Pipeline Intelligent Inspection Robot Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432121 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Pipeline Intelligent Inspection Robot Market Size

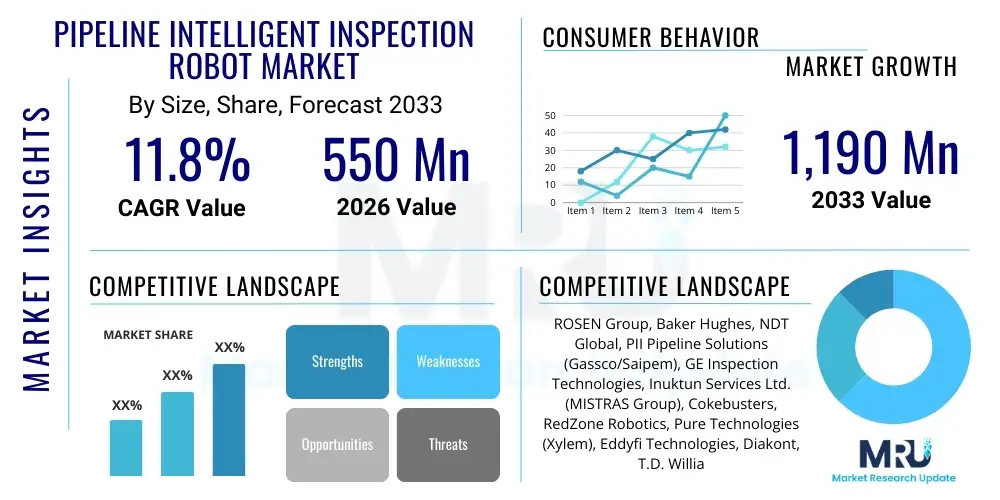

The Pipeline Intelligent Inspection Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 1,190 Million by the end of the forecast period in 2033.

Pipeline Intelligent Inspection Robot Market introduction

The Pipeline Intelligent Inspection Robot Market encompasses the design, manufacture, and deployment of advanced robotic systems dedicated to non-destructive testing (NDT) and comprehensive structural integrity assessment within intricate pipeline networks globally. These sophisticated robotic platforms are engineered to navigate challenging environments, including oil and gas transmission lines, water and wastewater infrastructure, chemical processing facilities, and power generation systems. The primary function involves detecting, classifying, and reporting defects such as corrosion, cracks, leaks, and structural anomalies with minimal operational interruption. The integration of high-resolution sensors, autonomous navigation capabilities, and real-time data processing represents a significant technological leap over traditional inspection methodologies, establishing these robots as critical assets for asset management and compliance.

Product descriptions vary significantly based on application and pipeline diameter, ranging from highly flexible, tethered crawlers equipped with magnetic flux leakage (MFL) and phased array ultrasonic testing (PAUT) tools, to untethered, autonomous underwater vehicles (AUVs) utilizing acoustics and optical sensing for submerged inspections. The core intellectual property resides in the robots' ability to maintain traction, overcome geometric obstacles such as bends and tees, and synchronize sensor data with precise geographic positioning. Furthermore, the intelligent aspect of these systems is rooted in embedded computing platforms that allow for on-the-fly data processing and anomaly identification, significantly reducing the dependence on post-inspection manual analysis and accelerating the mitigation lifecycle for critical infrastructure failure points.

Major applications span utilities, petrochemicals, municipal services, and industrial manufacturing, where pipeline integrity directly impacts operational safety, environmental compliance, and profitability. Key benefits driving market adoption include reduced inspection time, enhanced safety by minimizing human entry into hazardous confined spaces, improved data accuracy leading to predictive maintenance scheduling, and a substantial reduction in unplanned downtime associated with catastrophic failures. Driving factors are predominantly strict regulatory mandates concerning infrastructure aging, the necessity for prolonged asset lifespan management, and the increasing complexity and length of global pipeline networks requiring continuous, reliable monitoring solutions.

Pipeline Intelligent Inspection Robot Market Executive Summary

The Pipeline Intelligent Inspection Robot Market is experiencing robust acceleration, fundamentally driven by global infrastructure aging concerns and escalating safety standards imposed by governmental bodies across North America and Europe. Business trends indicate a strong shift towards service-based models (Robots-as-a-Service, RaaS), allowing smaller operators to access high-end inspection technologies without significant capital expenditure. Technological advancements, particularly in sensor fusion, autonomous decision-making algorithms, and battery longevity, are minimizing deployment risks and maximizing data capture efficiency. Furthermore, strategic collaborations between traditional NDT service providers and robotics manufacturers are shaping competitive dynamics, aiming to offer integrated, end-to-end pipeline integrity management solutions that combine hardware excellence with advanced data analytics platforms. The focus remains on developing robots capable of navigating non-piggable pipelines, which currently constitute a significant challenge area.

Regional trends highlight North America as the primary revenue generator due to vast oil and gas pipeline infrastructure and stringent regulatory frameworks mandating periodic internal inspections, particularly in the transmission and distribution segments. Asia Pacific is emerging as the fastest-growing region, fueled by rapid expansion in municipal water networks, urbanization-driven infrastructure projects, and increasing industrial investment in China and India. European growth is steady, emphasizing regulatory compliance (e.g., environmental protection directives) and the transition towards smart infrastructure utilizing digital twins, where inspection data provides the foundational input for simulation and modeling. The Middle East and Africa region is focusing investments on ensuring the reliability of major crude oil export lines, often requiring specialized robots for harsh desert and offshore environments.

Segmentation trends reveal that the Services segment dominates the market revenue, reflecting the complexity of deployment and the preference for specialized vendors handling operation and data interpretation. By application, the Oil & Gas segment retains the largest share, critical for energy security and environmental risk mitigation. However, the Water & Wastewater segment is forecast to exhibit the highest CAGR, driven by global efforts to address non-revenue water (NRW) losses and replace aging municipal piping. From a technology standpoint, Ultrasonic Testing (UT) and Magnetic Flux Leakage (MFL) technologies remain the most widely adopted sensor payloads, with increasing demand for Electro-Magnetic Acoustic Transducers (EMAT) due to their ability to inspect through coatings.

AI Impact Analysis on Pipeline Intelligent Inspection Robot Market

Common user questions regarding AI's influence center on whether AI can entirely automate defect classification, how machine learning (ML) models handle novel or unknown failure modes, and the reliability of autonomous navigation in environments where GPS is unavailable or restricted. Users are particularly concerned about the transition from human-validated interpretation to AI-driven decision-making, emphasizing the need for robust explainability (XAI) in anomaly detection reports. There is significant interest in AI's role in correlating various sensor inputs (e.g., visual, ultrasonic, and MFL data) to provide a unified, definitive assessment of pipeline health, moving beyond simple data logging to genuine intelligent prognostics. The consensus expectation is that AI will transform the efficiency of data processing, shifting human analysts' focus from raw data review to strategic maintenance planning.

The incorporation of Artificial Intelligence and Machine Learning algorithms is fundamentally redefining the efficiency and accuracy of pipeline integrity management. AI models, particularly deep convolutional neural networks (CNNs), are utilized to automatically analyze vast amounts of inspection data, including high-resolution video feeds and complex sensor readings from MFL and UT tools. This automated analysis drastically reduces the time required for post-inspection data processing, often transforming what historically took weeks into mere hours. The capability of AI to recognize subtle patterns indicative of incipient defects—patterns that might be overlooked by the human eye or standard threshold-based software—enhances the predictive power of the inspection process, moving operators closer to true condition-based maintenance.

Furthermore, AI facilitates the development of more truly intelligent robots through enhanced autonomy and adaptive behavior. ML is crucial for path planning and anomaly avoidance in complex, non-standard pipeline geometries (such as non-piggable lines), allowing robots to adjust propulsion and maneuvering strategies dynamically based on real-time environmental feedback and localization data. In essence, AI serves as the operational brain, improving not only the quality of the data output but also the reliability and repeatability of the robot's mission execution, thereby maximizing the return on investment for the robotic deployment phase and ensuring complete coverage of the asset being inspected.

- Enhanced Defect Recognition: Use of deep learning models (CNNs and RNNs) for automated, high-accuracy classification of corrosion pitting, stress corrosion cracking (SCC), and third-party damage from visual and sensor data.

- Predictive Maintenance Optimization: AI-driven analysis of historical inspection data combined with operational parameters (pressure, flow rate) to forecast the remaining useful life (RUL) of pipeline segments.

- Real-Time Anomaly Prioritization: Algorithms prioritize identified defects based on severity and risk profile, allowing immediate operational response rather than delayed manual review.

- Autonomous Navigation and Localization: Machine learning applied to sensor fusion (IMU, encoder, LiDAR) enables precise localization and path correction in GPS-denied, complex internal pipeline environments.

- Data Compression and Edge Computing: AI models optimized for edge devices allow for processing critical data onboard the robot, reducing bandwidth requirements and enabling faster feedback loops.

- Reduced False Positive Rates: Training models on extensive proprietary datasets minimizes erroneous reporting, improving the credibility of automated inspection results.

- Automated Reporting Generation: AI structures complex inspection findings into standardized, regulatory-compliant reports, significantly lowering administrative overhead.

- Multi-Sensor Data Fusion: Intelligent systems correlate disparate data streams (e.g., MFL depth measurements with acoustic monitoring) to generate a holistic, verifiable assessment of integrity.

DRO & Impact Forces Of Pipeline Intelligent Inspection Robot Market

The market dynamics of Pipeline Intelligent Inspection Robots are characterized by a strong interplay of regulatory push, technological pull, and significant capital constraints. Key drivers include the aging global energy and water infrastructure, which necessitates proactive integrity management to prevent environmental disasters and catastrophic failures, coupled with increasingly stringent government regulations globally enforcing higher standards of pipeline safety and monitoring frequency. The restraining forces predominantly involve the high initial capital investment required for these specialized robotic systems, particularly for smaller operators, alongside the technical challenges associated with inspecting "non-piggable" pipelines characterized by varying diameters, steep bends, and multi-diameter sections. Opportunities abound in the expansion of services utilizing AI/ML for predictive failure analysis and the penetration of robots into new application areas such as high-temperature process pipelines and nuclear facility infrastructure. These forces create a compelling environment where the demand for efficiency and safety outweighs the adoption barriers, pushing innovation forward.

Drivers: A primary driver is the urgent need for operational efficiency and risk mitigation in the oil and gas sector, where failures can result in billions of dollars in losses and severe environmental penalties. The advancement of sensor technology, particularly miniaturization and improved resolution in ultrasonic and eddy current sensors, allows robots to gather more comprehensive and accurate data than ever before, justifying the investment. Furthermore, the global emphasis on sustainability and minimizing leakages, particularly in municipal water distribution (reducing non-revenue water), is fueling demand for reliable internal inspection tools. Labor shortages for specialized NDT technicians also drive automation, as robots can perform repetitive, high-risk tasks consistently and efficiently.

Restraints: Significant restraints include the high development costs for robots tailored to unique pipeline specifications and materials, limiting standardization across the industry. The operational risk associated with potential robot failure or entrapment within a critical pipeline requires extensive redundancy planning and specialized retrieval mechanisms, increasing deployment complexity and overall cost. Data interpretation remains a bottleneck; while AI assists, the final, legally defensible integrity assessment often requires highly specialized engineering validation, which can slow down the overall repair cycle. Furthermore, resistance to adopting new technologies among traditionally conservative infrastructure operators presents a market penetration barrier, especially in emerging economies where regulatory oversight may be less centralized.

Opportunities: Opportunities lie heavily in the burgeoning field of smart water infrastructure, addressing massive global issues like non-revenue water loss through precise leak detection. The development of untethered, longer-range autonomous platforms using advanced power sources (e.g., high-density batteries or novel propulsion methods) will unlock the inspection of previously inaccessible long-distance pipelines. Service providers can capitalize by offering comprehensive data integration services, merging inspection findings with Geographic Information Systems (GIS) and digital twin models for holistic asset management. Finally, the ability to inspect extremely difficult materials, such as non-metallic or composite pipes, opens niche high-value market segments for specialized robotic solutions.

- Drivers:

- Strict global regulatory compliance standards for pipeline integrity (e.g., PHMSA in the US, European environmental directives).

- Aging global infrastructure necessitates preventative maintenance and integrity assessment.

- Growing complexity and length of oil, gas, and water distribution networks.

- Increased safety concerns and the need to reduce human exposure to hazardous pipeline environments.

- Technological breakthroughs in sensor miniaturization, autonomy, and data analytics (AI/ML).

- Restraints:

- High initial capital expenditure and deployment costs for customized robotic solutions.

- Technical limitations in inspecting complex "non-piggable" pipelines with varying diameters or tight bends.

- Risk of robot immobilization or failure within critical operating pipelines, requiring complex recovery protocols.

- Need for highly specialized operational expertise and data interpretation capabilities.

- Opportunities:

- Expansion into municipal water and wastewater inspection for leak detection and structural assessment.

- Development of Robotics-as-a-Service (RaaS) models to lower adoption barriers.

- Integration with Digital Twin technology for continuous, real-time asset lifecycle management.

- Innovation in power storage and propulsion systems enabling longer untethered missions.

- Penetration into niche industrial sectors like nuclear, chemical, and pharmaceutical pipelines.

- Impact Forces:

- High Regulatory Force: Drives mandatory, scheduled inspection cycles.

- High Technology Force: Rapid innovation in AI and sensors lowers operational barriers and increases data quality.

- Moderate Economic Force: High upfront cost acts as a barrier, partially mitigated by RaaS models.

- High Safety & Environmental Force: Market is strongly influenced by public and governmental pressure to prevent catastrophic leaks and spills.

Segmentation Analysis

The Pipeline Intelligent Inspection Robot Market is strategically segmented based on crucial dimensions including Technology, Application, Operation Mode, and Component, allowing stakeholders to target specific niche requirements within the broader infrastructure integrity landscape. Analysis of these segments is vital for understanding competitive positioning and identifying high-growth opportunities. The inherent complexity of pipeline inspection necessitates varied technological approaches; hence, segments based on sensor payload (MFL, UT) are highly influential. Market performance is intrinsically tied to the robust demand emanating from heavy industries, with the oil and gas sector driving technological advancement, while municipal segments define volume growth. The move towards fully autonomous, untethered operation modes represents the future trajectory across all application areas, promising unparalleled operational flexibility and reach.

- By Operation Mode: Tethered Robots, Untethered (Autonomous) Robots

- By Technology: Magnetic Flux Leakage (MFL), Ultrasonic Testing (UT), Eddy Current Testing (ECT), Visual Inspection (CCTV/Optical), Others (Laser Profiling, EMAT)

- By Application: Oil & Gas Pipelines (Transmission, Distribution, Gathering), Water & Wastewater Pipelines (Potable Water, Sewage), Chemical & Petrochemical Pipelines, Power Generation Pipelines, Others (Mining, HVAC)

- By Component: Hardware (Robotic Platforms, Sensors, Navigation Systems), Software (Data Processing & Visualization, AI/ML Algorithms), Services (Inspection & Maintenance, Training, Data Analysis)

Value Chain Analysis For Pipeline Intelligent Inspection Robot Market

The value chain for the Pipeline Intelligent Inspection Robot Market is intricate, starting with highly specialized upstream component manufacturing and culminating in high-value, data-driven service delivery to end-users. Upstream activities involve research and development of robust, miniaturized non-destructive testing sensors, specialized propulsion mechanisms (e.g., magnetic wheels or differential drive systems), and ruggedized control electronics capable of enduring harsh pipeline environments. Suppliers of advanced materials, such as corrosion-resistant alloys and high-density power units, form the backbone of the manufacturing phase. These specialized inputs require deep collaboration between NDT experts and robotics engineers to ensure optimal performance characteristics when integrated into the final robotic platform.

Midstream activities focus on the assembly and integration of the intelligent robotic system, including the integration of proprietary AI software for real-time data processing and navigation. This phase is characterized by stringent quality control and complex calibration procedures to ensure the accuracy of the inspection data collected. Market participants typically fall into two categories: specialized hardware manufacturers and integrated service providers. Service providers often procure hardware components and add proprietary software and expert operational teams, positioning themselves as complete pipeline integrity management solution vendors, thus capturing higher margins through intellectual property related to data interpretation.

Downstream distribution channels are heavily skewed towards direct engagement due to the technical complexity and high cost of the equipment and services. Direct sales and contracted services models are dominant, where the manufacturer or service provider deploys their trained personnel alongside the robots. Indirect channels, primarily used for ancillary components or standardized smaller robotic units (like basic CCTV crawlers), may involve specialized distributors focusing on industrial maintenance equipment. The interaction with end-users, such as pipeline operators or utility companies, is continuous, involving detailed planning, execution of the inspection mission, and delivery of comprehensive, data-rich reports, often necessitating ongoing software and data analytic support.

Pipeline Intelligent Inspection Robot Market Potential Customers

The primary customers for Pipeline Intelligent Inspection Robot technology are large-scale operators and owners of critical infrastructure where pipeline integrity directly impacts regulatory compliance, safety, and core business continuity. These entities prioritize minimizing downtime and preventing catastrophic failures associated with corrosion, external damage, or material fatigue. Key buyers include national and multinational oil and gas companies (e.g., Chevron, ExxonMobil, Saudi Aramco) that manage thousands of miles of high-pressure transmission lines, requiring specialized solutions for both piggable and non-piggable assets to meet strict jurisdictional mandates regarding internal inspection frequency and quality. Their procurement cycles are typically lengthy, involving rigorous proof-of-concept testing and large, multi-year service contracts.

A rapidly expanding customer base is found within municipal water and wastewater utilities. These government or privately-held entities utilize inspection robots to combat pervasive issues like non-revenue water (NRW) caused by leaks, and to assess the structural integrity of aging sewage and stormwater networks before capital-intensive replacement projects are initiated. Unlike the energy sector, these customers often seek standardized, cost-effective, and easy-to-deploy systems, driving demand for RaaS models that bundle hardware, software, and operational support. Furthermore, high-purity industries, such as pharmaceuticals and specialty chemicals, are niche but high-value customers needing specialized hygienic or inert inspection robots to maintain process quality and safety standards within smaller diameter piping systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 1,190 Million |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ROSEN Group, Baker Hughes, NDT Global, PII Pipeline Solutions (Gassco/Saipem), GE Inspection Technologies, Inuktun Services Ltd. (MISTRAS Group), Cokebusters, RedZone Robotics, Pure Technologies (Xylem), Eddyfi Technologies, Diakont, T.D. Williamson (TDW), Enel Group, Intertek Group plc, Halfwave, Deep Trekker, Nexxis. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pipeline Intelligent Inspection Robot Market Key Technology Landscape

The technological landscape of the Pipeline Intelligent Inspection Robot Market is defined by the convergence of advanced robotics, sophisticated sensor suites, and powerful computational intelligence designed to operate under extreme conditions. Core technologies include precision actuation and navigation systems, such as differential magnetic drive units or sophisticated hydrostatic propulsion for submerged operations, ensuring stable movement and sensor contact regardless of fluid flow or pipeline gradient. The shift is increasingly moving towards modular design architectures, allowing operators to quickly swap out inspection payloads—transitioning, for instance, from MFL tools for metal loss detection to Phased Array Ultrasonic Testing (PAUT) for crack detection—on a single robotic chassis, thereby maximizing platform versatility and operational utility across different pipeline material types and defect requirements.

Crucial to the 'intelligent' aspect of these robots is the integration of simultaneous localization and mapping (SLAM) algorithms adapted for confined, feature-poor internal environments. These localization technologies utilize proprietary inertial measurement units (IMUs) and odometer data combined with internal pipeline geometry mapping to provide highly accurate positioning of detected anomalies, which is essential for subsequent repair and maintenance crews. Furthermore, the push for enhanced data throughput necessitates the use of high-speed digital communication systems, often leveraging fiber optics in tethered systems, or advanced acoustic and radio frequency telemetry for untethered units, ensuring massive data streams generated by high-definition sensors are reliably transmitted for processing and real-time visualization.

The rapid evolution of Non-Destructive Testing (NDT) technology is continuously enhancing robot capabilities. While traditional methods like standard MFL remain critical, advanced technologies such as High-Resolution MFL (HR-MFL) and circumferential UT (C-UT) offer far superior detection capabilities, particularly for small-scale pitting and stress corrosion cracking (SCC). Moreover, the increasing adoption of Electro-Magnetic Acoustic Transducers (EMAT) is notable as it overcomes the need for liquid couplants, enabling inspection through various coatings and facilitating deployment in dry gas lines or pipelines with minimal fluid presence, significantly broadening the operational envelope of intelligent inspection robotics. The combination of these sensor advancements with AI-driven processing ensures that the inspection output is not just data, but actionable intelligence.

- Advanced NDT Sensor Suites: Integration of High-Resolution Magnetic Flux Leakage (HR-MFL), Phased Array Ultrasonic Testing (PAUT), and Electro-Magnetic Acoustic Transducers (EMAT).

- Autonomous Navigation and SLAM: Use of internal pipeline mapping and proprietary Inertial Measurement Units (IMU) for accurate defect localization in non-GPS environments.

- Modular Robotics Design: Chassis designed for rapid interchangeability of sensor payloads and propulsion modules to adapt to diverse pipeline specifications.

- High-Bandwidth Telemetry: Implementation of fiber optic communication (for tethered systems) and optimized acoustic/RF communication (for untethered systems) to handle high-volume sensor data transmission.

- Battery and Power Management: Development of high-density lithium polymer and solid-state batteries for extended untethered mission endurance and efficient power distribution to high-drain sensors.

- Artificial Intelligence and Machine Learning: Onboard and off-board processing using deep learning for automated defect recognition, filtering noise, and classifying damage types in real-time.

- Digital Twin Integration: Software platforms generating 3D models of pipeline segments based on inspection data, allowing for virtual integrity assessment and maintenance planning simulations.

Regional Highlights

The global Pipeline Intelligent Inspection Robot Market exhibits distinct growth trajectories influenced by regional infrastructure maturity, regulatory stringency, and investment capacity. North America currently leads the market in terms of revenue share, primarily due to the vast, interconnected network of oil and gas pipelines across the United States and Canada. Regulatory bodies like the Pipeline and Hazardous Materials Safety Administration (PHMSA) mandate rigorous inspection schedules, driving constant demand for technologically advanced and compliant robotic systems. The region is characterized by early adoption of sophisticated, large-diameter inspection tools, and a strong preference for service contracts leveraging AI-driven data analytics, focusing intensely on preventing spills and enhancing system reliability across aging assets.

Europe represents a mature market focusing heavily on environmental protection and the efficiency of urban infrastructure. Scandinavian countries and Germany are leaders in adopting sophisticated robotics for water and wastewater inspection to minimize non-revenue water losses and improve municipal service delivery. The European Union’s emphasis on smart infrastructure and digital transformation accelerates the integration of inspection data into overarching asset management strategies, favoring vendors who offer comprehensive digital twin solutions. While the oil and gas segment is present, the municipal and chemical sectors often drive niche demand, particularly for smaller, flexible robots capable of navigating complex urban piping layouts and specialized industrial facilities.

Asia Pacific (APAC) is projected to be the fastest-growing region, marked by explosive infrastructure development in China, India, and Southeast Asia. This growth is driven by the rapid expansion of city gas distribution networks, major investment in cross-country oil pipelines, and extensive projects to modernize water supply systems to meet the needs of surging urban populations. Although initial regulatory mandates may be less centralized than in Western markets, the sheer volume of new construction and the subsequent requirement for quality assurance and long-term asset management are creating massive market opportunities. Local governments and large state-owned enterprises are keen on adopting scalable, proven technologies, often via international partnerships.

The Middle East and Africa (MEA) region focuses almost exclusively on maximizing the uptime and integrity of critical crude oil and gas export pipelines. National oil companies (NOCs) are major purchasers of both high-end hardware and specialized inspection services, particularly requiring robots designed to withstand high temperatures and corrosive environments associated with petrochemical extraction and processing. Investment in intelligent inspection technology is viewed as strategically vital for maintaining global market share and ensuring geopolitical stability regarding energy supply. Latin America, while smaller, shows significant potential driven by energy sector liberalization and the modernization of aging infrastructure in Brazil and Mexico, leading to increased demand for cost-effective, reliable inspection solutions.

- North America: Highest market share; driven by PHMSA regulations, massive oil & gas network, and early adoption of AI-enhanced inspection services. Focus on large-diameter, high-pressure pipeline integrity.

- Asia Pacific (APAC): Fastest growth rate; fueled by rapid urbanization, extensive new municipal water projects, and expansion of gas distribution networks in China and India. Growing emphasis on QA/QC in new construction.

- Europe: Stable growth; driven by stringent environmental compliance, smart city initiatives, and strong demand for robotics in municipal water (leakage control) and wastewater management. High adoption of digital twin platforms.

- Middle East & Africa (MEA): Critical investment in energy export infrastructure; procurement dominated by NOCs for high-specification robots capable of operating in harsh, hot environments to ensure continuity of crude oil and gas flow.

- Latin America: Emerging market; increasing investment in energy infrastructure modernization and addressing operational efficiency in countries like Brazil, Mexico, and Argentina.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pipeline Intelligent Inspection Robot Market.- ROSEN Group

- Baker Hughes (Waygate Technologies)

- NDT Global

- PII Pipeline Solutions (Joint venture between Gazprom and Saipem)

- T.D. Williamson (TDW)

- GE Inspection Technologies

- Inuktun Services Ltd. (MISTRAS Group)

- Cokebusters

- Diakont

- RedZone Robotics

- Pure Technologies (A Xylem Brand)

- Eddyfi Technologies

- Intertek Group plc

- Halfwave

- Deep Trekker

- Nexxis

- Enel Group (Internal Robotics Division)

- I-Rod Technology

- Sewer Robotics

- Applied Inspection

Frequently Asked Questions

Analyze common user questions about the Pipeline Intelligent Inspection Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between intelligent inspection robots and traditional pipeline inspection gauges (PIGs)?

Intelligent inspection robots offer enhanced maneuverability and operational flexibility compared to traditional PIGs. Unlike PIGs, which are typically propelled by fluid flow and require specific pipeline geometries (piggable lines), robots possess independent power and propulsion systems, enabling them to stop, reverse, and navigate non-piggable segments (tight bends, varying diameters). Crucially, intelligent robots integrate AI for real-time, on-board data processing and precise defect localization, providing immediate, actionable integrity insights.

How does Artificial Intelligence improve the cost-effectiveness of pipeline inspection?

AI significantly improves cost-effectiveness primarily by reducing the time and labor required for data post-processing. Automated defect recognition (ADR) algorithms analyze sensor data orders of magnitude faster than human technicians, shifting expert focus from reviewing raw data to strategic maintenance planning. This acceleration minimizes operational downtime, prevents costly catastrophic failures through enhanced predictive maintenance, and lowers the overall operational expenditure (OPEX) associated with integrity management programs.

Which application segment is expected to drive the highest growth rate in robot adoption?

The Water & Wastewater segment is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by global mandates to combat Non-Revenue Water (NRW) losses and the dire need to assess the structural integrity of vastly aging municipal piping networks in major urban centers. Inspection robots provide the precision leak detection and structural assessment necessary for targeted, cost-efficient infrastructure rehabilitation, making them essential tools for utilities globally.

What are the main technical hurdles preventing the widespread use of untethered inspection robots?

The primary technical hurdles for untethered robots revolve around power density and long-range communication. Achieving sufficient battery life to power high-drain NDT sensors (like UT or MFL) and sustain propulsion over long distances (several kilometers) remains challenging. Furthermore, maintaining reliable, high-bandwidth data transmission between the submerged or internal robot and the external operator, particularly in metallic pipes or turbulent fluids, requires highly robust and often proprietary acoustic or radio frequency telemetry systems.

Are pipeline inspection robots typically purchased outright or utilized through service contracts?

For specialized, high-end intelligent inspection robots, the majority of market activity occurs through service contracts (Robots-as-a-Service, RaaS). Due to the high capital cost, complexity of deployment, and the specialized expertise required for data interpretation and operational logistics, most pipeline owners prefer contracting highly experienced integrity service providers. This model allows operators to utilize the latest technology without incurring massive upfront capital expenditure or maintaining internal robotics engineering teams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager