Plasma Etch System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434277 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Plasma Etch System Market Size

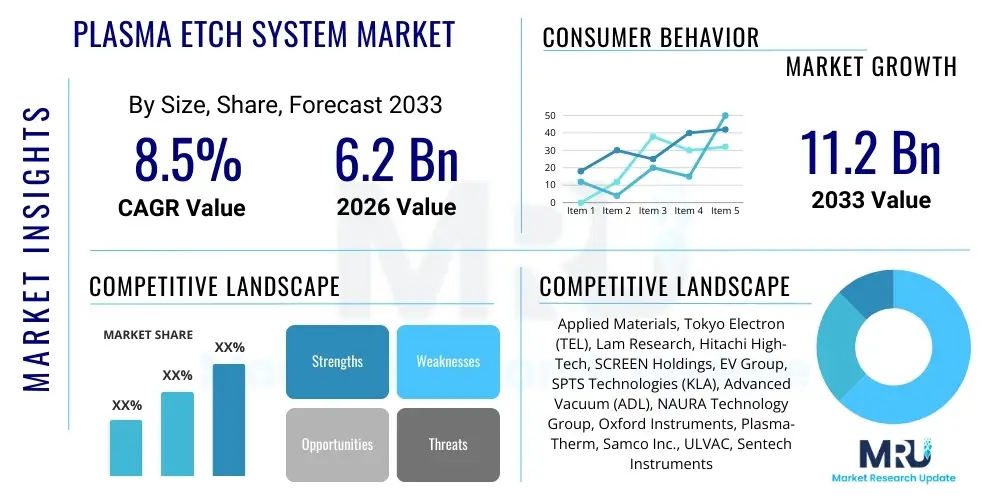

The Plasma Etch System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Plasma Etch System Market introduction

The Plasma Etch System Market encompasses highly advanced equipment crucial for manufacturing semiconductor devices, microelectronics, and photovoltaic cells. Plasma etching, a fundamental process in microfabrication, involves using chemically reactive plasmas or physical sputtering (or both) to selectively remove material from the wafer surface, creating intricate circuit patterns defined by lithography. These systems are indispensable for achieving the high-density and complex structures required for modern integrated circuits (ICs), including memory chips (DRAM, NAND) and advanced logic processors. The constant pressure from Moore's Law, demanding smaller feature sizes and higher transistor counts, directly fuels the necessity for more precise, uniform, and high-throughput plasma etch technology.

The primary products within this market include reactive ion etching (RIE), high-density plasma (HDP) etching, deep reactive ion etching (DRIE), and atomic layer etching (ALE) systems. Major applications span across front-end-of-line (FEOL) processes, such as gate patterning and contact hole creation, and back-end-of-line (BEOL) processes, involving interconnect formation. The benefits of utilizing plasma etching over traditional wet chemical etching include superior anisotropy, which allows for vertical feature definition critical for nanoscale devices, and enhanced process control and repeatability. Furthermore, the transition to 3D architectures, such as 3D NAND and FinFET/GAAFET transistors, necessitates extremely high aspect ratio (HAR) etching capabilities, pushing equipment manufacturers to innovate continuously in plasma source design and process chamber optimization.

Key driving factors propelling market growth include the robust global demand for advanced consumer electronics, the expansion of data centers requiring high-performance memory and logic chips, and significant capital expenditure increases by leading semiconductor foundries (fabs) globally. Additionally, government initiatives supporting domestic semiconductor manufacturing capacity in regions like the United States (CHIPS Act) and Europe (European Chips Act) are creating substantial procurement cycles for high-value process equipment, with plasma etch systems being a core component of these capacity expansions. The proliferation of IoT devices, 5G technology adoption, and the increasing complexity of automotive electronics further solidify the market's trajectory.

Plasma Etch System Market Executive Summary

The Plasma Etch System Market is characterized by intense technological competition and significant cyclical investment driven by the semiconductor industry's boom and bust cycles. Current business trends indicate a strong shift towards optimizing processes for heterogeneous integration and advanced packaging, requiring etch systems capable of handling diverse materials and wafer sizes, including 300mm and emerging 450mm processes in the long term. Strategic acquisitions and collaborations between equipment providers and materials suppliers are central to maintaining a competitive edge, particularly in developing solutions for emerging materials like high-k dielectrics and novel metals. Furthermore, sustainability and operational efficiency are becoming critical business drivers, leading to the development of systems that consume less power and utilize environmentally benign precursor gases, addressing both regulatory pressures and operational costs for manufacturers.

Regionally, the market dynamics are heavily skewed towards the Asia Pacific (APAC) region, primarily led by massive fab investments in China, Taiwan, and South Korea. Taiwan remains a critical hub due to TSMC's dominance in advanced nodes, while South Korea maintains leadership in memory fabrication (Samsung, SK Hynix). China's accelerated efforts toward semiconductor self-sufficiency are driving immense demand for imported and domestically developed etch equipment, often backed by substantial government subsidies. North America and Europe, while lagging in absolute volume compared to APAC, are focusing on high-value R&D and specialized segments, particularly in compound semiconductors and equipment manufacturing expertise.

Segment trends reveal that the Logic & Foundry application segment holds the largest market share due to the early adoption of cutting-edge technologies (e.g., GAAFET) that mandate complex multi-step etching. However, the Memory segment, driven by the shift towards 3D NAND with stack heights exceeding 200 layers, is exhibiting the highest growth rate, fueled by the demand for massive deep trench and contact hole etching capabilities. Technology-wise, Atomic Layer Etching (ALE) is gaining prominence as it offers unparalleled precision necessary for 5nm and below nodes, signaling a transition away from traditional RIE for critical steps, although RIE remains dominant for bulk material removal and less critical layers.

AI Impact Analysis on Plasma Etch System Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are being integrated into complex semiconductor manufacturing processes, specifically focusing on plasma etch systems, which are prone to subtle process variations. Key user concerns revolve around whether AI can significantly improve yield management, reduce the time required for process qualification (process window identification), and enable predictive maintenance to minimize costly downtime in high-volume manufacturing environments. Users expect AI to move beyond simple data logging, actively optimizing the multi-dimensional process parameters (RF power, pressure, gas flow ratios) in real-time, thereby stabilizing the highly complex plasma environment and ensuring nanometer-level uniformity across the entire wafer, which is crucial for maximizing throughput and profitability.

- Real-time Process Control: AI algorithms analyze plasma characteristics (e.g., optical emission spectroscopy) instantaneously to adjust system parameters, mitigating variations caused by equipment drift or micro-environmental changes.

- Predictive Maintenance (PdM): Machine learning models predict component failure (e.g., RF generator life, electrode erosion) based on sensor data patterns, allowing for proactive servicing and reducing unplanned tool downtime.

- Recipe Optimization and Qualification: AI accelerates the experimental phase (Design of Experiments - DOE) for new device nodes by simulating and predicting optimal etch recipes, drastically shortening the time-to-market for complex processes like HAR etching.

- Yield Enhancement: ML correlates etch uniformity maps with device performance data to identify and correct sub-optimal settings contributing to defects, leading to higher effective yields, especially for advanced logic devices.

- Cyber-Physical System Integration: AI acts as the central intelligence layer, integrating data from etch tools, metrology systems, and fab management software to create a unified, self-optimizing manufacturing environment (Industry 4.0 framework).

DRO & Impact Forces Of Plasma Etch System Market

The dynamics of the Plasma Etch System Market are shaped by a potent combination of drivers (D), restraints (R), and opportunities (O), whose interactive effects constitute the impact forces influencing long-term strategic decisions. Primary drivers include the continuous demand for miniaturization in semiconductors, the global transition to advanced 3D device architectures (3D NAND, GAA), and the massive investment cycles by major foundries seeking technological superiority. These factors create persistent demand for equipment capable of extreme precision and high throughput. Conversely, the market faces significant restraints, notably the incredibly high capital cost associated with acquiring and maintaining these complex systems, which limits participation primarily to top-tier semiconductor companies. Furthermore, the difficulty and expense involved in developing plasma chemistries for novel materials (like those required for extreme ultraviolet (EUV) lithography integration) pose a substantial technical hurdle, often requiring multi-year R&D commitments.

Opportunities for growth are concentrated in the rapid commercialization of 5G, 6G, IoT, and high-performance computing (HPC), which necessitate specialized compound semiconductor devices (e.g., SiC and GaN) requiring dedicated etch platforms. The most significant opportunity lies in the advancement of Atomic Layer Etching (ALE), which promises superior material selectivity and atomic-scale control, addressing the fundamental limitations of traditional etching at sub-5nm nodes. Geopolitical trends also present opportunities, as regions seek to diversify their supply chains, creating incentives for local equipment manufacturing and localized service networks in North America and Europe.

The key impact force is the cyclical nature of the semiconductor industry combined with the escalating complexity of chip design. When demand is high, the impact force drives massive capital expenditure (CapEx), leading to rapid market growth. However, overcapacity or global economic slowdowns can trigger sharp CapEx cutbacks, causing market deceleration. Currently, the overarching impact force is characterized by aggressive technological transition—specifically the shift to Gate-All-Around (GAA) transistors—which requires complete replacement or major upgrades of existing etch equipment, ensuring strong foundational growth for advanced systems, despite short-term cyclical volatility. This technological pivot generates a strong positive impact on high-end tool sales.

Segmentation Analysis

The Plasma Etch System Market is segmented based on several crucial parameters, including the type of plasma source used, the application sector within semiconductor manufacturing, the specific process technology employed, and the material being etched. This intricate segmentation allows market players to specialize in highly complex niche areas, such as equipment optimized exclusively for deep silicon etching (DRIE) used in MEMS fabrication, or general-purpose systems for oxide and nitride etching in logic manufacturing. The primary segmentation criterion, technology type, reflects the fundamental mechanisms used to generate and control the plasma, directly impacting performance metrics like etch rate, selectivity, and uniformity, which are paramount in advanced fabrication processes.

Segmentation by application (Foundry, Memory, IDM) dictates the volume and type of systems purchased. Memory fabrication, particularly 3D NAND, demands massive numbers of high-aspect ratio etch tools for critical vertical hole etching. Conversely, foundry operations focusing on cutting-edge logic nodes require highly precise, low-damage systems for gate patterning and critical dimension (CD) control. Geographic segmentation remains crucial, as purchasing power and technological adoption are heavily concentrated in specific East Asian countries. Furthermore, analyzing the market by wafer size (200mm vs. 300mm) highlights the ongoing capital transition, with 300mm systems dominating CapEx, though 200mm equipment remains vital for analog, power, and compound semiconductor applications.

- Technology Type:

- Reactive Ion Etching (RIE)

- High-Density Plasma (HDP) Etching

- Deep Reactive Ion Etching (DRIE)

- Atomic Layer Etching (ALE)

- Inductively Coupled Plasma (ICP) Etching

- Electron Cyclotron Resonance (ECR) Etching

- Application:

- Foundry (Logic)

- Memory (DRAM, NAND Flash)

- Integrated Device Manufacturers (IDMs)

- MEMS & Sensors

- Power Devices & Compound Semiconductors

- Process:

- Front-End-of-Line (FEOL) Etch

- Back-End-of-Line (BEOL) Etch

- Critical Dimension (CD) Etch

- Wafer Size:

- 200 mm

- 300 mm and Above

Value Chain Analysis For Plasma Etch System Market

The plasma etch system value chain is characterized by high barriers to entry, driven by intellectual property concentration and the stringent performance requirements set by tier-one semiconductor manufacturers. Upstream activities involve the highly specialized sourcing and manufacturing of complex components, including vacuum pumps, RF power supplies, gas delivery systems, and proprietary chamber materials resistant to corrosive plasma chemistries. Key upstream suppliers include manufacturers of high-purity ceramic components and advanced control electronics. These suppliers must maintain extremely high standards of quality and reliability, as component failure can lead to significant downtime for the high-value etch tools themselves. Robust control over the supply of specialty gases is also critical, given the reliance on specific fluorocarbons and noble gases for etch processes.

The core of the value chain is occupied by the original equipment manufacturers (OEMs) who design, integrate, and test the complete plasma etch systems. This stage requires extensive R&D investment to develop new plasma sources (e.g., magnetron enhanced plasma), sophisticated process chambers, and advanced software for process control and endpoint detection. Downstream activities involve the installation, qualification, and long-term servicing of these tools within the fabrication facilities (fabs). Given the complexity and cost of the equipment, service contracts, spare parts, and process support form a critical and highly profitable component of the downstream segment. Customer relationships are often long-term and strategic, involving deep collaboration on process development for next-generation devices.

Distribution channels for plasma etch systems are almost exclusively direct. Due to the high value, technical complexity, and requirement for precise process integration, OEMs maintain direct sales forces and application engineering teams to interface with foundries, IDMs, and memory manufacturers globally. Indirect channels are rarely utilized for the sale of the main tool but may be used for distributing standard consumables or spare parts through authorized regional distributors, particularly in emerging markets where the OEM presence is nascent. The direct model ensures control over installation quality and provides immediate feedback loops necessary for rapid technological iteration and customer support, crucial elements for success in this highly sensitive capital equipment market.

Plasma Etch System Market Potential Customers

The primary customers and end-users of plasma etch systems are the global leaders in semiconductor manufacturing, who require the most advanced tools to produce components at the cutting edge of technology. These entities fall into three major categories: dedicated foundries, which manufacture chips designed by others; integrated device manufacturers (IDMs), which design and fabricate their own chips (e.g., memory companies); and specialized manufacturers focusing on niche, high-growth areas. The purchasing decisions are characterized by long cycles, extensive qualification periods, and multi-million dollar investments per tool.

Dedicated foundries like Taiwan Semiconductor Manufacturing Company (TSMC) and GlobalFoundries are major buyers, focusing on procuring systems optimized for logic process control at 5nm and below nodes, where highly selective and uniform etching is paramount for successful gate-all-around (GAA) implementation. Their procurement drives innovation in critical dimension (CD) control etching. Memory manufacturers, including Samsung Electronics, SK Hynix, and Micron Technology, represent another massive consumer base, specifically driving demand for deep reactive ion etching (DRIE) and HAR etch systems necessary for constructing high-density 3D NAND flash stacks and advanced DRAM architectures.

Furthermore, an increasingly important customer segment includes manufacturers of specialized components, such as Micro-Electro-Mechanical Systems (MEMS), power semiconductor devices (SiC, GaN), and advanced sensor technologies used in automotive and industrial sectors. These companies often utilize 200mm equipment but require specialized etch chemistry capabilities tailored for compound semiconductor materials or complex microstructures. Government and university research laboratories also form a smaller but significant customer base, often purchasing R&D-scale tools to advance foundational research in nanotechnology and new materials processing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Tokyo Electron (TEL), Lam Research, Hitachi High-Tech, SCREEN Holdings, EV Group, SPTS Technologies (KLA), Advanced Vacuum (ADL), NAURA Technology Group, Oxford Instruments, Plasma-Therm, Samco Inc., ULVAC, Sentech Instruments, Veeco Instruments, AMEC, Picosun, Jusung Engineering, Wonik IPS, PVA TePla |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plasma Etch System Market Key Technology Landscape

The technology landscape of the Plasma Etch System market is dominated by advancements aimed at increasing anisotropy, selectivity, and minimizing plasma-induced damage at atomic scales. A core technological trend is the maturation and widespread adoption of Atomic Layer Etching (ALE). ALE is essential for sub-7nm nodes, offering sequential, self-limiting reactions that provide true atomic-scale removal control, crucial for maintaining critical dimensions and minimizing line-edge roughness (LER) in advanced logic gates. While slow, ALE’s precision is indispensable for the most critical steps, often requiring integration with Atomic Layer Deposition (ALD) for seamless manufacturing flow. Furthermore, OEMs are focusing heavily on developing advanced chamber coatings and electrostatic chucks (ESCs) to manage temperature uniformity and reduce contamination, which are critical variables in complex plasma environments.

Another major technological focus is Deep Reactive Ion Etching (DRIE), particularly for high-aspect ratio (HAR) structures required for 3D NAND and MEMS devices. Innovations in Bosch and Cryogenic processes are continuously pushed to achieve aspect ratios exceeding 80:1 and stack heights over 200 layers without sacrificing sidewall straightness or uniformity across the 300mm wafer. This involves optimizing the synchronization between the etch and passivation steps, requiring extremely fast switching capabilities and precise temperature control. High-Density Plasma (HDP) etching remains vital for filling and planarizing high aspect ratio structures, necessitating high ion density and low pressure to ensure effective material removal and deposition.

The integration of advanced monitoring and control systems—often leveraging AI, as noted—is fundamentally altering the technological landscape. Systems now incorporate sophisticated optical emission spectroscopy (OES), Langmuir probes, and mass spectrometry for real-time plasma state diagnostics. This real-time feedback loop allows for dynamic recipe adjustments, counteracting the inherent drift and instability of high-power plasma sources. The move towards specialized multi-chamber tools that can handle sequential etch and deposition steps within a high-vacuum cluster platform is also a key feature, maximizing throughput and reducing contamination risk inherent in atmospheric exposure between process steps.

Regional Highlights

- Asia Pacific (APAC): This region dominates the global market, accounting for the largest share of both consumption and manufacturing capacity, primarily driven by investments in Taiwan (TSMC), South Korea (Samsung, SK Hynix), and Mainland China. China’s push for self-sufficiency, fueled by national investment funds, generates robust demand, although competition for imported advanced technology remains intense. Taiwan and South Korea lead the adoption of the most advanced 300mm etch systems (sub-5nm and 3D NAND).

- North America: North America is characterized by high R&D intensity, driven by leading equipment manufacturers (Applied Materials, Lam Research) and strategic foundry expansion (Intel, TSMC/Samsung satellite fabs). Government initiatives, such as the CHIPS Act, are injecting significant capital into domestic manufacturing capacity, ensuring sustained demand for high-end etch tools and advanced materials research.

- Europe: The European market focuses on niche high-value sectors, including automotive semiconductors, power electronics (SiC, GaN), and advanced MEMS manufacturing. Key drivers include the European Chips Act aiming to boost local chip production. Demand is strong for specialized systems, such as those optimized for high-volume SiC etching (e.g., in Germany and Italy), rather than massive logic or memory capacity.

- Latin America, Middle East, and Africa (LAMEA): This region currently holds a small share, primarily consisting of R&D facilities and smaller assembly operations. Growth potential is focused on initial investments in domestic semiconductor assembly and testing (OSAT) and localized solar panel manufacturing, driving demand for basic RIE and PECVD tools, though advanced system adoption remains limited.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plasma Etch System Market.- Applied Materials

- Tokyo Electron (TEL)

- Lam Research

- Hitachi High-Tech

- SCREEN Holdings

- EV Group

- SPTS Technologies (KLA)

- Advanced Vacuum (ADL)

- NAURA Technology Group

- Oxford Instruments

- Plasma-Therm

- Samco Inc.

- ULVAC

- Sentech Instruments

- Veeco Instruments

- AMEC

- Picosun

- Jusung Engineering

- Wonik IPS

- PVA TePla

Frequently Asked Questions

What is the primary factor driving demand for advanced plasma etch systems in semiconductor manufacturing?

The primary driver is the fundamental shift to 3D semiconductor architectures, particularly 3D NAND flash memories with increasing layer counts and the transition from FinFET to Gate-All-Around (GAA) transistors in advanced logic nodes (sub-5nm). These structures require extremely precise, high-aspect ratio (HAR) etching capabilities that only modern plasma systems can deliver.

How does Atomic Layer Etching (ALE) differ from traditional Reactive Ion Etching (RIE)?

ALE is a highly precise process that uses sequential, self-limiting surface reactions to remove material one atomic layer at a time, providing exceptional control over critical dimensions and material selectivity. RIE, conversely, is a faster, bulk removal technique utilizing a continuous plasma, generally lacking the atomic-scale precision necessary for sub-5nm feature definition.

Which region dominates the global market for plasma etch systems, and why?

The Asia Pacific (APAC) region, specifically Taiwan, South Korea, and Mainland China, dominates the market. This dominance is due to the concentration of the world's largest semiconductor foundries and memory manufacturers (e.g., TSMC, Samsung, SK Hynix), which are engaged in continuous, massive capital expenditure cycles to maintain technological leadership and expand production capacity.

What are the main technical challenges faced by plasma etch system manufacturers?

Manufacturers face significant technical challenges, including achieving perfect etch uniformity across 300mm wafers for HAR structures, developing new plasma chemistries for novel device materials (e.g., EUV resists), and mitigating plasma-induced damage to ensure device reliability at nanoscale dimensions.

How is AI impacting the operational efficiency of plasma etch equipment?

AI significantly enhances operational efficiency by enabling real-time process parameter adjustment based on plasma diagnostics, optimizing complex etch recipes quickly, and implementing predictive maintenance programs. This leads to reduced process variation, higher yield rates, and minimized unscheduled downtime in high-volume production fabs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Plasma Etch System Market Size Report By Type (Inductively Coupled Plasma (ICP), Reactive Ion Etching (RIE), Deep Reactive Ion Etching (DRIE), Others), By Application (Semiconductor Industry, Medical Industry, Electronics & Microelectronics, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Electron Cyclotron Resonance Plasma Etch System Market Statistics 2025 Analysis By Application (Shallow Trench Isolation, Gate electrode, Self-Align Contact and Interconnect), By Type (Wet Etch System, Dry Etch System), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager