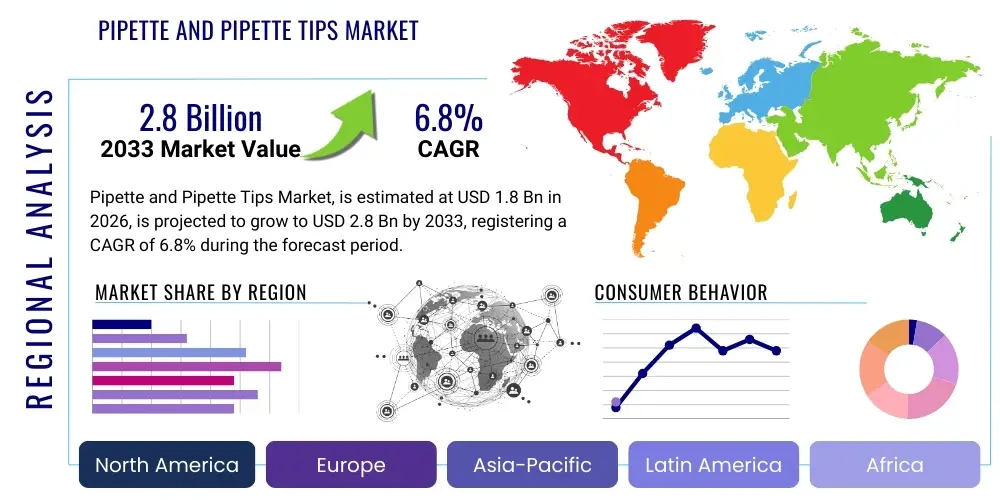

Pipette and Pipette Tips Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435261 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Pipette and Pipette Tips Market Size

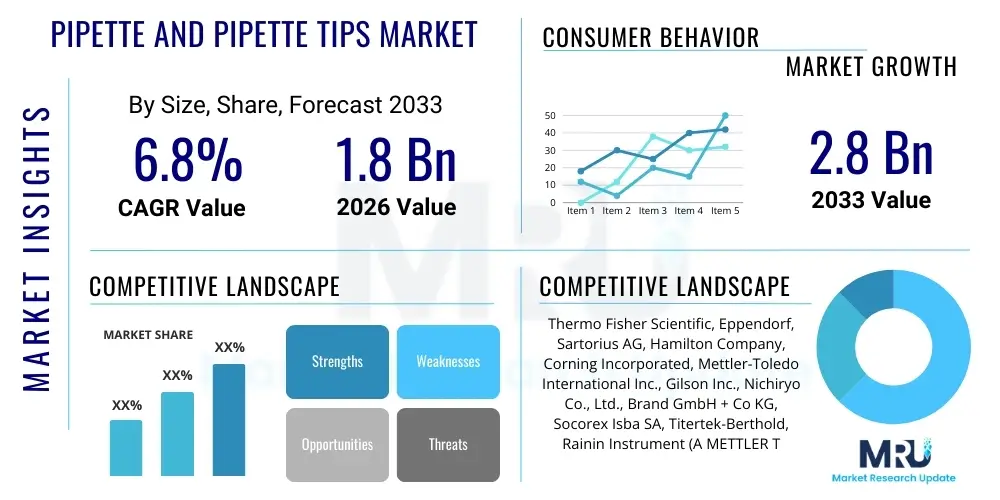

The Pipette and Pipette Tips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033. This substantial growth trajectory is primarily fueled by the increasing expenditure in pharmaceutical and biotechnology research and development, coupled with the rising global prevalence of chronic diseases necessitating extensive diagnostic testing.

The consistent demand for precision liquid handling instruments in molecular biology, genomics, and proteomics is a significant driver sustaining the market's expansion. Modern research methodologies, particularly high-throughput screening and automation in laboratory settings, inherently require reliable and accurate pipetting equipment. Furthermore, strict regulatory guidelines governing laboratory practices, especially in clinical diagnostics, mandate the use of certified and high-quality pipette tips and calibrated pipettes, thereby ensuring sustained market demand across all major geographical regions.

The market volume is heavily influenced by consumable sales, primarily pipette tips, which represent a recurrent revenue stream for key manufacturers. Innovations such as low-retention tips, filter tips, and specialized robotic tips designed for automation are continuously introduced, enhancing efficiency and reducing sample loss in sensitive assays. The shift from manual pipetting techniques to electronic and automated systems, driven by the need for reduced variability and improved ergonomics, is also contributing significantly to the overall market valuation.

Pipette and Pipette Tips Market introduction

The Pipette and Pipette Tips Market encompasses the manufacturing, distribution, and sale of instruments essential for precise liquid handling in laboratories worldwide. Products range from manual single-channel pipettes and multi-channel pipettes to sophisticated electronic and robotic systems, complemented by consumable accessories known as pipette tips. These instruments are fundamental tools across various scientific disciplines, ensuring accuracy and reproducibility in experiments ranging from basic academic research to complex clinical diagnostics and drug discovery processes. The primary benefit these products offer is highly controlled and verifiable volume dispensing, critical for quantitative analysis and contamination prevention.

Major applications of pipettes and tips span core areas such as polymerase chain reaction (PCR), enzyme-linked immunosorbent assay (ELISA), cell culture, genomics sequencing, and high-throughput screening (HTS) in drug development. The inherent need for miniaturization in assays and the desire for higher throughput in modern laboratory workflows necessitate continuous advancements in both instrument design and tip technology, focusing on features like improved sealing, reduced dead volume, and superior material purity. Market growth is intensely driven by increased global investments in life sciences infrastructure and governmental funding for public health initiatives and infectious disease research.

Key driving factors include the rapid pace of technological innovation in molecular diagnostics, the expansion of global biobanks, and the increasing adoption of automated laboratory systems in pharmaceutical companies and contract research organizations (CROs). The demand for disposable, sterile pipette tips is particularly robust, driven by rigorous regulatory requirements for cross-contamination prevention in clinical and forensic laboratories. The convergence of digital interfaces and IoT capabilities in modern electronic pipettes further enhances data logging and compliance, solidifying their role as indispensable tools in advanced scientific environments.

Pipette and Pipette Tips Market Executive Summary

The Pipette and Pipette Tips Market demonstrates robust business trends characterized by consolidation among major players and significant investment in automation-compatible consumables. Regional trends indicate North America currently dominating the market share due to its established biotechnology sector and high R&D spending, while the Asia Pacific region is poised for the fastest growth, driven by expanding healthcare infrastructure and rising academic research output in countries like China and India. Segmentation trends reveal a strong preference shift toward electronic and automated pipetting systems over traditional manual devices, although disposable pipette tips remain the dominant subsegment in terms of volume and frequency of purchase, ensuring stable recurring revenue for manufacturers.

A key finding from the market analysis is the increasing focus on sustainability and material science. Manufacturers are exploring biodegradable or recycled plastics for pipette tips to address environmental concerns raised by the enormous volume of plastic waste generated by laboratories globally. This focus on green lab practices is shaping product development and marketing strategies, particularly in environmentally conscious regions like Europe. Furthermore, the integration of smart features, such as Bluetooth connectivity for calibration tracking and cloud-based data management, is becoming a standard expectation for premium product lines, appealing to large institutional buyers focused on regulatory compliance and operational efficiency.

In terms of competitive landscape, the market is moderately fragmented, with a few large global players controlling the bulk of the automated and high-precision pipette segments, while numerous smaller specialized manufacturers compete effectively in the generic tip and manual pipette sectors. Strategic initiatives, including mergers and acquisitions (M&A) aimed at expanding product portfolios and geographical reach, are prevalent. The market remains sensitive to regulatory changes in diagnostics and drug testing, which constantly influence demand for specific product specifications, such as certified low-endotoxin or RNase/DNase-free tips.

AI Impact Analysis on Pipette and Pipette Tips Market

User queries regarding the impact of Artificial Intelligence (AI) on the Pipette and Pipette Tips Market frequently center on whether AI-driven automation will replace traditional human interaction with pipettes, and how AI can optimize liquid handling workflows, specifically in high-throughput environments. Key concerns include the standardization of AI protocols for complex biological assays and the data infrastructure required to support autonomous liquid handling systems. Users expect AI to reduce human error, enhance reproducibility, and accelerate experimental timelines, particularly in drug discovery and personalized medicine applications where large volumes of sequential liquid transfers are required under complex logistical constraints.

AI's primary influence is manifested through its role in orchestrating fully automated laboratory systems, known as 'smart labs.' AI algorithms process experimental data in real-time to adjust parameters, predict optimal liquid transfer paths, and schedule maintenance for robotic pipetting stations, moving beyond mere programmed repetition. This integration transforms pipetting from a labor-intensive manual task or simple robotic sequence into an intelligent, adaptive process. While manual pipettes will remain essential for basic research and educational settings, the high-end market for automated systems is directly benefiting from AI-enhanced scheduling and quality control, leading to demand for specialized, high-precision tips compatible with these sophisticated robotic arms.

Furthermore, AI-driven data analytics applied to liquid handling operations can flag anomalies, track instrument calibration status proactively, and optimize reagent consumption based on anticipated experimental success rates. This results in significant cost savings and improved experimental quality, directly increasing the value proposition of high-quality, AI-compatible pipetting instrumentation. The transition to AI-managed labs necessitates tips with stringent manufacturing tolerances to ensure compatibility and reliable interaction with automated sensors and grippers, subtly shifting the quality requirements for consumables in this high-growth segment.

- AI optimizes robotic pipetting sequences, minimizing reagent waste and transfer errors.

- Predictive maintenance schedules for electronic pipettes are generated using AI monitoring of usage patterns.

- AI integration drives demand for specialized, high-precision robotic pipette tips.

- Enhanced data logging and quality control in automated systems are supported by AI analytics.

- Accelerates high-throughput screening workflows by autonomously adjusting liquid handling protocols.

DRO & Impact Forces Of Pipette and Pipette Tips Market

The Pipette and Pipette Tips Market is subject to substantial Dynamics, Restraints, and Opportunities (DRO) which collectively dictate its growth trajectory and competitive intensity. The key Drivers include exponential growth in global pharmaceutical R&D activities, increasing government funding for life science research, and the rising demand for automated liquid handling systems to achieve high throughput and reduced variability in complex assays. These forces propel innovation in both instrument electronics and consumable materials, ensuring consistent market expansion, especially within diagnostic and drug development sectors where precision is paramount.

However, several Restraints pose challenges to market proliferation. High initial capital costs associated with advanced electronic and robotic pipetting stations can deter smaller research laboratories and academic institutions in developing regions. Furthermore, the persistent environmental concern surrounding the massive quantity of plastic waste generated by disposable pipette tips requires manufacturers to invest heavily in sustainable alternatives, adding complexity to production. Another restraint is the challenge of maintaining accurate calibration and compliance across diverse laboratory environments, often requiring specialized services which can be costly and time-consuming for end-users.

Significant Opportunities exist in emerging markets, particularly Asia Pacific and Latin America, where healthcare infrastructure is rapidly developing and local manufacturing capabilities are growing. Technological advancements such as the development of novel anti-static and low-retention tip materials, and the integration of IoT for remote diagnostics and calibration, open new revenue streams. The increasing adoption of personalized medicine and gene therapy also mandates precise, small-volume liquid handling, creating a lucrative niche for ultra-high-precision pipettes and specialized tips. These opportunities, when leveraged, provide sustained momentum against the identified constraints.

Segmentation Analysis

The Pipette and Pipette Tips Market is comprehensively segmented based on product type, technology, application, and end-user, providing detailed insights into specific demand patterns and growth areas. The segmentation by product type is crucial, dividing the market into durable instruments (pipettes) and high-volume consumables (tips). Pipettes are further categorized into manual (mechanical) and electronic, reflecting the ongoing transition towards automation. Pipette tips, the largest volume segment, are differentiated by features like filtration, low retention properties, and barrier presence, addressing diverse assay requirements and contamination concerns.

Segmentation by technology delineates air displacement and positive displacement methodologies, each suited for different liquid types; air displacement dominates the general laboratory settings, while positive displacement is vital for highly viscous or volatile liquids. Application segmentation highlights major usage areas such as drug discovery, where high-throughput systems are critical, and clinical diagnostics, demanding certified sterile and high-accuracy consumables. This granular view allows manufacturers to tailor product development and marketing strategies to specific laboratory needs, such as specialized tips for qPCR or automated systems for genomics research.

The end-user segmentation is key for understanding procurement patterns and institutional budget cycles, covering Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, and Hospitals & Diagnostic Centers. Pharmaceutical and Biotech firms are the primary drivers of demand for automated systems, while hospitals rely heavily on high-volume, reliable disposable tips for clinical testing. The growth within CROs is also notable, as these organizations increasingly handle complex, high-volume outsourcing tasks, requiring significant investment in efficient liquid handling infrastructure.

- By Product:

- Pipettes:

- Manual Pipettes (Single-channel, Multi-channel, Repeating)

- Electronic Pipettes (Single-channel, Multi-channel)

- Automated Pipetting Systems

- Pipette Tips:

- Standard Tips

- Filter Tips

- Low Retention Tips

- Barrier Tips (Sterile, Non-Sterile)

- By Technology:

- Air Displacement Pipettes

- Positive Displacement Pipettes

- By Application:

- Drug Discovery and Development

- Clinical Diagnostics and Forensics

- Genomics and Proteomics

- Academic Research

- Cell Culture and Microbiology

- By End-User:

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Centers

- Contract Research Organizations (CROs)

- Food and Beverage Testing Laboratories

Value Chain Analysis For Pipette and Pipette Tips Market

The value chain for the Pipette and Pipette Tips Market commences with upstream activities centered on raw material procurement, primarily high-grade plastics (polypropylene and polyethylene) and specialized electronic components for automated systems. Quality control at this stage is critical, particularly for consumables, ensuring materials are free from contaminants like RNase, DNase, and endotoxins. Key suppliers include specialized polymer manufacturers and micro-electronics firms. The manufacturing stage involves high-precision molding and assembly, often utilizing cleanroom environments to maintain sterility and accuracy, which is a major factor differentiating product quality among competitors.

Downstream activities involve distribution, sales, and post-sale services. Due to the diverse nature of end-users (from small academic labs to large pharmaceutical corporations), the distribution channel is complex. Direct sales are often preferred for expensive automated systems, allowing manufacturers to provide specialized installation and training. Conversely, generic pipette tips and standard manual pipettes are frequently distributed through large, global laboratory supply houses and regional distributors, leveraging their established logistics networks and existing customer relationships.

The distribution network relies heavily on both direct and indirect channels. Indirect channels, through large third-party distributors like VWR (Avantor) and Fisher Scientific (Thermo Fisher), provide extensive market reach and warehousing capabilities, especially for high-volume consumables. Direct channels are essential for high-value transactions involving customized automated liquid handlers, where specialized technical support and long-term service agreements are integral to the sale. Effective calibration and maintenance services form the final critical link in the value chain, ensuring the long operational lifespan and reliability of the instruments for the end-user.

Pipette and Pipette Tips Market Potential Customers

The primary consumers and end-users of pipettes and pipette tips are entities involved in scientific research, clinical testing, quality assurance, and biological manufacturing. These include Academic and Research Institutes, which require a vast array of standardized manual pipettes and high-volume generic tips for educational purposes and basic biological experiments. Universities and government research labs drive substantial volume demand, often prioritizing cost-effectiveness alongside standard quality certifications.

Pharmaceutical and Biotechnology Companies represent the highest-value segment, primarily due to their heavy investment in automated liquid handling systems and specialized, high-performance tips required for complex tasks like high-throughput screening (HTS), compound library management, and drug formulation. These customers demand the highest levels of precision, reproducibility, and compliance with stringent regulatory standards (e.g., GLP/GMP). Contract Research Organizations (CROs) also fall into this category, as they perform outsourced R&D tasks for the biotech industry, requiring similar sophisticated infrastructure.

Hospitals and Diagnostic Centers constitute another crucial customer group, relying on these products for routine clinical chemistry, hematology, microbiology, and molecular diagnostics. This segment generates consistent, recurring demand for sterile, single-use tips for contamination-sensitive procedures, where safety and reliability are paramount. Furthermore, specialized end-users like forensic laboratories, environmental testing agencies, and food safety labs also represent established, albeit smaller, market niches for specific certified liquid handling tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Eppendorf, Sartorius AG, Hamilton Company, Corning Incorporated, Mettler-Toledo International Inc., Gilson Inc., Nichiryo Co., Ltd., Brand GmbH + Co KG, Socorex Isba SA, Titertek-Berthold, Rainin Instrument (A METTLER TOLEDO Company), VWR International (Avantor), Sarstedt AG & Co. KG, Greiner Bio-One International GmbH, Dragon Laboratory Instruments, Hirschmann Laborgeräte GmbH & Co. KG, Ratiolab GmbH, VistaLab Technologies, Inc., INTEGRA Biosciences. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pipette and Pipette Tips Market Key Technology Landscape

The technology landscape of the Pipette and Pipette Tips Market is rapidly evolving, moving beyond traditional manual operation towards sophisticated electronic and robotic systems. A core technology is the Air Displacement principle, which relies on an air cushion between the piston and the liquid, dominating standard laboratory work due to its cost-effectiveness and ease of use. However, for highly viscous or volatile liquids, Positive Displacement technology, where the piston directly contacts the liquid, remains essential, offering superior accuracy under challenging conditions and eliminating vapor pressure issues.

The most transformative technologies currently impacting the market are linked to automation and connectivity. Electronic pipettes now incorporate advanced microprocessors, allowing for multi-mode functions (e.g., reverse pipetting, sequential dispensing, mixing) and sophisticated calibration tracking, often connected via Bluetooth or Wi-Fi to laboratory information management systems (LIMS). This IoT integration facilitates compliance and centralized data handling, a critical requirement for GMP-regulated environments. Furthermore, robotic liquid handlers employ complex programming, servo motors, and sensor technology to execute highly parallel and intricate liquid transfer protocols with minimal human intervention.

On the consumable side, technology advancements focus heavily on material science and manufacturing precision. Low retention tips, achieved through specialized polymer treatments or surface coatings, minimize sample adhesion, critical for working with expensive reagents or precious samples. Filter tips, incorporating hydrophobic filters, prevent aerosol contamination and potential instrument damage, becoming standard in molecular biology. Innovations in high-precision molding ensure tip compatibility across a wide range of pipette brands and guarantee perfect sealing for consistent, reliable performance in automated setups.

Regional Highlights

The regional analysis highlights distinct growth dynamics and market maturity levels across key global areas, primarily driven by variations in R&D spending and regulatory frameworks.

- North America: North America maintains its dominance in the Pipette and Pipette Tips Market, primarily due to the presence of world-leading pharmaceutical and biotechnology companies, extensive academic funding, and highly established diagnostic infrastructure. The United States is the largest regional consumer, characterized by early adoption of automated liquid handling systems and a high volume of complex genomic and personalized medicine research, driving demand for specialized tips and high-end electronic pipettes. Stringent quality control standards further bolster the market for certified, premium consumables.

- Europe: Europe represents a mature and technologically advanced market, second only to North America. Key growth drivers include robust public funding for scientific research, particularly in Germany, the UK, and France, and strong regulatory pressure emphasizing reproducibility and traceable liquid handling procedures. The region is increasingly adopting automated solutions and is also a pioneer in sustainable laboratory practices, leading to higher demand for recyclable or environmentally friendly pipette tip alternatives.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is attributed to massive investments by governments in countries such as China, India, and South Korea to upgrade healthcare infrastructure and foster domestic biotechnology and pharmaceutical manufacturing capabilities. The market here is characterized by a high volume of manual pipette sales in emerging academic settings, coupled with accelerating adoption of automation in new contract research and manufacturing organizations (CRO/CMO).

- Latin America (LATAM): The LATAM market, while smaller, exhibits steady growth fueled by improving access to advanced diagnostic technologies and expanding public health initiatives, particularly in Brazil and Mexico. The demand is currently focused on standard manual pipettes and cost-effective tips, though the introduction of advanced electronic models is gradually increasing through local distributorships aiming to enhance clinical laboratory standardization.

- Middle East and Africa (MEA): The MEA market is still nascent but shows promising potential, driven by strategic government investments in specialized healthcare sectors (e.g., infectious disease research in the Gulf Cooperation Council (GCC) countries). Challenges include fragmented supply chains and reliance on imports, but increased infrastructure development is slowly paving the way for better access to automated laboratory instrumentation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pipette and Pipette Tips Market.- Thermo Fisher Scientific

- Eppendorf

- Sartorius AG

- Hamilton Company

- Corning Incorporated

- Mettler-Toledo International Inc.

- Gilson Inc.

- Nichiryo Co., Ltd.

- Brand GmbH + Co KG

- Socorex Isba SA

- Titertek-Berthold

- Rainin Instrument (A METTLER TOLEDO Company)

- VWR International (Avantor)

- Sarstedt AG & Co. KG

- Greiner Bio-One International GmbH

- Dragon Laboratory Instruments

- Hirschmann Laborgeräte GmbH & Co. KG

- Ratiolab GmbH

- VistaLab Technologies, Inc.

- INTEGRA Biosciences

Frequently Asked Questions

Analyze common user questions about the Pipette and Pipette Tips market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Pipette and Pipette Tips Market?

The primary driver is the significant increase in global investment in pharmaceutical and biotechnology research and development (R&D), particularly the adoption of high-throughput screening and automated liquid handling systems essential for drug discovery and genomics.

How does automation technology affect the demand for pipette tips?

Automation dramatically increases the volume of pipette tip consumption and elevates quality requirements, driving demand specifically for specialized robotic tips, sterile filter tips, and tips with enhanced geometric precision for reliable machine integration.

Which regional market holds the largest share and which is the fastest growing?

North America currently holds the largest market share due to its established biotech sector and high R&D expenditure. The Asia Pacific (APAC) region, driven by infrastructural development in China and India, is projected to be the fastest-growing market segment.

What are the main types of pipette tips available in the market?

The main types include standard tips, filter tips (for contamination prevention), low retention tips (for precious samples), and barrier tips, all primarily made from high-grade polypropylene and categorized by volume capacity and sterility.

What major challenges does the market face regarding sustainability?

The primary sustainability challenge is the massive volume of non-biodegradable plastic waste generated by disposable pipette tips. Manufacturers are responding by developing eco-friendly materials and specialized recycling programs to mitigate environmental impact.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager