Plastic Inspection Chamber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433306 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Plastic Inspection Chamber Market Size

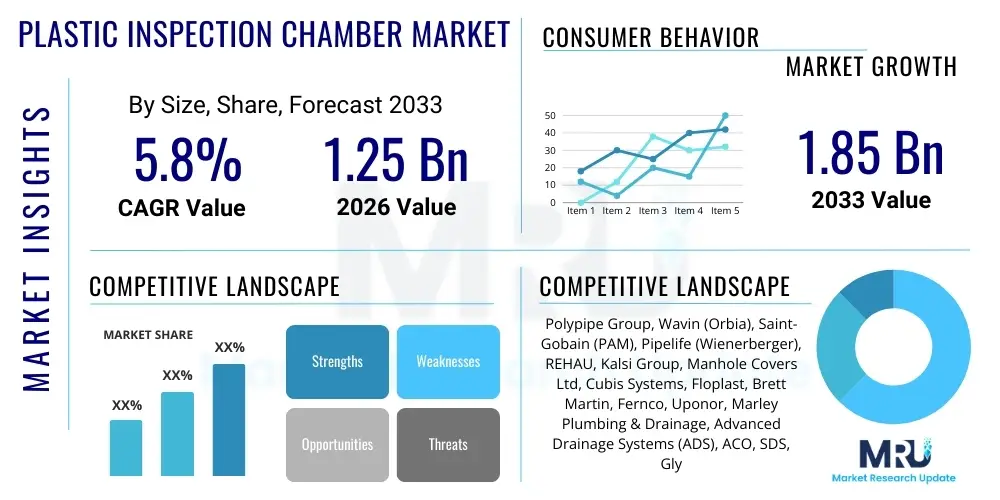

The Plastic Inspection Chamber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.85 Billion by the end of the forecast period in 2033.

Plastic Inspection Chamber Market introduction

The Plastic Inspection Chamber Market encompasses the manufacturing, distribution, and installation of modular, lightweight access points used primarily for drainage and sewage systems. These chambers, typically made from high-density polymers like uPVC and Polypropylene (PP), serve as vital access points for cleaning, inspection, and maintenance of underground pipe networks. Unlike traditional concrete or clay structures, plastic chambers offer superior resistance to corrosion, reduced installation time, and enhanced sealing capabilities, minimizing infiltration and exfiltration issues in critical infrastructure projects. The increasing global focus on sustainable and efficient water management systems directly fuels the adoption of these modern drainage components.

Key applications of plastic inspection chambers span residential, commercial, industrial, and major municipal infrastructure developments, particularly in stormwater and foul water systems. Product specifications vary significantly based on required depth, load-bearing capacity, and material composition, catering to environments ranging from domestic gardens to high-traffic roadways. The inherent benefits, such as durability, ease of handling, and conformity to stringent environmental standards, position plastic chambers as the preferred solution over heavier, less adaptable conventional materials in modern construction and renovation projects. Furthermore, standardization in component design allows for rapid assembly and reduced overall project costs, driving widespread acceptance across developed and emerging economies.

Driving factors for this market include rapid global urbanization leading to extensive new infrastructure development, supportive governmental regulations promoting sustainable building materials, and the need for long-term, low-maintenance subterranean networks. The ease of transporting and installing these lightweight components significantly cuts down on labor costs and heavy machinery requirements, offering a clear economic advantage to contractors and developers. As climate change increases the frequency of intense rainfall events, the demand for robust stormwater management systems utilizing flexible and reliable plastic chambers is expected to accelerate significantly throughout the forecast period.

Plastic Inspection Chamber Market Executive Summary

The Plastic Inspection Chamber Market is poised for substantial growth, driven primarily by favorable business trends centered on infrastructure renewal and accelerated urbanization across Asia Pacific and specific regions in Europe. Key business trends include the shift toward modular, standardized drainage solutions that offer quick assembly and high structural integrity, reducing overall life-cycle costs for infrastructure projects. Manufacturers are focusing on developing composite materials and integrating smart technologies—such as sensors for flow monitoring—into chamber designs to enhance functionality. Regulatory landscapes in developed markets increasingly favor plastic solutions due to their environmental performance (reduced leakage) and longevity compared to traditional materials, creating a robust framework for market expansion. Competitive intensity remains high, with leading players prioritizing strategic mergers and acquisitions to consolidate regional market shares and expand product portfolios tailored for deep-bury applications.

Regionally, the Asia Pacific market is expected to exhibit the highest CAGR, propelled by massive governmental investments in sanitation and stormwater infrastructure necessary to support burgeoning populations and megacities. North America and Europe maintain mature, yet stable, markets, focusing on replacing aging concrete and clay systems with modern plastic alternatives to comply with updated water quality mandates. European regional trends emphasize sustainability and recycling initiatives, demanding chambers manufactured from high percentages of recycled plastic (rPP or rPE), thereby influencing supply chain practices and material sourcing. The Middle East and Africa (MEA) represent emerging hotspots, with construction boom cycles in the GCC countries and essential sanitation projects in sub-Saharan Africa stimulating demand for robust, chemically resistant plastic drainage components.

Segmentation trends highlight the dominance of Polypropylene (PP) and uPVC materials due to their superior chemical resistance and cost-effectiveness. The fastest-growing segment is expected to be stormwater management applications, driven by the necessity for enhanced flood mitigation infrastructure globally. Furthermore, the market shows a trend towards deeper inspection chambers as infrastructure designers seek integrated systems that can handle complex gradients and greater flow volumes. Strategic product differentiation is increasingly achieved through design elements that facilitate easier maintenance, such as pre-fabricated benching and integrated pipe seals, optimizing both the manufacturing process and field performance.

AI Impact Analysis on Plastic Inspection Chamber Market

Common user questions regarding AI’s impact on the Plastic Inspection Chamber Market predominantly revolve around optimizing manufacturing efficiency, predictive maintenance for installed systems, and smart infrastructure planning. Users are concerned about how AI algorithms can predict demand fluctuations based on construction permits and climate data, thereby streamlining the production schedules for varied chamber sizes and materials. Key themes include the implementation of Machine Learning (ML) in quality control during the injection molding process to reduce defects, and the application of AI-driven Geographic Information Systems (GIS) to optimize the placement and sizing of inspection chambers within large-scale urban drainage networks. Expectations center on AI enabling a shift towards "smart chambers" that integrate sensing technology to provide real-time performance data, leading to a proactive and efficient maintenance paradigm, fundamentally altering the service life and value proposition of these essential infrastructure components.

- AI-Driven Manufacturing Optimization: Using ML algorithms to fine-tune injection molding parameters (temperature, pressure, cycle time) for defect reduction and increased throughput of plastic chamber components.

- Predictive Maintenance Integration: Deploying AI to analyze data streams from sensors embedded in drainage networks, forecasting potential blockages or structural failures within chambers, allowing for preventative intervention.

- Supply Chain and Inventory Management: Utilizing AI to model construction activity (based on permits and satellite imagery) to predict localized demand for specific chamber sizes and ensuring optimal stock levels, reducing warehousing costs.

- Infrastructure Planning and Design: Implementing Generative Design and AI-powered GIS tools to model optimal drainage routes and chamber placement, minimizing excavation requirements and improving hydraulic efficiency.

- Automated Quality Inspection: Using computer vision systems powered by AI for high-speed, non-destructive testing of finished plastic chambers to ensure adherence to stringent regulatory standards (e.g., load-bearing capacity).

- Energy Consumption Reduction: Applying ML to optimize the energy usage of large manufacturing facilities producing plastic components, aligning with corporate sustainability goals.

DRO & Impact Forces Of Plastic Inspection Chamber Market

The market dynamics are defined by robust drivers, structural restraints, and significant opportunities, all modulated by pervasive impact forces stemming from regulatory and technological shifts. The primary drivers include the global push for sustainable infrastructure, where the lightweight, corrosion-resistant nature of plastic chambers offers a compelling alternative to concrete, coupled with aggressive infrastructure spending programs in developing regions. Restraints center on the high initial investment required for advanced injection molding machinery and the price volatility of petrochemical raw materials, which directly impacts production costs. Opportunities are abundant in the integration of smart monitoring technologies within chambers (IoT enablement) and the vast potential for retrofitting existing, failing traditional sewer systems across Europe and North America. These elements collectively shape a market environment characterized by sustained, incremental growth tied closely to global construction health.

Impact forces significantly influence market trajectory, notably the increasingly stringent environmental regulations mandated by governmental bodies regarding water infiltration and exfiltration in sewage systems. Plastic chambers, with their superior sealing mechanisms, inherently meet these new compliance standards more readily than jointed concrete systems, accelerating their market penetration. Technological advancements in composite polymer formulation are another key force, allowing manufacturers to create lighter yet stronger chambers capable of withstanding extreme loads (e.g., D400 traffic loading) typically reserved for concrete, thereby eliminating a traditional barrier to plastic adoption in heavy-duty applications. Furthermore, competitive pressures drive continuous innovation in modular design, reducing complexity and installation time, forcing faster product cycles across the industry.

The synergistic effect of these forces results in a market prioritizing long-term value over initial product cost. While the initial raw material fluctuation poses a constraint, the long-term cost benefits derived from reduced installation labor, minimal maintenance requirements, and superior lifespan drive the purchasing decisions of municipal and private developers. The strategic leveraging of opportunities, such as focusing research and development on deeper chambers and integrating recycled content, will determine the market leaders over the forecast period, emphasizing both economic efficiency and environmental responsibility.

- Drivers:

- Increasing global urbanization and subsequent demand for new drainage infrastructure.

- Superior longevity, chemical resistance, and non-corrosive properties compared to concrete and clay.

- Significant reduction in installation time and labor costs due to lightweight, modular designs.

- Government initiatives promoting sustainable water management and strict regulations on system leakage.

- Restraints:

- Price volatility and supply chain disruption related to crude oil and petrochemical-based raw materials (plastics).

- Regulatory hesitation or mandates in certain geographies favoring traditional materials for very deep or highly sensitive installations.

- High capital expenditure required for sophisticated, large-scale plastic injection molding machinery.

- Opportunities:

- Development and integration of "Smart Chambers" with IoT sensors for remote monitoring and predictive maintenance.

- Large-scale potential for retrofitting aging drainage and sewage infrastructure in developed nations.

- Expansion into niche applications such as rainwater harvesting and sustainable urban drainage systems (SuDS).

- Innovation in composite materials enabling higher load-bearing capabilities for heavy-duty traffic areas.

- Impact Forces:

- Technological advancements in polymer chemistry and molding techniques.

- Evolving regional building codes and environmental standards.

- Shifting preferences among contractors and civil engineers toward modular, system-based solutions.

Segmentation Analysis

The Plastic Inspection Chamber Market is comprehensively segmented based on material type, the depth of the chamber, and its primary application, reflecting the diverse requirements of the global construction and utility industries. The segmentation provides critical insight into purchasing behavior and technological development focus areas. Material composition, encompassing uPVC, PP, and PE, dictates chemical resilience and cost structure, with Polypropylene currently dominating due to its excellent balance of cost, strength, and ease of processing. Depth segmentation is crucial as it determines structural engineering requirements and applicable standards, highlighting the challenges and opportunities in developing compliant solutions for deep sewer installations where traditional concrete still holds significant share. Application analysis reveals the market distribution across utility sectors, demonstrating strong sustained demand from both residential construction and large-scale municipal stormwater projects.

The most lucrative segment based on current adoption trends is the shallow chamber category (less than 600mm deep), primarily utilized for residential drainage connections and utility services where access is readily available and load-bearing requirements are moderate. However, the fastest growth is anticipated in the standard and deep chamber categories, as manufacturers successfully innovate to meet stricter load standards (D400 and above) for commercial and road infrastructure applications. This expansion into deeper applications is facilitated by multi-wall construction techniques and reinforced polymer designs. Understanding these granular segments allows stakeholders to tailor product development and marketing strategies, focusing on specific regulatory environments and construction methodologies prevalent in different geographical regions.

Furthermore, segmentation by application shows that municipal sewage systems and stormwater management collectively represent the largest share of the market, driven by governmental mandates to upgrade public sanitation infrastructure and manage increasing water runoff volumes effectively. The industrial use segment, requiring chambers with high chemical resistance to handle specialized effluents, also presents a high-value, albeit smaller, market opportunity. The continued optimization of manufacturing processes to produce customizable segment components rapidly will be a key differentiator among leading market players targeting these highly specified application areas.

- By Material:

- Unplasticized Polyvinyl Chloride (uPVC)

- Polypropylene (PP)

- Polyethylene (PE)

- Composite Polymers

- By Depth/Type:

- Shallow Chambers (often referred to as mini-access chambers) (< 600mm)

- Standard Chambers (600mm - 1200mm)

- Deep Chambers (Access Chambers) (> 1200mm)

- By Application:

- Residential Drainage and Housing Development

- Commercial Infrastructure (Office Parks, Retail Centers)

- Industrial Use and Manufacturing Facilities

- Municipal Sewage Systems (Foul Water)

- Stormwater Management and SuDS Applications

Value Chain Analysis For Plastic Inspection Chamber Market

The value chain for the Plastic Inspection Chamber Market begins with the upstream sourcing of raw petrochemical materials, specifically various grades of polymers like PP, uPVC, and PE. This initial stage is crucial as raw material price volatility directly impacts the final product cost and manufacturer margins. Key upstream activities involve polymerization and the integration of specialized additives (UV stabilizers, impact modifiers) necessary for enhancing the durability and lifespan of the chambers. Manufacturers typically rely on large chemical suppliers and refineries, emphasizing long-term contracts to mitigate supply risk. Efficiency in this segment is driven by high-volume purchasing and strategic location of manufacturing plants near key transport hubs to minimize logistics costs associated with handling bulky polymer pellets.

The core manufacturing process involves high-pressure injection molding or rotational molding, depending on the size and design complexity of the chamber base and risers. This midstream phase focuses heavily on precision engineering to ensure component fit, sealing integrity, and compliance with national standards (e.g., BS EN 13598). Manufacturers must invest heavily in quality control, utilizing advanced scanning and testing equipment to certify load-bearing capabilities. Distribution channels are varied: direct sales are common for large municipal or industrial projects, while indirect distribution through specialized plumbing and construction wholesalers, merchants, and retailers serves the high-volume residential and commercial sectors. The selection of the channel depends on the project scale and required technical support.

Downstream activities involve civil engineers, contractors, and installers who select, purchase, and install the chambers at the site. Customer support, including technical training on assembly and sealing techniques, forms a critical part of the value proposition, ensuring correct installation and system performance. The downstream phase often includes project lifecycle management, where the longevity and low-maintenance characteristics of the plastic chambers provide long-term value. The final consumers, such as property developers, municipal utility departments, or homeowners, ultimately benefit from the system's reliability. Optimization across the entire value chain involves streamlining logistics for bulky finished products and ensuring that product design facilitates rapid, error-free installation in diverse environments.

Plastic Inspection Chamber Market Potential Customers

The primary consumers and end-users of plastic inspection chambers are diverse, encompassing both public and private entities involved in construction and civil engineering projects. Key potential customers include municipal and governmental bodies responsible for public infrastructure—specifically water and sewage departments—which require thousands of chambers annually for new network extensions, remediation, and maintenance of existing underground services. These entities prioritize compliance with strict hydraulic performance and load-bearing standards, often requiring custom-engineered solutions for high-flow or deep installations. The purchasing decisions are typically based on tendering processes that value proven longevity, system integration compatibility, and total life-cycle cost.

Another major customer segment consists of residential and commercial property developers and construction companies. For housing and commercial estates, plastic chambers are favored due to their speed of installation and cost-efficiency in shallow to standard depth applications. These buyers value the ease of integration with standard piping systems and the labor savings achieved by using lightweight components. Furthermore, utility providers, particularly those managing telecoms and electricity networks, increasingly utilize specialized plastic inspection chambers (sometimes referred to as access chambers or duct access systems) for protecting and accessing underground cable infrastructure, valuing their corrosion resistance and secure, sealed designs.

Specialized buyers include industrial facilities, such as chemical plants and food processing centers, which require chambers made from highly chemically resistant polymers capable of handling aggressive effluents. Consulting engineers and architectural firms also act as influential indirect customers, specifying certain brands and types of plastic chambers in their design documents, thus directing procurement decisions. The continuous requirement for infrastructure renewal ensures a steady customer base, focusing on replacing outdated concrete or brick manholes with modern, sealed plastic alternatives, ensuring market stability and continuous demand across all regions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Polypipe Group, Wavin (Orbia), Saint-Gobain (PAM), Pipelife (Wienerberger), REHAU, Kalsi Group, Manhole Covers Ltd, Cubis Systems, Floplast, Brett Martin, Fernco, Uponor, Marley Plumbing & Drainage, Advanced Drainage Systems (ADS), ACO, SDS, Glynwed, Roth North Europe, Hauraton, Clark Drain. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Inspection Chamber Market Key Technology Landscape

The technological landscape of the plastic inspection chamber market is rapidly evolving, moving beyond simple manufacturing processes towards advanced material science and integration capabilities. The core technology remains high-precision injection molding and rotational molding, critical for producing seamless chamber bases and components that ensure hydraulic efficiency and watertight integrity. Recent advancements focus on multi-layer co-extrusion techniques, allowing manufacturers to combine different polymer materials within a single component, optimizing for strength on the exterior and chemical resistance on the interior surfaces. This technological evolution addresses the historical limitation of plastic chambers in high-load applications, making them viable substitutes for concrete in heavy traffic areas, particularly through the use of glass-fiber reinforced polymer composites.

A significant trend involves the integration of Smart Infrastructure Technology (SIT). This includes incorporating embedded sensors (IoT devices) into the chamber walls or lids during the molding process. These sensors monitor key operational parameters such as flow rates, level detection, temperature, and even gas concentration (H2S), providing utility operators with real-time diagnostic data. This shift from passive components to active monitoring points transforms the chamber into a critical data node within the wider drainage network, facilitating predictive maintenance and optimized resource deployment. The ability to retrofit existing plastic chambers with external monitoring equipment also forms a crucial part of the technology upgrade cycle, ensuring compliance with increasingly stringent regulatory requirements for system oversight.

Furthermore, technology related to sustainability is gaining prominence, specifically focusing on the use of recycled content. Manufacturers are employing advanced polymer sorting and processing technologies to incorporate high percentages of recycled Polypropylene (rPP) or Polyethylene (rPE) into non-structural chamber components without compromising performance. Design technology, including Computer-Aided Design (CAD) and Finite Element Analysis (FEA), plays a vital role in optimizing the structural geometry of the chambers to ensure maximum strength with minimum material usage, aligning with both cost reduction and environmental goals. The standardization of modular connection technologies, such as integrated rubber seals and proprietary jointing systems, also significantly contributes to field efficiency and long-term system reliability.

Regional Highlights

Regional dynamics are critical to understanding the Plastic Inspection Chamber Market, as regulatory environments, construction practices, and levels of infrastructure maturity vary significantly across major geographical zones.

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by explosive urbanization in countries like China, India, and Indonesia. Governments are prioritizing extensive investment in sanitation and sewage treatment infrastructure to accommodate rapid population growth. Demand here is characterized by high-volume requirements for standard residential and municipal applications, supported by favorable regulatory shifts promoting plastic over traditional materials for efficiency.

- Europe: A mature market characterized by stringent environmental regulations, particularly concerning water leakage (infiltration/exfiltration). The focus is heavily on infrastructure renewal, replacing aging clay and concrete systems with advanced, sealed plastic alternatives. Western European countries, especially the UK and Germany, are leading in the adoption of high-quality, sustainable chambers, including those made from recycled content and designed for SuDS (Sustainable Urban Drainage Systems).

- North America (NA): Represents a stable market emphasizing quality, long-term durability, and compliance with severe climatic conditions. Growth is steady, driven by municipal efforts to overhaul outdated sewer systems (particularly CSO reduction programs) and robust residential construction activity. Manufacturers in this region focus on producing chambers compliant with localized specifications and high-load ratings necessary for extensive highway infrastructure.

- Latin America (LATAM): Characterized by significant disparities in infrastructure maturity. Brazil and Mexico are key markets with ongoing urban development projects stimulating demand for basic and standard plastic chambers. The focus is often on initial cost-effectiveness and ease of transport in challenging terrains. Political and economic stability can, however, intermittently affect large-scale public sector investments.

- Middle East and Africa (MEA): Emerging market with high potential, particularly in the GCC states (UAE, Saudi Arabia) driven by mega-projects and rapid construction. The hot, arid climate necessitates chambers with excellent UV and chemical resistance. In Africa, growth is tied to international aid and governmental initiatives aimed at improving basic sanitation access, favoring modular and easily deployable plastic systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Inspection Chamber Market.- Polypipe Group

- Wavin (Orbia)

- Saint-Gobain (PAM)

- Pipelife (Wienerberger)

- REHAU

- Kalsi Group

- Manhole Covers Ltd

- Cubis Systems

- Floplast

- Brett Martin

- Fernco

- Uponor

- Marley Plumbing & Drainage

- Advanced Drainage Systems (ADS)

- ACO

- SDS

- Glynwed

- Roth North Europe

- Hauraton

- Clark Drain

Frequently Asked Questions

Analyze common user questions about the Plastic Inspection Chamber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of plastic inspection chambers over traditional concrete structures?

Plastic chambers offer superior benefits, including significant weight reduction (simplifying logistics and installation), enhanced chemical and corrosion resistance, watertight sealing capabilities to prevent leakage, and a considerably longer operational lifespan with minimal maintenance.

What are the current load-bearing standards for plastic inspection chambers in high-traffic areas?

Modern plastic inspection chambers are increasingly available with D400 load ratings, certifying them for use in heavy vehicular traffic areas, provided they are installed according to manufacturer specifications and relevant national standards like BS EN 13598-2 or equivalent regional codes.

Which material segment, uPVC or PP, is currently dominating the market?

Polypropylene (PP) currently holds a dominant share in the market due to its robust structural strength, high impact resistance, and cost-effective manufacturing process, making it highly versatile for various depth and application requirements.

How is the integration of IoT technology affecting the future design of inspection chambers?

IoT integration is transforming chambers into "smart" components by embedding sensors that monitor flow, level, and structural integrity. This allows utility providers to shift from reactive to proactive predictive maintenance models, optimizing resource allocation and system efficiency.

What role do environmental regulations play in the adoption of plastic chambers?

Strict environmental regulations, particularly those aimed at reducing leakage (infiltration and exfiltration) in drainage networks, significantly drive the adoption of plastic chambers, as their sealed joints and non-corrosive materials inherently offer better long-term watertight performance compared to aging concrete or brick systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager