Plastic Caps & Closures Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434883 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Plastic Caps & Closures Market Size

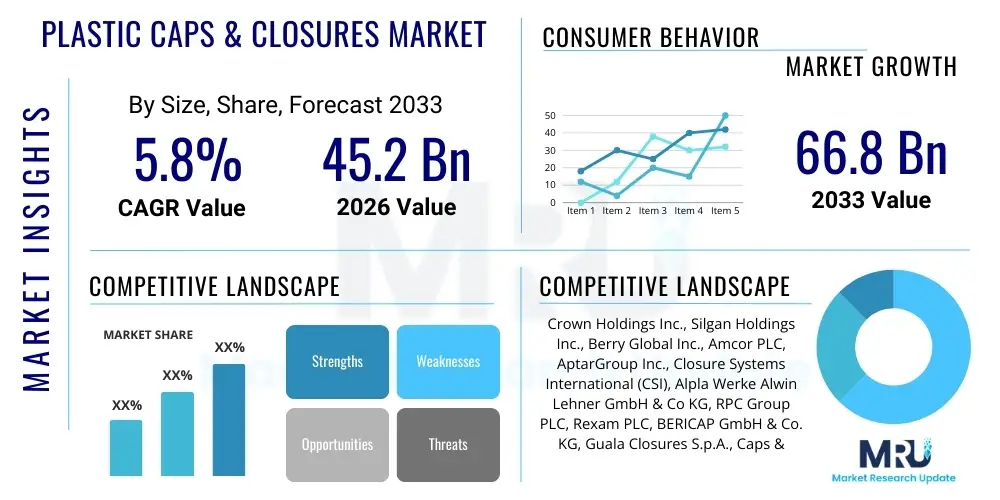

The Plastic Caps & Closures Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.2 billion in 2026 and is projected to reach USD 66.8 billion by the end of the forecast period in 2033.

Plastic Caps & Closures Market introduction

Plastic caps and closures are integral components of modern packaging, designed primarily to seal containers efficiently, protect the contents from contamination, prevent leakage, and preserve product freshness and shelf stability across an array of consumer and industrial applications. These packaging seals are predominantly manufactured using commodity and engineering polymer resins, including high-density polyethylene (HDPE), polypropylene (PP), and polyethylene terephthalate (PET), selected for their optimal balance of chemical resistance, dimensional stability, barrier properties, and low manufacturing cost. The diversity of products available is vast, ranging from standard continuous thread screw caps widely used in food and beverage packaging, to highly specialized dispensing systems such as pumps, triggers, and child-resistant closures (CRC) mandatory in pharmaceutical and household chemical sectors. The manufacturing processes leverage advanced techniques like injection molding and compression molding, enabling high-speed, high-volume production necessary to meet global demand efficiently. The market’s trajectory is inextricably linked to the performance of the global Fast-Moving Consumer Goods (FMCG) sector, particularly the rapid consumption increase observed in emerging economies undergoing demographic shifts and increasing urbanization. Regulatory mandates, specifically focusing on product safety, consumer convenience, and environmental responsibility, act as dual drivers for continuous innovation in design and material science within this crucial sector.

The principal applications for plastic closures span the entire gamut of consumer packaged goods, making market penetration extensive and diversified. The beverage industry remains the largest end-user, relying on lightweight screw caps for bottled water, soft drinks, and dairy products, where sealing integrity and cost-per-unit are primary concerns. In the pharmaceutical sector, closures must comply with stringent regulatory requirements for safety and efficacy, leading to the specialized development of tamper-evident and child-resistant mechanisms. The personal care and cosmetics market drives demand for aesthetically refined and functionally sophisticated dispensing solutions, such as flip-top caps, precise dosing pumps, and attractive overcaps, where brand image and user experience are key differentiation points. Furthermore, the household care industry utilizes robust, chemical-resistant trigger sprayers and induction-sealed caps for cleaning and chemical products. The inherent benefits of utilizing plastic closures, including their superior customization capabilities in terms of shape and color, their excellent barrier performance against gases and moisture, and their lightweight nature which contributes to reduced transportation emissions, ensure their continued prominence over materials like metal or glass closures, supporting global supply chain efficiencies and consumer accessibility across diverse market environments.

Driving factors that continue to propel the Plastic Caps & Closures Market forward include the relentless global push toward convenience packaging formats, such as single-serve bottles and on-the-go drinks, which intrinsically increase the per-unit closure requirement. The rapid expansion of e-commerce necessitates more resilient and leak-proof sealing solutions to withstand complex logistics and multiple handling points during shipping, elevating the performance requirements for standard closures. Technological advancements, particularly in compression molding, have allowed manufacturers to significantly reduce the weight of standard caps (lightweighting), leading to substantial material savings and enhanced sustainability profiles, attracting brand owner investment. Moreover, regulatory dynamics, such as the EU’s Single-Use Plastics Directive (SUPD) mandating tethered caps, although initially acting as a barrier due to retooling costs, ultimately drive substantial market opportunities for manufacturers who can successfully innovate and comply with these new design requirements across all relevant product lines. The shift towards circular economy models is accelerating investment in capabilities to process high levels of Post-Consumer Recycled (PCR) content into new closures without compromising critical sealing performance characteristics.

Plastic Caps & Closures Market Executive Summary

The Plastic Caps & Closures Market is undergoing a rapid transformation, characterized by intense focus on operational sustainability, regulatory compliance, and technological efficiency aimed at meeting soaring global demand for packaged goods while minimizing environmental impact. Current business trends show manufacturers prioritizing vertical integration and strategic partnerships with suppliers of recycled materials and brand owners to secure sustainable feedstock supplies and streamline the complex journey towards full recyclability. Consolidation within the market continues, with large, multinational players like Berry Global and Amcor leveraging their extensive manufacturing footprints and R&D capabilities to offer standardized global solutions, especially concerning critical features like tethered caps and high-barrier aseptic closures. Pricing strategies are highly competitive, heavily influenced by global oil and gas prices (which determine virgin resin costs) and the nascent, but growing, premium associated with verified PCR and bio-plastic inputs. Companies achieving breakthroughs in lowering the cost and improving the processability of recycled polymers are poised to gain significant competitive advantage and higher long-term market valuation as corporate sustainability reporting becomes mandatory for major global brands.

Geographically, market growth diverges based on economic maturity and regulatory frameworks. Asia Pacific (APAC) represents the volume powerhouse, where the sheer scale of the population and the explosive growth in packaged food and beverages drive demand for fundamental closure types, often prioritizing cost efficiency over complex functionality. Investment in APAC is focused on establishing new, highly automated manufacturing facilities capable of producing billions of standardized caps annually to satisfy local market needs. In contrast, North America and Europe, as mature, innovation-led markets, emphasize value-added features. In Europe, the immediate pressure of the SUPD is driving massive capital expenditures for tethered cap machinery upgrades, solidifying its position as the global leader in regulatory packaging compliance. North America excels in high-performance specialty packaging, particularly pumps, sprayers, and complex CRCs for the expanding healthcare and controlled substance sectors. Regional strategy now hinges on adapting global platforms to local environmental regulations, meaning closure designs are becoming increasingly standardized across regions but with tailored material inputs (virgin vs. PCR) depending on local availability and cost structures.

Segmentation trends confirm the dominance of the screw cap segment by volume, fueled by the bottled water and carbonated soft drink industries globally, which require maximum manufacturing throughput. However, the dispensing closure segment, including pump sprays and trigger systems, is demonstrating superior revenue growth, driven by consumer demand for hygienic, convenient, and measurable delivery of household and personal care products. The shift in raw material utilization is the most critical trend; while Polypropylene (PP) maintains its position due to its excellent flexibility for hinged designs (crucial for tethered caps), there is an observable acceleration in R&D budgets dedicated to certified circular polymers and alternatives to traditional petrochemical resins. Furthermore, technological segmentation shows compression molding increasingly favored for high-volume standard caps due to its energy efficiency and faster cycle times compared to traditional injection molding, underscoring the industry's commitment to optimizing resource utilization in high-speed, 24/7 manufacturing environments.

AI Impact Analysis on Plastic Caps & Closures Market

User inquiries frequently highlight the integration of Artificial Intelligence (AI) and Machine Learning (ML) as a potential catalyst for solving the dual challenges of high-volume, precision manufacturing and complex sustainability compliance within the plastic caps and closures sector. The core concern addressed by AI relates to achieving 'zero-defect' production goals at unprecedented speeds. Users commonly ask how AI-driven machine vision systems can handle the sheer variability and speed of modern production lines, where defects measured in microns must be identified instantly. Furthermore, a significant area of interest is AI's role in mitigating supply chain risks associated with raw material volatility and geopolitical instability. Manufacturers seek AI models that can process vast datasets, including commodity market forecasts, logistics constraints, and historical scrap rates, to provide actionable intelligence for procurement and production scheduling. The expectation is that AI will move the industry beyond reactive quality control towards a fully proactive, self-optimizing manufacturing environment, capable of adjusting machinery parameters in real-time based on material flow and environmental conditions, thereby minimizing waste and maximizing energy efficiency across the highly capital-intensive production floor.

AI's application extends profoundly into R&D and design optimization, allowing engineers to rapidly iterate on lightweight designs. Instead of slow, iterative physical prototyping, AI-driven generative design tools can suggest thousands of closure geometries that optimize material usage while meeting specific performance criteria, such as required burst pressure or thread strength. This accelerates the process of regulatory compliance, particularly for new designs like tethered caps, where mechanical reliability over the product lifespan is paramount. Manufacturers are also exploring AI for enhancing predictive maintenance protocols. By analyzing vibration data, temperature trends, and operational metrics from injection and compression molding machinery, ML algorithms can forecast equipment failure with high accuracy, enabling scheduled maintenance interventions instead of costly emergency breakdowns. This systematic reduction in downtime is critical in an industry where profitability is intrinsically tied to continuous, high-speed operation, providing substantial ROI justification for AI system implementation beyond simple quality inspection tasks.

Another crucial domain for AI deployment is in sustainability reporting and material traceability. As brand owners demand verifiable proof regarding the origin and percentage of Post-Consumer Recycled (PCR) content in their closures, AI platforms can manage complex data streams from material certification bodies, internal process sensors, and even end-of-life recycling data. This capability provides robust, auditable transparency, countering 'greenwashing' concerns and ensuring compliance with emerging recycling mandates. While the initial investment remains a barrier for smaller manufacturers, the demonstrated improvements in material yield, energy consumption (through optimized cycle times), and quality assurance solidify AI's position as a transformative technology, shifting the competitive landscape toward players capable of harvesting and interpreting the massive amounts of operational data generated by modern plastic molding operations. The ultimate impact is not just better closures, but a more resilient, resource-efficient, and regulatory-compliant supply chain for the world's packaged goods.

- AI-driven Predictive Maintenance: Optimizes machinery uptime by forecasting potential failures in injection molding machines, reducing unplanned downtime and enhancing operational efficiency by up to 20%.

- Advanced Quality Control: Implementation of AI-powered machine vision systems for real-time defect detection (e.g., flash, short shots, dimensional inconsistencies) with higher accuracy and speed, reducing false positives and improving yield rates significantly in high-speed lines.

- Supply Chain Optimization: Utilization of machine learning models to predict raw material (polymer resin) price fluctuations, optimize inventory management, and forecast logistics bottlenecks, minimizing cost exposure and ensuring continuity of production inputs.

- Manufacturing Process Optimization: AI algorithms adjust compression and injection molding parameters (temperature, pressure, cooling time, dosage) dynamically based on ambient conditions and material batch variations (especially for PCR), maximizing throughput and ensuring consistent product quality.

- Demand Forecasting Accuracy: Improved prediction of specific closure type demand (e.g., 28mm PCO, flip-top) based on complex consumer trends, seasonal fluctuations, and external macroeconomic indicators, facilitating highly efficient production scheduling and minimizing finished goods inventory holding costs.

- Sustainable Material Integration: AI assists in fine-tuning processing techniques for bio-based and high-PCR content polymers, ensuring the maintenance of critical mechanical properties and aesthetics, which is technically challenging due to material inconsistency inherent in recycled feedstocks.

- Generative Design for Lightweighting: AI tools rapidly explore novel closure geometries to achieve regulatory requirements (like tethering) while utilizing the minimum possible amount of plastic, accelerating R&D cycles for sustainable designs.

DRO & Impact Forces Of Plastic Caps & Closures Market

The Plastic Caps & Closures Market is currently navigated by a robust set of dynamic forces. Primary Drivers (D) include the pervasive global increase in packaged food and beverage consumption, necessitated by demographic changes, urbanization, and the corresponding shift from traditional retail to modern supply chains globally. Furthermore, the mandatory requirement for enhanced product safety in pharmaceuticals and specialized medical packaging, demanding child-resistant closures (CRC) and tamper-evident features, provides a stable, high-value growth impetus. The rapid proliferation of sophisticated dispensing closures (pumps, sprayers) across personal care and home cleaning sectors, catering to convenience-driven consumer lifestyles, substantially contributes to market volume growth. These drivers establish a foundation of constant, non-negotiable demand for functional and reliable sealing solutions, ensuring the market's long-term resilience even amidst economic fluctuations.

Conversely, the market faces significant Restraints (R), most notably the sharp and unpredictable volatility in the prices of virgin polymer resins (PP, HDPE), which are derived from petroleum. This price instability directly compresses manufacturer margins and complicates long-term contract pricing with major brand owners. The most influential structural restraint is the intensifying global regulatory scrutiny targeting single-use plastics, including outright bans, punitive taxes, and Extended Producer Responsibility (EPR) schemes, which increase operational costs and necessitate costly retooling, exemplified by the transition to tethered caps in major consumer regions. These environmental pressures require manufacturers to make difficult choices regarding material investments and potentially sacrifice manufacturing efficiency to integrate more expensive, less consistent recycled or bio-based feedstocks, presenting a core challenge to traditional manufacturing economics.

Significant Opportunities (O) emerge from these constraints, particularly in specialized closure segments and sustainable innovation. The mandatory adoption of tethered caps across Europe provides a massive market opportunity for companies that have successfully developed patented, efficient, and user-friendly designs for this new standard. Furthermore, the development and industrial scaling of bio-degradable, compostable, or advanced bio-based plastic closures offer a crucial market differentiation avenue, allowing brands to cater to the highest tier of environmentally conscious consumers. Technological opportunities in barrier film integration, smart closures (equipped with QR codes or NFC tags for traceability and anti-counterfeiting), and advanced lightweighting techniques offer pathways to increase the value proposition of closures beyond simple sealing, transforming them into data-enabled marketing and logistics tools. The ongoing rise of e-commerce also offers an opportunity for premium, rugged, spill-proof closures designed specifically for parcel post logistics.

The principal Impact Forces (IF) shaping the market are regulatory, economic, and environmental. Regulatory forces, particularly the far-reaching influence of the EU's directives, exert pressure globally as multinational brand owners seek harmonized packaging solutions, often adopting European standards worldwide. Economic forces, including global inflation affecting logistics, energy, and labor costs, continuously challenge manufacturers to maintain cost competitiveness while simultaneously investing in expensive sustainable upgrades. Environmental impact forces are the strongest catalysts for change, driving consumer preference shifts away from purely virgin plastic toward circular economy models, compelling immediate investment in recycling infrastructure partnerships and certified material sourcing. The cumulative effect of these complex and often conflicting forces dictates that success in the plastic caps and closures market is increasingly dependent on agility, high precision engineering, and a demonstrated commitment to verifiable sustainability outcomes across the entire product lifecycle.

Segmentation Analysis

The structured analysis of the Plastic Caps & Closures Market relies on segmentation across several critical axes: product type, raw material composition, end-use application, and manufacturing technology. This multi-dimensional segmentation provides crucial insight into where growth is concentrated and where technological innovation is essential. The segmentation by product type clearly delineates the high-volume commodity market (screw caps) from the high-value specialty market (pumps, sprayers, CRCs). Segmentation by raw material reflects the sustainability transition, tracking the usage and substitution rates of conventional polymers (PP, HDPE) with certified Post-Consumer Recycled (PCR) and emerging bio-based materials. Understanding these segments is vital for strategic planning, resource allocation, and targeted marketing efforts within the highly specialized closure manufacturing ecosystem.

The application segmentation is fundamental, with the Beverage sector requiring lightweight, high-barrier solutions compatible with high-speed bottling lines, often focusing on compression molding technologies. In stark contrast, the Pharmaceutical and Personal Care segments demand specialized functional closures that prioritize user safety, precise dosing mechanisms, and sophisticated aesthetics, driving innovation in advanced injection molding techniques and complex multi-component assembly processes. The manufacturing technology segment reveals the industry's lean towards efficiency: Compression Molding is gaining dominance for simple, high-volume closure formats due to its superior cycle times and lower energy footprint, solidifying its adoption for PCO 1881 and similar bottle standards worldwide. Conversely, Injection Molding continues to lead for closures with complex internal features, threads, or dispensing functionality that require extreme precision and material versatility.

Furthermore, segmentation allows market participants to accurately benchmark operational performance against industry standards relevant to their core offerings. For example, a manufacturer specializing in child-resistant closures (CRC) for the pharmaceutical sector must benchmark against peers using high-precision injection molding of PP, adhering to strict ISO 1553 and FDA compliance protocols, whereas a beverage cap producer focuses on optimizing compression molding throughput and minimizing material weight for HDPE PCO caps. This granular view of the market confirms that while the overarching trends are centered on sustainability and lightweighting, the specific technological and material requirements remain highly diverse and application-specific, necessitating tailored R&D and supply chain management strategies for each core segment to maintain competitive relevance and profitability in the fragmented global market landscape.

- By Product Type:

- Screw Caps (Continuous Thread & Threaded Closures)

- Dispensing Caps (Flip-top, Disc-top, Push-pull, Spouts)

- Tethered Caps

- Child-Resistant Closures (CRC)

- Tear-Off Closures & Pilfer-Proof Closures

- Pump and Spray Closures (Lotion Pumps, Fine Mist Sprayers, Trigger Sprayers)

- By Raw Material:

- Polypropylene (PP)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polyethylene Terephthalate (PET)

- Bio-based Plastics & Certified Circular Polymers (PCR)

- By Application:

- Beverages (Water, CSD, Juices, Dairy)

- Food (Sauces, Edible Oils, Condiments, Jars)

- Pharmaceuticals & Healthcare (OTC, Prescription Drugs, Vials)

- Personal Care & Cosmetics (Shampoos, Lotions, Creams)

- Household Care & Cleaning Products (Detergents, Chemicals)

- Industrial Chemicals

- By Technology (Manufacturing Process):

- Injection Molding

- Compression Molding

- Blow Molding

Value Chain Analysis For Plastic Caps & Closures Market

The value chain for plastic caps and closures begins at the upstream segment, dominated by major petrochemical producers such as ExxonMobil, SABIC, and Dow Chemical, which supply the virgin polymer resins (PP and HDPE). This segment is characterized by large-scale, commodity-based operations and is highly susceptible to global crude oil price fluctuations, which directly translate into raw material costs for closure manufacturers. Increasingly, this upstream segment now includes specialized recyclers and polymer compounders who are crucial for supplying certified Post-Consumer Recycled (PCR) resins and bio-based plastics. Securing stable, high-quality PCR feedstock is a major competitive differentiator, as recycled polymers often exhibit inconsistency, demanding closer quality collaboration between resin suppliers and closure manufacturers to ensure fitness for high-speed molding processes and critical sealing applications.

The core midstream activity is the manufacturing stage, where highly specialized closure producers, including global entities like Closure Systems International (CSI) and BERICAP, convert resins into finished products using precision injection and compression molding. This phase is capital-intensive, requiring advanced tooling, automated quality control systems (often AI-enhanced), and strict adherence to food-grade (e.g., ISO 22000) or pharmaceutical (e.g., GMP) standards. Manufacturers must continuously invest in lightweighting technologies and tooling upgrades to comply with regulatory changes, such as the tethered cap mandate. The complexity of manufacturing specialty closures (e.g., pumps, CRCs) often requires sophisticated multi-component assembly lines, adding further complexity and specialized labor requirements, pushing the manufacturing cost structure higher compared to standard screw caps.

The downstream segment involves distribution and the final end-use application. Distribution channels are twofold: direct sales to major multinational brand owners (e.g., Coca-Cola, PepsiCo, Unilever) via long-term contracts, and indirect sales through regional packaging distributors who service smaller private labels and contract fillers. Direct relationships allow for bespoke design collaboration and secure integration into the customer's bottling line procedures. End-users, the FMCG companies, place significant emphasis on supply reliability, consistent application torque, and performance on high-speed filling lines (up to 120,000 bottles per hour). A crucial trend in the downstream is the reverse logistics loop: the increasing need for manufacturers to design closures that are easily separable and highly detectable by Material Recycling Facilities (MRFs), ensuring the caps are captured and returned to the upstream recycling process, thereby completing the necessary circular economic model demanded by both consumers and regulatory bodies across major markets.

Plastic Caps & Closures Market Potential Customers

The potential customer base for the Plastic Caps & Closures Market is highly concentrated yet broadly distributed across critical consumer sectors. Large-scale global beverage corporations represent the single largest volume buyers. These customers require massive quantities of standard 28mm PCO closures for bottled water and carbonated soft drinks, demanding absolute reliability, minimum material usage (lightweighting), and maximum compatibility with extremely fast bottling lines. Their purchasing decisions are primarily influenced by unit cost, consistent quality performance (leak prevention), and a supplier's verified capacity to meet aggressive sustainability targets, particularly concerning the use of certified PCR content and compliance with new design standards like tethered caps. Securing contracts with these beverage giants guarantees substantial, long-term revenue streams and often dictates global manufacturing standardization efforts.

The pharmaceutical and healthcare sector constitutes the highest-value customer segment per unit, focusing on specialized safety and regulatory compliance over volume. Customers in this segment, including global generic and branded drug manufacturers, procure complex closures such as Child-Resistant Closures (CRC), tamper-evident seals, and specialized dosing cups/caps. They prioritize supplier certification (ISO, FDA compliance), rigorous quality management systems (QMS), and comprehensive documentation and traceability for every batch. The complexity of these closures means that customers seek suppliers with deep technical expertise in polymer science and regulatory affairs, viewing the closure as a critical safety component of the drug product rather than merely a packaging seal, leading to premium pricing and long-term, highly audited supplier relationships based on trust and regulatory adherence.

Furthermore, the personal care, cosmetics, and household products industries represent dynamic customer segments seeking design innovation and dispensing functionality. Cosmetic brands demand sophisticated, aesthetically appealing closures, often customized in shape, color, and finish (e.g., glossy, metallic effects) to enhance brand perception. They are the major buyers of high-value dispensing systems, including lotion pumps, fine-mist sprayers, and complex flip-top caps that offer convenience and controlled application. Customers in the household cleaning sector require durable, chemical-resistant trigger sprayers and induction-sealed caps capable of handling aggressive chemicals. For both these segments, supplier relationships hinge on co-development capabilities, design flexibility, and the ability to rapidly scale production for seasonal or promotional product launches, with sustainability features (like all-plastic pumps for easier recycling) now becoming a fundamental prerequisite for major procurement partnerships.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 billion |

| Market Forecast in 2033 | USD 66.8 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Crown Holdings Inc., Silgan Holdings Inc., Berry Global Inc., Amcor PLC, AptarGroup Inc., Closure Systems International (CSI), Alpla Werke Alwin Lehner GmbH & Co KG, RPC Group PLC, Rexam PLC, BERICAP GmbH & Co. KG, Guala Closures S.p.A., Caps & Closures Pty Ltd, DWK Life Sciences GmbH, Tetra Pak International SA, Greif Inc., O. Berk Company, Zeller Plastik GmbH, Pactiv LLC, Sonoco Products Company, Reynolds Group Holdings Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Caps & Closures Market Key Technology Landscape

The core technological foundation of the Plastic Caps & Closures Market rests upon advanced molding techniques, which are continuously optimized for speed, precision, and material efficiency. Compression Molding (CM) has become the preferred technology for producing standard, lightweight closures, particularly for the high-volume beverage sector. CM offers significant advantages over traditional injection molding (IM), including up to 40% energy savings, lower melt temperatures (ideal for processing sensitive recycled content), and dramatically reduced cycle times, enabling production rates exceeding 1,000 caps per minute per machine. Manufacturers are heavily investing in multi-cavity CM systems and proprietary cooling techniques to maximize throughput while minimizing material stress and warp, ensuring the resultant cap consistently meets stringent torque and sealing performance requirements required by high-speed filling lines globally. The efficiency gains delivered by CM are essential for offsetting rising raw material and energy costs, maintaining competitive unit pricing in the mass-market segments.

While Compression Molding dominates high-volume, standard formats, Injection Molding (IM) remains indispensable for closures requiring complex geometries, multi-component assembly, or fine thread details, particularly in the pharmaceutical and dispensing sectors. Technological advancements in IM focus on the integration of servo-electric drives for enhanced precision and energy efficiency, coupled with sophisticated hot runner systems that minimize material waste (sprues) and ensure even material flow across large, multi-cavity molds. The development of specialized IM tooling is crucial for producing intricate dispensing closures like all-plastic pumps, which are designed to eliminate non-recyclable metal components, addressing a key pain point in the plastic recycling stream. Furthermore, the integration of in-mold labeling (IML) technology into closure production is emerging as a method for adding high-quality graphics and tamper evidence directly during the molding process, offering advanced branding opportunities while enhancing security features against counterfeiting.

Beyond the molding machine itself, the technological landscape is defined by digitization and quality assurance systems. High-speed, high-resolution 3D machine vision systems are universally deployed post-molding to inspect every single closure for defects such as flash, short shots, missing features (like pilfer-proof bands), and dimensional inaccuracies. These systems, increasingly powered by AI and deep learning algorithms, operate at rates matching the molding machine throughput, ensuring near-zero defects reach the customer. Furthermore, the development of tethered cap solutions has necessitated innovative tooling that incorporates complex hinge mechanisms and specialized handling robots to ensure the cap-to-bottle bond is functional and durable without compromising consumer ease of use. This area of innovation focuses on polymer flow simulation and mechanical stress testing to guarantee compliance with the SUPD mandate requiring the hinge to withstand repeated opening cycles without breaking, marking a significant engineering challenge and opportunity in closure technology.

Regional Highlights

- Asia Pacific (APAC): The dominant market in terms of volume consumption, driven by mass market adoption of packaged water and affordable beverages. Growth is primarily supported by the expansion of local bottling infrastructure and increasing consumer preference for hygienic, sealed packaging. Key focus areas include rapid localization of production and investments in high-speed, cost-efficient compression molding machinery to serve the vast population centers of India and China. Regulatory environments are beginning to follow the Western model, introducing environmental restrictions and driving gradual adoption of advanced lightweighting technologies.

- North America: A mature market focused heavily on specialty closures, high-value closures, particularly dispensing systems for personal care and sophisticated child-resistant packaging for pharmaceuticals and cannabis products. Growth is driven by innovation in sustainability (high PCR content adoption) and demand for aesthetic, high-performance designs that cater to premium consumer goods segments.

- Europe: The global leader in regulatory-driven packaging innovation, dominated by the implementation of the Single-Use Plastics Directive (SUPD) mandate for tethered caps, requiring widespread retooling. The market growth is driven by compliance, forcing immediate investment in complex hinge technologies and advanced tooling. European manufacturers are also pioneering the use of bio-based polymers and standardized closure designs (design-for-recyclability principles) across the region, positioning itself at the forefront of the circular economy transition for plastic packaging.

- Latin America (LATAM): Exhibits consistent, stable growth, heavily influenced by urbanization and increasing accessibility to modern retail. The market is highly price-sensitive, leading to strong demand for cost-optimized, lightweight screw caps. Brazil and Mexico are primary investment hubs, seeing steady adoption of global standards, though regulatory pressure for sustainable materials often lags behind Europe and North America. Localized production is increasing to mitigate complex import tariffs and logistics costs across the diverse geographic landscape.

- Middle East and Africa (MEA): Represents a rapidly expanding frontier market, largely driven by significant governmental investments in local food and beverage production, particularly in the Gulf Cooperation Council (GCC) states and high-population African nations. The market relies heavily on technology transfer and imported machinery to meet rising domestic demand for bottled water and basic packaged goods, with initial sustainability focus centered on improving local collection and recycling infrastructure rather than immediate, radical material changes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Caps & Closures Market.- Crown Holdings Inc.

- Silgan Holdings Inc.

- Berry Global Inc.

- Amcor PLC

- AptarGroup Inc.

- Closure Systems International (CSI)

- Alpla Werke Alwin Lehner GmbH & Co KG

- BERICAP GmbH & Co. KG

- Guala Closures S.p.A.

- DWK Life Sciences GmbH

- Tetra Pak International SA

- Greif Inc.

- O. Berk Company

- Zeller Plastik GmbH

- Pactiv LLC

- Sonoco Products Company

- Reynolds Group Holdings Limited

- Hinges & Closures Limited

- Plastipak Holdings, Inc.

- SKS Bottle & Packaging, Inc.

Frequently Asked Questions

Analyze common user questions about the Plastic Caps & Closures market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are tethered caps and how do they impact plastic closure manufacturing?

Tethered caps are closures designed to remain physically attached to the bottle after opening, mandated primarily by the EU Single-Use Plastics Directive (SUPD) to reduce litter and enhance cap recycling rates. Their implementation requires massive retooling of high-speed compression and injection molding lines to incorporate durable, functional hinge mechanisms, driving substantial short-term capital expenditure and R&D effort across major global manufacturers.

Which raw materials dominate the plastic caps and closures industry, and why is PP favored?

Polypropylene (PP) and High-Density Polyethylene (HDPE) are the dominant materials. PP is increasingly favored for standard closures due to its superior flexibility and excellent stress-cracking resistance, making it ideal for compression molding and the crucial hinge component required in new tethered cap designs. HDPE is valued for its moisture barrier and stiffness, often used in screw cap applications requiring robust sealing integrity for water and other non-carbonated beverages.

How is sustainability affecting closure design and material sourcing?

Sustainability mandates a core shift toward lightweighting, maximizing Post-Consumer Recycled (PCR) content integration, and adopting 'design-for-recyclability' principles, which prioritize single-polymer materials and easy separation from the container. Brand owners demand verified PCR sourcing and certified closures to meet aggressive environmental targets, making eco-credentials a mandatory factor in supplier selection and procurement processes.

What role does compression molding play in the market compared to injection molding?

Compression molding (CM) is essential for high-volume, standard beverage caps (e.g., PCO 1881) because it offers faster cycle times, lower energy consumption (up to 40% less), and better material utilization compared to injection molding (IM). IM remains vital for complex, multi-component closures like dispensing pumps and Child-Resistant Closures (CRC) where high precision and intricate geometries are non-negotiable requirements for safety and functionality.

Which segment offers the highest revenue growth potential beyond standard screw caps?

The dispensing closures segment, encompassing lotion pumps, trigger sprayers, and specialized dosing caps, offers the highest revenue growth potential. This growth is driven by consumer demand for hygienic application, precise measurement, and convenience in the personal care, cosmetic, and household cleaning sectors, where functionality and design sophistication command significantly higher unit margins than commodity caps.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager