Piperylene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432940 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Piperylene Market Size

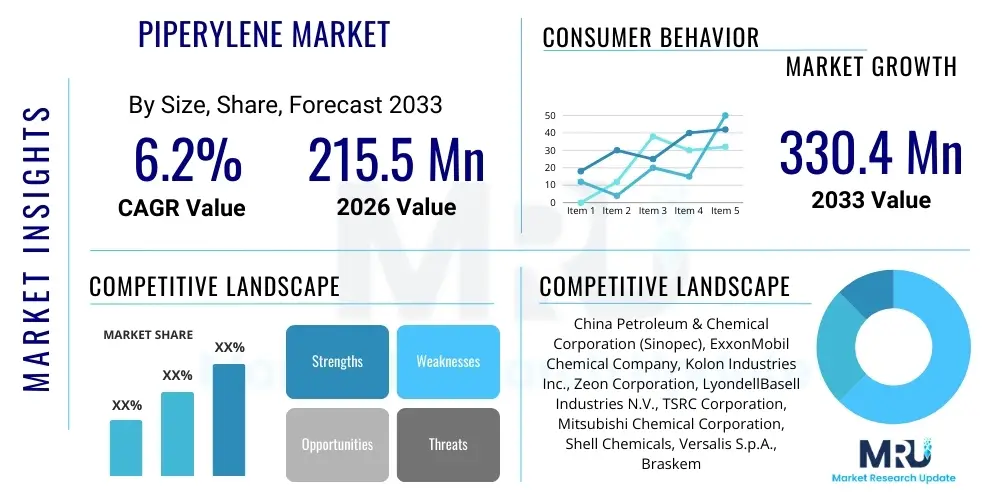

The Piperylene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 215.5 Million in 2026 and is projected to reach USD 330.4 Million by the end of the forecast period in 2033.

The valuation increase is fundamentally driven by the escalating demand for hydrocarbon resins, particularly C5 resins, which utilize piperylene as a critical monomer. These resins find extensive use across various industrial sectors, including adhesives, coatings, and road marking paints, sectors that are highly correlated with global construction and automotive industry expansion. Furthermore, the increasing consumption of synthetic rubber and elastomers, where piperylene derivatives are employed, contributes significantly to the market growth trajectory.

Regional dynamics, especially rapid industrialization and infrastructure development in the Asia Pacific region, play a pivotal role in boosting consumption volume. While the market faces volatility due to fluctuations in crude oil prices and the supply-demand balance of C5 fractions, technological advancements in polymerization processes and enhanced efficiency in piperylene separation techniques are expected to stabilize input costs and maximize yield, supporting sustained market expansion throughout the projection period. The focus on environmentally friendly and bio-based adhesive solutions also subtly influences the long-term outlook for piperylene-based products.

Piperylene Market introduction

Piperylene, also chemically known as 1,3-pentadiene, is a highly volatile, colorless liquid hydrocarbon primarily obtained as a co-product from the naphtha cracking process during ethylene and propylene production. It is a fundamental component of the C5 fraction derived from steam cracking and serves as a crucial intermediate in the chemical industry. Its primary commercial significance lies in its ability to undergo polymerization, either independently or with other monomers, to form poly-piperylene or, more commonly, specialized hydrocarbon resins, known as C5 resins. These resins are highly valued for their tackifying properties, making them indispensable in the formulation of pressure-sensitive adhesives (PSAs), hot melt adhesives (HMAs), and various coatings used across the packaging, hygiene, and construction sectors.

Major applications of piperylene extend beyond hydrocarbon resins into the synthesis of specific chemical compounds, including specialized rubber compounds like EPDM (Ethylene Propylene Diene Monomer) and various elastomers. The benefits derived from using piperylene derivatives include enhanced adhesion strength, improved thermal stability, and excellent compatibility with base polymers such as natural rubber, polyisoprene, and EVA (ethylene-vinyl acetate). The driving factors propelling the market include robust growth in the global construction industry, which increases the demand for road marking paints and sealants, and the burgeoning e-commerce sector, which necessitates high-performance packaging adhesives for secure transit. Additionally, the replacement of traditional solvent-based systems with HMA formulations provides a consistent growth avenue for piperylene utilization.

Piperylene Market Executive Summary

The Piperylene market is characterized by a strong correlation with the petrochemical and downstream chemical manufacturing sectors, exhibiting resilience despite cyclical commodity price fluctuations. Business trends indicate a strategic focus among major producers on expanding cracking capacity, particularly in regions with affordable feedstocks, coupled with investments in selective hydrogenation and precise fractionation technologies necessary for high-purity piperylene extraction. The market equilibrium is delicate, depending heavily on the output levels of major ethylene crackers globally. Key strategic movements include backward integration by resin manufacturers to secure C5 supply and forward integration by petrochemical giants to capture higher value through resin production. Sustainability concerns are increasingly prompting research into non-toxic and low-VOC piperylene-derived products, influencing product innovation and market positioning.

Regionally, Asia Pacific (APAC) stands as the undisputed leader, driven by colossal manufacturing bases in China and India, aggressive infrastructure projects, and massive demand from the packaging and automotive industries. North America and Europe, while representing mature markets, show steady demand, primarily driven by specialized applications, high-performance adhesive formulations, and strict regulatory adherence mandating advanced coating solutions, such as those used in pavement marking and high-durability sealants. Latin America and the Middle East & Africa (MEA) are emerging as high-growth regions, fueled by newfound cracking capacity and localized demand for construction materials and adhesives, signaling potential shifts in global production dominance towards the end of the forecast period.

Segment trends reveal that the application segment comprising Hydrocarbon Resins, particularly those used in Adhesives and Sealants, maintains the largest market share and projects the highest growth rate. Within the type segmentation, the demand for High-Purity Piperylene (typically 90% concentration or higher) is accelerating, driven by the need for advanced polymers and highly specific chemical synthesis reactions that require minimal impurities. Conversely, the market for Technical Grade Piperylene, while still substantial, faces some substitution pressure from cheaper alternatives in less demanding industrial applications. Overall, the market structure reflects continuous investment aimed at optimizing the utilization of the C5 stream, maximizing piperylene recovery, and meeting the stringent performance requirements of end-user industries.

AI Impact Analysis on Piperylene Market

User queries regarding AI's influence on the Piperylene market frequently center on maximizing yield from cracking operations, optimizing the purification and separation of C5 streams, and ensuring efficient inventory and supply chain logistics given the volatility of feedstock supply. Common concerns also relate to using predictive maintenance protocols in large-scale polymerization reactors and refining consumer demand forecasting for end-products like specialty adhesives. The primary analytical theme is how Artificial Intelligence and Machine Learning (ML) can be deployed to manage the inherent complexities of co-product markets, where the supply of piperylene is directly tied to ethylene production, rather than independent demand signals. Users expect AI to stabilize operational costs, improve product consistency, and provide superior predictive intelligence regarding crude oil and naphtha price movements, which are key determinants of overall profitability in this value chain.

- AI-powered predictive modeling optimizes naphtha cracking conditions, improving the selectivity and yield of the C5 fraction containing piperylene.

- Machine learning algorithms enhance the efficiency of complex separation processes, such as extractive distillation, leading to higher purity piperylene recovery and reduced energy consumption.

- AI facilitates real-time monitoring and predictive maintenance of polymerization reactors, minimizing downtime and ensuring consistent production quality for C5 resins.

- Advanced supply chain analytics use AI to forecast feedstock availability (C5 stream) and anticipate fluctuations in downstream demand (adhesives, coatings), optimizing inventory management.

- AI-driven simulation tools assist R&D efforts in formulating new, high-performance piperylene-based resins and specialty chemicals, accelerating product development cycles.

- AI models analyze global geopolitical and commodity market data to provide enhanced risk management strategies for managing volatile raw material costs.

DRO & Impact Forces Of Piperylene Market

The market dynamics for Piperylene are shaped by a complex interplay of growth stimulants, infrastructural hurdles, and strategic opportunities. The primary driver is the accelerating utilization of hydrocarbon resins in rapidly expanding sectors such as packaging, especially the growth of high-speed labeling and flexible packaging solutions, and increased investment in public infrastructure, requiring durable road markings and protective coatings. However, the market faces significant restraints, chiefly the non-dedicated nature of piperylene production—it is solely dependent on ethylene cracking output—meaning supply cannot be directly adjusted based on demand. Furthermore, the handling and transportation of highly volatile C5 components pose logistical challenges and require stringent safety protocols, increasing operational costs.

Opportunities for growth are concentrated in the development of specialty, high-performance C5 resins targeted at niche applications, such as medical adhesives and advanced composite materials, and the increasing trend towards solvent-free and low-VOC adhesive systems, where piperylene-derived resins offer favorable performance characteristics. The industry is also capitalizing on opportunities through improved process integration, particularly focusing on maximizing the valuable outputs from the entire C5 stream. Technological advancements in catalytic processes and enhanced purification techniques offer manufacturers a competitive edge by allowing them to reliably produce high-purity grades that command premium pricing and meet strict regulatory standards for critical applications.

The impact forces currently exerting the most pressure are technological advancements in cracking and purification, which enhance supply reliability, and shifts in global petrochemical investment, which dictates future capacity. Regulatory compliance, particularly concerning environmental standards for VOC emissions in adhesives and coatings, acts as a force driving innovation towards cleaner piperylene derivatives. Finally, the price volatility of upstream feedstocks (crude oil/naphtha) represents a constant market force, directly influencing the manufacturing cost structure and pricing power throughout the entire piperylene value chain, demanding sophisticated hedging and procurement strategies from key players to mitigate financial risk and maintain profitability margins.

Segmentation Analysis

The Piperylene market segmentation provides a detailed structural breakdown based on purity level (Type), the industrial method of extraction, and the final application where its derivatives are utilized. The analysis focuses on understanding how different purity requirements influence pricing and application suitability, differentiating between the large-volume industrial applications and high-value niche segments. Market segmentation is critical for strategic planning, allowing manufacturers to tailor production capacity towards the most profitable grades, particularly High Purity Piperylene (HPP) required for specialty polymer synthesis, or the standard technical grades suitable for bulk resin production used in basic adhesives and road markings.

- By Type

- High Purity Piperylene (HPP)

- Technical Grade Piperylene (TGP)

- By Application

- Hydrocarbon Resins (C5 Resins)

- Adhesives and Sealants

- Coatings and Paints (e.g., Road Marking Paints)

- Plastics and Elastomers (e.g., EPDM Synthesis)

- Specialty Chemicals and Intermediates

- By End-Use Industry

- Construction and Infrastructure

- Packaging and Labeling

- Automotive and Transportation

- Tire and Rubber Industry

- Personal Hygiene Products

Value Chain Analysis For Piperylene Market

The Piperylene value chain commences upstream with the petrochemical industry, where raw materials, primarily naphtha, are subjected to steam cracking to produce ethylene and propylene, generating the C5 crude stream as a critical co-product. Upstream suppliers are predominantly large integrated oil and gas companies and major chemical producers operating large-scale crackers. The efficiency and reliability of these cracking units are crucial, as they dictate the availability and initial cost of the C5 fraction. A key bottleneck in the upstream segment is the need for efficient handling of the complex C5 mix, which includes isoprene, cyclopentadiene, and various pentenes, alongside piperylene.

The core processing stage involves separating piperylene from the C5 stream, utilizing highly energy-intensive processes like extractive distillation or selective hydrogenation followed by precision fractionation. Midstream players are specialized chemical processors focused on achieving the requisite purity levels. The product then moves to downstream manufacturers, primarily C5 resin producers and specialty chemical companies, who convert the piperylene into high-value functional materials like tackifiers, elastomers, and intermediates. This downstream conversion adds the most significant value to the initial hydrocarbon input, transforming a volatile chemical into a formulated product suitable for industrial use.

Distribution channels for piperylene are segmented into direct sales to large, integrated resin manufacturers, often involving long-term supply contracts, and indirect distribution through chemical distributors for smaller or localized end-users who require less volume or different grades. Due to the hazardous nature and volatility of the product, specialized logistics providers are required for safe transport, typically via road tankers or dedicated rail cars, ensuring compliance with strict global chemical transportation regulations. The efficiency of this distribution network, especially in high-demand regions like APAC, is critical in managing inventory costs and ensuring timely supply to the expansive adhesives and coatings industries.

Piperylene Market Potential Customers

The core customer base for the Piperylene market is overwhelmingly concentrated within industries that utilize high-performance adhesive and coating systems, relying on the unique tackifying properties and thermal stability imparted by piperylene-derived C5 hydrocarbon resins. The most significant end-users are manufacturers of pressure-sensitive adhesives (PSAs) used in labels, tapes, and feminine hygiene products, and hot-melt adhesives (HMAs) crucial for carton sealing, bookbinding, and woodworking. These companies require consistent, high-purity piperylene to ensure the quality and performance consistency of their adhesive formulations, particularly those needing high shear strength and good color stability.

A secondary, yet rapidly growing, segment of potential customers includes large infrastructure and construction contractors, who demand piperylene-based products for specialized applications such as high-visibility, durable road marking paints and protective coatings for structural steel. These applications require resins that exhibit excellent weather resistance and chemical stability. Furthermore, manufacturers of specialty synthetic rubbers, particularly EPDM rubber producers, represent an important niche customer segment, as piperylene derivatives are used in the synthesis process to introduce specific molecular structures that enhance the elastomer's physical properties. The procurement decisions of these potential buyers are often influenced by regional environmental regulations regarding Volatile Organic Compounds (VOCs) and the performance requirements dictated by application standards, making high-purity, standardized supply essential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 215.5 Million |

| Market Forecast in 2033 | USD 330.4 Million |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | China Petroleum & Chemical Corporation (Sinopec), ExxonMobil Chemical Company, Kolon Industries Inc., Zeon Corporation, LyondellBasell Industries N.V., TSRC Corporation, Mitsubishi Chemical Corporation, Shell Chemicals, Versalis S.p.A., Braskem S.A., Eastman Chemical Company, JX Nippon Oil & Energy Corporation, Reliance Industries Limited (RIL), Dow Inc., LOTTE Chemical Corporation, CNOOC and Shell Petrochemicals Company Limited (CSPC), Nanjing Yuanyuan Chemical Co., Ltd., Zibo Luhua Hongjin New Material Co., Ltd., Shandong Qishun Chemical Co., Ltd., Fushun Yikang Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Piperylene Market Key Technology Landscape

The technological landscape of the Piperylene market is heavily focused on enhancing the efficiency and purity of the separation processes required to isolate the compound from the mixed C5 stream. The foundational technology remains steam cracking of naphtha or heavy feedstocks, but the innovation lies downstream. Selective hydrogenation and high-efficiency extractive distillation are the primary commercial technologies used. Extractive distillation, utilizing specific solvents (such as N-methyl-2-pyrrolidone or acetonitrile), is crucial for achieving the high purity levels necessary for specialty applications, demanding continuous optimization to reduce energy consumption and solvent loss, which are major operational expenses.

In addition to separation, advancements in polymerization technology are critical. Manufacturers of C5 resins are increasingly adopting continuous mass polymerization and solution polymerization techniques to produce resins with tighter molecular weight distributions and superior physical properties, leading to enhanced performance in final adhesive and coating products. Furthermore, catalytic technologies are being researched to selectively convert other less valuable C5 components into piperylene precursors or to integrate piperylene into complex polymer structures more efficiently. These technological improvements are geared toward minimizing waste, maximizing the utilization of the entire C5 fraction, and ensuring the final product meets stringent regulatory criteria, particularly regarding color stability and low-odor characteristics required for consumer goods packaging.

Process intensification, leveraging automation and advanced control systems (often integrating AI and ML tools as analyzed previously), is another key technological trend. This focus aims to maintain precise temperature and pressure profiles during the highly exothermic polymerization process, ensuring safety and product consistency. The development of proprietary catalyst systems that enable low-temperature polymerization and improve yield of high-molecular-weight resins is a significant area of competitive advantage. Companies are also exploring alternative, potentially bio-based, routes to piperylene production, although these are currently far from commercial viability on a large scale, representing a long-term research focus driven by sustainability goals and supply diversification needs.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global piperylene market, driven primarily by the massive ethylene cracking capacities established in China, South Korea, and Southeast Asia. The region benefits from lower feedstock costs and a rapidly expanding downstream demand base, particularly in construction (infrastructure projects), automotive manufacturing, and the packaging industry, fueled by e-commerce growth. China, in particular, acts as both the largest producer and consumer, making regional supply chain dynamics highly influential globally.

- North America: This region is characterized by mature demand, focusing on high-value applications such as specialty adhesives, sophisticated road safety markings, and high-performance elastomers. The availability of low-cost natural gas liquids (NGLs) as cracker feedstock in the US has stimulated ethylene production, indirectly bolstering C5 stream availability. Technological leadership in polymerization and resin formulation further supports the market here.

- Europe: Europe maintains steady demand, often driven by strict environmental regulations pushing innovation towards low-VOC and sustainable adhesive solutions. The focus is on quality and specialty grades of piperylene derivatives used in niche industrial applications and high-end automotive manufacturing. However, high operational costs compared to APAC temper rapid capacity expansion.

- Middle East & Africa (MEA): MEA is rapidly emerging due to massive investments in integrated petrochemical complexes, particularly in Saudi Arabia and the UAE. These investments are significantly increasing regional ethylene output, boosting C5 availability. The local demand is escalating due to national diversification strategies focusing on infrastructure development and localized manufacturing, positioning MEA as a critical future export hub.

- Latin America: The market here is smaller but exhibits potential, supported by local resin manufacturers serving regional construction and packaging markets. Growth is tied to macroeconomic stability and the development of local petrochemical infrastructure, reducing reliance on expensive imports, with Brazil and Mexico being the key consuming nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Piperylene Market.- China Petroleum & Chemical Corporation (Sinopec)

- ExxonMobil Chemical Company

- Kolon Industries Inc.

- Zeon Corporation

- LyondellBasell Industries N.V.

- TSRC Corporation

- Mitsubishi Chemical Corporation

- Shell Chemicals

- Versalis S.p.A.

- Braskem S.A.

- Eastman Chemical Company

- JX Nippon Oil & Energy Corporation

- Reliance Industries Limited (RIL)

- Dow Inc.

- LOTTE Chemical Corporation

- CNOOC and Shell Petrochemicals Company Limited (CSPC)

- Nanjing Yuanyuan Chemical Co., Ltd.

- Zibo Luhua Hongjin New Material Co., Ltd.

- Shandong Qishun Chemical Co., Ltd.

- Fushun Yikang Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Piperylene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary commercial use of Piperylene in the global market?

The primary commercial use of Piperylene is as a key monomer feedstock for the production of C5 Hydrocarbon Resins (petroleum resins). These resins are critically important tackifiers used extensively in the formulation of high-performance adhesives, particularly pressure-sensitive adhesives (PSAs) and hot-melt adhesives (HMAs) applied in packaging and hygiene products.

How is the supply of Piperylene linked to the petrochemical industry?

Piperylene supply is fundamentally dependent on the global operations of ethylene steam crackers. It is not a primary product but rather a co-product derived from the C5 fraction of the naphtha cracking process. Therefore, the availability and pricing of piperylene fluctuate directly in line with global ethylene production capacity and feedstock volatility, particularly naphtha and crude oil prices.

Which segmentation segment is driving the highest growth in the Piperylene market?

The Application segment of Hydrocarbon Resins (C5 Resins) is the primary driver of market growth. Increasing global demand for specialized adhesive formulations in the rapidly expanding packaging and labeling industry, alongside infrastructure development requiring advanced road marking paints and protective coatings, fuels this segment's high growth trajectory.

What major technological challenges exist in the purification of Piperylene?

The major technological challenge involves efficiently and economically separating high-purity piperylene from the complex C5 stream, which contains close-boiling components like isoprene and cyclopentadiene. This requires energy-intensive processes, such as selective hydrogenation or complex extractive distillation, necessitating continuous optimization to maintain high yield and minimize operational costs while achieving required purity levels.

Why is the Asia Pacific region dominant in the Piperylene market share?

The Asia Pacific region dominates the market share due to its significant concentration of world-class ethylene cracking facilities, particularly in China and South Korea, ensuring robust feedstock availability. Furthermore, the region boasts the world's largest consumer base for downstream products, driven by rapid urbanization, massive infrastructure projects, and the expansion of the regional manufacturing and packaging sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Piperylene Market Size Report By Type (40% Purity, 40% -65% Purity, 65% Purity), By Application (Plastics, Adhesives, Resins, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Piperylene Market Statistics 2025 Analysis By Application (Adhesives, Paints, Rubber), By Type (? 40% Purity, 40% -65% Purity, ? 65% Purity), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager