Piperonyl Butoxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434030 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Piperonyl Butoxide Market Size

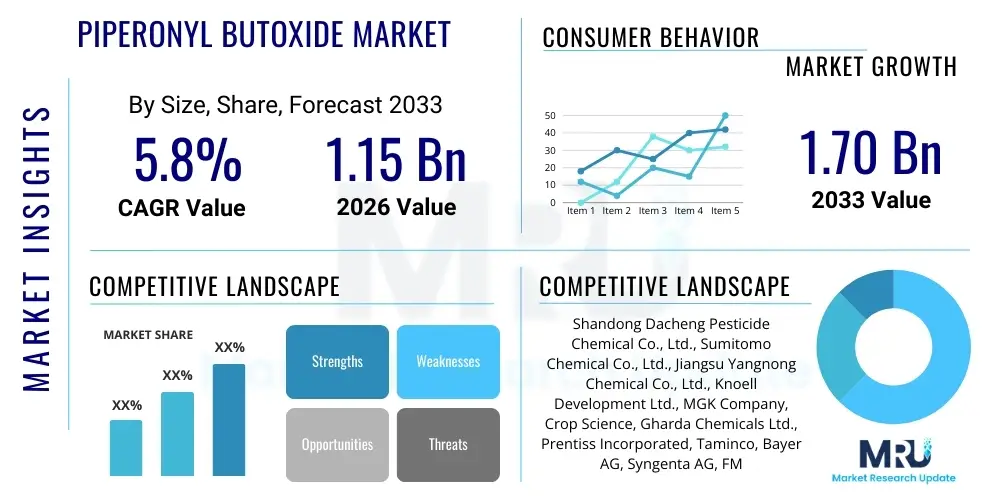

The Piperonyl Butoxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.15 Billion in 2026 and is projected to reach USD 1.70 Billion by the end of the forecast period in 2033.

Piperonyl Butoxide Market introduction

Piperonyl Butoxide (PBO) is a critical synthetic chemical compound used extensively as a synergist in insecticide formulations, primarily in combination with pyrethrins and pyrethroids. Its primary function is not to act as a direct insecticide, but rather to inhibit the mixed-function oxidases (MFOs) enzymes within insects, which are responsible for the detoxification of insecticides. By blocking these defensive enzymes, PBO significantly enhances the efficacy, knockdown power, and lethality of the primary pesticide, thereby allowing for the use of lower concentrations of the active ingredient. This synergy is particularly crucial in combating insecticide resistance, a growing global challenge that threatens public health and agricultural yields.

Major applications of PBO span several high-stakes sectors, including agricultural crop protection, public health vector control (e.g., mosquito and fly control), stored grain protection, and consumer household pest control products. In agriculture, PBO-enhanced formulations are vital for protecting high-value crops against resistant pests, ensuring food security and minimizing harvest losses. The benefits of using PBO include cost-effectiveness through lower active ingredient usage, rapid action against pests, and the ability to maintain the effectiveness of existing pesticide classes, especially pyrethroids, against increasingly resilient insect populations. These synergistic effects are indispensable for modern pest management strategies across developed and developing economies.

The driving factors for market growth are intrinsically linked to the escalating threat of vector-borne diseases, such as dengue fever, malaria, and Zika virus, necessitating robust public health intervention programs that rely heavily on potent adulticides. Furthermore, increasing global trade and climate change contribute to the rapid geographical spread of invasive and destructive agricultural pests. Regulatory pressure on highly toxic organophosphate and carbamate insecticides has further boosted the reliance on pyrethroid-PBO combinations as safer alternatives, despite ongoing scrutiny regarding PBO's own environmental profile. Continuous innovation in formulation science, focusing on microencapsulation and targeted delivery systems, also supports the sustained demand for PBO.

Piperonyl Butoxide Market Executive Summary

The Piperonyl Butoxide market demonstrates robust growth driven by persistent global challenges in pest management, necessitating effective synergists to combat widespread insecticide resistance across agricultural and public health domains. Key business trends highlight a significant shift toward specialized, high-purity PBO tailored for aerosol and fogging applications, particularly in dense urban areas facing heightened risks of vector-borne disease outbreaks. The market structure remains moderately concentrated, with key players focusing heavily on navigating the complex and divergent regulatory landscapes across North America and Europe, while simultaneously expanding production capacity in Asia Pacific to meet surging demand from developing economies prioritizing infrastructure for malaria and dengue prevention.

Regional trends indicate that the Asia Pacific (APAC) region is poised for the most substantial growth, fueled by population density, reliance on agriculture, and endemic vector-borne diseases, making it the largest consumer and potentially the fastest-growing market by volume. North America and Europe, characterized by mature markets, exhibit steady demand driven primarily by stringent quality standards for household and commercial pest control. Segmentation analysis reveals that the public health application segment, which includes governmental and non-governmental organization procurement for vector control, holds a dominant market share, although the agricultural segment is registering accelerated growth due to severe pest infestations and the widespread failure of standalone pyrethroid treatments in major crop production zones.

Overall market dynamics are shaped by the dichotomy between the indispensable functional role of PBO in resistance management and the environmental and toxicological scrutiny it faces from regulatory bodies. Successful market participation requires intense focus on supply chain resilience, ensuring sustainable sourcing of precursor chemicals, and investment in data transparency regarding human and ecological exposure assessments. Future profitability hinges on developing PBO alternatives or formulating existing PBO products into ultra-low volume, highly targeted, and environmentally benign delivery systems that satisfy both efficacy requirements and emerging sustainability mandates from global consumers and regulators.

AI Impact Analysis on Piperonyl Butoxide Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Piperonyl Butoxide (PBO) market frequently revolve around predictive modeling, optimization of synthesis processes, and the development of new, targeted delivery formulations. Users are keenly interested in how AI can enhance the precision of pest management, specifically addressing where and when PBO-enhanced treatments are most effective, thereby reducing environmental load while maximizing impact. Key themes emerging from these inquiries include the use of machine learning algorithms to predict pest resistance evolution, which directly informs the necessary PBO synergy ratio in new product development, and the application of generative AI in exploring novel PBO analogs or synergistic compounds that might offer improved toxicological profiles.

The immediate and tangible influence of AI lies in its ability to process vast, disparate datasets—including climate patterns, historical pesticide usage, genomic data of target pests, and real-time field observations—to create highly accurate resistance management strategies. This capability allows manufacturers and agricultural organizations to dynamically adjust the PBO concentration in formulations, moving away from static, broad-spectrum applications to dynamic, localized treatments. Consequently, AI helps optimize inventory management, ensuring that PBO production meets specific regional demand spikes related to outbreak forecasts, thereby stabilizing supply chains and reducing waste from improperly timed or ineffective applications. This level of optimization significantly improves the cost-efficiency of pest control campaigns, particularly in large-scale public health initiatives.

Furthermore, AI is instrumental in accelerating the R&D pipeline. Computational chemistry, powered by machine learning, is being deployed to model the interaction of PBO with insect cytochrome P450 enzymes (the detoxification system), providing deeper mechanistic insights into resistance circumvention. This predictive modeling capability dramatically reduces the time and cost associated with synthesizing, screening, and testing new synergistic compounds or optimized PBO derivatives. The convergence of AI with advanced material science is also yielding smart formulations, such as those employing nano-encapsulation, where AI models dictate the optimal particle size and release kinetics of PBO, ensuring controlled, sustained efficacy with minimal non-target exposure.

- AI-driven predictive modeling forecasts vector-borne disease outbreaks and agricultural pest flare-ups, optimizing PBO allocation.

- Machine learning algorithms analyze genomic data to anticipate insect resistance mechanisms, guiding optimal PBO synergy ratios in new formulations.

- AI optimizes synthesis and manufacturing processes for PBO, improving yield, reducing energy consumption, and ensuring batch consistency.

- Computational chemistry accelerates the discovery of next-generation synergists, reducing reliance on traditional, time-intensive laboratory screening.

- Smart spray systems utilize real-time data and AI to precisely manage PBO application rates, enhancing efficiency and minimizing environmental drift.

DRO & Impact Forces Of Piperonyl Butoxide Market

The dynamics of the Piperonyl Butoxide market are shaped by a complex interplay of essential drivers, significant restraints, and emerging opportunities, collectively defining the impact forces across its value chain. The primary market driver is the pervasive and rapidly accelerating development of insecticide resistance, particularly to pyrethroids, across key target species such as mosquitoes (Aedes, Anopheles), houseflies, and critical agricultural pests. As public health and agricultural productivity remain critically dependent on the effectiveness of these chemical classes, PBO's role as a potent resistance-breaking synergist ensures its irreplaceable demand. Coupled with this is the escalating risk of vector-borne diseases, exacerbated by urbanization and climate change, necessitating continuous, high-volume use of PBO-enhanced insecticides in government-funded public health programs worldwide.

However, the market faces considerable restraints, chief among them being increasingly rigorous regulatory oversight concerning PBO’s toxicological and environmental profile. Regulatory agencies, particularly in the European Union (EU) and North America, frequently review the maximum allowable limits (MRLs) for PBO residues in food crops and scrutinize its potential endocrine-disrupting properties, leading to usage restrictions or outright bans in specific applications or regions. These regulatory hurdles necessitate substantial investment in toxicology studies and registration fees, raising operational costs and introducing market uncertainty for manufacturers. Furthermore, growing consumer preference for organic and non-chemical pest control methods, particularly in developed markets, poses a long-term threat to the market penetration of synthetic synergists like PBO.

Significant opportunities exist in the development of novel, sustainable PBO applications, specifically within integrated pest management (IPM) strategies. This includes formulating PBO for synergistic use with newer, less toxic biopesticides or incorporating PBO into controlled-release, highly targeted systems (such as insecticide-treated nets or precise seed treatments) that minimize non-target exposure. The development of high-purity PBO specifically designed for sensitive applications, ensuring minimal impurity profiles, also presents a premium market opportunity. The impact forces acting on the market are high, driven by geopolitical instability affecting supply chains of essential precursor chemicals and the constant pressure to innovate safer, more effective resistance-management tools to safeguard global food security and public health.

Segmentation Analysis

The Piperonyl Butoxide market is primarily segmented based on its Purity Level, Application Method, and End-use Application. Purity level segmentation is crucial as different regulatory standards and application sensitivities necessitate varying grades of PBO; high-purity grades (typically >95%) are mandatory for pharmaceutical, cosmetic, and sensitive public health uses, while commercial grades (90-94%) suffice for broad agricultural use. The application method breakdown covers aerosols, sprays (including Ultra-Low Volume ULV and thermal fogging), dusts, and topical treatments, with aerosols and ULV applications dominating due to their efficiency in delivering instantaneous knockdown effects against flying insects in both urban and rural settings.

The segmentation by end-use application offers the clearest insight into market demand drivers. The public health sector, encompassing government vector control programs (e.g., malaria, dengue, West Nile virus prevention) and institutional pest control, constitutes the largest segment, driven by global initiatives and procurement contracts. The second major segment, agriculture, relies on PBO-enhanced formulations for protection against various crop-destroying insects that have developed resistance to pyrethroids. The household and consumer segment, which includes over-the-counter sprays, pet treatments, and structural pest control products, remains stable, benefiting from consumer demand for quick and reliable pest elimination, often prioritizing formulations with low odor and fast action.

Future growth segmentation is expected to be catalyzed by specialized niche markets, such as veterinary medicine for controlling external parasites on livestock and companion animals, where resistance management is becoming increasingly critical. Furthermore, the segmentation focusing on product type, such as encapsulated PBO versus conventional PBO, highlights the industry trend toward controlled-release mechanisms. These advanced formulations aim to extend residual efficacy and improve safety, making them highly attractive for long-term protection required in warehouses, food processing facilities, and outdoor perimeter treatments. Strategic segmentation allows manufacturers to tailor their production, marketing, and regulatory compliance efforts effectively to meet the diverse needs across these distinct user groups.

- By Purity Level:

- Standard Grade (90% - 94%)

- High Purity Grade (>95%)

- By Application Method:

- Aerosols and Sprays

- Thermal Fogging and ULV

- Dusts and Powders

- Topical and Residual Treatments

- By End-use Application:

- Public Health and Vector Control (Mosquitoes, Flies)

- Agriculture and Crop Protection (Field Crops, Stored Grains)

- Household and Commercial Pest Control

- Veterinary Applications (Livestock, Pets)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Piperonyl Butoxide Market

The value chain of the Piperonyl Butoxide market begins with upstream activities focused on the procurement and processing of key raw materials. The synthesis of PBO heavily relies on precursors derived from petroleum chemistry, primarily catechol or its derivatives, and specific alcohols such as n-butanol. Upstream complexity involves securing stable, high-quality supplies of these petrochemical intermediates, which are subject to global commodity price volatility and geopolitical influences. Manufacturing processes often involve multiple reaction steps, including etherification and alkylation, requiring specialized chemical synthesis plants capable of meeting stringent quality controls, particularly for high-purity grades required for regulated markets like pharmaceuticals and premium crop protection.

Midstream activities center on the formulation and distribution stages. PBO is rarely sold as a standalone active ingredient but is instead formulated with pyrethrins or pyrethroids into end-use products. Formulators, who are often large multinational agrochemical or specialty chemical companies, receive bulk PBO, integrate it with active ingredients, solvents, and inert carriers, and package it into various delivery forms (e.g., concentrated emulsions, wettable powders, ready-to-use aerosols). Distribution channels are highly fragmented, categorized into direct and indirect routes. Direct distribution involves large-scale sales to governmental health agencies for vector control or large commercial agricultural enterprises. Indirect channels rely on a network of regional distributors, specialty retailers, e-commerce platforms, and pest control operators (PCOs) who purchase formulated products for end-user application.

Downstream analysis focuses on the end-users and the consumption patterns. The effectiveness of the overall value chain hinges on the ability of formulators to provide products compliant with local regulations and tailored to specific regional pest resistance profiles. The public health sector demands products certified by bodies like the WHO Pesticide Evaluation Scheme (WHOPES). The competitive landscape downstream is driven by efficacy (speed of knockdown and residual action), price point, and ease of application. Technological innovations in packaging and delivery systems play a crucial role in maintaining market share, as end-users prioritize convenience and reduced environmental exposure. Furthermore, the disposal and end-of-life management of PBO products, aligning with circular economy principles, are increasingly becoming a critical part of the downstream responsibility.

Piperonyl Butoxide Market Potential Customers

The potential customer base for the Piperonyl Butoxide market is extensive and diversified, spanning governmental bodies, large agricultural enterprises, commercial service providers, and individual consumers. The most significant buyers, driving substantial volume, are governmental and non-governmental public health organizations, including national health ministries, international aid organizations (like the Global Fund), and local municipal vector control agencies. These entities procure massive quantities of PBO-enhanced formulations, often through competitive bidding processes, for large-scale eradication or control programs targeting disease vectors such as mosquitoes and biting flies across tropical and subtropical regions.

Another primary customer segment includes agrochemical formulators and distributors who serve the agricultural industry. These companies integrate PBO into their proprietary crop protection brands, selling directly to large-scale farmers, cooperatives, and agronomic consultancies focused on managing resistant pests in cash crops (e.g., cotton, rice, fruits, and vegetables). The demand here is cyclical and linked to planting seasons and pest outbreak severity. Furthermore, commercial pest management operators (PCOs) represent a crucial B2B customer segment, purchasing concentrated PBO formulations for use in structural pest control, managing infestations in hotels, hospitals, food service facilities, and warehouses where effective resistance management is paramount to operational hygiene and compliance.

Finally, the retail and household segment targets individual consumers. This market segment includes manufacturers of over-the-counter consumer products such as household insecticide aerosols, pet flea and tick treatments, and mosquito repellent spatial sprays. While purchasing smaller individual volumes, the high frequency and broad market reach of these products ensure significant aggregate demand for PBO. Success in servicing this segment relies heavily on brand recognition, robust marketing, and compliance with consumer safety regulations, highlighting the necessity for high-purity PBO grades and effective retail distribution networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.15 Billion |

| Market Forecast in 2033 | USD 1.70 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shandong Dacheng Pesticide Chemical Co., Ltd., Sumitomo Chemical Co., Ltd., Jiangsu Yangnong Chemical Co., Ltd., Knoell Development Ltd., MGK Company, Crop Science, Gharda Chemicals Ltd., Prentiss Incorporated, Taminco, Bayer AG, Syngenta AG, FMC Corporation, Dow AgroSciences, Alfa Aesar, BASF SE, Changzhou Hongsheng Chemical Co., Ltd., Jiangsu Huifeng Bio-Agriculture Co., Ltd., Hainan Wenshi Chemical Co., Ltd., China National Chemical Corporation (ChemChina), ADAMA Agricultural Solutions Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Piperonyl Butoxide Market Key Technology Landscape

The technological landscape surrounding the Piperonyl Butoxide market is primarily driven by efforts to enhance product safety, improve efficacy against rapidly evolving resistance, and optimize manufacturing processes through green chemistry principles. Traditional PBO synthesis involves multi-step chemical reactions that can yield impurities; therefore, advancements are focused on developing high-efficiency purification technologies, such as advanced distillation and chromatography methods, to achieve the >95% purity levels increasingly demanded by regulators for human and animal health applications. This focus on purity minimizes toxicological risk associated with manufacturing byproducts, making the end product more acceptable in highly regulated markets.

A major area of innovation lies in formulation technology, specifically the utilization of microencapsulation and nano-emulsion techniques. Encapsulation technology involves coating PBO with polymeric shells to create controlled-release formulations. This not only significantly extends the residual activity of the insecticide combination, reducing the frequency of application, but also provides a crucial layer of protection, limiting the potential for dermal exposure and environmental degradation. These advanced formulations improve photostability and rainfastness, crucial features for outdoor agricultural and public health applications, ensuring the synergist remains effective for longer periods under harsh environmental conditions.

Furthermore, technology pertaining to application efficiency is revolutionizing PBO consumption. This includes the adoption of Ultra-Low Volume (ULV) spraying equipment and electrostatic sprayers, which drastically reduce the total volume of formulated product required per hectare by achieving optimal droplet size and uniform coverage. Integrating these physical technologies with digital tools, such as GPS-guided spraying and sensor-based decision support systems (often AI-enhanced), allows for precision targeting of pest hot spots. This technological ecosystem ensures that PBO is delivered only where and when needed, maximizing synergistic impact while adhering to sustainability mandates and reducing overall chemical input into the environment, thereby future-proofing PBO usage in IPM programs.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region for the PBO market, primarily due to its vast agricultural base, high population density, and the endemic nature of vector-borne diseases like malaria and dengue fever in countries such as India, China, Indonesia, and Vietnam. The region's reliance on pyrethroids for both crop protection and public health necessitates high volumes of PBO to manage the widespread and severe insecticide resistance prevalent across South and Southeast Asia. Regulatory environments, while varying, often prioritize public health outcomes over immediate environmental concerns, facilitating rapid uptake of PBO in national vector control campaigns. Furthermore, China serves as a critical manufacturing hub, influencing global supply chain stability and pricing.

- North America: The North American market (US and Canada) is characterized by high quality standards and robust demand from the household/commercial pest control sector, which prioritizes efficacy and speed of knockdown. Demand is steady, driven by strict urban pest management requirements and the need for residential and structural pest control products, often utilizing high-purity PBO grades. However, the market operates under rigorous regulatory scrutiny from the EPA regarding residual toxicity and environmental fate, requiring constant reformulation and adherence to specific labeling restrictions, especially concerning food handling establishments and aquatic environments.

- Europe: The European PBO market is mature but faces the most significant regulatory challenges under the European Union’s Biocidal Products Regulation (BPR) and REACH framework. The use and acceptance of PBO are highly scrutinized, often leading to market withdrawal or restriction for certain applications, such as post-harvest treatment. Demand primarily originates from niche agricultural applications and authorized professional pest control services where no viable alternatives exist for managing resistant pests. Market growth in Europe is constrained by regulatory hurdles, pushing innovation towards sustainable, low-dosage, and fully encapsulated PBO formulations to maintain registration status.

- Latin America (LATAM): LATAM represents a rapidly expanding market, mirroring APAC’s high need for vector control due to widespread outbreaks of Zika, Chikungunya, and Dengue, particularly in Brazil, Mexico, and Argentina. The region’s tropical climate and reliance on intensive agriculture create fertile ground for pest proliferation and resistance development. Governmental spending on public health interventions, often supported by international organizations, drives bulk procurement of PBO, making the public health sector the primary demand engine. Economic stability and governmental policy shifts can, however, introduce volatility into purchasing patterns.

- Middle East & Africa (MEA): Demand in MEA is almost entirely concentrated in public health vector control, particularly in sub-Saharan Africa, where malaria eradication efforts are critically dependent on Long-Lasting Insecticidal Nets (LLINs) and indoor residual spraying (IRS), both increasingly featuring PBO as a resistance breaker. The market is heavily funded by international aid and non-governmental organizations. Growth is linear, tied directly to funding cycles and the establishment of robust public health infrastructure, emphasizing high-volume, low-cost PBO products suitable for these large-scale interventions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Piperonyl Butoxide Market.- Shandong Dacheng Pesticide Chemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Jiangsu Yangnong Chemical Co., Ltd.

- Knoell Development Ltd.

- MGK Company

- Crop Science

- Gharda Chemicals Ltd.

- Prentiss Incorporated

- Taminco

- Bayer AG

- Syngenta AG

- FMC Corporation

- Dow AgroSciences

- Alfa Aesar

- BASF SE

- Changzhou Hongsheng Chemical Co., Ltd.

- Jiangsu Huifeng Bio-Agriculture Co., Ltd.

- Hainan Wenshi Chemical Co., Ltd.

- China National Chemical Corporation (ChemChina)

- ADAMA Agricultural Solutions Ltd.

Frequently Asked Questions

Analyze common user questions about the Piperonyl Butoxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Piperonyl Butoxide (PBO) in pest control formulations?

PBO functions as a potent synergist, not a direct poison. Its primary role is to inhibit the detoxification enzymes (mixed-function oxidases) in insects, thereby preventing them from metabolizing and neutralizing the primary active ingredients, such as pyrethrins and pyrethroids, significantly boosting the insecticide's efficacy and speed of action.

How does the increasing insecticide resistance affect the demand for PBO?

Rising insecticide resistance, particularly to conventional pyrethroids in mosquitoes and agricultural pests, directly increases the demand for PBO. As resistance mechanisms become stronger, higher PBO ratios are required in formulations to successfully break down the insect's defenses, making PBO essential for maintaining the viability of major insecticide classes globally.

Which end-use application segment contributes most significantly to the PBO market size?

The Public Health and Vector Control segment holds the largest market share. This is driven by massive, government-funded international programs aimed at controlling disease vectors like mosquitoes responsible for malaria and dengue, utilizing PBO-enhanced products like Long-Lasting Insecticidal Nets (LLINs) and widespread spraying operations.

What are the key regulatory challenges impacting the PBO market, especially in Europe?

The primary regulatory challenges involve scrutiny under the EU’s Biocidal Products Regulation (BPR) and stringent assessment of PBO's environmental fate and toxicological profile, including potential endocrine disruption. This leads to use restrictions, demanding that manufacturers invest in advanced data generation and reformulation towards safer, enclosed delivery systems.

How is advanced technology, such as AI and microencapsulation, utilized in the PBO industry?

Microencapsulation technology is used to create controlled-release PBO formulations, extending residual activity and minimizing environmental exposure. AI is utilized for predictive modeling of pest outbreaks and resistance development, optimizing application timing, and guiding the development of new, highly efficient, targeted PBO delivery methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Piperonyl Butoxide (PBO) Market Statistics 2025 Analysis By Application (Indoor Home, Gardens, Agricultural, Veterinary), By Type (Top Class (More than 94%), A Class (More than 92%), Standard Class (More than 90%)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Piperonyl Butoxide Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Standard Class, A Class, Top Class), By Application (Pyrethrin, Pyrethroid, Carbamate, Rotenone, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager