Plant Frost Cloth Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434534 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Plant Frost Cloth Market Size

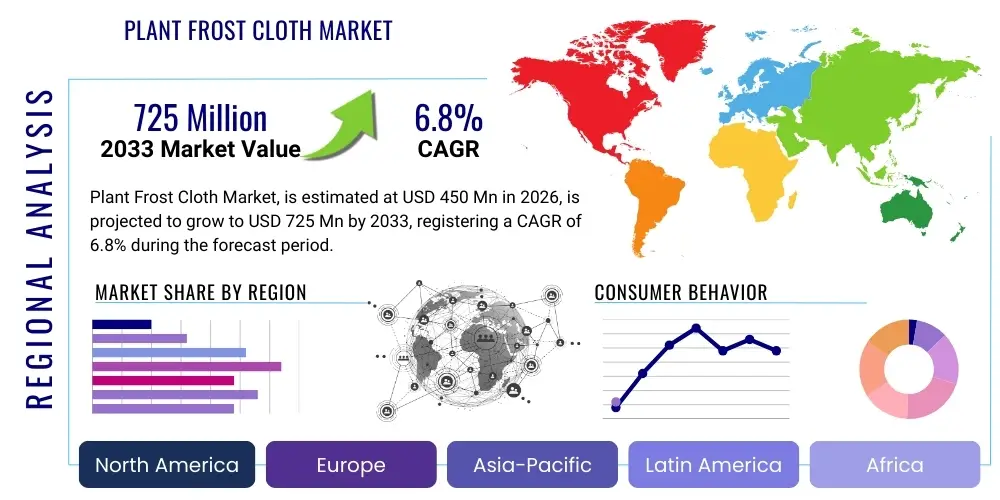

The Plant Frost Cloth Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 725 Million by the end of the forecast period in 2033.

Plant Frost Cloth Market introduction

The Plant Frost Cloth Market encompasses the production and distribution of specialized protective fabrics designed to shield crops, garden plants, and agricultural produce from damaging cold temperatures, frost, and freezing conditions. These fabrics, often made from non-woven materials such as polypropylene or polyester, act as thermal barriers, trapping heat radiated from the soil and preventing direct contact with frigid air while still allowing light, air, and moisture penetration. The primary product description centers on lightweight, durable, and UV-stabilized materials available in various thicknesses (weights) to accommodate different levels of required protection, ranging from light frost protection to severe freeze mitigation.

Major applications of plant frost cloth are widespread across the agricultural and horticultural sectors. They are critically utilized in commercial farming, especially for high-value crops like berries, citrus, and early-season vegetables, where a sudden frost can lead to complete yield loss. Furthermore, residential gardening and landscaping are rapidly emerging applications, driven by increased consumer interest in home gardening and extending the growing season. The effectiveness of these cloths in maintaining a microclimate favorable for plant survival makes them an indispensable tool in regions experiencing volatile weather patterns and unpredictable seasonal transitions.

The market benefits significantly from its ability to enhance agricultural productivity and resilience against climate change impacts. Key driving factors include the growing global demand for high-quality fresh produce year-round, increasing investment in protected agriculture (greenhouses and hoop houses), and heightened awareness among professional growers and amateur gardeners regarding climate volatility. The relatively low cost and ease of deployment associated with frost cloths, compared to mechanical heating systems, further cement their position as a preferred solution for cold weather protection in temperate and sub-tropical farming areas.

Plant Frost Cloth Market Executive Summary

The Plant Frost Cloth Market is exhibiting robust growth, propelled by strong business trends focusing on sustainable and climate-resilient agriculture. Manufacturers are increasingly investing in advanced materials engineering to produce lighter yet more thermally efficient fabrics, driving innovation in material segmentation, particularly in UV-treated and biodegradable options. Key business strategies revolve around expanding distribution networks to reach fragmented end-user segments, including small commercial farms and large retail chains catering to residential consumers. The market structure remains moderately fragmented, with specialized textile producers competing on performance specifications and cost-effectiveness, fostering continuous product refinement aimed at maximizing crop yield protection under extreme weather scenarios.

Regional trends indicate that North America and Europe currently dominate the market due to established commercial agriculture sectors and the prevalence of climate volatility necessitating reliable frost protection measures. However, the Asia Pacific region, particularly countries like China and India, is poised for the highest growth rate, fueled by expanding greenhouse cultivation, modernization of agricultural practices, and significant government initiatives supporting crop protection technologies. Latin America is also emerging as a high-potential market, driven by the need to protect delicate export crops, such as avocados and tropical fruits, from unexpected cold snaps at higher altitudes or during transitional seasons.

Segment trends highlight the dominance of the polypropylene material segment due to its excellent balance of cost, durability, and thermal performance. Concurrently, the medium-weight and heavy-weight cloth segments are gaining traction, especially in commercial applications requiring protection against severe, multi-day freezes. Application-wise, commercial farming remains the largest revenue generator, but the residential gardening segment is accelerating fastest, reflecting the pervasive shift towards decentralized food production and urban agriculture, demanding easily accessible and user-friendly frost protection solutions.

AI Impact Analysis on Plant Frost Cloth Market

Common user questions regarding AI's influence on the Plant Frost Cloth Market often center on how technology can optimize the deployment and effectiveness of physical protection measures. Users inquire about predictive frost modeling (Can AI accurately forecast micro-climate frost events?), automated deployment mechanisms (Will AI integrate with IoT sensors to deploy covers automatically?), and material optimization (Can AI analyze field data to recommend the precise cloth thickness needed?). The analysis reveals that while AI does not directly manufacture the cloth, its impact is transformative in enabling precision agriculture, ensuring that frost cloths are utilized only when and where absolutely necessary. This capability leads to reduced operational waste, labor savings, and maximized asset lifespan, shifting the frost protection strategy from reactive to predictive and intelligent, fundamentally improving the return on investment for growers.

- AI-Powered Predictive Modeling: Utilizing machine learning algorithms to analyze hyper-local weather data, elevation, soil moisture, and historical patterns to predict precise timing and severity of frost events, optimizing the deployment window for frost cloths.

- Smart Irrigation and Climate Integration: Integration of AI-driven platforms with existing smart farm infrastructure (irrigation, vents, heaters) to determine if cloth deployment is the most energy-efficient protective strategy, often recommending a combined approach.

- IoT-Enabled Automated Deployment: Development of autonomous systems using sensors and robotics, guided by AI predictions, to automatically roll and unroll large-scale frost cloths over commercial fields, drastically reducing manual labor costs and reaction time.

- Inventory and Procurement Optimization: AI analysis assisting farm managers in calculating the exact quantity and required thickness of frost cloth inventory based on historical climate risk assessment, preventing both stockouts and excess materials.

- Material Recommendation Systems: Using neural networks to process crop type, growth stage, regional climate, and cost constraints to recommend the optimal frost cloth material (polypropylene vs. polyester) and weight specification for maximum efficacy.

DRO & Impact Forces Of Plant Frost Cloth Market

The dynamics of the Plant Frost Cloth Market are governed by powerful drivers such as unpredictable climate change patterns, which necessitate reliable crop protection, and the increasing global demand for high-value agricultural products. However, the market faces significant restraints, including the reliance on petroleum-derived polymers for manufacturing, leading to environmental concerns regarding disposal, and the high initial capital investment required for covering large commercial farms. Opportunities abound in developing sustainable and biodegradable frost cloths and integrating these products into sophisticated smart farming systems. These factors create strong impact forces, pushing the industry toward greater innovation in material science and enhanced integration with digital agricultural technologies.

Drivers primarily center on enhancing agricultural resilience. The intensification of extreme weather events globally, including early and late frosts, is a primary catalyst compelling growers to adopt passive protection methods. Furthermore, the expansion of high-density and specialized crops (e.g., specialty coffee, tender vegetables, ornamental flowers) in non-native or marginal climates increases the vulnerability profile, making frost cloth a necessity rather than an optional expense. The supportive regulatory environment in developed economies, often subsidizing agricultural inputs that mitigate climate risk, also significantly drives adoption rates among large-scale growers seeking assurance against unpredictable weather-related losses.

Restraints largely relate to environmental and operational challenges. A major constraint is the limited lifespan and difficult end-of-life management of standard synthetic frost cloths, contributing to agricultural plastic waste—a significant regulatory and public relations issue for the farming industry. Additionally, while the material cost is manageable, the labor required for manual installation and removal on vast fields presents an operational bottleneck, especially during time-sensitive frost events. The effectiveness of the cloth can also be compromised by severe wind or heavy snow loads, requiring additional structural support which increases complexity and cost for certain application types.

Opportunities for growth are concentrated in sustainability and technological advancement. The most compelling opportunities lie in the research and commercialization of next-generation biodegradable polymers derived from natural or bio-based sources, addressing environmental concerns and catering to environmentally conscious consumers and growers. Furthermore, leveraging advancements in nanotechnology to improve the thermal efficiency of existing materials (e.g., integrating phase change materials) could allow for thinner, lighter, and more protective fabrics. Finally, the integration with precision agriculture platforms, as detailed in the AI analysis, offers substantial opportunities for market expansion through value-added services and automated system sales.

Segmentation Analysis

The Plant Frost Cloth Market is strategically segmented based on material type, thickness (weight), and end-use application, allowing for a targeted analysis of specific market needs and growth trajectories. Segmentation by material is crucial as it dictates the cost structure, durability, and effectiveness of the cloth, with synthetic polymers like polypropylene dominating the volume share. The classification by thickness directly correlates with the temperature protection level offered, impacting purchasing decisions based on regional climate severity. Analyzing end-user application reveals distinct purchasing behaviors between large-scale commercial operations requiring bulk material and smaller residential users focusing on convenience and smaller package sizes.

- By Material: Polypropylene (PP), Polyester, Others (e.g., Biodegradable Polymers, HDPE)

- By Thickness (Weight per Square Yard): Light Weight (0.5 – 0.9 oz), Medium Weight (1.0 – 1.4 oz), Heavy Weight (1.5 oz and above)

- By Application: Commercial Farming/Agriculture, Residential Gardening/Horticulture, Nurseries and Greenhouses

- By Distribution Channel: Direct Sales (B2B), Retail Channels (Offline & Online)

Value Chain Analysis For Plant Frost Cloth Market

The value chain for the Plant Frost Cloth Market begins with the upstream procurement of raw materials, primarily polymer resins (polypropylene and polyester granules), from large petrochemical suppliers. This stage is highly susceptible to volatility in global oil and gas prices. The manufacturing phase involves polymerization, extrusion, spinning, and complex non-woven textile processing to create the specific fibrous structure required for thermal insulation, UV stability, and breathability. Manufacturing capabilities, including technological expertise in thermal bonding and calendering, are critical differentiators at this stage.

Midstream activities involve sophisticated converting and processing, where the raw fabric rolls are cut, packaged, branded, and prepared for distribution, often including specialized treatment like UV stabilization for extended outdoor life. Distribution channels are highly varied: direct sales dominate the commercial agriculture segment, where bulk rolls are shipped directly to large farms or agricultural cooperatives (B2B model). Conversely, the residential and small-scale nursery segments rely heavily on indirect channels, including major agricultural supply retailers, garden centers, and, increasingly, e-commerce platforms.

Downstream activities focus on reaching the end-users. Direct distribution ensures personalized technical consultation and bulk pricing for large growers, which is essential given the varying crop needs and regional climate demands. The indirect channel relies heavily on robust logistics and retail merchandising to ensure product availability in appropriate dimensions and quantities for the highly fragmented residential market. Efficiency in the logistics of bulky, lightweight material is a key determinant of operational profitability throughout the entire value chain, directly impacting the final delivered price to the farmer or consumer.

Plant Frost Cloth Market Potential Customers

The primary customers for plant frost cloth span across professional agricultural enterprises, specialized horticultural businesses, and the expansive base of individual consumers engaged in gardening. Large commercial farms, particularly those cultivating high-value, frost-sensitive crops such as citrus fruits, tender vegetables (tomatoes, peppers), wine grapes, and specialized tree nuts, represent the largest volume buyers, often requiring thousands of square yards of heavy-weight cloth annually. These customers prioritize performance specifications, durability, and bulk pricing agreements, seeking integrated solutions that minimize labor and maximize yield protection.

Specialized potential customers include greenhouses and commercial nurseries, which utilize the cloth not only for direct frost protection but also for internal climate moderation and shading, often demanding medium-weight, highly breathable fabric. These institutional buyers value consistent quality and reliable supply chains, as disruptions can severely impact their seasonal planting schedules and inventory of delicate starter plants. The move towards controlled environment agriculture (CEA) is expanding the demand from this segment for specialized, reusable frost protection tools.

The fastest-growing customer base is the residential segment. This includes avid home gardeners, small-scale hobby farmers, community gardens, and suburban landscapers. These customers typically purchase smaller, pre-cut, or pre-packaged cloths available through retail channels. Their purchasing decisions are driven by ease of use, clear installation instructions, positive reviews, and availability through online or local garden supply stores, making marketing and packaging accessibility paramount for this crucial segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 725 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, Freudenberg Group, Kimberly-Clark, Agribon, Grow-It-Hydroponics, DeWitt Company, Easy Gardener Products, Hanes Geo Components, Fibertex Nonwovens, Belton Industries, Tyvek, Reemay, Tildenet, Rhino-Mat, Dalen Products, Svensson, Ludvig Svensson, Berry Global, Tenax, C.I. Kasei Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plant Frost Cloth Market Key Technology Landscape

The technological landscape of the Plant Frost Cloth Market is predominantly centered on advanced non-woven textile manufacturing and polymer chemistry aimed at optimizing thermal performance and longevity. Key technologies include spun-bonding and melt-blown techniques used in creating polypropylene and polyester fabrics, which allow for a structure that is both lightweight and highly insulative. Continuous innovation is focused on improving fiber fineness and uniformity to achieve higher breathability while maintaining the critical barrier function. Furthermore, the development of specialized extrusion processes ensures the fabrics possess high tear resistance and UV stability, essential for multi-season outdoor use, reducing the overall cost of ownership for commercial growers.

Beyond core manufacturing, material science plays a crucial role through the incorporation of additives. UV stabilizers, often based on hindered amine light stabilizers (HALS), are essential to prevent photodegradation, significantly extending the practical lifespan of the cloth in intense solar environments. A growing area of innovation involves smart textiles, specifically the integration of microencapsulated materials or phase change materials (PCMs) within the non-woven matrix. Although nascent, PCMs have the potential to absorb and release latent heat during temperature fluctuations, providing an enhanced buffer against sudden temperature drops and offering a superior level of frost protection compared to purely passive thermal insulation.

The technology landscape also encompasses the machinery used for application and removal on a commercial scale. Advanced agricultural machinery, including specialized roll-out and retrieval systems mounted on tractors or autonomous platforms, utilizes GPS and hydraulic systems to efficiently cover vast areas. These systems require engineering solutions that minimize fabric damage during handling and ensure even coverage, addressing the operational restraint posed by manual labor. Looking forward, the integration of these machines with IoT sensors and AI predictive models represents the frontier of technology adoption, turning a basic textile product into a component of a sophisticated climate control strategy.

Regional Highlights

Regional dynamics significantly influence the adoption and composition of the Plant Frost Cloth Market, driven by localized climate risks, dominant agricultural practices, and economic development levels. North America (NA) and Europe are mature markets characterized by highly industrialized agriculture and a strong focus on high-value crops, leading to high consumption of heavy-weight, multi-season frost cloths. Regulatory stability and high labor costs in these regions also accelerate the adoption of large-scale automated application equipment and high-performance, durable fabrics. The strong presence of leading textile manufacturers further solidifies their market share, focusing on customized solutions for large cooperatives.

The Asia Pacific (APAC) region is projected to register the fastest growth, driven primarily by the rapid expansion of protected agriculture, particularly in China and Southeast Asia. Governments in this region are actively promoting modern farming techniques to enhance food security and quality, creating a vast customer base among small and medium-sized farmers. While cost-sensitivity remains a factor, the increasing volatility of monsoons and unexpected cold fronts in temperate zones like Northern India and parts of Australia fuels the demand for cost-effective, medium-weight polypropylene cloths.

Latin America and the Middle East & Africa (MEA) are emerging markets with unique needs. Latin America, particularly countries like Chile, Mexico, and Argentina, relies heavily on export agriculture (berries, avocados), making frost protection crucial for maintaining global supply chain integrity. The MEA region, characterized by arid climates, utilizes frost cloth not only for cold protection in highland areas but also for shading and moisture retention, requiring highly specialized, often co-extruded fabrics. Growth in these regions is heavily influenced by foreign investment in large-scale agribusiness and climate adaptation projects.

- North America (USA, Canada, Mexico): Mature market segment, high adoption of heavy-weight and durable fabrics, strong demand driven by major citrus and berry producers, high integration with automated application technology.

- Europe (Germany, France, UK, Italy): Focus on organic and sustainable farming, increasing regulatory pressure for biodegradable solutions, strong market for premium, high-performance polyester and PP materials for vineyards and specialty crops.

- Asia Pacific (China, India, Japan, Australia): Fastest growing market, driven by modernization and expansion of commercial greenhouses, high volume consumption of cost-effective polypropylene cloths, significant government support for crop protection.

- Latin America (Brazil, Chile, Argentina): Demand concentrated around export-oriented horticulture and high-altitude farming, requiring reliable protection for sensitive crops like berries and tropical fruits; emphasis on quality control.

- Middle East & Africa (MEA): Emerging market where frost cloth serves dual purposes (cold protection and solar protection/moisture retention), growth linked to large-scale agricultural infrastructure projects and climate-resilient farming initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plant Frost Cloth Market.- DuPont de Nemours, Inc.

- Freudenberg Group

- Kimberly-Clark Corporation (Professional)

- Agribon (Pliant Corp.)

- Grow-It-Hydroponics

- DeWitt Company

- Easy Gardener Products, Inc.

- Hanes Geo Components (Leggett & Platt)

- Fibertex Nonwovens A/S

- Belton Industries, Inc.

- Tyvek (DuPont)

- Reemay (part of Lydall)

- Tildenet Ltd.

- Rhino-Mat, Inc.

- Dalen Products, Inc.

- Svensson (Ludvig Svensson AB)

- Berry Global Group, Inc.

- Tenax Corporation

- C.I. Kasei Co., Ltd.

- Fibras Industrializadas S.A. (FISA)

Frequently Asked Questions

Analyze common user questions about the Plant Frost Cloth market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are primarily used to manufacture plant frost cloth?

The market predominantly utilizes non-woven fabrics made from synthetic polymers, primarily polypropylene (PP) and polyester. Polypropylene is preferred for its cost-effectiveness and thermal insulation properties, while polyester offers superior strength and durability, especially in heavy-weight variations.

How does the thickness of frost cloth impact its protective capabilities?

The thickness, measured in ounces per square yard, directly dictates the level of thermal insulation provided. Light-weight cloths (0.5–0.9 oz) protect against light frost (down to 28°F), while heavy-weight cloths (1.5 oz and above) offer protection against severe freezes (potentially down to 20°F or lower) by creating a larger temperature differential.

Is the Plant Frost Cloth Market moving towards sustainable or biodegradable options?

Yes, significant market opportunity and ongoing R&D are dedicated to developing biodegradable frost cloths. Driven by environmental concerns regarding agricultural plastic waste and consumer preference, manufacturers are experimenting with bio-based polymers to create viable, end-of-life sustainable alternatives to traditional synthetic materials.

Which geographical region exhibits the highest growth potential for frost cloth sales?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, shows the highest potential for market growth. This acceleration is driven by rapid agricultural modernization, increasing investments in protected horticulture, and the adoption of resilient farming techniques to combat climate unpredictability.

What is the main driver behind the commercial adoption of frost cloth over other protection methods?

The main driver is the balance between cost-effectiveness and performance. Frost cloth provides reliable, passive thermal protection without the high operational energy consumption or complex infrastructure requirements associated with active heating systems, making it highly scalable for large commercial agricultural operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager