Plastic Polymer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436377 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Plastic Polymer Market Size

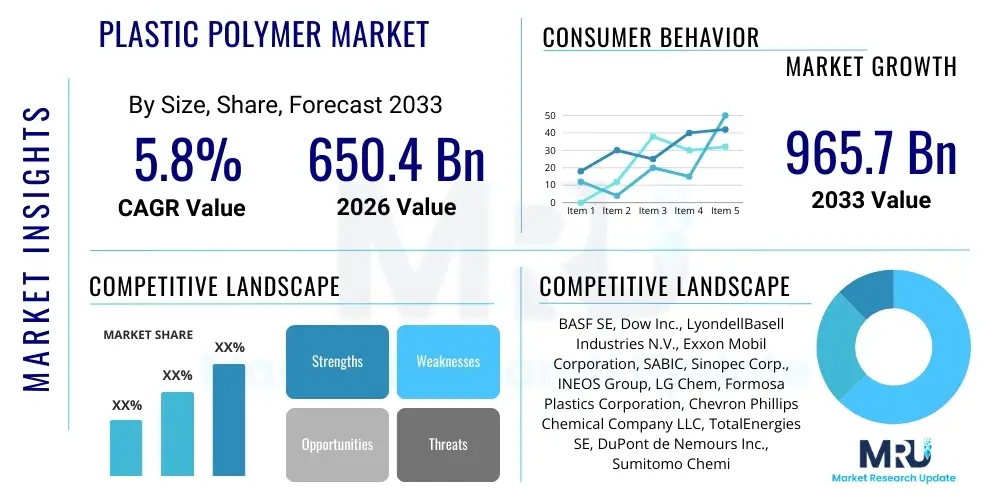

The Plastic Polymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 650.4 Billion in 2026 and is projected to reach USD 965.7 Billion by the end of the forecast period in 2033.

Plastic Polymer Market introduction

The Plastic Polymer Market encompasses the production, distribution, and consumption of synthetic or semi-synthetic organic compounds characterized by high molecular weight and consisting of repeating structural units, known as monomers. These materials, derived primarily from petrochemical feedstocks, exhibit unparalleled versatility in terms of mechanical strength, chemical resistance, thermal stability, and low density, making them indispensable across virtually all industrial sectors globally. Key products include high-volume commodity plastics such such as Polyethylene (PE), Polypropylene (PP), and Polyvinyl Chloride (PVC), alongside higher-performance engineering plastics like Polycarbonate (PC) and Acrylonitrile Butadiene Styrene (ABS), which cater to specialized, demanding applications in automotive and aerospace industries.

Major applications of plastic polymers span across packaging, which remains the single largest segment due to the necessity for product protection and preservation, and the building and construction industry, utilizing PVC for pipes and window profiles, and insulation materials. The automotive sector relies heavily on lightweight polymers to enhance fuel efficiency and reduce vehicle mass, while the electrical and electronics sector depends on polymers for insulation, casings, and component encapsulation. The increasing global population, coupled with rapid urbanization in emerging economies, fundamentally drives the persistent demand for plastic polymers, particularly in disposable consumer goods and crucial infrastructural developments, including water management systems and housing construction.

The primary benefits driving the market’s expansion include the superior cost-to-performance ratio compared to traditional materials like metals or glass, exceptional durability, and ease of manufacturing through various processes such as injection molding, blow molding, and extrusion. Furthermore, advancements in polymer chemistry are introducing sustainable and high-performance bioplastics and recycled polymers, addressing growing environmental concerns and regulatory pressures. Despite challenges related to end-of-life management and circular economy integration, plastic polymers remain foundational materials in modern industrial societies, with their demand closely tied to global macroeconomic indicators and technological innovation in material science.

Plastic Polymer Market Executive Summary

The Plastic Polymer Market is experiencing a pivotal shift driven by sustainability mandates and technological innovations focused on circularity and enhanced material performance. Business trends highlight significant investment in advanced recycling infrastructure, including chemical recycling technologies, aiming to mitigate the environmental impact of plastic waste and reduce reliance on virgin fossil fuel feedstocks. Mergers and acquisitions are common as major petrochemical players seek to consolidate their feedstock integration and diversify their portfolio towards high-value, specialty polymers and bioplastics, thereby optimizing supply chain resilience and capitalizing on premium market segments. Furthermore, the market structure is increasingly influenced by geopolitical stability and fluctuating crude oil prices, compelling manufacturers to focus on operational efficiency, lean manufacturing, and digitization across the entire value chain.

Regionally, the Asia Pacific (APAC) continues its dominance, fueled by robust manufacturing growth, rapid infrastructure expansion, and a burgeoning consumer base, particularly in China and India, making it the highest volume consumer globally. North America and Europe, while slower in terms of volume growth, are leading the transition towards sustainable plastics, driven by stringent regulatory frameworks such as the European Green Deal and consumer demand for eco-friendly packaging solutions. These developed regions are the primary innovators in specialty polymers and advanced composites, commanding higher average selling prices and focusing on sophisticated applications in electric vehicles, specialized healthcare equipment, and renewable energy technologies.

Segmentation trends indicate Polyethylene (PE) and Polypropylene (PP) retaining their supremacy as the largest volume segments, primarily due to their ubiquitous use in packaging and consumer goods, but Polyethylene Terephthalate (PET) is witnessing rapid growth spurred by its crucial role in beverage bottles and increasing adoption in fiber and film applications, often due to its recyclability profile. In terms of application, packaging maintains its lead, but the automotive and transportation segment is projected to exhibit the fastest growth, benefiting from the global pivot towards lightweight materials necessary for electric vehicle battery casings, interior components, and structural parts, enhancing efficiency and reducing carbon footprint across the transportation ecosystem.

AI Impact Analysis on Plastic Polymer Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Plastic Polymer Market primarily revolve around three core themes: operational efficiency and predictive maintenance in polymer production, acceleration of Research and Development (R&D) for novel material discovery, and optimization of waste management and recycling processes to achieve circular economy goals. Users frequently question how AI can improve complex polymerization reaction monitoring, predict equipment failure in high-pressure reactors, and enhance quality control systems to minimize batch deviations. Furthermore, there is significant interest in AI's role in screening potential sustainable polymer formulations and optimizing sorting processes in Material Recovery Facilities (MRFs), moving the industry toward data-driven, sustainable manufacturing and resource management practices.

AI's application in polymer manufacturing provides substantial gains in throughput, energy usage, and cost reduction. Machine learning algorithms analyze vast datasets generated by sensors throughout the plant—including temperature, pressure, and catalyst concentration—to fine-tune process parameters in real-time, achieving tighter quality specifications and higher yield rates than traditional control systems. Predictive analytics allows producers to forecast the remaining useful life of critical assets like extruders and injection molding machines, scheduling maintenance precisely before failure, thereby drastically reducing unplanned downtime which is costly in continuous chemical processing environments. This shift towards smart manufacturing integrates AI-powered vision systems for rapid defect detection and classification, ensuring high product integrity.

Beyond the plant floor, AI is transformative in material innovation and sustainability. AI-driven simulation tools significantly reduce the time and cost associated with synthesizing new polymer structures by predicting material properties based on molecular structure input, accelerating the discovery of novel bioplastics or high-performance composites. Crucially, in the recycling domain, AI-powered robotic sorters utilizing deep learning capabilities can accurately identify and separate different polymer types (including complex multilayer plastics) at high speeds, overcoming human limitations and increasing the purity of recycled feedstock, which is vital for reintroducing these materials into high-value applications and fundamentally supporting the realization of a robust global circular economy for plastics.

- AI optimizes polymerization process control, leading to improved yield and reduced energy consumption.

- Predictive maintenance driven by Machine Learning (ML) minimizes unplanned downtime for crucial production assets like reactors and extruders.

- AI accelerates R&D by simulating material properties and predicting the performance of novel polymer formulations and bioplastics.

- Deep Learning algorithms enhance quality control by identifying and classifying micro-defects in finished products faster than traditional methods.

- Robotic sorting powered by AI and computer vision significantly boosts the efficiency and purity of plastic recycling at Material Recovery Facilities (MRFs).

- Supply chain risk management is enhanced through AI forecasting models predicting fluctuations in feedstock prices and logistical bottlenecks.

- Smart factory integration uses AI to create digital twins of production lines for real-time monitoring and optimization across large-scale facilities.

DRO & Impact Forces Of Plastic Polymer Market

The Plastic Polymer Market is governed by a dynamic interplay of factors where persistent economic growth and technological advancement act as primary drivers, juxtaposed against increasingly stringent environmental regulations and volatility in raw material prices serving as key restraints. Opportunities are concentrated in the rapid development of specialized, high-performance, and sustainable polymer solutions tailored for rapidly expanding high-tech sectors, notably electric vehicles, advanced medical devices, and renewable energy infrastructure. These forces collectively dictate the strategic maneuvering of market players, determining investment priorities in capacity expansion versus innovation in sustainable alternatives.

Key drivers include the burgeoning demand for lightweight materials in automotive and aerospace sectors seeking fuel efficiency and reduced carbon emissions, alongside the expansion of the packaging industry driven by e-commerce proliferation and changing consumer lifestyles that favor convenience and ready-to-eat solutions. Furthermore, rapid global infrastructure development, particularly in Asia, necessitates vast quantities of PVC, PE, and composite materials for piping, insulation, and protective coatings. Conversely, significant restraints involve the fluctuating cost and availability of crude oil and natural gas, the primary feedstocks, which directly impact profit margins. Crucially, the intensifying global scrutiny on plastic waste and pollution, leading to single-use plastic bans, taxation (like plastic taxes), and mandates for recycled content, represents a profound challenge requiring extensive industrial restructuring.

The principal opportunity lies in the transition toward a circular economy model, where advanced chemical and mechanical recycling technologies become standard, transforming plastic waste into valuable resources. This enables companies to meet regulatory compliance and satisfy growing consumer demand for sustainable products, thereby opening new, high-margin revenue streams. Impact forces, such as shifts in consumer preference towards sustainable branding and the powerful influence of regulatory bodies like the EU Commission and national environment agencies, exert immense pressure on the industry. The collective impact forces push companies not only toward operational excellence but also toward adopting comprehensive ESG (Environmental, Social, and Governance) strategies as a prerequisite for sustained market relevance and investor confidence.

Segmentation Analysis

The Plastic Polymer Market segmentation provides a granular view of diverse product types, applications, and end-use industries, essential for understanding specific market dynamics and growth pockets. The segmentation highlights the intrinsic differences in demand drivers, manufacturing complexities, and regulatory landscapes across various polymer families. Commodity plastics (PE, PP, PVC) dominate the volume metric due to their low cost and versatility in high-volume applications like packaging and construction, forming the backbone of global demand. Conversely, engineering and specialty plastics command higher prices and are characterized by stringent performance requirements in specialized, smaller-volume applications such as medical and aerospace components.

Analysis by application clearly illustrates the market's dependence on the packaging industry, but also points to the accelerated shift toward technical and durable goods sectors. The growth rate of segments such as automotive components (driven by lightweighting mandates) and electrical and electronics (owing to the continuous miniaturization and increased complexity of devices) often surpasses that of more mature packaging segments. Furthermore, the segmentation by end-use industry helps track major procurement trends; for instance, the healthcare sector exhibits stable, high-value demand for certified, medical-grade polymers, insulated against typical economic volatility, whereas demand from the construction industry is highly sensitive to capital expenditure cycles and government infrastructure spending.

Understanding these segments allows market participants to tailor their product offerings, R&D investments, and geographical expansion strategies. For example, producers focusing on high-density polyethylene (HDPE) will target utility and piping applications, while those specializing in PEEK or PTFE (high-performance polymers) will concentrate on niche, high-margin aerospace and medical implant markets. The growing focus on sustainability necessitates further segmentation refinement, tracking the market penetration rates of recycled polymers, bioplastics, and bio-based polymers within each traditional segment, offering crucial data for circular economy transition planning.

- By Type:

- Polyethylene (PE) (LDPE, LLDPE, HDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Engineering Plastics (PC, ABS, Nylon, PEEK)

- Others (Thermoplastic Elastomers, Fluoropolymers)

- By Application:

- Packaging (Rigid and Flexible)

- Automotive & Transportation (Interior, Exterior, Under-the-Hood Components)

- Building & Construction (Pipes, Fittings, Insulation, Window Profiles)

- Electrical & Electronics (Casings, Wires & Cables, Connectors)

- Consumer Goods & Household

- Medical Devices & Healthcare

- Textile & Apparel

- Others (Agriculture, Industrial Machinery)

- By End-Use Industry:

- FMCG (Fast-Moving Consumer Goods)

- Infrastructure & Construction

- Healthcare & Pharmaceutical

- Automotive & Transportation

- Energy & Power

- Aerospace & Defense

Value Chain Analysis For Plastic Polymer Market

The Plastic Polymer Market value chain is highly integrated and capital-intensive, starting with the upstream sourcing of raw materials, primarily crude oil and natural gas, which are refined into monomers such as ethylene, propylene, and benzene. Upstream analysis focuses on the petrochemical industry, where stability of feedstock supply, global oil price volatility, and geopolitical factors significantly influence the cost structure of monomers. Major integrated petrochemical companies often benefit from competitive advantages by controlling both oil refining and monomer production, ensuring supply reliability and optimizing production costs, which is critical given that raw materials account for a substantial portion of the final polymer price.

Midstream activities involve the actual polymerization process, where monomers are transformed into various plastic resins (polymers) through complex chemical reactions. This stage is characterized by high operational complexity, stringent quality control requirements, and massive scale to achieve economies of scale. Producers here must constantly innovate in catalyst technology and process efficiency to differentiate their products, especially in high-performance or specialty polymer grades. The resulting polymer resins are then processed into different forms (pellets, powders, flakes) and prepared for distribution to downstream converters.

Downstream analysis centers on processors and converters, which utilize various molding and extrusion techniques to manufacture final or semi-finished plastic products, such as packaging films, automotive parts, and construction pipes. The distribution channel is multifaceted, relying on direct sales to large, integrated converters, or indirect distribution through specialized distributors and traders, particularly for smaller purchasers or specialty resins requiring regional stockholding and technical support. The entire chain is currently undergoing transformation due to the necessity of incorporating recycled content, demanding tighter integration between waste management infrastructure (the reverse logistics chain) and traditional manufacturing facilities, influencing both direct material sourcing and indirect sustainability compliance costs.

Plastic Polymer Market Potential Customers

Potential customers, or end-users, of plastic polymers are extraordinarily diverse, spanning nearly every manufacturing and services sector globally due to the material’s foundational role in modern product design and execution. The largest procurement groups include major Fast-Moving Consumer Goods (FMCG) companies, which require enormous volumes of flexible and rigid packaging made from PE, PP, and PET to protect, preserve, and market their products. Additionally, global automotive manufacturers and their Tier 1 suppliers represent critical buyers, demanding high-performance, lightweight materials (e.g., engineering plastics and composites) for reducing vehicle weight and improving safety standards in both internal combustion engine and electric vehicles.

The construction and infrastructure sectors constitute another major customer base, relying on bulk quantities of PVC for pipes, window frames, and siding, and insulation materials like polyurethane foam. These purchasers are driven by large infrastructure projects and housing development cycles. Furthermore, the burgeoning healthcare industry offers high-value demand, requiring specialized, sterile, and biocompatible polymers (often PC, PP, or specific grades of PE) for single-use medical devices, diagnostic equipment, and pharmaceutical packaging, where regulatory compliance and material purity are paramount purchase criteria.

Other vital potential customer segments include the electronics industry, utilizing polymers for device casings, circuit boards, and connectors where flame retardancy and dielectric properties are crucial; the textile industry, which uses synthetic polymers like polyester and nylon; and the agriculture sector, which consumes films and piping. Customer decisions are increasingly influenced not just by price and performance, but also by the supplier's commitment to providing sustainable, certified, and traceable recycled or bio-based polymer options to meet their own corporate sustainability goals and consumer expectations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.4 Billion |

| Market Forecast in 2033 | USD 965.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Inc., LyondellBasell Industries N.V., Exxon Mobil Corporation, SABIC, Sinopec Corp., INEOS Group, LG Chem, Formosa Plastics Corporation, Chevron Phillips Chemical Company LLC, TotalEnergies SE, DuPont de Nemours Inc., Sumitomo Chemical Co. Ltd., Mitsubishi Chemical Corporation, Borealis AG, Reliance Industries Limited, PTT Global Chemical Public Company Limited, Covestro AG, Arkema S.A., Eastman Chemical Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Polymer Market Key Technology Landscape

The technological landscape of the Plastic Polymer Market is rapidly evolving, driven by the dual pressures of optimizing manufacturing efficiency and achieving environmental sustainability. Core production technologies remain centered on advanced polymerization techniques, including Ziegler-Natta and metallocene catalysts, which allow for precise control over polymer architecture, resulting in materials with tailored properties such as improved clarity, strength, or processability. Significant investments are directed towards developing highly efficient continuous polymerization processes to reduce energy consumption and operational footprint, maximizing throughput while minimizing off-spec production and utility costs, ensuring competitive pricing for commodity polymers globally.

A major focus of innovation is the development and commercialization of advanced recycling technologies, specifically chemical recycling, which represents a paradigm shift from traditional mechanical recycling. Chemical recycling processes, such as pyrolysis, gasification, and depolymerization, break down post-consumer plastic waste (including mixed and multilayer plastics previously considered non-recyclable) back into their original monomer or petrochemical feedstocks. This allows for the production of "circular polymers" that are chemically indistinguishable from virgin plastics, enabling the industry to address difficult-to-recycle waste streams and meet the rising demand for high-quality recycled content, particularly in food-contact applications where purity is non-negotiable.

Furthermore, technology advancements include the accelerated development of bio-based and biodegradable polymers, moving beyond traditional bioplastics like PLA (Polylactic Acid) to explore high-performance alternatives derived from non-food biomass sources. Digitalization, integrating technologies such as the Industrial Internet of Things (IIoT), Artificial Intelligence (AI), and advanced process control (APC), is becoming standard for creating smart manufacturing environments. These tools enable real-time monitoring, predictive modeling of material properties, and highly automated production lines, ensuring optimal resource utilization and positioning the industry for high-flexibility, localized production models.

Regional Highlights

The global Plastic Polymer Market exhibits distinct regional dynamics shaped by varying levels of industrialization, regulatory environments, feedstock availability, and consumer preferences regarding sustainability. Each region plays a unique role in the global supply and demand matrix, influencing investment decisions and trade flows across continents. Understanding these regional specificities is essential for companies aiming to establish robust supply chains and maximize market penetration in key consumption hubs.

Asia Pacific (APAC): APAC is undeniably the powerhouse of the global plastic polymer market, characterized by the highest consumption volume and fastest growth rate, fueled by robust manufacturing sectors in China, India, and Southeast Asian nations. This region benefits from lower production costs, extensive availability of skilled labor, and massive infrastructure development projects requiring large volumes of commodity polymers like PE, PP, and PVC. The demand here is primarily volume-driven, although increasing environmental pressures are forcing regulatory bodies to introduce recycled content mandates, prompting shifts towards sustainable polymer adoption, particularly in export-oriented industries and urban centers.

North America: North America, particularly the U.S., benefits significantly from the availability of low-cost natural gas and shale gas resources, serving as cost-competitive feedstocks for ethane and propane production. This economic advantage supports substantial capacity expansion, particularly in Polyethylene (PE) and Polypropylene (PP) production. The region is characterized by high demand for specialty and engineering plastics in its mature automotive, aerospace, and advanced medical sectors. Furthermore, North America is a leader in adopting advanced recycling technologies and developing high-performance, lightweight composites to meet stringent industry standards.

Europe: Europe is the global frontrunner in the movement towards plastic circularity and stringent environmental governance. Driven by the European Green Deal and specific directives like the Single-Use Plastics Directive, the region imposes high demand for recycled, bio-based, and biodegradable polymers. While feedstock costs are generally higher than in North America or the Middle East, Europe maintains high innovative capacity, focusing on high-value, niche polymer markets and chemical recycling commercialization. Companies in this region must prioritize ESG compliance and demonstrate clear pathways toward achieving mandated recycled content targets to remain competitive.

Latin America (LATAM): LATAM presents significant growth potential, although market stability is often challenged by economic and political volatility in major economies like Brazil and Mexico. Demand is concentrated in the packaging, automotive, and construction sectors. Investment in polymer production often lags behind consumption, leading to reliance on imports. However, local initiatives are focusing on improving waste management infrastructure and promoting sustainable packaging solutions to address localized environmental concerns.

Middle East and Africa (MEA): The Middle East is a critical global supplier, leveraging vast crude oil and natural gas reserves to produce cost-competitive feedstocks, making it a major exporter of commodity polymers to Asia and Europe. Companies in the region, particularly in Saudi Arabia and the UAE, are highly integrated and operate world-scale facilities, focusing on export efficiency and maximizing production scale. The African sub-region, while small in overall consumption, represents an emerging market with future demand potential driven by urbanization and improved standards of living, particularly for commodity plastics.

- Asia Pacific: Largest market size and fastest growth; center of high-volume commodity plastic production and consumption, driven by manufacturing and construction.

- North America: Strong feedstock advantage due to shale gas; high demand for specialty polymers in automotive and healthcare; a key area for advanced recycling investment.

- Europe: Leading region for circular economy mandates and stringent environmental regulations; high focus on R&D for bio-based and chemical recycling solutions; high-value niche market.

- Middle East: Major global export hub due to competitive feedstock pricing from extensive oil and gas reserves; highly integrated production facilities.

- Latin America: Emerging market characterized by volatile economic conditions; growing demand across packaging and construction sectors.

- Africa: Low consumption base but high potential growth driven by urbanization and infrastructure needs in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Polymer Market.- BASF SE

- Dow Inc.

- LyondellBasell Industries N.V.

- Exxon Mobil Corporation

- SABIC

- Sinopec Corp.

- INEOS Group

- LG Chem

- Formosa Plastics Corporation

- Chevron Phillips Chemical Company LLC

- TotalEnergies SE

- DuPont de Nemours Inc.

- Sumitomo Chemical Co. Ltd.

- Mitsubishi Chemical Corporation

- Borealis AG

- Reliance Industries Limited

- PTT Global Chemical Public Company Limited

- Covestro AG

- Arkema S.A.

- Eastman Chemical Company

Frequently Asked Questions

Analyze common user questions about the Plastic Polymer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the Plastic Polymer Market growth?

The foremost driver is the increasing global demand for lightweight materials in the automotive and aerospace industries to meet stringent fuel efficiency and emission standards, coupled with sustained growth in the packaging sector driven by e-commerce expansion and urbanization.

How is environmental regulation impacting the future trajectory of plastic polymers?

Environmental regulations, particularly single-use plastic bans and mandates for incorporating recycled content (e.g., in the EU and North America), are forcing significant technological shifts towards chemical recycling and the development of sustainable, bio-based, and biodegradable polymer alternatives.

Which type of plastic polymer holds the largest market share globally?

Polyethylene (PE), including its various densities (HDPE, LDPE, LLDPE), consistently holds the largest market share due to its wide range of applications, primarily in flexible and rigid packaging, films, and piping systems globally.

What role does Artificial Intelligence (AI) play in polymer manufacturing?

AI is crucial for enhancing operational efficiency through predictive maintenance, optimizing complex chemical processes in real-time to maximize yield, and accelerating material discovery for novel high-performance and sustainable polymer formulations.

Which geographical region is projected to exhibit the fastest growth in plastic polymer consumption?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by substantial industrial expansion, rapid urbanization, high infrastructural spending, and a growing consumer base in major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager