Plant Engineering Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433417 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Plant Engineering Software Market Size

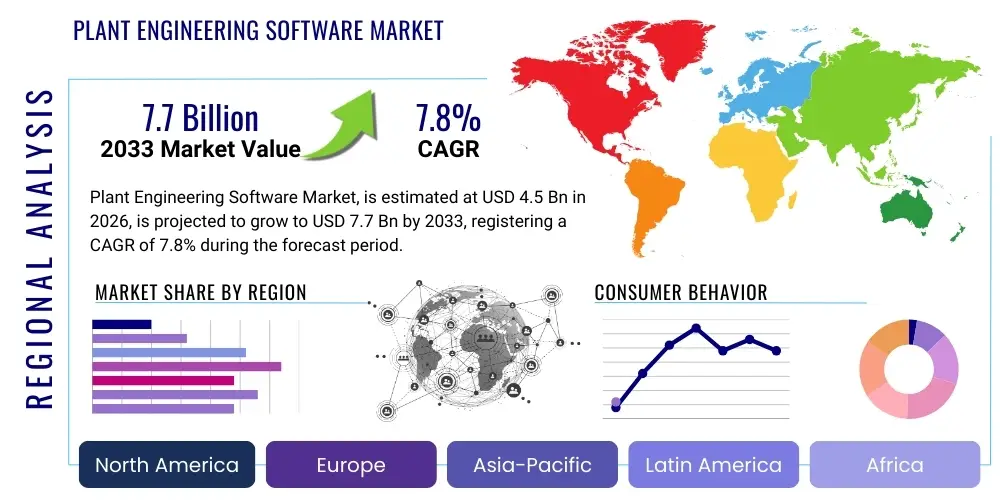

The Plant Engineering Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Plant Engineering Software Market introduction

Plant Engineering Software (PES) encompasses a suite of specialized digital tools designed to support the entire lifecycle of industrial facilities, power plants, chemical processing units, and manufacturing complexes. These tools are critical for enhancing productivity, ensuring compliance, and reducing the total cost of ownership (TCO) associated with large-scale projects. Core functionalities of PES include 3D modeling and design (CAD), process simulation, project management, asset performance management (APM), and sophisticated documentation control, all tailored to the rigorous demands of infrastructure and heavy industry. The primary objective of implementing PES solutions is to streamline workflows from conceptual design through commissioning and handover, minimizing errors and maximizing operational efficiency.

Major applications of PES span various capital-intensive sectors, including Oil & Gas, Energy & Utilities, Chemicals, Pharmaceuticals, and Discrete Manufacturing. In the energy sector, for instance, PES is vital for designing complex piping systems, optimizing heat exchanger performance, and simulating transient fluid dynamics within power generation facilities. The inherent benefits derived from adopting these systems include accelerated time-to-market for new assets, improved collaboration among multidisciplinary engineering teams located globally, and robust risk mitigation through advanced simulation and visualization capabilities. Furthermore, regulatory adherence, particularly concerning safety standards and environmental mandates, is significantly simplified and auditable using integrated PES platforms.

The primary driving factor behind the sustained growth of the PES market is the accelerating pace of global industrial digitalization, often referred to as Industry 4.0. The demand for highly customized, efficient, and sustainable industrial assets necessitates sophisticated planning and execution tools that traditional methodologies cannot provide. Coupled with the rising complexity of mega-projects, especially in emerging economies requiring new infrastructure build-out, the reliance on advanced PES for detailed engineering, procurement, and construction (EPC) management becomes indispensable. The push towards integrating Digital Twins and Building Information Modeling (BIM) principles into plant operations further solidifies the market's trajectory.

Plant Engineering Software Market Executive Summary

The Plant Engineering Software Market is experiencing a pivotal shift driven by the transition from traditional perpetual licensing models to cloud-based Software-as-a-Service (SaaS) subscriptions, significantly lowering the barrier to entry for smaller engineering firms and facilitating rapid deployment across multinational corporations. Key business trends indicate a strong focus on platform integration, enabling seamless data flow between design, procurement, and operational phases. Vendors are heavily investing in modular solutions that offer specialized capabilities such as advanced fluid dynamics (CFD) and finite element analysis (FEA), integrating these into unified engineering environments to support comprehensive digital thread initiatives. Mergers and acquisitions remain a central strategy for major players seeking to expand their technological portfolios, particularly in areas related to Artificial Intelligence (AI) and Machine Learning (ML) for optimization and predictive maintenance.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive infrastructure investments in China, India, and Southeast Asia, coupled with substantial governmental initiatives to modernize manufacturing capabilities and address increasing energy demands. North America and Europe, while mature, maintain leadership in terms of technological innovation and high-value project execution, driving demand for advanced digital twin functionalities and stringent cybersecurity features. Regional trends also reflect varying regulatory environments; European companies prioritize sustainable design parameters using PES, while North American firms focus on modular construction and rapid project scaling, necessitating flexible software solutions.

Segment trends reveal that the Services segment, encompassing consulting, implementation, and maintenance, is growing faster than the core Software segment, reflecting the complexity of integrating these advanced platforms into legacy IT infrastructures and the constant need for customized user training. Within deployment, the Cloud-based segment is expected to outpace On-Premise installations due to advantages in scalability, reduced upfront capital expenditure, and enhanced remote collaboration capabilities essential for globally distributed EPC projects. Furthermore, the Process Industries sector (Oil & Gas, Chemicals) remains the largest end-user segment, although the discrete manufacturing sector is rapidly adopting PES solutions to manage sophisticated automated production lines and factory layouts, demanding software that supports both physical asset design and operational technology (OT) integration.

AI Impact Analysis on Plant Engineering Software Market

User queries regarding AI's influence on Plant Engineering Software frequently revolve around its practical application in automating design validation, optimizing plant layouts, and enhancing predictive asset reliability. Users are keen to understand how AI can move beyond simple data analysis to become a generative tool—generating multiple feasible design iterations based on performance constraints and cost criteria. Concerns often surface regarding the reliability of AI-driven simulations, the security of proprietary data used for model training, and the displacement of human engineering expertise. Expectations are high for AI to significantly reduce project timelines, minimize human errors during complex documentation and compliance checks, and create truly self-optimizing industrial assets. The key themes summarized across user queries point towards AI as a transformative force shifting PES from descriptive modeling tools to prescriptive and autonomous engineering platforms.

The implementation of Artificial Intelligence and Machine Learning algorithms is fundamentally changing how engineering decisions are made, shifting the focus from manual iteration to data-driven optimization. AI-powered generative design tools can rapidly explore millions of design possibilities for equipment placement or piping routing, identifying configurations that maximize throughput while minimizing material usage, a task impractical for human engineers alone. Furthermore, in the operational phase, ML models analyze vast streams of sensor data from industrial assets, integrated via the Digital Twin, to predict equipment failure with high accuracy, transforming routine maintenance into proactive, condition-based upkeep, thereby drastically reducing unplanned downtime and improving safety metrics across the facility lifecycle.

This integration demands that PES providers offer robust, scalable platforms capable of handling large datasets and integrating with external data sources like weather patterns or commodity prices to inform design decisions and operational adjustments in real-time. The primary competitive advantage for vendors will lie in the quality and relevance of the domain-specific AI models they embed within their software suites, moving beyond generic machine learning applications to specialized tools trained on decades of engineering best practices and failure mode data. This technological evolution not only enhances the capability of the software but also necessitates a new skill set among plant engineers, focusing on validation and interpretation of AI outputs rather than routine drawing and calculation tasks.

- Generative Design: AI automates the creation of optimal plant layouts and component designs based on performance constraints.

- Predictive Maintenance: Machine Learning models analyze sensor data within Digital Twins to forecast equipment failure, minimizing operational downtime.

- Automated Compliance and Validation: AI rapidly scans design specifications against regulatory standards and internal requirements, ensuring immediate adherence.

- Intelligent Project Scheduling: Algorithms optimize EPC timelines by simulating resource allocation and identifying potential bottlenecks proactively.

- Knowledge Extraction: AI extracts insights from legacy engineering documents and unstructured data, enhancing knowledge transfer and reuse.

DRO & Impact Forces Of Plant Engineering Software Market

The Plant Engineering Software market is primarily driven by the mandatory shift towards digitalization across heavy industries, fueled by global initiatives like Industry 4.0 and the increasing demand for operational efficiency and environmental sustainability. Restraints often include the significant initial capital expenditure required for purchasing licenses and implementing the complex software suites, alongside the inherent resistance to change within conservative industrial environments. Opportunities abound in the rapid adoption of cloud computing for enhanced collaboration and scalability, and the lucrative potential in providing specialized software solutions tailored to emerging sectors such as hydrogen production, carbon capture, and advanced pharmaceutical manufacturing. These combined forces shape the market trajectory, rewarding vendors who prioritize user experience, integration capabilities, and flexible deployment models.

Drivers: The growing complexity of large-scale infrastructure projects, particularly those involving multidisciplinary teams spread across different continents, necessitates standardized and integrated PES solutions to ensure data integrity and project alignment. Furthermore, regulatory pressures demanding stricter safety protocols, detailed hazard analysis, and comprehensive life-cycle documentation (especially in highly regulated sectors like nuclear and chemical processing) enforce the adoption of advanced engineering tools capable of maintaining an auditable digital record. The economic benefit of reducing rework costs, which can constitute a significant percentage of project budgets, provides a compelling financial driver for high-fidelity simulation and 3D modeling tools provided by PES platforms.

Restraints: High costs remain a major impediment, particularly for small and medium-sized engineering enterprises (SMEs) that struggle with the initial investment in top-tier software licenses, specialized hardware requirements, and ongoing training fees. Integration challenges also pose a significant restraint; PES often needs to interface with existing legacy Enterprise Resource Planning (ERP) systems, Manufacturing Execution Systems (MES), and proprietary control systems, which can lead to complex and costly customization processes. Additionally, cybersecurity concerns related to housing sensitive intellectual property (IP) and operational data on cloud-based platforms sometimes slow the adoption rate among highly security-conscious end-users, despite strong protective measures implemented by vendors.

Opportunities: The transition towards modular and prefabricated construction techniques creates a substantial opportunity for PES that specializes in optimizing interfaces and logistics for off-site fabrication. The proliferation of the Industrial Internet of Things (IIoT) provides a vast data ecosystem that, when paired with advanced PES like Digital Twins, enables revolutionary post-commissioning services focused on real-time optimization and predictive analytics. Geographical expansion into fast-growing markets, notably in the Middle East and Africa (MEA) and specific emerging Asian nations undergoing massive industrialization efforts, offers untapped revenue streams for vendors capable of adapting their solutions to local engineering standards and infrastructure needs. The development of user-friendly, low-code/no-code interfaces is also an emerging opportunity to broaden the accessibility of complex engineering tools.

- Drivers (D): Industry 4.0 Adoption; Increased complexity of global capital projects; Stringent regulatory requirements for safety and environmental compliance; Demand for reduced project lifecycle costs.

- Restraints (R): High initial implementation cost and training requirements; Challenges in integrating with existing legacy systems (IT/OT convergence); Cybersecurity risks associated with cloud deployment of sensitive IP.

- Opportunity (O): Expanding adoption of cloud-based SaaS models; Growth in emerging economies driving infrastructure development; Integration with BIM and Digital Twin technologies; Demand for specialized tools in renewable energy and sustainable engineering.

- Impact Forces: Technological advancements (AI/ML integration) exert high positive impact; Economic stability and capital project spending directly influence market demand (medium impact); Availability of skilled personnel (low-medium negative impact).

Segmentation Analysis

The Plant Engineering Software Market is comprehensively segmented based on component, deployment type, and end-user industry, reflecting the diverse needs of the global engineering and construction sector. Analyzing these segments provides crucial insights into market dynamics, expenditure patterns, and technological preferences. The core segmentation is designed to differentiate between the sale of the core software application itself and the necessary accompanying professional services, recognizing that the latter often represents a recurring and high-margin revenue stream crucial for market stability and customer retention. Deployment segmentation highlights the ongoing migration from traditional on-premise installations to highly flexible, scalable cloud architectures.

The Component segmentation differentiates between Software and Services. The Software segment includes core applications such as 3D CAD, Process Simulation (including FEA and CFD), and Project Lifecycle Management (PLM) tools. The Services segment, conversely, covers critical activities such as implementation, consulting, system integration, data migration, and ongoing maintenance and support. This service component is becoming increasingly vital as plants seek full lifecycle support, from initial design optimization through to operational integrity management, requiring continuous technical support and customized engineering workflows tailored to specific plant requirements and compliance mandates.

End-user industry segmentation clearly divides the market into Process Industries (e.g., Oil & Gas, Power, Chemicals, Water Treatment) and Discrete Manufacturing (e.g., Automotive, Aerospace, Industrial Machinery). Process industries historically dominate the market due to the high complexity and safety risks associated with fluid and material handling, necessitating specialized software for pipe routing, pressure vessel design, and process optimization. However, the Discrete Manufacturing sector is increasingly adopting sophisticated PES for factory planning, layout optimization, and integrating production machinery into a cohesive digital factory model, driving faster growth in specialized sub-segments focused on modular assembly and robotics integration.

- Component:

- Software (CAD, 3D Modeling, Simulation, PLM)

- Services (Consulting, System Integration, Implementation, Maintenance, Support)

- Deployment Type:

- On-Premise

- Cloud-based (SaaS)

- End-User Industry:

- Process Industries (Oil & Gas, Chemicals & Petrochemicals, Power Generation, Pharmaceuticals, Water & Wastewater)

- Discrete Manufacturing (Automotive, Aerospace & Defense, Industrial Equipment)

Value Chain Analysis For Plant Engineering Software Market

The value chain for the Plant Engineering Software Market begins with upstream activities focused on core research and intellectual property development, where major vendors invest heavily in cutting-edge simulation algorithms, user interface development, and cloud infrastructure integration capabilities. Upstream suppliers are predominantly high-technology R&D labs and strategic partnerships with universities and specialized data analytics firms that provide the foundational technologies, such as advanced solvers for fluid dynamics or machine learning libraries for predictive modeling. Successful upstream strategy hinges on rapid innovation cycles and the ability to acquire or develop proprietary technological differentiators that offer superior performance or unique features, such as seamless integration of BIM data into operational Digital Twins.

The midstream segment involves the actual software manufacturing, packaging, and integration—where the software product is finalized, tested, and bundled with deployment tools and technical documentation. A crucial element here is the role of system integrators and value-added resellers (VARs), who customize the standard software package to meet specific client requirements, manage data migration from legacy systems, and provide initial user training. Direct distribution channels, typically used by the largest vendors for global accounts, ensure maximum control over the client relationship and pricing. Indirect channels leverage regional distributors and specialized engineering consulting firms, particularly effective in reaching smaller enterprises and niche geographic markets, providing localized support essential for complex software deployment.

Downstream activities center around the end-user deployment and post-implementation support. This includes ongoing maintenance subscriptions, software upgrades, and crucial professional services like performance auditing and operational data analysis. For plant owners and EPC firms, the value realization occurs downstream, driven by the software's ability to reduce project delays, improve asset performance, and ensure regulatory compliance throughout the plant's operational lifetime. Strong after-sales support and proactive customer engagement are essential for retaining subscription revenue and driving upgrades, completing the high-value lifecycle loop. The overall value chain is highly specialized, demanding deep technical knowledge at every stage, from algorithm development to end-user consultation.

Plant Engineering Software Market Potential Customers

The primary customers for Plant Engineering Software are organizations involved in the conceptualization, design, construction, and operation of capital-intensive industrial assets. These include large multinational Engineering, Procurement, and Construction (EPC) firms, who utilize PES extensively for project execution, cost estimation, risk management, and 3D modeling of complex systems. EPC firms are heavy consumers of both design software and project management suites, seeking integrated platforms that enhance collaboration between geographically dispersed teams and accelerate project delivery while maintaining stringent quality control and safety standards. Their purchasing decisions are often driven by vendor reputation, software interoperability, and the ability to handle massive project scale.

Another major buyer segment comprises Plant Owners and Operators, particularly in the Oil & Gas, Chemical, and Power generation sectors. For these end-users, the purchase driver shifts from project design to asset integrity management and operational excellence. They seek PES solutions that integrate with their existing operational technology (OT) systems to create accurate Digital Twins of their facilities. These Digital Twins are used for predictive maintenance, process optimization, operator training, and simulation of modifications without disrupting live operations, providing continuous value long after the initial construction phase is complete. The focus for these customers is on reliability, data security, and long-term total cost of ownership (TCO).

Beyond these primary groups, government bodies responsible for regulating infrastructure and environmental compliance, independent design consultants, and academic research institutions also represent significant, albeit smaller, segments of potential customers. Consultants often leverage specialized simulation software to advise clients on process improvements or regulatory compliance. Furthermore, the increasing adoption by discrete manufacturers, especially in sophisticated sectors like semiconductor fabrication and complex machinery production, is expanding the customer base by seeking tools to optimize factory floor layout, workflow, and robotic cell integration for higher production efficiency and flexibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AVEVA Group Plc, Siemens AG, Autodesk Inc., Bentley Systems, Dassault Systèmes SE, Hexagon AB, Intergraph Corporation, Nemetschek Group, SAP SE, Oracle Corporation, Aspen Technology Inc., Yokogawa Electric Corporation, Rockwell Automation, EPLAN Software & Service GmbH & Co. KG, Trimble Inc., COADE Inc., CADISON, General Electric, Schneider Electric, Comos Industry Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plant Engineering Software Market Key Technology Landscape

The Plant Engineering Software Market is defined by a rapidly evolving technological landscape, with several key innovations reshaping how industrial assets are designed, built, and operated. Building Information Modeling (BIM) principles, traditionally confined to commercial architecture, are now deeply integrated into plant engineering, providing a structured, data-rich approach to 3D modeling that enhances collaboration and minimizes clashes during the design phase. This shift ensures that all project stakeholders work with a consistent, validated data model throughout the EPC process. Concurrently, the proliferation of cloud computing and Software-as-a-Service (SaaS) delivery models has democratized access to high-performance computing resources, enabling small and mid-sized firms to utilize complex simulation tools (like CFD and FEA) previously restricted to large corporations, thereby accelerating innovation across the industry.

Perhaps the most significant technological development is the maturation and widespread deployment of the Digital Twin. A Digital Twin is a virtual replica of a physical plant asset, continuously updated with real-time data from Industrial Internet of Things (IIoT) sensors, allowing operators to run "what-if" scenarios, optimize performance, and predict failures in a safe, simulated environment. This technology bridges the gap between the engineering design phase and the operational phase, ensuring that engineering data remains relevant and actively utilized throughout the plant's 30-40 year lifespan. Furthermore, the integration of Virtual Reality (VR) and Augmented Reality (AR) tools is transforming visualization and training, enabling immersive plant walkthroughs for safety checks, construction planning, and sophisticated maintenance procedures without requiring physical presence on site, significantly reducing travel time and operational risks.

Cybersecurity features are increasingly becoming a standard component of modern PES, addressing the critical vulnerability introduced by integrating operational technology (OT) with traditional IT systems. Secure data exchange protocols, robust access controls, and encryption are now mandatory components, particularly for cloud-hosted solutions handling sensitive infrastructure data. Additionally, the shift toward modular design and off-site fabrication is promoting the adoption of advanced material management and logistics optimization software, often leveraging predictive analytics and geospatial mapping. These technologies collectively enable more agile, cost-effective, and safe project delivery, setting a new benchmark for efficiency in capital projects worldwide, driving competition based on the depth of technological features offered.

Regional Highlights

- Asia Pacific (APAC): APAC is the projected leader in market growth, driven by substantial national investment in infrastructure, power generation (both conventional and renewable), and the expansion of manufacturing capabilities in nations like China, India, and Vietnam. The region's rapid industrialization necessitates the deployment of advanced PES to manage complex mega-projects efficiently and meet escalating domestic energy demand. Government initiatives supporting smart city development and sustainable industrial practices further bolster demand, especially for cloud-based and BIM-integrated solutions.

- North America: North America holds a dominant market share in terms of technology adoption and expenditure on high-end PES, particularly driven by the Oil & Gas sector and stringent regulatory environments that demand high-fidelity simulation and detailed compliance documentation. The region is a pioneer in the deployment of sophisticated Digital Twin technologies and advanced predictive analytics, with a high concentration of key software vendors and a strong focus on utilizing PES for complex, capital-intensive projects and rapid technological upgrades.

- Europe: The European market is characterized by a strong emphasis on sustainability, energy transition (renewable and hydrogen projects), and adherence to strict environmental regulations. This drives demand for PES capable of optimizing design for maximum energy efficiency and minimizing carbon footprint. Germany and the UK are major contributors, emphasizing integrated engineering workflows (BIM and PLM integration) and favoring SaaS models that support cross-border engineering collaboration across the European Union.

- Latin America (LATAM): Market growth in LATAM is more moderate but steady, focused mainly on modernizing existing industrial infrastructure, particularly in resource-rich nations like Brazil and Mexico. The adoption is often project-driven, with strong preference for cost-effective solutions and locally supported service models. The increasing investment in mining and oil infrastructure drives the necessity for robust plant design and asset management software.

- Middle East and Africa (MEA): The MEA market is heavily influenced by large-scale oil and gas projects and national diversification strategies aimed at developing non-petroleum industrial sectors, such as manufacturing and tourism infrastructure (e.g., Saudi Arabia’s Vision 2030). These ambitious mega-projects require leading-edge PES for rapid, large-scale deployment and long-term asset management, creating significant opportunities for vendors specializing in complex EPC project management suites.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plant Engineering Software Market.- AVEVA Group Plc

- Siemens AG

- Autodesk Inc.

- Bentley Systems

- Dassault Systèmes SE

- Hexagon AB

- Intergraph Corporation

- Nemetschek Group

- SAP SE

- Oracle Corporation

- Aspen Technology Inc.

- Yokogawa Electric Corporation

- Rockwell Automation

- EPLAN Software & Service GmbH & Co. KG

- Trimble Inc.

- COADE Inc.

- CADISON

- General Electric (GE Digital)

- Schneider Electric

- Comos Industry Solutions

Frequently Asked Questions

Analyze common user questions about the Plant Engineering Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Plant Engineering Software (PES) and standard CAD software?

PES is highly specialized and encompasses the entire lifecycle of an industrial asset, integrating 3D modeling (CAD) with data management, process simulation, equipment specifications, materials management, and regulatory compliance checks. Standard CAD is primarily a geometric drafting tool, whereas PES is a comprehensive, data-centric solution built specifically for complex industrial process design and engineering workflows.

How is the adoption of Digital Twins influencing the Plant Engineering Software Market?

Digital Twin adoption is transitioning PES from purely design-focused tools to essential operational tools. By integrating real-time sensor data, the Digital Twin extends the lifespan value of the engineering model, enabling predictive maintenance, operational optimization, and simulation of modifications before they are implemented in the physical plant, thereby driving higher demand for specialized APM and integration services.

Which deployment model (On-Premise vs. Cloud) is showing the fastest growth in the PES market?

Cloud-based (SaaS) deployment is exhibiting the fastest growth. Cloud models offer superior scalability, reduced upfront capital expenditure, simplified maintenance, and critically, enhanced remote collaboration capabilities essential for global EPC projects. While security-sensitive industries still maintain on-premise solutions, the economic and operational advantages of SaaS are accelerating the shift toward cloud architectures.

What role does Artificial Intelligence play in modern Plant Engineering Software?

AI is integrated into PES primarily for optimization and automation. This includes generative design, where AI suggests optimal plant layouts based on constraints, and predictive maintenance within Digital Twins. AI also automates tedious tasks like clash detection, design validation against compliance codes, and intelligent scheduling, significantly reducing project timelines and engineering errors.

What are the key challenges preventing broader adoption of Plant Engineering Software among SMEs?

The primary challenges for Small and Medium-sized Enterprises (SMEs) are the high initial licensing costs and the complexity of integration with existing IT infrastructure. However, the rise of modular, subscription-based cloud solutions (SaaS) is helping to mitigate these financial barriers by offering pay-as-you-go models and reducing the need for extensive in-house IT support and specialized hardware.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager