Plastering Robot Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434530 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Plastering Robot Market Size

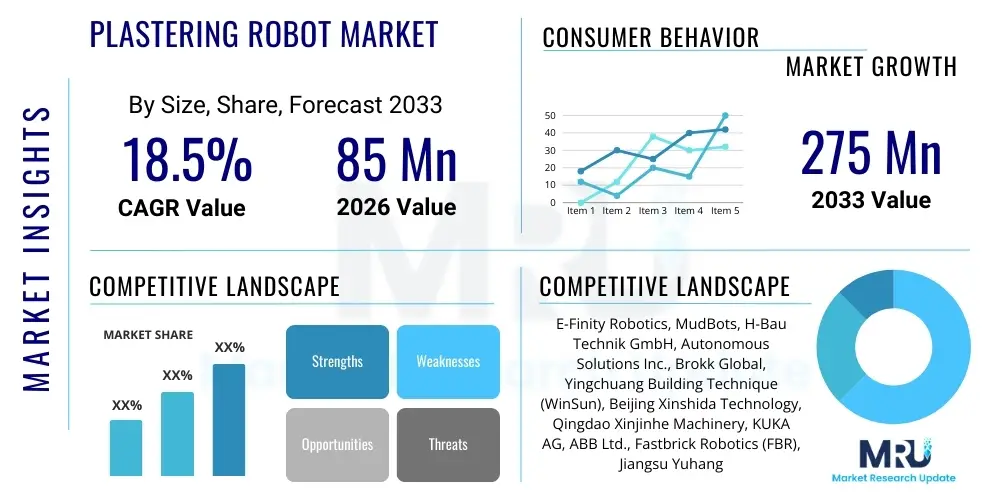

The Plastering Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 85 million in 2026 and is projected to reach USD 275 million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for automated solutions in the construction sector, particularly in economies facing acute labor shortages and increasing pressure for enhanced operational safety and efficiency.

Plastering Robot Market introduction

The Plastering Robot Market encompasses advanced machinery designed to automate the laborious and time-consuming process of applying plaster or mortar to walls and ceilings in construction environments. These robotic systems are fundamentally electro-mechanical devices integrating sophisticated sensor technology, precise motion control systems, and specialized material delivery mechanisms. The primary product offerings range from small, highly mobile, semi-automatic units suitable for residential renovations to large, track-mounted, fully automated systems optimized for high-rise commercial structures and extensive infrastructure projects. These machines significantly reduce manual labor dependency, ensuring consistent quality and speed far surpassing traditional methods, thereby addressing critical industry challenges related to skill shortages and project deadlines.

Major applications of plastering robots span across residential construction, large-scale commercial complexes, and industrial facility development, including internal wall rendering, exterior façade finishing, and fireproofing mortar application. The versatility of modern plastering robots allows them to handle various materials, including cement-based plaster, gypsum plaster, and specialized decorative coatings, provided the consistency parameters are appropriately managed through integrated mixing units. The core benefits derived from their adoption include minimized material waste due to precise application control, improved worker safety by removing personnel from hazardous height operations, and standardized surface finish quality which reduces the need for costly rework. Furthermore, the ability to operate continuously, often requiring minimal supervision, accelerates the construction lifecycle significantly.

Driving factors propelling this market forward include stringent regulatory mandates concerning construction worker safety, particularly in developed economies, coupled with the rising cost of skilled labor worldwide. Technological advancements, notably in Simultaneous Localization and Mapping (SLAM) algorithms and sensor fusion, have made these robots more adaptable to complex, unstructured construction site environments. Government initiatives promoting construction digitalization and Smart City infrastructure investments also provide fertile ground for market expansion, positioning plastering robots as essential tools for achieving future building standards. The competitive advantage offered by rapid project completion using robotic systems further incentivizes large construction conglomerates to integrate this technology into their core workflows.

Plastering Robot Market Executive Summary

The Plastering Robot Market is undergoing rapid transformation, characterized by shifting business trends favoring Robotics-as-a-Service (RaaS) models over outright purchase, particularly among small and medium-sized construction enterprises, lowering the barrier to entry for adoption. Key technological trends center around enhanced autonomy, improved compatibility with Building Information Modeling (BIM) software for seamless integration into construction planning, and the development of lightweight composite materials for robot chassis to improve mobility and deployment speed. Financially, the market is attracting significant venture capital investment, driving rapid innovation cycles focused on multi-functional capabilities, such as combined plastering and sanding operations.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, dominates the current market landscape due to the sheer volume of new construction projects and government focus on modernizing outdated construction techniques. North America and Europe, however, exhibit higher adoption rates of premium, fully autonomous robots, driven by high labor costs and strict quality standards. Future growth is anticipated to be steepest in Latin America and the Middle East, fueled by large-scale infrastructure and residential development programs requiring rapid, high-quality finishing solutions. Localization of manufacturing and dedicated technical support networks are becoming crucial regional competitive differentiators.

In terms of segmentation, the market for Automatic Plastering Robots is projected to grow faster than Semi-Automatic units, reflecting the industry's commitment to maximizing labor efficiency. By application, the Commercial and High-Rise segment remains the largest revenue generator due to the scale and complexity of projects demanding high throughput and precision. However, the Residential segment is emerging as a high-growth area, spurred by the introduction of smaller, more cost-effective robotic solutions tailored for single-family and multi-story housing developments. The integration of advanced sensor systems and proprietary mortar formulas compatible with robotic application will further define segment performance over the forecast period.

AI Impact Analysis on Plastering Robot Market

User queries regarding AI integration in plastering robots frequently focus on two main themes: performance optimization and quality assurance. Common questions include how AI improves path planning in complex environments, whether machine learning can predict and compensate for material inconsistencies (such as varying viscosity or rapid drying times), and the reliability of AI-driven vision systems for real-time defect detection and surface smoothness measurement. Users are keenly interested in whether AI can truly deliver ‘zero-defect’ plastering and how this technology will affect the required skill set of onsite operators, often expressing concerns about job displacement versus job augmentation. The overarching expectation is that AI integration will transition the technology from mere automation tools to smart, self-optimizing finishing systems capable of making real-time adjustments based on environmental and material variables.

AI's primary influence is moving robots beyond simple pre-programmed movements toward genuinely autonomous operation. By utilizing deep learning algorithms fed with vast datasets of construction site variability, robots can rapidly calculate the most energy-efficient and time-effective trajectory for plaster application, minimizing overlaps and skips. Furthermore, AI-powered predictive maintenance is reducing operational downtime by monitoring wear and tear on pumps, nozzles, and joints, alerting operators before catastrophic failures occur. This shift towards intelligent operational management significantly enhances the Return on Investment (ROI) for construction firms adopting these technologies.

Crucially, AI vision systems, leveraging convolutional neural networks (CNNs), are integrating into the application process. These systems continuously scan the newly plastered surface, comparing it against established quality metrics (e.g., thickness uniformity, flatness, texture consistency). If deviations are detected, the AI can instantaneously instruct the robotic arm to perform a corrective pass or adjust the material flow rate, ensuring the finish meets precise specifications without human intervention. This real-time quality control capability is a game-changer for high-precision architectural projects.

- AI enhances path planning and obstacle avoidance using SLAM data processing.

- Machine learning optimizes material consumption based on wall substrate variability and humidity levels.

- Real-time quality control and defect detection are enabled by integrated computer vision (CNNs).

- Predictive maintenance algorithms reduce operational downtime and extend component lifespan.

- AI-driven parameter adjustment ensures consistent plaster thickness and surface uniformity.

DRO & Impact Forces Of Plastering Robot Market

The Plastering Robot Market dynamic is shaped by a strong interplay of drivers, restraints, and opportunities, all magnified by significant external impact forces such as governmental regulation and technological convergence. Key drivers include the critical shortage of skilled masonry and plastering labor globally, pushing companies toward automation to maintain project timelines and quality standards. Simultaneously, opportunities arise from the increasing market penetration in high-density residential developments and the necessity for high-speed, repeatable quality in façade construction using lightweight materials. However, restraints such as the substantial initial capital investment required for high-end autonomous units and the steep learning curve for existing construction site personnel hinder widespread adoption, particularly among smaller contractors.

The primary impact forces acting on the market are the accelerating pace of technological innovation in robotics and materials science. Integration with IoT platforms and 5G connectivity is enabling remote monitoring and control, significantly improving efficiency. Furthermore, geopolitical shifts influencing trade tariffs on key robotic components (sensors, servo motors) can impact manufacturing costs and market pricing, especially for systems manufactured in Asian hubs and sold in Western markets. Sustainability mandates demanding reduced material waste and energy consumption in construction further compel manufacturers to develop lighter, more efficient robots, effectively turning regulatory pressure into a driver for innovation.

Ultimately, the market’s trajectory depends on how effectively manufacturers address the restraint concerning adaptability. Current robotic systems often struggle with non-standardized substrates or highly complex architectural geometries, areas where manual labor still holds an advantage. Addressing this through enhanced AI mapping capabilities and modular tooling remains a core opportunity. The convergence of automated plastering with other finishing automation technologies, such as robotic painting or tiling, creates synergistic opportunities for construction firms seeking holistic automated project management solutions, thereby reinforcing the market's long-term growth potential.

Segmentation Analysis

The Plastering Robot Market is meticulously segmented based on key functional and application attributes to cater to the diverse needs of the global construction industry. This granular segmentation allows market players to specialize their product offerings, focusing on optimizing efficiency within specific project constraints, such as wall height limitations or required material throughput. The fundamental split exists between the degree of autonomy offered by the robot, the environment in which it operates, and the materials it is designed to handle efficiently. Understanding these segments is crucial for strategic market entry and product development, ensuring alignment with end-user requirements regarding capital expenditure and operational complexity.

Segmentation by Type, differentiating between Automatic and Semi-Automatic systems, highlights the ongoing transition toward full autonomy. While Semi-Automatic robots require human assistance for tasks like repositioning or material loading, making them cheaper and easier to deploy on smaller sites, Automatic systems use advanced navigation (e.g., laser scanning, computer vision) to manage entire sections of wall preparation and plastering without constant supervision. The latter is increasingly favored for large-scale commercial projects where continuous operation over extended shifts maximizes ROI. Further divisions within this category include differentiating systems based on their mobility mechanism, typically categorized as tracked, wheeled, or rail-mounted systems, depending on the terrain and vertical operational requirements.

Application-based segmentation divides the market into Residential, Commercial, and Industrial sectors. The Commercial segment, encompassing high-rise office buildings, hospitals, and large retail centers, currently holds the largest market share due to the vast surface area requiring uniform finishing. Conversely, the Residential segment is experiencing the fastest growth, driven by affordable, smaller robots suitable for standardized housing projects. Finally, the segmentation by Material Type, focusing on systems optimized for cement-based mortar versus gypsum plaster, allows manufacturers to fine-tune material handling and nozzle design for optimal compatibility, ensuring the mechanical properties of the final surface are achieved consistently.

- By Type:

- Automatic Plastering Robots (Fully Autonomous, High Throughput)

- Semi-Automatic Plastering Robots (Assisted Operation, Lower Cost)

- By Application:

- Residential (Housing Projects, Apartment Blocks)

- Commercial (Office Towers, Hospitals, Educational Institutions)

- Industrial (Warehouses, Factories, Infrastructure Projects)

- By Movement Mechanism:

- Tracked Systems (Better stability on uneven terrain)

- Wheeled Systems (Higher speed on smooth floors)

- Rail/Scaffolding Mounted Systems (Vertical high-rise application)

- By Material Type:

- Cement-Based Plaster Robots

- Gypsum Plaster Robots

- Specialized Mortar/Coating Robots

Value Chain Analysis For Plastering Robot Market

The value chain of the Plastering Robot Market begins significantly upstream with the suppliers of specialized components, distinct from traditional construction equipment manufacturing. This includes high-precision sensor manufacturers (LiDAR, ultrasonic), advanced motion control and servo drive producers, and specialized composite material providers for lightweight chassis construction. The upstream competitiveness is often determined by the reliability, miniaturization, and cost-effectiveness of these sophisticated electronic and mechanical components, with reliance on key regions like Germany, Japan, and South Korea for high-grade robotics hardware. Effective supply chain management at this stage is critical to mitigate the risk of component shortages which can significantly inflate final product costs and delay manufacturing schedules.

Midstream, the value chain involves the core processes of design, system integration, and final assembly by the Original Equipment Manufacturers (OEMs). This is the stage where proprietary software development, specifically the path-planning algorithms, human-machine interface (HMI) design, and material delivery system optimization, adds the most significant value. Integration of off-the-shelf components into a robust construction-ready machine is a complex engineering task requiring specialized expertise in fluid dynamics (for mortar pumping) and structural robotics. OEMs often establish strategic partnerships with software firms specializing in AI and cloud connectivity to ensure their robots are ‘smart’ and future-proof, facilitating over-the-air updates and remote diagnostics.

Downstream distribution channels are bifurcated into direct sales to large, multinational construction firms and indirect distribution through regional equipment dealers and specialized construction technology resellers. Direct channels often include comprehensive service and maintenance contracts, providing a high-touch customer relationship essential for expensive, complex machinery. Indirect channels, particularly the RaaS model facilitated by third-party rental companies, are expanding rapidly, making the technology accessible to smaller contractors. Post-sales support, encompassing training, field maintenance, and spare parts supply, forms a critical part of the downstream value delivery, as operational uptime is paramount for maximizing project efficiency and securing repeat business from end-users.

Plastering Robot Market Potential Customers

The primary end-users and buyers of plastering robot technology are large-scale construction enterprises and specialized façade and finishing contractors who execute major commercial and residential projects under tight deadlines. These customers prioritize efficiency, standardized quality output across thousands of square meters, and a reduction in long-term operational costs associated with maintaining a large, skilled labor force. Multinational construction conglomerates, particularly those operating in multiple geographies, seek advanced robotic solutions that offer consistency and compliance with varying international building standards and safety regulations, viewing the initial high capital expenditure as a necessary investment for competitive differentiation and risk mitigation.

A secondary, but rapidly growing, segment of potential customers includes prefabrication and modular construction companies. These entities require automated finishing solutions that can operate within controlled factory environments, demanding extremely high precision and repeatability to ensure components fit perfectly on site. For these customers, the robot's integration capability with existing manufacturing execution systems (MES) and BIM is a decisive purchasing factor. The ability of the robot to process complex 3D models and execute precise, non-standardized finishes, such as curved walls or architectural features, makes the technology highly appealing in this evolving construction method.

Furthermore, equipment rental and leasing companies represent a critical customer segment, particularly in high-labor-cost regions like Western Europe and North America. These companies purchase robots in bulk to offer them on a short-term basis or via RaaS agreements to smaller local contractors who cannot justify the outright purchase price. This model allows contractors to test the technology and utilize it for specific projects, significantly broadening the overall market reach. These customers demand highly durable, easily maintained robots with robust telematics and diagnostic capabilities to manage a diverse, decentralized fleet effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85 Million |

| Market Forecast in 2033 | USD 275 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | E-Finity Robotics, MudBots, H-Bau Technik GmbH, Autonomous Solutions Inc., Brokk Global, Yingchuang Building Technique (WinSun), Beijing Xinshida Technology, Qingdao Xinjinhe Machinery, KUKA AG, ABB Ltd., Fastbrick Robotics (FBR), Jiangsu Yuhang Robot, Suzhou Long-Term Robot, Shenzhen Ruitong, Construction Robotics Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastering Robot Market Key Technology Landscape

The technological sophistication of modern plastering robots revolves around the convergence of advanced sensor fusion, precise motion control, and dedicated software optimization for construction materials. Core to robot navigation and mapping is Simultaneous Localization and Mapping (SLAM) technology, often utilizing a blend of LiDAR, inertial measurement units (IMUs), and visual sensors to create accurate 3D maps of the often-changing construction site environment. This allows the robot to dynamically recalculate paths, detect obstacles, and ensure precise localization relative to the target wall surface, which is critical for maintaining uniform plaster thickness regardless of minor wall irregularities. Furthermore, high-performance servo motors and drives are essential for enabling the fast, repeatable, and heavy-duty movements required for maneuvering the application arm and material hoses, maintaining dynamic stability during operation.

Material handling technology represents another critical aspect of the landscape. This includes specialized peristaltic or screw-pump systems designed to handle the abrasive and viscous nature of mortar and plaster mixtures without excessive wear or clogging. Innovations in nozzle design are focused on achieving various surface textures and maximizing material transfer efficiency while minimizing overspray and rebound. Crucially, the integration of real-time material condition monitoring sensors (viscosity, temperature) allows the onboard computer to adjust pump speed and mixing ratio dynamically, ensuring that the material applied consistently meets the specified engineering requirements for curing and adhesion, significantly enhancing the final structural quality.

Beyond hardware, software integration is increasingly defining market leadership. This includes the seamless communication between the robot's operating system and Building Information Modeling (BIM) platforms. BIM integration allows project specifications—such as precise layer thickness, boundary limits, and architectural features—to be fed directly to the robot, minimizing manual input errors. Furthermore, the adoption of proprietary telematics and IoT frameworks enables remote diagnostics, fleet management, and performance analytics, allowing construction managers to monitor productivity metrics (e.g., square meters per hour) across multiple job sites. This digital integration maximizes operational transparency and supports the predictive maintenance models necessary for maintaining high equipment utilization rates.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily fueled by massive infrastructural investment in rapidly urbanizing countries like China, India, and Southeast Asia. The intense pressure to complete large-scale projects quickly, coupled with persistent demographic shifts leading to a shortage of manual labor, makes automation solutions highly attractive. Government support for modern construction techniques, particularly in China's push toward modular and prefabricated construction, mandates the adoption of technologies like plastering robots to meet quality and speed standards. The region’s focus is currently balanced between low-cost, high-throughput systems and high-end automated solutions.

- North America (NA): North America represents a mature, high-value market characterized by high labor costs and stringent safety regulations enforced by bodies like OSHA. Adoption here is driven less by volume and more by the necessity for precision, safety, and operational efficiency. The market favors fully autonomous, AI-driven systems that integrate seamlessly with advanced construction management software (BIM, ERP). The Robotics-as-a-Service (RaaS) model is gaining significant traction, allowing smaller contractors to access expensive technology without significant upfront capital investment, mitigating risk and accelerating deployment.

- Europe: Europe exhibits strong demand driven by high skilled labor wages and an environmental focus on material efficiency and waste reduction. Countries like Germany, the UK, and Scandinavia lead in adopting premium, sustainable robotic solutions. The market is highly segmented, with strong emphasis on systems capable of handling specific regional materials (e.g., specialized thermal insulation plasters) and complying with rigorous EU machinery directives. Innovation is often focused on mobility, precision application, and reducing the physical footprint of the equipment to navigate densely populated urban construction sites.

- Middle East and Africa (MEA): This region is characterized by large, ambitious, long-term construction projects (e.g., Saudi Vision 2030, UAE urban developments). Demand is concentrated in high-profile commercial and residential towers where speed and aesthetic quality are paramount. The market growth is reliant on foreign direct investment and large government contracts, favoring robust, high-durability robots capable of operating effectively in harsh environmental conditions (high heat, dust). Localized distribution and strong after-sales service are critical factors due to complex logistics.

- Latin America (LATAM): The LATAM market is currently nascent but shows significant potential, particularly in high-growth economies like Brazil and Mexico. Market adoption is currently constrained by economic volatility and higher import tariffs on machinery. However, the increasing industrialization of the construction sector and growing focus on quality control in urban housing projects are expected to drive steady growth, focusing initially on semi-automatic and lower-cost automatic robot models that offer a favorable cost-benefit ratio compared to manual labor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastering Robot Market.- E-Finity Robotics

- MudBots

- H-Bau Technik GmbH

- Autonomous Solutions Inc.

- Brokk Global

- Yingchuang Building Technique (WinSun)

- Beijing Xinshida Technology

- Qingdao Xinjinhe Machinery

- KUKA AG

- ABB Ltd.

- Fastbrick Robotics (FBR)

- Jiangsu Yuhang Robot

- Suzhou Long-Term Robot

- Shenzhen Ruitong

- Construction Robotics Inc.

- Foshan Dike Mechanical Equipment

- Wuhan BCX Technology

- Pudu Robotics

Frequently Asked Questions

Analyze common user questions about the Plastering Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical Return on Investment (ROI) period for a high-performance plastering robot?

The ROI period for a fully automatic plastering robot typically ranges from 18 to 36 months, heavily dependent on regional labor costs, the average number of operational hours per project, and the capacity utilization rate. High-volume commercial contractors in high-wage economies often achieve the shortest payback periods.

How do plastering robots manage uneven wall surfaces or non-standard architectural designs?

Advanced plastering robots utilize integrated LiDAR and vision systems to create a precise 3D map of the wall before application. AI algorithms then compensate for irregularities by dynamically adjusting the robotic arm's angle and the material flow rate, ensuring consistent plaster thickness across variable surfaces and complex geometries.

What are the primary safety benefits associated with adopting automated plastering technology?

The core safety benefits include significantly reducing the need for workers to operate at hazardous heights (e.g., on scaffolding or ladders), minimizing exposure to airborne dust and chemicals, and mitigating physical strain injuries associated with repetitive manual tasks, leading to fewer site accidents overall.

Are plastering robots compatible with all standard construction plaster and mortar materials?

While most robots are compatible with common cement, gypsum, and polymer-based plasters, optimal performance often requires materials formulated specifically for robotic application, possessing consistent viscosity and grain size. Manufacturers often provide guidance or specialized mixing units to ensure material consistency.

What is the difference between Automatic and Semi-Automatic plastering robots?

Automatic robots operate autonomously, handling navigation, positioning, and application execution without constant human intervention, ideal for large sites. Semi-Automatic robots require an operator to manually position the machine or reload material frequently, making them better suited for smaller projects or environments with frequent logistical changes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager