Platinum and Palladium Carbon Catalyst Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431423 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Platinum and Palladium Carbon Catalyst Market Size

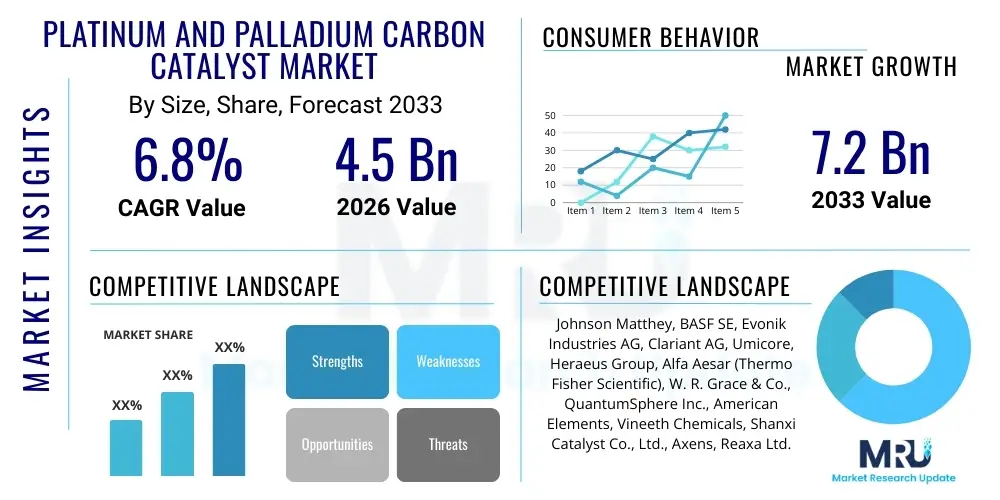

The Platinum and Palladium Carbon Catalyst Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Platinum and Palladium Carbon Catalyst Market introduction

The Platinum and Palladium Carbon Catalyst Market encompasses catalysts where active Platinum Group Metals (PGMs) like platinum (Pt) and palladium (Pd) are dispersed onto high-surface-area carbon supports, typically activated carbon or carbon nanotubes. These catalysts are indispensable in organic synthesis, chemical processing, and environmental applications due to their high selectivity, excellent catalytic activity, and recyclability. The stability provided by the carbon support minimizes PGM leaching, making them cost-effective solutions for large-scale industrial reactions, particularly hydrogenation, dehydrogenation, and various coupling reactions crucial for the pharmaceutical and specialty chemical sectors. Their unique structural composition, leveraging the synergistic effects of the metal and the inert carbon matrix, ensures optimal performance under diverse reaction conditions.

Platinum and palladium carbon catalysts are commercially vital components, enabling efficient production routes for numerous high-value chemicals. Palladium on carbon (Pd/C) is extensively used in the synthesis of APIs (Active Pharmaceutical Ingredients), intermediates, and fine chemicals, playing a crucial role in reducing nitro compounds and synthesizing protecting groups. Platinum on carbon (Pt/C), while often more expensive, finds specialized applications in processes requiring higher stability or specific reaction profiles, such as in fuel cell electrodes (though often specialized carbon materials are used here) and complex hydrogenation steps in the petrochemical industry. The demand is heavily influenced by strict environmental regulations mandating cleaner production processes and the burgeoning requirement for specialized chemical synthesis routes in emerging markets.

Major applications driving the market include hydrogenation processes in fat hardening (edible oils), purification steps in bulk chemical manufacturing, and, significantly, the synthesis of advanced chemical components for the electronics and polymer industries. The benefits of using these catalysts—such as high yield, minimized by-product formation, and superior catalyst longevity—further solidify their irreplaceable position in modern industrial chemistry. Driving factors prominently feature the increasing investment in hydrogen energy technologies, where Pt/C catalysts are central to fuel cell membranes, and the consistent growth of the global pharmaceutical industry which relies heavily on high-purity catalytic steps.

Platinum and Palladium Carbon Catalyst Market Executive Summary

The Platinum and Palladium Carbon Catalyst Market is characterized by robust growth, driven primarily by technological advancements in green chemistry and the accelerating global shift towards sustainable energy solutions. Current business trends indicate a strong focus on developing highly specialized catalysts with enhanced durability and lower PGM loading to mitigate high raw material costs and improve overall process economics. Key market players are concentrating on integrating advanced synthesis techniques, such as atomic layer deposition (ALD), to achieve precise control over metal particle size and distribution, thereby maximizing catalytic efficiency and lowering the total cost of ownership for end-users. Mergers and acquisitions focused on securing sustainable PGM supply chains and expanding regional manufacturing footprints are becoming prominent strategies, particularly in the Asia Pacific region, reflecting the intense competition and the need for vertical integration.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing market, propelled by rapid industrial expansion in China and India, particularly in specialty chemicals, generic pharmaceuticals, and petrochemical refining capacity. North America and Europe maintain significant market shares, largely driven by stringent regulatory frameworks promoting environmental catalysts and high R&D intensity in advanced material science and fuel cell development. The European market, in particular, is focused on reducing reliance on conventional synthesis methods, pushing demand for highly efficient, recyclable catalysts. Investment in catalytic converter recycling technologies is also influencing regional dynamics, indirectly impacting the fresh demand for primary PGMs used in carbon supported catalysts.

Segment trends reveal that the Pd/C catalyst segment holds the larger revenue share due to its widespread application in bulk and fine chemical synthesis, offering versatility and cost-effectiveness. However, the Pt/C segment is projected to exhibit a faster growth trajectory, specifically driven by its indispensable role in the burgeoning hydrogen economy, particularly Proton Exchange Membrane (PEM) fuel cells, and specialized high-pressure, high-temperature chemical reactions where platinum exhibits superior resilience. The application segment analysis underscores the dominance of the pharmaceutical and petrochemical industries, although environmental applications, such as water treatment and air purification catalysts, are rapidly gaining traction due to global regulatory pressures on industrial emissions and water quality standards.

AI Impact Analysis on Platinum and Palladium Carbon Catalyst Market

User queries regarding AI's impact on the Platinum and Palladium Carbon Catalyst Market frequently revolve around optimizing catalyst synthesis protocols, predicting catalytic performance under variable conditions, and accelerating the discovery of novel catalyst formulations. Users are concerned about how AI-driven high-throughput experimentation (HTE) can reduce the reliance on empirical trial-and-error, lowering R&D costs and shortening time-to-market for new catalytic products. Key themes include the use of machine learning (ML) models for predicting the optimal metal loading, particle size distribution, and support material structure based on desired reaction kinetics. Expectations center on AI enhancing quality control through real-time monitoring of large-scale industrial catalytic processes and identifying precursors for catalyst deactivation, thereby extending operational lifetimes and improving resource utilization efficiency.

- AI accelerates the discovery of novel PGM catalyst structures by simulating molecular interactions and predicting stability/activity before physical synthesis.

- Machine learning models optimize the synthesis parameters (e.g., temperature, pH, precursor concentration) to achieve precise control over PGM nanoparticle size and dispersion on carbon supports.

- Predictive analytics enhance quality control in manufacturing, ensuring batch-to-batch consistency and minimizing defects in catalyst production.

- AI-driven sensors and IoT devices enable real-time monitoring of industrial reactors, allowing for predictive maintenance and optimizing catalyst regeneration cycles, reducing downtime.

- Computational material science, powered by AI, helps in identifying suitable, lower-cost carbon support alternatives, reducing dependency on conventional activated carbon.

- Data mining techniques applied to vast chemical reaction databases guide chemists toward the most selective and sustainable catalytic pathways, enhancing green chemistry initiatives.

DRO & Impact Forces Of Platinum and Palladium Carbon Catalyst Market

The dynamics of the Platinum and Palladium Carbon Catalyst Market are shaped by a complex interplay of internal and external forces. The primary drivers include the exponential demand from the hydrogen and fuel cell sector, where Pt/C catalysts are foundational components for energy conversion, coupled with stringent environmental regulations worldwide that necessitate highly efficient catalysts for pollution control and cleaner manufacturing processes. However, the market faces significant restraints, chiefly the volatility and high cost associated with the sourcing of Platinum Group Metals (PGMs), which constitute a substantial portion of the final product price, challenging price competitiveness, and hindering widespread adoption in price-sensitive bulk chemical processes. These market variables, interacting with global economic stability and technological progression, define the market's trajectory.

Opportunities for growth are abundant, particularly through technological innovation focusing on catalyst recycling efficiency and the development of core-shell structured catalysts that use less PGM while maintaining or enhancing activity. The rapidly expanding generic pharmaceutical industry in emerging economies presents a substantial opportunity, as these manufacturers require reliable, high-pselectivity catalysts for API synthesis at scale. Moreover, the shift toward sustainable chemical synthesis, emphasizing solvent-free reactions and continuous flow chemistry, opens new avenues where highly specialized supported catalysts are essential for maintaining control and efficiency in miniaturized or intensified reactor designs. Strategic partnerships with recycling specialists and PGM suppliers are key to capitalizing on these opportunities and mitigating supply chain risks.

Impact forces heavily influence the market structure. The bargaining power of PGM suppliers remains high due to the concentrated nature of mining operations, primarily in South Africa and Russia, subjecting the market to geopolitical risks and supply disruptions. Concurrently, technological advancement acts as a powerful transformative force, consistently pushing the efficiency envelope, forcing manufacturers to invest heavily in R&D to maintain relevance. Regulatory impact is also critical; for instance, stricter Euro 7 emission standards or new pharmaceutical synthesis guidelines can instantaneously shift demand towards specific catalyst types. Overall, the market's resilience relies on its ability to innovate around high raw material costs and capitalize on the long-term, structurally driven demand from the renewable energy and life sciences sectors.

Segmentation Analysis

The Platinum and Palladium Carbon Catalyst Market segmentation provides a detailed framework for understanding market dynamics based on product type, application, and geography. Segmentation by Product Type differentiates between Palladium Carbon Catalysts (Pd/C) and Platinum Carbon Catalysts (Pt/C), reflecting their distinct reactivity profiles and cost structures. The segmentation by Application highlights the crucial role these materials play across diverse high-growth sectors, primarily including pharmaceuticals, petrochemicals, agrochemicals, and environmental catalysis. This structured analysis is essential for market participants to tailor their investment strategies, focusing on segments where technological superiority and supply chain optimization can yield the highest competitive advantage and profitability, especially given the high fixed costs associated with PGM usage.

- By Product Type

- Palladium Carbon Catalyst (Pd/C)

- Platinum Carbon Catalyst (Pt/C)

- By Application

- Pharmaceutical Synthesis (API Production, Intermediate Synthesis)

- Petrochemical and Refining (Purification, Hydrogenation of Aromatics)

- Agrochemical Manufacturing

- Fine Chemicals and Specialty Chemicals

- Environmental Catalysis (Water Treatment, Air Purification)

- New Energy (Fuel Cells, Hydrogen Production)

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (South Africa, GCC Countries, Rest of MEA)

Value Chain Analysis For Platinum and Palladium Carbon Catalyst Market

The value chain for Platinum and Palladium Carbon Catalysts begins with the highly specialized and concentrated sourcing of Platinum Group Metals (PGMs). Upstream analysis involves the mining and refining of PGMs, dominated by a few global players, which significantly impacts raw material costs and supply stability. Following PGM refinement, specialized chemical manufacturers undertake the critical step of catalyst preparation, involving the precise deposition of PGM nanoparticles onto carbon supports (activated carbon, carbon nanotubes, or graphene). This manufacturing phase demands high levels of technical expertise to control particle morphology and dispersion, which directly determines the final catalyst efficiency and longevity, acting as a crucial value-add step in the chain. Quality assurance and rigorous testing are integral before distribution.

The distribution channel involves a mix of direct and indirect sales models. Direct sales are common for large-volume purchases by major petrochemical corporations or multi-national pharmaceutical giants, where customized specifications and technical support are paramount. Indirect channels utilize specialized chemical distributors and agents, particularly in fragmented markets like fine chemicals and smaller contract manufacturing organizations (CMOs). These intermediaries manage inventory, logistics, and localized regulatory compliance. The effective management of the logistics, especially concerning cross-border transfer of high-value PGMs and finished catalysts, is a key consideration within the distribution segment, requiring secure and compliant transport solutions to mitigate theft and regulatory hurdles.

Downstream analysis focuses on the end-user industries, primarily chemical synthesis, pharmaceuticals, and energy. The pharmaceutical industry is the largest consumer, valuing selectivity and purity above cost, justifying the high price of these catalysts. Petrochemical and refining customers prioritize large-scale availability and consistent performance in demanding industrial environments. Critically, the value chain extends beyond product consumption to include end-of-life management: catalyst users often sell spent catalysts back to specialized recyclers (part of the PGM supply loop) to recover the valuable metals, thus creating a circular economy segment that mitigates primary PGM dependency and adds a layer of economic efficiency to the overall value chain management for large industrial consumers.

Platinum and Palladium Carbon Catalyst Market Potential Customers

Potential customers for Platinum and Palladium Carbon Catalysts are predominantly large-scale industrial consumers and specialized chemical manufacturers whose core processes rely on highly selective catalytic hydrogenation, oxidation, and coupling reactions. The primary end-users are concentrated within the pharmaceutical sector, including major drug manufacturers and Contract Development and Manufacturing Organizations (CDMOs), which utilize these catalysts extensively for synthesizing Active Pharmaceutical Ingredients (APIs) and critical drug intermediates, demanding extremely high purity standards. The robust demand from the generic drug sector, particularly in Asia, contributes significantly to the customer base, seeking cost-effective, high-throughput catalytic solutions for mass production.

Beyond pharmaceuticals, the petrochemical industry represents a massive segment, utilizing Pd/C and Pt/C for crucial purification steps, such as removing trace impurities (e.g., acetylenes) from olefins and deep hydrogenation processes required for fuel upgrading and specialty polymer monomer production. The agrochemical sector also constitutes a vital customer base, relying on these catalysts for synthesizing complex intermediates required for pesticides, herbicides, and fertilizer components. These industrial consumers often require customized catalyst formulations designed to withstand severe operating conditions and maximize operational uptime, prioritizing product reliability and technical support alongside competitive pricing.

Emerging customers include companies heavily invested in the sustainable energy transition, specifically manufacturers of Proton Exchange Membrane (PEM) fuel cells and developers of hydrogen production technologies (e.g., methanol reforming). These clients demand ultra-high-performance platinum catalysts with specific nanostructures optimized for electrochemical reactions. Furthermore, environmental technology firms utilizing catalytic systems for water purification (e.g., removal of nitrates or chlorinated hydrocarbons) and air pollution control are increasingly important potential customers, driven by evolving global sustainability mandates and the need for durable, selective purification media capable of operating efficiently across variable pollutant concentrations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Matthey, BASF SE, Evonik Industries AG, Clariant AG, Umicore, Heraeus Group, Alfa Aesar (Thermo Fisher Scientific), W. R. Grace & Co., QuantumSphere Inc., American Elements, Vineeth Chemicals, Shanxi Catalyst Co., Ltd., Axens, Reaxa Ltd., PGM Chemicals, TCI Chemicals (India) Pvt. Ltd., Nanjing Hanru Science and Technology Co., Ltd., GFS Chemicals, Strem Chemicals, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Platinum and Palladium Carbon Catalyst Market Key Technology Landscape

The technology landscape for Platinum and Palladium Carbon Catalysts is rapidly evolving, driven by the imperative to reduce PGM usage while maintaining or increasing catalytic activity and selectivity. A core technological focus is on advanced deposition methods, moving beyond traditional impregnation techniques toward sophisticated approaches like colloidal synthesis and atomic layer deposition (ALD). ALD allows for precise, atomic-level control over the size and morphology of the PGM nanoparticles, ensuring uniform dispersion and maximizing the number of accessible active sites. This precision is crucial for developing "single-atom catalysts" (SACs) or catalysts with ultra-low metal loading, a frontier technology promising revolutionary efficiency gains and drastic reductions in raw material costs, thereby addressing the market's primary restraint regarding PGM price volatility.

Another significant technological advancement involves optimizing the carbon support material itself. While traditional activated carbon remains prevalent, research and commercialization efforts are increasingly directed toward utilizing high-performance carbon nanomaterials such as carbon nanotubes (CNTs), graphene, and porous carbon frameworks (PCFs). These advanced supports offer superior surface area, enhanced electronic interactions with the PGM particles, and better thermal stability, crucial for demanding high-temperature or high-pressure applications common in petrochemical refining and continuous flow reactors. Customizing the support material allows manufacturers to tune the catalyst’s electronic properties and surface chemistry, optimizing it for specific reaction types, such as improving resistance to coking or facilitating selective oxidation over hydrogenation.

Furthermore, the focus on recycling and regeneration technologies represents a critical part of the technology landscape. Innovations in leaching processes and hydrometallurgical recovery are enhancing the efficiency of extracting PGMs from spent carbon catalysts, pushing recovery rates higher and making the circular economy model more economically viable. On the utilization front, the implementation of microreactor technology and continuous flow chemistry is transforming how these catalysts are used, shifting from batch processing to more efficient, safer, and highly controllable continuous processes. These flow reactors require robust, pelletized or structured carbon catalysts that offer minimal pressure drop and high mechanical integrity, fueling technological development in catalyst formulation and physical structuring (e.g., monoliths or foams) tailored for intense operating conditions.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, driven by massive investments in chemical and pharmaceutical manufacturing, particularly in China and India. The region benefits from lower manufacturing costs and rapidly expanding capacity for generic drug production, demanding high volumes of Pd/C catalysts. Furthermore, significant government backing for renewable energy infrastructure, especially in South Korea and Japan regarding fuel cell technology, is accelerating the demand for Pt/C catalysts. Environmental regulations, though historically less stringent, are rapidly tightening, creating new demand for environmental purification catalysts.

- North America: North America holds a substantial market share, characterized by high R&D intensity, strict environmental standards, and a focus on specialized, high-value catalyst applications. The demand is heavily concentrated in the high-purity pharmaceutical sector and the pioneering development of hydrogen fuel cell vehicles and stationary power generation. Technological leadership in advanced material science and catalyst engineering drives the adoption of premium, specialized catalysts with superior longevity and lower PGM loading.

- Europe: Europe is a mature but highly innovative market, propelled by rigorous environmental legislation (e.g., REACH regulations and EU Green Deal initiatives) and strong emphasis on sustainability and circular economy principles. Key drivers include the mature fine chemical industry and substantial investment in hydrogen mobility and green ammonia production. The region exhibits high demand for advanced recycling technologies and catalysts optimized for green chemistry processes, focusing on reducing chemical waste and energy consumption.

- Latin America: This region presents moderate growth, largely linked to its petrochemical refining sector and increasing self-sufficiency in agrochemical production, particularly in Brazil and Argentina. Market growth is sensitive to commodity price fluctuations and relies on imports of advanced catalyst formulations. Opportunities exist through foreign direct investment aimed at modernizing aging industrial infrastructure and improving local refining capabilities.

- Middle East and Africa (MEA): Growth in MEA is primarily dictated by large-scale petrochemical projects, particularly in the GCC countries, focusing on feedstock purification and specialized chemical production. South Africa plays a dual role, being both a major global source for PGMs and an emerging market for localized catalyst applications. The demand centers on bulk catalysts for oil and gas processing, but the push for diversification is creating niches in specialty chemicals and localized energy projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Platinum and Palladium Carbon Catalyst Market.- Johnson Matthey

- BASF SE

- Evonik Industries AG

- Clariant AG

- Umicore

- Heraeus Group

- Alfa Aesar (Thermo Fisher Scientific)

- W. R. Grace & Co.

- QuantumSphere Inc.

- American Elements

- Vineeth Chemicals

- Shanxi Catalyst Co., Ltd.

- Axens

- Reaxa Ltd.

- PGM Chemicals

- TCI Chemicals (India) Pvt. Ltd.

- Nanjing Hanru Science and Technology Co., Ltd.

- GFS Chemicals

- Strem Chemicals, Inc.

- Engelhard Corporation (Legacy, now part of BASF)

Frequently Asked Questions

Analyze common user questions about the Platinum and Palladium Carbon Catalyst market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Palladium Carbon (Pd/C) catalysts?

Pd/C catalysts are primarily used in organic synthesis, notably for hydrogenation, dehydrogenation, reductive amination, and the synthesis of Active Pharmaceutical Ingredients (APIs) and fine chemicals due to their high selectivity and versatility.

How does the high cost of Platinum Group Metals (PGMs) impact market growth?

The volatility and high cost of PGMs (Platinum and Palladium) restrain market growth by increasing the final product price. This drives research toward developing low-PGM loading catalysts, single-atom catalysts, and improving catalyst recycling efficiency to manage input costs.

Which region currently dominates the Platinum and Palladium Carbon Catalyst Market?

The Asia Pacific (APAC) region currently dominates the market, primarily driven by the rapid expansion of the pharmaceutical and specialty chemical manufacturing sectors in countries like China and India, alongside significant investments in green energy technologies.

What technological innovations are driving catalyst efficiency?

Key innovations include Atomic Layer Deposition (ALD) for precise nanoparticle control, the use of advanced carbon supports like carbon nanotubes and graphene, and the development of Single-Atom Catalysts (SACs) to maximize PGM utilization and catalytic activity.

How are these catalysts used in the hydrogen economy?

Platinum on Carbon (Pt/C) catalysts are essential components in the hydrogen economy, primarily serving as the electrode catalysts in Proton Exchange Membrane (PEM) fuel cells, facilitating the electrochemical reaction that generates electricity from hydrogen.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager