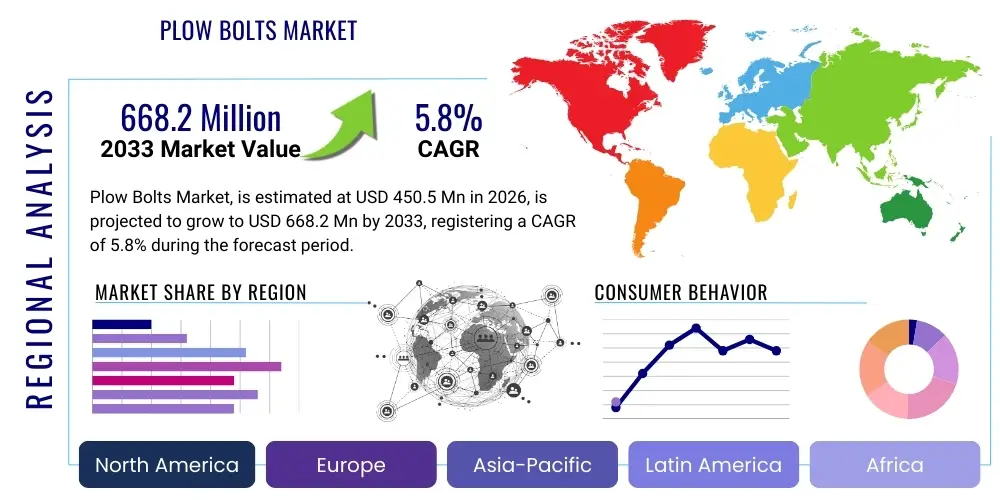

Plow Bolts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431793 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Plow Bolts Market Size

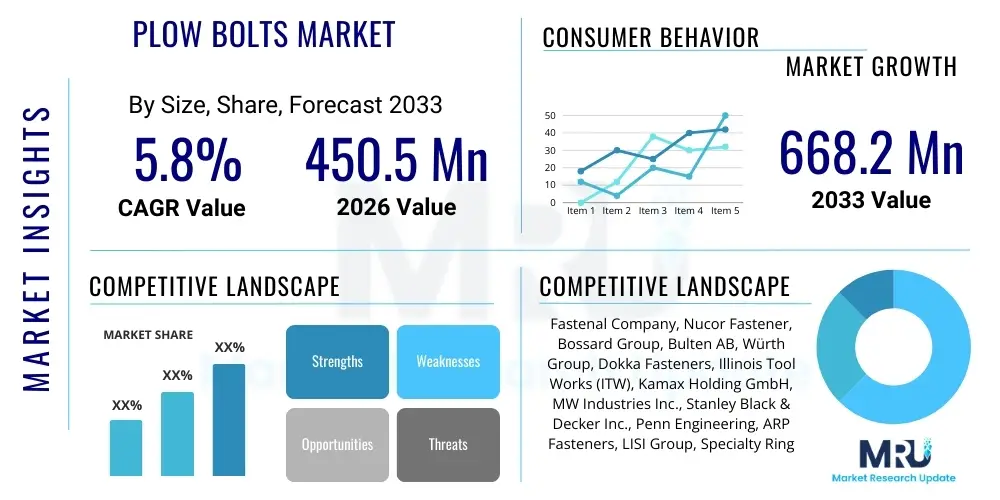

The Plow Bolts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 668.2 Million by the end of the forecast period in 2033.

Plow Bolts Market introduction

The Plow Bolts Market encompasses the manufacturing, distribution, and utilization of specialized fasteners designed explicitly for heavy-duty applications, particularly in connecting wear parts—such as cutting edges, moldboards, and blades—to plows, bulldozers, graders, and other earthmoving and agricultural equipment. These fasteners are characterized by their countersunk head design, which allows them to sit flush with the surface of the implemented component, minimizing protrusion and wear resistance against abrasive materials like soil, rock, and concrete. This unique design, often featuring a square or elliptical neck beneath the head, ensures the bolt resists rotation when torque is applied, thereby maintaining joint integrity under extreme stress and vibration prevalent in demanding operational environments. The market's stability is intrinsically linked to infrastructure development, mining activities, and the mechanization rate within the global agricultural sector, making it a critical, albeit often overlooked, segment within the industrial fastener industry.

Plow bolts, fabricated typically from high-strength alloy steels, often require specific heat treatment processes to meet demanding tensile strength and hardness requirements dictated by ASTM or equivalent international standards. Common materials include Grade 5, Grade 8, or specialized high-tensile steel to ensure longevity and resistance to shearing forces. Major applications span several core industries: construction (for connecting bulldozer blades and excavator bucket teeth), agriculture (for plowshares and tillage equipment), mining (for heavy-duty scraper and grader edges), and snow removal (for attaching snowplow cutting edges). The reliability of these bolts is paramount; a failure in a plow bolt during operation can lead to catastrophic equipment downtime, costly repairs, and significant project delays. Therefore, product benefits revolve around enhanced durability, superior wear resistance, reduced maintenance cycles, and ultimately, maximized operational efficiency for end-users relying on heavy machinery.

The primary driving factors sustaining the growth of the Plow Bolts Market include rapid urbanization and infrastructure expansion globally, particularly in emerging economies of the Asia-Pacific and Latin American regions. Large-scale government investments in road construction, dam projects, and utility installations necessitate continuous use and replacement of wear parts and, consequently, high-strength fasteners. Furthermore, the global need for increased food production is spurring mechanization in agriculture, driving demand for robust and reliable tillage equipment. Technological advancements in metallurgy and surface treatments, such as specialized coatings (e.g., zinc plating, hot-dip galvanizing) to prevent corrosion, are also expanding the application scope and lifespan of plow bolts, making them more attractive to sectors operating in harsh, moisture-rich, or highly corrosive environments.

Plow Bolts Market Executive Summary

The Plow Bolts Market is currently navigating a period of moderate but stable growth, primarily underpinned by resilient demand from global construction and agricultural sectors, despite localized economic slowdowns. Key business trends indicate a strong focus on premiumization, driven by end-users seeking extended operational life and reduced frequency of replacement. Manufacturers are responding by developing bolts made from advanced, proprietary steel alloys and implementing stricter quality controls to meet higher performance benchmarks required by modern, powerful machinery. There is also a noticeable trend towards supply chain diversification, as major procurement managers seek to mitigate risks associated with reliance on single geographical manufacturing hubs, leading to increased investment in production capabilities across North America and Europe, supplementing the established Asian dominance in high-volume, standard grade products. Sustainability is beginning to influence purchasing decisions, with a minor shift towards fasteners manufactured using lower-emission processes, although performance remains the overriding criterion.

Regionally, Asia Pacific (APAC) continues to dominate the market share, driven by massive infrastructure development programs in China, India, and Southeast Asian nations. The high volume of construction and mining activities ensures consistent replacement demand for wear part fasteners. North America and Europe, while exhibiting slower volume growth, contribute significantly to market value due to the higher adoption rates of premium, specialized, and coated plow bolts, especially within the mechanized farming and large-scale commercial snow removal segments. Latin America and the Middle East & Africa (MEA) are emerging rapidly, fueled by commodity extraction industries (mining in Chile, Peru, South Africa) and significant investment in agricultural expansion, representing lucrative future growth avenues for international fastener suppliers focusing on localized distribution networks and competitive pricing strategies.

Segment trends highlight the dominance of high-strength alloy steel bolts, which account for the largest share by material type, reflecting the industry's need for maximum durability. In terms of application, the construction and earthmoving segment remains the primary revenue generator, directly correlated with global urban expansion. However, the agricultural segment is showing accelerated growth due to increasing tractor horsepower and the subsequent requirement for stronger fasteners to handle deeper tillage and heavier loads. Furthermore, within the size segmentation, larger diameter plow bolts (exceeding 3/4 inch or M20) are seeing disproportionate growth, indicative of the trend towards larger, more powerful heavy equipment that demands superior fastening performance and structural integrity, pushing manufacturers to innovate in heat treatment and threading precision for these larger components.

AI Impact Analysis on Plow Bolts Market

Common user questions regarding AI's impact on the Plow Bolts Market typically revolve around operational efficiency, manufacturing automation, and supply chain predictability rather than the product itself. Users frequently inquire: "How can AI optimize the manufacturing process of high-strength fasteners?", "Will predictive maintenance enabled by AI reduce the demand for replacement bolts?", and "Can AI improve raw material procurement and pricing stability?" The consensus among industry stakeholders and users suggests that AI's primary influence will not be product innovation but process enhancement. Key themes include leveraging machine learning for defect detection during high-speed forging and heat treatment, utilizing predictive analytics to forecast demand based on regional infrastructure cycles, and optimizing complex logistics paths for distributing these heavy, standardized components globally. While AI might lead to slightly longer wear part lifecycles through optimized equipment operation (reducing shear stress on bolts), the continuous growth in infrastructure projects ensures that replacement demand remains robust, focusing AI's efforts primarily on increasing manufacturing throughput and quality consistency.

- AI-driven Predictive Maintenance: Optimizing equipment usage patterns to minimize sudden fastener failure, marginally extending service life but requiring real-time stress monitoring, which increases data collection complexity.

- Manufacturing Optimization: Implementation of Machine Learning (ML) algorithms in forging and heat treatment lines to precisely control temperature cycles, minimizing material stress inconsistencies and improving batch-to-batch quality of high-grade alloy bolts.

- Defect Detection and Quality Control: Utilizing computer vision and AI for real-time inspection of finished bolts (thread integrity, head geometry, material surface defects), leading to near-zero defective parts reaching the end market.

- Supply Chain Resilience: Employing advanced analytics to forecast shifts in raw material (steel alloy) pricing and procurement lead times, optimizing inventory holding costs for high-volume standard bolts.

- Demand Forecasting: Using geospatial and economic data (infrastructure spending indices, agricultural output forecasts) to predict regional demand fluctuations, allowing manufacturers to adjust production capacity proactively.

DRO & Impact Forces Of Plow Bolts Market

The Plow Bolts Market is fundamentally shaped by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively dictate the market trajectory and define the Impact Forces (I) acting upon manufacturers and suppliers. The core drivers—global infrastructure spending, agricultural mechanization, and the inherent necessity for replacement parts due to extreme wear and tear—provide a strong foundation of demand stability. These drivers ensure that even during economic contraction, the underlying need to maintain existing equipment and complete essential projects continues to necessitate the procurement of high-quality, durable fasteners. Conversely, the market is restrained by the high volatility in raw material prices, particularly specialized alloy steels, which directly impacts production costs and profitability margins. Additionally, the proliferation of counterfeit or substandard products, often entering the market at significantly lower prices, poses a continuous challenge to established manufacturers who adhere to stringent quality and safety standards.

Opportunities in the market center around specialization and geographical expansion. The growing demand for specialized coatings (e.g., ceramic or enhanced polymers) to combat extreme corrosion in coastal or chemical environments presents a clear pathway for premium product development and higher margins. Geographically, untapped or rapidly industrializing regions, such as parts of Central Asia and Sub-Saharan Africa, offer high growth potential as these areas increase investment in mining and large-scale farming. Furthermore, innovation in fastening technology, such focusing on anti-loosening designs or incorporating IoT capabilities for remote monitoring of fastener stress (though nascent), could redefine the value proposition beyond simple mechanical attachment. The successful navigation of these opportunities requires significant R&D investment and robust intellectual property protection.

The impact forces influencing market dynamics are primarily driven by economic cycles and regulatory pressures. The highly competitive nature of the commodity-grade bolt segment forces constant price compression, severely impacting lower-tier manufacturers. Simultaneously, stricter global quality and safety regulations (e.g., ISO standards, specific regional construction codes) raise the barrier to entry for new players, favoring established manufacturers with proven adherence to international specifications. The threat of substitutes, while low for specific plow bolt designs, is present through alternative joining techniques (e.g., welding for permanent fixes) or superior wear part materials that extend the component lifespan, thus decreasing bolt replacement frequency. Overall, the market remains moderately attractive, characterized by consistent demand resilience but subject to significant external pressures related to input costs and quality compliance.

Segmentation Analysis

The Plow Bolts Market segmentation provides a granular view of demand patterns based on crucial parameters such as material type, application, grade, and size, reflecting the diverse requirements across various heavy-duty industries. Analyzing these segments is essential for manufacturers to tailor their production, inventory management, and marketing strategies effectively. The core material segmentation separates standard carbon steel bolts, used in lighter or less abrasive applications, from high-strength alloy steel and specialized stainless steel variants, which command premium pricing due to their enhanced mechanical properties necessary for extreme operational environments like heavy mining or deep tillage. The market is increasingly skewed towards the higher-specification segments as modern machinery generates greater forces and requires components with superior fatigue life.

Application segmentation reveals the dominance of the Construction and Earthmoving category, driven by constant global infrastructure renewal and development, which necessitates vast fleets of bulldozers, graders, and scrapers utilizing plow bolts for blade attachment. However, the Agricultural segment exhibits higher seasonal volatility but strong underlying structural growth fueled by precision farming and increasing mechanization rates globally, requiring specific corrosion-resistant and fatigue-optimized fasteners for tillage equipment. Further differentiating the market is the grading system, where high-grade fasteners (e.g., Grade 8 equivalent or higher) represent the highest value segment, reflecting uncompromising demand for safety and durability in mission-critical operations, especially in mining and large infrastructural projects.

Size segmentation, categorized primarily by diameter (both imperial and metric), dictates the specific machinery type a bolt can fasten. Larger diameters (e.g., M24 and above) are critical for heavy earthmoving equipment and large-scale mining shovels, while smaller diameters are used widely in agricultural implements and lighter construction machinery. This detailed segmentation allows stakeholders to accurately gauge market penetration potential within specific industrial sub-sectors and identify niches where specialized materials or coatings can generate superior return on investment. The complexity of these requirements necessitates that key players maintain a broad product portfolio capable of meeting the diverse mechanical and environmental challenges faced by end-users across all major application domains.

- By Material Type:

- High-Strength Alloy Steel (Dominant Segment)

- Carbon Steel

- Stainless Steel (For Corrosion Resistance)

- Specialty Coated Materials

- By Grade:

- Grade 5 (Standard Duty)

- Grade 8 (Heavy Duty)

- Metric Class 8.8

- Metric Class 10.9 (Very Heavy Duty)

- By Application:

- Construction and Earthmoving (Bulldozers, Graders, Loaders)

- Agriculture (Plows, Tillers, Harvesters)

- Mining and Quarrying (Shovels, Scrapers)

- Snow Removal and Municipal Services

- By Size (Diameter):

- Less than 1/2 inch (M12 and below)

- 1/2 inch to 3/4 inch (M16 to M20)

- Greater than 3/4 inch (M22 and above)

- By Coating Type:

- Zinc Plating

- Hot-Dip Galvanizing

- Dacromet/Geomet Coatings

Value Chain Analysis For Plow Bolts Market

The value chain for the Plow Bolts Market is characterized by several distinct stages, beginning with the highly capital-intensive upstream segment and culminating in specialized distribution channels reaching diverse end-user industries. The upstream phase primarily involves raw material procurement, dominated by the sourcing of high-quality steel alloys (e.g., boron steel, high-carbon steel) and the initial wire or bar drawing processes. Fluctuations in global steel prices, controlled by major steel mills and commodity markets, significantly influence the profitability across the entire chain. Key activities include alloying, hot rolling, and surface preparation. Manufacturers in this phase focus heavily on minimizing material wastage and achieving metallurgical specifications required for subsequent forging and heat treatment processes.

The manufacturing and midstream segment involves the transformation of raw steel into finished plow bolts through processes such as cold or hot forging, threading, and crucially, heat treatment (quenching and tempering) to achieve the specified mechanical grades (e.g., Grade 8 or Class 10.9). This stage demands precision machinery and stringent quality assurance protocols, as the performance of the final product—its tensile strength, shear resistance, and fatigue life—is determined here. Direct distribution channels involve large Original Equipment Manufacturers (OEMs) of heavy machinery (Caterpillar, Komatsu, John Deere), who purchase high volumes of custom-specified bolts directly from tier-one manufacturers for factory installation. This segment is driven by long-term contracts and strict quality certifications, offering stable, high-volume revenue.

The downstream analysis focuses on the aftermarket and replacement market, which typically accounts for a larger volume of sales and involves indirect distribution. This network relies on specialized industrial distributors, hardware wholesalers, authorized dealer networks for heavy equipment, and independent repair shops. Indirect channels are critical for reaching thousands of localized end-users—farmers, smaller construction firms, and municipal maintenance crews—who require immediate, small-batch replacements. Successful market penetration downstream requires robust inventory management, regional warehousing capabilities, and strong partnerships with channel partners capable of providing technical support and rapid fulfillment, leveraging e-commerce platforms increasingly for smaller, urgent orders.

Plow Bolts Market Potential Customers

The potential customer base for the Plow Bolts Market is diverse, anchored predominantly by the heavy-duty machinery sectors that rely on replaceable wear parts to perform essential functions in abrasive environments. The largest and most consistent buyers are Original Equipment Manufacturers (OEMs) within the construction and agricultural machinery industries. These customers require standardized, high-volume production of specific bolt configurations integrated into their machinery designs (e.g., bulldozer blades, scraper edges) and typically demand advanced logistical support and guaranteed quality certification. Their purchasing decisions are driven by long-term strategic supply agreements, price stability, and the assurance of supply chain resilience, focusing on Grade 8/Class 10.9 specifications to match the durability of their flagship equipment lines.

A second major customer segment comprises the aftermarket industrial distributors and specialized agricultural suppliers. These buyers act as intermediaries, stocking a wide variety of standardized and specialty plow bolts to service the vast network of equipment owners requiring maintenance and replacement parts. These customers value inventory breadth, competitive wholesale pricing, and the ability to fulfill just-in-time orders quickly, often favoring manufacturers who offer comprehensive product lines including various coatings (galvanized, plated) and uncommon sizes (both metric and imperial). The aftermarket segment is inherently cyclical, often peaking during spring planting seasons, summer construction booms, and winter snow removal operations.

Finally, direct large-scale end-users, particularly major mining operations (coal, iron ore, copper) and governmental infrastructure agencies (highway departments, military construction corps), represent high-value potential customers. These entities often manage vast fleets of heavy equipment and procure plow bolts in large tenders or contracts, specifically demanding specialized, often oversized, bolts with exceptional resistance to corrosion, shear stress, and impact forces typical of extreme operational depths or high-tonnage material handling. Their requirement is often dictated by performance metrics and total cost of ownership rather than initial purchase price, leading to a preference for premium, fully traceable fasteners with documented material specifications and failure analysis support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 668.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fastenal Company, Nucor Fastener, Bossard Group, Bulten AB, Würth Group, Dokka Fasteners, Illinois Tool Works (ITW), Kamax Holding GmbH, MW Industries Inc., Stanley Black & Decker Inc., Penn Engineering, ARP Fasteners, LISI Group, Specialty Ring Products, Infasco, Brighton-Best International, Aoyama Seisakusho Co. Ltd., Standard Bolt, Portland Bolt, Topy Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plow Bolts Market Key Technology Landscape

The technology landscape in the Plow Bolts Market is characterized less by radical product invention and more by continuous incremental improvements focused on material science, manufacturing precision, and surface engineering to enhance performance and durability under extreme conditions. A primary technological focus is on advanced heat treatment protocols, specifically controlled quenching and tempering cycles. Modern furnace technology utilizing vacuum or inert atmospheres allows manufacturers to achieve superior hardness and core strength uniformity, mitigating the risk of brittle fracture under high dynamic loading. The integration of specialized alloying elements, such as boron, manganese, and molybdenum, is crucial for producing high-grade fasteners (Grade 8 and above) that meet the tensile strength demands of contemporary heavy machinery, requiring precise control over the alloy composition and grain structure during the steelmaking and subsequent processing phases.

Another significant technological advancement lies in cold forging and threading techniques. Cold forging, employed increasingly for standard to mid-sized plow bolts, offers superior mechanical properties, including enhanced fatigue resistance and a smoother surface finish, compared to hot forging, which is typically reserved for very large or complex geometry fasteners. Precision rolling of threads post-forging, rather than cutting, preserves the integrity of the material's grain flow, significantly boosting the bolt's resistance to stripping and extending its fatigue life. Furthermore, automated non-destructive testing (NDT) using ultrasonic and eddy current technology is standard practice, ensuring that internal material defects, such as voids or cracks resulting from the forming process, are identified before the product leaves the factory, guaranteeing adherence to mission-critical safety standards demanded by construction and mining OEMs.

Surface technology represents a vital competitive frontier, driven by the need to protect plow bolts against severe environmental corrosion and wear. Key technologies include advanced anti-corrosion coatings like Dacromet and Geomet, which offer non-electrolytic, thin-layer protection highly resistant to salt spray and chemical exposure—a necessity for snow removal equipment and coastal infrastructure projects. Furthermore, technologies focused on hydrogen embrittlement prevention are paramount for high-strength bolts (Grade 10.9 and higher) that undergo plating processes. Manufacturers utilize sophisticated baking cycles and chemical baths to prevent hydrogen ingress, maintaining the structural integrity of these critical fasteners. The trend is moving towards multi-layer coating systems that combine sacrificial corrosion resistance with abrasion resistance, optimizing the bolt's performance in combined corrosive and abrasive environments.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market share and growth trajectory, fueled by aggressive government investments in infrastructure, urbanization projects in China, India, and Indonesia, and substantial growth in heavy-duty machinery manufacturing. The region is characterized by high volume consumption of both standard and high-grade fasteners, especially in earthmoving and mining sectors. Demand is highly responsive to commodity price cycles and regulatory changes in construction standards.

- North America: A mature, high-value market characterized by stringent quality requirements, high adoption rates of premium Grade 8 and specialized coated bolts, and significant demand driven by highly mechanized agriculture (US and Canada) and extensive snow removal operations. Aftermarket replacement demand is consistently strong, supported by robust distribution networks and adherence to specific ANSI/ASME standards.

- Europe: Exhibits steady, moderate growth, driven by stringent environmental and safety regulations necessitating the use of certified, traceable fasteners. Western Europe focuses on highly engineered, customized solutions for specialized machinery OEMs, while Eastern Europe presents growth opportunities tied to EU-funded infrastructure renewal projects and increasing agricultural efficiency demands.

- Latin America: An emerging high-growth region, strongly influenced by the performance of the commodity mining sector (Chile, Peru, Brazil) and substantial expansion in large-scale agribusiness. The demand often focuses on cost-effective yet durable solutions, with regional suppliers increasingly competing with established international players on price and logistical efficiency for bulk orders.

- Middle East and Africa (MEA): Marked by significant capital expenditure in energy infrastructure, desert construction, and urbanization projects, particularly in the GCC states. Demand is highly concentrated on fasteners resistant to extreme heat and corrosive desert environments. Africa's rising infrastructure development and burgeoning commercial farming sectors represent long-term potential, though logistical challenges remain a constraint.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plow Bolts Market.- Fastenal Company

- Nucor Fastener

- Bossard Group

- Bulten AB

- Würth Group

- Dokka Fasteners

- Illinois Tool Works (ITW)

- Kamax Holding GmbH

- MW Industries Inc.

- Stanley Black & Decker Inc.

- Penn Engineering

- ARP Fasteners

- LISI Group

- Specialty Ring Products

- Infasco

- Brighton-Best International

- Aoyama Seisakusho Co. Ltd.

- Standard Bolt

- Portland Bolt

- Topy Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the Plow Bolts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes a plow bolt from standard hex head fasteners?

Plow bolts are specifically designed for applications requiring a flush surface connection, primarily on heavy equipment wear parts. They feature a flat, countersunk head and a specialized neck (usually square or elliptical) under the head. This neck locks into a corresponding hole in the plate, preventing the bolt from rotating when the nut is tightened, crucial for maintaining integrity against abrasive forces and shear stress.

Which material grade is most commonly recommended for heavy-duty earthmoving equipment applications?

For heavy-duty earthmoving and mining applications, the most recommended and widely used specification is Grade 8 (in imperial units) or Metric Class 10.9 (or higher). These grades are manufactured from quenched and tempered alloy steel, providing significantly superior tensile strength, hardness, and fatigue resistance necessary to withstand the high impact and abrasive environments encountered by bulldozer blades and scraper edges.

How do corrosive coatings affect the performance and cost of plow bolts?

Corrosive coatings, such as hot-dip galvanizing, Dacromet, or specialized polymer finishes, significantly extend the operational life of the bolt in moisture-rich, saline, or chemical environments (like snow removal). While coatings increase the unit cost, they reduce maintenance downtime and replacement frequency. However, manufacturers must apply specific processes to high-strength bolts to mitigate the risk of hydrogen embrittlement during plating, which could compromise the bolt's mechanical integrity.

What are the primary factors driving the demand for replacement plow bolts in the agricultural sector?

Demand in the agricultural sector is primarily driven by the high operational wear experienced by tillage and planting equipment (plowshares, cultivators) as they interact directly with soil and rocks. Increased mechanization, higher horsepower tractors enabling deeper tillage, and the need for precision farming equipment contribute to continuous, seasonal replacement demand for fasteners optimized for abrasive wear and fatigue resistance.

Is the manufacturing process for plow bolts subject to strict international quality standards?

Yes, plow bolt manufacturing is subject to rigorous international standards, including specifications set by the American Society of Mechanical Engineers (ASME), the American Society for Testing and Materials (ASTM), and the International Organization for Standardization (ISO). Compliance ensures consistency in mechanical properties, thread fit, and material traceability, which is mandatory for safety-critical applications in construction and mining equipment OEMs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager