Plastic Logistics Box Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433448 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Plastic Logistics Box Market Size

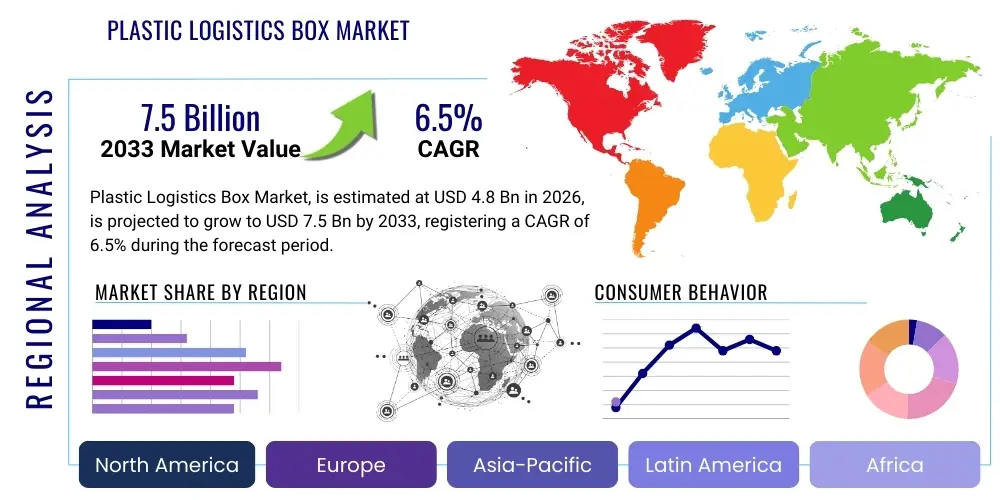

The Plastic Logistics Box Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Plastic Logistics Box Market introduction

The Plastic Logistics Box Market encompasses the production and distribution of reusable containers primarily utilized for the efficient storage, handling, and transportation of goods across diverse supply chains. These boxes, often manufactured from robust polymers like High-Density Polyethylene (HDPE) and Polypropylene (PP), are characterized by durability, light weight, stackability, and often, collapsibility, offering significant advantages over traditional single-use packaging solutions. Their design facilitates integration with automated material handling systems, standardized pallet sizes, and warehouse management protocols, making them indispensable assets in modern logistics infrastructure. The inherent benefits of plastic logistics boxes, including hygiene, weather resistance, and reduced long-term packaging waste, position them as foundational elements for optimizing operational efficiency in complex distribution networks. The market is heavily influenced by global shifts towards sustainability and the circular economy, driving demand for robust, long-lifecycle packaging alternatives.

Product descriptions within this segment vary significantly, ranging from rigid, heavy-duty containers designed for automotive parts and manufacturing components to lightweight, nesting totes ideal for retail order fulfillment and fresh food distribution. Major applications span critical sectors such as automotive manufacturing, where parts require precise, protective handling; food and beverage, demanding stringent hygienic conditions; and the rapidly expanding e-commerce sector, which necessitates swift, scalable, and reverse-logistics-compatible packaging. The increasing requirement for inventory visibility and trackability has further spurred innovation, incorporating features like embedded RFID tags and integrated sensors into the basic box structure. Key benefits driving market adoption include substantial cost savings over time due to reusability, minimization of product damage during transit, optimization of storage space through nesting or folding capabilities, and compliance with stringent international shipping and hygiene standards.

The primary driving factors fueling the expansion of this market include the relentless growth of the global e-commerce industry, which mandates efficient and standardized packaging for last-mile delivery and reverse logistics; the ongoing trend of automation in warehousing and distribution centers, where plastic boxes are essential for robotic handling systems; and increasing pressure from governments and corporations to adopt sustainable packaging practices and reduce carbon footprints. Furthermore, the pharmaceutical and healthcare sectors, driven by the need for secure, traceable, and temperature-controlled logistics, represent high-growth opportunities. Continuous material science advancements are leading to lighter yet stronger polymers, enhancing box performance and expanding the operational lifespan of these crucial logistics tools, thereby cementing their position as critical components of the global logistics ecosystem.

Plastic Logistics Box Market Executive Summary

The global Plastic Logistics Box market is undergoing rapid transformation, underpinned by significant shifts in global supply chain management, particularly the move toward integrated, technology-driven logistics. Current business trends indicate a strong focus on circular economy models, where major manufacturers are increasingly offering rental or pooling services for logistics boxes (Reusable Plastic Container Pooling), thus shifting from a CapEx to an OpEx structure for end-users. This pooling model not only reduces initial investment for businesses but also ensures high utilization rates and standardized hygiene maintenance, particularly critical for food and pharmaceutical logistics. Furthermore, mergers and acquisitions remain a key strategic move for market leaders seeking to expand their geographical footprint and diversify their specialized product portfolios, particularly in areas like insulated or temperature-controlled plastic containers necessary for cold chain logistics. Innovations in material compounding, such as incorporating antimicrobial additives and utilizing recycled content (Post-Consumer Resin - PCR), are defining competitive advantages and responding directly to consumer and regulatory calls for sustainability.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven primarily by exponential growth in domestic manufacturing, industrialization, and the massive scale of e-commerce markets in countries like China and India. The robust expansion of the automotive and electronics manufacturing bases in Southeast Asia further accelerates the demand for standardized, durable logistics boxes. North America and Europe, while being mature markets, are leading in the adoption of high-tech logistics solutions, including boxes integrated with IoT capabilities (e.g., GPS tracking, temperature monitoring) to support sophisticated, highly regulated supply chains. Regulatory pressures regarding packaging waste, especially in the European Union, are strongly favoring reusable plastic solutions over single-use cardboard or wood, providing a consistent structural tailwind for market penetration and replacement cycles. Economic recovery post-pandemic has also resulted in significant investment in warehousing capacity globally, directly increasing the addressable market for logistics boxes.

Segment trends underscore the dominance of the Folding/Collapsible Box segment, which offers unparalleled advantages in optimizing return logistics costs by drastically reducing void space during empty transit. Polypropylene (PP) remains the preferred material due to its optimal balance of strength, impact resistance, and cost-effectiveness, although HDPE is crucial for applications requiring greater rigidity and chemical resistance. Application-wise, the Retail and E-commerce sector is the leading consumer, necessitating rapid deployment of varied box types suitable for automated picking and sorting processes. However, the Food & Beverage segment is registering high-value growth, spurred by stricter food safety regulations (e.g., HACCP) that require easily sanitizable and highly durable containers for fresh produce, meats, and processed foods. The convergence of physical product characteristics with digital tracking technologies is defining the next generation of plastic logistics solutions, focusing on data integration and supply chain transparency.

AI Impact Analysis on Plastic Logistics Box Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Plastic Logistics Box market primarily revolve around three interconnected themes: optimization, predictive maintenance, and operational integration. Users frequently ask how AI can enhance the utilization efficiency of box fleets, how predictive analytics can forecast container damage or loss to minimize replacement costs, and what role AI plays in integrating smart logistics boxes into larger Warehouse Management Systems (WMS). Key concerns include the initial cost of embedding smart technologies (like RFID or sensors) and ensuring that the data generated by these smart boxes can be effectively analyzed by AI algorithms to deliver tangible benefits beyond simple location tracking. The consensus expectation is that AI will move the market beyond passive packaging to active data generation, turning a physical asset into an intelligent component of the digital supply chain.

AI’s influence is manifesting through sophisticated algorithms applied to logistics data streams, enabling real-time optimization of box circulation and pooling management. For large pooling operators, AI processes massive datasets related to box location, transit times, utilization rates, and cleaning cycles. This allows for dynamic redistribution planning, ensuring that the correct type and quantity of containers are available at specific distribution centers precisely when needed, thereby reducing inventory surplus and associated holding costs. Furthermore, AI-powered image recognition and machine learning are being deployed in automated quality control lines to rapidly detect subtle damage or wear on boxes, scheduling them for maintenance or recycling proactively. This predictive maintenance approach extends the operational life of the assets and minimizes unexpected failures in high-speed automated systems, directly enhancing ROI.

The ultimate strategic impact of AI lies in its ability to integrate the physical status of the logistics box—its content, environmental conditions (temperature, humidity), and location—into overarching supply chain decision-making processes. For example, in cold chain applications, AI analyzes temperature data reported by smart boxes alongside external weather conditions and transit history to predict potential temperature excursions and recommend corrective actions in real time. This level of proactive, data-driven management enhances product safety and reduces spoilage. For the manufacturers of the boxes, AI helps in designing more resilient and ergonomic containers by analyzing operational stress points and failure modes identified in real-world usage scenarios, leading to continuous product innovation and improved asset lifecycle planning.

- AI optimizes fleet management and asset tracking for pooling services, minimizing idle time and maximizing utilization rates.

- Machine learning algorithms predict container damage and failure modes, enabling proactive maintenance and extending product lifespan.

- AI integrates real-time box data (location, temperature, humidity) into WMS and ERP systems for enhanced supply chain visibility.

- Demand forecasting models utilize AI to predict future requirements for specific box types based on seasonality and macroeconomic indicators.

- Automated quality control systems use AI vision to inspect boxes rapidly for structural integrity and cleanliness compliance.

DRO & Impact Forces Of Plastic Logistics Box Market

The Plastic Logistics Box market is propelled by robust structural drivers, moderated by key restraints, and presents considerable long-term opportunities, all of which are subject to defining impact forces. A major driver is the accelerating trend of retail and industrial automation, where standardized plastic containers are essential prerequisites for robotic handling, automated storage and retrieval systems (AS/RS), and conveyor belt compatibility. This standardization drastically reduces manual handling errors and increases throughput efficiency across warehouses globally. Coupled with this is the powerful mandate for sustainability: organizations are increasingly replacing high-volume, single-use cardboard packaging with durable, reusable plastic boxes to meet circular economy goals and reduce landfill waste, providing a clear environmental and economic incentive for adoption. These drivers create a compelling economic argument for shifting operational expenditure away from constant packaging resupply toward long-term asset investment.

However, significant restraints temper this growth trajectory. The most pronounced restraint is the volatility in the cost of raw plastic materials, primarily HDPE and PP, which are petrochemical derivatives. Fluctuations in crude oil prices directly impact manufacturing costs, often leading to unpredictability in pricing for end-users, potentially slowing down large-scale procurement decisions. Furthermore, the high initial capital investment required for establishing large fleets of plastic logistics boxes, especially compared to the low unit cost of traditional packaging, acts as a barrier for smaller enterprises or those with tighter budget constraints. Competition from alternative reusable materials, such as metal or hybrid containers designed for extremely heavy loads or specialized temperature requirements, also fragments the market share and necessitates continuous innovation in plastic material performance.

Opportunities for market expansion are centered on technological integration and geographical penetration. The integration of IoT, RFID, and NFC technologies into logistics boxes presents an opportunity to capture value beyond physical asset provision, moving toward offering data-as-a-service. This digitalization creates smarter supply chains, particularly beneficial for high-value goods, pharmaceuticals, and sensitive electronics. Geographically, significant opportunities exist in developing economies in Africa, Latin America, and emerging parts of APAC, where logistics infrastructure is rapidly modernizing and requires scalable, durable solutions. Key impact forces shaping the market include shifting regulatory mandates concerning food safety (e.g., requiring easily sanitized plastic for food contact) and international trade dynamics, which prioritize container standardization for efficient cross-border movement. The increasing focus on labor safety and ergonomics also drives demand for lighter, easier-to-handle plastic solutions, reinforcing their long-term viability against heavier alternatives.

Segmentation Analysis

The segmentation of the Plastic Logistics Box Market is crucial for understanding specific demands across various industrial and commercial applications. The market is primarily analyzed based on Material Type, Product Type, and Application (End-User Industry). This multi-dimensional analysis allows stakeholders, from raw material suppliers to logistics service providers, to tailor products and services to exact operational requirements, ensuring optimal performance regarding load capacity, chemical resistance, and hygiene standards. The segmentation reveals dynamic shifts, particularly in material choice driven by sustainability pressures and product type influenced by space optimization needs within automated warehouses. Understanding these segments is key to strategic resource allocation and targeted market penetration strategies, especially given the diverse functional requirements across major end-user verticals like automotive and e-commerce.

The categorization by Product Type—encompassing Folding/Collapsible, Non-folding/Rigid, and Nesting boxes—reflects operational priorities related to storage and return logistics efficiency. Collapsible boxes dominate segments where high volumes of empty containers must be returned efficiently, significantly reducing transportation costs. Material Type segmentation highlights the preference for Polypropylene (PP) and High-Density Polyethylene (HDPE), chosen for their respective balances of flexibility, strength, and recyclability. The market analysis further dissects consumption patterns based on Application, recognizing that requirements for a pharmaceutical logistics box (e.g., traceability, temperature stability) are vastly different from those needed for a manufacturing or retail environment (e.g., high turnover, durability in rough handling). This granular detail ensures that products meet specific industry compliance mandates and performance metrics.

In essence, market segmentation provides a roadmap for innovation. For instance, the growing demand from the cold chain segment drives innovation within the Material Type segment toward advanced, insulated plastics, while the massive scaling of e-commerce propels product development in the Folding/Collapsible segment, focusing on quick assembly mechanisms and integration with robotic handling interfaces. Furthermore, sustainability concerns are leading to a new sub-segment focusing solely on boxes made from high percentages of recycled plastic or bio-based polymers. Strategic differentiation, therefore, hinges on mastering the niche demands identified through deep segmentation analysis, enabling manufacturers to provide value-added features like custom colors for identification, ergonomic handling points, and seamless integration with existing logistics infrastructure.

- Material Type:

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Other Polymers (e.g., PVC, specialty blends)

- Product Type:

- Folding/Collapsible Boxes

- Non-folding/Rigid Boxes

- Nesting Boxes

- Stacking Boxes (Crates)

- Application (End-User Industry):

- Retail and E-commerce Logistics

- Automotive and Manufacturing

- Food and Beverage (including cold chain)

- Pharmaceutical and Healthcare

- Chemical and Petrochemical

- Agriculture and Fisheries

Value Chain Analysis For Plastic Logistics Box Market

The value chain of the Plastic Logistics Box market begins with upstream activities, dominated by the procurement and processing of raw petrochemical materials. This stage involves major chemical companies supplying critical polymer resins, primarily HDPE and PP. Raw material quality is paramount, dictating the final mechanical properties, lifespan, and sustainability profile (e.g., recyclability) of the finished box. Stability in raw material supply and price management are critical upstream factors influencing manufacturer profitability and final product pricing. Following polymerization, specialized compounders may integrate additives, such as UV stabilizers, colorants, or impact modifiers, enhancing the polymer blend for specific logistical environments. Manufacturers must maintain strong relationships with these suppliers to ensure access to high-grade, cost-effective, and increasingly, recycled polymer compounds (PCR).

The midstream involves the core manufacturing process, primarily through injection molding or structural foam molding techniques, transforming the plastic resin into the final box product. This stage requires significant investment in heavy machinery, tooling (molds), and energy resources. Manufacturing efficiency, particularly cycle time optimization and waste reduction, determines cost competitiveness. Specialized features, such as folding mechanisms, reinforced corners, and integration points for RFID technology, are engineered and incorporated here. Downstream activities involve distribution and end-user engagement. The distribution channel is multifaceted, relying heavily on both direct sales, especially to large-scale industrial customers (e.g., major automotive manufacturers or retail chains purchasing dedicated fleets), and indirect sales through specialized logistics equipment distributors and pooling service providers.

Direct distribution offers greater control over branding and immediate customer feedback, facilitating tailored product solutions and long-term service contracts, especially for custom-designed or automated system-compatible boxes. Indirect distribution through third-party logistics (3PL) providers and equipment rental/pooling companies (like CHEP or ORBIS) allows manufacturers to access broader markets, particularly small and medium enterprises (SMEs) that prefer operating expenditure models (rental/pooling) over capital investment. The role of pooling operators in the downstream is becoming increasingly significant, as they manage the lifecycle, cleaning, tracking, and repair of the boxes, effectively providing a closed-loop logistics service. This reliance on 3PLs and pooling operators necessitates strong partnerships and standardized product offerings suitable for widespread use across multiple clients and industries, underscoring the shift toward service-based delivery within the market.

Plastic Logistics Box Market Potential Customers

The Plastic Logistics Box market serves a vast and diverse customer base, categorized primarily as large industrial manufacturers, massive retail and e-commerce enterprises, and specialized providers operating within highly regulated sectors. These potential customers are typically the decision-makers responsible for optimizing material handling, warehousing, and transportation costs. Large manufacturing companies, especially those in the automotive, electronics, and aerospace industries, require high volumes of standardized, robust, and often compartmentalized boxes for protecting complex components throughout assembly and supply processes. For these industrial users, the key purchase criteria revolve around durability, compatibility with automated assembly lines, and precise dimensional consistency, ensuring seamless integration into sophisticated internal logistics systems and minimizing manufacturing downtime caused by parts handling issues.

The rapid expansion of the e-commerce and fast-moving consumer goods (FMCG) retail sectors represents another dominant segment of potential customers. These entities, including major online retailers and grocery chains, demand flexible, lightweight, and often collapsible boxes optimized for high-frequency use in order fulfillment centers and for last-mile delivery operations. The emphasis here is on throughput speed, efficient nesting or folding capabilities to minimize return logistics costs, and integration with sorting technology. Furthermore, the rise of grocery e-commerce specifically necessitates boxes that meet stringent hygiene standards and support temperature-controlled environments for perishable goods. These companies often opt for managed pooling services to avoid the capital expenditure and management complexities associated with maintaining a massive, widely dispersed fleet of containers.

Highly specialized sectors, such such as pharmaceuticals, healthcare, and cold chain logistics, constitute high-value potential customers. For pharmaceutical companies, logistics boxes must not only be tamper-evident and traceable but often require thermal insulation or validated temperature stability features to protect sensitive medications and biological samples. Regulatory compliance (e.g., FDA, EMA standards) and data security become paramount purchasing factors. Across all segments, the modern potential customer is increasingly focused on the total cost of ownership (TCO), weighing the initial investment against long-term benefits derived from reduced product damage, improved supply chain velocity, and documented environmental sustainability achievements derived from transitioning away from single-use packaging solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schoeller Allibert, ORBIS Corporation, Linpac Group, Supreme Industries, KTP, AUER Packaging, BITO Storage Systems, Remcon Plastics, Rehrig Pacific Company, Loadhog, SSI Schaefer, DS Smith, Rattan Plastic, Jiangsu Rulian, Zhejiang Chaoyue, Kunnall Plastics, TranPak, Monoflo International, Goplasticboxes, Georg Utz Holding AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Logistics Box Market Key Technology Landscape

The technology landscape governing the Plastic Logistics Box market extends beyond basic injection molding to incorporate advanced material science and digital integration tools essential for modern supply chain management. Core manufacturing technologies focus on optimizing the strength-to-weight ratio of the containers. Innovations in injection molding, such as gas-assist injection molding and structural foam molding, are used to produce lightweight yet robust boxes with complex geometries, maximizing rigidity while minimizing material usage. Furthermore, the development of new polymer blends, including antimicrobial plastics for high-hygiene applications (e.g., food and medical), and high-impact co-polymers that resist cracking in extreme cold environments, are crucial technological differentiators. The increasing use of Post-Consumer Resin (PCR) mandates sophisticated sorting and reprocessing technologies to ensure the recycled input material maintains the necessary mechanical properties for long-life logistics applications.

A transformative area of technology lies in the integration of digital tracking and monitoring capabilities. Radio Frequency Identification (RFID) tags, Near Field Communication (NFC) chips, and sometimes even low-power Bluetooth (BLE) beacons are embedded directly into the plastic structure of the boxes during manufacturing. These technologies enable real-time asset tracking, improving inventory accuracy, reducing loss rates, and facilitating automated check-in/check-out processes in distribution centers. For high-value or temperature-sensitive goods, boxes are increasingly equipped with integrated sensors that monitor internal conditions such as temperature, humidity, and shock/vibration. This data is critical for validating compliance with cold chain protocols and establishing liability in case of product damage, providing an essential layer of transparency and accountability that paper-based systems cannot match.

The ultimate goal of these technological integrations is the creation of a "Smart Box" ecosystem that communicates seamlessly with digital logistics platforms (e.g., WMS and Transportation Management Systems - TMS). This requires robust data standards and cloud connectivity solutions. Furthermore, the design process itself leverages technology, utilizing advanced Computer-Aided Engineering (CAE) and Finite Element Analysis (FEA) software to simulate stress, deflection, and stacking loads. This virtual testing ensures that new box designs meet stringent industry standards (like ISO or EURO pallet standards) before costly tooling is developed. The convergence of material sustainability, enhanced mechanical performance, and digital visibility technologies defines the competitive frontier for manufacturers in this market.

Regional Highlights

Regional dynamics within the Plastic Logistics Box Market reflect global manufacturing and consumption patterns, with Asia Pacific (APAC) demonstrating the most vigorous expansion. This rapid growth is attributable to massive industrialization, the relocation of global manufacturing operations to countries like Vietnam and India, and the unparalleled scale of e-commerce markets, particularly in China. The demand in APAC is twofold: high volumes of basic, durable containers for manufacturing logistics and advanced, traceable solutions for new cold chain infrastructure and modern retail supply chains. Government initiatives supporting infrastructure development and logistics modernization further accelerate market absorption, making APAC the primary engine for future volume growth.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on automation and the adoption of advanced, integrated logistics solutions. In North America, demand is heavily driven by large retail chains, the automotive sector, and robust food processing industries that rely on sophisticated pooling networks managed by specialized 3PLs. The shift towards automation in vast fulfillment centers necessitates highly standardized boxes optimized for robotic handling systems. European market growth is structurally supported by stringent environmental regulations, particularly those promoting reusable packaging over single-use alternatives, which strongly favors durable plastic logistics boxes. Furthermore, Europe leads in the adoption of technology integration, driven by high labor costs and the need for precision logistics across numerous national borders.

Latin America, and the Middle East & Africa (MEA) are emerging regions offering significant untapped potential. In Latin America, market growth is often linked to the expansion of organized retail and the development of modern agricultural supply chains requiring improved hygiene and traceability solutions. In the MEA region, substantial investment in large-scale infrastructure projects, coupled with the establishment of significant new logistics hubs and free trade zones, is creating initial demand for standardized logistics assets. While these regions currently exhibit lower per capita plastic box utilization compared to developed markets, their rapidly evolving infrastructure and increasing demand for higher standards in food safety and pharmaceutical logistics promise robust future expansion, making them attractive targets for strategic market entry.

- Asia Pacific (APAC): Highest growth market driven by manufacturing expansion, e-commerce dominance (China, India), and investment in cold chain logistics infrastructure.

- North America: Mature market characterized by high adoption of pooling systems and demand from large retail, automotive, and food & beverage sectors; focus on automation compatibility.

- Europe: Growth supported by stringent environmental regulations favoring reusability; high adoption of smart boxes and integrated technologies for cross-border supply chains.

- Latin America: Emerging market driven by modernization of retail and agriculture sectors, seeking solutions for improved transit protection and hygiene standards.

- Middle East & Africa (MEA): Growth tied to significant infrastructure development, creation of logistics hubs, and increasing need for standardized, durable logistics assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Logistics Box Market.- Schoeller Allibert

- ORBIS Corporation

- Linpac Group

- Supreme Industries

- KTP

- AUER Packaging

- BITO Storage Systems

- Remcon Plastics

- Rehrig Pacific Company

- Loadhog

- SSI Schaefer

- DS Smith

- Rattan Plastic

- Jiangsu Rulian

- Zhejiang Chaoyue

- Kunnall Plastics

- TranPak

- Monoflo International

- Goplasticboxes

- Georg Utz Holding AG

Frequently Asked Questions

Analyze common user questions about the Plastic Logistics Box market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using plastic logistics boxes over traditional cardboard or wooden packaging?

Plastic logistics boxes offer superior durability, multiple reuses, resistance to moisture and chemicals, improved hygiene (especially important for food and pharma), and standardization compatibility with automated systems. They significantly reduce waste and lower the Total Cost of Ownership (TCO) over their long operational lifespan compared to single-use options.

Which material type dominates the market and why is it preferred for logistics applications?

Polypropylene (PP) and High-Density Polyethylene (HDPE) collectively dominate the market. PP is favored for its strength, impact resistance, and cost-effectiveness in general-purpose containers, while HDPE is preferred for applications requiring greater chemical resistance, rigidity, and resilience in low temperatures, making both essential components of modern supply chain assets.

How does the growth of e-commerce specifically influence the demand for plastic logistics boxes?

E-commerce growth drives demand by requiring standardized, lightweight, and often collapsible containers for efficient automated order picking, sorting, and high-volume reverse logistics. Collapsible plastic boxes minimize shipping costs on empty returns, a critical factor for large-scale online retail fulfillment centers and last-mile delivery operations.

What role does technology, such as RFID or IoT, play in the evolution of logistics boxes?

Technology transforms the boxes into smart assets by embedding RFID or IoT sensors for real-time tracking, inventory management, and condition monitoring (temperature, shock). This integration provides crucial data for supply chain visibility, enhances security, enables predictive maintenance, and facilitates seamless automation within smart warehouses.

What is the significance of the pooling services model in the market, and how does it benefit end-users?

Pooling services involve renting standardized plastic boxes managed by a third party (3PL), offering end-users access to a large, hygienic fleet without the high initial capital investment. This model converts CapEx to OpEx, ensures maintenance compliance, maximizes asset utilization, and simplifies logistics management, particularly for global or multi-site operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager