Planar Target Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440060 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Planar Target Market Size

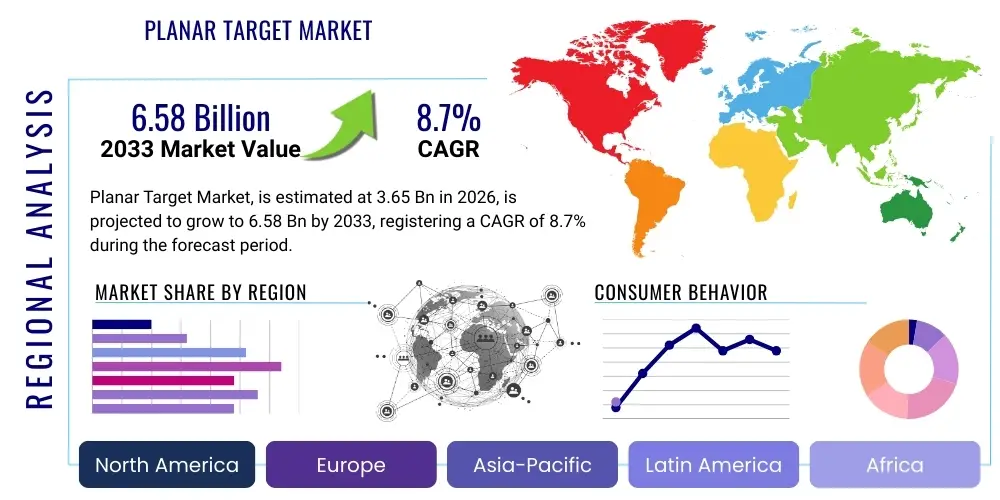

The Planar Target Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 3.65 Billion in 2026 and is projected to reach USD 6.58 Billion by the end of the forecast period in 2033. This growth is primarily driven by the escalating demand for advanced materials in high-technology industries such as semiconductors, flat panel displays, and solar cells, which are critical for various next-generation electronic devices and energy solutions. The continuous pursuit of higher performance, miniaturization, and energy efficiency across these sectors directly fuels the need for high-purity, uniform planar targets.

The market expansion is also underpinned by robust investments in research and development aimed at discovering and commercializing novel target materials that can meet increasingly stringent technical specifications. Furthermore, the global expansion of manufacturing capabilities, particularly in Asia Pacific, coupled with the rising adoption of sputtering technology in diverse industrial applications, contributes significantly to this projected market trajectory. Strategic collaborations between material suppliers and end-use manufacturers are expected to streamline the development of customized planar target solutions, further accelerating market growth and penetration.

Planar Target Market introduction

The Planar Target Market encompasses the production and supply of highly purified, precisely shaped material blocks used in physical vapor deposition (PVD) processes, predominantly sputtering. These targets serve as the source material from which thin films are deposited onto substrates in a vacuum environment. The quality and composition of planar targets are paramount, directly influencing the performance, purity, and uniformity of the resulting thin films, which are foundational components in numerous advanced technological applications. The continuous evolution of electronics and related industries mandates ongoing innovation in target material science and manufacturing processes to meet ever-tightening specifications for film properties and deposition efficiency.

Key applications for planar targets span a wide array of high-tech sectors. In the semiconductor industry, they are indispensable for creating intricate circuit layers, interconnects, and dielectric films crucial for microprocessors, memory chips, and sensors. For flat panel displays, planar targets are used to deposit transparent conductive oxides (TCOs) like Indium Tin Oxide (ITO) and other functional layers for liquid crystal displays (LCDs) and organic light-emitting diode (OLED) screens. The solar energy sector relies on them for depositing absorber layers and transparent electrodes in photovoltaic cells, enhancing efficiency and durability. Beyond these, planar targets are utilized in optical coatings for lenses and mirrors, decorative coatings for consumer goods, wear-resistant coatings for tools, and biocompatible coatings for medical implants, highlighting their versatile utility and critical role in modern manufacturing.

The primary benefits associated with high-quality planar targets include superior film uniformity, excellent adhesion, high material utilization efficiency, and precise control over film composition, all of which are essential for producing high-performance devices. Driving factors for this market include the relentless demand for smaller, faster, and more powerful electronic devices, the rapid expansion of the Internet of Things (IoT) and artificial intelligence (AI) hardware, increasing investment in renewable energy infrastructure, and the growing adoption of advanced coating technologies in automotive, aerospace, and medical industries. Additionally, stringent quality requirements and the push for higher purity materials in these sophisticated applications continue to fuel market innovation and growth.

Planar Target Market Executive Summary

The Planar Target Market is currently experiencing dynamic shifts driven by accelerating technological advancements and a surge in demand across several critical end-use industries. Business trends indicate a strong focus on high-purity and advanced material targets, responding to the escalating requirements for miniaturization, higher performance, and enhanced energy efficiency in electronic devices. Manufacturers are increasingly investing in specialized production capabilities and R&D to develop novel alloys and ceramic compositions, addressing complex challenges such as reducing resistance in interconnects or improving light transmission in display technologies. There is also a notable trend towards customization, with end-users seeking bespoke target solutions tailored to specific deposition processes and film properties, fostering closer collaboration across the value chain. Furthermore, sustainability initiatives are gaining traction, pushing for more efficient material utilization and improved recycling processes for depleted targets.

Regional trends highlight the Asia Pacific (APAC) region as the undisputed leader in the Planar Target Market, primarily due to the concentrated presence of major semiconductor foundries, flat panel display manufacturers, and solar cell production facilities in countries like China, South Korea, Taiwan, and Japan. This region also benefits from significant government investments in high-tech manufacturing and robust consumer electronics markets. North America and Europe, while representing mature markets, are characterized by strong innovation hubs, significant R&D spending, and the demand for ultra-high-purity targets for advanced military, aerospace, and medical applications. Emerging markets in Latin America and the Middle East and Africa (MEA) are showing nascent growth, driven by increasing industrialization and gradual adoption of advanced manufacturing techniques, albeit from a lower base.

Segmentation trends reveal particular strength in targets made from metals such as aluminum, titanium, and copper, alongside increasing demand for precious metals and complex ceramic targets like Indium Tin Oxide (ITO) and Aluminum-doped Zinc Oxide (AZO). The semiconductor segment remains the largest revenue contributor, propelled by continuous innovation in chip design and manufacturing processes, including advanced packaging technologies. However, the flat panel display and solar cell segments are exhibiting robust growth, driven by the expansion of OLED technology, large-format displays, and the global push for renewable energy. The market is also seeing increased demand for targets used in functional and decorative coatings, reflecting a broader industrial adoption of advanced surface modification techniques to improve product aesthetics, durability, and performance.

AI Impact Analysis on Planar Target Market

Common user questions regarding AI's impact on the Planar Target Market frequently revolve around how artificial intelligence can revolutionize manufacturing efficiency, material discovery, quality control, and supply chain optimization. Users are keen to understand if AI can significantly reduce production costs and improve yields in target fabrication, given the high purity and precision required. There is also considerable interest in AI's potential to accelerate the development of new, high-performance target materials, predict equipment failures, and enhance overall operational intelligence. Concerns often focus on the investment required for AI integration, data security, and the need for specialized expertise, reflecting a desire for practical and cost-effective AI applications that deliver tangible benefits throughout the planar target lifecycle.

- AI-driven process optimization: AI algorithms can analyze vast datasets from manufacturing processes, including sputtering parameters, material compositions, and environmental conditions, to identify optimal production settings for planar targets. This leads to reduced waste, improved yields, and more consistent product quality, thereby lowering manufacturing costs and enhancing operational efficiency.

- Accelerated material discovery: Machine learning models can predict the properties of novel material compositions, allowing researchers to quickly screen and design new alloys or ceramic compounds for planar targets with desired characteristics, such as enhanced purity, specific electrical conductivity, or superior thermal stability, significantly shortening R&D cycles.

- Enhanced quality control and defect detection: AI-powered vision systems and sensor networks can monitor target manufacturing in real-time, detecting microscopic defects, impurities, or inconsistencies that might be missed by human inspection. This proactive quality assurance minimizes the production of faulty targets, reduces rework, and ensures high-reliability products for critical applications.

- Predictive maintenance for manufacturing equipment: AI models can analyze sensor data from target fabrication machinery (e.g., hot presses, sintering furnaces, machining tools) to predict potential equipment failures before they occur. This enables proactive maintenance, reducing downtime, extending equipment lifespan, and ensuring continuous production of planar targets.

- Supply chain optimization and demand forecasting: AI can process complex market data, geopolitical factors, and historical demand patterns to provide highly accurate forecasts for planar target demand. This helps manufacturers optimize raw material procurement, manage inventory levels efficiently, and respond more agilely to market fluctuations, thereby reducing operational risks and costs.

- Improved customization and design: AI tools can assist in designing planar targets with highly specific geometries and material distributions required for niche applications. By simulating different designs and predicting their performance, AI facilitates rapid prototyping and customized solutions that precisely meet unique customer specifications.

- Energy efficiency in production: AI can monitor and optimize energy consumption across various stages of planar target manufacturing, from raw material processing to final shaping and quality control. By identifying energy-intensive bottlenecks and suggesting more efficient operational modes, AI contributes to reducing the overall carbon footprint and operating expenses.

DRO & Impact Forces Of Planar Target Market

The Planar Target Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the incessant demand from the semiconductor industry for smaller, faster, and more powerful microchips, which necessitates high-purity and increasingly specialized target materials for advanced metallization and dielectric layers. Similarly, the exponential growth in flat panel display technologies, particularly the widespread adoption of OLED and QLED, along with the global push for renewable energy through solar cells, further propels market expansion by requiring sophisticated transparent conductive oxides and absorber materials. The continuous pursuit of innovation in areas like augmented reality, virtual reality, 5G technology, and autonomous vehicles also translates into heightened demand for advanced thin-film coatings, directly stimulating the planar target sector.

However, the market faces notable restraints that could temper its growth trajectory. The high capital investment required for establishing and maintaining state-of-the-art target manufacturing facilities, especially for ultra-high-purity materials, creates significant barriers to entry and expansion. Furthermore, the volatility and scarcity of certain critical raw materials, such as indium and tantalum, pose supply chain risks and can lead to price fluctuations, impacting production costs and market stability. The complex and often proprietary manufacturing processes, which demand extensive R&D and specialized technical expertise, also act as a bottleneck, limiting the rapid scaling of production and the adoption of new materials. Additionally, stringent quality control standards and the need for precise material characterization add to the manufacturing complexity and cost.

Despite these challenges, substantial opportunities exist for market players. The continuous development of novel materials, including advanced alloys, nitrides, and oxides, designed for next-generation devices and applications, presents significant growth avenues. Customization and specialization for niche markets, such as biocompatible coatings for medical implants or high-performance coatings for aerospace components, offer premium value propositions. Moreover, the expanding industrial base in emerging economies, coupled with increased investment in local manufacturing capabilities, represents untapped markets with considerable potential for growth. Strategic partnerships and collaborations between target manufacturers, equipment suppliers, and end-users are also crucial opportunities to drive innovation, optimize processes, and ensure market competitiveness. Furthermore, the increasing focus on circular economy principles presents opportunities for advanced recycling and material recovery technologies to mitigate raw material scarcity and environmental concerns.

External impact forces such as global economic conditions significantly influence market demand, with economic downturns potentially leading to reduced capital expenditure in end-use industries. Geopolitical stability and trade policies also play a critical role, affecting raw material supply chains, manufacturing locations, and international market access. Rapid technological advancements in alternative deposition techniques or new materials could disrupt traditional sputtering applications, necessitating continuous innovation from planar target manufacturers. Environmental regulations, particularly concerning hazardous materials and energy consumption, further shape manufacturing processes and product development, pushing for greener and more sustainable solutions. Lastly, the rapid evolution of digital transformation and AI integration across industries creates both opportunities for process optimization and challenges related to technological adaptation and cybersecurity within the planar target manufacturing ecosystem.

Segmentation Analysis

The Planar Target Market is comprehensively segmented based on various critical parameters, including material type, purity, application, and end-use industry. This granular segmentation provides a detailed understanding of market dynamics, identifies specific growth drivers within each category, and highlights the diverse needs of different technological sectors. Each segment represents distinct chemical compositions, fabrication requirements, and performance characteristics, catering to specialized functions in advanced thin-film deposition processes. Analyzing these segments is essential for market players to develop targeted strategies, innovate new products, and effectively address the evolving demands of their diverse customer base across the global landscape.

- Material Type: This segment categorizes planar targets based on their elemental or compound composition, directly impacting the functional properties of the deposited thin films.

- Metals: Includes high-purity targets of Aluminum (Al), Titanium (Ti), Copper (Cu), Tantalum (Ta), Tungsten (W), Molybdenum (Mo), Nickel (Ni), and Chromium (Cr), extensively used for interconnects, barrier layers, and decorative coatings.

- Alloys: Comprises targets like Aluminum-Copper (Al-Cu), Nickel-Chromium (Ni-Cr), Titanium-Aluminum (Ti-Al), and various intermetallic compounds, offering customized electrical, mechanical, and thermal properties for specific applications.

- Ceramics: Encompasses targets such as Indium Tin Oxide (ITO), Aluminum-doped Zinc Oxide (AZO), Silicon Dioxide (SiO2), Titanium Dioxide (TiO2), and Silicon Nitride (Si3N4), crucial for transparent conductive layers, dielectric films, and protective coatings.

- Precious Metals: Includes Gold (Au), Silver (Ag), Platinum (Pt), and Palladium (Pd) targets, utilized in highly specialized applications requiring excellent conductivity, corrosion resistance, or catalytic properties, particularly in medical devices and high-end electronics.

- Purity: Purity levels are paramount in advanced applications, directly affecting film performance and device reliability. This segment differentiates targets based on their elemental purity, typically measured in 'N's (e.g., 4N for 99.99%, 5N for 99.999%).

- 4N (99.99%): Standard purity for general industrial coatings and some less critical electronic applications.

- 5N (99.999%): Widely used in display technologies and some semiconductor processes where moderate purity is acceptable.

- 6N (99.9999%): Critical for high-performance semiconductor devices, advanced optical coatings, and high-reliability electronics, minimizing defects and enhancing performance.

- 7N (99.99999%) and above: Ultra-high purity targets for the most advanced semiconductor manufacturing processes and cutting-edge research, where even trace impurities can significantly impact device functionality.

- Application: This segment focuses on the primary intended use of the thin films deposited from planar targets.

- Semiconductor: The largest segment, covering metallization layers, barrier layers, dielectric films, and transparent electrodes for integrated circuits, memory chips, and sensor devices.

- Flat Panel Displays (FPDs): Includes applications for LCDs, OLEDs, and other display technologies, primarily for transparent conductive films (e.g., ITO, AZO), reflective layers, and protective coatings.

- Solar Cells: Targets used for depositing absorber layers (e.g., CIGS), transparent conductive oxides, and anti-reflective coatings in various photovoltaic technologies to enhance energy conversion efficiency.

- Optical Coatings: For anti-reflective coatings, filters, mirrors, and protective layers on lenses, eyewear, and other optical components.

- Decorative Coatings: Applied to consumer electronics, automotive interiors, and fashion accessories to achieve specific aesthetic finishes, such as metallic luster or color effects.

- Wear-Resistant Coatings: For tools, medical instruments, and industrial components to enhance hardness, durability, and extend lifespan.

- Medical Devices: Biocompatible coatings for implants, surgical instruments, and diagnostic equipment, ensuring inertness and functionality within biological systems.

- End-Use Industry: This segmentation categorizes the market based on the major industrial sectors that consume planar targets.

- Electronics: Encompasses semiconductor manufacturing, data storage, consumer electronics, and communication devices.

- Automotive: For functional and decorative coatings on automotive components, sensors, and lighting systems.

- Aerospace and Defense: High-performance coatings for aircraft components, sensors, and satellite systems, requiring extreme durability and reliability.

- Medical: Coatings for surgical tools, implants, prosthetics, and diagnostic equipment.

- Energy: Primarily for solar panels, but also includes components for energy storage and other power generation systems.

- Architecture and Glass: Coatings for energy-efficient windows, smart glass, and decorative architectural elements.

Value Chain Analysis For Planar Target Market

The value chain for the Planar Target Market is a complex and highly specialized ecosystem, commencing from the meticulous sourcing of raw materials and extending to the final integration of thin films in sophisticated end-products. The upstream segment of the value chain is dominated by the extraction, refining, and purification of elemental metals and compounds, which are then processed into precursor materials. This stage is critical as the purity of the raw materials directly dictates the ultimate quality and performance of the planar target. Key players in this phase include global mining companies and specialized chemical refiners who employ advanced techniques such as zone refining, electrolysis, and chemical vapor deposition (CVD) to achieve the ultra-high purity levels demanded by target manufacturers, often exceeding 99.999% (5N) to 99.99999% (7N).

Midstream activities involve the highly technical manufacturing of planar targets. This process typically includes powder metallurgy, vacuum melting, hot pressing, sintering, and advanced machining processes to form targets with precise dimensions, uniform density, and specific microstructures. These intricate fabrication steps are performed by specialized planar target manufacturers who possess proprietary technologies and deep material science expertise. Quality control throughout this stage is rigorous, involving sophisticated analytical techniques such as glow discharge mass spectrometry (GDMS), inductively coupled plasma mass spectrometry (ICP-MS), and scanning electron microscopy (SEM) to verify chemical composition, purity, and structural integrity. The aim is to ensure the targets are free from impurities and defects that could compromise the thin film deposition process or the performance of the final device.

The downstream segment of the value chain involves the distribution of these highly specialized targets to end-users, primarily thin-film coating service providers, semiconductor fabrication plants (fabs), flat panel display manufacturers, and solar cell producers. Distribution channels can be both direct and indirect. Direct distribution involves target manufacturers selling directly to large-scale end-users, often with customized specifications and long-term contracts. This approach allows for closer collaboration, technical support, and rapid problem-solving. Indirect distribution, on the other hand, involves sales through specialized distributors and agents who cater to a wider array of smaller and medium-sized enterprises (SMEs), providing logistical support, local inventory, and technical consulting. The choice of channel often depends on the customer's size, geographic location, and the complexity of the target requirements. Both channels emphasize technical expertise and reliable supply chains, given the critical role planar targets play in high-value manufacturing processes.

Planar Target Market Potential Customers

The potential customers for the Planar Target Market are diverse and concentrated within industries that heavily rely on advanced thin-film deposition technologies for producing high-performance components and devices. Primarily, semiconductor manufacturers represent the largest segment of end-users, requiring a vast array of high-purity metal, alloy, and ceramic targets for creating integrated circuits, memory chips, and advanced packaging solutions. These companies constantly seek targets that enable further miniaturization, improved conductivity, and enhanced reliability in their fabrication processes. The relentless innovation in chip design and increasing demand for computing power across various applications ensure a continuous and growing need for advanced planar targets.

Another significant customer base includes manufacturers of flat panel displays, encompassing LCD, OLED, and emerging display technologies. These firms demand transparent conductive oxide (TCO) targets, such as ITO and AZO, along with other specialized metal and dielectric targets for forming electrodes, barrier layers, and optical coatings that define the visual quality and functionality of modern screens. The rapid evolution of display technologies towards larger formats, higher resolutions, and flexible designs fuels a constant requirement for innovative and high-performance planar target solutions. Furthermore, solar cell manufacturers constitute a rapidly expanding customer segment, driven by global initiatives for renewable energy. They utilize planar targets for depositing absorber layers, transparent electrodes, and anti-reflective coatings in various types of photovoltaic cells, aiming to maximize energy conversion efficiency and durability.

Beyond these major sectors, potential customers also extend to companies specializing in optical coatings for lenses, mirrors, and eyewear, where precision and specific optical properties are paramount. Manufacturers of decorative coatings for consumer goods, automotive parts, and architectural elements also represent a growing segment, seeking targets that can produce aesthetically pleasing and durable finishes. Additionally, industries focused on wear-resistant coatings for cutting tools, industrial components, and medical devices are critical consumers, requiring targets that provide enhanced hardness, corrosion resistance, and biocompatibility. The broad applicability of thin-film technology ensures that any industry pursuing surface modification for improved performance, functionality, or aesthetics is a potential customer for planar target manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.65 Billion |

| Market Forecast in 2033 | USD 6.58 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TOSOH SMD, JX Nippon Mining & Metals, ULVAC, Praxair S.T. Technology (now Linde), Materion, KFMI, Umicore, Honeywell, Sumitomo Chemical, Hitachi Metals, Solar Applied Materials Technology (SAMT), ADMAP, Plasmaterials, Inc., SCI Engineered Materials, Inc., FHR Anlagenbau GmbH, Grikin Advanced Material Co., Ltd., Ningbo Jiangfeng Electronic Material Co., Ltd., VEM S.r.l., SAM Speciality Alloys & Metals GmbH, American Elements. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Planar Target Market Key Technology Landscape

The planar target market is characterized by a sophisticated technological landscape encompassing advanced material synthesis, precision manufacturing, and rigorous characterization techniques, all aimed at producing targets with unparalleled purity, uniformity, and structural integrity. A core technology involves sophisticated sputtering processes, predominantly magnetron sputtering, which relies on the interaction of electric and magnetic fields to efficiently eject target material onto a substrate. Advances in sputtering equipment, such as rotary targets for enhanced material utilization and larger planar targets for increased throughput, continually push the boundaries of deposition efficiency and film quality. The design of these sputtering systems is often tailored to specific target materials and application requirements, necessitating close collaboration between target manufacturers and equipment providers.

The manufacturing of the planar targets themselves is a complex multi-stage process, heavily leveraging advanced powder metallurgy and vacuum melting techniques. For ceramic targets, sintering and hot pressing methods are crucial for achieving high density and uniform microstructures while minimizing porosity. For metal and alloy targets, vacuum induction melting and electron beam melting are employed to ensure ultra-high purity by removing impurities and preventing contamination. Subsequent processes include hot isostatic pressing (HIP) to further densify materials and eliminate internal defects, followed by precision machining, grinding, and polishing to achieve the exact dimensions and surface finishes required by sputtering systems. These processes often take place in cleanroom environments to prevent external contamination, which is critical for the semiconductor and display industries.

Beyond manufacturing, the technological landscape includes a suite of advanced characterization and quality control methods. Techniques such as Glow Discharge Mass Spectrometry (GDMS), Inductively Coupled Plasma Mass Spectrometry (ICP-MS), and Atomic Absorption Spectroscopy (AAS) are routinely used to verify elemental composition and trace impurity levels down to parts per billion. Microstructural analysis via Scanning Electron Microscopy (SEM) and Transmission Electron Microscopy (TEM) provides insights into grain size, crystal orientation, and defect distribution, all of which influence sputtering performance and film properties. Furthermore, non-destructive testing methods like ultrasonic inspection are used to detect internal flaws, ensuring the structural integrity of large targets. The continuous development and integration of these advanced technologies are essential for meeting the ever-increasing performance demands of thin-film applications and maintaining competitiveness in the planar target market.

Regional Highlights

- Asia Pacific (APAC): This region dominates the Planar Target Market, primarily driven by the robust presence of leading semiconductor manufacturers, flat panel display producers, and solar cell fabrication plants in countries such as China, South Korea, Japan, and Taiwan. Significant government investments in high-tech manufacturing, coupled with a large consumer electronics market and expanding industrial base, fuel demand for high-purity and advanced target materials. The region also benefits from lower manufacturing costs and established supply chain networks, making it a critical hub for both production and consumption of planar targets.

- North America: Characterized by a strong emphasis on research and development, North America is a key region for innovation in planar target technology. The demand here stems from advanced semiconductor manufacturing, aerospace and defense applications requiring ultra-high-purity materials, and a growing medical device sector. The presence of major R&D institutions and technology companies drives the need for cutting-edge target solutions, often with bespoke specifications. While not as large in volume as APAC, the market in North America commands premium pricing for specialized, high-performance targets.

- Europe: Europe represents a mature market with a focus on high-value applications, including advanced automotive coatings, industrial tools, and specialized electronics. Countries like Germany, France, and the UK have strong manufacturing bases that utilize planar targets for functional and protective coatings. There is a growing emphasis on sustainable production methods and the development of new materials to meet stringent environmental regulations and performance standards. European market growth is steady, driven by innovation in industrial processes and increasing automation.

- Latin America: This region is an emerging market for planar targets, with growth driven by increasing industrialization and expanding manufacturing capabilities, particularly in electronics assembly and automotive components in countries like Brazil and Mexico. While the market size is currently smaller compared to other regions, rising foreign direct investment and local governmental support for industrial development are expected to foster steady growth in the demand for thin-film technologies and, consequently, planar targets.

- Middle East and Africa (MEA): The MEA region is at an early stage of market development for planar targets, primarily influenced by growing investments in renewable energy projects (especially solar) and gradual diversification of industrial sectors beyond oil and gas. Countries such as UAE and Saudi Arabia are investing in technology parks and manufacturing initiatives, which could spur future demand for advanced materials and coating technologies. The market here is expected to grow incrementally as industrial infrastructure develops and local production capabilities expand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Planar Target Market.- TOSOH SMD

- JX Nippon Mining & Metals

- ULVAC

- Praxair S.T. Technology (now Linde)

- Materion

- KFMI

- Umicore

- Honeywell

- Sumitomo Chemical

- Hitachi Metals

- Solar Applied Materials Technology (SAMT)

- ADMAP

- Plasmaterials, Inc.

- SCI Engineered Materials, Inc.

- FHR Anlagenbau GmbH

- Grikin Advanced Material Co., Ltd.

- Ningbo Jiangfeng Electronic Material Co., Ltd.

- VEM S.r.l.

- SAM Speciality Alloys & Metals GmbH

- American Elements

Frequently Asked Questions

Analyze common user questions about the Planar Target market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a planar target and why is its purity important?

A planar target is a highly purified, precisely shaped block of material used as a source for depositing thin films onto substrates in a vacuum via physical vapor deposition (PVD), typically sputtering. Its purity is paramount because even trace impurities can significantly degrade the electrical, optical, or mechanical properties of the deposited thin film, leading to device malfunction or reduced performance in critical applications like semiconductors and displays. High purity ensures consistent film quality and device reliability.

What are the primary applications driving the demand for planar targets?

The demand for planar targets is predominantly driven by the semiconductor industry for microchip fabrication, the flat panel display sector for screens (LCDs, OLEDs), and the solar cell industry for photovoltaic energy conversion. Other significant applications include optical coatings, decorative finishes, wear-resistant layers for tools, and biocompatible coatings for medical devices, all requiring precise thin-film functionalities.

How does AI impact the manufacturing and supply chain of planar targets?

AI significantly impacts the Planar Target Market by optimizing manufacturing processes for higher yields and lower costs, accelerating the discovery of new materials, and enhancing real-time quality control for defect detection. In the supply chain, AI improves demand forecasting and inventory management, leading to greater efficiency and reduced risks. It also aids in predictive maintenance of equipment, minimizing downtime.

What challenges does the planar target market face, and what opportunities exist?

The market faces challenges such as high capital investment requirements, volatility in raw material prices, complex manufacturing processes demanding specialized expertise, and stringent quality standards. However, opportunities arise from the continuous development of novel high-performance materials, customization for niche applications, expansion into emerging economies, and the adoption of sustainable production and recycling methods to mitigate resource constraints.

Which regions are key players in the Planar Target Market, and why?

Asia Pacific (APAC) is the dominant region due to its concentrated manufacturing base for semiconductors, displays, and solar cells in countries like China, South Korea, Japan, and Taiwan. North America and Europe are significant for their innovation in advanced materials and high-value applications, driven by strong R&D and demand for ultra-high-purity targets in aerospace, defense, and medical sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager