PLA Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432202 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

PLA Films Market Size

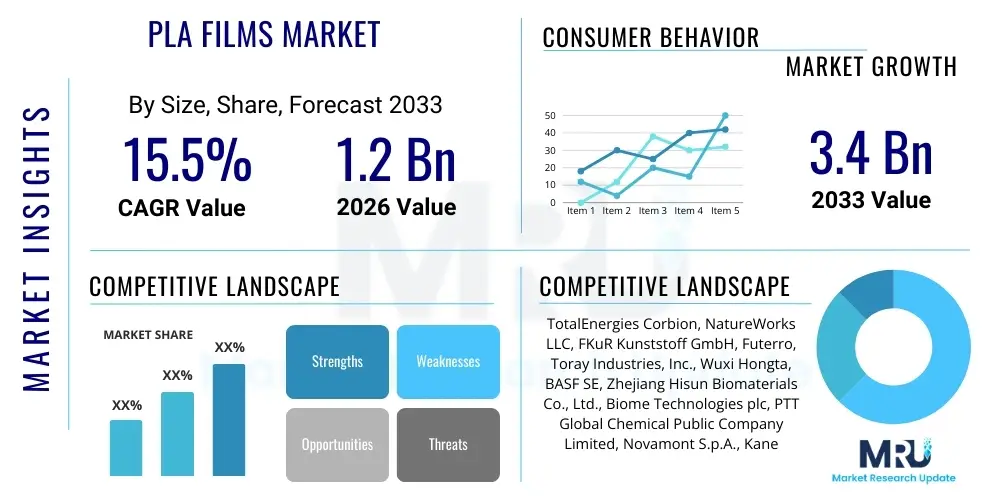

The PLA Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

PLA Films Market introduction

The Polylactic Acid (PLA) Films Market is fundamentally driven by the global imperative to shift away from traditional petroleum-based plastics toward sustainable, bio-based alternatives. PLA films, derived from renewable resources such as corn starch, sugarcane, and tapioca roots, offer a compelling environmentally friendly profile, primarily due to their compostability and reduced carbon footprint compared to polyethylene terephthalate (PET) or polyvinyl chloride (PVC). These characteristics position PLA films as a vital material in achieving circular economy goals, particularly within highly regulated and consumer-facing sectors. The material's versatility allows it to be processed using conventional plastic manufacturing equipment, although specific modifications related to heat sensitivity and crystallization kinetics are often required for high-speed industrial applications.

PLA films serve a broad spectrum of major applications, predominantly centered in the packaging industry, where they are utilized for flexible packaging, rigid containers, lamination, and window patching in cartons. Beyond packaging, PLA films are crucial in the agricultural sector for manufacturing biodegradable mulch films, which eliminate the need for costly and environmentally damaging plastic film removal after harvest. Other significant applications include biomedical devices, textile manufacturing, and disposable consumer goods. The inherent benefits of PLA films, such as transparency, good barrier properties against aroma, and excellent printability, enhance their appeal across diverse end-use markets seeking both performance and demonstrable sustainability.

Driving factors propelling this market include increasingly stringent governmental regulations concerning single-use plastics across key regions, robust corporate sustainability commitments from global Fast-Moving Consumer Goods (FMCG) corporations, and growing consumer awareness regarding plastic pollution. Moreover, continuous advancements in PLA resin technology, particularly those enhancing heat resistance and moisture barrier capabilities, are opening up new, higher-value application segments previously dominated by conventional polymers. The synergy between regulatory pressure and technological innovation is cementing PLA films' role as a foundational material for future sustainable packaging solutions.

PLA Films Market Executive Summary

The PLA Films Market is experiencing robust acceleration fueled by a confluence of favorable business trends, notably the substantial capital investment flowing into global bio-plastic production facilities and the strategic adoption of bio-based materials by multinational packaging conglomerates. A key business trend involves cross-industry partnerships between biochemical producers and waste management entities aimed at developing scalable industrial composting infrastructure, which is essential for realizing the end-of-life benefits of PLA. Furthermore, price volatility in crude oil markets periodically makes bio-plastics economically competitive, encouraging broader commercial uptake. The focus remains on improving the cost-to-performance ratio of PLA films to overcome historical barriers related to processing speed and material stability under varied environmental conditions, thereby facilitating seamless substitution for traditional films across high-volume production lines.

From a regional perspective, Europe maintains market leadership due to aggressive legislative mandates, such as the European Union’s Plastic Strategy, which actively incentivizes the use of bio-based and compostable materials. This regulatory environment creates a stable and predictable demand side, stimulating technological development and capacity expansion within the region. Asia Pacific, however, is emerging as the primary growth engine, characterized by significant industrial capacity expansion in countries like China and Thailand, coupled with high demand for agricultural mulch films and flexible packaging in rapidly urbanizing economies. North America demonstrates mature, yet consistent, growth, largely driven by corporate sustainability reporting requirements and strong consumer preference for transparently sustainable product packaging, particularly in the food and beverage sectors.

Segment trends reveal that the food packaging application segment dominates the market, capturing the largest revenue share, primarily driven by demand for compostable clamshells, overwraps, and lidding films. Within the film type segmentation, the Cast PLA Film segment is anticipated to witness rapid growth due to its superior clarity and rigidity, making it suitable for high-visual-appeal packaging. Furthermore, the market is seeing a pivotal shift towards customized PLA film grades specifically engineered for high-barrier applications, such as those protecting sensitive foodstuffs, addressing a long-standing performance challenge of early-generation PLA materials. Investment in multilayer PLA film structures incorporating biodegradable barrier layers is a crucial technical trend supporting market evolution.

AI Impact Analysis on PLA Films Market

Common user questions regarding AI's impact on the PLA Films Market frequently revolve around optimizing complex bio-polymerization processes, enhancing sustainable supply chain transparency, and accelerating the development of advanced compostable material formulations. Users are keenly interested in how Artificial Intelligence can address the inherent challenges of PLA, such as its thermal instability and limited barrier properties, often asking if AI-driven simulations can predict and optimize polymerization recipes to achieve superior material characteristics faster than traditional R&D cycles. Furthermore, significant concern exists regarding the complex logistics of feedstock sourcing and distribution, leading to questions about AI’s role in creating resilient, traceable, and carbon-efficient supply chains for bio-based raw materials. The overarching theme is the expectation that AI will serve as a critical acceleration tool, bridging the gap between current PLA limitations and the required performance thresholds for widespread adoption in highly demanding applications.

AI's role transcends mere operational efficiency; it is fundamentally altering material science innovation within the PLA films domain. Machine Learning algorithms are being applied to analyze vast datasets related to molecular structure, polymerization kinetics, and processing parameters, enabling researchers to design novel PLA co-polymers with specific, enhanced properties (e.g., increased glass transition temperature or improved moisture vapor transmission rate). This predictive modeling drastically reduces the need for expensive and time-consuming physical experimentation, shrinking the product development lifecycle from years to months. The ability of AI to model the complex interactions between different additives and PLA matrices is particularly beneficial in developing high-performance film formulations suitable for specialized industrial uses.

In manufacturing and quality control, AI-powered computer vision systems are deployed to monitor film extrusion processes in real-time, detecting microscopic defects or inconsistencies related to thickness variation, clarity, and crystallization state far more accurately and rapidly than human inspection. This enhancement in quality assurance minimizes material waste and ensures compliance with stringent industry standards, thereby improving overall manufacturing yield and reducing production costs—a critical factor for improving PLA’s competitive standing against conventional plastics. Furthermore, AI platforms are being utilized for predictive maintenance of specialized PLA processing equipment, preventing costly downtimes associated with the often-delicate thermal requirements of bio-plastic processing.

- AI optimizes bio-feedstock sourcing and logistics, ensuring sustainable and resilient raw material supply chains for PLA production.

- Machine Learning accelerates PLA co-polymer development by predicting material properties and optimizing polymerization parameters, leading to enhanced thermal and barrier performance.

- Computer Vision systems enable real-time, precision quality control in film extrusion, minimizing material defects and boosting manufacturing efficiency.

- Predictive analytics enhance supply chain transparency by tracking the carbon footprint and sustainability metrics of PLA films from raw material to final disposal.

- AI-driven simulation tools optimize film processing conditions (temperature, speed, pressure) to minimize energy consumption and reduce production waste in manufacturing plants.

DRO & Impact Forces Of PLA Films Market

The dynamics of the PLA Films Market are fundamentally shaped by strong drivers centered around environmental sustainability mandates and significant restraints related to cost and performance tradeoffs, creating numerous opportunities tied to infrastructure development and application diversification. The primary driver is the pervasive legislative movement across developed and developing economies to phase out non-compostable single-use plastics, creating mandatory demand for materials like PLA. Simultaneously, the core restraint remains the higher production cost of PLA resins compared to high-volume fossil fuel-based polymers, exacerbated by fluctuating prices of agricultural feedstocks. However, the opportunity landscape is vast, particularly in leveraging advancements in industrial composting and developing specialized, high-heat resistant PLA grades that can penetrate lucrative markets like hot-fill beverage packaging and durable consumer goods. These forces interact to form a complex set of market dynamics, requiring manufacturers to strategically balance sustainability goals with economic viability to maximize long-term market penetration.

Drivers are strongly influenced by consumer sentiment and corporate social responsibility (CSR) initiatives. Increasingly, brands recognize that using bio-based and compostable packaging is a significant differentiator that appeals to environmentally conscious consumers, translating into a direct market pull. This is amplified by substantial investments in biorefinery infrastructure globally, which are slowly bringing down the marginal cost of PLA production through economies of scale and process efficiency improvements. Conversely, restraints involve not only the material cost but also end-of-life management complexities. The current global composting infrastructure is often insufficient or misaligned with the specific requirements for industrial composting of PLA, leading to consumer confusion and contamination risks in recycling streams. Additionally, early-generation PLA films exhibited poor heat deflection temperatures, restricting their use in demanding industrial applications, although significant research is mitigating this specific limitation through stereocomplexation and blending.

The most compelling opportunities reside in developing functional blends and multi-layer structures incorporating PLA, allowing the film to meet demanding performance specifications such as high oxygen and moisture barriers essential for sensitive food products and pharmaceuticals. Another significant avenue is the expansion of PLA usage in the agricultural sector, particularly in arid and water-stressed regions, where biodegradable mulch films offer substantial benefits in soil health and operational efficiency. The collective impact forces—regulatory push, technological advances in material science, and infrastructure investment—are converging to create a high-growth environment, steadily reducing the competitive pressure exerted by cheap conventional plastics and making sustainable alternatives a primary strategic focus for major global packaging companies.

Segmentation Analysis

The PLA Films Market is meticulously segmented based on criteria critical to understanding application-specific demand and manufacturing processes. These segments include Film Type (Cast Film, Blown Film, and Others), Application (Packaging, Agriculture, Textiles, and Others), and End-Use Industry (Food and Beverage, Consumer Goods, Agriculture and Horticulture, and Healthcare). This granular segmentation is essential because the performance requirements for a PLA film used as agricultural mulch film (focused on biodegradation rate and mechanical strength) are vastly different from those for a high-clarity, high-barrier film used in flexible food packaging (focused on transparency, printability, and shelf-life extension). Market growth within these segments is often non-uniform, with the Packaging sector, particularly flexible packaging, currently exhibiting the highest growth trajectory due to rapid substitution mandates driven by regulatory bodies and major brand commitments toward achieving zero plastic waste goals. The analysis of these segments helps stakeholders tailor production capabilities and product specifications to target the most profitable and high-growth niches within the overall bio-plastics ecosystem.

- Film Type

- Cast PLA Film: Known for superior clarity, gloss, and stiffness, making it ideal for visual packaging applications and thermoforming.

- Blown PLA Film: More flexible, often used for shrink wraps, bags, and certain types of flexible pouches. Requires specialized processing to manage crystallization.

- Other Film Types (e.g., Biaxially Oriented PLA (BOPLA)): Offers enhanced barrier properties and mechanical strength, positioning it for more demanding applications.

- Application

- Packaging: Includes flexible packaging (sachets, wraps), rigid packaging (clamshells, trays), and labeling applications. Dominant market segment.

- Agriculture: Primarily involves biodegradable mulch films used to retain moisture and control weeds, disintegrating naturally after the growing season.

- Textiles: Used in non-woven fabrics, disposable hygienic products, and specialized apparel due to its bio-based origin and skin-friendly properties.

- Others: Encompasses medical applications (e.g., dissolving sutures, drug delivery), and electronics components.

- End-Use Industry

- Food and Beverage (F&B): The largest consumer, using PLA for fresh produce, bakery items, dairy packaging, and disposable serviceware.

- Consumer Goods: Utilizes PLA for non-food packaging, promotional wraps, and clear windows in cardboard boxes.

- Agriculture and Horticulture: Direct use of mulch films and plant pots, particularly in large-scale farming operations seeking sustainable methods.

- Healthcare: Niche but high-value applications requiring biocompatibility and sterility, such as blister packs and medical device packaging.

Value Chain Analysis For PLA Films Market

The value chain for the PLA Films Market begins with the highly specialized Upstream Analysis, which focuses on the sourcing and processing of renewable agricultural feedstocks, such as corn or sugarcane, into fermentable sugars. This stage is dominated by large agricultural conglomerates and industrial biotechnology companies responsible for fermentation, purification, and the critical step of polymerization to create high-purity PLA resin pellets. The efficiency and environmental impact of this upstream stage—particularly regarding land use, water consumption, and the fermentation process—are pivotal in determining the overall sustainability credentials and cost structure of the final film product. Integration between feedstock suppliers and biorefinery operators is becoming increasingly common to secure stable supply and optimize production economics, minimizing reliance on volatile commodity markets for raw materials.

Midstream activities involve the transformation of the PLA resin into films, which includes specialized extrusion processes, casting, and orientation (e.g., BOPLA production). This stage requires dedicated machinery optimized for PLA's unique thermal profile, differentiating it from conventional film manufacturing. Film converters then take these master rolls of PLA film and perform lamination, printing, coating, and sealing to create the final functional packaging formats. The distribution channel analysis is multifaceted, involving both direct sales models for large, specialized packaging customers (e.g., major food corporations) and indirect distribution through regional distributors and wholesalers for smaller-scale applications and general consumer goods packaging. The choice of channel is dictated by the volume requirements, the complexity of the film specifications, and geographical reach, with the technical support capabilities of distributors being a critical differentiator due to PLA's relatively specialized handling needs.

Downstream analysis centers on the End-User industries, primarily Packaging, Agriculture, and Healthcare, and critically, the final disposal mechanism. The successful adoption of PLA films is intrinsically linked to the development and accessibility of adequate composting infrastructure. While direct sales models ensure high-volume commitment and technical alignment, the indirect channels facilitate market penetration into diverse geographic areas and smaller businesses. The complexity of the value chain, from raw material to end-of-life management, necessitates strong collaboration among all stakeholders, particularly to ensure proper labeling and consumer education regarding compostability standards, which directly impacts the product's environmental value proposition.

PLA Films Market Potential Customers

The primary cohort of potential customers for the PLA Films Market comprises large-scale Food and Beverage (F&B) corporations and international Quick Service Restaurants (QSRs) driven by substantial public commitments to eliminate single-use plastic waste and enhance brand image through visible sustainability practices. These customers, acting as large volume end-users, require high-performance, food-contact compliant PLA films for applications such as flexible pouches, clear window patches on bakery cartons, rigid salad containers, and disposable cutlery. Their purchasing decisions are heavily influenced not only by unit cost but also by the consistency of supply, scalability, and adherence to certifications like industrial compostability standards (e.g., EN 13432 or ASTM D6400). The shift in this sector is accelerating as regulatory deadlines approach, creating immediate high-volume demand for reliable PLA film suppliers capable of global delivery and technical support.

A secondary, yet rapidly expanding, customer segment is the Agricultural and Horticultural sector, particularly large commercial farms specializing in high-value crops such as strawberries, tomatoes, and certain vegetables. These end-users prioritize biodegradable mulch films that enhance crop yield by controlling soil temperature and retaining moisture, while simultaneously reducing labor costs associated with the collection and disposal of conventional plastic films at the end of the season. Their purchasing criteria focus heavily on the certified biodegradation timeline of the film in different soil types and climates, requiring material solutions tailored to specific regional agricultural practices. Government subsidies and environmental programs often incentivize the adoption of these sustainable agricultural inputs, further driving demand from this segment.

Finally, the market includes packaging converters and specialized contract manufacturers who act as intermediaries, procuring large quantities of specialized PLA film rolls to serve a diverse client base across consumer goods and healthcare. These buyers focus on technical specifications such as film thickness, barrier properties, and surface treatment suitability for advanced printing or sealing processes. They require strong technical partnerships with PLA film manufacturers to ensure that the material integrates seamlessly into existing high-speed packaging lines. Healthcare potential customers represent a high-value niche, focusing on specialized, sterile packaging applications like blister packs and medical device wraps, where the biocompatibility and sterilizability of PLA are key purchasing determinants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | CAGR 15.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TotalEnergies Corbion, NatureWorks LLC, FKuR Kunststoff GmbH, Futerro, Toray Industries, Inc., Wuxi Hongta, BASF SE, Zhejiang Hisun Biomaterials Co., Ltd., Biome Technologies plc, PTT Global Chemical Public Company Limited, Novamont S.p.A., Kaneka Corporation, Mitsui Chemicals, Inc., Synbra Technology B.V., TIP Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PLA Films Market Key Technology Landscape

The technological landscape of the PLA Films Market is primarily defined by continuous innovation aimed at overcoming the intrinsic material limitations of first-generation PLA, specifically focusing on enhancing thermal resistance and improving barrier properties. A crucial technological advancement is the development of Biaxially Oriented PLA (BOPLA) films, achieved through specialized stretching processes that align the polymer chains. This orientation significantly enhances the tensile strength, transparency, and, most importantly, the gas barrier performance of the film, making it a viable substitute for BOPP (Biaxially Oriented Polypropylene) in certain high-demand flexible packaging applications. Furthermore, stereocomplexation—a technique involving blending PLLA (Poly-L-lactic acid) and PDLA (Poly-D-lactic acid) stereoisomers—is being commercialized to dramatically raise the melting temperature and crystallization speed of the material, enabling its use in hot-fill processes and high-speed industrial sealing machinery.

Another significant technological focus involves barrier enhancement through blending and coating techniques. Since pure PLA exhibits moderate moisture and oxygen barrier properties, researchers are integrating bio-based additives, such as natural clays (nanoclays) or cellulose derivatives, into the PLA matrix to create composite films with significantly reduced permeability. Alternatively, high-performance barrier coatings, which are also often bio-based or biodegradable, are applied to the film surface. These advancements are critical for extending the shelf life of perishable goods, allowing PLA to penetrate markets currently dominated by multi-layer fossil fuel plastics that rely on high-barrier polymers like EVOH or PVDC. The challenge lies in ensuring that these enhanced, multi-component PLA structures remain fully compostable under industrial conditions, maintaining the core sustainability promise of the material.

Processing technology also plays a pivotal role, with film manufacturers focusing on refining extrusion equipment to manage PLA's sensitivity to temperature and shear stress, which can lead to degradation. Innovations in melt filtration systems and precise temperature control mechanisms are essential for producing high-quality, defect-free films at industrial speeds. The market is also witnessing the rise of specialized technology for producing ultra-thin, high-performance PLA films, which minimizes material consumption while maximizing surface area coverage. This constant technological push for material modification and process optimization is key to achieving cost parity and performance equivalence with established conventional plastics, securing PLA's long-term viability as a mainstream packaging solution.

Regional Highlights

- North America (United States, Canada, Mexico)

The North American PLA Films Market is primarily driven by powerful corporate sustainability goals and consumer willingness to pay a premium for eco-friendly packaging, particularly within the United States. Major retail chains, large food processors, and technology companies are leading the adoption curve by committing to use 100% reusable, recyclable, or compostable packaging by specified deadlines, creating a stable, high-value demand base for PLA films. The regulatory landscape, while less uniform than in Europe, includes specific state- and municipal-level bans on certain single-use plastics, further stimulating market penetration. Investment is heavily focused on optimizing the PLA supply chain to ensure consistent quality and volume necessary for large-scale domestic manufacturing operations.

The U.S. market specifically favors high-clarity Cast PLA Films used in fresh produce packaging and deli containers, where visual appeal and transparency are paramount. Challenges in this region largely revolve around the highly fragmented waste management infrastructure; the lack of widespread, standardized industrial composting facilities limits the effectiveness of the compostability feature, often necessitating significant corporate investment in educational programs and infrastructure development partnerships. However, robust academic research and private sector funding in bio-plastic technologies continue to solidify North America's position as a key innovation hub for advanced PLA applications.

- Europe (Germany, France, UK, Italy, Spain)

Europe stands as the global leader in the PLA Films Market, driven by the most stringent and unified regulatory environment worldwide, particularly through the implementation of the EU Single-Use Plastics Directive and national circular economy strategies. These policies mandate high recycling rates and often prioritize certified compostable materials over non-recyclable plastics in specific applications like flexible packaging for foodstuffs and disposable serviceware. This regulatory framework provides manufacturers with clear, long-term market signals, encouraging substantial investment in PLA production capacity and application development across Western and Central Europe. Germany and Italy are especially strong markets, benefiting from advanced industrial composting infrastructure and high consumer awareness regarding biodegradable products.

The European market shows a strong preference for certified BOPLA films, especially those developed for advanced barrier applications in premium food packaging, where shelf-life requirements are strict. Localized legislative efforts, such as the Italian mandate for compostable shopping bags, have created major localized spikes in demand, forcing rapid market maturation. The strategic focus in Europe is not just on volume, but on the technical certification of end-of-life options, ensuring that PLA products meet the highest environmental performance standards. European firms are heavily invested in optimizing the fermentation and polymerization steps to reduce the carbon intensity of the PLA lifecycle, maintaining a competitive edge in sustainability credentials.

- Asia Pacific (APAC) (China, Japan, India, South Korea)

The Asia Pacific region is rapidly transitioning into the epicenter of PLA film manufacturing and consumption growth, largely fueled by massive industrial expansion, lower production costs, and increasing domestic environmental awareness. China, in particular, dominates the manufacturing capacity, benefiting from government support for bio-based material development and a high demand for sustainable materials to address staggering levels of plastic waste pollution. Furthermore, the extensive agricultural sectors in countries like India and Southeast Asia are major consumers of PLA mulch films, providing a significant, high-volume application segment that bypasses the complexities of urban waste infrastructure initially.

Market dynamics in APAC are split between being a global production hub and a rapidly growing consumption market. While initial adoption was price-sensitive, increased regulatory action, especially in packaging restrictions in urban centers of China and India, is driving genuine demand for sustainable alternatives. Japan, with its mature environmental consciousness and focus on quality, represents a high-value niche market for premium, functional PLA films in electronics and specialized medical packaging. Future growth hinges on balancing the export-oriented manufacturing base with expanding local consumption, supported by ongoing infrastructure investment in both industrial composting and anaerobic digestion facilities across key metropolitan areas.

- Latin America (Brazil, Argentina, Colombia) and Middle East & Africa (MEA)

Growth in Latin America is heterogeneous, led by countries like Brazil and Mexico, which possess strong agricultural bases and are beginning to implement local regulations targeting single-use plastics. Brazil, with its immense sugarcane industry, is strategically positioned to be a major feedstock supplier for PLA, creating vertical integration opportunities that enhance regional competitiveness. The demand here is steadily growing, driven by food processing industries and a nascent consumer movement favoring sustainable products, though high import costs for specialized PLA resin can occasionally constrain market expansion and limit high-end application development.

The Middle East and Africa (MEA) markets represent the emerging frontier for PLA films. Adoption is generally confined to affluent Gulf Cooperation Council (GCC) countries, primarily focused on substituting disposable serviceware and rigid food packaging in the hospitality and tourism sectors, often driven by large-scale infrastructure projects and high-profile events prioritizing sustainability. In parts of Africa, the demand is limited but significant in specialized agricultural projects or high-end retail. The primary challenge in MEA is establishing the necessary processing infrastructure and managing high logistical costs, requiring PLA film suppliers to focus on high-durability and cost-effective film grades for widespread adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PLA Films Market.- TotalEnergies Corbion

- NatureWorks LLC

- FKuR Kunststoff GmbH

- Futerro

- Toray Industries, Inc.

- Wuxi Hongta

- BASF SE

- Zhejiang Hisun Biomaterials Co., Ltd.

- Biome Technologies plc

- PTT Global Chemical Public Company Limited

- Novamont S.p.A.

- Kaneka Corporation

- Mitsui Chemicals, Inc.

- Synbra Technology B.V.

- TIP Corporation

- Bio-Fed (Akro-Plastic GmbH)

- Teijin Limited

- Mitsubishi Chemical Holdings Group

- Unitika Ltd.

- Green Dot Bioplastics

Frequently Asked Questions

Analyze common user questions about the PLA Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating the global adoption of PLA films?

The primary drivers are stringent global governmental regulations banning single-use, non-compostable plastics, coupled with robust corporate commitments from major multinational brands prioritizing sustainable packaging solutions. Additionally, continuous technological advancements improving PLA's thermal and barrier properties, making it competitive with conventional polymers, further accelerates its market penetration across crucial sectors like food and agriculture.

How does the cost structure of PLA films compare to traditional petroleum-based plastic films?

PLA films typically possess a higher base material cost compared to high-volume fossil fuel-based polymers like PET or PP, mainly due to the specialized feedstock processing and lower current economies of scale in biorefinery production. However, this cost differential is narrowing as global PLA production capacity increases and as the cost of conventional plastics becomes more volatile, making PLA increasingly cost-competitive, especially when considering the long-term compliance costs associated with non-sustainable materials.

What key material limitations of PLA films are currently being addressed by new technologies?

The two main material limitations being addressed are insufficient thermal resistance (low heat deflection temperature) and moderate gas barrier properties (especially against moisture and oxygen). Technological solutions, including stereocomplexation (blending PLLA and PDLA) and the development of Biaxially Oriented PLA (BOPLA) films and composite structures incorporating nanoclays, are significantly enhancing both heat tolerance for industrial processing and barrier performance for shelf-life critical applications.

Which application segment holds the largest market share for PLA films and why is it growing?

The Packaging application segment holds the largest market share, specifically encompassing flexible packaging, rigid containers, and lamination films. Growth is immense because this segment is the primary target of global plastic reduction legislation and corporate sustainability pledges. PLA films offer a certified compostable solution ideal for short-shelf-life goods and quick-service applications, directly addressing the critical environmental impact of food packaging waste.

What is the role of industrial composting infrastructure in the long-term success of the PLA Films Market?

Industrial composting infrastructure is crucial for the long-term market success and the environmental credibility of PLA films. While PLA is bio-based, it requires specific conditions (high heat and controlled microbial environments) found in industrial composting facilities to fully decompose within the necessary time frame. Widespread, standardized, and accessible composting infrastructure ensures that PLA products fulfill their end-of-life promise, differentiating them clearly from traditional plastics and building consumer confidence in the material's sustainable value proposition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager