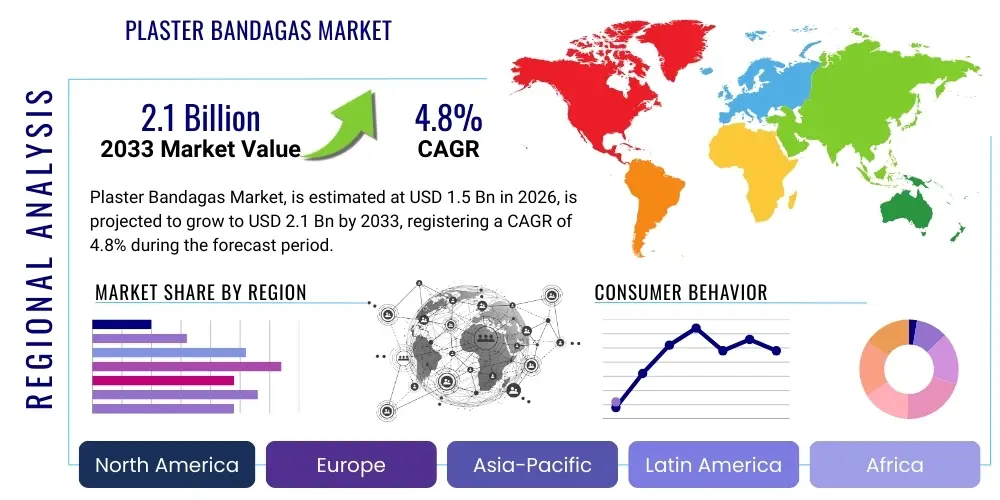

Plaster Bandagas Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438798 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Plaster Bandagas Market Size

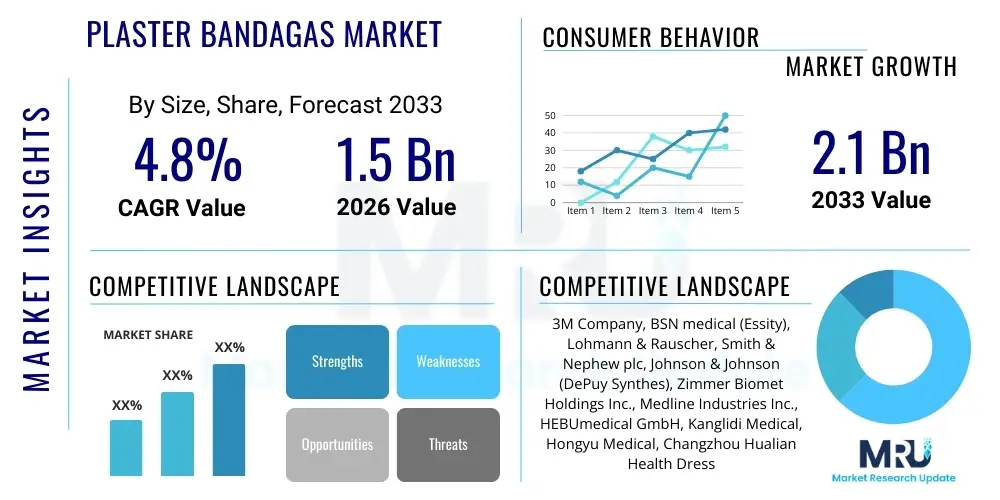

The Plaster Bandagas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Plaster Bandagas Market introduction

The Plaster Bandagas Market encompasses products primarily utilized for immobilization in orthopedic procedures, including the management of fractures, sprains, and congenital deformities. Plaster bandagas, historically known as Plaster of Paris (POP) casts, are fundamentally composed of gypsum powder mixed with water, forming a moldable material that hardens rapidly. While traditional POP remains relevant due to its cost-effectiveness and excellent moldability, the market has seen a significant shift toward synthetic casting tapes, predominantly fiberglass and polyester-based, which offer superior strength-to-weight ratio, water resistance, and quicker setting times. These devices are critical components in trauma care and elective orthopedic surgery globally, ensuring proper alignment and stabilization necessary for successful bone fusion and recovery.

The driving forces behind the market's sustained growth include the rising global incidence of road traffic accidents, leading to increased trauma and fracture cases, especially in developing economies. Furthermore, the expanding geriatric population, inherently susceptible to falls and fragility fractures such as hip and wrist fractures, significantly fuels the demand for effective immobilization solutions. Medical advancements, particularly in the development of lightweight, breathable, and highly durable synthetic materials, are enhancing patient comfort and improving clinical outcomes, thereby stimulating adoption. The market structure involves a steady supply chain serving hospitals, orthopedic clinics, and ambulatory surgical centers (ASCs), where prompt and reliable casting solutions are essential for patient management.

Major applications for plaster bandagas span across both emergency care settings and long-term rehabilitative environments. Besides standard fracture immobilization, they are extensively used in serial casting for treating conditions like clubfoot (Ponseti method), corrective orthopedic procedures, and post-operative stabilization. The continuous innovation focuses on optimizing material characteristics, such as improving ventilation in synthetic casts to mitigate skin complications and refining the biodegradability of traditional materials to address environmental concerns. The essential benefit of these products lies in their ability to provide rigid support, minimizing motion at the injury site, which is paramount for the natural healing process of skeletal injuries, making them indispensable in musculoskeletal healthcare.

Plaster Bandagas Market Executive Summary

The global Plaster Bandagas Market is characterized by a stable but evolving landscape, driven primarily by demographic shifts, escalating trauma incidents, and technological innovation focused on synthetic alternatives. Business trends indicate a strong move away from traditional Plaster of Paris (POP) towards synthetic casting materials like fiberglass and polyester resins, due to their superior performance attributes, which command higher price points and offer better profitability margins for manufacturers. Key strategies involve portfolio diversification by major players to offer a complete spectrum of casting and splinting products, catering to varying clinical needs and economic brackets across different geographies. Furthermore, manufacturers are increasingly investing in educational programs for healthcare providers regarding the correct application and removal techniques for advanced synthetic casts to ensure optimal utilization.

Regional trends highlight North America and Europe as mature markets, characterized by high adoption rates of premium synthetic products and stringent regulatory environments emphasizing safety and quality. These regions are also witnessing increased utilization in Ambulatory Surgical Centers (ASCs), driven by cost-containment efforts and a shift toward outpatient care models. Conversely, the Asia Pacific (APAC) region is poised for the highest growth, fueled by massive population bases, improving healthcare infrastructure, rising disposable incomes, and the high volume of orthopedic procedures performed. While POP remains dominant in many rural or lower-income areas in APAC and MEA due to its affordability, demand for synthetic products is accelerating rapidly in metropolitan centers across China, India, and Southeast Asian nations.

Segmentation trends reveal that the Synthetic Casting Materials segment holds the largest market share in terms of value, largely because of the premium pricing and performance benefits offered by fiberglass and polyurethane-based products. Within applications, fracture management remains the foundational segment, absorbing the majority of products. However, the segment for specialized applications, such as orthotics and corrective serial casting, is experiencing above-average growth, driven by early intervention programs for pediatric musculoskeletal conditions. End-user analysis confirms that hospitals, particularly tertiary care trauma centers, represent the largest purchasing segment, although the procurement power of specialized orthopedic clinics and ASCs is expanding steadily, indicating a fragmentation of the traditional hospital-centric supply chain.

AI Impact Analysis on Plaster Bandagas Market

User inquiries regarding AI's influence on the Plaster Bandagas Market primarily revolve around its role in diagnostic accuracy, personalized casting, and optimizing inventory management in clinical settings. Users are keen to understand if AI can predict fracture healing times more accurately, potentially influencing the duration the cast is needed, or if computational modeling could aid in designing custom-fit casts, especially for complex or iterative casting needs like congenital deformities. There is also interest in AI-driven logistical systems that manage the consumption rates of different casting materials across multiple hospital units, ensuring timely supply and reducing waste. The overall expectation is that while AI will not replace the material product itself, it will fundamentally enhance the diagnostic, application, and patient monitoring processes surrounding the use of plaster bandagas, leading to quicker, more predictable, and less complication-prone recovery periods.

- AI-enhanced diagnostic imaging for precise fracture classification, aiding in optimal cast choice (POP vs. Synthetic).

- Computational modeling for personalized 3D-printed casts, minimizing the margin of error associated with manual casting application.

- Integration of AI algorithms into wearables (smart casts) to monitor skin temperature, pressure points, and humidity, preventing cast complications like pressure sores or dermatitis.

- Predictive analytics for inventory management of casting supplies based on trauma center admission rates and seasonal injury patterns.

- AI-supported training simulators for medical staff to perfect casting techniques, crucial for both traditional and synthetic applications.

DRO & Impact Forces Of Plaster Bandagas Market

The Plaster Bandagas Market dynamics are shaped by a complex interplay of internal and external forces. Key Drivers (D) include the escalating prevalence of orthopedic injuries driven by an aging global population and rising accident rates, coupled with the proven effectiveness and affordability (for POP) or superior convenience (for synthetics) of casting materials. Restraints (R) primarily involve the high risk of complications associated with improper casting, such as compartment syndrome, skin breakdown, and neurovascular compromise, which necessitate strict training and cautious application. Furthermore, the emergence of advanced, non-casting immobilization alternatives, such as functional braces and specialized external fixators, presents competition. Opportunities (O) lie in the development of smart casts integrated with sensors for remote monitoring, expansion into emerging markets with underdeveloped trauma care systems, and the creation of eco-friendly, biodegradable synthetic casting materials to appeal to environmentally conscious healthcare systems. These factors collectively determine the trajectory of market growth and adoption rates globally.

Impact forces within the market are predominantly technological and regulatory. Technological advancements in material science have fundamentally shifted demand towards synthetic products, which, despite being more expensive, offer better patient outcomes and lower chances of revision or replacement. This technological push increases the barrier to entry for new manufacturers relying solely on traditional materials. Regulatory scrutiny, particularly concerning material safety (e.g., minimizing volatile organic compounds in resins) and sterilization standards, significantly influences product development cycles and market approval processes, particularly in highly regulated regions like the EU and the US. Furthermore, pricing pressures exerted by centralized procurement agencies and insurance companies force manufacturers to seek cost efficiencies in production while maintaining high-quality standards.

The long-term success in this market is intrinsically tied to addressing the inherent limitations of rigid immobilization. Restraints, particularly complications, drive research toward materials that offer dynamic support or better monitoring capabilities, transforming potential threats into areas for innovation (Opportunities). The necessity for effective, quick fracture management globally (Drivers) ensures a foundational demand, but future growth will be heavily dependent on how effectively manufacturers integrate technology to mitigate risks and improve the overall patient experience, aligning with the shift towards value-based healthcare models that prioritize reduced complications and faster recovery. The balance between cost, performance, and risk management defines the competitive landscape.

Segmentation Analysis

The Plaster Bandagas Market segmentation provides a clear framework for understanding market dynamics based on material composition, application area, and the type of end-user facility. Analyzing these segments is critical for manufacturers to tailor their production, pricing, and distribution strategies effectively. The dominant segregation is by material type, which clearly distinguishes the mature, high-volume Plaster of Paris segment from the high-growth, high-value Synthetic segment. Application segmentation reflects the major clinical uses, with fracture management being the primary consumer, while end-user categorization illustrates the evolving procurement landscape, transitioning from purely hospital-centric purchases to significant volume absorption by specialized orthopedic clinics and ambulatory settings, reflecting changes in healthcare delivery models worldwide.

- By Material Type:

- Plaster of Paris (POP) Bandagas

- Synthetic Casting Materials (Fiberglass, Polyester, Thermoplastics)

- By Application:

- Fracture Management

- Joint Immobilization

- Deformity Correction (e.g., Clubfoot, Scoliosis)

- Post-Operative Support

- By End-User:

- Hospitals (Trauma Centers, General Hospitals)

- Ambulatory Surgical Centers (ASCs)

- Orthopedic Clinics and Physician Offices

- Emergency Medical Services (EMS)

- By Distribution Channel:

- Direct Sales

- Distributors & Wholesalers

- Online Retailers

Value Chain Analysis For Plaster Bandagas Market

The value chain for the Plaster Bandagas Market begins with upstream activities focused on raw material sourcing and preparation. For Plaster of Paris, this involves mining and processing gypsum (calcium sulfate), a relatively inexpensive and abundant resource, followed by calcination to create the hemihydrate powder. For synthetic casts, the upstream involves the production of specialized knitted fiberglass or polyester fabric tapes impregnated with polyurethane or resin, requiring chemical manufacturing expertise. Quality control at this stage is crucial, as the chemical properties directly influence the setting time, durability, and rigidity of the final product. Manufacturers often integrate key parts of the material processing or maintain strong, long-term contracts with specialized chemical suppliers to ensure material consistency and manage volatile input costs, especially concerning petrochemical-derived resins.

Midstream activities involve the primary manufacturing processes, including impregnation, packaging, and sterilization. This stage is characterized by high operational efficiencies and adherence to stringent quality and safety standards (ISO and FDA/CE mark compliance). Distribution channels then manage the flow of finished goods. The dominant distribution strategy is a mixed model: large multi-national corporations utilize direct sales forces for high-volume hospital contracts and government tenders, ensuring personalized customer service and deeper market penetration. Simultaneously, indirect distribution through specialized medical distributors and wholesalers is leveraged to reach smaller clinics, pharmacies, and geographically dispersed end-users, optimizing logistical efficiency and inventory management across diverse regional markets.

Downstream analysis focuses on the end-users—hospitals, ASCs, and clinics—which consume the products. The procurement process in major hospitals is highly centralized and price-sensitive, often favoring bundled purchasing agreements encompassing a range of orthopedic supplies. Indirect distribution plays a vital role in ensuring rapid availability, especially in emergency settings where immediate access to casting materials is critical for patient stabilization. The value chain concludes with the application of the bandagas by trained healthcare professionals (orthopedic surgeons, nurses, and technicians), where the quality of application directly impacts patient outcomes. Feedback from these clinical users often drives product innovation regarding ease of use, comfort, and complication reduction, thus completing the cyclical value generation process.

Plaster Bandagas Market Potential Customers

The primary customers for Plaster Bandagas are institutional buyers within the healthcare ecosystem, where immobilization supplies are mandatory for trauma and orthopedic procedures. Hospitals, particularly those with dedicated emergency departments and trauma centers, represent the largest and most frequent procurement channel, driven by the need for bulk supply to manage routine and high-acuity fracture cases resulting from accidents, sports injuries, and falls. These institutions prioritize reliability, speed of delivery, and material consistency when selecting suppliers. The procurement departments act as gatekeepers, balancing clinical needs with budget constraints, making cost-effectiveness a crucial factor, especially for Plaster of Paris usage in publicly funded systems.

Ambulatory Surgical Centers (ASCs) and specialized orthopedic clinics constitute a rapidly growing customer segment. These facilities typically handle elective orthopedic procedures and lower-acuity fracture management that does not require lengthy hospital stays. ASCs favor high-performance synthetic materials that facilitate quicker application and removal, contributing to faster patient turnaround and enhanced patient satisfaction. Their purchasing decisions are often influenced by orthopedic surgeons who dictate product preferences based on clinical experience and perceived superior outcomes. The purchasing volume per facility might be lower than a major hospital, but their decentralized nature makes them strategically important targets for specialized distributors.

Furthermore, specialized segments such as rehabilitation centers focusing on pediatric orthopedics (e.g., for clubfoot correction via serial casting) are key consumers of both POP (due to its excellent moldability for intricate corrections) and specialized synthetic options. Emergency medical service (EMS) providers and military medical units also represent important, albeit smaller, segments that require portable, rapidly deployable splinting and casting solutions for field stabilization. For all customer types, the ability of manufacturers to provide comprehensive educational support and disposal solutions significantly enhances their value proposition beyond the product itself.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, BSN medical (Essity), Lohmann & Rauscher, Smith & Nephew plc, Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings Inc., Medline Industries Inc., HEBUmedical GmbH, Kanglidi Medical, Hongyu Medical, Changzhou Hualian Health Dressings Co., Ltd., Winner Medical Co., Ltd., Alcare Co., Ltd., Shandong Jierui Medical Equipment Co., Ltd., O&P Supply, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plaster Bandagas Market Key Technology Landscape

The technology landscape for the Plaster Bandagas Market is bifurcated, focusing on refining traditional material usage while aggressively pushing innovations in synthetic substitutes. For traditional Plaster of Paris (POP), technological advancements are relatively minor, centering on improving the plaster-to-water ratio for faster setting times and incorporating high-quality, fine-mesh gauze to ensure smooth unwrapping and minimize plaster shedding. The fundamental technology relies on the exothermic reaction of calcium sulfate hemihydrate converting back to dihydrate upon hydration. However, the true innovation lies in the specialized weaving techniques for the cotton crinoline used, ensuring uniform impregnation and strength across the bandage roll. Research is also ongoing into additives that can reduce dust during application and removal, addressing occupational health concerns for healthcare providers.

The synthetic casting segment is the primary hub of technological evolution, spearheaded by advanced material science. Fiberglass casting tapes are the current standard, featuring a knitted fiberglass substrate impregnated with a water-activated polyurethane resin. Key technological differentiators include lightweight, radiolucency (allowing clear X-ray imaging through the cast), and high durability achieved through optimized resin formulations. Newer developments involve thermoplastic casting materials, which can be heated, molded, and subsequently cooled to achieve rigid immobilization. These materials offer the advantage of remoldability, making adjustments easier and minimizing material waste, particularly useful in pediatric serial casting procedures where frequent changes are required. This technology aims to balance the superior strength of fiberglass with the adjustability of traditional POP.

A crucial technological trend gaining traction is the integration of digital tools and auxiliary devices, often referred to as "smart casting." This involves embedding miniature sensors into the cast padding or the cast itself to monitor critical physiological parameters such as internal temperature, humidity, pressure exerted on the limb, and physical movement. Data collected is transmitted wirelessly to healthcare providers, allowing for early detection of potential complications like pressure sores or compartment syndrome, a significant risk associated with rigid immobilization. While not yet widespread, this convergence of material science, IoT (Internet of Things), and data analytics represents the future technological apex of the Plaster Bandagas market, shifting the product from a static device to a dynamic monitoring tool essential for optimized patient recovery management.

Regional Highlights

- North America: This region maintains the largest market share in terms of revenue, primarily driven by high healthcare expenditure, the prevalence of advanced trauma care infrastructure, and the dominant adoption of high-value synthetic casting products. The U.S. market is characterized by stringent FDA regulations ensuring product quality and safety, contributing to premium pricing. High rates of sports injuries and an increasing elderly population contribute consistently to the volume demand.

- Europe: Europe is a mature and highly competitive market, characterized by strong regulatory compliance (CE Mark) and a split preference between traditional POP in some public health systems (due to cost control) and advanced synthetic casts. Western European countries, particularly Germany and the UK, are key consumers. Emphasis on sustainable and biodegradable options is accelerating due to environmental policies.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This robust growth is attributed to rapid urbanization, improving road infrastructure leading to higher accident rates, and substantial investment in developing healthcare facilities across China, India, and Southeast Asia. While price sensitivity keeps POP demand high in rural areas, metropolitan centers are quickly adopting synthetic materials due to increasing access to private healthcare insurance and global medical standards.

- Latin America (LATAM): The LATAM market growth is steady, driven by the need for better trauma management and orthopedic care, particularly in Brazil and Mexico. Market penetration is often challenged by economic instability and fragmented distribution networks, leading to a strong reliance on cost-effective traditional POP products, though major multinational companies are expanding their synthetic offerings targeting private clinics.

- Middle East and Africa (MEA): This region is characterized by heterogeneous market development. Countries in the GCC (Gulf Cooperation Council) exhibit high per-capita healthcare spending and strong demand for advanced synthetic casts. In contrast, sub-Saharan Africa relies heavily on charitable donations and basic POP products, making affordability the paramount factor influencing procurement decisions across the majority of the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plaster Bandagas Market.- 3M Company

- BSN medical (Essity)

- Lohmann & Rauscher

- Smith & Nephew plc

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet Holdings Inc.

- Medline Industries Inc.

- HEBUmedical GmbH

- Kanglidi Medical

- Hongyu Medical

- Changzhou Hualian Health Dressings Co., Ltd.

- Winner Medical Co., Ltd.

- Alcare Co., Ltd.

- Shandong Jierui Medical Equipment Co., Ltd.

- O&P Supply, Inc.

- Technol (Karnal)

- Prime Medical Inc.

- Hanger, Inc.

- Orthofix Medical Inc.

- B Braun Melsungen AG

Frequently Asked Questions

Analyze common user questions about the Plaster Bandagas market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Plaster of Paris (POP) and synthetic bandagas?

The primary difference lies in composition and performance; POP uses gypsum, is low-cost, offers superior moldability, but is heavy and non-water resistant. Synthetic bandagas, typically fiberglass or polyester with polyurethane resin, are lightweight, highly durable, water resistant, and offer faster setting times, driving their increased adoption in orthopedic care.

Why is the Synthetic Casting Materials segment growing faster than Plaster of Paris?

The synthetic segment is experiencing rapid growth due to superior patient benefits, including enhanced comfort, reduced weight, and water resistance, which contribute to better hygiene and mobility during recovery. Healthcare providers favor synthetics for their speed of application and reduced risk of breakdown compared to traditional plaster.

Which region holds the largest market share for Plaster Bandagas?

North America currently holds the largest market share, driven by high per capita healthcare spending, advanced trauma care infrastructure, and the widespread preference and purchasing power for premium synthetic immobilization products.

What are the key risks associated with the application of plaster bandagas?

Key risks include neurovascular compression, compartment syndrome (requiring immediate cast removal), pressure sores, skin irritation (dermatitis), and difficulties in monitoring the underlying injury due to the opaque nature of the cast. These risks necessitate professional application training and careful patient monitoring.

How will 'smart casting' technology influence the future of the market?

Smart casting, utilizing embedded sensors to monitor pressure, temperature, and humidity, is expected to significantly enhance patient safety by providing real-time data to clinicians. This technological integration aims to proactively detect and mitigate casting complications, improving clinical outcomes and shifting the product into a dynamic diagnostic tool.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager