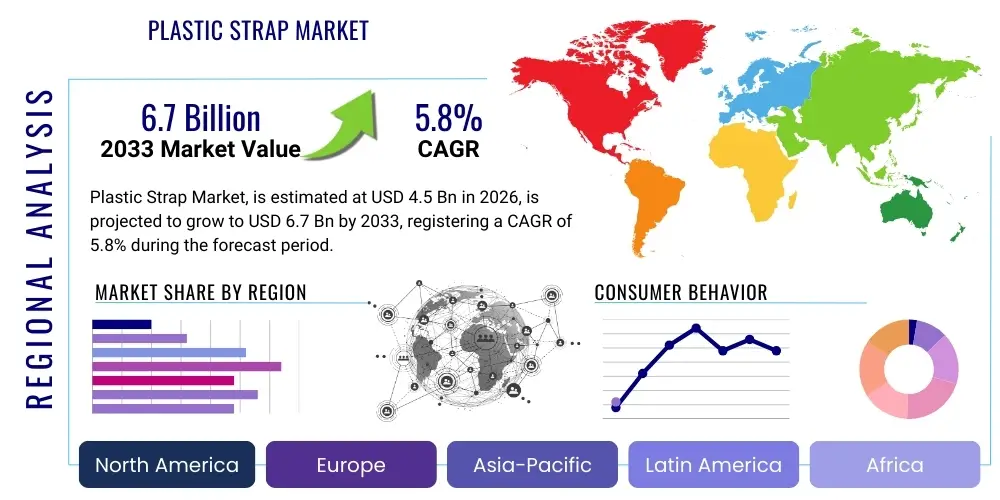

Plastic Strap Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437948 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Plastic Strap Market Size

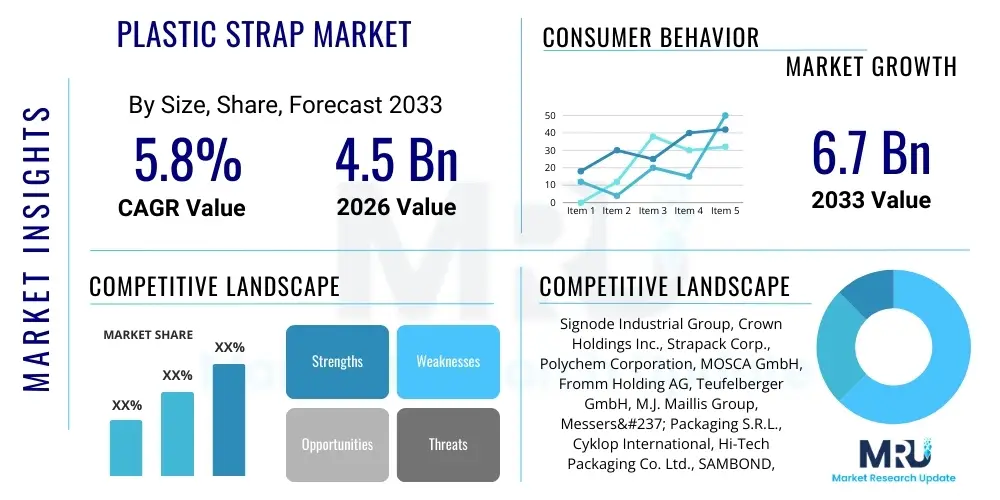

The Plastic Strap Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Plastic Strap Market introduction

The Plastic Strap Market encompasses the manufacturing and distribution of flexible packaging materials, primarily made from polypropylene (PP) and polyethylene terephthalate (PET), designed for bundling, palletizing, securing, and unitizing heavy or unstable loads during storage and transportation. These straps, also known as banding, are critical components in the logistics and warehousing sectors, ensuring product integrity and safety across various supply chains. The market's foundational product, the plastic strap, provides superior elasticity, strength-to-weight ratio, and weather resistance compared to traditional steel banding, leading to its widespread adoption, particularly in applications where corrosion is a concern or where safer handling characteristics are required.

Major applications driving market demand include the securing of corrugated boxes, lumber, agricultural products, textiles, and building materials. The transition towards e-commerce and globalized logistics networks necessitates efficient and secure packaging solutions, bolstering the demand for high-performance plastic strapping systems. Furthermore, the inherent benefits of plastic straps, such as lower cost, easy recyclability, lighter weight, and reduced damage risk to packaged goods and handling equipment, position them favorably against alternative materials, contributing significantly to their increased market penetration across emerging and developed economies.

The core driving factors underpinning market expansion include the continuous proliferation of the global packaging industry, driven by burgeoning consumer goods production and international trade flows. Regulatory changes promoting sustainable packaging practices are accelerating the shift toward recycled PET (RPET) straps, which align with corporate environmental mandates. Moreover, technological advancements in automated strapping machines, which increase the speed and precision of packaging processes, are further integrating plastic strapping solutions into high-volume manufacturing and distribution environments, ensuring sustained growth throughout the forecast period.

Plastic Strap Market Executive Summary

The Plastic Strap Market is characterized by a strong emphasis on material science innovation, focusing on developing higher tenacity and thinner gauge straps, primarily utilizing PET and PP, to reduce material usage while maintaining load security. Key business trends show a significant push towards automation, with manufacturers investing heavily in fully automatic and semi-automatic strapping machines that integrate seamlessly into modern production lines, addressing labor efficiency challenges and high-volume demands in sectors like food and beverage and construction. The competitive landscape is moderately fragmented, featuring global leaders offering integrated strapping systems alongside regional players specializing in specific material types or end-use applications, with merger and acquisition activities focused on vertical integration and technological capability expansion.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid industrialization, massive infrastructure development, and the expansion of domestic and export-oriented manufacturing bases, particularly in China and India. North America and Europe, while mature markets, are experiencing growth driven by stringent sustainability regulations and high demand for recycled content strapping (RPET), necessitating product portfolio shifts towards eco-friendly alternatives. Operational trends across all regions highlight the critical role of logistics and warehousing expansion, where plastic strapping is indispensable for stable pallet loads, thereby directly correlating market performance with global trade volumes.

Segment trends reveal that the PET segment is poised for the fastest growth due to its superior strength, making it a viable alternative to steel strapping in heavy-duty applications, complemented by strong recyclability credentials. The application segment growth is dominated by palletizing and unitizing, critical functions for ensuring stable shipments in complex logistics environments. Furthermore, the end-use segment shows robust demand from the Industrial Goods and Logistics sectors, reflecting global manufacturing output and the continuous pressure on supply chain stakeholders to enhance operational efficiency and reduce product damage during transit.

AI Impact Analysis on Plastic Strap Market

User queries regarding the impact of Artificial Intelligence on the Plastic Strap Market frequently revolve around three core themes: optimization of the strapping process, predictive maintenance for packaging machinery, and supply chain efficiency improvements facilitated by data analytics. Users are keen to understand if AI can reduce material waste through intelligent tensioning systems and whether machine learning algorithms can predict equipment failure in high-speed strapping heads, thus maximizing uptime. Furthermore, inquiries focus on how AI-driven demand forecasting and inventory management systems might influence the production volumes and distribution patterns of plastic straps, moving away from reactive stock management towards proactive supply chain planning. The overarching expectation is that AI will not fundamentally change the strap material itself but rather revolutionize the surrounding ecosystem—manufacturing, application, and logistics integration—making the use of plastic straps more efficient, sustainable, and cost-effective.

- AI-Powered Process Optimization: Implementing machine learning models to dynamically adjust strapping tension based on load characteristics (weight, dimensions, material compressibility), significantly reducing strap breakage and material waste.

- Predictive Maintenance: Utilization of AI algorithms to analyze sensor data from automatic strapping machines (e.g., motor strain, cycle time consistency, heat seal quality) to predict component failure, increasing operational uptime and reducing costly emergency repairs.

- Demand Forecasting and Inventory Management: Integration of AI tools with logistics data to accurately predict regional and seasonal demand fluctuations for specific strap types (PET vs. PP), optimizing production schedules and raw material procurement.

- Quality Control Enhancement: Deployment of computer vision systems integrated with AI to instantaneously verify strap alignment, seal integrity, and overall load stability, ensuring compliance with shipping standards before dispatch.

- Automated Supply Chain Integration: Using AI to optimize the routing and distribution of bulk strap orders from production facilities to end-user warehouses, minimizing transportation costs and carbon footprint.

DRO & Impact Forces Of Plastic Strap Market

The Plastic Strap Market is primarily driven by the relentless expansion of global trade and the pervasive need for secure packaging across diverse industries, notably logistics, construction, and consumer goods manufacturing. However, this growth trajectory is tempered by significant restraints, particularly volatility in petrochemical raw material prices (affecting PP and PET resin costs) and the persistent threat of substitution from alternative materials, specifically steel strapping in extremely heavy-duty applications. Opportunities abound in sustainability, with growing consumer and regulatory pressure creating a strong demand pull for high-quality recycled plastic straps (RPET), opening new avenues for innovation in material recovery and strap manufacturing technologies. These dynamic forces collectively shape the market's direction, pushing stakeholders towards efficiency, material specialization, and compliance with environmental standards.

Drivers include the rapid growth of the e-commerce sector globally, necessitating robust and high-speed packaging operations to handle increased parcel volume and diverse product sizes. Furthermore, the inherent safety advantage of plastic strapping—being lighter, easier to handle, and less likely to cause injuries compared to steel banding—makes it the preferred choice in automated environments. The development of advanced co-extrusion technologies allows for the production of straps with enhanced tensile strength and elasticity, effectively broadening the scope of applications where plastic straps can successfully replace metal alternatives, contributing significantly to market volume expansion and revenue generation across key geographies.

Restraints are centred around the perception of plastic waste and the stringent regulations targeting single-use plastics, although plastic strapping is categorized as durable packaging material often designed for high recyclability. The competition from advanced adhesive tapes and stretch films in light-to-medium packaging applications also poses a localized threat to market share. The primary impact force influencing the market structure is the sustainability imperative, which mandates material innovation and drives investment in recycling infrastructure, shifting the focus from simple cost reduction to total environmental lifecycle management for strapping products, ensuring long-term viability against competing material solutions.

Segmentation Analysis

The Plastic Strap Market segmentation provides a critical view of the diverse material preferences, application requirements, and end-user demands shaping the industry. The market is primarily segmented by material type, application, and end-use industry, reflecting the specific performance characteristics required for different packaging needs. Polypropylene (PP) straps typically cater to light to medium-duty applications due to their cost-effectiveness and good tension retention, whereas Polyethylene Terephthalate (PET) straps are utilized for heavy-duty applications requiring high breaking strength and elongation recovery, often challenging traditional steel banding. Understanding these segment dynamics is crucial for manufacturers to tailor product offerings and optimize distribution strategies to align with localized industrial demands.

- Material Type

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Nylon

- Others (Rayon, Composite, etc.)

- Application

- Bundling

- Baling

- Palletizing & Unitizing

- Tying & Reinforcement

- End-Use Industry

- Food & Beverage

- Industrial Goods & Machinery

- Logistics & Warehousing

- Construction & Building Materials

- Printing & Paper

- Textiles & Garments

- Agriculture

- Strap Type

- Machine Grade Strapping

- Hand Grade Strapping

Value Chain Analysis For Plastic Strap Market

The value chain for the Plastic Strap Market begins with the upstream procurement of petrochemical raw materials, primarily PP and PET resins, which are highly sensitive to crude oil price fluctuations and supply chain stability within the chemical industry. Manufacturers often integrate backward by securing long-term contracts with resin suppliers or investing in specialized recycling facilities to ensure a stable supply of recycled PET (RPET) flake, mitigating dependency on virgin polymers and addressing sustainability goals. The manufacturing stage involves complex extrusion and co-extrusion processes, where polymer resins are melted, extruded into filaments, stretched to achieve the required tensile strength and elongation characteristics, and then wound onto coils. Efficiency and quality control at this stage are paramount, particularly concerning strap uniformity and consistent strength specifications for automated machine use.

The midstream involves the conversion of plastic straps into finished products, often including embossing, printing, and coating, followed by quality assurance testing. The downstream component focuses heavily on distribution channels. Due to the bulk nature of straps and the need for accompanying machinery, sales often rely on specialized industrial distributors who provide technical support, machine installation, and maintenance services. This distribution network is bifurcated into direct sales to large, integrated end-users (e.g., global logistics firms, major industrial manufacturers) and indirect sales through local packaging material wholesalers serving small and medium enterprises (SMEs). This dual approach ensures broad market penetration and comprehensive service coverage across different consumer scales.

Direct distribution channels are preferred for high-volume, automated machine-grade strapping sales where technical consultancy and system integration are critical. Indirect channels, utilizing packaging distributors and re-sellers, manage the regional sales of hand-grade and semi-automatic machine strapping, offering convenience and localized inventory management for smaller businesses. The efficiency of the distribution system, combined with the continuous development of sophisticated strapping equipment, ultimately determines the value captured by stakeholders throughout the supply chain, reinforcing the crucial link between material supply, manufacturing quality, and localized technical support for end-users.

Plastic Strap Market Potential Customers

Potential customers for the Plastic Strap Market are primarily industrial entities requiring high-volume, secure unitization of goods for storage and transit across global supply chains. The largest group comprises third-party logistics (3PL) providers and warehousing operators who handle diverse product types, from raw materials to finished consumer packaged goods, making plastic strapping essential for pallet stability and safe mechanical handling. These customers prioritize machine compatibility, strap consistency, and competitive total cost of ownership, heavily favoring high-tensile PET and reliable PP machine-grade straps to maintain uninterrupted high-speed operations.

A significant segment of end-users originates from the manufacturing sector, including producers of industrial machinery, automotive components, construction materials (e.g., bricks, lumber, tiles), and fabricated metal products. For these heavy-duty applications, the strength and security offered by PET strapping, often replacing traditional steel banding due to its resilience and safer handling characteristics, are critical purchasing determinants. These buyers require specific strap widths, thicknesses, and high breaking strength customized to the weight and potential sharp edges of their manufactured items, demanding customized technical specifications from suppliers.

Furthermore, the food and beverage industry represents a rapidly growing customer base, driven by the necessity of bundling large volumes of packaged goods (bottles, cans, cartons) on pallets for cold storage and refrigerated transit. This segment demands hygienic, food-safe strapping materials and systems capable of operating efficiently in high-humidity or temperature-controlled environments. Other prominent buyers include the paper and printing industries, which require straps for bundling large stacks of paper or corrugated cardboard, where tight tension is needed without damaging product edges, leading to steady demand for specialized PP strapping.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Strapack Corporation, FROMM Packaging Systems, Teufelberger Holding AG, M.J. Maillis Group, Mosca GmbH, Crown Holdings Inc., Dupont Teijin Films, Polychem Corporation, Dynaric, Inc., Samuel Strapping Systems, Linyi Kaisa Industry, Signode Industrial Group, TransPak Inc., Sperr & Lechner GmbH, Endutex, North American Strapping, H.B. Fuller Company, Sealed Air Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Strap Market Key Technology Landscape

The technological landscape of the Plastic Strap Market is centered on enhancing material performance, improving recycling processes, and automating application methods. A significant advancement is the shift towards high-tenacity PET strapping through advanced co-extrusion and orientation technologies. These processes allow manufacturers to control the molecular structure and crystallinity of the polymer, resulting in straps that offer extremely high breaking strength comparable to steel, but with the added benefits of elongation recovery and safety. This material innovation is critical for penetrating heavy-duty industrial sectors previously dominated by metallic banding. Furthermore, the development of recycled PET (RPET) manufacturing processes focuses on efficient filtering and processing of post-consumer waste to maintain stringent quality specifications necessary for high-speed machine applications, driving sustainability in the supply chain.

On the equipment front, the market is characterized by rapid integration of automation. Fully automatic strapping machines are becoming standard in large-scale logistics and manufacturing operations, featuring proprietary technologies for reliable heat sealing, precise tension control, and minimal cycle times. Key technological differentiators among equipment manufacturers include modular machine designs that facilitate easier maintenance, advanced sensor systems for precise strap alignment, and proprietary sealing head mechanisms that ensure joint integrity even under fluctuating environmental conditions. The increasing adoption of the Internet of Things (IoT) in these machines allows for real-time monitoring of performance metrics and integration into plant-wide Enterprise Resource Planning (ERP) systems, optimizing overall packaging line efficiency.

Another emerging technology involves smart strapping solutions. While still nascent, these systems incorporate RFID tags or bar codes embedded within the strap or applied during the strapping process. This technology enables enhanced traceability of palletized goods throughout the logistics network, facilitating automated inventory checks and verification of load integrity upon arrival. This digital layer adds significant value, especially in pharmaceutical and high-value industrial sectors where chain of custody and load tampering detection are paramount. Continued R&D focuses on creating thinner, lighter straps that maintain strength (down-gauging) to reduce material consumption, aligning economic goals with environmental responsibility.

Regional Highlights

The Plastic Strap Market exhibits distinct growth patterns influenced by industrial activity, logistics infrastructure maturity, and regulatory environments across major geographical regions. Asia Pacific (APAC) leads the global market in terms of volume and growth potential, driven primarily by the colossal manufacturing output in China, India, Japan, and Southeast Asian nations. Rapid urbanization and massive infrastructure projects, coupled with the expansion of international trade hubs, create an insatiable demand for strapping solutions to secure construction materials, manufactured goods, and export containers. The growth in the APAC region is supported by relatively lower operational costs and a burgeoning domestic consumption market, accelerating the adoption of both PP and PET straps in high-volume packaging applications.

North America and Europe represent mature, high-value markets where innovation and sustainability are the primary growth catalysts. In these regions, market penetration is driven less by volume expansion and more by the transition from traditional steel strapping to high-performance PET strapping, along with a strong preference for recycled content materials. Strict environmental policies, such as the European Union’s push for circular economy initiatives, mandate higher recycled content, stimulating significant investment in RPET production capacity and technology. Furthermore, the sophisticated logistics and e-commerce infrastructure in these regions demands highly automated strapping machinery, translating to premium revenue generation for specialized equipment and high-consistency machine-grade straps.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions demonstrating steady, albeit moderate, growth. LATAM's market expansion is tied to the growth of its agricultural exports, food processing industry, and infrastructure investments, requiring resilient packaging solutions for long-haul transportation. The MEA region's growth is predominantly linked to construction booms and the rapid development of oil & gas related logistics hubs, particularly in the Gulf Cooperation Council (GCC) countries. These regions often rely on a mix of domestic production and imported premium strapping products, with demand being highly sensitive to regional commodity price fluctuations and large-scale industrial project timelines.

- Asia Pacific (APAC): Dominates the market due to robust manufacturing and export activity (especially electronics, automotive, textiles). High adoption rate of automated systems in China and India.

- North America: Strong focus on high-strength PET strapping to replace steel. Market growth fueled by highly efficient e-commerce logistics and a priority on workplace safety over steel banding.

- Europe: Driven by stringent sustainability regulations necessitating high adoption of Recycled PET (RPET) straps. Mature market with high demand for premium machine-grade strapping and automated equipment.

- Latin America (LATAM): Growth linked to agricultural exports and increasing industrialization, demanding reliable strapping for shipping raw and processed materials over long distances.

- Middle East and Africa (MEA): Market expansion concentrated in construction, infrastructure, and warehousing supporting energy sector logistics. Growth is project-driven and characterized by increasing automation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Strap Market.- Strapack Corporation

- FROMM Packaging Systems

- Teufelberger Holding AG

- M.J. Maillis Group

- Mosca GmbH

- Crown Holdings Inc.

- Dupont Teijin Films

- Polychem Corporation

- Dynaric, Inc.

- Samuel Strapping Systems

- Linyi Kaisa Industry

- Signode Industrial Group (A division of Crown Holdings)

- TransPak Inc.

- Sperr & Lechner GmbH

- Endutex

- North American Strapping

- H.B. Fuller Company

- Sealed Air Corporation

Frequently Asked Questions

Analyze common user questions about the Plastic Strap market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between PET and PP strapping?

PET (Polyethylene Terephthalate) strapping offers significantly higher tensile strength and maintains tension over longer periods, making it ideal for heavy-duty applications where it can replace steel. PP (Polypropylene) strapping is more economical, has greater elongation, and is commonly used for light to medium-duty bundling and sealing tasks.

How is the Plastic Strap Market addressing sustainability concerns?

The market is prioritizing the production and adoption of Recycled PET (RPET) strapping, which utilizes post-consumer waste, aligning with global circular economy goals. Manufacturers are also focusing on down-gauging straps—reducing material use while maintaining strength—and developing highly recyclable mono-material solutions.

Which industry segment drives the highest demand for plastic straps?

The Logistics & Warehousing segment, followed closely by the Industrial Goods and Construction sectors, drives the highest demand. This is due to the critical necessity of unitizing, palletizing, and securing diverse loads for efficient storage, internal movement, and long-distance transport within complex global supply chains.

What role does automation play in the future of the Plastic Strap Market?

Automation is crucial, driving the adoption of high-speed, fully automatic strapping machines that integrate with modern packaging lines. This shift improves operational efficiency, reduces labor costs, ensures consistent strap tension, and minimizes potential errors, particularly in high-volume distribution centers.

Is plastic strapping a viable alternative to steel strapping for heavy loads?

Yes, modern high-tenacity PET strapping is increasingly viable for many heavy-load applications previously reserved for steel. PET offers comparable break strength, superior shock absorption, and enhanced safety characteristics (no sharp edges, lighter weight) while being resistant to rust and weathering.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager