Platinum Crucible Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432000 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Platinum Crucible Market Size

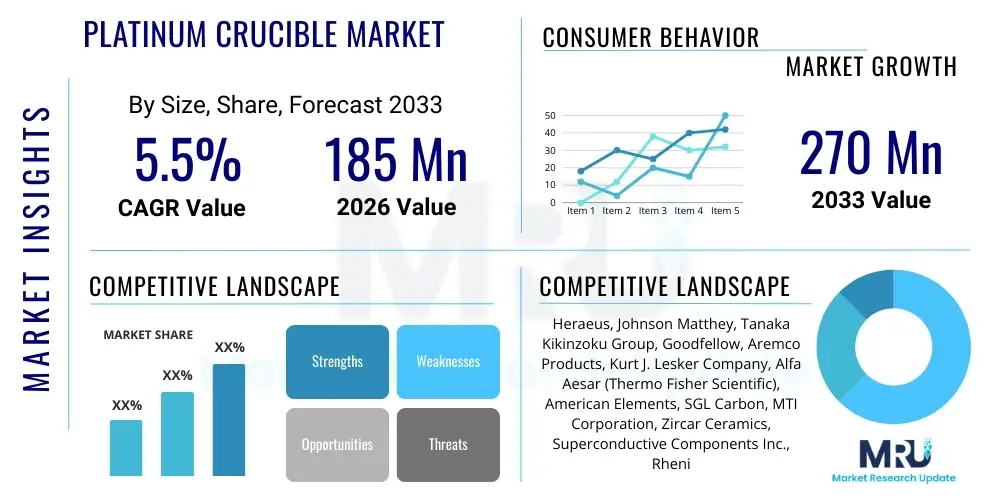

The Platinum Crucible Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at $185 Million USD in 2026 and is projected to reach $270 Million USD by the end of the forecast period in 2033. This growth trajectory is primarily fueled by the sustained demand for high-purity chemical analysis vessels within critical scientific research sectors, particularly material science and geochemistry, where standard materials cannot withstand extreme thermal or corrosive environments. Furthermore, the expansion of high-end manufacturing, such as specialized glass production and single-crystal growth utilized in advanced electronics, mandates the use of platinum crucibles due to their superior resistance to contamination and high melting point.

The valuation of the market is heavily influenced by the volatile price dynamics of platinum group metals (PGMs), which constitute the primary raw material cost. While technological advancements, such as the introduction of specialized platinum alloys (e.g., Pt/Rh, Pt/Au) offering improved rigidity, reduced material transfer, and prolonged service life, contribute to market value, the underlying demand is fundamentally inelastic. Users prioritize reliability and purity, making substitution challenging in specialized analytical and production processes. Investment in advanced characterization laboratories across developing economies further solidifies the steady growth rate, ensuring long-term consumption patterns remain robust despite high initial acquisition costs.

Platinum Crucible Market introduction

The Platinum Crucible Market encompasses the manufacturing, distribution, and utilization of vessels made primarily of high-purity platinum or its specialized alloys, designed for applications requiring exceptional chemical inertness and resistance to extreme temperatures, often exceeding 1500°C. Platinum crucibles are indispensable tools in quantitative and qualitative chemical analysis, enabling sample preparation through processes like high-temperature fusion, ashing, and gravimetric analysis without introducing contamination. These products are characterized by superior resistance to most mineral acids and molten salts, crucial factors distinguishing them from conventional ceramic or refractory metal alternatives in stringent laboratory and industrial environments.

Major applications of platinum crucibles span diverse high-technology sectors. In research, they are crucial for synthesizing novel materials and conducting geological sample analysis. Industrially, they are vital components in the production of specialized optical fibers, high-pindex glasses, and single crystals (such as sapphire) used in advanced laser systems and semiconductor substrates. The inherent benefits of platinum crucibles, including minimal sample loss due to non-wetting properties, ease of cleaning, and extended operational lifecycles, drive their adoption across high-value scientific and manufacturing processes. Key driving factors include increasing global investment in material science research and the continuous technological advancements in fields requiring ultra-pure production environments, particularly aerospace, defense, and high-performance electronics.

Platinum Crucible Market Executive Summary

The Platinum Crucible Market is characterized by stable, incremental growth, underpinned by non-discretionary demand from core scientific and high-technology manufacturing sectors. Business trends highlight a consolidation among specialized PGM fabricators who focus on value-added services such as certified purity levels, custom alloying, and recycling programs to manage raw material volatility. The market structure remains oligopolistic, dominated by a few major players with deep expertise in PGM refining and manufacturing processes. Strategic emphasis is shifting towards optimizing crucible lifespan through advanced manufacturing techniques, including grain stabilization and precision cold working, thereby providing long-term value to end-users and mitigating the impact of high material cost variability.

Regional trends indicate that North America and Europe maintain dominance, primarily due to established research infrastructure, stringent quality control standards in chemical analysis, and significant investment in aerospace and high-tech defense sectors that utilize advanced materials synthesized in platinum vessels. However, the Asia Pacific region, particularly China and South Korea, is experiencing the fastest growth, fueled by massive government investment in semiconductor fabrication, advanced materials R&D, and expansion of academic research facilities. Segment trends show a sustained preference for standard shape crucibles in analytical laboratories, while the specialized Pt/Rh alloy segment witnesses heightened growth due to its superior mechanical strength and reduced high-temperature creep required in industrial applications like continuous optical fiber drawing.

AI Impact Analysis on Platinum Crucible Market

User inquiries regarding AI's influence often focus on how automation and predictive modeling might affect the usage patterns, design, and lifespan of platinum crucibles. Key themes revolve around whether AI-driven robotic laboratories (Robo-Labs) will increase consumption through higher throughput, or if sophisticated machine learning models predicting material degradation and optimizing crucible usage parameters will decrease replacement rates. Users are particularly concerned with AI's potential role in analyzing crucible failures, designing customized alloy compositions for specific high-temperature reactions, and optimizing inventory management based on fluctuating PGM prices and projected research output. Expectations center on AI enhancing efficiency rather than fundamentally replacing the need for the physical product, focusing instead on extending the functional life and improving the reproducibility of experiments conducted within these vessels.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning to predict platinum crucible fatigue, creep deformation, and contamination build-up, thus optimizing replacement schedules and maximizing operational safety.

- Automated High-Throughput Screening: Integration of crucibles into fully automated robotic chemical analysis systems (Robo-Labs), increasing the volume of experiments requiring sample fusion or high-temperature processing.

- Material Synthesis Optimization: AI algorithms guiding the precise temperature profiles, heating rates, and atmospheric controls during crystal growth or high-purity synthesis within the crucible, improving yield and reducing thermal stress on the vessel.

- Alloy Design and Customization: Application of generative AI to simulate and propose novel platinum alloy compositions (e.g., Pt-Rh-Au-based systems) specifically tailored to resist highly aggressive fluxes or complex industrial glass melts, extending operational lifespan.

- Supply Chain and Inventory Management: AI models forecasting PGM price volatility and optimizing procurement strategies for manufacturers, simultaneously helping end-users manage inventory of costly crucibles based on real-time research demands.

- Data Analysis in Geochemistry: AI tools processing vast datasets generated from samples prepared using platinum fusion techniques, enhancing the speed and accuracy of elemental composition analysis and geological interpretation.

DRO & Impact Forces Of Platinum Crucible Market

The dynamics of the Platinum Crucible Market are governed by a unique set of drivers, restraints, and opportunities, collectively shaped by significant internal and external impact forces. A primary driver is the non-substitutable nature of platinum in high-purity, high-temperature analytical applications, particularly where contamination of trace elements is strictly prohibited. The continued expansion of global research and development expenditure in areas like advanced ceramics, photovoltaics, and specialized metallurgy provides a foundational demand base. Furthermore, stringent environmental regulations requiring precise elemental analysis (often involving fusion techniques) in environmental monitoring and quality control protocols perpetuate the need for high-reliability platinum vessels.

Restraints are heavily linked to the high capital investment required due to the inherently high cost of platinum group metals, which creates purchasing barriers for smaller laboratories or institutions with limited budgets. Additionally, the complex recycling and refining process required for damaged or contaminated crucibles adds operational complexity and cost. Price volatility in the PGM market presents a constant challenge for both manufacturers and consumers, introducing uncertainty in long-term procurement planning and pricing stability. Technological advances in alternative, less resource-intensive analytical methods, such as certain forms of spectroscopy that bypass high-temperature preparation, pose a long-term, though currently limited, substitution threat.

Opportunities for growth lie primarily in emerging application areas, specifically the exponential growth of the semiconductor industry, which relies on ultra-pure materials often processed or melted in large platinum vessels (or specialized liners) to prevent metallic contamination. The development of advanced, specialized platinum alloys that offer superior mechanical strength, reduced weight, and enhanced resistance to specific molten chemicals (e.g., borax, lithium compounds) opens new premium market segments. Impact forces, driven by global economic stability and geopolitical factors affecting PGM supply chains (often concentrated geographically), significantly influence manufacturing costs and availability, dictating the overall market velocity and penetration of new product lines. The mandatory PGM recycling loop also acts as a critical impact force, ensuring sustainable material utilization but requiring specialized infrastructure and expertise.

Segmentation Analysis

The Platinum Crucible Market segmentation is critical for understanding the varied demand profiles across different end-user industries, reflecting differences in required purity, dimensional specifications, and application severity. Segmentation by type typically differentiates between standard laboratory formats (e.g., cylindrical, low form) and highly customized industrial inserts. Segmentation by alloy composition highlights the functional trade-offs between pure platinum (offering maximum chemical inertness) and alloys incorporating rhodium or gold (providing enhanced mechanical stability and reduced volatilization at extremely high temperatures). This structural analysis reveals that the greatest revenue potential often resides in the highly specialized and custom-designed crucibles utilized in industrial melting and continuous production lines, rather than high-volume, standardized laboratory products.

The key functional segments include crucibles used for analytical fusion (ashing, gravimetry), which demand high purity and consistency, and those used for large-scale material synthesis (crystal growth, specialized glass melting), which require robust mechanical properties and dimensional stability under continuous thermal cycling. End-user industries—ranging from academic research and metallurgy to advanced electronics manufacturing—dictate both the volume and the technical specification requirements. For instance, the semiconductor industry requires large, proprietary platinum liners with exceptional thermal shock resistance, whereas a geochemistry lab typically uses smaller, standard-shape pure platinum crucibles for rock sample dissolution. Understanding these usage patterns is essential for market players to prioritize manufacturing capabilities and strategic stocking of raw materials.

- By Type:

- Standard Shape (Low Form/Cylindrical)

- Tall Form Cruicibles

- Micro and Semi-Micro Cruicibles

- Lids and Covers

- Custom Industrial Liners/Inserts

- By Purity and Alloy:

- Pure Platinum (99.95% minimum)

- Platinum/Rhodium Alloys (e.g., 5%, 10%, 20% Rhodium)

- Platinum/Gold Alloys (e.g., 5% Gold, non-wetting applications)

- Dispersion-Strengthened Platinum (DS Platinum)

- By Application:

- Ashing and Fusion Sample Preparation (Geochemistry, Mining)

- Gravimetric Analysis

- High-Temperature Material Synthesis

- Single Crystal Growth (Sapphire, Optoelectronics)

- Specialized Glass and Fiber Optic Production

- By End-User:

- R&D Laboratories and Academic Institutions

- Metallurgy and Mining Industries

- Glass and Ceramics Manufacturing

- Semiconductor and Electronics Industry

- Precious Metal Refiners

Value Chain Analysis For Platinum Crucible Market

The value chain for the Platinum Crucible Market begins upstream with the mining and refining of Platinum Group Metals (PGMs), which is characterized by high geographical concentration (South Africa, Russia) and complex extraction processes. The critical upstream analysis involves securing long-term, stable access to high-purity platinum sponge or granules, demanding robust relationships with primary PGM refiners. Specialized PGM manufacturers then employ advanced fabrication techniques, including powder metallurgy, rolling, deep drawing, and precision welding, often operating under strict ISO 9001 and high-purity standards. The initial material cost accounts for the vast majority of the final product price, meaning efficiency in recycling and minimizing manufacturing waste are paramount to profitability throughout the chain.

The downstream segment involves direct and indirect distribution channels tailored to the end-user profile. Direct sales are predominant for large industrial customers (e.g., glass manufacturers, large crystal growers) requiring custom dimensions, proprietary alloys, and specialized consulting services regarding usage parameters. Indirect distribution, leveraging specialized laboratory equipment distributors and scientific supply houses, serves the fragmented R&D and academic sectors, providing standardized catalogue items. Effective inventory management of high-value stock and provision of comprehensive recycling services form the critical link between manufacturing and end-user deployment.

The distribution channel often involves highly specialized logistics due to the high monetary value of the product, requiring insured, secure transport. Post-sale services, particularly the buyback and refining of spent crucibles, are integrated into the value chain as a critical component, enabling manufacturers to recover valuable platinum content. This circular economy model is essential for mitigating raw material costs and maintaining competitive pricing, differentiating specialized PGM fabricators from generic laboratory suppliers. The efficiency of this closed-loop recycling system profoundly impacts the sustainability and resilience of the entire market structure.

Platinum Crucible Market Potential Customers

Potential customers for platinum crucibles are highly specialized entities requiring exceptional thermal stability and zero-contamination environments in their processes. The largest segment of end-users consists of major research laboratories, both governmental and private, involved in fundamental material science, chemical analysis, and geological sampling. Geochemistry laboratories, particularly those focused on mineral exploration and high-precision trace element analysis, are consistent high-volume buyers due to their reliance on fire assay and fusion techniques for sample preparation. These customers prioritize guaranteed purity levels and certified traceability of the crucible material.

A secondary, high-value customer base is found within specialized industrial sectors. This includes manufacturers of high-performance optical glass, where platinum liners are essential to maintain the homogeneity and purity of molten glass used in high-end telecommunications and aerospace optics. Similarly, the producers of synthetic single crystals, such as sapphire or specialized oxides for semiconductor applications, rely on large, custom-fabricated platinum or platinum/rhodium alloy vessels for crystal growth processes requiring continuous, precise temperature control over extended periods. These industrial users demand exceptional mechanical integrity and highly customized dimensions, often placing long-term, high-value contracts with PGM fabricators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million USD |

| Market Forecast in 2033 | $270 Million USD |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heraeus, Johnson Matthey, Tanaka Kikinzoku Group, Goodfellow, Aremco Products, Kurt J. Lesker Company, Alfa Aesar (Thermo Fisher Scientific), American Elements, SGL Carbon, MTI Corporation, Zircar Ceramics, Superconductive Components Inc., Rhenium Alloys Inc., Xiamen Jiaxing Refractory Co. Ltd., Luoyang Kekai Advanced Material Technology Co. Ltd., ESPI Metals, Midwest Tungsten Service. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Platinum Crucible Market Key Technology Landscape

The technology landscape for the Platinum Crucible Market is defined by manufacturing excellence focused on maximizing purity, structural integrity, and thermal endurance. Key technologies revolve around advanced metallurgical processing, primarily the methods used to produce high-density, ultra-fine-grained platinum structures that minimize creep and deformation at extreme operating temperatures (often above 1300°C). Techniques like high-frequency induction melting under vacuum or inert atmosphere ensure the removal of volatile impurities, achieving the mandatory 99.95% purity levels or higher demanded by high-specification applications. Furthermore, specialized cold working and annealing cycles are crucial for imparting superior mechanical strength and preventing premature failure caused by grain growth during thermal cycling.

A significant technological advancement involves the development and manufacturing of specialized platinum alloys, particularly those containing rhodium (Pt/Rh) or gold (Pt/Au). Rhodium increases the high-temperature tensile strength and dramatically improves resistance to creep, making Pt/Rh crucibles essential for industrial processes like continuous glass drawing where sustained mechanical stress is applied at elevated temperatures. Conversely, Pt/Au alloys are favored in applications involving highly corrosive molten fluxes (e.g., lithium borate fusion) due to the reduced tendency of the melt to wet and adhere to the crucible surface, minimizing sample loss and simplifying cleaning procedures. Manufacturers leverage advanced electron beam welding and precise deep drawing processes to achieve seamless construction and tight dimensional tolerances, crucial for standardized laboratory use and industrial automation.

Beyond material science, the technology landscape includes sophisticated non-destructive testing (NDT) methods, such as ultrasonic testing and detailed microscopic analysis, used to verify the structural integrity and uniformity of the fabricated crucibles before deployment. Furthermore, significant investment is placed in efficient PGM recycling technologies, utilizing hydrometallurgical or pyrometallurgical routes to recover platinum from spent crucibles with minimal loss. This technological focus on circularity is not just an environmental mandate but a critical economic factor, stabilizing the cost structure against volatile PGM commodity pricing. Future technological innovations are expected in additive manufacturing (3D printing) of complex, lattice-structured crucible supports to improve heat distribution and reduce overall platinum mass while maintaining performance characteristics.

Regional Highlights

- North America: This region holds a significant market share due to the presence of world-leading governmental research institutions, high R&D spending in the defense and aerospace sectors, and a strong regulatory environment driving demand for high-accuracy chemical analysis (e.g., EPA standards). The demand is concentrated around specialized manufacturing hubs and major university research centers requiring Pt/Rh alloys for advanced material synthesis and high-purity Pt for routine geochemistry.

- Europe: Europe is a mature market characterized by long-standing expertise in PGM fabrication (e.g., Germany, UK). Key drivers include the robust automotive sector requiring specialized materials testing, high investment in pharmaceutical research utilizing gravimetric analysis, and the demanding aerospace industry. Strict European recycling mandates also drive the technological adoption of efficient closed-loop platinum utilization programs among regional manufacturers.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven primarily by massive capital investment in the semiconductor and advanced display panel manufacturing sectors, particularly in South Korea, Taiwan, and China. These industries require large quantities of specialized, custom platinum crucibles and liners for ultra-pure melting processes and crystal growth. Increasing academic research funding and infrastructure development across India and Southeast Asia further bolster demand for standard laboratory formats.

- Latin America: Market penetration here is closely tied to the regional natural resource sectors, specifically mining and metallurgy. Platinum crucibles are essential for fire assay processes used to determine precious metal concentrations in ore samples. While smaller in overall size, demand is highly specialized and inelastic, linked directly to global commodity price cycles and exploration activity.

- Middle East and Africa (MEA): Growth in the MEA region is moderate but focused. Demand is primarily generated by newly established governmental and academic research centers focused on energy and material science, often utilizing imported expertise and equipment. South Africa remains a crucial segment not as a consumer but as the primary source for the upstream platinum raw material, fundamentally influencing global market stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Platinum Crucible Market, analyzing their product offerings, geographic presence, strategic initiatives, and recycling capabilities.- Heraeus Group

- Johnson Matthey PLC

- Tanaka Kikinzoku Group

- Goodfellow Corporation

- Aremco Products Inc.

- Kurt J. Lesker Company

- Alfa Aesar (Thermo Fisher Scientific)

- American Elements

- SGL Carbon SE

- MTI Corporation

- Zircar Ceramics Inc.

- Superconductive Components Inc.

- Rhenium Alloys Inc.

- Xiamen Jiaxing Refractory Co. Ltd.

- Luoyang Kekai Advanced Material Technology Co. Ltd.

- ESPI Metals

- Midwest Tungsten Service

- Metalor Technologies SA

- Materion Corporation

- GfE (Gesellschaft für Elektrometallurgie)

Frequently Asked Questions

Analyze common user questions about the Platinum Crucible market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for platinum crucibles?

The primary drivers include the non-substitutable chemical inertness and extreme temperature resistance of platinum, essential for zero-contamination sample preparation in geochemistry and high-purity material synthesis for advanced industries like semiconductors, glass manufacturing, and specialized R&D.

How does the volatile price of platinum affect the overall market?

Platinum price volatility significantly impacts the initial capital cost for end-users and introduces uncertainty in manufacturers' pricing and inventory planning. However, demand remains relatively inelastic due to the critical nature of the applications, though high costs necessitate robust PGM recycling programs to mitigate financial risk.

Which specialized platinum alloys are most commonly used in industrial applications?

Platinum/Rhodium (Pt/Rh) alloys, particularly those containing 5% to 10% Rhodium, are preferred in industrial settings. Rhodium inclusion enhances mechanical strength, high-temperature creep resistance, and service life, making them ideal for continuous operations like fiber optic drawing or large-scale crystal growth apparatus.

What is the typical lifespan of a platinum crucible and how is it maximized?

The lifespan is highly variable, ranging from months to several years, depending on operating temperature, chemical flux aggressiveness, and frequency of thermal cycling. Lifespan is maximized by using specialized alloys (like DS Platinum), strictly adhering to recommended heating/cooling rates, and implementing continuous cleaning and minor repair protocols to prevent structural deformation and contamination.

Which geographical region exhibits the fastest growth potential for platinum crucible consumption?

The Asia Pacific (APAC) region, driven by massive governmental and private investment in advanced electronics, semiconductor manufacturing (wafer fabrication), and high-tech material R&D, shows the highest Compound Annual Growth Rate potential during the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager