lay Vessels)

- By Operation Depth:

- Shallow Water (Up to 500 meters)

- Deepwater (500 to 1,500 meters)

- Ultra-Deepwater (Greater than 1,500 meters)

- By End-Use Application:

- Oil & Gas Exploration & Production (Flowlines, Export Pipelines, Risers)

- Offshore Renewables (Export Cables, Inter-Array Cables, Infrastructure Tie-ins)

- Decommissioning and Abandonment (Removal of aging subsea infrastructure)

Value Chain Analysis For Pipelay Vessel Market

The Pipelay Vessel Market value chain is structured around highly specialized phases, beginning with upstream activities involving vessel design, construction, and core technology provision. Upstream players include specialized marine architects, shipyards (primarily in Asia and Europe), and major equipment suppliers providing critical systems such as dynamic positioning, heavy-lift cranes, and automated welding systems. The capital intensity and technological sophistication required in the upstream stage create significant barriers to entry, concentrating power among a few key specialized technology providers. Decisions made at this stage regarding vessel configuration—such as choosing S-Lay versus J-Lay capability—fundamentally determine the asset's utility and competitive positioning for decades.

The midstream and core operational phase involves the vessel owners and EPCI contractors who manage the actual pipelay project execution. These entities combine the high-value physical assets (the vessels) with essential human capital (skilled marine crew, welding specialists, and project managers). This phase is characterized by complex tender processes, project mobilization, installation, and strict adherence to safety and environmental regulations. Pricing power often rests with the major EPCI contractors who can offer integrated solutions, encompassing survey, engineering, installation, and commissioning, mitigating risk for the final asset owner. Efficiency in this stage, driven by high utilization rates and minimal weather downtime, is paramount to profitability.

Downstream activities include the final commissioning and handover of the completed pipeline system to the asset owners (typically Major International Oil Companies, National Oil Companies, or large Utility Providers for offshore wind). Distribution channels are predominantly direct, characterized by long-term contractual relationships established through competitive bidding for large infrastructure projects. Indirect influence, however, comes from specialized subsea survey and inspection companies who provide crucial data before, during, and after installation. The long-term profitability of the value chain is increasingly being influenced by the maintenance and inspection lifecycle (M&I), ensuring the longevity and integrity of the installed pipelines, thereby fostering recurrent business opportunities for the vessel owners and subsea service providers.

Pipelay Vessel Market Potential Customers

The primary customers for pipelay vessel services are large energy corporations requiring extensive subsea infrastructure installation. These customers fall into three main categories: Major International Oil Companies (IOCs) and National Oil Companies (NOCs), independent Exploration and Production (E&P) companies, and utility/power generation companies focused on offshore renewables. IOCs and NOCs, such as ExxonMobil, Shell, TotalEnergies, Petrobras, Saudi Aramco, and China National Offshore Oil Corporation (CNOOC), constitute the largest buyer group, requiring services for multi-billion dollar field developments in deep and ultra-deep waters. Their needs are highly complex, demanding vessels capable of handling large-diameter export lines, intricate riser systems, and long-distance tie-backs under stringent safety and technical specifications.

Independent E&P companies and smaller developers, while undertaking projects of lesser scale than the majors, still require high-quality, efficient pipelay services, often focusing on standardized field tie-backs or marginal field developments. These buyers prioritize cost-effectiveness and fast mobilization times, often leading them to contract specialized Reel-Lay vessels for efficient flowline installation. Furthermore, the burgeoning segment of utility and power generation companies—such as Ørsted, Equinor, and RWE—is rapidly emerging as a critical customer base. Their demand is specifically centered on vessels capable of installing heavy, high-voltage export and inter-array cables for offshore wind farms, requiring precise cable laying, burial, and trenching capabilities, often necessitating vessel modifications or new builds optimized for cable handling rather than pipe welding.

A third, increasingly important customer group involves governments and specialized decommissioning funds that finance the removal or abandonment of aging subsea assets, particularly in mature basins like the North Sea. These entities require specialized vessel operations that focus on recovery, cutting, and handling of degraded pipelines and platforms in an environmentally responsible manner. The contracting strategy across all customer types is shifting towards integrated project execution, preferring EPCI contractors who can manage the entire project lifecycle—from engineering design and procurement through to installation and testing—thereby simplifying the procurement process for the end-user and ensuring cohesive project delivery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TechnipFMC, Saipem, Subsea 7, McDermott International, Allseas, Heerema Marine Contractors, Boskalis, Petrofac, EMAS AMC, Sapura Energy, DeepOcean, DOF Subsea, China Oilfield Services Limited (COSL), Fugro, Helix Energy Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pipelay Vessel Market Key Technology Landscape

The Pipelay Vessel Market relies heavily on continuous technological advancements to address the growing complexity of offshore environments and improve operational efficiency. A core technological area is the deployment of highly sophisticated Dynamic Positioning (DP) systems, typically DP3 class, which utilize integrated sensors, thrusters, and satellite navigation to maintain the vessel's precise position over the target lay route, even in severe weather. This capability is non-negotiable for deepwater J-Lay operations where minor positional errors can induce catastrophic pipe failure. Furthermore, the shift towards ultra-deepwater necessitates continuous development in tensioner technologies and sophisticated control systems that manage the enormous weight and stress exerted on the pipeline as it transitions from the vessel to the seabed, ensuring the pipe remains within its acceptable stress limits during installation.

Another crucial technological development involves the automation and optimization of the firing line. Traditional manual welding processes are rapidly being replaced by high-speed, automated welding systems (e.g., flash-butt welding or automated gas metal arc welding) that significantly reduce the time required to join pipe segments, boosting the vessel's lay rate—a key metric for profitability. Coupled with this are advanced Non-Destructive Testing (NDT) technologies, such as automated ultrasonic testing (AUT), which ensure immediate and reliable quality assurance of the welds before the pipe segment is deployed subsea. The integration of these high-tech systems demands significant onboard computing power and specialized operational personnel.

Emerging technologies focus on increasing vessel versatility and reducing environmental footprint. There is a strong movement towards dual-fuel and LNG-powered vessels to comply with increasingly stringent IMO Tier III emission standards, reducing operational carbon intensity. Moreover, the integration of advanced data analytics and predictive modeling is enabling better management of complex subsea installations, optimizing deployment sequences and minimizing operational downtime caused by equipment failure or weather delays. For the renewable segment, innovative technologies involve sophisticated cable lay equipment, including high-capacity carousels and precise subsea trenching and burial tools, tailored specifically to protect large-diameter export cables from external damage.

Regional Highlights

The global Pipelay Vessel Market exhibits distinct operational characteristics and growth trajectories across its key geographical segments: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa (MEA). North America, anchored by the Gulf of Mexico, remains a crucial market, predominantly focusing on deepwater oil and gas tie-backs and long-distance gas export pipelines. The demand here is highly technical, favoring J-Lay and Reel-Lay vessels for complex subsea architecture, complemented by increasing activity in vessel maintenance and specialized inspection services for existing infrastructure.

Europe stands out as the global leader in the transition towards offshore renewables, driving intense demand for vessels capable of handling heavy subsea cables for major offshore wind farm developments in the North Sea and the Baltic Sea. While traditional oil and gas decommissioning remains a significant revenue source in the mature North Sea basin, the majority of new capital expenditure for pipelay services is directed towards supporting renewable energy transmission infrastructure, requiring high-specification, multi-functional vessels optimized for dynamic positioning and severe weather operations.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, fueled by substantial investments in natural gas exploration, particularly in Australia, Indonesia, and Malaysia. The vast, geographically dispersed nature of the region drives demand for a mix of specialized shallow-water S-Lay assets and deepwater J-Lay capacity for major greenfield gas developments. Latin America, particularly Brazil, is experiencing renewed deepwater development, relying heavily on foreign-owned ultra-deepwater vessels to connect major pre-salt discoveries. Finally, the Middle East and Africa (MEA) region provides a stable market base for shallow-water operations, characterized by large, scheduled maintenance and expansion projects predominantly utilizing efficient S-Lay techniques to expand regional oil and gas export capacity.

- North America (NA): Focus on complex deepwater tie-backs in the Gulf of Mexico; high technological requirements for ultra-deepwater vessels; stable market driven by maintenance and inspection.

- Europe: Primary growth driver is the Offshore Wind sector; high demand for cable-lay capabilities and decommissioning services; market governed by strict environmental compliance and safety standards.

- Asia Pacific (APAC): Strongest growth expected due to large-scale natural gas field development; diverse requirement across shallow and deep waters; increasing investment from NOCs in localized fleets.

- Latin America (LATAM): Heavily reliant on Brazil's ultra-deepwater pre-salt developments; demand concentrates on J-Lay technology and complex subsea systems; market sensitive to local regulatory changes.

- Middle East & Africa (MEA): Stable, large-scale shallow water pipeline expansion projects; dominant use of S-Lay vessels for long-distance pipelines; increasing deepwater activity off the coast of West Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pipelay Vessel Market.- TechnipFMC

- Saipem

- Subsea 7

- McDermott International

- Allseas

- Heerema Marine Contractors

- Boskalis

- Petrofac

- EMAS AMC

- Sapura Energy

- DeepOcean

- DOF Subsea

- China Oilfield Services Limited (COSL)

- Fugro

- Helix Energy Solutions

- Havfram (formerly integrated with TechnipFMC assets)

- Micoperi

- Swiber Holdings

- NPCC (National Petroleum Construction Company)

- Maritime Construction Services

Frequently Asked Questions

Analyze common user questions about the Pipelay Vessel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between J-Lay and S-Lay pipelaying methods?

The distinction lies in the angle of pipeline deployment and operational depth. S-Lay vessels lay the pipe horizontally, suitable for shallow to intermediate depths, forming an S-curve on deployment. J-Lay vessels deploy the pipe almost vertically (J-curve), which minimizes bending stress and is essential for installations in ultra-deepwater environments exceeding 1,500 meters.

How is the growth of offshore wind energy influencing the demand for Pipelay Vessels?

Offshore wind expansion is driving demand for vessels capable of handling heavy subsea power cables (export and inter-array lines), requiring modifications to traditional pipelay vessels or the construction of new assets optimized for cable laying, trenching, and complex subsea infrastructure integration, significantly diversifying the market beyond hydrocarbon transport.

Which regions currently offer the highest growth potential for new pipelay projects?

The Asia Pacific (APAC) and the North Sea (Europe) offer the highest growth potential. APAC is driven by massive greenfield gas development and infrastructure needs, while Europe’s growth is anchored by extensive government commitments to developing large-scale offshore wind farms and associated high-voltage cable grids.

What are the main financial risks associated with operating Pipelay Vessels?

Key financial risks include substantial capital expenditure required for asset ownership and maintenance, extreme sensitivity to global oil and gas price volatility affecting project sanctioning rates, and the high cost of maintaining specialized, highly trained maritime and technical crews, leading to pressure on utilization rates and day rates.

How does Dynamic Positioning (DP) technology enhance the efficiency of pipelay operations?

DP systems, particularly DP3 class, use integrated sensors and thrusters to automatically maintain the vessel's precise location and heading over the designated lay route, even in adverse weather. This precision is critical for deepwater installation integrity, minimizing downtime, and ensuring the accurate connection of complex subsea architecture.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager