Plant Extraction Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431459 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Plant Extraction Equipment Market Size

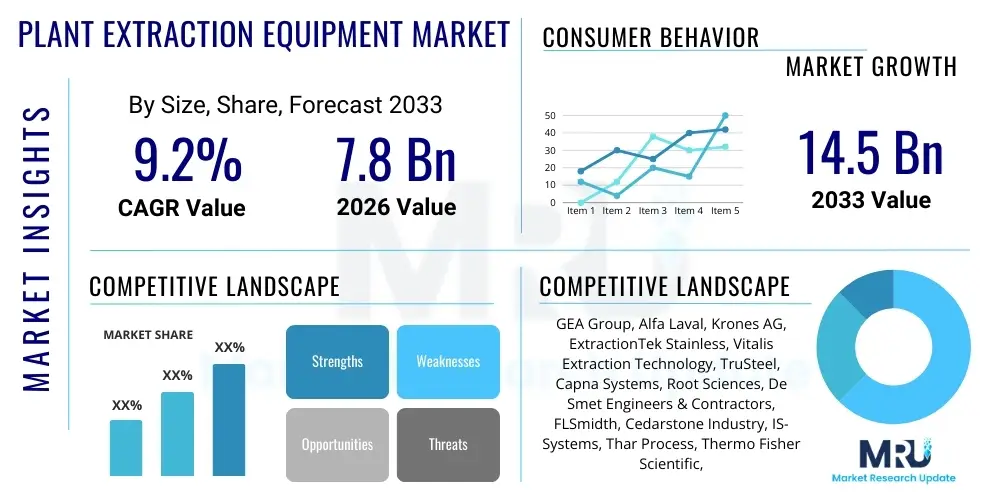

The Plant Extraction Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at USD 7.8 Billion in 2026 and is projected to reach USD 14.5 Billion by the end of the forecast period in 2033.

Plant Extraction Equipment Market introduction

The Plant Extraction Equipment Market encompasses machinery and systems utilized for isolating and concentrating target phytochemicals—such as cannabinoids, essential oils, flavors, and active pharmaceutical ingredients—from raw botanical materials. These sophisticated systems are crucial for industries ranging from pharmaceuticals and nutraceuticals to cosmetics and functional foods, where the purity and potency of natural compounds are paramount. Products include technologies like supercritical CO2 extractors, ethanol extraction systems, and hydro-distillation units, each catering to specific requirements regarding solvent characteristics, operational scalability, and final product quality. The essential function of this equipment is to ensure efficient material processing while preserving the integrity of heat-sensitive compounds, driving innovation in yield optimization and solvent recovery.

Major applications of plant extraction equipment are extensively distributed across health-focused sectors. In the pharmaceutical industry, advanced extraction techniques are vital for isolating specific therapeutic agents from medicinal herbs, ensuring standardized dosing and high purity levels required for clinical applications. The burgeoning nutraceutical and dietary supplement sector relies heavily on these systems to produce concentrated botanical extracts like turmeric, ginseng, and specialized fruit polyphenols, meeting the accelerating consumer demand for natural wellness solutions. Furthermore, the global legalization and increasing commercial acceptance of cannabis and hemp derivatives have catalyzed massive investment in high-capacity, precise extraction systems, particularly those utilizing CO2 and ethanol methodologies to produce oils, isolates, and distillates.

The core benefits derived from utilizing specialized plant extraction equipment include enhanced operational efficiency, superior control over extract composition, and significant improvements in final product safety and compliance. Driving factors for market expansion include the rapid growth of the functional food and beverage market, where natural flavors and colorants are preferred over synthetic alternatives, and the stringent regulatory environment in developed economies that mandates purity testing, thereby favoring robust and traceable extraction technologies. Technological advancements, particularly in automated, closed-loop solvent recovery systems, further reduce operational costs and environmental impact, solidifying the market's positive trajectory.

Plant Extraction Equipment Market Executive Summary

The Plant Extraction Equipment Market is experiencing robust growth fueled by significant global shifts towards natural ingredient sourcing and regulatory harmonization regarding botanical derivatives, particularly in North America and Europe. Business trends indicate a strong move toward high-throughput, modular extraction systems, allowing manufacturers to quickly scale operations in response to fluctuating consumer demand for specialized extracts, such as CBD, terpenes, and high-value essential oils. Key players are focusing intensely on integrating automation and remote monitoring capabilities to enhance process repeatability and reduce labor costs. Regionally, North America continues to dominate due to the established pharmaceutical industry and the expansive, rapidly maturing cannabis market, although Asia Pacific is emerging as the fastest-growing region, driven by massive traditional medicine and nutraceutical industries in China and India. Segment trends reveal that supercritical CO2 extraction remains highly valued for its non-toxic residue profile and high purity yield, while ethanol extraction is gaining traction for large-scale, cost-effective production, reflecting a market stratification based on required purity versus operational volume.

AI Impact Analysis on Plant Extraction Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Plant Extraction Equipment Market predominantly focus on how AI can enhance process optimization, predict equipment maintenance needs, and improve the consistency and yield of botanical extracts. Common questions revolve around the implementation of machine learning algorithms for real-time monitoring of solvent flow rates, temperature, and pressure within closed-loop systems, aiming to achieve peak extraction efficiency specific to varying raw material batches. Users are highly interested in AI’s capability to analyze large datasets derived from chromatograms and spectra, predicting optimal processing parameters that maximize the yield of desired compounds while minimizing unwanted co-extracts. Furthermore, a major theme is the expectation that AI will dramatically reduce human error, allowing for fully autonomous control systems that ensure regulatory compliance and facilitate standardized global production practices across multi-site operations.

- Predictive Maintenance: AI algorithms analyze sensor data (vibration, heat, pressure) to forecast equipment failure, minimizing unplanned downtime and optimizing asset lifespan.

- Process Optimization: Machine learning identifies ideal solvent ratios, temperature profiles, and processing times specific to botanical strain and desired phytochemical outcome, maximizing yield and purity.

- Real-time Quality Control: AI integrates with spectroscopic analysis (e.g., Near-Infrared or Raman) to instantly verify extract quality and concentration during the run, reducing post-processing analysis time.

- Automated Compliance Reporting: AI systems automatically log all critical processing parameters, simplifying regulatory audits and ensuring adherence to Good Manufacturing Practices (GMP).

- Enhanced Solvent Recovery: Smart systems adjust parameters for distillation and evaporation units, maximizing solvent recycling efficiency and reducing environmental footprint.

DRO & Impact Forces Of Plant Extraction Equipment Market

The dynamic expansion of the Plant Extraction Equipment Market is fundamentally shaped by several interconnected Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. Key drivers include the escalating global consumer preference for natural and organic products, which necessitates efficient, industrial-scale botanical processing, coupled with the global trend of cannabis and hemp legalization, which mandates high-purity extraction for cannabinoid products. Major restraints involve the exceptionally high initial capital investment required for advanced equipment, especially supercritical CO2 systems, and the complexity associated with operating and maintaining these technically sophisticated systems, which requires highly specialized personnel. Significant opportunities lie in the development of modular, energy-efficient equipment tailored for smaller enterprises, the integration of advanced automation (AI/IoT) for process precision, and the untapped potential of waste valorization, extracting valuable compounds from previously discarded plant material, collectively creating a market environment highly conducive to technological advancement and consolidation.

Segmentation Analysis

The Plant Extraction Equipment Market is intricately segmented based on technology, application, plant source, and operational scale, reflecting the diverse needs of end-user industries seeking specific phytochemical profiles. Analyzing these segments provides critical insights into purchasing behaviors, investment priorities, and areas ripe for technological innovation. The technological landscape is dominated by supercritical CO2 and ethanol extraction, but emerging methods like ultrasonic and microwave-assisted extraction are disrupting niche markets by offering faster processing times and lower energy consumption for certain compound classes. Understanding these segment dynamics is crucial for manufacturers to tailor their R&D efforts and marketing strategies, ensuring that equipment specifications align with stringent regulatory requirements prevalent in pharmaceutical and high-end nutraceutical sectors.

The segmentation by application reveals a clear hierarchy of precision and scale demands. Pharmaceutical applications require the highest levels of purity and validation, often favoring CO2 or highly controlled fractional distillation setups. Conversely, the food and beverage industry often prioritizes throughput and cost-efficiency for flavor and color extracts, frequently utilizing large-scale ethanol or hydro-distillation units. The shift toward personalized medicine and highly specific nutraceutical formulations, such as those targeting specific biological pathways, is increasingly driving demand for chromatography and ancillary downstream purification equipment, thereby expanding the definition of the 'extraction equipment' market to include full separation train systems.

Furthermore, segmentation by plant source (e.g., medicinal herbs, fruits, algae) impacts design requirements, particularly concerning material handling and corrosion resistance. Processing high-moisture fruits requires fundamentally different pretreatment and extraction approaches compared to dry, dense medicinal roots. The interplay between plant chemistry and extraction technology defines market profitability; for instance, high-value, heat-sensitive terpenes require low-temperature, non-polar solvent approaches, solidifying the market position of cryogenic ethanol systems. This granular segmentation allows industry participants to target specific value chains and develop highly specialized machinery, moving beyond generic extraction solutions.

- By Technology:

- Supercritical CO2 Extraction

- Ethanol Extraction

- Hydro-distillation/Steam Distillation

- Solvent Extraction (Butane, Propane)

- Ultrasonic Assisted Extraction (UAE)

- Microwave Assisted Extraction (MAE)

- By Application:

- Pharmaceutical Industry

- Nutraceutical and Dietary Supplements

- Cosmetics and Personal Care

- Food and Beverage (Flavors and Colors)

- Aromatherapy and Essential Oils

- By Plant Source:

- Cannabis and Hemp

- Medicinal Herbs (e.g., Turmeric, Ginseng)

- Fruits and Vegetables

- Spices and Seasonings

- By Scale:

- Industrial/Commercial Scale

- Pilot/Research Scale

Value Chain Analysis For Plant Extraction Equipment Market

The value chain for Plant Extraction Equipment begins with upstream activities focused on raw material sourcing and component manufacturing. Upstream suppliers are critical and include specialized providers of high-pressure components (valves, pumps, compressors) essential for supercritical CO2 systems, precision metal fabrication companies supplying stainless steel vessels, and manufacturers of specialized heat exchangers and chillers necessary for solvent temperature control. The quality and certification of these specialized components directly dictate the safety ratings and operational lifespan of the final extraction unit. Manufacturers must maintain robust relationships with these suppliers to ensure compliance with stringent material standards, particularly ASME (American Society of Mechanical Engineers) codes for pressurized vessels, which are non-negotiable for high-pressure systems.

The middle segment of the value chain involves the original equipment manufacturers (OEMs) who design, integrate, assemble, and test the complete extraction systems. These OEMs differentiate themselves through proprietary technological advancements, such as automated control interfaces, efficient solvent recovery mechanisms, and modular system designs allowing for future scalability. Distribution channels are highly specialized, often relying on direct sales teams or highly technical, authorized distributors who possess deep knowledge of the chemical engineering required for commissioning and operational training. Given the high investment value and technical complexity, indirect distribution through non-specialized channels is rare; clients typically require comprehensive pre-sales consultation and extensive post-installation support, integrating the OEM deeply into the customer's operational success.

Downstream activities primarily involve end-user industries (pharmaceuticals, nutraceuticals, cannabis processors) utilizing the equipment to produce final extracts. Further downstream, specialized third-party services, including post-extraction purification (e.g., winterization, distillation, chromatography) and analytical testing laboratories, play crucial roles in refining the crude extract into high-purity isolates or distillates. The equipment market is highly interdependent with these downstream purification services, as the efficiency of the initial extraction dictates the complexity and cost of subsequent refinement steps. Successful value chain participation requires OEMs not only to sell equipment but often to provide consultation on process flows that maximize downstream purity and minimize overall processing time.

Plant Extraction Equipment Market Potential Customers

The primary end-users and buyers of Plant Extraction Equipment span several high-growth industries demanding standardized, high-quality botanical extracts. The largest segment of potential customers includes pharmaceutical manufacturers and contract manufacturing organizations (CMOs) focused on developing plant-derived drugs, requiring GMP-compliant, validated extraction systems capable of achieving exceptionally high purity and traceability for regulatory submissions. These organizations prioritize system reliability, validation documentation, and precision control over all process parameters, often opting for premium, highly automated equipment with extensive data logging capabilities, reflecting their commitment to therapeutic efficacy and patient safety standards.

Another major segment consists of nutraceutical companies and dietary supplement producers. These customers are driven by the consumer shift towards functional ingredients and preventative health, leading them to invest heavily in large-scale extraction capacity for popular botanicals such as antioxidants, adaptogens, and complex vitamin sources. Their key purchasing criteria center on maximizing throughput and optimizing the cost per kilogram of extract, favoring robust, high-capacity ethanol or large-scale CO2 systems that can handle significant volumes of raw plant material efficiently, balancing purity demands with economic scalability for mass-market products.

The rapidly expanding cannabis and hemp processing industry represents a uniquely specialized customer base. These extractors range from small, craft-focused operations emphasizing terpene retention and specialized extracts to massive industrial facilities producing high-purity CBD and THC isolates for global distribution. Their purchasing decisions are highly influenced by local jurisdiction requirements, throughput demands, and the desire for closed-loop systems that maximize solvent recovery and meet stringent environmental and safety standards. Furthermore, research institutions and academic laboratories focusing on phytochemistry and drug discovery also constitute a vital, albeit smaller, segment, requiring flexible, smaller-scale pilot units capable of handling diverse research applications and novel solvent methodologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.8 Billion |

| Market Forecast in 2033 | USD 14.5 Billion |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GEA Group, Alfa Laval, Krones AG, ExtractionTek Stainless, Vitalis Extraction Technology, TruSteel, Capna Systems, Root Sciences, De Smet Engineers & Contractors, FLSmidth, Cedarstone Industry, IS-Systems, Thar Process, Thermo Fisher Scientific, Heidolph Instruments, IKA Works GmbH & Co. KG, Pfaudler Group, Hitachi Zosen Corporation, CEM Corporation, Aker Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plant Extraction Equipment Market Key Technology Landscape

The technology landscape within the Plant Extraction Equipment Market is characterized by a mature portfolio of traditional methods alongside rapid innovation in specialized and environmentally conscious techniques. Supercritical CO2 (scCO2) extraction remains a benchmark technology, favored primarily by pharmaceutical and high-end nutraceutical sectors due to its ability to fractionate compounds by manipulating temperature and pressure, yielding solvent-free, highly pure extracts suitable for direct consumption or formulation. Recent technological advancements in scCO2 systems focus on automated pressure ramping, improved heat recovery efficiency, and the integration of larger, multi-vessel skids designed to significantly increase batch capacity while maintaining tight control over selectivity, addressing previous limitations related to throughput and operational speed.

Ethanol extraction represents the primary high-volume solution, particularly with the widespread adoption of cryogenic ethanol methods. Operating at extremely low temperatures (-40°C to -80°C), cryogenic ethanol significantly reduces the co-extraction of undesirable compounds like lipids, waxes, and chlorophyll, thereby simplifying the necessary downstream purification steps and greatly enhancing efficiency. Manufacturers are currently concentrating on developing highly efficient, closed-loop solvent recovery units that integrate seamlessly with the primary extraction vessel. These recovery systems utilize advanced distillation and evaporation techniques, minimizing solvent loss to below 5% per run, which is crucial for reducing operational costs and ensuring compliance with stringent safety regulations related to volatile organic compounds (VOCs).

Emerging and specialized technologies are carving out important niches by offering enhanced kinetics and targeted extraction profiles. Ultrasonic Assisted Extraction (UAE) utilizes high-frequency acoustic waves to disrupt cell walls, dramatically increasing mass transfer rates and reducing extraction time and solvent consumption, making it ideal for rapid laboratory analysis or small-scale, high-value extracts where compound degradation must be minimized. Microwave Assisted Extraction (MAE) similarly uses electromagnetic energy to heat the solvent and sample matrix internally, accelerating the process. Additionally, the increasing focus on complex phytochemical separation is driving substantial demand for ancillary technologies such as Preparative Chromatography Systems and Molecular Distillation units, which are often bundled with primary extraction equipment to offer integrated, start-to-finish processing solutions, enabling clients to produce fully refined isolates and distillates.

Regional Highlights

North America currently holds the dominant share in the Plant Extraction Equipment Market, a position cemented by the mature pharmaceutical industry, high levels of technological adoption, and, most significantly, the rapid commercialization and regulatory clarity surrounding cannabis and hemp across the United States and Canada. The region demonstrates the highest concentration of high-throughput extraction facilities, characterized by early adoption of advanced cryogenic ethanol and modular CO2 systems. Regulatory frameworks, particularly regarding food safety and cannabis product manufacturing, drive continuous investment in validation services and GMP-compliant equipment, ensuring that regional players often set the global standard for scale and quality control. Furthermore, substantial R&D expenditure by U.S.-based companies in automated process control and proprietary separation techniques maintains the region’s technological edge.

Europe represents the second-largest market, characterized by stringent quality requirements imposed by the European Medicines Agency (EMA) and a strong historical presence in the nutraceutical and essential oils sectors. Countries like Germany and Switzerland are leaders in precision engineering and pharmaceutical manufacturing, leading to a high demand for high-specification, reliable scCO2 and vacuum distillation equipment. The European market is highly focused on sustainability and efficiency, driving innovation in energy-saving and solvent recovery technologies. The recent, albeit fragmented, relaxation of rules concerning industrial hemp and CBD products has stimulated significant investment in large-scale production facilities across Central and Eastern Europe, positioning the continent for accelerated growth over the forecast period, particularly in standardized botanical medicinal products.

Asia Pacific (APAC) is projected to be the fastest-growing market, primarily fueled by the massive traditional Chinese medicine (TCM) sector in China, the burgeoning nutraceutical industry in India, and rising consumer spending on premium cosmetics across South Korea and Japan. While the region traditionally relies on basic solvent and hydro-distillation methods, there is a clear and accelerating shift toward modern, efficient technologies like supercritical CO2 and high-pressure solvent systems, driven by increasing regulatory pressures for extract standardization and purity in export-oriented manufacturing. Government initiatives supporting modernization of agricultural processing and investment in food safety infrastructure further boost the adoption rate of specialized extraction equipment across key regional economies.

- North America: Dominant market share due to cannabis legalization, established pharmaceutical R&D, and high demand for automated, high-throughput systems. Key growth in industrial hemp processing and specialized cannabinoid extracts.

- Europe: High focus on GMP compliance and sustainability; strong demand driven by essential oils, herbal medicines, and the growing regulated CBD market.

- Asia Pacific (APAC): Fastest growing; robust expansion linked to the modernization of traditional medicine, rapid growth of the nutraceutical industry, and increasing regulatory standards in China and India.

- Latin America: Emerging market potential driven by expanding agricultural base, particularly in specialty crops and the potential for medicinal cannabis cultivation in countries like Colombia and Brazil, requiring modular and cost-effective solutions.

- Middle East and Africa (MEA): Growth primarily concentrated in the pharmaceutical and cosmetic manufacturing hubs, focusing on imported, high-specification equipment for controlled substance processing and specialized botanical ingredients.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plant Extraction Equipment Market.- GEA Group

- Alfa Laval

- Krones AG

- ExtractionTek Stainless

- Vitalis Extraction Technology

- TruSteel

- Capna Systems

- Root Sciences

- De Smet Engineers & Contractors

- FLSmidth

- Cedarstone Industry

- IS-Systems

- Thar Process

- Thermo Fisher Scientific

- Heidolph Instruments

- IKA Works GmbH & Co. KG

- Pfaudler Group

- Hitachi Zosen Corporation

- CEM Corporation

- Aker Solutions

Frequently Asked Questions

Analyze common user questions about the Plant Extraction Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most widely adopted technology in the Plant Extraction Equipment Market?

Supercritical CO2 (scCO2) and Ethanol Extraction are the most widely adopted technologies. scCO2 is preferred for high-purity, solvent-free extracts in small to medium scale operations, offering compound selectivity. Ethanol extraction, particularly cryogenic methods, dominates large-scale industrial throughput due to its cost-efficiency and high recovery rates, especially for bulk oil production in the nutraceutical and cannabis sectors.

How does the legalization of cannabis impact the demand for extraction equipment?

The legalization of cannabis and hemp has exponentially increased demand for industrial-scale, specialized extraction equipment, making it a primary market driver. This regulatory shift mandates the use of validated, compliant systems capable of producing standardized oils, distillates, and isolates, ensuring consumer safety and regulatory traceability, favoring manufacturers offering certified, high-capacity machinery.

What are the primary factors determining the high cost of advanced extraction systems?

The high cost is primarily driven by the stringent material requirements (high-grade stainless steel), the necessity for specialized high-pressure components (pumps, vessels certified by bodies like ASME), and the integration of sophisticated automation, safety features, and precise temperature/pressure control systems required to ensure GMP compliance and efficient operation.

Which application segment shows the highest growth potential in the forecast period?

The Nutraceutical and Dietary Supplements segment is expected to show the highest consistent growth potential. This growth is driven by increasing global consumer awareness regarding preventive healthcare, coupled with the rising demand for natural, high-potency ingredients such as functional adaptogens, vitamins, and specialized botanical antioxidants derived through precise extraction methods.

How are key manufacturers leveraging AI and IoT in their new equipment offerings?

Key manufacturers are leveraging AI and IoT by integrating sensors and machine learning algorithms for predictive maintenance and real-time process optimization. This allows equipment to self-adjust parameters based on raw material variability, maximizing extract yield, ensuring product consistency, and providing remote diagnostics and automated compliance logging capabilities to operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager