Plastic Sorting Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440336 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Plastic Sorting Machine Market Size

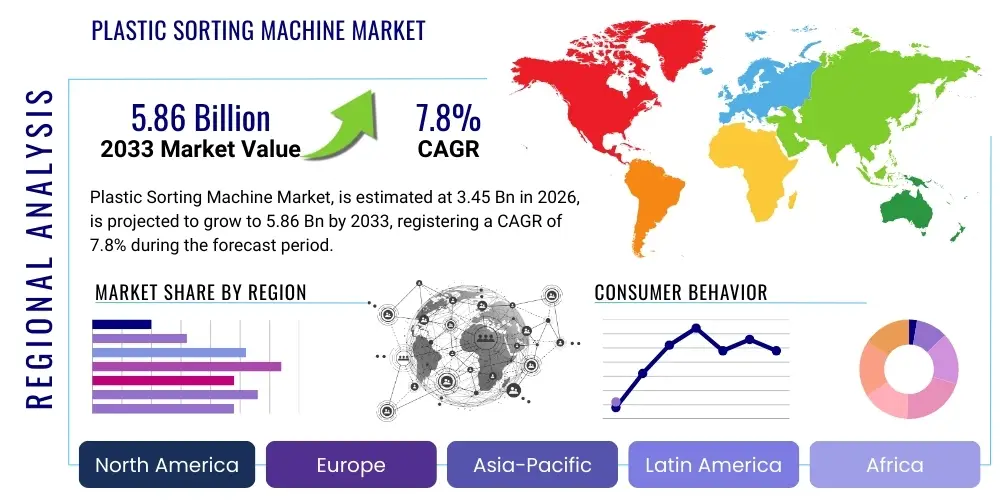

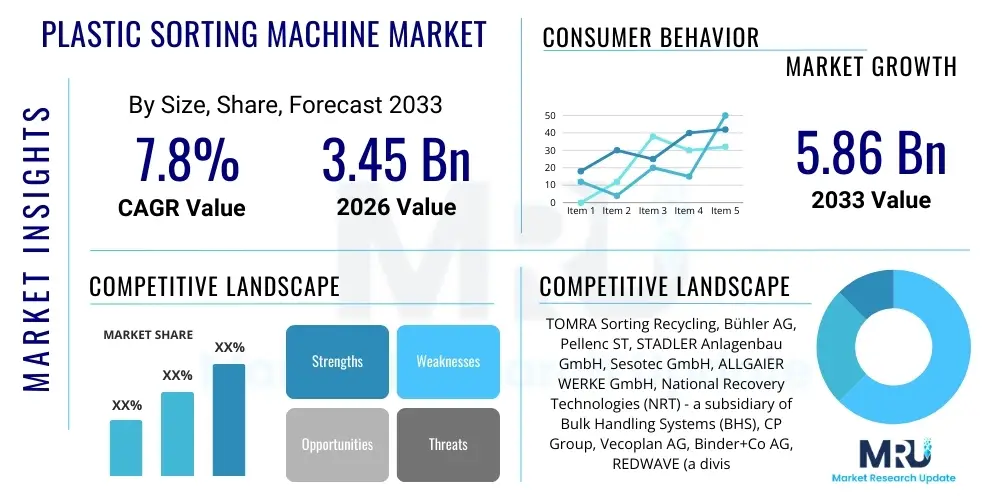

The Plastic Sorting Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.45 billion in 2026 and is projected to reach USD 5.86 billion by the end of the forecast period in 2033.

Plastic Sorting Machine Market introduction

The plastic sorting machine market is an increasingly vital component of the global circular economy, driven by escalating environmental concerns, stringent regulatory frameworks, and a growing emphasis on sustainable waste management practices. These advanced machines are designed to automatically identify and separate various types of plastic waste based on their material composition, color, and size, significantly enhancing the efficiency and purity of recycled plastic streams. Their deployment is critical for transforming heterogeneous plastic waste into valuable secondary raw materials, thereby reducing landfill reliance and minimizing the ecological footprint of plastic consumption.

Plastic sorting machines leverage a sophisticated array of technologies, including near-infrared (NIR) spectroscopy, X-ray transmission (XRT), visual cameras, and hyperspectral imaging, to achieve precise separation. NIR technology, for instance, identifies plastic types based on their unique molecular absorption spectra, while XRT can detect material density differences to separate plastics from other contaminants or distinguish between different plastic types. The integration of artificial intelligence and machine learning further refines their capabilities, allowing for improved accuracy, adaptability to diverse waste streams, and real-time operational optimization. These machines are robust, engineered for continuous operation in demanding environments, ensuring high throughput and consistent performance in large-scale recycling operations.

Major applications for plastic sorting machines span across material recovery facilities (MRFs), dedicated plastic recycling plants, and industrial waste management systems. They are instrumental in processing mixed municipal solid waste, commercial and industrial waste, and even agricultural plastics. The primary benefits derived from their use include significantly improved purity of sorted plastics, which commands higher market prices for recyclates, reduced labor costs due to automation, increased operational efficiency, and a substantial decrease in environmental pollution. The market's growth is predominantly fueled by global legislative mandates pushing for higher recycling rates, corporate sustainability initiatives, brand owner commitments to using recycled content, and continuous technological advancements making sorting solutions more accessible and effective.

Plastic Sorting Machine Market Executive Summary

The plastic sorting machine market is experiencing robust growth, primarily driven by the global imperative to transition towards a circular economy and mitigate plastic pollution. Key business trends indicate a strong move towards enhanced automation, the pervasive integration of artificial intelligence and machine learning for superior sorting accuracy and efficiency, and the development of modular, scalable sorting solutions that can be adapted to various operational sizes and waste stream complexities. Manufacturers are focusing on developing machines capable of handling increasingly complex and mixed plastic waste, including flexible packaging and multi-layer plastics, which traditionally pose significant challenges to conventional sorting technologies. Furthermore, there is a rising demand for integrated sorting lines that offer end-to-end solutions, from pre-sorting to final material preparation, enhancing overall recycling plant productivity and material purity.

Regional trends highlight distinct dynamics across major geographies. Europe stands as a frontrunner, characterized by stringent environmental regulations, ambitious recycling targets, and substantial government investments in recycling infrastructure, leading to high adoption rates of advanced sorting technologies. The Asia-Pacific region, driven by rapid industrialization, burgeoning populations, and increasing awareness of waste management, represents a significant growth market, with countries like China, India, and Southeast Asian nations investing heavily in modern recycling facilities. North America is also witnessing considerable investment in upgrading existing infrastructure and implementing new technologies, spurred by increasing consumer demand for sustainable products and corporate pledges to reduce virgin plastic consumption. Latin America and the Middle East & Africa regions are emerging markets, with growing environmental consciousness and infrastructure development initiatives paving the way for future market expansion, albeit at a slower pace due to nascent regulatory frameworks and capital constraints.

Segmentation trends reveal that sensor-based sorting, particularly near-infrared (NIR) and X-ray transmission (XRT) technologies, continues to dominate the market due to their proven effectiveness and versatility in identifying various plastic polymers and contaminants. The demand for sorting machines catering to specific polymer types, such as PET, HDPE, and PP, remains consistently high, reflecting their widespread use and established recycling value chains. However, there is an increasing focus on developing solutions for less commonly recycled plastics and mixed plastic streams to maximize resource recovery. The market is also seeing a shift towards higher capacity machines to meet the growing volume of plastic waste, while smaller, more flexible units are gaining traction for niche applications and decentralized recycling efforts, indicating a diverse range of market needs being addressed by technological advancements and strategic product development.

AI Impact Analysis on Plastic Sorting Machine Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into plastic sorting machines is revolutionizing the industry, addressing long-standing challenges related to efficiency, accuracy, and the identification of complex plastic waste streams. Users are keenly interested in understanding how AI can significantly improve sorting accuracy for increasingly diverse and contaminated waste, reduce operational costs through automation and predictive maintenance, and enable the processing of previously unrecyclable materials. Common questions revolve around the scalability of AI solutions, their ability to adapt to new plastic types or mixed materials, the potential for real-time data analysis to optimize performance, and the economic viability of upgrading existing machinery with AI capabilities. These queries highlight a clear expectation for AI to deliver smarter, more adaptable, and ultimately more cost-effective sorting solutions that contribute to a truly circular economy.

The core themes emerging from user inquiries underscore a desire for AI to not only automate but also intellectualize the sorting process. Users seek assurances regarding AI's capability to differentiate between plastics with similar spectral properties, identify smaller plastic fragments, and handle a higher throughput without compromising precision. There's also significant interest in AI's role in quality control, ensuring that sorted plastics meet stringent purity standards required by reprocessors, which directly impacts the market value of recycled materials. Furthermore, the potential for AI-driven systems to provide valuable insights into waste composition and recycling trends is highly anticipated, offering data that can inform policy-making, resource allocation, and future investment strategies within the recycling sector, thereby moving beyond simple sorting to comprehensive waste intelligence.

Expectations for AI's influence include a transformative shift towards "smart" recycling facilities where machines learn and improve over time, adapting to regional waste variations and fluctuating material characteristics without constant manual recalibration. This advanced adaptability is crucial for handling the evolving landscape of plastic packaging, which increasingly features multi-layer, multi-material, and bio-based plastics. Users also anticipate that AI will facilitate better resource allocation by predicting equipment maintenance needs, thereby minimizing downtime and extending the operational lifespan of expensive machinery. Ultimately, the market expects AI to be a game-changer, pushing the boundaries of what is possible in plastic recycling, making it more robust, efficient, and economically sustainable while simultaneously addressing pressing environmental concerns.

- Enhanced sorting accuracy for complex and mixed plastic waste streams.

- Real-time material identification and differentiation, including flexible and multi-layer plastics.

- Optimized machine performance through predictive analytics and autonomous learning algorithms.

- Reduced operational costs by minimizing manual intervention and improving throughput.

- Adaptability to new plastic materials and packaging innovations without extensive re-calibration.

- Improved quality control, ensuring higher purity rates for recycled plastic flakes and pellets.

- Valuable data generation for waste composition analysis and operational efficiency insights.

- Facilitation of autonomous decision-making for sorting mechanisms, leading to increased efficiency.

DRO & Impact Forces Of Plastic Sorting Machine Market

The Plastic Sorting Machine Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating global focus on environmental sustainability and circular economy principles, leading to stringent governmental regulations and ambitious recycling targets worldwide. This regulatory push, combined with increasing public awareness of plastic pollution, compels industries and municipalities to invest in advanced sorting technologies to improve recycling rates and reduce landfill waste. Furthermore, the growing demand from brand owners and manufacturers for high-quality recycled plastics (rPET, rHDPE, rPP) to meet corporate sustainability goals and consumer preferences is creating a robust market for purified plastic streams, directly fueling the adoption of efficient sorting solutions. Technological advancements, particularly in sensor technology and AI integration, are also key drivers, making sorting machines more accurate, efficient, and capable of handling diverse and complex waste streams, thereby expanding their applicability and economic viability.

However, the market also faces notable restraints that can impede its growth trajectory. The high initial capital investment required for purchasing and installing sophisticated plastic sorting machines presents a significant barrier, especially for smaller recycling facilities or developing economies with limited access to financing. The operational complexities involved in managing highly heterogeneous and contaminated plastic waste streams can challenge machine efficiency and increase maintenance costs, impacting the overall return on investment. Furthermore, a lack of standardized waste collection and sorting infrastructure in many regions globally, coupled with inconsistencies in plastic material types and packaging designs, complicates the sorting process and necessitates adaptable, often more expensive, solutions. The fluctuating market prices for virgin plastics can also intermittently reduce the economic incentive to invest in recycling infrastructure, as recycled plastics sometimes struggle to compete on cost, particularly during periods of low oil prices.

Despite these challenges, substantial opportunities exist for market expansion and innovation. Emerging economies, particularly in Asia-Pacific and Latin America, present vast untapped markets with rapidly developing waste management sectors and increasing environmental awareness, offering significant growth potential for sorting machine manufacturers. Continuous research and development into advanced sensor technologies, such as hyperspectral imaging and robotic sorting, promise to unlock new levels of precision and efficiency, enabling the recovery of previously unrecyclable plastic fractions. The integration of IoT and cloud-based analytics offers opportunities for enhanced predictive maintenance, remote diagnostics, and real-time operational optimization, improving machine uptime and performance. Moreover, the increasing adoption of chemical recycling methods, which often require highly purified plastic feedstock, creates a new, high-value demand segment for advanced sorting solutions capable of delivering exceptional material purity, positioning these machines at the forefront of future recycling paradigms.

Segmentation Analysis

The Plastic Sorting Machine Market is comprehensively segmented across various dimensions, providing a granular understanding of its structure, dynamics, and growth drivers. This segmentation allows for precise market analysis, enabling stakeholders to identify specific growth areas, competitive landscapes, and strategic opportunities. The primary classifications include segmentation by technology, which reflects the core operational principles of these machines; by polymer type, addressing the specific plastic materials they are designed to process; by capacity, categorizing machines based on their processing volume; and by end-use application, highlighting the diverse environments in which these machines are deployed. Each segment reveals unique market characteristics, growth rates, and technological preferences, contributing to a nuanced view of the overall market landscape.

- By Technology

- Near-Infrared (NIR) Spectroscopy

- X-ray Transmission (XRT)

- Visual (Camera-based) Recognition Systems

- Hyperspectral Imaging

- Metal Detection

- Robotic Sorting Systems

- Sensor-based (Combined Technologies)

- By Polymer Type

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Low-Density Polyethylene (LDPE)

- Mixed Plastics

- Other Plastics (e.g., ABS, PC)

- By Capacity

- Small-Scale (e.g., less than 5 tons/hour)

- Medium-Scale (e.g., 5-15 tons/hour)

- Large-Scale (e.g., greater than 15 tons/hour)

- By End-Use Application

- Material Recovery Facilities (MRFs)

- Dedicated Plastic Recycling Plants

- Industrial Waste Generators

- Waste Management Companies

- E-Waste Recycling Facilities

- Consumer Waste Sorting Facilities

Value Chain Analysis For Plastic Sorting Machine Market

The value chain for the plastic sorting machine market begins with upstream activities involving the research, development, and manufacturing of critical components and raw materials. This includes specialized sensor technologies such as NIR sensors, X-ray tubes, high-resolution cameras, and hyperspectral imaging modules, which are often sourced from specialized electronics and optics manufacturers. Software development, particularly for AI/ML algorithms and control systems, also forms a significant upstream component, provided by dedicated software firms or in-house R&D teams. Fabrication of mechanical parts, such as conveyor belts, air ejectors, and structural steel, by material suppliers and component manufacturers, is also crucial. These upstream suppliers ensure the availability of high-quality, precise components that are essential for the performance and durability of the sorting machines. Their innovation cycles and cost structures directly influence the final product's capabilities and pricing.

Midstream activities primarily encompass the core manufacturing, assembly, and testing of the plastic sorting machines. Leading market players design, engineer, and integrate the various components—sensors, control systems, mechanical frameworks, and software—into fully functional sorting units. This stage involves complex engineering processes, quality control, and rigorous testing to ensure machines meet specified performance benchmarks, sorting accuracy, and throughput capacities. Customization for specific client needs, such as adapting machines for particular waste stream compositions or facility layouts, often takes place at this stage. Effective supply chain management is critical here to ensure timely procurement of components, efficient production, and cost-effective manufacturing processes, which directly impact the competitiveness and delivery timelines of the final product.

Downstream activities involve the distribution, installation, commissioning, and aftermarket support for plastic sorting machines. Distribution channels are typically a mix of direct sales to large-scale recycling operations and governmental bodies, and indirect sales through a network of regional distributors, system integrators, and value-added resellers. These partners often provide localized sales, technical expertise, and support services. Post-sales support, including training, maintenance services, spare parts supply, and software upgrades, is a critical component of the downstream value chain, ensuring optimal machine performance and customer satisfaction throughout the machine's lifecycle. Strong service networks enhance customer loyalty and provide recurring revenue streams for manufacturers. The efficient functioning of these distribution and service networks is paramount for widespread market penetration and sustained operational reliability of sorting machines in diverse global environments.

Plastic Sorting Machine Market Potential Customers

The primary potential customers and end-users of plastic sorting machines are diverse, encompassing various sectors within the waste management and recycling industry, as well as industrial operations with significant plastic waste streams. Material Recovery Facilities (MRFs) represent a cornerstone of demand, as they process large volumes of mixed municipal solid waste and require sophisticated sorting technologies to efficiently separate plastics from other recyclables and contaminants. Dedicated plastic recycling plants, which specialize in processing specific types of plastics into flakes or pellets for reuse, are also key buyers, seeking machines that can deliver high purity levels to meet stringent reprocessing requirements. Their operational scale and need for precision make them ideal candidates for advanced, high-capacity sorting solutions, crucial for transforming plastic waste into valuable secondary raw materials for a circular economy.

Beyond traditional recycling facilities, industrial plastic waste generators constitute another significant customer segment. This includes manufacturing facilities in sectors such as automotive, packaging, electronics, and consumer goods, which generate substantial volumes of plastic scrap and off-cuts during production processes. These industries increasingly implement in-house recycling solutions to recover valuable materials, reduce waste disposal costs, and adhere to corporate sustainability mandates. For them, plastic sorting machines offer an efficient way to separate different types of plastic scrap, often allowing for direct reuse or sale to specialized recyclers, thereby closing the loop within their own operations and enhancing resource efficiency. This trend is amplified by the growing pressure for Extended Producer Responsibility (EPR) schemes, driving manufacturers to take greater ownership of their products' end-of-life management.

Furthermore, waste management companies that handle collection, transfer, and preliminary processing of waste streams, as well as government municipalities responsible for public waste infrastructure, are important potential customers. These entities invest in sorting machines to improve the efficiency of their waste management systems, meet environmental compliance standards, and potentially generate revenue from the sale of sorted recyclable materials. Emerging markets and developing regions are also becoming increasingly vital as they seek to modernize their waste management practices, driven by urbanization and growing waste volumes. The need for efficient, scalable, and adaptable sorting solutions in these areas presents substantial opportunities for manufacturers. The varied operational scales and specific material recovery goals of these customer groups necessitate a broad portfolio of plastic sorting machine offerings, from compact, flexible units to large-scale, high-throughput systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.45 Billion |

| Market Forecast in 2033 | USD 5.86 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TOMRA Sorting Recycling, Bühler AG, Pellenc ST, STADLER Anlagenbau GmbH, Sesotec GmbH, ALLGAIER WERKE GmbH, National Recovery Technologies (NRT) - a subsidiary of Bulk Handling Systems (BHS), CP Group, Vecoplan AG, Binder+Co AG, REDWAVE (a division of BT-Wolfgang Binder GmbH), Satake Corporation, Green Machine, MSS Inc., Daewon GSI Co. Ltd., Steinert GmbH, Remondis SE & Co. KG, ANDRITZ AG, Hitachi Zosen Inova AG, FIMIC Srl |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Sorting Machine Market Key Technology Landscape

The plastic sorting machine market is characterized by a dynamic and evolving technological landscape, driven by the continuous need for higher accuracy, efficiency, and adaptability to increasingly complex waste streams. At the forefront are sensor-based sorting technologies, with Near-Infrared (NIR) Spectroscopy being a widely adopted and highly effective method. NIR sensors emit infrared light onto plastic materials and analyze the reflected light to identify specific polymer types based on their unique molecular absorption characteristics. This technology is excellent for separating common plastics like PET, HDPE, PP, and PS, making it foundational for most modern recycling facilities. Its widespread adoption is due to its proven reliability, speed, and ability to differentiate between various plastic types, contributing significantly to the purity of sorted materials essential for high-quality recycling processes and enabling the shift towards a circular economy by maximizing resource recovery.

Complementing NIR, X-ray Transmission (XRT) technology offers another critical dimension to plastic sorting. XRT machines use X-ray beams to penetrate materials, measuring their atomic density to distinguish between different substances. This is particularly effective for separating plastics from inert materials like glass, ceramics, and metals, as well as for identifying certain plastic types that NIR might struggle with, such as PVC, which contains chlorine and has a higher density. The combination of NIR and XRT technologies in integrated sorting lines provides a comprehensive solution for cleaning mixed plastic streams and achieving exceptional material purity. Furthermore, visual recognition systems, employing high-resolution cameras and advanced image processing software, are used for color sorting, shape detection, and identifying other visual attributes that might not be detectable by spectral analysis, adding another layer of sorting precision and flexibility to the overall system.

The advent of Hyperspectral Imaging (HSI) and the rise of Robotic Sorting Systems are further enhancing the technological capabilities of the market. HSI combines visual imaging with spectroscopy, capturing a much broader spectrum of light to identify materials with greater specificity than traditional NIR, making it ideal for differentiating between similar plastic types or for identifying new, less common polymers. Robotic sorting systems, powered by advanced AI and machine learning algorithms, are transforming manual sorting tasks by offering unparalleled speed, accuracy, and endurance. These robots can pick and place specific items from a moving conveyor belt at very high rates, making them particularly effective for handling small, diverse, or hazardous waste fragments. The continuous evolution of these technologies, coupled with increasing integration of IoT for data analytics and predictive maintenance, ensures that plastic sorting machines remain at the cutting edge of waste management, continually improving efficiency, reducing operational costs, and supporting the global drive for sustainability.

Regional Highlights

The global Plastic Sorting Machine Market exhibits significant regional variations in adoption rates, technological maturity, and market drivers, largely influenced by varying regulatory frameworks, waste management infrastructures, and economic development levels. Europe stands as a leading market, characterized by its stringent environmental regulations, ambitious recycling targets set by the European Union, and well-established waste management and recycling infrastructure. Countries like Germany, France, and the Netherlands are at the forefront of adopting advanced sorting technologies, driven by a strong commitment to circular economy principles and significant investments in modern recycling facilities. The region's emphasis on high-quality recyclates and its proactive approach to banning certain single-use plastics further fuel the demand for sophisticated plastic sorting solutions, making it a benchmark for technological innovation and market growth.

Asia-Pacific is emerging as the fastest-growing market for plastic sorting machines, propelled by rapid urbanization, industrialization, and an escalating volume of plastic waste. Countries such as China, India, Japan, and South Korea are investing heavily in improving their recycling infrastructure and implementing more effective waste management policies. The region's vast population and burgeoning consumer markets generate immense amounts of plastic waste, creating an urgent need for efficient sorting solutions. While initial adoption may have been driven by basic sorting needs, there is a growing trend towards incorporating advanced sensor-based and AI-driven technologies to meet rising quality standards for recycled plastics and to address increasing environmental concerns, reflecting a significant shift towards more sustainable practices and substantial market opportunities.

North America represents another robust market, primarily driven by increasing awareness of plastic pollution, growing consumer demand for sustainable products, and corporate sustainability pledges from major brands to incorporate recycled content. Both the United States and Canada are witnessing significant investments in upgrading existing Material Recovery Facilities (MRFs) and building new state-of-the-art recycling plants, thereby increasing the demand for advanced plastic sorting machines. Regulatory pressures at state and provincial levels, coupled with private sector initiatives, are stimulating innovation and adoption. Latin America and the Middle East & Africa (MEA) regions are also experiencing nascent growth, with developing waste management infrastructures and increasing environmental consciousness providing long-term market potential. While these regions currently have lower adoption rates, rising investments in urban infrastructure and sustainable development projects are expected to drive future demand for plastic sorting technologies.

- Europe: Dominant market due to strict regulations, high recycling targets, and advanced infrastructure in countries like Germany, France, and the Nordic nations.

- Asia-Pacific (APAC): Fastest-growing market driven by rapid urbanization, increasing plastic waste volumes, and growing investments in recycling infrastructure, particularly in China, India, and Southeast Asia.

- North America: Significant market with increasing investments in MRF upgrades, corporate sustainability commitments, and rising consumer demand for recycled content in the U.S. and Canada.

- Latin America: Emerging market with developing waste management systems and increasing environmental awareness, showing potential for future growth as infrastructure improves.

- Middle East & Africa (MEA): Developing market with nascent recycling infrastructure, but growing government initiatives and investments in sustainable waste management are paving the way for future market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Sorting Machine Market.- TOMRA Sorting Recycling (a division of TOMRA Systems ASA)

- Bühler AG

- Pellenc ST

- STADLER Anlagenbau GmbH

- Sesotec GmbH

- ALLGAIER WERKE GmbH

- National Recovery Technologies (NRT) - a subsidiary of Bulk Handling Systems (BHS)

- CP Group

- Vecoplan AG

- Binder+Co AG

- REDWAVE (a division of BT-Wolfgang Binder GmbH)

- Satake Corporation

- Green Machine (a division of Green Machine & Co.)

- MSS Inc. (a division of CP Group)

- Daewon GSI Co. Ltd.

- Steinert GmbH

- Remondis SE & Co. KG (through its recycling technology ventures)

- ANDRITZ AG

- Hitachi Zosen Inova AG

- FIMIC Srl

Frequently Asked Questions

What is a plastic sorting machine and why is it important?

A plastic sorting machine is an automated system that identifies and separates different types of plastic waste based on properties like material composition, color, and size using advanced sensors (e.g., NIR, X-ray) and software. It is crucial for improving the purity and efficiency of plastic recycling, reducing landfill waste, and enabling the production of high-quality recycled materials for the circular economy.

How does AI enhance the performance of plastic sorting machines?

AI significantly enhances plastic sorting machines by providing superior accuracy in material identification, even for complex or mixed plastic streams. It enables real-time adaptation to diverse waste inputs, optimizes machine operation for higher throughput, and supports predictive maintenance to minimize downtime. AI-driven robots can perform high-speed, precise sorting tasks, drastically improving overall efficiency and purity.

What are the main types of technologies used in plastic sorting machines?

The main technologies include Near-Infrared (NIR) Spectroscopy for identifying polymer types, X-ray Transmission (XRT) for density-based separation and contaminant removal, Visual (camera-based) Recognition for color and shape sorting, Hyperspectral Imaging for advanced material differentiation, and Robotic Sorting Systems powered by AI for automated material handling and picking.

Which industries or facilities are the primary users of plastic sorting machines?

Primary users include Material Recovery Facilities (MRFs), dedicated plastic recycling plants, and industrial waste generators (e.g., plastic manufacturers, automotive, electronics industries). Waste management companies and municipalities also invest in these machines to enhance their overall waste processing and recovery capabilities, aiming for improved resource efficiency and environmental compliance.

What are the key drivers for the growth of the plastic sorting machine market?

Key drivers include increasingly stringent environmental regulations and recycling targets worldwide, growing demand for high-quality recycled plastics by brand owners, advancements in sensor and AI technologies leading to more efficient sorting, and the global imperative to reduce plastic pollution and transition towards a circular economy. These factors collectively push for greater investment in advanced sorting infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Plastic Sorting Machine Market Statistics 2025 Analysis By Application (PVC Recycling, PET Recycling, HDPE Recycling, Other), By Type (Plastic Bottle Sorting Equipment, Plastic Flake Sorting Equipment), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- NIR Plastic Sorting Machine Market Statistics 2025 Analysis By Application (Plastic Flakes/Particles, Pretreatment Plastics), By Type (Chute-Type, Belt-Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager