Plastic Packaging Sacks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438163 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Plastic Packaging Sacks Market Size

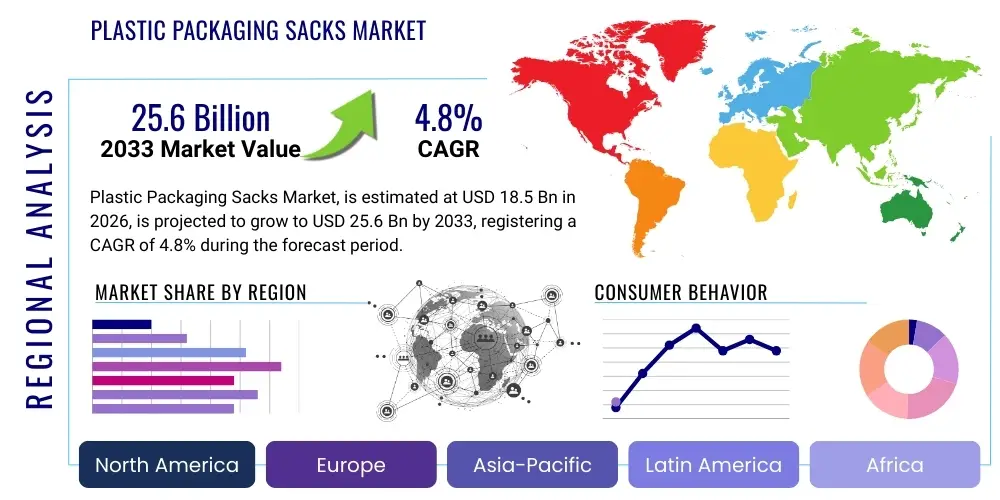

The Plastic Packaging Sacks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 25.6 Billion by the end of the forecast period in 2033.

Plastic Packaging Sacks Market introduction

The Plastic Packaging Sacks Market encompasses the production and distribution of various types of flexible containers made primarily from polymers such as polypropylene (PP), polyethylene (PE), and specialized co-extruded films. These sacks are essential for bulk packaging across numerous industrial and commercial sectors, offering superior strength-to-weight ratio, moisture resistance, and cost-effectiveness compared to traditional materials like jute or paper. Key product types include woven sacks, heavy-duty shipping sacks (HDSS), and flexible intermediate bulk containers (FIBCs), each tailored for specific product requirements concerning weight capacity and material compatibility.

Major applications of plastic packaging sacks span highly demanding industries, including construction (cement, aggregates), agriculture (fertilizers, seeds), food and beverage (grains, flour, sugar), and chemicals (polymers, powders). The primary benefit these sacks offer is enhanced product integrity and reduced logistical costs. They are lightweight, stackable, and highly durable, minimizing product loss during transit and storage, especially in harsh environmental conditions. Furthermore, advancements in printing technology allow these sacks to serve as effective branding tools, incorporating high-resolution graphics and critical product information.

Market growth is predominantly driven by the robust expansion of the global construction and agricultural sectors, particularly in developing economies, which necessitates efficient and high-volume packaging solutions for raw materials. Increased industrialization, coupled with continuous innovation in polymer science leading to more sustainable and recyclable plastic formulations, further fuels market demand. The shift from rigid packaging to flexible solutions due to economic benefits and improved logistical efficiencies also serves as a critical driving factor.

Plastic Packaging Sacks Market Executive Summary

The Plastic Packaging Sacks Market is characterized by steady growth, underpinned by fundamental demand from critical end-use sectors like construction, agriculture, and food processing. Business trends indicate a strong movement towards customization and specialization, with manufacturers increasingly investing in machinery capable of producing sacks with specific barrier properties, anti-slip coatings, and advanced ventilation features. There is a palpable shift towards automation in sack manufacturing to reduce operational costs and improve quality consistency. Furthermore, sustainability is becoming a non-negotiable business metric, pushing companies to integrate recycled content (PCR) into production and design sacks that are mono-material for easier recycling.

Regionally, Asia Pacific (APAC) continues to dominate the market, driven by rapid infrastructure development, intensive agricultural activities, and large population bases necessitating mass production and distribution of packaged goods. North America and Europe, while mature markets, exhibit strong demand for high-performance and premium sacks, particularly FIBCs for specialized chemical and pharmaceutical powders, often mandated by stringent regulatory standards emphasizing safety and traceability. The Middle East and Africa (MEA) region presents significant growth opportunities, particularly in industrial sectors and mineral extraction, driving demand for robust, heavy-duty solutions.

Segment trends reveal that the woven polypropylene (WPP) sack segment holds the largest market share due to its versatility and cost-efficiency in packaging bulk commodities like cement and grains. However, the heavy-duty shipping sacks (HDSS) segment is projected to exhibit the fastest growth, largely due to innovations in film technology that enhance puncture resistance and load bearing capabilities, catering to complex logistics requirements. In terms of end-use, the construction sector remains the primary consumer, but the food and beverage industry is rapidly increasing its uptake, driven by rising global demand for packaged staples and ingredients that require high levels of hygiene and protection from contaminants.

AI Impact Analysis on Plastic Packaging Sacks Market

Common user questions regarding AI's impact on the Plastic Packaging Sacks Market generally revolve around how Artificial Intelligence can enhance manufacturing efficiency, optimize supply chain logistics, and improve material quality control. Users are keen to understand if AI can predict equipment failures, automate complex packaging line adjustments, or identify defects invisible to the human eye. There is also significant interest in using AI algorithms to analyze consumer recycling patterns and material recovery rates, thereby optimizing the design of future plastic sacks for improved sustainability and circular economy implementation. Overall, key themes center on AI driving operational efficiency, precision manufacturing, and supporting sustainability goals through data-driven insights.

The integration of AI and machine learning (ML) is fundamentally changing traditional sack manufacturing processes. AI-powered predictive maintenance is reducing costly downtime by accurately forecasting when machinery components, such as extruders or weaving looms, are likely to fail, scheduling maintenance proactively rather than reactively. This shift increases overall equipment effectiveness (OEE) significantly. Furthermore, AI algorithms are being applied to optimize resin blending processes, ensuring material consistency and reducing scrap rates, which is crucial given the fluctuating prices and performance metrics of recycled and virgin polymers.

In the supply chain, AI is employed for advanced demand forecasting, enabling manufacturers to adjust production schedules precisely based on anticipated regional or seasonal spikes in demand from agricultural or construction clients. This capability minimizes excess inventory and storage costs while ensuring timely product availability. Beyond manufacturing, computer vision systems, an application of AI, are deployed on production lines for high-speed, accurate quality control, inspecting sack seals, printing alignment, and weave integrity, ensuring that every product meets stringent international standards for packaging durability and safety.

- AI-driven Predictive Maintenance: Reduces machine downtime and maintenance costs on extrusion and weaving equipment.

- Optimized Quality Control: Utilizes computer vision for high-speed detection of microscopic defects in material sealing and weaving patterns.

- Enhanced Supply Chain Efficiency: ML algorithms forecast demand variations, optimizing inventory management and logistics planning.

- Process Optimization: AI fine-tunes extruder temperatures and resin ratios, maximizing material tensile strength and minimizing energy consumption.

- Sustainable Design Acceleration: Data analytics identifies optimal mono-material structures for recyclability based on current waste stream capabilities.

DRO & Impact Forces Of Plastic Packaging Sacks Market

The Plastic Packaging Sacks Market is primarily driven by the expanding need for bulk material handling solutions in burgeoning global industries, offset by increasing regulatory pressure concerning plastic waste and sustainability mandates. Key drivers include rapid urbanization and infrastructure development worldwide, which necessitate vast quantities of bagged cement, minerals, and building materials. Opportunities lie heavily in the adoption of specialized, value-added sacks, such as breathable or anti-static versions, and in developing bio-based or fully closed-loop recyclable plastic formulations to address environmental concerns. Restraints, however, are substantial, centered on volatile raw material prices (polymers) and the widespread public and governmental backlash against single-use plastics, which forces expensive product redesigns.

Drivers for market expansion include the efficiency and cost-effectiveness inherent in flexible packaging. Plastic sacks are significantly lighter than their paper or woven counterparts (when factoring in required strength), leading to reduced transportation fuel costs and enhanced payload capacity per shipment. This economic advantage, coupled with the superior moisture barrier properties of plastics, particularly crucial for sensitive goods like fertilizers and specialty chemicals, ensures sustained preference among industrial users. Furthermore, technological advancements have enabled the production of sacks with higher burst strength using less material, aligning performance with resource efficiency.

Conversely, the market faces strong headwinds from environmental regulations. Numerous jurisdictions are imposing taxes or outright bans on certain types of plastic packaging, pushing manufacturers to rapidly transition to more sustainable, often costlier, alternatives. This regulatory uncertainty forces companies to commit substantial capital to research and development. Additionally, the fluctuating global price of crude oil directly impacts the cost of virgin polymers (e.g., polyethylene and polypropylene), creating margin volatility for sack producers who must compete aggressively on price in commodity markets.

- Drivers (D): Global infrastructure boom; high durability and moisture resistance; cost-effectiveness over rigid packaging; growth in organized retail and logistics.

- Restraints (R): Volatility in polymer raw material prices; stringent environmental regulations and plastic bans; negative public perception regarding plastic waste.

- Opportunities (O): Development of advanced barrier films; rising demand for FIBCs in non-traditional sectors; innovation in sustainable, biodegradable, and recycled content sacks; market penetration in emerging economies.

- Impact Forces: High supplier bargaining power due to concentrated polymer production; low consumer switching costs in basic sack segments; increasing threat of substitution from paper or bio-based alternatives; intense competitive rivalry based on pricing and capacity.

Segmentation Analysis

The Plastic Packaging Sacks Market is extensively segmented based on material, product type, capacity, and end-use industry, reflecting the diverse requirements of bulk material handling across the global economy. Understanding these segments is crucial for manufacturers to target specific niche markets, such as high-barrier sacks for specialty chemicals or ventilated sacks for agricultural produce. Segmentation by material often dictates the sack's performance metrics, with PP offering robust mechanical strength suitable for heavy materials and PE providing excellent sealing and moisture protection often required for food products.

In terms of product type, the market is broadly divided into Woven Plastic Sacks, which dominate the volume share due to their high load capacity and breathability (necessary for products like cement), and Film-based Sacks (like heavy-duty shipping sacks or valve sacks), which offer superior water protection and printing quality. The growing demand for larger, reusable packaging solutions has significantly bolstered the Flexible Intermediate Bulk Containers (FIBCs) segment, which caters to complex industrial logistics requiring ton-level packaging capacity.

The end-use industry segmentation provides the clearest insight into demand drivers. The construction sector commands the largest share, followed closely by agriculture (fertilizers, animal feed). However, the chemical and mineral industries are exhibiting high growth due to their specialized needs for safety, anti-static properties, and precise dosing mechanisms offered by advanced plastic sack designs. These segments demonstrate the continuous evolution of plastic packaging sacks from simple containers to highly engineered, specialized logistical components.

- By Material:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Others (e.g., specialty polymers)

- By Product Type:

- Woven Plastic Sacks (WPP Sacks)

- Heavy-Duty Shipping Sacks (HDSS)

- Flexible Intermediate Bulk Containers (FIBCs/Bulk Bags)

- Valve Sacks

- Gusseted Sacks

- By Capacity:

- Up to 25 kg

- 25 kg to 50 kg

- Above 50 kg (Excluding FIBCs)

- FIBC (500 kg to 2000 kg)

- By End-Use Industry:

- Construction (Cement, Dry Mortar, Aggregates)

- Agriculture and Allied Industries (Fertilizers, Seeds, Feed)

- Food & Beverage (Grains, Flour, Sugar, Salt)

- Chemical and Petrochemical (Polymers, Resins, Powders)

- Minerals and Mining

- Others (e.g., Retail, Pharmaceuticals)

Value Chain Analysis For Plastic Packaging Sacks Market

The Plastic Packaging Sacks value chain begins with upstream activities dominated by major petrochemical companies that supply the primary raw materials: polypropylene (PP) and polyethylene (PE) resins, which are derivatives of crude oil and natural gas. Price volatility in these raw materials significantly dictates the cost structure and profitability of the downstream sack manufacturers. Secondary upstream suppliers include additives providers (UV stabilizers, color masterbatches) and specialized machinery manufacturers (extruders, weaving looms, printing presses). Competition is intense among resin suppliers, influencing their bargaining power over sack producers.

The mid-stream encompasses the core manufacturing process, involving extrusion, weaving, lamination (for woven sacks), or film blowing and sealing (for heavy-duty sacks). Manufacturers in this stage focus heavily on process efficiency, quality control, and maximizing material yield. Direct distribution channels are often preferred for large industrial customers (e.g., major cement companies or large agricultural cooperatives), where sacks are delivered in bulk directly to the customer’s packaging line. This direct model allows for better customization and relationship management.

Downstream activities involve sales, distribution, and consumption. Indirect channels utilize packaging distributors and wholesalers who stock various sack types and capacities, serving smaller-to-medium enterprises (SMEs) across diverse sectors. End-users, spanning construction, agriculture, and food processing, are the ultimate consumers. The rising emphasis on reverse logistics and recycling infrastructure, driven by regulatory pressure, is becoming an integral part of the downstream value chain, requiring manufacturers to collaborate with waste management entities to close the material loop effectively.

Plastic Packaging Sacks Market Potential Customers

The primary customers for plastic packaging sacks are large-scale industrial consumers requiring robust and high-volume packaging solutions for raw materials and finished bulk goods. These end-users prioritize sack specifications related to material integrity, load-bearing capacity, moisture protection, and cost per unit. The largest consumer base resides within the heavy industrial sectors, where materials often need protection during long-distance transportation and outdoor storage, making the durability of plastic sacks indispensable.

The construction sector represents a cornerstone of demand, driven by cement manufacturers, dry mix mortar producers, and construction chemical suppliers who rely on Woven PP sacks for efficiency and strength. In the agricultural domain, large fertilizer producers, seed companies, and animal feed mills are key buyers, demanding sacks that offer UV protection, moisture barriers, and often require specialized ventilation to maintain product quality, especially during seasonal peak demands. These customers typically negotiate long-term supply contracts to ensure stable pricing and consistent material quality.

A growing segment of potential customers includes specialized chemical and pharmaceutical companies utilizing Flexible Intermediate Bulk Containers (FIBCs) for handling high-value or hazardous powders and granules. These customers have stringent requirements for contamination control, anti-static properties (Type C or D FIBCs), and compliance with international transport regulations. Furthermore, the food industry, encompassing large grain processors, sugar refineries, and industrial bakers, increasingly uses high-barrier plastic sacks to meet stringent hygiene standards and extend the shelf life of staple ingredients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 25.6 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mondi Group, Berry Global Inc., LC Packaging International BV, W&H, Al-Tawfiq Co., Knack Packaging, Uflex Ltd., B.G. Plastic Packaging, Greif Inc., Novolex, United Bags, Hussein Makarem & Sons Co., Elif Holding, Jokey Group, Sealed Air Corporation, Bischof + Klein, AEP Industries Inc., Daqing Packaging, Time Technoplast, Silgan Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Packaging Sacks Market Key Technology Landscape

The technological landscape of the Plastic Packaging Sacks market is rapidly evolving, driven primarily by the need for increased strength, weight reduction, and enhanced sustainability. Key technologies center on advanced extrusion and weaving processes. Multi-layer co-extrusion technology is vital for producing high-performance heavy-duty shipping sacks (HDSS). This technique allows manufacturers to combine different polymer layers (e.g., linear low-density polyethylene with high-density polyethylene) to achieve optimal performance characteristics, such as superior seal strength, excellent moisture barrier protection, and high puncture resistance, using minimal material thickness.

For woven polypropylene (WPP) sacks, the focus is on high-speed circular weaving technology. Modern weaving looms utilize sophisticated electronic control systems to ensure uniformity in the fabric structure, which is critical for maximizing load-bearing capability and minimizing material creep under sustained load. Another crucial technological advancement is lamination and coating processes, where thin polymer films are applied to the woven structure. This lamination provides the necessary moisture and dust barrier without compromising the sack's overall mechanical strength, making the sacks suitable for highly sensitive powders like cement or fine chemicals.

Furthermore, printing technology has seen significant evolution. High-definition flexographic and rotogravure printing allow manufacturers to apply complex, multi-color graphics directly onto the plastic sacks, turning them into effective marketing tools. This ability to deliver aesthetic quality alongside functional performance is increasingly important in competitive consumer-facing sectors like agriculture and pet food packaging. Finally, the development of specialized additives, such as anti-static agents, UV stabilizers, and slip-resistant coatings, ensures that sacks can perform reliably under extreme storage and transportation conditions, reducing risks associated with stacking and handling.

Regional Highlights

Regional dynamics are critical to the Plastic Packaging Sacks Market, reflecting varying levels of industrialization, infrastructure investment, and regional regulatory environments regarding plastic use.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily fueled by the massive scale of infrastructure projects in countries like China, India, and Southeast Asia. The region’s intense agricultural output and growing consumption base drive substantial demand for woven polypropylene and smaller capacity sacks for packaging staples like rice, flour, and fertilizer. Cost-effectiveness is a primary competitive factor here, though sustainability mandates are beginning to influence material choices, particularly in countries like Japan and South Korea.

- North America: This region is characterized by high demand for specialized and high-quality sacks, particularly FIBCs, driven by stringent safety regulations in the chemical and pharmaceutical industries. Automation in agriculture and advanced manufacturing processes create a strong market for high-performance, multilayer HDSS. The focus here is less on volume and more on features, traceability, and incorporating recycled content to meet brand sustainability pledges.

- Europe: The European market is highly mature and heavily regulated. Growth is relatively slower but driven entirely by innovation in sustainability. The emphasis is on closed-loop recycling, use of certified Post-Consumer Recycled (PCR) content, and the development of bio-based plastics. Countries like Germany and the Netherlands are leading the adoption of advanced, mono-material PE sacks designed for optimal recyclability, responding directly to EU directives concerning plastic waste reduction.

- Latin America: Economic growth and expanding construction sectors in Brazil and Mexico drive substantial demand. The market relies heavily on Woven PP sacks for bulk commodities. Challenges include logistics complexity and economic volatility, but the region presents significant potential for foreign investment in local manufacturing capacity to serve local infrastructure needs.

- Middle East and Africa (MEA): This region is experiencing high demand due to significant investments in mining, petrochemicals, and large-scale agricultural projects. The durability and climate resilience of plastic sacks are highly valued here, particularly in GCC nations and South Africa. Demand for FIBCs is strong, driven by the export of minerals, fertilizers, and polymers, requiring robust and specialized transport solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Packaging Sacks Market.- Mondi Group

- Berry Global Inc.

- LC Packaging International BV

- W&H

- Al-Tawfiq Co.

- Knack Packaging

- Uflex Ltd.

- B.G. Plastic Packaging

- Greif Inc.

- Novolex

- United Bags

- Hussein Makarem & Sons Co.

- Elif Holding

- Jokey Group

- Sealed Air Corporation

- Bischof + Klein

- AEP Industries Inc.

- Daqing Packaging

- Time Technoplast

- Silgan Holdings

- Smurfit Kappa

- Huhtamaki Oyj

- NNZ Group

Frequently Asked Questions

Analyze common user questions about the Plastic Packaging Sacks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for plastic packaging sacks?

The primary factor is the robust expansion of global construction and infrastructure sectors, particularly in emerging economies, creating immense demand for cost-effective, durable bulk packaging solutions for cement, aggregates, and building materials.

How is sustainability impacting the future material composition of packaging sacks?

Sustainability mandates are pushing manufacturers toward mono-material designs (like 100% recyclable PE sacks), increased integration of Post-Consumer Recycled (PCR) content, and development of bio-based or biodegradable polymers to comply with stricter global environmental regulations and brand requirements.

Which plastic packaging sack segment is projected to show the highest growth rate?

The Flexible Intermediate Bulk Containers (FIBCs) segment and Heavy-Duty Shipping Sacks (HDSS) are projected to show the highest growth, driven by increased international bulk trade, specialized logistical needs for chemicals and food ingredients, and large-capacity requirements.

What are the key technological advancements in plastic sack manufacturing?

Key technological advancements include multi-layer co-extrusion for enhanced barrier properties, high-speed circular weaving for improved mechanical strength, and the application of AI/ML for quality control and predictive maintenance on production lines.

What is the expected growth rate (CAGR) for the Plastic Packaging Sacks Market?

The Plastic Packaging Sacks Market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period from 2026 to 2033, reflecting consistent demand across industrial and agricultural applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager