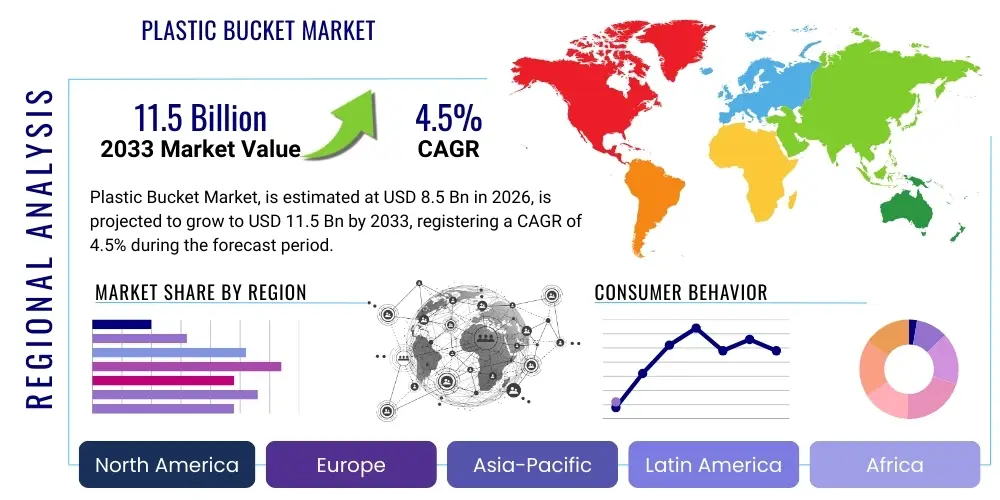

Plastic Bucket Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437371 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Plastic Bucket Market Size

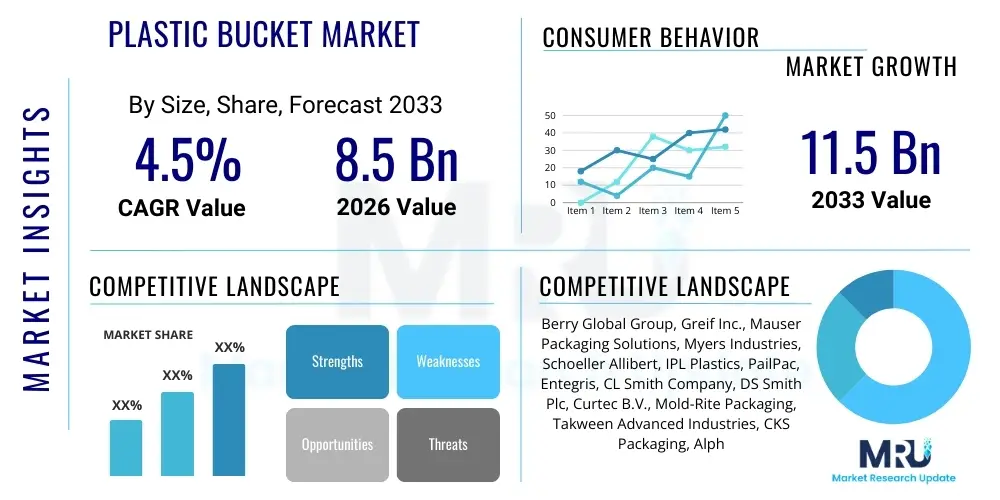

The Plastic Bucket Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 11.5 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by sustained demand from critical end-use sectors such as construction, paints and coatings, food and beverage processing, and chemical industries globally. The market expansion is characterized by continuous material science innovation focusing on enhancing durability, chemical resistance, and the integration of recycled content to meet evolving regulatory and consumer preferences for sustainable packaging solutions.

Plastic Bucket Market introduction

The Plastic Bucket Market encompasses the global production, distribution, and consumption of containers predominantly manufactured from high-density polyethylene (HDPE) and polypropylene (PP), designed for bulk packaging, storage, and transport of various materials. These containers, ranging in volume from 1 liter to over 25 liters, are characterized by their robust construction, resistance to corrosion, and cost-effectiveness compared to metal alternatives. They are essential packaging solutions, providing hermetic sealing capabilities crucial for preserving the integrity and safety of sensitive contents, including industrial solvents, food ingredients, and consumer goods like paints and adhesives. The intrinsic properties of plastic, such as its lightweight nature and stackability, significantly contribute to optimized logistics and reduced transportation costs, bolstering its ubiquitous adoption across nearly every major industrial sector.

Plastic buckets serve major applications across diverse industries due to their versatility and customizable features, such as tamper-evident lids and specialized handling mechanisms. In the construction sector, they are indispensable for packaging dry mixes, sealants, and various building chemicals. For the food and beverage industry, food-grade HDPE buckets ensure compliance with stringent safety regulations (e.g., FDA standards) for storing and transporting bulk ingredients, including dairy products, flavorings, and processed foods. The primary benefits driving market demand include superior durability, which extends product shelf life; enhanced hygiene standards achievable through easy cleaning; and significant economic advantages derived from lower manufacturing and lifecycle costs compared to alternative packaging formats like fiber drums or metal pails. Furthermore, advancements in in-mold labeling (IML) technology have made plastic buckets highly attractive for consumer segments seeking high-quality graphic displays and branding opportunities.

Major driving factors influencing the sustained growth of this market include the global expansion of the chemical manufacturing and infrastructure development sectors, particularly in emerging economies of Asia Pacific and Latin America. Increased focus on improving supply chain efficiency, where lightweight packaging is crucial, further accelerates adoption. However, the market dynamics are increasingly shaped by the imperative for sustainability. Manufacturers are actively investing in circular economy initiatives, shifting towards manufacturing buckets using Post-Consumer Resin (PCR) and developing easily recyclable mono-material designs, ensuring the market remains aligned with global environmental mandates and consumer movements towards reduced plastic waste.

Plastic Bucket Market Executive Summary

The Plastic Bucket Market executive summary highlights robust growth driven by industrial expansion in emerging economies, coupled with increasing technological integration focused on manufacturing efficiency and material substitution. Current business trends indicate a strong focus on consolidation among major players seeking economies of scale and vertical integration, particularly into recycling operations to secure high-quality feedstock (PCR). The key strategic imperative for market participants is balancing the demand for durable, performance-driven packaging required by industrial users with the rising pressure from regulatory bodies and consumers for environmentally friendly solutions. Innovations in barrier plastics and specialized coatings are enhancing the functionality of plastic buckets, allowing them to compete effectively in highly regulated sectors previously dominated by glass or metal packaging.

Regionally, the Asia Pacific (APAC) market is projected to maintain its position as the largest and fastest-growing segment, propelled by rapid industrialization, burgeoning construction activities, and expanding chemical production capacities, especially in China, India, and Southeast Asian nations. North America and Europe, characterized by established regulatory frameworks, are demonstrating slower volume growth but higher value growth, attributable to the adoption of premium, sustainable, and technologically advanced products, such as smart buckets equipped with RFID or IoT integration for inventory tracking. These developed markets are leading the transition towards bio-based and certified sustainable plastics, which commands a higher price point and necessitates sophisticated manufacturing capabilities.

Segmentation trends reveal that the industrial application segment, encompassing chemicals, lubricants, and construction materials, holds the largest market share due to the necessity for robust, secure bulk packaging. However, the food and beverage segment is exhibiting the highest growth rate, driven by the shift towards bulk preparation and ingredient storage in hygienic, compliant plastic pails. Furthermore, the 5-gallon (18.9-liter) capacity segment remains the most dominant size due to its standardization across construction and industrial applications globally, although smaller volume segments (1-5 liters) are gaining traction in consumer-facing markets, optimized by advancements in high-definition graphic printing enabled by In-Mold Labeling (IML) techniques, maximizing shelf appeal and brand differentiation.

AI Impact Analysis on Plastic Bucket Market

User queries regarding the impact of Artificial Intelligence (AI) on the Plastic Bucket Market frequently revolve around optimizing complex manufacturing processes, reducing material wastage, and enhancing supply chain resilience. Key concerns include how AI can manage the volatility of polymer prices (HDPE, PP), predict equipment failure in high-speed injection molding lines, and automate quality control inspections to ensure lid fit and seal integrity, which is critical for compliance and product safety. Users also frequently ask about the role of AI in designing lighter-weight buckets that maintain structural integrity and whether predictive analytics can improve inventory management across fragmented global distribution networks. The core expectation is that AI integration will lead to significant reductions in operational costs, highly customized production runs, and a faster response time to market demand fluctuations, thereby increasing overall competitiveness.

AI is transforming the plastic bucket manufacturing landscape by enabling predictive maintenance for injection molding machines, drastically reducing unscheduled downtime and improving overall equipment effectiveness (OEE). By analyzing real-time sensor data—such as temperature, pressure, and cycle time variations—AI algorithms can identify subtle deviations indicative of potential tool wear or material flow issues long before they cause production defects. This shift from reactive to predictive maintenance ensures higher utilization rates and reduces the scrap rate associated with inconsistent component quality. Furthermore, AI-powered computer vision systems are deployed for instantaneous quality inspection, capable of detecting minute surface defects, inconsistencies in wall thickness, or flaws in tamper-evident features at speeds far exceeding human capability, guaranteeing that every packaged product meets rigorous industrial and food safety standards.

Beyond the factory floor, AI profoundly impacts the market by optimizing raw material procurement and logistics. Machine learning models analyze global petrochemical market data, commodity pricing trends, and logistical bottlenecks to advise procurement teams on optimal timing and volume for purchasing polymer feedstocks, mitigating exposure to price volatility. In the supply chain, AI algorithms optimize routing and packaging configurations (pallet stacking patterns) to maximize container space and reduce fuel consumption during transport. This integration of advanced analytics across the value chain not only enhances profitability but also directly addresses environmental concerns by minimizing waste and optimizing the energy consumption inherent in the production and distribution of bulk plastic packaging solutions.

- AI optimizes injection molding parameters for reduced cycle times and energy consumption.

- Predictive maintenance algorithms minimize machine downtime and tooling wear, increasing OEE.

- Computer vision systems enable high-speed, automated quality control for defect detection and compliance verification.

- Machine learning models forecast raw material price fluctuations, optimizing procurement strategies (HDPE, PP).

- AI enhances supply chain planning, optimizing logistics, inventory placement, and demand forecasting.

- Generative AI supports rapid product design iteration for lightweighting and structural optimization of new pail formats.

DRO & Impact Forces Of Plastic Bucket Market

The Plastic Bucket Market is governed by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the competitive landscape and strategic direction of manufacturers. Key drivers include the consistent growth of the global paints, coatings, and construction sectors, particularly in rapidly urbanizing regions, necessitating robust and affordable bulk packaging. The inherent advantages of plastic—low cost, chemical compatibility, and reduced weight compared to metal—solidify its position as the preferred packaging material for industrial and non-sensitive chemical applications. However, the market faces significant restraints, primarily stemming from stringent global regulations targeting single-use plastics and escalating public scrutiny regarding plastic pollution, forcing manufacturers to invest heavily in sustainable alternatives, which often carry higher initial costs. Opportunities abound in the development of buckets made from high percentages of Post-Consumer Resin (PCR) and bio-based plastics, as well as the expansion into specialized, high-margin segments requiring advanced barrier properties for oxygen-sensitive or volatile contents.

The primary impact forces influencing market profitability relate to the volatility of crude oil and natural gas prices, which directly affect the cost of virgin polymer feedstocks (HDPE and PP). Manufacturers must manage tight margins while absorbing these fluctuations, often leading to increased pressure on operational efficiencies and supply chain agreements. Furthermore, the shift towards closed-loop recycling and Extended Producer Responsibility (EPR) schemes in developed economies acts as a regulatory force, mandating manufacturers to take responsibility for the end-of-life management of their products. This pressure is accelerating technological innovation in container design, specifically focusing on monomaterial construction and easy disassembly to facilitate efficient recycling processes, thereby transforming manufacturing standards.

Geopolitical stability also exerts a critical impact force, particularly concerning trade tariffs and cross-border logistics for commodity plastics and manufactured goods. The reliance on globally sourced materials means that regional trade disputes or logistical disruptions can significantly impact production schedules and lead times. Conversely, opportunities arising from new technologies, such as advanced rotational molding techniques and sophisticated In-Mold Labeling, allow players to differentiate their products based on aesthetics, functionality (e.g., self-pouring mechanisms), and consumer convenience. Successful market participation now requires a sophisticated strategy that mitigates raw material price risk, adheres proactively to environmental regulations, and leverages technological advancements to capture specialized, higher-value market niches.

Segmentation Analysis

The Plastic Bucket Market is comprehensively segmented based on material type, volume capacity, end-use application, and closure type, providing a granular view of demand dynamics across various industries and consumer levels. High-Density Polyethylene (HDPE) dominates the material segment due to its excellent strength-to-density ratio, chemical resistance, and suitability for industrial and construction environments, representing the backbone of the market. However, Polypropylene (PP) is gaining significant ground, particularly in the food-grade and consumer segments, owing to its superior clarity, heat resistance, and excellent compatibility with In-Mold Labeling (IML) techniques, enhancing product presentation and branding. The analysis across these segments is vital for manufacturers to tailor production capabilities and align investment strategies with high-growth areas, such as smaller volume specialty chemical packaging and large-capacity food processing containers required for industrial kitchens and commissaries.

- By Material Type:

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low-Density Polyethylene (LDPE)

- Polyethylene Terephthalate (PET)

- By Volume Capacity:

- Less than 5 Liters

- 5 Liters to 10 Liters

- 10 Liters to 20 Liters (Most Dominant)

- Above 20 Liters

- By End-Use Application:

- Industrial (Chemicals, Lubricants, Solvents)

- Paints and Coatings

- Food and Beverage (Dairy, Edible Oils, Flavorings)

- Construction (Dry Mixes, Grouts, Adhesives)

- Consumer Goods (Household Cleaning, Pet Food)

- By Closure Type:

- Lids with Gasket (Hermetic Seal)

- Tamper-Evident Lids

- Screw Lids

- Snap-on Lids

Value Chain Analysis For Plastic Bucket Market

The value chain of the plastic bucket market is characterized by a high degree of integration between raw material producers and manufacturers, emphasizing efficiency and cost management due to the commodity nature of the final product. Upstream analysis focuses intensely on petrochemical manufacturers that supply key thermoplastic resins, primarily HDPE and PP, derived from crude oil and natural gas derivatives. Price negotiations, long-term supply agreements, and the sourcing of sustainable alternatives (e.g., bio-based resins or certified recycled resins) are critical control points upstream. Given that raw materials account for a substantial percentage of the bucket’s manufacturing cost, securing stable and cost-effective material inputs directly determines the competitive posture of downstream bucket manufacturers. Furthermore, the quality and consistency of these resins directly influence the performance characteristics of the final bucket, such as its impact resistance and stacking strength.

The midstream segment involves the core manufacturing process, predominantly high-speed injection molding, blow molding, and, for certain specialty products, thermoforming. Bucket manufacturers focus on continuous process optimization, tooling maintenance, and quality assurance, leveraging advanced automation and robotics to minimize cycle times and reduce scrap rates. This stage also includes crucial activities like decoration, where In-Mold Labeling (IML) technology has become standard for high-end products, and the integration of specialized components like spouts, handles, and tamper-evident mechanisms. Distribution channels are generally categorized into direct sales to large industrial customers (e.g., major chemical or paint corporations) and indirect distribution through industrial packaging distributors, wholesalers, and retail chains for smaller, consumer-focused volumes. The effectiveness of the supply chain in managing inventory and just-in-time delivery is paramount, especially for construction and food processing customers who require consistent, reliable volumes.

Downstream analysis highlights the end-users, where the functionality and compliance of the bucket are tested in real-world applications. Industrial clients, such as chemical producers and construction firms, demand specific technical specifications, including UN certification for hazardous materials, requiring manufacturers to tailor products to strict regulatory standards. The downstream process also involves the collection and recycling of used buckets, increasingly becoming a mandatory component of the value chain under Extended Producer Responsibility mandates. Successful participation in the circular economy, often through partnerships with material recovery facilities, represents a significant opportunity for market players to secure a consistent supply of PCR, enhancing their sustainability profile and reducing reliance on volatile virgin polymer markets. The integration of digital technologies, such as IoT sensors embedded in high-value buckets, further extends the value chain by providing data on product usage and location, optimizing replenishment cycles for large commercial customers.

Plastic Bucket Market Potential Customers

The potential customers for the Plastic Bucket Market are highly diversified, spanning multiple verticals but largely concentrated in industrial and commercial sectors requiring reliable bulk containment. The largest segments of end-users include the vast array of companies operating in the Paints and Coatings sector, where plastic pails are the standard packaging format for retail and commercial-grade paints, primers, and specialty coatings. These customers prioritize excellent chemical compatibility, resealability, and high-quality graphics enabled by IML to enhance shelf presence. Similarly, the Construction industry represents a massive potential customer base, utilizing buckets for packaging dry cement mixes, adhesives, sealants, joint compounds, and various construction chemicals, demanding exceptional durability and weather resistance for job-site applications.

Another major segment consists of the Chemical Manufacturing and Specialty Chemicals industries. Customers here require highly specialized buckets, often certified for the transportation of hazardous goods (UN certified) and possessing advanced barrier properties to prevent leaching or interaction with reactive substances such as corrosives, solvents, or concentrated detergents. The purchase decisions in this segment are strictly driven by safety compliance, material compatibility documentation, and the integrity of tamper-evident sealing mechanisms. These customers often procure large volumes directly from manufacturers under long-term supply contracts, emphasizing consistency and quality control throughout the entire order fulfillment process to ensure compliance with global transport regulations.

Furthermore, the Food and Beverage Processing sector represents a high-growth customer segment, where plastic buckets are essential for bulk handling of ingredients, flavorings, dairy products, edible oils, and prepared foods. These buckets must meet the most stringent food safety standards (e.g., FDA and EU regulations), requiring virgin-grade resins, meticulous quality assurance, and often specialized features like airtight gaskets to maximize freshness and prevent microbial contamination. Potential buyers range from large multinational food corporations and commercial bakeries to dairy processors and catering services. The increasing demand for bulk food storage and transportation due to globalized supply chains continues to solidify this segment’s importance, necessitating specialized bucket production focusing on hygiene, odorless materials, and reliable stackability for cold chain logistics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Growth Rate | CAGR 4.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Berry Global Group, Greif Inc., Mauser Packaging Solutions, Myers Industries, Schoeller Allibert, IPL Plastics, PailPac, Entegris, CL Smith Company, DS Smith Plc, Curtec B.V., Mold-Rite Packaging, Takween Advanced Industries, CKS Packaging, Alpha Packaging, Silgan Holdings Inc., RPC Group (now part of Berry Global), BWAY Corporation, Wanhua Chemical Group, Rehrig Pacific Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Bucket Market Key Technology Landscape

The Plastic Bucket Market is dominated by advanced manufacturing techniques centered around high-speed injection molding, which remains the most efficient process for producing complex bucket geometries with precise wall thickness and high structural integrity. Recent technological advancements in injection molding focus on reducing cycle times through improved cooling channels (e.g., conformal cooling via 3D printing of molds) and utilizing sophisticated robotics for automated parts removal and stacking. Another crucial technology is high-precision mold engineering, ensuring tight dimensional tolerances required for perfect lid-to-pail fit, which is paramount for achieving hermetic sealing and maintaining tamper-evident features necessary for sensitive or hazardous materials. Furthermore, the integration of multi-cavity molds and faster plasticizing units significantly increases throughput, allowing manufacturers to meet high-volume demand while maintaining competitive unit costs, essential for a commodity packaging item.

Beyond the core molding process, the adoption of In-Mold Labeling (IML) technology represents a major technological differentiator. IML involves injecting molten plastic directly behind a pre-printed label inside the mold cavity, fusing the label permanently to the bucket wall. This technology provides superior, high-definition graphics, complete resistance to moisture and solvents, and creates a finished product that is 100% recyclable, as the label and bucket are typically made of the same polymer (e.g., PP). IML is critical for manufacturers targeting the premium consumer paints, coatings, and food packaging segments where brand aesthetics and durability are highly valued. This capability not only enhances marketing appeal but also improves the overall sustainability profile by eliminating the need for separate adhesive labels or shrink wraps, simplifying the recycling stream.

The materials technology landscape is rapidly evolving towards sustainable solutions. Manufacturers are increasingly utilizing advanced material compounding techniques to incorporate high percentages of Post-Consumer Resin (PCR) without compromising mechanical performance, chemical resistance, or food-grade compliance. Specialized polymer additives are being employed to enhance UV stability for outdoor storage applications and to improve barrier properties, enabling plastic buckets to protect oxygen-sensitive contents effectively, traditionally requiring multi-layer composite structures. Moreover, the integration of smart packaging technologies, such such as near-field communication (NFC) tags or QR codes directly printed via sophisticated labeling methods, is gaining traction. These digital features allow for enhanced product traceability, inventory management, and interactive customer engagement, positioning the plastic bucket as more than just a container but a data-rich component within the modern supply chain ecosystem.

Regional Highlights

Regional dynamics are highly differentiated, driven by variations in industrial maturity, construction activity levels, and the stringency of environmental regulations across major geographies.

- Asia Pacific (APAC): APAC is the dominant market in terms of volume and the fastest-growing region globally. This expansion is fueled by massive infrastructure development projects, rapid industrialization, and booming manufacturing sectors in China, India, and Southeast Asia. High demand from the construction, chemical, and food processing sectors, coupled with less stringent recycling infrastructure requirements compared to the West, makes bulk, cost-effective plastic buckets the packaging standard.

- North America: Characterized by high technological adoption and a strong focus on circular economy initiatives. The market here is mature, focusing on high-value products, including UN-certified chemical pails and specialized food-grade containers. Key drivers include regulatory pressure to increase PCR content and high integration of automation and smart packaging technologies in the supply chain to enhance efficiency.

- Europe: Europe is defined by some of the world’s most demanding environmental regulations, particularly concerning single-use plastics and waste reduction (e.g., REACH, EPR schemes). Growth is concentrated in the development and adoption of bio-based plastics and highly recyclable monomaterial buckets. The region serves as a benchmark for sustainability innovation, influencing global design and material standards in packaging.

- Latin America (LATAM): This region offers significant growth potential, driven by expanding agriculture, oil and gas, and domestic manufacturing sectors. Market growth is spurred by the need for durable, cost-effective packaging solutions, though it faces challenges related to economic volatility and developing logistics infrastructure.

- Middle East and Africa (MEA): Growth in MEA is primarily linked to robust construction activity, petrochemical industry expansion, and increasing food security initiatives. The demand is strong for large-volume industrial buckets, particularly in the UAE, Saudi Arabia, and South Africa, supporting oil field services and water treatment chemical distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Bucket Market.- Berry Global Group

- Greif Inc.

- Mauser Packaging Solutions

- Myers Industries

- Schoeller Allibert

- IPL Plastics

- PailPac

- Entegris

- CL Smith Company

- DS Smith Plc

- Curtec B.V.

- Mold-Rite Packaging

- Takween Advanced Industries

- CKS Packaging

- Alpha Packaging

- Silgan Holdings Inc.

- Wanhua Chemical Group

- Rehrig Pacific Company

- Pöppelmann GmbH & Co. KG

- Al-Tawfiq Plastic Factory

Frequently Asked Questions

Analyze common user questions about the Plastic Bucket market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are primarily used for manufacturing plastic buckets?

The majority of plastic buckets are manufactured using High-Density Polyethylene (HDPE) due to its excellent impact resistance, chemical compatibility, and durability, particularly for industrial use. Polypropylene (PP) is also extensively used, especially for food-grade applications and containers featuring In-Mold Labeling (IML) for enhanced branding aesthetics.

How are environmental regulations impacting the design and material choice for plastic buckets?

Stringent regulations and Extended Producer Responsibility (EPR) schemes are forcing manufacturers to prioritize sustainability. This includes increasing the incorporation of Post-Consumer Resin (PCR) into production, designing products for easy recycling (monomaterial design), and exploring bio-based or biodegradable polymers to reduce reliance on virgin plastics and improve circularity.

Which end-use segment accounts for the highest demand in the plastic bucket market?

The Industrial and Construction segment, encompassing paints, coatings, lubricants, and construction chemicals (such as dry mixes and adhesives), consistently accounts for the largest volume share. However, the Food and Beverage segment is demonstrating the fastest growth rate due to increased bulk ingredient storage and processing requirements.

What role does technology play in modern plastic bucket manufacturing?

Technology primarily centers on optimizing high-speed injection molding (reducing cycle times, enhancing precision) and decorative techniques like In-Mold Labeling (IML) for superior graphics. AI is increasingly used for predictive maintenance, quality control, and optimizing supply chain logistics to enhance overall operational efficiency and product quality.

What are the key drivers expected to fuel market growth through 2033?

Key drivers include rapid urbanization and infrastructure development, especially in the APAC region, leading to increased demand from the construction and chemical sectors. Additionally, the versatility, cost-effectiveness, and advancements in barrier plastics and sustainable material adoption are sustaining continuous market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager