Plant Based Vegan Leather Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438654 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Plant Based Vegan Leather Market Size

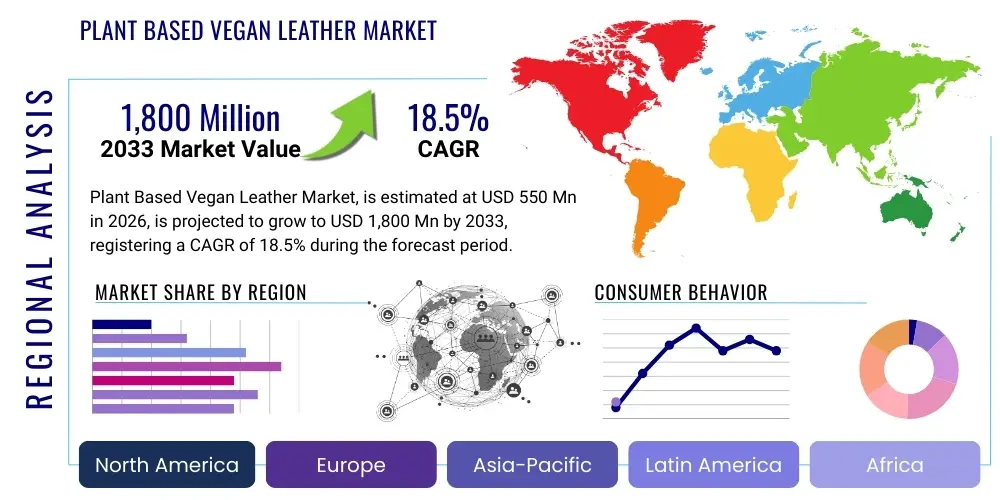

The Plant Based Vegan Leather Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $550 million in 2026 and is projected to reach $1,800 million by the end of the forecast period in 2033.

Plant Based Vegan Leather Market introduction

The Plant Based Vegan Leather Market encompasses the manufacturing and distribution of sustainable textile materials derived from natural, non-animal sources, specifically utilizing agricultural waste, fungal mycelium, fruit fibers (like pineapple and apple), or specialized plant polymers. These materials are engineered to replicate the aesthetic, tactile, and performance characteristics of traditional animal hide leather while addressing critical environmental and ethical concerns associated with livestock farming and synthetic petroleum-based materials (PU/PVC). The core innovation lies in biochemical processing and material science, turning unconventional feedstock into durable, fashionable, and biodegradable or highly recyclable end products, aligning seamlessly with the global shift towards circular economies and ethical sourcing practices. This market serves as a crucial bridge between consumer demand for luxury aesthetics and corporate commitments to Environmental, Social, and Governance (ESG) criteria.

Product applications span a wide range of industries, primarily focused on luxury and mass-market consumer goods where durability and aesthetics are paramount. Major applications include high-end fashion accessories such as handbags, wallets, and belts; automotive interiors, particularly seating and trim; footwear production for both casual and performance categories; and home furnishings and upholstery. The inherent benefits of these plant-derived materials—including a lower carbon footprint, reduced water usage compared to conventional leather production, and the elimination of animal cruelty—are strong driving factors for market adoption. Furthermore, the ability of certain plant-based leathers to biodegrade, or at least offer superior end-of-life options compared to plastics, positions them favorably in regulatory landscapes increasingly restricting single-use or non-recyclable materials.

Driving factors for sustained growth include heightened consumer awareness regarding sustainability and ethical consumption, rigorous commitments by major fashion houses and automotive OEMs to phase out animal or fossil fuel-derived materials, and technological advancements that continuously improve the longevity, elasticity, and scalability of bio-based fibers. As production techniques move toward industrial scale, the cost parity with conventional materials is improving, making plant-based vegan leather a viable and often preferable alternative for brands aiming to meet stringent sustainability targets while maintaining premium product positioning. Government incentives supporting bio-economy initiatives and stringent regulations regarding chemical use in manufacturing further amplify market expansion opportunities.

Plant Based Vegan Leather Market Executive Summary

The Plant Based Vegan Leather Market is characterized by rapid technological innovation and robust integration into high-value consumer segments, reflecting a pivotal business trend where sustainability is becoming a non-negotiable factor for brand equity. Business trends indicate significant venture capital funding flowing into material science startups specializing in fermentation-derived materials (mycelium) and agricultural waste utilization, focusing on increasing scalability and reducing time-to-market for novel fibers. Strategic collaborations between material developers and luxury fashion conglomerates are defining the competitive landscape, shifting the industry focus from simple substitution to material innovation that exceeds the performance metrics of traditional leather. Companies are heavily investing in patented formulations and transparent supply chain reporting to capitalize on the ethical consumer base.

Regionally, Europe and North America currently dominate the market, primarily due to high consumer spending power coupled with stringent regulatory environments favoring sustainable materials and strong ethical consumer activism. European markets, particularly Italy and France, are hubs for luxury goods manufacturing, driving the demand for premium, certified bio-based alternatives. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by increasing disposable incomes, expanding manufacturing capabilities for footwear and apparel, and emerging domestic brands adopting eco-friendly materials to appeal to younger, environmentally conscious populations. Regulatory harmonization across different trade blocks regarding bio-content certification and composting standards will be crucial for sustained international market penetration.

Segment trends demonstrate the dominance of the 'Fruit and Agricultural Waste' derived segment (e.g., Pinatex, AppleSkin) due to its established supply chain and relatively lower production complexity, although the 'Mycelium-based' segment is anticipated to witness the most accelerated growth rate, driven by superior material strength, texture, and the ability to grow material into complex shapes, reducing waste. The application segment remains heavily concentrated in Fashion and Apparel, but the Automotive Interior segment is showing remarkable acceleration, as electric vehicle (EV) manufacturers increasingly market their products not just on efficiency but on holistic sustainability, demanding durable, high-performance vegan leather alternatives for their cabins. Cost optimization in the fermentation and processing stages remains the key determinant for the mass-market viability of these advanced segments.

AI Impact Analysis on Plant Based Vegan Leather Market

User queries regarding AI's influence on the Plant Based Vegan Leather Market frequently revolve around optimizing material synthesis, ensuring quality control, and improving supply chain transparency and consumer interaction. Key themes include the use of AI in predicting the optimal blend of plant polymers for enhanced durability and texture (material discovery), automating complex fermentation processes for mycelium-based leather to ensure consistent scale and yield, and implementing predictive analytics for feedstock management (e.g., forecasting agricultural waste availability). Users are concerned about whether AI can truly democratize the high-cost barrier associated with bio-material R&D and manufacturing, and they are keenly interested in how machine learning can be leveraged to verify the authenticity and sustainability claims (reducing greenwashing) of vegan leather products throughout the entire value chain.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the R&D and manufacturing paradigms within the plant-based leather industry, moving beyond simple automation to genuine biochemical and material innovation. AI algorithms are being deployed to simulate molecular interactions and predict the performance metrics (tensile strength, abrasion resistance, fire retardancy) of novel bio-polymers before costly physical synthesis, dramatically accelerating the material discovery phase. Furthermore, in controlled bio-fabrication environments, such as those used for growing mycelium, AI-driven sensor networks monitor environmental parameters (temperature, humidity, nutrient levels) in real-time, adjusting conditions autonomously to optimize the growth rate and structural uniformity of the material, ensuring industrial-grade consistency required by major commercial clients like the automotive sector.

Beyond material engineering, AI plays a crucial role in enhancing supply chain efficiency and consumer trust. Predictive logistics powered by ML optimize the sourcing and transportation of bulky agricultural waste feedstocks, reducing overall supply chain emissions and costs. Moreover, blockchain solutions, often integrated with AI-driven authentication markers, provide verifiable transparency, allowing consumers to trace the product back to its plant source, confirming its vegan and sustainable origins. This AEO-optimized content addresses the high-intent user concern regarding the operationalization of sustainable claims, ensuring that the plant-based leather market can credibly meet its ethical promise through data-driven verification.

- AI-driven material discovery: Accelerating the identification and simulation of optimal plant polymer blends for enhanced material performance (durability, flexibility).

- Automated bio-fabrication: Utilizing machine learning to control and optimize complex processes like mycelium fermentation, ensuring batch consistency and industrial scalability.

- Predictive feedstock analytics: Optimizing the sourcing, inventory management, and logistics of agricultural waste inputs to reduce supply chain costs and carbon footprint.

- Quality control and defect detection: Employing computer vision systems on production lines to quickly identify and reject material inconsistencies, improving yield efficiency.

- Sustainability verification through AI/Blockchain integration: Enhancing supply chain transparency and providing verifiable proof of bio-content and ethical sourcing to combat greenwashing.

DRO & Impact Forces Of Plant Based Vegan Leather Market

The Plant Based Vegan Leather Market is driven primarily by escalating global demand for ethical and sustainable consumer goods, stringent governmental regulations targeting animal welfare and plastic pollution, and significant technological breakthroughs in bio-material science that enhance performance parity with traditional leather. However, the market faces significant restraints, chiefly concerning the high initial production costs, dependency on fluctuating agricultural feedstock supply, and the challenge of achieving industrial-scale production consistency. Opportunities are expansive, centered on exploiting partnerships with fast-growing sectors like electric vehicles (EVs) and tapping into emerging markets in APAC. These dynamics generate powerful impact forces on pricing, material standardization, and competitive rivalry, pushing developers to rapidly innovate processes while managing complex resource acquisition. Ultimately, the successful navigation of these forces hinges on achieving cost-effective scalability without compromising the material’s verifiable sustainability credentials.

Drivers: Consumer ethics and regulatory pressure form the primary catalysts. The pronounced shift toward conscious consumption, particularly among millennials and Gen Z, dictates that brands must prioritize verifiable sustainability, making plant-based leather a mandatory offering for luxury and mainstream brands alike. Furthermore, regulatory frameworks, such as the EU's Green Deal and various national plastic reduction targets, implicitly favor bio-based, often biodegradable alternatives over petrochemical polymers like PVC and certain PU formulations. Technological advancements have also made these materials commercially viable, specifically through process innovations that reduce production time and increase yield, gradually closing the price gap with traditional materials. The successful demonstration of durability in demanding environments, such as automotive interiors, validates their functional viability and accelerates adoption across critical segments.

Restraints: The most critical restraint is the economic barrier: plant-based leather often commands a significant price premium compared to both animal leather and conventional synthetic alternatives, hindering mass-market penetration, particularly in price-sensitive segments. Scalability remains a technical challenge; moving from laboratory-scale perfection to continuous, large-volume manufacturing while maintaining quality consistency requires enormous capital investment and sophisticated process engineering, particularly for novel materials like mycelium. Additionally, the supply chain for specific feedstocks (e.g., specialized fungal strains or specific fruit waste streams) can be volatile and seasonally dependent, creating logistical bottlenecks and risks regarding resource security and pricing stability, demanding robust secondary sourcing strategies.

Opportunities: A massive opportunity lies in expanding into the high-growth automotive industry, where EVs are intrinsically linked to sustainability narratives and require high-performance, non-animal materials. Market penetration can also be significantly deepened through licensing agreements with established textile manufacturers, enabling rapid utilization of existing production infrastructure and circumventing the need for completely new capital expenditure. Developing materials with advanced functionalities, such as inherent anti-microbial properties or enhanced breathability, provides premium positioning and differentiation beyond mere sustainability claims. Furthermore, entering untapped consumer goods categories, such as sporting equipment and high-performance technical apparel, offers diversified revenue streams and utilizes the inherent lightweight nature of many bio-based composites.

- Drivers:

- Increasing ethical consumerism and demand for animal-free products.

- Stricter environmental regulations limiting petroleum-based textiles and promoting bio-economy.

- Corporate ESG commitments driving adoption by major fashion and automotive OEMs.

- Technological improvements leading to enhanced material performance parity (durability, texture).

- Restraints:

- High initial production and R&D costs leading to higher end-product pricing compared to conventional alternatives.

- Challenges in achieving consistent industrial scalability and meeting bulk order requirements.

- Dependence on potentially volatile and seasonal agricultural waste or feedstock supply chains.

- Perceived lack of long-term durability data for certain nascent material types compared to decades-proven animal leather.

- Opportunities:

- Strategic entry into the rapidly expanding Electric Vehicle (EV) interior component sector.

- Development of certified biodegradable or compostable material options, securing a competitive edge.

- Licensing technological patents to traditional textile manufacturers for rapid market scaling.

- Geographical expansion into high-growth APAC markets driven by rising middle-class consumer demand.

- Impact Forces:

- Intense competitive rivalry driven by material innovation (patents are critical).

- High bargaining power of major corporate buyers (OEMs) dictating price and performance standards.

- Constant pressure to standardize material testing and certification protocols (e.g., bio-content verification).

- Substitution threat from next-generation lab-grown materials or high-performance recycled plastics.

Segmentation Analysis

The Plant Based Vegan Leather Market is comprehensively segmented based on its Source Material, the Application Industry, and the geographical region of consumption and manufacturing. Source segmentation is crucial as it dictates the material's properties, cost structure, and biodegradability profile, covering areas from fruit waste and cellulose to advanced mycelium and bacterial materials. Application segmentation highlights the penetration strategies, with Fashion and Apparel holding the largest share due to early adoption and high brand visibility, while the Automotive segment is poised for the most significant growth due to long product lifecycles and high material performance requirements. Understanding these segments provides critical insights into R&D focus and market prioritization for key stakeholders, emphasizing the push toward high-performance, verifiable sustainability.

- By Source Material:

- Fruit & Agricultural Waste Derived (e.g., Pineapple, Apple, Grape, Cactus)

- Mycelium/Fungal Derived

- Tree & Leaf Fiber Derived (e.g., Cork, Teak Leaf)

- Cellulose and Bio-Polymer Derived (e.g., Bacterial Cellulose)

- By Application:

- Footwear

- Apparel (Outerwear, Jackets)

- Accessories (Handbags, Wallets, Belts)

- Automotive Interiors (Seating, Dashboard Trim)

- Upholstery and Home Furnishings

- By Distribution Channel:

- B2B Sales (Direct to Manufacturers)

- Retail Sales (Online, Specialty Stores)

Value Chain Analysis For Plant Based Vegan Leather Market

The value chain for plant-based vegan leather is complex, beginning with the highly specialized Upstream Analysis involving feedstock procurement, which is either agricultural waste collection or controlled bio-fabrication (fermentation for mycelium). This stage demands robust logistical networks and often proprietary intellectual property (IP) for material extraction and initial processing into usable polymer sheets or fibers. Midstream activities focus intensely on R&D, chemical optimization, and manufacturing—the core process of converting raw biomass into the final leather-like textile via specialized coating, tanning (chemical-free processes preferred), and texturizing. Direct channel sales often involve supplying large material volumes directly to original equipment manufacturers (OEMs) in the automotive and luxury fashion sectors, demanding stringent quality assurance and long-term supply contracts. Conversely, indirect channels rely on specialized textile distributors who cater to smaller designers and specialty brands.

Downstream analysis centers on material conversion and end-product assembly, where manufacturers cut and stitch the vegan leather into consumer goods (shoes, car seats, bags). This requires specialized training for production staff to handle the novel material properties, which may differ significantly from animal hides or PU. The distribution channel structure plays a pivotal role in market penetration. Direct distribution ensures better quality control and margin capture, typical for high-volume automotive suppliers. Indirect channels utilize global textile agents and traders, expanding reach but adding layers of cost. Consumer feedback, primarily regarding durability and long-term aesthetics, flows back up the value chain, directly influencing R&D priorities and formulation improvements.

The efficacy of the distribution channel is directly correlated with the market segment being targeted. For the premium fashion segment, transparency and certification (e.g., PETA certification, bio-content ISO standards) are paramount marketing tools used within the retail environment. For the automotive industry, the distribution channel is almost exclusively B2B, focusing on long qualification processes and technical validation documentation. The increasing trend of digitally native vertical brands (DNVBs) adopting plant-based leather necessitates a strong indirect distribution through e-commerce platforms and specialized, ethically focused marketplaces, maximizing the visibility of the sustainable material story.

Plant Based Vegan Leather Market Potential Customers

The primary potential customers and end-users of plant-based vegan leather materials are large, established consumer brands that possess robust corporate sustainability mandates, particularly within high-visibility industries. Luxury Fashion Houses represent a critical segment, motivated by brand image, ethical sourcing, and the high-margin potential of premium sustainable lines; they require materials that offer sophisticated texture, drape, and color fidelity. Automotive OEMs, especially those focused on Electric Vehicles (EVs) and premium internal combustion engine (ICE) models, are massive volume buyers demanding superior abrasion resistance, flame retardancy, and UV stability for long-term interior use. Their purchasing decisions are driven by high technical specifications and long-term consistency in supply.

Beyond these major segments, high-growth niche markets are emerging as significant buyers. Specialty Footwear Brands, particularly those focusing on athletic or outdoor performance gear, are seeking lightweight, breathable, and water-resistant vegan alternatives. Home Furnishing and Upholstery manufacturers represent a promising, high-volume segment, requiring materials that are easy to clean, highly durable against wear, and meet stringent flammability standards. Additionally, smaller, Direct-to-Consumer (DTC) ethical brands and sustainable startup apparel companies constitute an important customer base, often favoring materials derived from localized waste streams to support their regional sustainability narrative, requiring smaller, customized batch orders.

In essence, the ideal customer profile combines a high volume demand with a strategic commitment to ESG criteria, coupled with the ability to absorb the current cost premium associated with novel bio-materials. These customers act as market validators, leveraging the material in highly scrutinized public products (like a flagship car model or a high-profile fashion collection), which in turn accelerates broader market acceptance and helps manufacturers achieve the economies of scale necessary to drive down overall production costs for future buyers. Focusing marketing efforts on brands with net-zero commitments or strong anti-cruelty policies yields the highest conversion rates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $1,800 Million |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ananas Anam (Pinatex), MycoWorks, Bolt Threads (Mylo), Desserto (Cactus Leather), Fruitleather Rotterdam, Natural Fiber Welding, Ecovative Design, Treekind, Adriano di Marti, Beyond Leather Materials, MIRUM, Kering, VitroLabs, MuSkin, Modern Meadow, Polybion, Malai Biomaterials, Vegea, Zvook, Pyrus Leather. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plant Based Vegan Leather Market Key Technology Landscape

The technological landscape of the Plant Based Vegan Leather Market is highly fragmented and characterized by intensive intellectual property development across two primary domains: maximizing agricultural waste utilization and pioneering advanced bio-fabrication methods. For waste utilization technologies (e.g., Pinatex, Desserto), the innovation focuses on chemical-free or low-toxicity extraction of cellulosic and pectin fibers, followed by complex polymer matrix stabilization to achieve leather-like strength and flexibility. Key advancements include proprietary physical and mechanical processing methods that replace harsh chromium tanning processes with bio-based cross-linking agents, improving the material’s overall life cycle assessment (LCA) scores. These technologies are crucial for reducing the reliance on petrochemical inputs and ensuring the final product meets stringent biodegradability standards.

The cutting edge of technology resides in bio-fabrication, particularly Mycelium-based Leather (e.g., Mylo, MycoWorks). This method utilizes controlled fermentation where fungal root structures are grown into dense, customizable sheets. Technological breakthroughs here center on controlling the fungal strain genetics, optimizing the nutrient medium, and developing bioreactor designs that facilitate rapid, consistent growth across large surface areas. Advanced monitoring systems, often utilizing AI and computational fluid dynamics (CFD), are essential for maintaining the ideal microenvironment, thereby ensuring the structural uniformity and reducing batch-to-batch variation, which is critical for securing large contracts from sectors like automotive. Successful scale-up of these fermentation processes represents the single greatest technological hurdle and opportunity.

A third area involves the development of hybrid materials and next-generation coating technologies. While the base material is plant-derived, often a final coating is necessary to achieve high water resistance, scuff resistance, and coloration retention. Innovation is shifting away from traditional petrochemical Polyurethane (PU) coatings towards high-performance, water-based, and bio-derived coatings formulated from sources like algae or specialized plant oils. The integration of nanotechnology is also being explored to embed functionalities, such as inherent anti-UV properties or self-cleaning surfaces, without compromising the material’s bio-content percentage. These composite technology strategies are vital for overcoming previous material limitations and achieving full functional parity with traditional premium leather products.

- Mycelium Bio-fabrication: Controlled fermentation of fungal strains (mycelium) to grow durable, customizable, sheet materials requiring minimal processing, optimizing speed and reducing infrastructure footprint.

- Agricultural Waste Conversion (AWC): Proprietary mechanical and enzymatic processes to isolate and stabilize fibers (e.g., pineapple leaf fibers, cactus fibers) into resilient polymer substrates.

- Non-Toxic Cross-linking Agents: Replacing traditional chrome or heavy-metal tanning chemicals with bio-based, low-impact agents to stabilize the material structure and enhance durability.

- Bio-derived Coating Technology: Development of high-performance, water-based polyurethane alternatives sourced from plants or algae to provide crucial abrasion resistance and water repellency while maintaining a high bio-content ratio.

- Digital Manufacturing and Monitoring: Use of IoT sensors and AI in bioreactors to ensure batch consistency and optimize growth parameters, facilitating industrial scalability and lowering production costs.

Regional Highlights

The global Plant Based Vegan Leather Market exhibits varied dynamics across key geographical regions, driven by different regulatory environments, consumer wealth, and manufacturing capacities. North America, particularly the United States, represents a highly lucrative market characterized by strong consumer brand influence, substantial R&D investment, and a mature ethical consumer base willing to pay a premium for certified sustainable goods. The region is a major hub for collaborations between Silicon Valley bio-material startups and established fashion and tech companies, prioritizing novel, high-tech derived materials like mycelium-based products. Furthermore, increasing regulatory focus on carbon emissions and product transparency supports market growth, making it a critical area for early-stage commercialization.

Europe stands as the current market leader in adoption volume and diversity, anchored by its strict environmental policies (EU Green Deal) and the concentrated presence of global luxury goods manufacturers. European brands are keen to integrate plant-based leathers not merely as an ethical alternative but as a foundational element of their commitment to sustainable luxury, driving demand for materials with the highest aesthetic quality and verifiable LCA scores. Countries like Italy, a traditional leather manufacturing powerhouse, are rapidly transitioning their expertise into advanced bio-material finishing and texturizing, focusing on materials derived from wine and fruit waste (Vegea, AppleSkin), leveraging regional agricultural abundance. Government incentives for bio-economy investment further solidify Europe’s pioneering role.

The Asia Pacific (APAC) region is poised to be the fastest-growing market throughout the forecast period. While traditional manufacturing reliance on low-cost synthetics remains, rapid urbanization, growing middle-class wealth, and increasing domestic awareness of environmental issues (especially air and water pollution associated with traditional tanneries) are shifting consumer preferences. Countries like China and India, major production centers for footwear and apparel, are starting to incorporate locally sourced agricultural waste materials into their supply chains to meet both domestic ethical demand and stringent export requirements from Western buyers. The scalability of manufacturing infrastructure in APAC provides immense potential for mass production once cost efficiencies are fully achieved in bio-material synthesis.

- North America: Dominant in R&D investment, high consumer purchasing power for premium sustainable goods, strong early adoption of cutting-edge materials (e.g., Mycelium). Focus on high-performance automotive and luxury goods applications.

- Europe: Current market volume leader, driven by stringent EU environmental regulations, strong presence of luxury fashion houses, and established supply chains for high-quality fruit/wine waste-derived materials. Emphasis on LCA certification and circularity.

- Asia Pacific (APAC): Fastest growing region, fueled by expanding manufacturing capacity, rising domestic ethical consumerism, and increasing efforts by local governments to support bio-based material production (especially in China and India).

- Latin America: Emerging market with strong potential, particularly leveraging local agricultural waste (e.g., cactus leather from Mexico), focusing on regional supply chain independence and unique material aesthetics.

- Middle East & Africa (MEA): Growth driven primarily by luxury brand retail demand in the GCC countries and sustainability initiatives linked to new smart city developments, requiring imported bio-materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plant Based Vegan Leather Market.- Ananas Anam (Pinatex)

- MycoWorks

- Bolt Threads (Mylo)

- Desserto (Cactus Leather)

- Fruitleather Rotterdam

- Natural Fiber Welding

- Ecovative Design

- Treekind

- Adriano di Marti

- Beyond Leather Materials

- MIRUM (Natural Fiber Welding)

- Kering (Investor/Adopter)

- VitroLabs

- MuSkin

- Modern Meadow

- Polybion

- Malai Biomaterials

- Vegea

- Zvook

- Pyrus Leather

Frequently Asked Questions

Analyze common user questions about the Plant Based Vegan Leather market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary raw materials used to produce plant-based vegan leather?

The primary raw materials include specialized agricultural waste products such as pineapple leaf fibers, apple pomace, grape skins, and cactus fibers. Advanced alternatives also utilize controlled bio-fabrication techniques involving fungal mycelium (the root structure of mushrooms) and bacterial cellulose, processed into flexible sheets.

Is plant-based vegan leather truly more sustainable than synthetic PU leather?

Generally, yes. Plant-based options often have significantly lower carbon footprints and reduced reliance on fossil fuels compared to synthetic Polyurethane (PU) and Polyvinyl Chloride (PVC) leathers. Sustainability is enhanced further when the material is certified biodegradable or compostable, particularly if it uses bio-based, non-toxic coatings instead of traditional chemical finishes.

What is the durability and lifespan of plant-based leather compared to animal hide?

Durability varies by source material and manufacturing process. Mycelium-based and certain specialized agricultural waste leathers (like Desserto) are engineered to meet or exceed the performance metrics (abrasion resistance, tensile strength) required for high-stress applications like automotive interiors and footwear, demonstrating comparable lifespan to quality animal hide leather under standard usage.

Which application segment holds the largest share in the plant-based vegan leather market?

The Fashion and Apparel Accessories segment (including footwear and handbags) currently holds the largest market share. This dominance is driven by high-profile brand adoption, relatively shorter material testing cycles compared to the automotive industry, and strong consumer demand for ethically sourced, fashion-forward products.

How is the scalability challenge being addressed for novel plant-based materials like mycelium?

Scalability is being addressed through massive private investments in advanced bioreactor technologies and optimizing fermentation processes using Artificial Intelligence (AI) and Machine Learning (ML). These innovations aim to standardize batch quality and significantly increase the output volume, moving production from pilot plant scale to continuous, industrial-level manufacturing suitable for global supply chains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager