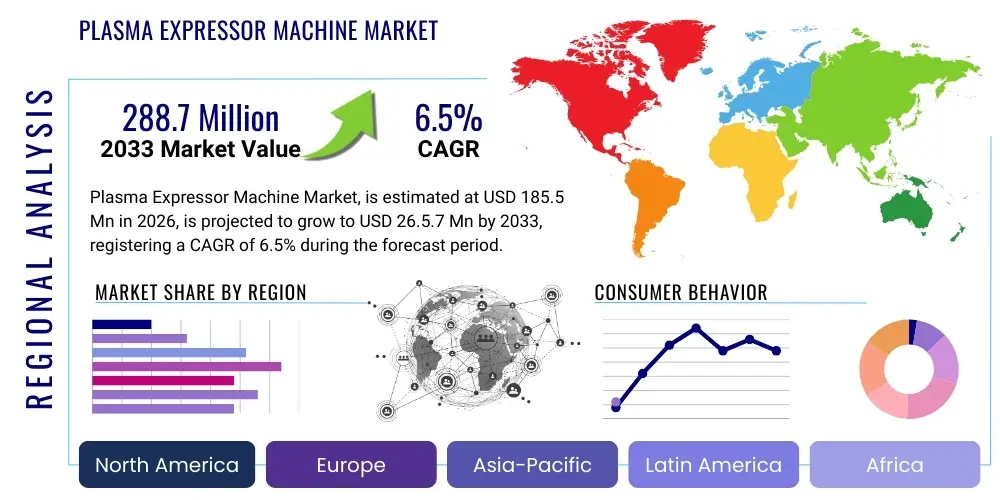

Plasma Expressor Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436968 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Plasma Expressor Machine Market Size

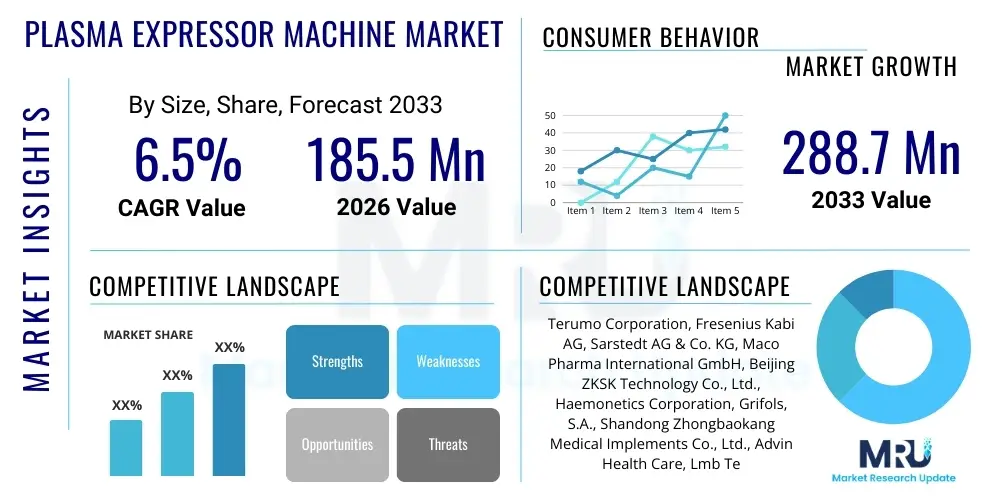

The Plasma Expressor Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. This consistent growth trajectory is driven primarily by the escalating demand for plasma-derived medicinal products (PDMPs) and the necessity for precise blood component separation in transfusion medicine. The adoption of automated and semi-automated expressor systems is rapidly replacing manual methods, ensuring higher safety standards and greater processing efficiency in critical healthcare settings globally. Furthermore, increasing investment in blood bank infrastructure across emerging economies contributes substantially to the market expansion.

The market is estimated at $185.5 Million in 2026 and is projected to reach $288.7 Million by the end of the forecast period in 2033. This significant valuation increase reflects the ongoing innovation within the device manufacturing sector, specifically the integration of smart features for pressure control and component tracking. Market dynamics are heavily influenced by stringent regulatory requirements mandating standardized blood processing techniques, which favor the use of sophisticated, validated expressor technologies. The rising incidence of chronic diseases requiring specialized plasma transfusions further solidifies the long-term revenue potential of this specialized medical equipment sector.

Plasma Expressor Machine Market introduction

The Plasma Expressor Machine Market encompasses equipment designed to mechanically and automatically separate blood plasma from cellular components (like packed red blood cells or platelets) collected in donor bags, primarily used in clinical laboratories, blood centers, and pharmaceutical processing facilities. These devices operate by applying controlled pressure to the blood bag system, ensuring optimal extraction of the plasma volume while minimizing the risk of contamination or cellular damage. The operational reliability and precision offered by modern plasma expressors are fundamental to the safety and efficacy of subsequent transfusion and fractionation processes, making them indispensable tools in modern hematology and immunobiology. The primary applications span routine blood processing, therapeutic plasma exchange (TPE), and the preparation of raw material for pharmaceutical fractionation, highlighting their critical role in the global healthcare supply chain.

Major applications of plasma expressor machines include high-volume processing in large regional blood centers, essential preparation steps for component therapy in hospitals, and quality control procedures in manufacturing plasma-derived therapies. Key benefits derived from utilizing automated expressors include enhanced donor product standardization, significant reduction in processing time compared to manual expression, and improved biosafety through closed-system operation. The machine’s ability to precisely control the expression endpoint minimizes red cell contamination in the extracted plasma, preserving the quality needed for critical pharmacological uses.

The market's driving factors are multifold: the global increase in blood donations, advancements in blood component therapy requiring higher-purity plasma, and sustained focus on infectious disease control, which necessitates standardized, automated processing methods. Furthermore, the aging population globally drives the demand for complex medical treatments and surgeries, subsequently increasing the need for blood components and robust processing equipment. Regulatory support for Good Manufacturing Practices (GMP) and standardized blood banking protocols continues to accelerate the adoption rate of technologically advanced expressor systems worldwide, ensuring market buoyancy.

Plasma Expressor Machine Market Executive Summary

The Plasma Expressor Machine Market demonstrates robust growth, propelled by technological evolution toward fully automated systems integrating sensor technology and data logging capabilities, positioning efficiency and traceability as major business trends. Regional expansion is notably aggressive in the Asia-Pacific (APAC) region, driven by governmental initiatives to modernize healthcare infrastructure, significant population volumes contributing to high donation rates, and rapid urbanization leading to increased accessibility to organized blood banking services. Conversely, established markets in North America and Europe focus on replacing aging equipment with smart, interconnected devices compliant with strict EU and FDA regulations, driving premium segment sales. Business stakeholders are prioritizing mergers and acquisitions to consolidate market share and leverage specialized distribution networks, especially targeting niche therapeutic segments requiring ultra-high purity plasma components.

Segment trends reveal a pronounced shift toward automated plasma expressors, valued for their minimal requirement for operator intervention and superior output consistency, significantly reducing procedural variability compared to semi-automated or manual units. The dominance of applications within blood centers and hospitals remains strong, yet the pharmaceutical segment, particularly contract manufacturing organizations (CMOs) specializing in fractionation, is showing the highest Compound Annual Growth Rate (CAGR) due to the increasing demand for immunoglobulins and coagulation factors. Disposable accessories, including specialized blood bags and tubing sets designed for specific expressor models, constitute a crucial ancillary revenue stream, characterized by high volume and recurring sales necessitated by strict single-use sterile protocols in hematology.

From an investment perspective, the market is structurally sound, benefiting from essential service provision resistant to major economic downturns. Key strategic initiatives involve developing systems with enhanced connectivity features, facilitating integration with laboratory information management systems (LIMS) for seamless data transfer and quality assurance tracking. Regulatory adherence, especially concerning component quality and cross-contamination prevention, acts as a significant entry barrier, favoring established manufacturers with proven track records. Overall, the market outlook is overwhelmingly positive, characterized by sustained infrastructure spending and an inelastic demand for processed plasma products globally.

AI Impact Analysis on Plasma Expressor Machine Market

User inquiries regarding AI's influence on the Plasma Expressor Machine Market predominantly revolve around optimizing efficiency, enhancing quality control, and predictive maintenance capabilities. Common questions address how AI can reduce plasma contamination risk, whether machine learning algorithms can automate complex decision-making during the expression process, and the potential for integrating smart diagnostics to forecast equipment failure. Users are keen to understand if AI can analyze historical data from blood bags to determine optimal pressure profiles in real-time based on donor characteristics or collection conditions, thereby maximizing yield and minimizing hemolysis. The prevailing expectation is that AI will transform the expressor from a simple mechanical device into an intelligent processing unit capable of autonomous quality assessment and seamless integration into digitized laboratory workflows, drastically improving turnaround times and regulatory compliance. The focus is keenly placed on AI’s potential to uphold and elevate the stringent standards required for high-purity plasma intended for fractionation.

The implementation of AI/ML models is poised to revolutionize the operational efficiency of blood component separation. By analyzing vast datasets related to blood viscosity, hematocrit levels, and processing variables, AI can dynamically adjust the expression rate and pressure settings specific to each blood unit. This level of personalized processing minimizes the incidence of red blood cell carryover into the plasma, a critical factor for fractionation efficiency. Furthermore, AI-driven image recognition systems can be integrated with the expressor to visually inspect the plasma product for clarity and potential contamination in real-time, providing an immediate quality release decision before the plasma is frozen, streamlining the quality assurance bottleneck.

Beyond process optimization, AI significantly impacts maintenance and inventory management. Predictive maintenance algorithms utilize sensor data (pressure, temperature, motor load) to detect subtle anomalies indicative of impending mechanical failure, allowing blood banks to schedule maintenance proactively, thereby eliminating unexpected downtime—a critical factor in high-throughput environments. This shift from reactive to predictive servicing enhances equipment uptime and operational reliability. In terms of inventory, AI can forecast demand for specific disposable consumables (like sterile connectors and expression bags) based on fluctuating donor schedules and local epidemiological trends, optimizing supply chain logistics for blood centers operating under just-in-time protocols.

- AI-driven real-time pressure optimization maximizes plasma yield and minimizes hemolysis.

- Machine learning algorithms enhance quality control through autonomous visual inspection of plasma clarity.

- Predictive maintenance reduces unexpected equipment downtime by forecasting mechanical failures.

- Automated data logging and analysis ensure superior traceability and regulatory compliance (e.g., CFR 21 Part 11).

- Integration with LIMS systems via AI facilitates smarter workflow management and inventory forecasting of consumables.

- Development of AI-powered diagnostics for immediate anomaly detection during the expression cycle.

DRO & Impact Forces Of Plasma Expressor Machine Market

The Plasma Expressor Machine Market is fundamentally influenced by a strong set of driving forces centered on increasing global health needs and advancements in transfusion medicine, counterbalanced by restrictive regulatory landscapes and high initial capital expenditure. Key drivers include the escalating global demand for specialized plasma-derived therapeutics, such as intravenous immunoglobulins (IVIG), which mandates increased plasma collection and processing efficiency. Technological innovations, particularly automation and connectivity, push the adoption cycle. Restraints primarily involve the substantial initial cost associated with purchasing and implementing automated expressor systems, particularly challenging for smaller clinics or blood centers in developing regions, alongside the highly complex regulatory approval processes for new medical devices, which slow down market entry. Opportunities are abundant in emerging markets, driven by government investments in modernizing blood bank infrastructure, and through the development of specialized expressors tailored for mobile blood collection units or niche laboratory research applications.

The impact forces within the market are predominantly technological and governmental. The continuous evolution toward fully closed, disposable component systems exerts immense pressure on manufacturers to innovate in materials science and device design, minimizing contamination risks and enhancing operational biosafety. Governmental and non-governmental organizations (NGOs) promoting global access to safe blood products create powerful upward demand. However, the consistent price sensitivity observed among institutional buyers, particularly governmental healthcare systems, necessitates a focus on long-term cost-effectiveness and durability from market leaders. The threat of substitutes is relatively low, as manual expression methods are increasingly deemed unsafe or non-compliant with modern standards, solidifying the machine’s essential position.

Market dynamics are intensely affected by standardization bodies like the AABB and ISO, whose guidelines often dictate the minimum requirements for blood processing equipment performance. Manufacturers must constantly adapt their offerings to comply with these evolving standards, driving product upgrades and iterative improvements. The interplay between high regulatory oversight (a restraint) and the inelastic demand for high-quality plasma (a driver) creates a stable yet highly competitive environment. Success in this market relies heavily on maintaining a pristine quality record and ensuring seamless integration with existing blood bank operational systems, utilizing these impact forces to differentiate superior product offerings from standard mechanical alternatives.

Segmentation Analysis

The Plasma Expressor Machine Market segmentation provides a granular view of device differentiation, application focus, and regional demand dynamics, crucial for targeted marketing and product development strategies. The market is primarily segmented by product type (automated, semi-automated), application (blood centers, hospitals, pharmaceutical/biotechnology companies), and operation mechanism (manual expressors, pneumatic expressors, electromechanical expressors). Automated systems dominate the revenue share due to their high throughput and consistency, essential for large blood collection organizations. However, semi-automated units maintain relevance in smaller healthcare facilities where processing volumes do not justify the higher capital outlay for full automation. Analyzing these segments is vital for understanding procurement trends, particularly the increasing shift towards systems compatible with integrated LIMS solutions for enhanced data management.

Segmentation by end-user illustrates the varying requirements across the healthcare ecosystem. Blood centers, serving as primary collection and initial processing hubs, prioritize high-speed, robust expressors capable of 24/7 operation and stringent quality control features. Hospitals, typically focused on immediate patient component needs and therapeutic apheresis, require flexible machines capable of handling diverse collection bag sizes and specific component separation protocols. The fastest-growing end-user segment is the pharmaceutical/biotechnology sector, which requires highly precise, traceable expression for sourcing raw plasma for fractionation, driving demand for premium, validated systems that meet strict GMP standards globally. This pharmaceutical sub-segment often necessitates custom features related to documentation and validation compliance.

Geographic segmentation remains pivotal, identifying North America and Europe as matured markets focused on replacement cycles and technological upgrades, whereas the Asia-Pacific region represents a dynamic growth market characterized by new infrastructural development and initial adoption of automated technologies. The segmentation analysis confirms the industry's sustained movement away from labor-intensive, variability-prone manual systems toward reliable, high-tech devices that uphold global standards of blood safety and product quality, reflecting a mature market that prioritizes technological investment over cost minimization for critical medical devices.

- By Product Type:

- Automated Plasma Expressors

- Semi-Automated Plasma Expressors

- Manual Plasma Expressors

- By Operation Mechanism:

- Pneumatic Expressors (Air Pressure Based)

- Electromechanical Expressors (Motorized Control)

- By Application/End-User:

- Blood Centers and Blood Banks

- Hospitals and Clinics (Transfusion Services)

- Pharmaceutical and Biotechnology Companies (Fractionation)

- Research and Academic Institutions

- By Plasma Bag Capacity:

- Small Volume (Under 500 ml)

- Standard Volume (500 ml - 1000 ml)

- Large Volume (Above 1000 ml)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Plasma Expressor Machine Market

The value chain for the Plasma Expressor Machine Market begins with upstream activities focused on raw material sourcing and specialized component manufacturing, moving through assembly, distribution, and critical post-sales services. Upstream analysis involves the procurement of high-precision components, including specialized sensors (pressure and optical), robust motor systems, microprocessor units, and medical-grade plastics for external casings. Key upstream challenges involve maintaining a stable supply chain for complex electronic components and ensuring the quality and long-term durability of precision mechanical parts necessary for controlled expression. Relationships with specialized technology suppliers capable of meeting stringent medical device quality standards (e.g., ISO 13485) are vital for cost control and product reliability, often requiring long-term contractual agreements to stabilize component pricing and availability.

Midstream activities encompass the manufacturing, assembly, testing, and validation of the final expressor units. High capital investment in cleanroom facilities and sophisticated calibration equipment is mandatory due to the precision required for blood processing. This stage is characterized by rigorous quality control protocols and regulatory audits to obtain necessary certifications (e.g., CE Mark, FDA clearance). The core value addition here lies in the integration of specialized software for workflow management, data security, and connectivity features. Downstream activities involve market access, distribution, sales, installation, and critical maintenance services. Given the specialized nature of the equipment and the highly regulated environment of end-users, distribution channels are often limited to specialized medical equipment distributors with deep ties to blood banks and hospital procurement departments.

Distribution channels are categorized as direct and indirect. Direct sales are often preferred for large, strategic institutional clients (like major hospital chains or global fractionation centers) where complex contracts, customizations, and specialized training are required, allowing manufacturers maximum control over pricing and customer relationship management. Indirect channels utilize authorized regional distributors who possess established logistical networks, handle localized regulatory paperwork, and provide essential first-line technical support in geographically diverse regions. Post-sales service—including calibration, preventative maintenance contracts, and rapid access to spare parts—represents a significant portion of the total value provided and is a key competitive differentiator, ensuring sustained operational reliability for customers whose operations are time-sensitive and mission-critical.

Plasma Expressor Machine Market Potential Customers

The Plasma Expressor Machine Market primarily targets organizations deeply entrenched in blood collection, processing, and the subsequent manufacturing of blood products. The most prominent end-users are large regional blood centers and independent blood banks, which handle massive volumes of whole blood donations daily and require high-throughput, automated expressors to efficiently separate plasma for transfusion and commercial use. These centers represent the largest volume buyers, focused heavily on scalability, integration capabilities with laboratory information systems, and compliance with national transfusion service guidelines. Their purchasing decisions are often centralized and heavily influenced by total cost of ownership (TCO) over a long operational lifespan.

Hospitals and clinical laboratories, particularly those with active trauma centers or specialized therapeutic apheresis units, constitute the second major customer segment. While their throughput might be lower than large blood centers, their need for rapid and reliable plasma preparation for immediate patient care is paramount. They often procure semi-automated or compact automated units that fit within clinical laboratory spaces, prioritizing ease of use, swift component handling, and robust safety features to manage urgent transfusion requirements. Furthermore, hospitals engaged in complex surgical procedures and transplantation services maintain a consistent, high demand for processed plasma components.

A rapidly expanding segment of potential customers includes pharmaceutical and biotechnology companies, specifically those involved in the fractionation of recovered plasma into therapeutic products such as albumin, immunoglobulins, and clotting factors. These industrial buyers demand the highest level of precision, traceability, and documentation compliance (GMP/GLP) from their plasma expressors, often necessitating bespoke systems optimized for high-volume industrial processing lines. Contract manufacturing organizations (CMOs) that provide plasma processing services to these large pharmaceutical firms also represent a vital, high-growth customer base, seeking systems that offer maximum yield and minimal cross-contamination risk essential for high-value biological manufacturing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $288.7 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Terumo Corporation, Fresenius Kabi AG, Sarstedt AG & Co. KG, Maco Pharma International GmbH, Beijing ZKSK Technology Co., Ltd., Haemonetics Corporation, Grifols, S.A., Shandong Zhongbaokang Medical Implements Co., Ltd., Advin Health Care, Lmb Technologie GmbH, Bio-Rad Laboratories, Inc., REMI Group, B Medical Systems S.à r.l., Helmer Scientific, C. R. Bard, Inc. (now BD), Nanjing Shuangwei Biotech Co., Ltd., Kewaunee Scientific Corporation, Conroy Medical AB, HemoFlow, Inc., Thermo Fisher Scientific Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plasma Expressor Machine Market Key Technology Landscape

The Plasma Expressor Machine Market is characterized by a mature technology base rapidly transitioning towards smart, digitized systems utilizing enhanced sensor and connectivity features. Pneumatic pressure control systems remain a cornerstone technology, offering precise, reproducible forces for expressing plasma without damaging blood cells. Modern expressors integrate advanced sensors—including infrared sensors and high-resolution optical detectors—to accurately identify the plasma-cellular interface (the buffy coat layer). This precision is critical for maximizing yield while ensuring minimal residual red cell contamination, a key quality metric for pharmaceutical fractionation plasma. The shift is evident toward electromechanical expressors, which use motors and electronic controls instead of solely relying on air pressure, offering smoother, more customizable expression profiles that are essential for handling diverse blood component bag configurations and volumes.

A significant technological focus is placed on enhancing connectivity and data management to meet modern regulatory requirements for traceability and quality assurance. New expressor models feature integrated barcode scanners for immediate donor unit identification, embedded microprocessors for automated data logging (recording time, pressure curves, and volume expressed), and compatibility with Ethernet or Wi-Fi for seamless communication with Laboratory Information Management Systems (LIMS). This integration facilitates automatic population of processing records, minimizes human error, and supports rapid electronic validation protocols. Furthermore, the development of specialized, non-invasive flow meters and weight scales integrated directly into the expressor platform allows for real-time monitoring of collected volumes, ensuring accuracy and reducing the need for separate manual verification steps in high-throughput environments.

The future technology landscape is heavily invested in improving biosafety and ease of use. This includes developing fully closed system protocols utilizing sterile docking devices and specialized expression cassettes that eliminate the risk of environmental contamination during the separation process, aligning with stricter GMP guidelines globally. Manufacturers are also incorporating user-friendly touch screen interfaces, diagnostic trouble-shooting guidance, and remote monitoring capabilities to reduce operator training time and enable faster technical support. Innovation in disposable components, such as multi-layer, low-adhesion blood bags optimized for automated expressor geometries, further supports improved separation efficiency and standardized product quality across the entire processing chain.

Regional Highlights

Regional dynamics play a crucial role in shaping the Plasma Expressor Machine Market, reflecting varying levels of healthcare maturity, regulatory stringency, and prevalence of organized blood donation programs. North America currently dominates the market share due to its established infrastructure, stringent FDA regulations mandating high-quality blood processing equipment, and the presence of major manufacturers and large-scale commercial plasma fractionators. The region's emphasis is on replacing legacy equipment with advanced, automated, and AI-enabled expressors that offer LIMS integration and predictive maintenance capabilities, driving value growth rather than volume expansion.

Europe represents the second-largest market, characterized by standardized EU directives regarding blood component preparation and a robust network of centralized blood transfusion services. Countries like Germany, France, and the UK are key adopters, prioritizing high-precision expressors that comply with European Pharmacopoeia standards. The European market focuses on technological harmonization and ensuring cross-border compatibility of processed components, fostering demand for globally standardized expressor platforms. Investment in plasma collection capacity across Eastern European nations is also providing sustained growth opportunities.

The Asia Pacific (APAC) region is projected to register the highest CAGR during the forecast period. This accelerated growth is primarily attributed to rapidly improving healthcare accessibility, significant government funding for establishing modern blood banks in populous nations like China and India, and the rising awareness regarding safe blood processing techniques. While the APAC market remains sensitive to pricing, the increasing penetration of automated and semi-automated systems, replacing outdated manual methods, represents a massive volume opportunity for manufacturers.

Latin America (LATAM) and the Middle East and Africa (MEA) regions present emerging opportunities. Growth in LATAM is driven by public health reforms aimed at increasing the self-sufficiency of local blood supplies, particularly in Brazil and Mexico. MEA market expansion is more nascent, concentrated around highly urbanized centers in the UAE, Saudi Arabia, and South Africa, focusing on adopting mid-range automated expressors supported by international aid organizations and private investment to ensure basic component preparation capabilities.

- North America: Market leader driven by technological maturity, stringent FDA oversight, and high demand from sophisticated pharmaceutical fractionators.

- Europe: Strong regulatory adherence (EU standards), focus on replacement cycles, and high penetration of automated systems in centralized transfusion services.

- Asia Pacific (APAC): Fastest-growing region due to infrastructure modernization, large population size, and increasing adoption of automated technology in key developing economies (China, India).

- Latin America (LATAM): Growth catalyzed by healthcare reforms and efforts to improve national blood security and safety standards.

- Middle East and Africa (MEA): Emerging market concentrated in economically developed hubs, characterized by initial adoption of semi-automated and standardized equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plasma Expressor Machine Market.- Terumo Corporation

- Fresenius Kabi AG

- Sarstedt AG & Co. KG

- Maco Pharma International GmbH

- Beijing ZKSK Technology Co., Ltd.

- Haemonetics Corporation

- Grifols, S.A.

- Shandong Zhongbaokang Medical Implements Co., Ltd.

- Advin Health Care

- Lmb Technologie GmbH

- Bio-Rad Laboratories, Inc.

- REMI Group

- B Medical Systems S.à r.l.

- Helmer Scientific

- C. R. Bard, Inc. (now BD)

- Nanjing Shuangwei Biotech Co., Ltd.

- Kewaunee Scientific Corporation

- Conroy Medical AB

- HemoFlow, Inc.

- Thermo Fisher Scientific Inc.

Frequently Asked Questions

Analyze common user questions about the Plasma Expressor Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Plasma Expressor Machine Market?

The Plasma Expressor Machine Market is projected to grow at a steady CAGR of 6.5% between 2026 and 2033, driven by increasing global blood donation rates and rising demand for plasma-derived medical products (PDMPs).

What are the primary factors driving the adoption of automated plasma expressors?

Adoption is primarily driven by the need for enhanced blood safety, standardization of plasma components for fractionation, reduction of human error, and integration capabilities with modern Laboratory Information Management Systems (LIMS).

Which geographical region holds the largest market share for plasma expressor machines?

North America currently holds the largest market share, characterized by its mature healthcare infrastructure, high technological adoption rates, and strict regulatory environment supporting advanced medical devices.

How does the segmentation by end-user influence product development?

End-user segmentation leads to specialized product development: Blood Centers require high-throughput automation; Hospitals seek compact, versatile units; and Pharmaceutical companies demand ultra-precision expressors compliant with GMP standards for raw plasma sourcing.

What role does Artificial Intelligence (AI) play in the future of plasma expression technology?

AI is crucial for future development, enabling predictive maintenance, real-time quality control checks (minimizing cell contamination), and dynamic optimization of expression parameters to maximize plasma yield and purity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager