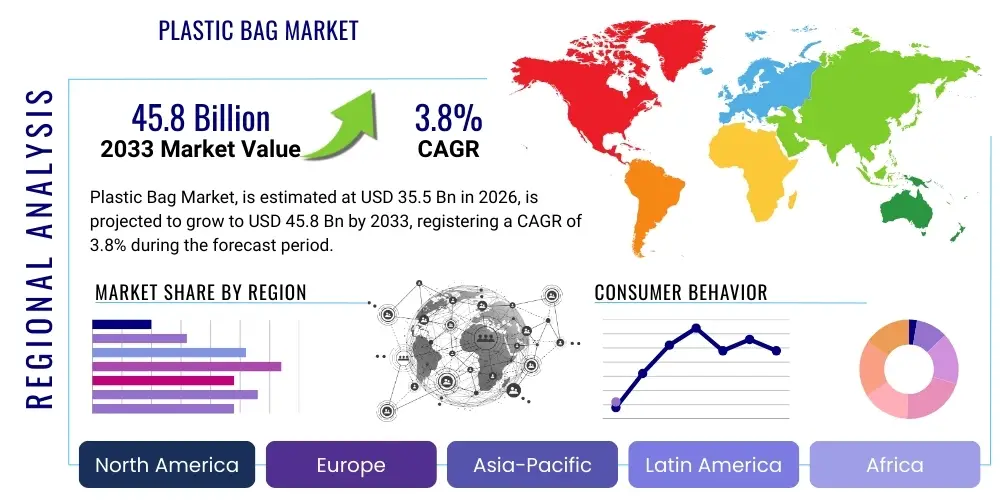

Plastic Bag Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435150 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Plastic Bag Market Size

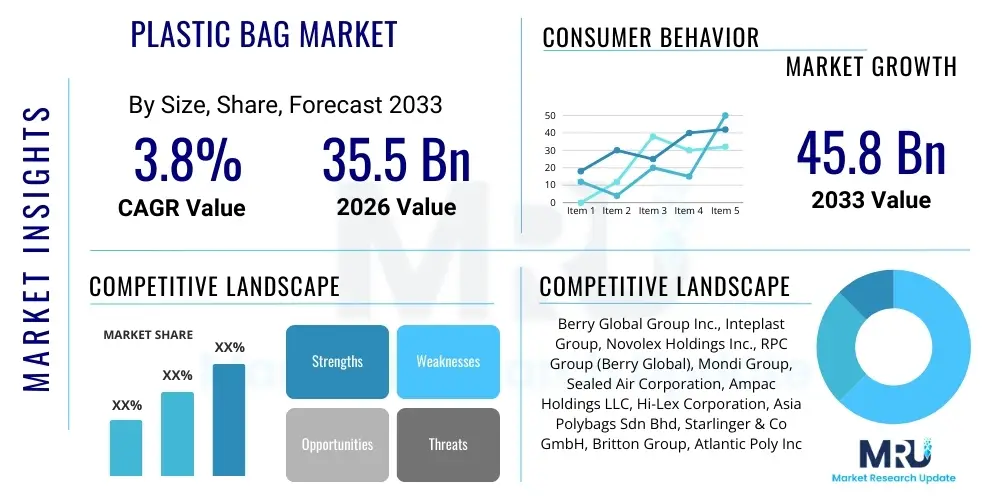

The Plastic Bag Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 45.8 Billion by the end of the forecast period in 2033.

Plastic Bag Market introduction

The global Plastic Bag Market encompasses the manufacturing, distribution, and sale of lightweight containers primarily made from plastic polymers such as High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), and Linear Low-Density Polyethylene (LLDPE). These bags are widely utilized across various sectors due to their inherent advantages, including durability, low cost of production, impermeability, and high tensile strength. Traditionally, plastic bags have been indispensable in retail, grocery, and packaging operations globally, serving as a vital component in the efficient movement of consumer goods. However, the market dynamics are currently undergoing a profound transformation driven by increasing environmental scrutiny and stringent regulatory policies aimed at minimizing plastic waste, particularly single-use items.

The product scope extends beyond standard grocery and t-shirt bags to include heavy-duty refuse sacks, specialized industrial liners, and bags for medical and agricultural applications. While conventional plastic bags dominate based on volume, the fastest-growing segment involves biodegradable and compostable alternatives, which utilize polymers like Polylactic Acid (PLA) or Polyhydroxyalkanoates (PHA) to offer environmentally friendlier solutions. Major applications are concentrated in the food and beverage industry for packaging perishable items, followed closely by the retail sector where bags are used for consumer transport, and the industrial sector for waste management and protective linings.

Key driving factors include rapid urbanization, the expansion of the organized retail sector, particularly in emerging economies, and the sustained growth of the e-commerce industry, which relies heavily on flexible and durable packaging solutions for last-mile delivery. Furthermore, technological advancements in manufacturing processes are leading to the production of thinner, yet stronger, plastic films, optimizing material usage and reducing production costs. Despite robust demand, the market faces significant headwinds from global regulatory bans, consumer preference shifts towards reusable options, and high investment costs associated with transitioning manufacturing lines towards sustainable biodegradable materials, necessitating continuous innovation in polymer science and recycling infrastructure.

Plastic Bag Market Executive Summary

The Plastic Bag Market is characterized by a high degree of fragmentation and intense competitive pressure, increasingly focused on sustainability and compliance rather than pure cost optimization. Business trends indicate a critical pivot away from virgin fossil fuel-based polyethylene towards circular economy models, emphasizing high-quality recycling feedstock and the integration of bio-based or compostable polymers. Large manufacturers are strategically acquiring specialized firms focused on bioplastics technology or investing heavily in in-house research and development to diversify their material portfolios, ensuring resilience against fluctuating crude oil prices and tightening environmental regulations. Supply chain robustness is becoming paramount, particularly regarding the sourcing of reliable, certified biodegradable resins and establishing efficient collection and composting infrastructure to close the loop on sustainable alternatives, driving partnership formation between resin producers, converters, and waste management companies.

Regionally, the market exhibits sharp contrasts. Developed markets in Europe and North America are experiencing contraction in volume sales of conventional plastic bags due to pervasive bans and high consumer awareness, but they are leading in the adoption and premium pricing of sustainable alternatives. Conversely, the Asia Pacific region, driven by large population bases, rapidly expanding retail infrastructure, and less uniformly strict regulatory enforcement across all countries, remains the largest consumer by volume, although growth momentum is shifting towards middle-income nations within this region imposing phased restrictions. Latin America and the Middle East and Africa represent growing opportunities, particularly in industrial and institutional applications, though regulatory compliance across these fragmented markets presents challenges for international manufacturers seeking standardization.

Segment trends underscore the dominance of HDPE bags due to their lightweight properties and low material cost, especially in general retail applications. However, based on material growth trajectory, the biodegradable/compostable segment is poised for the most rapid expansion, albeit from a smaller base, spurred by governmental mandates in municipalities worldwide. Application-wise, the grocery and food packaging segment continues to hold the largest market share, but the industrial and construction sector is showing steady growth driven by the need for durable and high-capacity refuse bags. Differentiation within the market is increasingly achieved not just through pricing, but through features such as enhanced barrier properties, customizable branding, and verifiable sustainability certifications (e.g., DIN CERTCO, BPI), transforming the plastic bag from a commodity item into a value-added packaging solution.

AI Impact Analysis on Plastic Bag Market

Common user inquiries regarding AI's influence on the Plastic Bag Market often center on how advanced analytics and machine learning can mitigate the environmental impact and optimize complex, highly regulated supply chains. Users frequently ask about AI's role in predicting regulatory shifts, optimizing the blend of recycled content versus virgin material, and enhancing quality control in the manufacturing of biodegradable films. Key concerns revolve around the feasibility of using AI to track the lifecycle of plastic bags post-consumer use, particularly ensuring proper disposal into composting or recycling streams, and whether AI-driven demand forecasting can reduce overproduction and subsequent material waste. The underlying expectation is that AI technology will provide the necessary intelligence for manufacturers to achieve sustainability targets while maintaining cost efficiency and navigating the volatile landscape of resin pricing and global trade policies.

In manufacturing operations, AI algorithms are being deployed to conduct predictive maintenance on extrusion and conversion machinery, minimizing downtime and energy consumption, which is crucial given the high-volume, low-margin nature of the plastic bag industry. Furthermore, complex machine learning models are optimizing material input ratios, ensuring that bags utilizing Post-Consumer Recycled (PCR) content meet stringent strength and quality standards without excessive material usage. AI-powered vision systems are also revolutionizing quality control by inspecting thin films for defects at high speeds, improving product consistency, and reducing scrap rates, thereby enhancing overall resource efficiency and reducing waste generation during the production phase.

Beyond the factory floor, AI provides critical insights for market strategy and circular economy initiatives. Predictive analytics models are assisting businesses in anticipating geographical regulatory changes (e.g., upcoming phase-outs of certain bag types), allowing companies to adjust production capacities and distribution networks proactively. In the realm of waste management, AI-driven sorting systems in Material Recovery Facilities (MRFs) are improving the identification and separation of different plastic polymers, including distinguishing standard polyethylene from biodegradable varieties, which is essential for maintaining the purity of recycled feedstock and successfully implementing composting programs, thus bridging the gap between production and end-of-life management.

- AI optimizes manufacturing processes by predicting machine failure and scheduling preventative maintenance, enhancing operational efficiency.

- Machine learning models are used for dynamic material blending, maximizing the incorporation of recycled content (PCR) while maintaining bag strength and quality standards.

- Predictive analytics assists in forecasting regional regulatory changes and consumer demand shifts towards sustainable alternatives, enabling proactive inventory and production adjustments.

- AI-powered visual inspection systems improve quality control on the production line, reducing scrap material and ensuring film consistency at high conversion speeds.

- Advanced optimization algorithms determine the most energy-efficient settings for film extrusion and bag conversion machinery, lowering the manufacturing environmental footprint.

- AI aids in supply chain risk management by analyzing geopolitical factors and commodity market volatility impacting resin prices.

- AI applications in waste infrastructure (smart MRFs) enhance sorting accuracy for different polymers, supporting high-quality plastic recycling and proper composting of certified biodegradable bags.

DRO & Impact Forces Of Plastic Bag Market

The Plastic Bag Market is shaped by a confluence of powerful forces, where stringent environmental regulations and shifting consumer preferences serve as dominant restraints, while the burgeoning need for efficient and lightweight packaging, especially in e-commerce, acts as a primary driver. The continuous global push for sustainable alternatives provides a significant opportunity for manufacturers capable of scaling up production of compostable and bio-based bags, though the high cost and complexity of these materials present inherent restraints. The dominant impact force is the regulatory environment; local and national bans on single-use plastics directly restrict the largest volume segments of the market, compelling rapid innovation and market diversification into reusable or certified sustainable options, fundamentally altering the competitive landscape and demanding substantial capital investment in new technology and feedstock sourcing.

The primary drivers propelling the market include the enduring growth of the organized retail sector and the logistical requirements of modern commerce. Plastic bags remain the most cost-effective and functionally efficient solution for transporting purchased goods, especially in markets where alternative infrastructure (like widespread reusable bag systems) is underdeveloped. Furthermore, the sanitation and medical sectors rely heavily on specialized plastic bags for safe waste containment, providing a steady demand segment where regulatory pressure is less acute due to public health necessities. Technological innovation leading to stronger, thinner films also acts as a driver by improving the cost-performance ratio and reducing the amount of plastic material required per unit, partially mitigating environmental concerns related to raw material consumption.

Conversely, significant restraints hinder conventional market expansion. The global momentum against plastic pollution, manifesting in widespread legislative action (fees, taxes, and outright bans) across major economies, severely restricts market size potential for traditional products. Additionally, the lack of sufficient global infrastructure for recycling and composting biodegradable bags limits the efficacy of supposed sustainable solutions, creating market confusion and skepticism among consumers and regulators. Opportunities arise primarily in the development and commercialization of next-generation biodegradable polymers that offer better performance, reduced cost profiles, and verifiable end-of-life solutions. Furthermore, exploring niche applications, such as specialized bags for controlled-atmosphere storage in agriculture or high-performance liners for industrial bulk shipping, allows manufacturers to circumvent competition and regulatory hurdles associated with mass-market retail bags.

Segmentation Analysis

The Plastic Bag Market segmentation provides a granular view of diverse product types, materials, applications, and regional consumption patterns, reflecting the complex nature of this highly diversified industry. Segmentation is crucial for understanding market dynamics, especially the divergence between declining conventional segments and rapidly expanding sustainable alternatives. The market is primarily categorized by the type of resin used, such as polyethylene variants (HDPE, LDPE, LLDPE), which determines the bag’s properties and application suitability. Secondary segmentation focuses on application (grocery, retail, trash, industrial), which drives demand volume, and technology (biodegradable, non-biodegradable), which dictates future growth potential and regulatory compliance requirements across various geographical zones.

By material, HDPE bags dominate volume due to their lightweight structure and lower cost, making them preferred for supermarket checkout and general merchandise packaging. However, LLDPE and LDPE bags maintain a strong presence in applications requiring greater stretch and tear resistance, such as refuse sacks and heavy-duty industrial liners. The crucial growth segment is driven by bio-based materials like PLA, starch blends, and PHA, which are positioned to capture market share in regulated regions where compostability or biodegradability certifications are mandatory for retail use. Manufacturers are continuously optimizing blends to balance cost, barrier performance, and degradation kinetics, aiming to bridge the functional gap between conventional and sustainable plastics.

Application analysis highlights the grocery and food service sector as the largest consumer, driven by daily necessity and high turnover rates. However, this segment is also the most heavily targeted by single-use plastic bans globally. In contrast, the refuse and industrial segments, which require specialized thickness, durability, and large capacity, exhibit stable demand, often driven by public health standards and industrial operations, offering more stable revenue streams away from intense regulatory pressures. The complexity of segmentation demands that market players adopt a flexible manufacturing approach, capable of switching production based on regional legislative requirements and evolving end-user demand across these disparate applications and material specifications.

- By Material Type:

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Bio-based Plastics (e.g., PLA, PHA, Starch Blends)

- By Product Type:

- T-Shirt Bags/Grocery Bags

- Gusseted Bags

- Lay Flat Bags

- Trash Bags/Refuse Sacks

- Woven Sacks

- Produce Bags

- Bags on Rolls

- By Application:

- Grocery and Food Packaging

- Retail and Consumer Goods

- Institutional and Industrial (Waste Management, Construction)

- Pharmaceutical and Medical

- Agriculture and Horticulture

- By Technology:

- Non-Biodegradable/Conventional

- Biodegradable and Compostable (ASTM D6400/EN 13432 Certified)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Plastic Bag Market

The plastic bag market value chain commences with upstream activities involving raw material procurement, primarily petrochemical derived resins (polyethylene pellets) or, increasingly, bio-based resins. This stage is highly susceptible to volatility in global oil and natural gas prices, directly impacting manufacturing costs. Key suppliers at this stage are major chemical and petrochemical companies. Upstream analysis focuses heavily on securing stable, cost-effective feedstock, and for sustainable segments, obtaining certified and consistently high-quality recycled polymers or bio-resins is critical. Manufacturing (conversion) follows, where resins are extruded into thin films, printed, cut, and sealed into final bag products. This phase requires significant capital investment in highly automated machinery but often operates on thin margins, necessitating continuous process optimization and high throughput rates to ensure profitability.

Midstream activities encompass logistics and warehousing, where mass-produced bags are prepared for distribution. The distribution channel structure is highly critical for market access and cost management. Direct distribution often involves large converters supplying massive volumes directly to major national retail chains (e.g., Walmart, Tesco) or large industrial clients, minimizing intermediary costs and allowing for highly customized product specifications and just-in-time delivery schedules. Conversely, indirect distribution utilizes wholesalers, distributors, and packaging brokers, which is prevalent when supplying smaller, independent retail stores, local businesses, or specialized markets, offering wider reach but often at a higher unit cost due to markups.

Downstream analysis focuses on end-users, primarily the organized and unorganized retail sectors, institutional waste management, and the fast-growing e-commerce sector. The purchasing decisions at this stage are increasingly influenced by regulatory requirements, corporate sustainability mandates, and consumer willingness to pay a premium for certified sustainable packaging. The shift towards biodegradable bags imposes additional supply chain complexities, demanding that manufacturers verify the end-of-life disposal pathway (e.g., access to industrial composting facilities), making strong partnerships with waste management companies a critical downstream requirement for compliance and market acceptance. Effective supply chain management is therefore essential for mitigating regulatory risk and ensuring material traceability from resin source to consumer use.

Plastic Bag Market Potential Customers

Potential customers for plastic bags span a broad spectrum of commercial, industrial, and public entities, defined primarily by their need for low-cost, disposable containment and transport solutions. The largest segment remains the Fast-Moving Consumer Goods (FMCG) sector, encompassing grocery chains, supermarkets, and convenience stores that require high volumes of T-shirt bags and produce bags for daily operations. These buyers prioritize cost efficiency, reliability, and increasingly, compliance with local single-use plastic regulations. Consequently, major retail corporations are shifting towards sourcing certified biodegradable options or highly robust reusable bags, driving manufacturers to offer hybrid product portfolios catering to these varied demands.

Beyond retail, the institutional and municipal waste management sectors represent substantial, non-cyclical buyers of specialized products. This includes public sanitation departments, healthcare facilities (hospitals, clinics), and industrial complexes that purchase heavy-duty refuse sacks, medical waste bags (often colored and certified for biohazard handling), and large industrial liners. For these institutional buyers, the critical purchasing criteria are product durability, puncture resistance, guaranteed capacity, and strict adherence to health and safety standards, where price competition is often secondary to performance and certification, particularly for biohazard and heavy industrial applications requiring specific polymer blends.

The third major customer group includes packaging distributors, wholesalers, and e-commerce companies. E-commerce relies on durable, protective bags for shipping and mailing, valuing lightweight materials that reduce shipping costs while offering adequate product protection. Wholesalers and distributors serve as vital intermediaries, purchasing diverse bag types in bulk and redistributing them to smaller, independent businesses that cannot meet the minimum order quantities of large manufacturers. These customers value inventory reliability, competitive bulk pricing, and a wide array of product choices, making manufacturer relationships based on consistent supply and diverse offerings highly valuable in the fragmentation of the independent retail segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 45.8 Billion |

| Growth Rate | 3.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Berry Global Group Inc., Inteplast Group, Novolex Holdings Inc., RPC Group (Berry Global), Mondi Group, Sealed Air Corporation, Ampac Holdings LLC, Hi-Lex Corporation, Asia Polybags Sdn Bhd, Starlinger & Co GmbH, Britton Group, Atlantic Poly Inc., Cosmoplast Industrial Company LLC, Schur Flexibles Group, PCL Packaging, Shiplake Enterprises, RKW Group, Al-Gosaibi Group, Polykar Inc., Xtex Polythene Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Bag Market Key Technology Landscape

The technology landscape of the plastic bag market is undergoing a fundamental shift, moving beyond traditional blown film extrusion towards advanced manufacturing techniques focused on material reduction and sustainability integration. The core technology remains film extrusion, which processes polymer pellets into thin, continuous sheets. However, modern extrusion lines utilize sophisticated controls and dies to produce ultra-thin gauge films (source reduction) that maintain or exceed the strength of thicker predecessors, optimizing material efficiency. Crucially, multi-layer co-extrusion technology is becoming more prominent, allowing manufacturers to combine different polymers—such as incorporating a layer of recycled content with a virgin polymer outer layer—to achieve specific barrier properties, tensile strength, and appearance, which is vital for high-performance industrial and food contact applications.

In the realm of materials science, the most significant technological advancements relate to biodegradable and compostable polymers. Research is focused on developing bio-based resins (PLA, PHA, PVOH) that are cost-competitive with conventional polyethylene while offering verifiable degradation in specific environments (e.g., industrial composting). Technology is evolving to improve the heat resistance and moisture barrier properties of these bio-plastics, addressing previous functional drawbacks. Furthermore, the integration of high percentages of Post-Consumer Recycled (PCR) content into plastic bag manufacturing is a major technological focus. This requires advanced sorting and cleaning technologies at recycling facilities and specialized compounding techniques at the manufacturing stage to ensure PCR material meets the rigorous quality and safety standards required for flexible packaging applications, preventing material degradation during processing.

Beyond material composition, converting and printing technologies are also advancing. High-speed, automated bag conversion lines are implementing precision cutting and sealing mechanisms to minimize scrap waste and increase throughput, essential for mitigating rising operational costs. Digital printing technology is gaining traction, allowing for faster changeovers and high-definition graphics for promotional bags, catering to personalized branding requirements with minimal setup time compared to traditional flexographic printing. These technological innovations collectively aim to address the dual market pressure of maximizing production efficiency and strictly adhering to global mandates for reducing plastic use and enhancing circularity.

Regional Highlights

Regional dynamics play a definitive role in shaping the Plastic Bag Market due to disparate regulatory environments and varying stages of economic development. Asia Pacific (APAC) currently holds the largest market share by volume, driven by high population density, rapid expansion of modern retail infrastructure, and sustained industrial growth in economies like China, India, and Southeast Asian nations. While conventional plastic bag usage remains high, regulatory restrictions are being introduced or strengthened across several key APAC economies, particularly municipal bans in urban centers, forcing manufacturers to establish parallel supply chains for sustainable alternatives. This region represents the primary global production hub, benefiting from lower labor costs and large-scale manufacturing capacity, although it is increasingly grappling with domestic waste management challenges.

North America and Europe, representing mature economies, are characterized by slow or negative volume growth in conventional plastic bags due to the implementation of sweeping bans, taxes, and mandatory fees aimed at encouraging reusable alternatives. These regions are market leaders in the adoption of premium, certified biodegradable and compostable bags, often driven by highly informed consumers and aggressive corporate sustainability commitments. Manufacturers operating here focus on R&D for advanced material science, utilizing high percentages of PCR content, and optimizing high-barrier film technologies for specialized medical and food safety applications. The European Union’s Plastic Strategy, particularly directives targeting single-use plastics, dictates the pace of innovation and market transition across the continent, prioritizing verifiable circularity and end-of-life accountability for all packaging.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions exhibiting moderate to high growth potential, primarily driven by increasing consumer expenditure and urbanization. While regulatory action is generally less comprehensive than in North America or Europe, certain metropolitan areas in countries like Brazil, Chile, and the UAE have proactively introduced limitations on single-use bags, setting precedents for wider regional adoption. The challenge in these regions often lies in establishing robust collection and recycling infrastructure necessary to support the transition to circular models, meaning conventional plastic bags remain dominant due to superior cost-efficiency and established supply networks, providing a substantial, but time-limited, opportunity for volume growth before widespread restrictions take effect.

- Asia Pacific (APAC): Largest market volume holder, fueled by burgeoning e-commerce and retail expansion, particularly in China and India. Regulatory pressure is mounting, spurring investments in manufacturing localized biodegradable solutions.

- North America: Market stability is maintained by industrial and institutional demand (refuse sacks, medical), while consumer retail volume contracts due to state and municipal bans (e.g., California, New York). High adoption rates for expensive sustainable alternatives.

- Europe: Highly regulated market environment due to the EU Single-Use Plastics Directive; strong focus on high PCR content and certified compostable bags. Manufacturers prioritize circular economy models and regional supply chains.

- Latin America (LATAM): Growing market driven by urbanization and rising middle-class consumption. Regulatory landscape is fragmented; opportunities exist in both conventional and nascent biodegradable markets, depending on country-specific legislation.

- Middle East and Africa (MEA): Growth stimulated by infrastructure projects and increasing retail penetration. High potential for industrial plastic bag applications. Facing challenges in establishing formalized waste management systems, slowing the sustainable transition compared to developed markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Bag Market.- Berry Global Group Inc.

- Inteplast Group

- Novolex Holdings Inc.

- Mondi Group

- Sealed Air Corporation

- Ampac Holdings LLC

- Hi-Lex Corporation

- Asia Polybags Sdn Bhd

- Starlinger & Co GmbH

- Britton Group (Coveris)

- Atlantic Poly Inc.

- Cosmoplast Industrial Company LLC

- Schur Flexibles Group

- PCL Packaging

- Shiplake Enterprises

- RKW Group

- Al-Gosaibi Group

- Polykar Inc.

- Xtex Polythene Ltd.

- Trebax AB

Frequently Asked Questions

Analyze common user questions about the Plastic Bag market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the transition from traditional plastic bags to sustainable alternatives?

The transition is primarily driven by stringent global regulatory mandates, specifically bans and taxation on single-use plastics implemented across major economies like the European Union and parts of North America. Additionally, heightened consumer awareness regarding ocean plastic pollution and strong corporate social responsibility initiatives are accelerating the demand shift toward certified biodegradable, compostable, or high-recycled content bags.

What are the key material segments contributing to market growth in the plastic bag industry?

While High-Density Polyethylene (HDPE) remains the dominant material by volume for conventional applications due to its cost-efficiency, the fastest-growing segment is bio-based plastics, including Polylactic Acid (PLA) and Polyhydroxyalkanoates (PHA), which are essential for manufacturers seeking compliance in markets where certified compostability is a legal requirement for retail packaging.

How does the volatile price of crude oil affect the production costs in the Plastic Bag Market?

Crude oil and natural gas are primary feedstocks for producing virgin plastic resins (HDPE, LDPE). Therefore, volatility in global petrochemical prices directly impacts the raw material cost component for conventional plastic bag manufacturers. This volatility encourages market players to integrate higher volumes of cheaper Post-Consumer Recycled (PCR) content or transition to bio-based materials to stabilize their input costs.

Which geographical region holds the largest market share for plastic bag consumption?

The Asia Pacific (APAC) region currently holds the largest market share by consumption volume. This dominance is attributed to rapid urbanization, immense population size, robust manufacturing activity, and the ongoing expansion of organized retail and e-commerce sectors, despite increasing localized regulatory efforts to restrict single-use plastics.

What is the significance of AEO and GEO strategies in generating market insights for the Plastic Bag Market?

Answer Engine Optimization (AEO) and Generative Engine Optimization (GEO) are critical for structuring market insights effectively, ensuring the report content is easily digestible and highly relevant for large language models and search queries. By anticipating user intent regarding trends, regulations, and technologies, this optimization maximizes the visibility and utility of the structured data, such as market size, CAGR, and segmentation analysis, in search results and AI-generated summaries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Plastic Bag Market Statistics 2025 Analysis By Application (Food Packaging & Fresh Keeping, Fiber Products Packaging, Daily Chemical Packaging, Convenient for Shopping, Gift Etc, Garbage &), By Type (PE, PP, Bio Plastics), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Plastic Bag and Pouch Machine Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Side Seal, Bottom Seal, Others), By Application (Goods and Beverages, Agriculture, Medical, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager