Plasma Surface Preparation Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434325 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Plasma Surface Preparation Machines Market Size

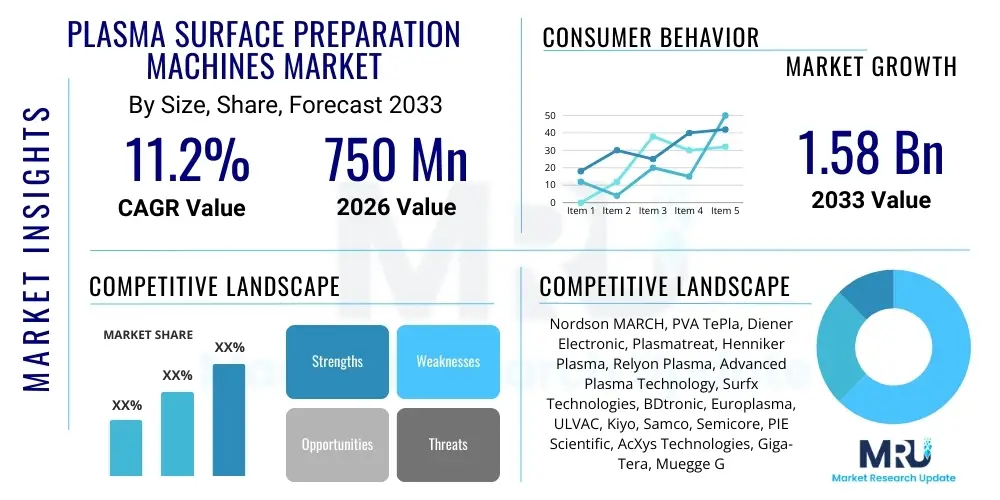

The Plasma Surface Preparation Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.2% between 2026 and 2033. The market is estimated at USD 750 million in 2026 and is projected to reach USD 1.58 billion by the end of the forecast period in 2033.

Plasma Surface Preparation Machines Market introduction

The Plasma Surface Preparation Machines Market encompasses equipment designed to modify, clean, or activate material surfaces using plasma technology prior to bonding, coating, printing, or assembly processes. Plasma, often generated using gases like argon, oxygen, or nitrogen, offers an exceptionally effective, eco-friendly, and residue-free method for enhancing surface energy and wettability, which are critical for maximizing adhesion performance across various industrial applications. These machines are integral to precision manufacturing, where micro-contamination or insufficient surface preparation can lead to catastrophic product failure, particularly in high-reliability sectors such as medical and aerospace.

The primary applications of these machines span the advanced electronics, semiconductor manufacturing, medical device industry, and automotive sectors. In semiconductor fabrication, plasma systems are essential for ultra-fine cleaning of wafers and preparing surfaces for metallization layers. For medical devices, plasma ensures biocompatibility and robust adhesion of specialized coatings. The core benefits driving adoption include superior cleaning efficacy compared to traditional wet chemical processes, lower operational costs due to reduced chemical waste, and the ability to process complex 3D geometries uniformly without causing thermal damage to sensitive materials.

Major driving factors include the rapid miniaturization and increasing complexity in semiconductor devices, demanding pristine surface conditions. Furthermore, the growing adoption of advanced composites and dissimilar materials in automotive and aerospace industries requires sophisticated surface treatments to ensure reliable joining. Strict regulatory standards, especially in the medical sector regarding sterility and material performance, also necessitate the use of highly controlled plasma processing techniques, thereby sustaining the market’s growth trajectory globally.

Plasma Surface Preparation Machines Market Executive Summary

The Plasma Surface Preparation Machines Market demonstrates robust growth driven primarily by advancements in microelectronics and the shift towards high-reliability manufacturing across Asia Pacific. Business trends indicate a strong focus on automation integration, enabling machines to operate seamlessly within Industry 4.0 frameworks, emphasizing real-time monitoring and data analytics for process optimization. Companies are heavily investing in developing atmospheric plasma systems, offering higher throughput and easier integration into existing production lines compared to traditional vacuum systems. Strategic acquisitions and collaborations aimed at expanding technological portfolios, especially in specialized areas like ultra-low pressure plasma for sensitive materials, characterize the competitive landscape.

Regionally, Asia Pacific maintains market dominance due to its concentration of leading semiconductor foundries, electronics assembly plants, and robust automotive production base, particularly in China, South Korea, and Taiwan. North America and Europe show steady growth, primarily fueled by the strong demand for advanced medical devices, aerospace components, and specialized high-end industrial coatings. Regional market variations reflect application focus, with APAC leading in large-scale volume manufacturing, while Western markets prioritize high-mix, low-volume specialized processes requiring extreme precision and verification.

Segment trends highlight the increasing prominence of Vacuum Plasma Systems based on revenue due to their high precision required in semiconductor etching and cleaning, while Atmospheric Plasma Systems are gaining momentum rapidly in terms of unit volume adoption across general industrial applications like automotive bonding and textile treatment due to their cost-effectiveness and scalability. The application segment growth is overwhelmingly led by Semiconductors and Electronics, although the Medical Device segment exhibits the highest growth potential due to increasing global standards for device reliability and sterilization processes.

AI Impact Analysis on Plasma Surface Preparation Machines Market

User queries regarding AI integration in plasma processing frequently revolve around how artificial intelligence can enhance process reliability, predictive maintenance, and overall yield. Key themes include the implementation of machine learning (ML) algorithms for real-time fault detection and classification, optimization of complex plasma parameters (such as gas flow rates, power levels, and processing time) to achieve desired surface properties consistently, and the development of self-correcting plasma systems. Users anticipate that AI will minimize the necessity for costly post-process inspection and significantly reduce material waste by proactively adjusting processes based on sensor data analysis, leading to unprecedented levels of precision and repeatability in surface modification, which is critical for high-stakes applications like advanced packaging and biomedical device manufacturing.

The integration of AI/ML models facilitates the transition from standardized recipes to dynamic process control. By analyzing vast datasets generated during plasma operation—including optical emission spectroscopy (OES), pressure monitoring, and power input curves—AI can detect subtle shifts in plasma characteristics indicative of contamination or tool wear far quicker than human operators or conventional statistical process control (SPC). This capability translates directly into higher uptime, improved equipment utilization, and enhanced consistency of the treated surface, ultimately validating investments in sophisticated plasma technology.

Furthermore, AI-driven simulation and predictive modeling are revolutionizing the R&D phase, allowing manufacturers to rapidly design and optimize plasma chamber geometries and processing recipes for novel materials or complex surface requirements without extensive physical prototyping. This acceleration in materials science and process development shortens the time-to-market for products relying on superior surface preparation, positioning AI as a crucial enabler for next-generation manufacturing techniques requiring flawless interfacial engineering.

- AI-driven Predictive Maintenance: Minimizing unplanned downtime by analyzing equipment health sensor data in real-time.

- Real-time Parameter Optimization: ML algorithms dynamically adjust gas composition, power, and time for consistent surface energy.

- Automated Defect Classification: Using image recognition and spectroscopy data to instantly identify and mitigate surface treatment flaws.

- Enhanced Process Traceability: Creating digital twins of plasma processes for rigorous compliance and quality auditing.

- Accelerated R&D: Utilizing AI simulation to optimize chamber design and processing recipes for new materials.

DRO & Impact Forces Of Plasma Surface Preparation Machines Market

The Plasma Surface Preparation Machines Market is significantly influenced by a confluence of driving factors, restrictive barriers, and emerging opportunities, all contributing to the overall market impact forces. The primary drivers stem from the technological imperative for miniaturization and enhanced reliability in advanced electronics and specialized manufacturing sectors, demanding cleaner and more precise surface modification than traditional chemical or mechanical methods can offer. Restraints largely include the high initial capital expenditure associated with sophisticated vacuum plasma systems and the complexity involved in maintaining and operating these high-precision machines, requiring highly trained personnel.

Key opportunities revolve around the expanding adoption of atmospheric pressure plasma (APP) systems, which offer a cost-effective alternative for high-throughput, continuous processing applications such as roll-to-roll manufacturing and large-area textile treatment. Furthermore, the push towards sustainable manufacturing practices globally creates a substantial opportunity, as plasma processing is environmentally superior to solvent-based cleaning methods. The primary impact force driving expansion is the relentless demand from the semiconductor industry for advanced packaging and wafer cleaning, which sets the standard for cleanliness and precision across all other industries utilizing plasma technology.

The market faces impact forces that necessitate continuous innovation, particularly regarding process control and scalability. The need for precise adhesion across dissimilar materials (e.g., plastics to metals) in electric vehicle battery pack construction and lightweighting initiatives also serves as a strong accelerator. Overcoming the restraint of high operational complexity through increased automation and AI integration is vital for mainstream industrial adoption beyond specialized high-tech sectors, thereby maximizing the market penetration of plasma solutions globally.

Segmentation Analysis

The Plasma Surface Preparation Machines Market is strategically segmented based on factors such as the operating environment (type), the power configuration, and the final industrial application, reflecting the diverse needs of end-users ranging from ultra-high precision semiconductor fabrication to large-scale industrial component treatment. Analyzing these segments provides crucial insights into growth drivers and investment hot spots. The Type segmentation, distinguishing between vacuum, atmospheric, and low-pressure systems, dictates the machine's complexity, cost, and suitability for specific materials and throughput requirements. Vacuum systems dominate high-end precision applications, while atmospheric systems lead in accessibility and industrial scalability.

The application segmentation is fundamental to market valuation, with Semiconductors and Electronics consistently holding the largest share due to the obligatory nature of plasma cleaning in wafer processing and advanced packaging. However, emerging segments like Medical Devices and Aerospace are exhibiting the fastest CAGR, driven by stringent regulatory requirements for surface sterility, biocompatibility, and secure bonding of complex structures. Furthermore, the segmentation by operating power reflects performance capabilities, where high-power systems are utilized for faster material ablation and etching, and low-power systems are optimized for sensitive surface activation without material damage.

Understanding the interplay between these segments is critical for manufacturers, enabling them to tailor their product offerings—such as highly automated, integrated atmospheric plasma jets for automotive paint preparation or ultra-clean, low-pressure vacuum systems for specialized optics components. This granularity ensures that technological development aligns with specific industry demands for throughput, cost-efficiency, and surface quality metrics, guaranteeing optimal resource allocation and maximizing competitive advantage in diverse vertical markets.

- By Type:

- Vacuum Plasma Systems (Low-Pressure Plasma)

- Atmospheric Plasma Systems (High-Pressure Plasma)

- Remote Plasma Systems

- By Application:

- Semiconductors and Electronics

- Medical Devices and Healthcare

- Automotive and Aerospace

- Textiles and Consumer Goods

- Packaging and Printing

- Others (Research and Development)

- By Operating Power:

- Low Power (Surface Activation/Cleaning)

- High Power (Etching/Material Modification)

Value Chain Analysis For Plasma Surface Preparation Machines Market

The value chain for Plasma Surface Preparation Machines is highly integrated, starting with specialized upstream suppliers providing critical components such as high-frequency power generators (RF/MW), vacuum pumps, gas delivery systems, and sophisticated process control software. The performance and reliability of the final machine are heavily dependent on the quality and precision of these input components, making supplier relationship management crucial. Innovation at this stage, particularly in developing energy-efficient power sources and highly precise mass flow controllers, directly influences the machine's efficiency and process repeatability.

Midstream activities involve the core machine manufacturers who design, assemble, and rigorously test the final plasma systems, integrating the hardware components with proprietary control software and process recipes. Distribution channels vary significantly depending on the market segment; for high-value vacuum systems targeting the semiconductor industry, direct sales models are prevalent, allowing for bespoke customization, extensive post-installation service, and close collaboration with the customer’s process engineers. In contrast, standard atmospheric plasma units often utilize indirect distribution through specialized industrial equipment distributors and integrators who can offer rapid local support and integration into existing assembly lines.

Downstream analysis focuses on the end-users across various sectors—semiconductor fabs, medical device OEMs, and automotive tier 1 suppliers. Post-sales service, including maintenance contracts, spare parts supply, and process optimization consulting, constitutes a significant portion of the downstream value proposition. The long lifecycle and high complexity of plasma machines ensure that ongoing service and process support generate sustained revenue for manufacturers, making strong technical support a key differentiator in highly competitive markets.

Plasma Surface Preparation Machines Market Potential Customers

The potential customers for Plasma Surface Preparation Machines are diverse, spanning industries that require precise surface engineering to ensure product integrity, reliability, and regulatory compliance. The core buyers are typically major manufacturing entities focused on high-reliability components or products where surface adhesion and cleanliness are non-negotiable performance factors. These customers often possess large-scale, automated production facilities and require customized plasma solutions that can integrate seamlessly into existing production lines, often demanding high throughput and minimal downtime.

The largest customer base resides within the semiconductor and electronics manufacturing industries, including integrated device manufacturers (IDMs), pure-play foundries, and advanced packaging companies. These entities use plasma for wafer cleaning, photoresist stripping, etching, and surface activation prior to bonding. A second, rapidly growing segment is the medical device industry, encompassing manufacturers of implants, catheters, diagnostic equipment, and surgical instruments that rely on plasma for sterilization, surface functionalization (e.g., promoting cell adhesion), and preparing materials for reliable sealing and bonding processes.

Further key customers include automotive component manufacturers, particularly those involved in producing electric vehicle battery packs, electronic control units (ECUs), and specialized lightweight composite structures. In these applications, plasma is used to treat plastics, metals, and composites to ensure durable adhesive bonds that can withstand harsh operating environments. Additionally, aerospace and defense contractors, specialized research institutions, and large-scale printing and packaging companies also represent important customer segments seeking environmentally friendly, high-precision surface modification tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 million |

| Market Forecast in 2033 | USD 1.58 billion |

| Growth Rate | 11.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson MARCH, PVA TePla, Diener Electronic, Plasmatreat, Henniker Plasma, Relyon Plasma, Advanced Plasma Technology, Surfx Technologies, BDtronic, Europlasma, ULVAC, Kiyo, Samco, Semicore, PIE Scientific, AcXys Technologies, Giga-Tera, Muegge GmbH, RIE-TECH, ADTEC Plasma Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plasma Surface Preparation Machines Market Key Technology Landscape

The technology landscape of the Plasma Surface Preparation Machines Market is characterized by continuous advancements aimed at improving process uniformity, increasing throughput, and reducing energy consumption. The core technological dichotomy exists between low-pressure (vacuum) plasma systems and atmospheric pressure plasma (APP) systems. Low-pressure systems utilize RF or microwave power sources to generate highly controlled, uniform plasma within a vacuum chamber, ideal for ultra-precision applications where purity and process control are paramount, such as semiconductor etching and ultra-fine cleaning. Recent innovations in vacuum systems focus on chamber geometry optimization and advanced end-point detection using optical emission spectroscopy (OES) to achieve sub-micron level precision.

Conversely, Atmospheric Plasma Systems, which operate at ambient pressure, are revolutionizing large-scale industrial treatment. These systems typically use high voltage discharge to generate a plasma stream that is highly reactive yet targeted. Key technologies here include plasma jets, rotating nozzles, and wide-area dielectric barrier discharge (DBD) systems. Technological advancements in APP focus on improving gas cooling mechanisms and designing highly stable plasma sources that prevent arcing or thermal damage to heat-sensitive substrates like polymers and textiles. The primary driver for APP innovation is the need for inline processing capabilities without the overhead and cycle time limitations imposed by vacuum chambers.

Emerging technological trends include the development of hybrid plasma systems that combine the benefits of both vacuum and atmospheric processing, allowing for sequential treatments optimized for complex multi-layer structures. Furthermore, the push towards green manufacturing encourages research into noble gas-free plasma chemistries, utilizing standard air or oxygen plasma more efficiently. Software integration, specifically leveraging sensor fusion and machine learning for closed-loop control, represents the most significant technological leap, ensuring process stability regardless of environmental or material variations, thereby cementing the market's trajectory towards smarter, more automated surface preparation solutions.

Regional Highlights

The Plasma Surface Preparation Machines Market exhibits distinct regional dynamics, heavily influenced by the geographical distribution of high-tech manufacturing, particularly semiconductor and medical device production. Asia Pacific (APAC) currently dominates the market, contributing the largest share of revenue and demonstrating the highest growth rate. This leadership is attributable to the region's concentration of global electronics manufacturing hubs, immense investments in advanced semiconductor foundries (e.g., in Taiwan, South Korea, and China), and significant growth in the automotive electronics sector. High-volume manufacturing requirements in APAC drive demand for high-throughput, reliable plasma systems, both vacuum and atmospheric types.

North America holds a substantial market share, primarily driven by strong demand from the aerospace and defense industries, coupled with a robust, highly regulated medical device manufacturing sector. The focus in this region is often on high-precision, low-volume specialized processes where adherence to stringent quality and validation standards is critical. The regional market growth is also supported by extensive research and development activities in advanced materials science and nanotechnology, often utilizing sophisticated low-pressure plasma systems for materials modification.

Europe represents a mature market characterized by early adoption of plasma technology, particularly in Germany and Switzerland, driven by the strong presence of high-end automotive, industrial machinery, and specialized packaging sectors. European manufacturers are leading innovation in atmospheric plasma systems for sustainable industrial applications, focusing on energy efficiency and integration into automated Industry 4.0 environments. The Middle East and Africa (MEA) and Latin America (LATAM) currently hold smaller market shares but are projected to experience modest growth as industrial diversification and expansion of local manufacturing capabilities increase the need for modern surface treatment technologies.

- Asia Pacific (APAC): Dominant market share due to semiconductor and consumer electronics manufacturing scale; highest projected CAGR fueled by industrial automation in China and South East Asia.

- North America: Strong demand from aerospace, defense, and high-value medical device manufacturing sectors; emphasis on ultra-precision vacuum plasma systems.

- Europe: Focus on automotive components, specialized industrial coatings, and textile processing; leading adoption of energy-efficient atmospheric plasma solutions.

- Latin America: Emerging market, driven by local electronics assembly and increasing foreign investment in automotive manufacturing, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Growth linked to industrial diversification efforts and establishment of new manufacturing zones, requiring basic surface treatment capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plasma Surface Preparation Machines Market.- Nordson MARCH

- PVA TePla

- Diener Electronic

- Plasmatreat GmbH

- Henniker Plasma

- Relyon Plasma GmbH

- Advanced Plasma Technology

- Surfx Technologies

- BDtronic

- Europlasma

- ULVAC, Inc.

- Kiyo Plasma Technology Co., Ltd.

- Samco Inc.

- Semicore Equipment, Inc.

- PIE Scientific LLC

- AcXys Technologies

- Giga-Tera, Inc.

- Muegge GmbH

- RIE-TECH Co., Ltd.

- ADTEC Plasma Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Plasma Surface Preparation Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of plasma surface preparation over traditional chemical methods?

Plasma preparation offers a residue-free, environmentally superior, and highly controlled surface activation process. It significantly improves adhesion strength for bonding and coating processes without using harmful solvents, enhancing product reliability and reducing environmental compliance costs.

Which market segment is expected to show the highest growth rate?

The Medical Devices and Healthcare application segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to increasing global regulatory standards requiring stringent surface sterility, biocompatibility, and high-reliability sealing for critical components and implants.

What is the key difference between vacuum and atmospheric plasma systems?

Vacuum plasma systems (low-pressure) provide superior process purity and uniformity, essential for semiconductor and high-end optics, but require longer cycle times. Atmospheric plasma systems (APP) are faster, suitable for inline processing and large areas, and offer easier integration for general industrial applications without requiring expensive vacuum hardware.

How is AI impacting the performance and reliability of plasma machines?

AI integrates machine learning for real-time process control, optimizing parameters like gas flow and power based on sensor data. This capability leads to reduced fault rates, minimizes material waste, enables predictive maintenance, and ensures highly consistent surface treatment uniformity.

What are the main factors restraining the broader adoption of plasma surface preparation machines?

The primary constraints are the high initial capital investment required for high-precision vacuum systems and the necessity for specialized technical expertise and training to operate and maintain the complex equipment efficiently across diverse manufacturing environments.

Market Outlook and Strategic Recommendations

The Plasma Surface Preparation Machines Market is poised for sustained, high-growth expansion, fundamentally driven by the global manufacturing trend toward miniaturization, multi-material assembly, and the imperative for absolute reliability in finished products. The market’s resilience is underpinned by its indispensability within the semiconductor supply chain and its rapidly expanding necessity in high-stakes fields like medical implantology and electric vehicle battery production. Strategic maneuvering in this market will increasingly focus on system intelligence, moving beyond simple automation to incorporate self-optimizing, AI-driven process control systems capable of managing complex plasma chemistries and variable substrate inputs.

For established market players, maintaining a technological lead requires continuous investment in both vacuum and atmospheric technologies, recognizing that vacuum systems dictate precision while atmospheric systems drive volume accessibility. Furthermore, focusing product development on reducing the total cost of ownership (TCO) through improved energy efficiency and enhanced modularity will be crucial for competitive differentiation. Opportunities for growth are particularly strong in developing specialized solutions tailored for emerging applications, such as roll-to-roll processing of flexible electronics and treating specialized composite materials used in advanced aerospace applications, necessitating machines capable of handling large geometries and high thermal sensitivity.

New entrants and smaller specialized firms should concentrate their efforts on the atmospheric plasma segment, which presents lower barriers to entry and vast scope for innovation in integration capabilities (e.g., robotic arm mounting) and portability. Geographically, while APAC remains the powerhouse for volume manufacturing, companies should solidify their presence in North America and Europe to capture the premium segment focused on complex, highly regulated high-mix, low-volume production. Ultimately, success in this market is directly correlated with the ability to offer validated, repeatable, and traceable surface treatment results that meet or exceed stringent industry specifications for cleanliness and adhesion.

- Focus on developing hybrid plasma systems that offer both vacuum precision and atmospheric speed.

- Invest heavily in AI/ML integration for real-time quality control and predictive process adjustment.

- Target the Medical Device and Automotive EV battery sectors as key high-growth application areas.

- Expand service and support infrastructure in APAC to capitalize on high-volume manufacturing demand.

- Prioritize sustainable manufacturing practices by developing low-power consumption and non-hazardous gas chemistry solutions.

Competitive Landscape Analysis

The competitive landscape of the Plasma Surface Preparation Machines Market is moderately fragmented, featuring a mix of large diversified industrial equipment providers and specialized niche players focusing exclusively on plasma technology. Competition is primarily centered on technological innovation, machine reliability, process expertise, and the global reach of service and support networks. Leading companies, such as Nordson MARCH and PVA TePla, leverage their extensive experience and broad portfolio covering both vacuum and atmospheric systems to service high-volume, precision-demanding industries like semiconductors and advanced packaging, often securing long-term contracts based on proven performance and established installed base.

Specialized firms like Plasmatreat and Diener Electronic excel in the atmospheric and low-pressure segments, respectively. Plasmatreat, for instance, has gained significant market traction by developing highly robust and easily integratable atmospheric plasma jets, making them a preferred choice for automotive and general industrial bonding applications. Their competitive advantage lies in developing application-specific solutions that minimize system footprint and maximize throughput in inline operations. Price competition is less severe in the high-precision vacuum segment where performance is paramount, but it is much more pronounced in the standardized atmospheric segment, where integration cost and system flexibility become major differentiators.

Strategic movements defining the market include mergers and acquisitions aimed at consolidating complementary technologies (e.g., combining surface measurement tools with plasma systems) and forming key partnerships with automation providers to deliver turnkey solutions compliant with Industry 4.0 standards. To maintain market share, companies must continuously invest in research that addresses the industry shift towards treating sensitive, complex materials and heterogeneous assemblies, ensuring their machines can deliver flawless surface preparation regardless of substrate type or geometry. Customer relationships centered on detailed process consulting and validated recipe development are essential for long-term success in this technologically complex domain.

- Technology Leadership: Companies compete based on process uniformity, power efficiency, and proprietary control software (e.g., utilizing advanced OES).

- Service and Support: Global accessibility of expert technicians for installation, maintenance, and process optimization is a critical differentiator.

- Strategic Alliances: Partnerships with system integrators and robotics firms to offer complete automated surface treatment cells.

- Product Diversification: Offering a comprehensive range spanning low-cost atmospheric systems to high-end vacuum systems to address all market segments.

Emerging Market Opportunities

The expansion of electric vehicle (EV) manufacturing presents a monumental opportunity for the Plasma Surface Preparation Machines Market. EV battery packs require exceptional bonding reliability between dissimilar materials, such as metal housings and plastic sealants, to ensure structural integrity and thermal management over the vehicle's lifespan. Plasma treatment is uniquely positioned to offer the necessary surface activation to guarantee these critical bonds, overcoming the limitations of traditional mechanical or chemical abrasion methods. The rapid scaling of giga-factories dedicated to battery production will necessitate thousands of high-throughput atmospheric and vacuum plasma systems for preparation prior to sealing, potting, and module assembly processes, creating a high-volume, high-value demand corridor.

Furthermore, the textile and technical fabric sector is beginning to adopt plasma processes for advanced surface functionalization. Beyond simple cleaning, plasma can be used to impart unique properties such as permanent hydrophilicity, flame retardation, or antimicrobial characteristics onto fabrics without altering the bulk material properties or requiring excessive water and chemicals. This shift is driven by consumer demand for high-performance textiles (e.g., outdoor gear, medical textiles) and the industry's desire to transition towards sustainable, dry processing technologies. The ability of atmospheric plasma systems to operate efficiently in a continuous, roll-to-roll manufacturing environment makes them ideal for this sector.

A third significant opportunity lies in the burgeoning market for advanced micro-optics and specialized sensor manufacturing. These components demand ultra-clean surfaces and precise etching capabilities, often involving materials highly sensitive to heat or mechanical stress. Low-temperature, low-pressure plasma systems are becoming indispensable for preparing surfaces prior to deposition of specialized optical coatings or for fine-tuning sensor surfaces at the nano-scale. As the demand for augmented reality (AR) devices, LiDAR sensors, and complex medical imaging equipment grows, so too will the specialized requirement for contamination-free, plasma-enhanced surface modification.

- Electric Vehicle (EV) Battery Production: Ensuring robust adhesion and sealing for complex multi-material battery packs.

- Technical Textiles: Implementing sustainable, dry plasma processes for advanced surface functionalization (e.g., antimicrobial coatings).

- Advanced Micro-Optics and Sensors: Providing ultra-clean preparation for deposition of specialized coatings on heat-sensitive components.

- 3D Printing Post-Processing: Preparing complex 3D printed parts for painting, coating, or subsequent bonding steps.

Regulatory Environment and Compliance

The regulatory environment profoundly influences the adoption and specifications of Plasma Surface Preparation Machines, particularly within the medical device and aerospace industries. In the medical sector, stringent requirements set by bodies like the FDA and European Medicines Agency (EMA) mandate validated and repeatable processes for surface treatment to ensure sterility, biocompatibility, and consistent adhesion for device longevity. Plasma equipment manufacturers must therefore provide comprehensive process documentation, validation protocols (IQ/OQ/PQ), and systems capable of rigorous data logging and traceability to meet ISO 13485 standards for medical device quality management.

In the aerospace and defense sectors, materials processing must comply with strict industry specifications (e.g., AMS standards) regarding surface integrity and bond strength, as failure is catastrophic. This environment drives demand for plasma systems that offer ultra-high reliability, minimal process variation, and exceptional measurement capabilities. The trend here is towards implementing closed-loop control systems, often utilizing AI, to guarantee that every treated part meets non-negotiable performance criteria, reflecting the low tolerance for process drift in mission-critical applications.

Furthermore, global environmental regulations, such as REACH in Europe and similar initiatives worldwide, favor plasma technology. As industries increasingly seek to eliminate volatile organic compounds (VOCs) and hazardous chemical solvents traditionally used in cleaning and activation, plasma processing gains significant strategic advantage as a green, dry, and sustainable alternative. Compliance with these environmental standards acts as a major market driver, pressuring manufacturers across all sectors, from automotive to packaging, to adopt plasma technology to achieve their sustainability targets and maintain market access in environmentally conscious regions.

- Medical Device Compliance: Adherence to FDA/EMA standards and ISO 13485, requiring extensive validation and traceability features.

- Aerospace Quality: Compliance with strict material and process specifications (e.g., AMS), driving demand for ultra-reliable, high-precision vacuum systems.

- Environmental Standards: Plasma is favored globally due to its elimination of hazardous chemical solvents (VOCs), supporting REACH compliance and sustainability goals.

- Data Integrity: Need for sophisticated data logging and process monitoring tools to ensure compliance and audit readiness.

Future Technology Trends

The future of the Plasma Surface Preparation Machines Market is highly dependent on achieving superior control at the nano-scale, integration into automated ecosystems, and enhanced energy efficiency. A leading trend is the refinement of atmospheric pressure plasma (APP) sources to achieve precision levels previously exclusive to vacuum systems. This involves developing novel micro-plasma arrays and highly focused jet technologies that maintain plasma stability and temperature control at ambient conditions, allowing for highly selective, localized surface modification without affecting adjacent materials.

The move towards complete integration within the factory floor, often referred to as Industry 4.0 or smart manufacturing, is accelerating. Future plasma machines will be modular, equipped with extensive sensor packages for continuous diagnostics, and fully enabled for remote monitoring and diagnostics via the Industrial Internet of Things (IIoT). This level of connectivity will enable predictive maintenance models and allow manufacturers to sell 'plasma as a service'—guaranteed surface treatment quality—rather than just selling hardware, shifting the value proposition toward process outcome assurance.

Finally, a major technological push will be the development of multi-gas and pulsed plasma systems. Current systems often rely on a single gas chemistry; however, future requirements demand sequential or simultaneous treatments using diverse gas mixtures (e.g., blending argon, oxygen, and fluorine compounds) to achieve highly complex surface functionalization or controlled etching profiles. Pulsed plasma technology, which allows for extremely precise control over energy input and radical formation, will become standard for treating highly sensitive polymers and organic materials, ensuring maximum activation depth with minimal thermal damage.

- Advanced Atmospheric Precision: Achieving vacuum-like uniformity and control using micro-plasma arrays at ambient pressure.

- Industry 4.0 Integration: Full connectivity, remote diagnostics, and seamless integration into automated production lines via IIoT protocols.

- Pulsed Plasma Technology: Utilizing rapid energy pulsing for ultra-low temperature, highly selective treatment of heat-sensitive materials.

- Multi-Gas Chemistry: Developing machines capable of rapid, sequential, or simultaneous treatment using complex gas mixtures for advanced functionalization.

Key Market Challenges

Despite the strong growth forecast, the Plasma Surface Preparation Machines Market faces several persistent challenges that could impede broader adoption. The most significant challenge remains the high initial investment required, particularly for high-end vacuum plasma systems used in semiconductor and aerospace applications. This high capital expenditure creates a barrier to entry for smaller manufacturers and limits the rate of adoption in cost-sensitive industrial sectors, making the justification for sophisticated plasma systems difficult unless mandated by performance requirements.

A second major challenge is the inherent operational complexity and the steep learning curve associated with maintaining and optimizing plasma processes. Plasma recipes are highly sensitive to subtle changes in gas flow, pressure, power density, and chamber cleanliness. Achieving consistent, repeatable results requires highly skilled technicians and specialized process engineers, leading to high operational expenditure (OPEX) related to personnel training and retention. A lack of globally standardized plasma process metrics further exacerbates this issue, often requiring customized, proprietary validation for each new application.

Furthermore, technical limitations related to the throughput and size handling of vacuum systems restrict their use in mass industrial applications. While atmospheric plasma addresses throughput concerns, ensuring the long-term stability and uniformity of APP treatment over very large areas or during high-speed roll-to-roll processing remains a technological hurdle. Addressing these challenges requires continuous innovation in user interface design, AI-driven parameter stabilization, and the development of cost-effective, modular system designs suitable for small to medium-sized enterprises (SMEs).

- High Capital Investment: Significant cost of vacuum systems restricts adoption by SMEs and cost-sensitive industries.

- Operational Complexity: Need for highly skilled personnel to develop, maintain, and troubleshoot sensitive plasma process recipes.

- Lack of Standardization: Absence of global, universal metrics for plasma treatment quality and effectiveness complicates industrial transferability.

- Throughput Limitations: Scaling up vacuum processes or ensuring uniformity over large areas with APP systems remains technically challenging.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Plasma Surface Preparation Machines Market Statistics 2025 Analysis By Application (Automotive, Electronics, PCB, Medical), By Type (Atmospheric Pressure Plasma Surface Preparation Machines, Low Pressure/Vacuum Plasma Surface Preparation Machines), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Plasma Surface Preparation Machines Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Atmospheric Pressure Plasma Surface Preparation Machines, Low Pressure / Vacuum Plasma Surface Preparation Machines), By Application (Automotive, Electronics, PCB, Medical, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager