Plating Power Supplies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436313 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Plating Power Supplies Market Size

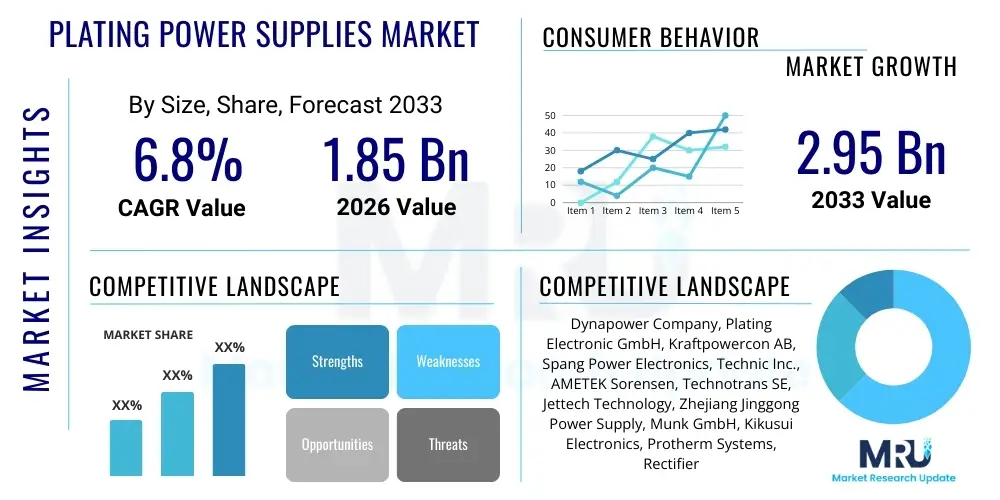

The Plating Power Supplies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033.

Plating Power Supplies Market introduction

Plating power supplies, often referred to as industrial rectifiers, are specialized DC power sources engineered to provide highly stable, regulated, and precise current and voltage for electrochemical processes, primarily electroplating, anodizing, electrowinning, and coating applications. These critical devices convert incoming AC utility power into the required DC output, ensuring the consistent deposition of metals onto substrates. The foundational technology has evolved significantly, shifting from traditional Silicon Controlled Rectifier (SCR) based systems, known for their robustness and lower initial cost, to advanced Switch-Mode Power Supply (SMPS) rectifiers, which offer superior efficiency, compact size, higher precision in current control, and the capability for high-frequency pulsing necessary for modern micro-scale plating requirements.

The primary function of these power supplies is to enable precision finishing across diverse industrial sectors. Major applications include the automotive industry, where they facilitate protective coatings for corrosion resistance and aesthetic finishes; the aerospace sector, demanding high-reliability coatings for critical components; and, crucially, the electronics and semiconductor industry, where micron-level precision is essential for wafer metallization, connector plating, and printed circuit board (PCB) manufacturing. The increasing complexity and miniaturization of electronic components are driving the demand for power supplies capable of generating sophisticated waveforms, such as pulse and reverse pulse plating capabilities, which enhance deposit quality, uniformity, and adherence.

The market is predominantly driven by global industrial expansion, particularly in Asia Pacific manufacturing hubs, and the accelerating adoption of electric vehicles (EVs) which require extensive plating for battery connectors and lightweight chassis components. Furthermore, the stringent quality requirements in high-tech manufacturing, coupled with the need for energy efficiency in industrial operations, are compelling manufacturers to invest in state-of-the-art SMPS technology. The benefits provided by modern plating power supplies—including reduced energy consumption, enhanced process control, minimized chemical waste, and ultimately, superior product quality—make them indispensable tools in the advanced manufacturing landscape.

Plating Power Supplies Market Executive Summary

The Plating Power Supplies Market is undergoing a rapid transition driven by advancements in power electronics and increasing demand for ultra-precise surface finishing. Key business trends indicate a definitive shift away from bulky, less efficient SCR rectifiers toward compact, energy-efficient, and digitally controlled Switch-Mode Power Supplies (SMPS). This technological migration is underpinned by the growing complexity in semiconductor and high-end automotive plating, requiring precise current control, often utilizing high-frequency pulse rectification to achieve specified metallurgical properties. Manufacturers are focusing heavily on integrating communication protocols (like EtherCAT or Modbus) and sophisticated user interfaces to enable seamless integration into Industry 4.0 automation systems, enhancing traceability and remote diagnostic capabilities for large-scale production environments.

Geographically, the Asia Pacific (APAC) region continues to dominate the global market, primarily due to the massive concentration of electronics manufacturing, PCB production, and burgeoning EV supply chains in countries such as China, South Korea, and Taiwan. This region acts as both a major consumer and an increasingly important hub for manufacturing plating equipment. Conversely, North America and Europe demonstrate robust growth stemming from the aerospace and defense sectors, stringent quality requirements in medical device manufacturing, and high investment in R&D focusing on specialized plating techniques like decorative chrome alternatives and environmentally sustainable coating processes. Regulatory mandates regarding energy consumption and hazardous materials are also shaping regional purchasing decisions, favoring high-efficiency, closed-loop systems.

Segment trends highlight the dominance of the electroplating application segment, driven by essential needs for corrosion resistance and aesthetic finishes across general industry. However, the electronics and semiconductor segment is exhibiting the fastest growth rate, fueled by the demand for advanced packaging, micro-bump plating, and high-aspect-ratio through-silicon vias (TSVs). In terms of product type, SMPS technology is rapidly capturing market share over SCR-based systems, especially in high-precision and high-power density applications. This market evolution reflects a strong commitment from end-users to optimize operational expenditure through energy savings and minimize defects associated with unstable power delivery, thereby confirming the market trajectory toward digital and highly precise power solutions.

AI Impact Analysis on Plating Power Supplies Market

Common user questions regarding AI's impact on the Plating Power Supplies Market revolve around how artificial intelligence can stabilize complex electrochemical processes, reduce material waste, and extend equipment lifespan. Users frequently inquire about the feasibility of AI-driven predictive maintenance, asking if algorithms can accurately forecast rectifier failures based on subtle fluctuations in power output, temperature, or current ripples long before catastrophic failure occurs. Furthermore, there is significant interest in AI's role in closed-loop quality control—specifically, using machine learning models to correlate plating parameters (voltage, current density, pulse timing) with real-time sensor data (bath chemistry, temperature) and resulting coating thickness or uniformity, thus achieving autonomous process optimization and eliminating manual adjustments traditionally required by highly skilled operators. The key themes summarized include AI’s potential for predictive reliability, automated quality assurance, and enhanced energy optimization within high-power industrial environments.

- Implementation of predictive maintenance models to analyze operational data (temperature, ripple, duty cycle) for anticipating rectifier component failure.

- Optimization of plating parameters (current waveform, frequency, cycle time) using machine learning algorithms to achieve optimal deposit characteristics and minimize material usage.

- Integration of AI-driven vision systems with power supplies for real-time defect detection and automatic adjustment of plating current density to correct uniformity issues.

- Enhancement of energy efficiency through smart load management and power distribution optimization, dynamically adjusting power draw based on production schedules and electricity costs.

- Facilitation of digital twinning of the plating line, allowing for simulation and optimization of power supply behavior under various electrochemical stress conditions.

DRO & Impact Forces Of Plating Power Supplies Market

The Plating Power Supplies Market dynamics are characterized by powerful drivers such as the escalating global production of electric vehicles (EVs) which rely heavily on robust and reliable plating for battery components and internal electronics, alongside the relentless technological advancements in the semiconductor sector requiring micro-scale precision plating for advanced packaging. These drivers are tempered by significant restraints, primarily the high initial capital investment required for modern, high-efficiency switch-mode power supplies, especially those featuring advanced pulsing capabilities, and the inherent technical complexity involved in integrating these precise power systems into legacy manufacturing environments. Opportunities abound, particularly in the development of sustainable plating solutions, such as chrome replacement processes, and the growth in customized, high-frequency waveform generation technologies tailored for specialized nanomaterials and functional coatings. The collective influence of these factors dictates market movement, pushing manufacturers towards developing smarter, more sustainable, and highly efficient power delivery systems.

The primary impact forces propelling market growth stem from global industrial mandates for high quality and energy conservation. The need to maintain uniform coating thickness and high adhesion across increasingly intricate component geometries—driven by sectors like 5G infrastructure, IoT devices, and miniaturized electronics—demands power supplies with extremely low ripple and highly stable output, achievable only through sophisticated SMPS technology. Furthermore, the rising cost of energy worldwide is making the operational expenditure associated with older, less efficient SCR rectifiers economically unsustainable, accelerating the adoption curve for new, high-efficiency models. The pursuit of enhanced throughput and reduced downtime also acts as a critical force, where the diagnostic capabilities and reliability of modern power supplies contribute directly to improved overall equipment effectiveness (OEE) in high-volume plating facilities.

However, market expansion is frequently impeded by the long replacement cycles typical in heavy industrial machinery, where legacy SCR systems, despite their inefficiency, remain operational for decades. Additionally, the shortage of highly specialized technicians capable of maintaining and troubleshooting complex, digitally controlled power electronics can pose a restraint in emerging industrial regions. To mitigate these challenges and capitalize on growth opportunities, manufacturers are innovating through modular design (allowing for easy capacity expansion and maintenance) and developing highly customized plating waveforms to address unique material science challenges, positioning the market for sustained, technology-driven growth, especially in precision applications where quality cannot be compromised.

Segmentation Analysis

The Plating Power Supplies Market segmentation provides a granular view of the diverse technologies and applications driving demand across global industries. The market is primarily segmented by Technology Type (Switch-Mode vs. SCR), Application (Electroplating, Anodizing, Electrowinning), End-Use Industry (Electronics & Semiconductor, Automotive, Aerospace & Defense, General Industry), and Output Power Range. The proliferation of complex electronic devices and the increasing stringency of coating requirements heavily favor the adoption of Switch-Mode Power Supplies (SMPS) due to their superior efficiency, precision, and ability to generate advanced pulse waveforms crucial for micro-plating. Conversely, SCR-based systems maintain a stable niche in high-current, high-power electrowinning applications and standard bulk electroplating where precision requirements are less critical and robust reliability under harsh conditions is prioritized. Analyzing these segments is crucial for strategic business planning, as it highlights the faster growth rates observed in high-precision technology sectors.

- By Technology Type:

- Switch-Mode Power Supply (SMPS)

- Silicon Controlled Rectifier (SCR) Based

- By Application:

- Electroplating (Decorative Plating, Functional Plating)

- Anodizing (Type I, II, and III)

- Electrowinning and Electrorefining

- By End-Use Industry:

- Electronics and Semiconductor (PCB, Connectors, Wafer Metallization)

- Automotive (EV Components, Chassis, Trim)

- Aerospace and Defense

- General Industry (Jewelry, Hardware, Construction)

- By Output Power:

- Low Power (Below 5 kW)

- Medium Power (5 kW to 50 kW)

- High Power (Above 50 kW)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For Plating Power Supplies Market

The value chain for the Plating Power Supplies Market begins with upstream analysis, focusing on the procurement of critical raw materials and electronic components. Key inputs include high-frequency magnetics (transformers and inductors), power semiconductors (IGBTs and MOSFETs), control microprocessors, and heat dissipation materials (aluminum, copper). The quality and stable supply of these specialized power electronics directly influence the final product’s reliability and efficiency, placing suppliers of high-grade IGBT modules and digital controllers in a critical position. Manufacturers often engage in strategic partnerships with semiconductor suppliers to ensure access to the latest, most robust power switching technology required for generating clean, low-ripple DC output necessary for precision plating.

Midstream activities involve the design, manufacturing, and assembly of the rectifier units. Manufacturers must possess specialized expertise in high-power thermal management, advanced control loop design, and firmware development to create units capable of handling harsh industrial environments while delivering precise waveform control (e.g., pulse and reverse pulse). The distribution channel encompasses both direct sales and indirect routes through specialized distributors and system integrators. For large, customized, high-power systems used in electrowinning or large-scale automotive plating, direct sales, installation, and service by the manufacturer are common. Conversely, smaller, standard units for general electroplating often move through indirect distribution networks, leveraging local chemical suppliers or plating equipment dealers who provide installation and local support.

Downstream analysis focuses on the end-users and the after-market services, which are critical revenue streams. End-users require extensive technical support, preventive maintenance, and calibration services to ensure the longevity and accuracy of the power supplies. The indirect channel often relies on local engineering firms to provide these services, while leading power supply manufacturers offer proprietary maintenance contracts and remote diagnostic support, especially for complex, integrated plating lines. The effectiveness of the service network significantly impacts customer retention and market reputation, emphasizing the importance of a robust global service infrastructure that can rapidly address downtime issues crucial in high-volume, continuous manufacturing processes like PCB fabrication and automotive component production.

Plating Power Supplies Market Potential Customers

The potential customers for plating power supplies span a wide array of industrial sectors where surface finishing is a non-negotiable requirement for component functionality, durability, or aesthetic appeal. The electronics and semiconductor industry represents the most demanding customer segment, requiring ultra-precise, high-frequency pulse power supplies for advanced applications such as wafer bumping, through-silicon via (TSV) metallization, and the production of high-density interconnect (HDI) PCBs. These customers prioritize power quality, low ripple, and fast response times to ensure defect-free, uniform deposition on micro-scale features. Tier 1 suppliers in the automotive industry constitute another massive customer base, utilizing high-power rectifiers for corrosion-resistant coatings (e.g., zinc, nickel) on structural components and for aesthetic chrome plating on exterior trims. The rapid growth of Electric Vehicle (EV) manufacturing specifically targets suppliers offering high-efficiency power units for specialized battery cell plating processes.

The aerospace and defense sector represents a critical, albeit smaller volume, customer segment characterized by extremely stringent qualification standards and high-reliability requirements. These end-users utilize plating power supplies for functional coatings like hard chrome alternatives, cadmium replacement coatings, and high-temperature protective layers on turbine blades and landing gear components. Furthermore, the general industrial sector, encompassing manufacturers of hardware, jewelry, plumbing fixtures, and consumer goods, requires medium-power rectifiers for decorative finishes and standard corrosion protection. For these customers, cost-effectiveness, ruggedness, and ease of use are often weighted higher than the ultra-high precision features demanded by the semiconductor market. Consequently, the customer base ranges from small job shops utilizing standard SCR units to massive multinational foundries and OEMs demanding integrated, fully automated SMPS systems connected to centralized plant control software.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dynapower Company, Plating Electronic GmbH, Kraftpowercon AB, Spang Power Electronics, Technic Inc., AMETEK Sorensen, Technotrans SE, Jettech Technology, Zhejiang Jinggong Power Supply, Munk GmbH, Kikusui Electronics, Protherm Systems, Rectifier Technologies, Rapid Power, Inc., SIFU Industrial Power. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plating Power Supplies Market Key Technology Landscape

The technological landscape of the Plating Power Supplies Market is defined by the ongoing transition from traditional Silicon Controlled Rectifier (SCR) systems to sophisticated, digitally controlled Switch-Mode Power Supplies (SMPS). SCR technology, while robust and reliable for high-current applications, operates at low switching frequencies and inherently produces higher ripple content in the DC output, which can be detrimental to the quality of coatings in high-precision applications like semiconductor metallization. In contrast, SMPS technology, leveraging high-frequency switching components like Insulated Gate Bipolar Transistors (IGBTs) or power MOSFETs, allows for compact size, significantly lower energy consumption (typically 90%+ efficiency), and dramatically reduced output ripple, making them essential for nanoscale and micro-scale plating requirements where uniformity and crystallographic structure control are paramount.

A major advancement in the technology landscape is the widespread adoption of Pulse Plating and Reverse Pulse Plating (RPP) capabilities. Standard DC power supplies deposit material continuously, which can lead to uneven layer growth, especially in complex geometries. Pulse plating involves rapid on/off cycling of the current, enabling finer control over the diffusion layer, crystal grain size, and distribution of plating additives. Reverse Pulse Plating, an even more advanced technique, incorporates periodic anodic current pulses (reverse polarity) to selectively dissolve high-current density peaks, thereby achieving unparalleled thickness uniformity, superior adhesion, and filling power in intricate features such as high-aspect-ratio holes and vias common in PCB and semiconductor manufacturing. The ability to precisely tune these waveforms—including frequency, duty cycle, and reverse time—is now a key differentiator among leading power supply manufacturers.

Furthermore, the integration of advanced digital control systems and communication interfaces constitutes a significant technological shift. Modern plating power supplies are equipped with microcontrollers that enable highly accurate closed-loop control, compensating instantly for voltage drops or load changes in the plating bath. Connectivity features, such as integrated fieldbus protocols (e.g., Profibus, EtherCAT, Modbus TCP), allow for real-time monitoring, remote diagnostics, and seamless integration into automated manufacturing execution systems (MES). This integration supports the tenets of Industry 4.0, facilitating automated data logging, process standardization, and compliance reporting, which are increasingly vital for high-reliability sectors like aerospace and medical device manufacturing. The focus is shifting toward "smart" power supplies that offer modularity, high power density (kW per unit volume), and built-in self-diagnostic capabilities to minimize downtime and simplify maintenance.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and the fastest-growing region for plating power supplies, driven by its massive manufacturing ecosystem. Countries such as China, South Korea, Taiwan, and Japan are global leaders in PCB fabrication, semiconductor production, and automotive manufacturing. The aggressive expansion of electric vehicle battery production in China and South Korea generates immense demand for high-power, high-efficiency rectifiers used in electroplating busbars, connectors, and internal battery components. Furthermore, the region’s strong presence in consumer electronics dictates the need for sophisticated SMPS systems capable of precision micro-plating for advanced packaging and complex substrates. The competitive environment and high-volume production requirements ensure continued investment in automated, energy-saving plating technologies.

- North America: This region is characterized by high demand for specialized and high-reliability power supplies, primarily stemming from the aerospace and defense sectors, advanced medical device manufacturing, and niche automotive R&D. While not the largest volume market, North America leads in the adoption of cutting-edge technologies, including advanced pulse and reverse pulse rectifiers, particularly within the semiconductor foundries focusing on leading-edge node fabrication. Regulatory pressures, especially concerning environmental compliance and energy efficiency, drive the demand for fully programmable, highly efficient power sources that minimize waste and optimize resource usage. Innovation centers often partner with local universities and technology firms to develop custom power solutions for novel materials and functional coatings.

- Europe: Europe represents a mature market characterized by stringent quality controls, strong industrial automation, and a strong emphasis on sustainability and energy efficiency, particularly led by Germany and Italy. The automotive industry, including premium and luxury vehicle manufacturers, remains a core consumer, requiring aesthetically superior and highly durable plating finishes. European manufacturers are rapidly migrating towards modular, energy-efficient SMPS units, often incorporating liquid cooling for maximum power density and reduced noise in sensitive manufacturing environments. Regulatory frameworks, such such as RoHS and REACH, heavily influence material choices and, consequently, the specialized plating processes and power supply characteristics required for compliance.

- Latin America, Middle East, and Africa (LAMEA): This emerging region presents diverse demands. Latin America, particularly Brazil and Mexico, demonstrates steady growth tied to automotive assembly and general industrial manufacturing, preferring reliable, robust SCR systems for standard high-power applications due to lower initial costs. The Middle East sees specific demand in electrowinning and electrorefining operations for base metals, requiring very high-power, durable rectifiers. Market growth is gradually accelerating as industrialization progresses, leading to increased adoption of entry-level SMPS units for moderate precision electroplating, particularly driven by foreign investment in manufacturing infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plating Power Supplies Market.- Dynapower Company

- Plating Electronic GmbH

- Kraftpowercon AB

- Spang Power Electronics

- Technic Inc.

- AMETEK Sorensen

- Technotrans SE

- Jettech Technology

- Zhejiang Jinggong Power Supply

- Munk GmbH

- Kikusui Electronics Corporation

- Protherm Systems

- Rapid Power, Inc.

- SIFU Industrial Power

- Rectifier Technologies

- Advanced Energy Industries, Inc.

- Fuji Electric Co., Ltd.

- Controlled Power Company

- SanRex Corporation

- Ningbo Juneng Power Technology Co., Ltd.

Frequently Asked Questions

What is the primary difference between Switch-Mode Power Supply (SMPS) and SCR rectifiers in plating?

SMPS units use high-frequency switching (IGBTs/MOSFETs) to achieve superior energy efficiency (90%+), reduced size, and highly precise, low-ripple DC output suitable for micro-plating and pulse applications. SCR rectifiers, based on Silicon Controlled Rectifiers, are robust but offer lower efficiency, larger size, and higher output ripple, primarily used for bulk, high-power electrowinning or standard plating.

How does the growth of the Electric Vehicle (EV) industry impact the plating power supplies market?

The EV industry significantly boosts demand by requiring specialized, high-efficiency plating power supplies for manufacturing battery components (connectors, busbars), robust corrosion-resistant coatings on chassis parts, and specialized functional plating necessary for high-performance thermal management systems within the vehicle.

Which application segment exhibits the fastest growth rate in the market?

The Electronics and Semiconductor segment is witnessing the fastest growth due to the relentless push for miniaturization and advanced packaging (e.g., micro-bump, TSV metallization), which necessitates the use of ultra-precise, digitally controlled pulse and reverse pulse plating power supplies capable of micron-level accuracy.

What is the significance of Pulse Plating technology in modern surface finishing?

Pulse plating involves cycling the current on and off rapidly to control the electrochemical process at the molecular level. This technique is critical for achieving improved crystal structure, finer grain size, superior deposit uniformity, and better throwing power, especially vital when plating deep, intricate features in PCB or semiconductor components.

What role does digitalization play in the latest generation of plating power supplies?

Digitalization allows modern power supplies to integrate complex control algorithms for precise waveform generation, provide real-time remote diagnostics, enable seamless communication via industrial protocols (like EtherCAT), and support data logging for Industry 4.0 applications, significantly enhancing process traceability and operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager