Plastics Sterile Medical Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435736 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Plastics Sterile Medical Packaging Market Size

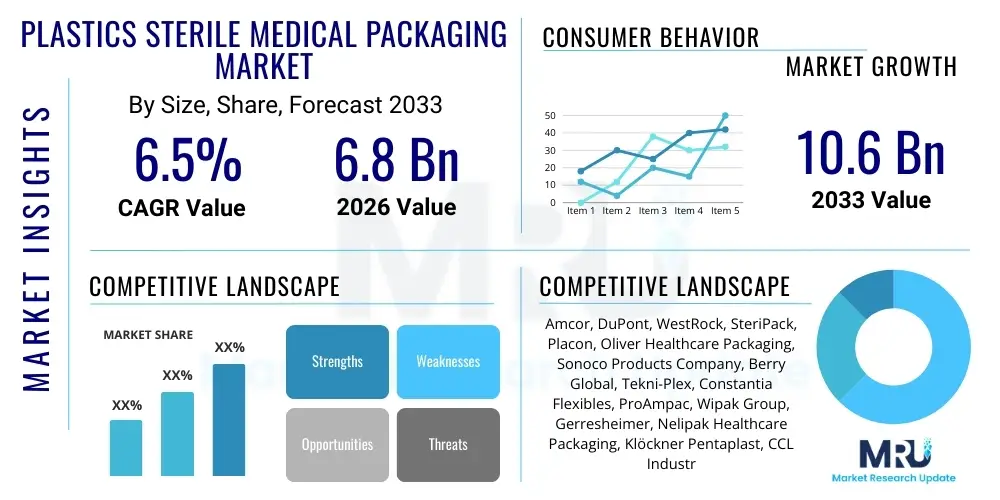

The Plastics Sterile Medical Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 10.6 Billion by the end of the forecast period in 2033.

Plastics Sterile Medical Packaging Market introduction

The Plastics Sterile Medical Packaging Market encompasses materials and systems specifically designed to maintain the sterility of medical devices, pharmaceuticals, and diagnostics until their point of use. This specialized packaging, predominantly utilizing various polymers like Polypropylene (PP), Polyethylene (PE), Polyethylene Terephthalate (PET), and various co-polymers, is critical for patient safety and regulatory compliance within the healthcare sector. The primary function is to provide a robust microbial barrier, withstand diverse sterilization processes (such as ethylene oxide, gamma radiation, e-beam, and autoclave), and offer physical protection against handling and transport stresses. The inherent characteristics of plastics, including their flexibility, transparency, cost-effectiveness, and compatibility with thermoforming and sealing processes, position them as the material of choice over alternatives like glass or paper for many sterile applications.

Major applications of plastics sterile medical packaging span across high-volume disposable medical products, complex surgical kits, implanted devices (like stents and pacemakers), and pre-filled syringes and vials. The increasing complexity of medical devices, coupled with stricter global regulatory standards set by bodies like the FDA and EMA, necessitates sophisticated packaging solutions that can offer long shelf life and verifiable sterile integrity. Furthermore, the global trend towards single-use instruments and preventative healthcare, especially accelerated by recent public health crises, drives continuous demand for reliable, sterile plastic packaging formats such as blisters, trays, pouches, and clamshells. Product design in this market focuses heavily on ease of use, including peel-open features, while simultaneously ensuring the seal integrity remains absolute.

Key driving factors fueling market expansion include the rapidly aging global population, which increases the prevalence of chronic diseases requiring sophisticated medical interventions and devices; the surging growth in emerging economies leading to enhanced healthcare infrastructure investment; and continuous advancements in polymer science yielding materials with superior barrier properties and enhanced resistance to extreme sterilization methods. The shift towards minimal invasive surgery, which utilizes complex, often smaller, sterilized tools, also requires precision-engineered sterile plastic packaging. The benefits derived from these packaging solutions are manifold, ensuring infection control, streamlining surgical procedures through organized kits, and extending the shelf life of temperature-sensitive biological products, thereby safeguarding public health and reducing healthcare-associated infections (HAIs).

Plastics Sterile Medical Packaging Market Executive Summary

The Plastics Sterile Medical Packaging Market is experiencing robust growth driven primarily by escalating global demand for sterile medical devices and stricter regulatory mandates surrounding infection control across developed and developing nations. Business trends indicate a strong focus on sustainable packaging solutions, with manufacturers increasingly investing in recyclable or bio-based plastics (such as bio-PE and bio-PET) and optimizing material usage to reduce environmental footprint without compromising barrier performance. Strategic mergers and acquisitions are prominent, particularly as large packaging conglomerates seek to integrate specialized sterilization capabilities and broaden their geographic reach, aiming for vertical integration from raw material sourcing to final package conversion. Automation in packaging lines is another significant trend, boosting throughput, reducing human contamination risk, and improving traceability through advanced serialization systems.

Regional trends highlight North America and Europe as mature markets characterized by high per capita healthcare spending, advanced regulatory frameworks, and rapid adoption of innovative packaging technologies, particularly for high-value implants and complex surgical systems. These regions are pioneers in incorporating smart packaging features, such as temperature monitoring indicators and RFID tags, into sterile applications. Conversely, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by expanding universal healthcare coverage, massive population growth, increasing establishment of medical device manufacturing hubs (especially in China, India, and Southeast Asia), and rising disposable incomes allowing access to modern medical treatments. Investment in healthcare infrastructure improvement in MEA and Latin America is also contributing moderately to global market expansion, particularly for essential disposables and pharmaceutical packaging.

Segment trends underscore the dominance of Polyethylene (PE) and Polypropylene (PP) materials due to their excellent compatibility with gamma and EtO sterilization, cost-effectiveness, and inherent flexibility for pouch and tray applications. The pouches and bags segment, primarily used for surgical dressings and disposables, maintains a high market share due to its flexibility and high seal strength. However, the rigid trays and clamshells segment, utilizing thermoformed plastics, is expected to show significant growth, driven by the need to protect sensitive, high-cost medical devices like surgical instruments and orthopedic implants during shipping and handling. The medical devices application segment remains the largest consumer, reflecting the vast volume and diversity of sterilized devices required in hospitals and clinics globally, ranging from catheters to sophisticated diagnostic kits.

AI Impact Analysis on Plastics Sterile Medical Packaging Market

Common user questions regarding AI's impact on sterile medical packaging center on how this technology can ensure unprecedented levels of quality control, streamline complex sterilization validation processes, and optimize supply chain efficiency for sensitive, high-value medical goods. Users are keenly interested in predictive maintenance of high-speed packaging machinery, AI-driven visual inspection systems capable of detecting microscopic defects in seals or barrier films, and the potential for AI algorithms to design optimally protective and material-efficient packaging structures. The central themes emerging from this user analysis are the desire for zero-defect packaging integrity, faster time-to-market for new sterile devices via accelerated regulatory approval enabled by AI-validated processes, and enhanced traceability to prevent counterfeiting and ensure regulatory adherence throughout the product lifecycle. AI is therefore anticipated not just as an efficiency tool, but as a critical component in enhancing safety and compliance.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is set to revolutionize several facets of the plastics sterile medical packaging supply chain. In manufacturing, AI-powered vision systems are exponentially more effective than human inspectors at identifying subtle imperfections, such as pinholes, compromised seals, or minor material irregularities, ensuring that the sterile barrier system is robust before sterilization. Furthermore, AI can model the complex interaction between the plastic material, the sterilization agent (e.g., EtO concentration, radiation dose), and the device itself, leading to predictive validation protocols that drastically reduce testing cycles and material waste associated with traditional validation methods. This predictive capability translates directly into accelerated product launches and reduced operational costs for packaging manufacturers and device companies.

Beyond quality control, AI is transforming logistics and inventory management. Given the critical nature of sterile products, ensuring they are available where and when needed is paramount. AI-driven demand forecasting leverages complex data sets, including epidemiological trends, hospital admission rates, and geographical regulatory shifts, to optimize production scheduling and minimize costly overstocking or dangerous stockouts of essential sterile supplies. This optimization is particularly crucial for custom surgical kits and implant packaging where demand can be sporadic. By integrating AI across the entire value chain—from smart manufacturing floors to optimized distribution networks—the market can achieve superior operational resilience, a factor deemed essential following recent global supply chain disruptions.

- AI-powered visual inspection for detecting micro-leaks and seal integrity failures in real-time, achieving near-zero defect rates.

- Predictive maintenance schedules for high-speed thermoforming and sealing equipment, minimizing unplanned downtime and enhancing operational efficiency.

- Machine learning algorithms optimizing plastic material selection based on specific sterilization methods (e-beam, gamma) and required barrier properties.

- AI-driven simulation and modeling of sterilization processes to accelerate validation cycles and ensure regulatory compliance.

- Enhanced supply chain visibility and demand forecasting for sterile products, leveraging ML to manage fluctuating hospital and pharmaceutical requirements.

- Integration of smart packaging and IoT sensors, analyzed by AI, to monitor and report sterility assurance parameters during transit.

DRO & Impact Forces Of Plastics Sterile Medical Packaging Market

The Plastics Sterile Medical Packaging market dynamics are characterized by strong underlying growth drivers related to demographic shifts and medical advancements, moderated by significant constraints concerning material costs and environmental pressures, while offering substantial opportunities in emerging markets and specialized product design. Key drivers include the global expansion of the medical device industry, increased surgical volumes driven by aging populations in developed economies, and stringent regulatory requirements mandating validated sterile barriers for almost all invasive medical products. The rising incidence of chronic diseases, requiring continuous treatment with sterilized devices and pharmaceuticals, acts as a perpetual demand generator. The primary restraint is the ongoing global pressure to replace single-use plastics with sustainable alternatives, forcing companies into costly research and development of recyclable or biodegradable barrier films while maintaining uncompromising sterility standards. Additionally, volatility in petrochemical raw material prices directly impacts manufacturing costs and profit margins.

Impact forces stemming from technological innovation are significantly reshaping the competitive landscape. Advances in material science, particularly multilayer films and coextruded plastics, allow packaging manufacturers to achieve superior oxygen and moisture barrier properties necessary for long shelf life, even for highly sensitive biological products. The demand for user-friendly packaging that minimizes the risk of contamination during aseptic presentation (the "peel-ability" factor) is a powerful influencing force on design and sealing technology. The overarching macro force is the increasing consolidation of the healthcare provider and device manufacturing sectors, leading to greater purchasing power concentrated in the hands of a few large entities who demand cost efficiency alongside impeccable quality assurance. Furthermore, geopolitical instability impacting global shipping and supply routes necessitates resilient, regionally diversified manufacturing bases, influencing capital expenditure decisions.

Opportunities for market growth are abundant, particularly in underserved geographical areas such as parts of Asia, Latin America, and Africa, where healthcare infrastructure is rapidly improving and reliance on imported, sterilized medical goods is high. A major product-focused opportunity lies in the burgeoning field of personalized medicine and combination devices, which require unique, often smaller-batch, highly specialized sterile packaging solutions. Developing packaging that seamlessly integrates monitoring and authentication technologies (smart packaging) presents a high-value segment, offering enhanced safety features and addressing counterfeit concerns prevalent in pharmaceutical distribution. Finally, manufacturers who can successfully navigate the transition to circular economy models—developing truly recyclable medical-grade plastics while securing regulatory approval for these new materials—will capture significant long-term market advantage and meet corporate social responsibility goals mandated by increasingly conscious end-users and governments.

Segmentation Analysis

The Plastics Sterile Medical Packaging market is highly diversified, segmented primarily by the type of plastic material utilized, the specific product format, and the final application of the packaged sterile item. Understanding these segmentations is crucial for manufacturers to target optimal material choices based on compatibility with sterilization methods and the required shelf life, while meeting the precise form and functionality demanded by medical device companies. The selection of materials directly dictates the barrier performance, cost structure, and environmental impact of the final package. The applications segment, particularly medical devices and pharmaceuticals, drives the volume and technological complexity within the market, as each application has unique regulatory and physical protection needs.

The material segmentation is dominated by polyolefins (PP and PE) due to their excellent heat sealability, chemical resistance, and wide-ranging compatibility with standard sterilization techniques. However, the rise of specialized devices necessitates materials like PET and Nylon for enhanced rigidity, puncture resistance, and superior gas barriers, especially for critical implants. Product format segmentation distinguishes between flexible packaging (pouches, bags) preferred for high-volume, low-cost disposables, and rigid packaging (trays, blisters, clamshells) essential for protecting delicate, high-value instruments. The rigid segments command a higher price point due to the complexity of thermoforming and the protective function they provide during sterilization and transit. Each segment faces continuous innovation pressure to improve barrier properties while simultaneously reducing material thickness and weight to meet sustainability targets.

Geographic segmentation remains vital, reflecting the uneven distribution of advanced medical device manufacturing and healthcare expenditure globally. North America and Europe possess the highest market maturity and focus on advanced, specialized, and often custom-designed packaging for novel surgical procedures and advanced biotechnology products. Asia Pacific, driven by high-volume manufacturing capabilities and massive population bases, focuses on cost-effective, reliable sterile packaging for general surgical supplies and disposables, emerging as the fastest-growing region. Understanding the unique regulatory environment and sterilization preferences (e.g., preference for gamma vs. EtO) in each region is critical for market entry and sustained success.

- By Material:

- Polyethylene (PE) (LDPE, HDPE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET, PETG)

- Polyvinyl Chloride (PVC)

- Polystyrene

- Others (Nylon, EVOH, Co-polymers)

- By Product Type:

- Sterile Pouches & Bags

- Trays & Lids

- Blister Packaging (Formable and Non-Formable)

- Clamshells

- Vials & Ampoules (Plastic)

- Others (Tubes, Bottles)

- By Sterilization Method:

- Ethylene Oxide (EtO) Sterilization

- Gamma Irradiation

- E-beam Sterilization

- Steam (Autoclave) Sterilization (limited plastic use)

- By Application:

- Medical Devices (Surgical Instruments, Catheters, Syringes)

- Implants & Active Implantable Devices (Stents, Pacemakers)

- In-vitro Diagnostic Products

- Pharmaceuticals & Biologics

- Disposable Medical Supplies

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Plastics Sterile Medical Packaging Market

The value chain for plastics sterile medical packaging is complex and highly specialized, beginning with upstream raw material suppliers and culminating in the final delivery to healthcare facilities. The upstream segment involves major petrochemical companies that produce the base resins (PP, PE, PET) essential for all subsequent manufacturing steps. Pricing volatility and sustainability mandates from this raw material stage significantly influence the entire chain's cost structure and innovation trajectory. Specialist additives manufacturers also form part of the upstream segment, providing barrier coatings, antimicrobial agents, and colorants necessary for specific applications. The dependence on a few global resin suppliers often creates pricing pressures for packaging converters, who must maintain stable costs despite fluctuating raw material markets.

The midstream of the value chain is dominated by packaging converters and thermoformers—companies that transform the plastic resins into specialized medical-grade forms such as multilayer films, rigid trays, and pre-formed blisters. This stage requires significant capital investment in cleanroom manufacturing facilities, advanced thermoforming equipment, and highly regulated quality control systems to meet ISO 13485 standards. These converters often work in close collaboration with medical device manufacturers (MDMs) in a downstream capacity to custom-design packaging that is compatible with the device, the sterilization process, and end-user needs. Integration of printing and labeling, along with the application of specialized breathable materials (like Tyvek for lidding), is also performed at this converting stage, making it the most value-added step.

The downstream distribution channel involves the finished sterile packaging being supplied directly (direct distribution) or indirectly (through distributors/wholesalers) to the end-users. Direct distribution is common for high-volume, long-term contracts between major packaging companies and large medical device manufacturers (the primary potential customers). Indirect distribution facilitates reach into smaller medical device firms, specialized surgical centers, and pharmaceutical compounding facilities. Logistics integrity is paramount in the downstream segment, requiring validated temperature and humidity control during transportation to ensure the sterile barrier is not compromised before the product reaches the hospital or clinic. End-user feedback is critical for continuous improvement, influencing material choice and package opening ergonomics, thereby completing the feedback loop back up the value chain.

Plastics Sterile Medical Packaging Market Potential Customers

The primary potential customers for plastics sterile medical packaging are entities within the highly regulated healthcare ecosystem that manufacture, distribute, or utilize sterilized medical goods. The largest and most demanding customer segment consists of Medical Device Manufacturers (MDMs). These companies, ranging from global giants producing surgical robots and orthopedic implants to specialized firms creating diagnostic kits, require custom-engineered packaging solutions that not only protect high-value, sensitive devices but also comply with stringent international packaging standards like ASTM F2097 and ISO 11607. Their purchasing decisions are heavily influenced by supplier capability for high-volume, cleanroom manufacturing, validation expertise, and material consistency across global sites.

The second major group comprises Pharmaceutical and Biotechnology Companies. While traditional pharmaceutical packaging often uses glass or less specialized plastics, the rise of sterile biologics, injectables, pre-filled syringes, and combination products (drug-device pairings) necessitates high-barrier, sterile plastic packaging. These customers demand materials that exhibit low extractables and leachables (E&L) profiles, ensuring chemical compatibility with sensitive drug formulations. Furthermore, packaging for clinical trials and novel therapies requires agile, small-batch sterile production capabilities. Hospitals, surgical centers, and large-scale healthcare systems also function as indirect but highly influential customers, dictating demand for sterile surgical supplies, disposable instruments, and procedural kits. They often prioritize packaging that minimizes waste and simplifies inventory management at the point of care.

Finally, Contract Manufacturing Organizations (CMOs) and Contract Packaging Organizations (CPOs) specializing in medical outsourcing represent a growing customer base. As many medical device and pharma companies divest non-core manufacturing functions, they rely on CMOs/CPOs to handle the complex, validated sterile packaging process. These customers require partners with flexibility, capacity for rapid scale-up, and expertise across multiple sterilization methods. Their purchasing criteria center on reliability, speed, and proven quality management systems that can withstand rigorous audits from their original equipment manufacturer (OEM) clients. Overall, the market caters to buyers for whom regulatory compliance and absolute sterility assurance are non-negotiable prerequisites.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 10.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor, DuPont, WestRock, SteriPack, Placon, Oliver Healthcare Packaging, Sonoco Products Company, Berry Global, Tekni-Plex, Constantia Flexibles, ProAmpac, Wipak Group, Gerresheimer, Nelipak Healthcare Packaging, Klöckner Pentaplast, CCL Industries, GSG, 3M Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastics Sterile Medical Packaging Market Key Technology Landscape

The technological landscape of the Plastics Sterile Medical Packaging Market is defined by continuous advancements focused on achieving superior barrier function, enhancing sterilization compatibility, and integrating intelligence into the packaging structure. A critical area of focus is the development of advanced multi-layer films and coextruded plastics. These technologies allow manufacturers to combine the desirable properties of several polymers—such as the moisture barrier of polyethylene and the strength of nylon—into a single, thinner structure. This not only reduces material consumption, addressing sustainability concerns, but also provides customized barrier performance necessary for sensitive products, like complex biologics, which require specific gas and moisture transmission rates (MVTR/OTR) to maintain efficacy over long periods. Innovation in adhesive and sealant technologies, particularly peelable, clean-opening systems, is crucial to ensure that the sterile barrier can be breached easily and safely at the point of use without releasing particulates, a major focus for regulatory bodies.

Furthermore, technology related to sterilization compatibility is constantly evolving. As devices become more sophisticated and often incorporate electronics or drug coatings, traditional sterilization methods (like high-heat autoclaving) are unsuitable. This drives the need for new plastic materials and packaging designs compatible with low-temperature processes, such as vaporized hydrogen peroxide (VHP) or improved EtO cycles. Packaging material providers are developing specialized Tyvek alternatives and plastic films that maintain porosity and barrier integrity while enduring higher radiation doses (gamma or e-beam) without significant material degradation, discoloration, or loss of mechanical strength. The integration of proprietary non-toxic indicator inks that change color upon successful sterilization validation is another essential technology, providing immediate, visual confirmation of the process completion.

The increasing prominence of Industry 4.0 principles introduces sophisticated monitoring and traceability technologies. This includes the implementation of smart packaging solutions utilizing integrated sensors, Near Field Communication (NFC), and Radio Frequency Identification (RFID) tags. These technologies are encapsulated within the plastic packaging structure, allowing for real-time tracking of environmental conditions (temperature, humidity, shock) throughout the supply chain. Data captured by these smart systems is vital for meeting regulatory requirements, verifying product authenticity (anti-counterfeiting measures), and ensuring that the product has remained within validated parameters, safeguarding the integrity of the sterile contents until the final use. This technological integration transforms the packaging from a static protective shell into an intelligent, data-generating component of the healthcare logistics system.

Regional Highlights

- North America: This region holds a dominant market share, driven by a high concentration of leading medical device manufacturers, high healthcare expenditure, and a well-established regulatory environment that strictly enforces sterility standards. The U.S. market leads in adopting advanced packaging formats, including custom-designed thermoformed trays and smart packaging technologies for high-value orthopedic, cardiovascular, and neurological implants. Continuous investment in R&D and a quick adoption rate for innovative materials compatible with challenging sterilization methods like VHP ensure its sustained leadership.

- Europe: The European market is characterized by stringent environmental regulations, particularly concerning plastic waste (EU Packaging and Packaging Waste Regulation). This drives high demand for recyclable and bio-based sterile plastics, pushing material innovation. Germany, France, and the UK are major contributors, maintaining strong manufacturing bases for both pharmaceuticals and medical instruments. The market focus is on optimizing resource efficiency, ensuring high-speed packaging lines, and addressing serialization requirements for drug traceability.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period. This growth is underpinned by massive government investment in healthcare infrastructure, the expansion of medical tourism, and the establishment of new, large-scale medical device manufacturing clusters in China, India, and Japan. The region emphasizes cost-effective, high-volume sterile packaging solutions for disposable syringes, surgical gloves, and basic surgical kits. Rising middle-class populations demanding modern healthcare services significantly boost market opportunities.

- Latin America: This region presents moderate growth, primarily driven by improving economic conditions in key countries like Brazil and Mexico, leading to increased access to modern medical treatments. The market relies heavily on imported medical devices, creating demand for robust, secure sterile packaging capable of withstanding long and complex distribution chains. Regulatory harmonization efforts, particularly within Mercosur, are gradually standardizing packaging requirements and opening up cross-border market opportunities.

- Middle East & Africa (MEA): Growth in MEA is highly localized, concentrated in the Gulf Cooperation Council (GCC) countries due to substantial wealth invested in advanced hospital systems and medical tourism initiatives. Demand focuses on high-quality, international standard sterile packaging, often imported. The African segment, though smaller, offers opportunities for basic, essential sterile disposables as healthcare access expands, particularly for packaging compatible with simple, robust sterilization methods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastics Sterile Medical Packaging Market.- Amcor plc

- DuPont de Nemours, Inc.

- WestRock Company

- SteriPack

- Placon

- Oliver Healthcare Packaging

- Sonoco Products Company

- Berry Global Group, Inc.

- Tekni-Plex

- Constantia Flexibles

- ProAmpac

- Wipak Group

- Gerresheimer AG

- Nelipak Healthcare Packaging

- Klöckner Pentaplast

- CCL Industries Inc.

- GSG (Global Sterile Group)

- 3M Company

Frequently Asked Questions

Analyze common user questions about the Plastics Sterile Medical Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary sterilization methods compatible with plastic medical packaging materials?

The most common and compatible sterilization methods are Ethylene Oxide (EtO) for heat-sensitive devices, Gamma and E-beam Irradiation for high-volume disposables, and, to a limited extent, Steam (autoclaving) for specific heat-resistant plastic applications. Packaging must ensure porosity for gas exchange (EtO) or stability against radiation dosage.

How is sustainability impacting the plastics sterile medical packaging industry?

Sustainability mandates are pushing manufacturers toward developing recyclable monomaterial plastic structures (e.g., all-PE pouches instead of mixed materials), utilizing bio-based or post-consumer recycled (PCR) resins where regulations allow, and optimizing package design to reduce overall plastic volume without compromising the sterile barrier integrity required by ISO 11607.

Which plastic materials offer the best barrier properties for sterile applications?

Complex, multilayer co-polymers incorporating materials like EVOH or Nylon offer superior moisture and oxygen barrier properties necessary for protecting high-value biologics and sensitive devices. However, standard Polypropylene (PP) and High-Density Polyethylene (HDPE) remain the leading choices for general applications due to their balance of cost, strength, and EtO/radiation compatibility.

What is the main challenge in ensuring the sterile integrity of plastic medical packaging?

The main challenge is maintaining the integrity of the seal, particularly the heat seal, which is the weakest point in most flexible sterile barrier systems. Any microscopic imperfection, puncture, or compromise in the seal area can allow microbial ingress, necessitating sophisticated, validated sealing processes and advanced quality assurance testing methods like dye penetration and bubble emission tests.

Why is the Asia Pacific region projected to exhibit the highest growth rate?

APAC's high growth is attributed to rapid expansion of healthcare infrastructure, increasing accessibility to modern medical services across populous nations like China and India, rising volumes of medical device manufacturing for global export, and growing government and private expenditure on improving regional healthcare standards and infection control practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager