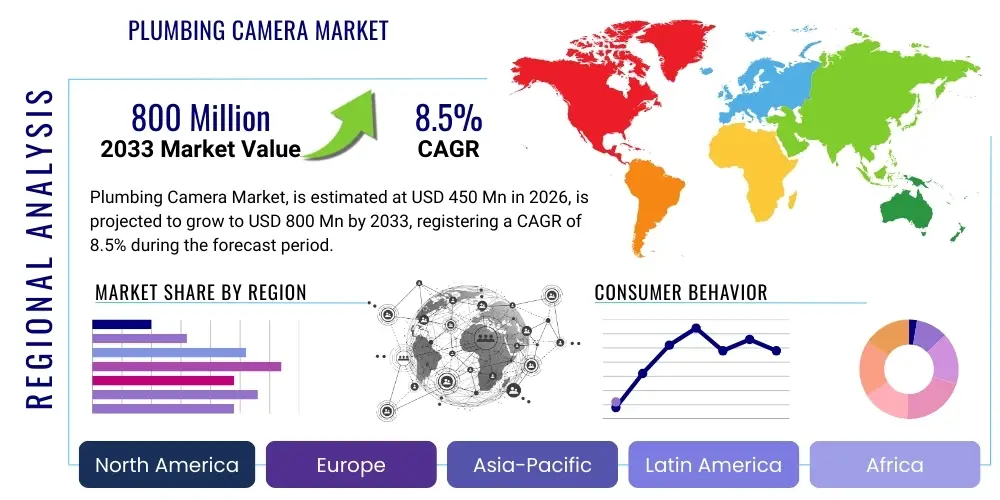

Plumbing Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438099 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Plumbing Camera Market Size

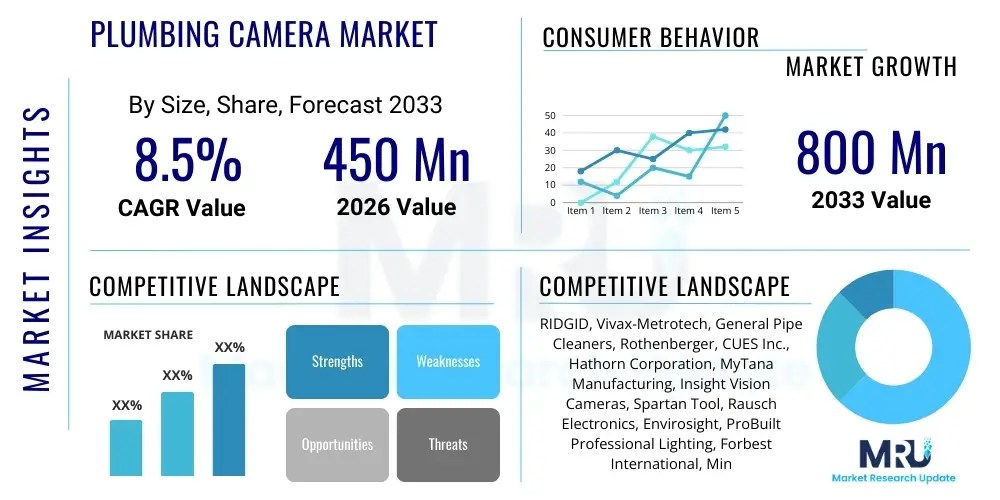

The Plumbing Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Plumbing Camera Market introduction

The Plumbing Camera Market encompasses specialized inspection tools designed for visually examining the interiors of pipelines, sewage systems, and drainage infrastructure. These systems typically consist of a high-resolution camera head mounted on a flexible push cable or robotic crawler, integrated with powerful lighting, a control unit, and a monitor for real-time viewing and recording. Products range from small, flexible micro-cameras used for residential P-traps to large, self-propelled mainline inspection crawlers utilized by municipal water authorities and industrial facilities. The core function of these devices is non-destructive testing (NDT), enabling professionals to accurately diagnose issues such as blockages, pipe corrosion, root intrusion, structural damage, and cross-bore identification without extensive excavation, thereby reducing labor costs and minimizing environmental disruption.

Major applications of plumbing cameras span across residential maintenance, commercial building infrastructure management, large-scale industrial facility inspections (including chemical and processing plants), and critical municipal water and wastewater management. In the residential segment, plumbers frequently employ these tools to locate difficult blockages or identify the cause of recurring drain issues, offering transparency to homeowners. Commercially, they are essential for mandatory inspections, insurance claims, and preventative maintenance in large structures like hospitals, hotels, and high-rise apartments, where system downtime is highly detrimental. Industrial and municipal applications, which require traversing larger diameter pipes over longer distances, drive demand for high-end, ruggedized, and often robotic systems featuring advanced localization and reporting capabilities.

Key driving factors for market growth include stringent regulatory mandates regarding infrastructure health and environmental protection, particularly in developed regions focusing on aging utility systems replacement and rehabilitation. The growing consumer preference for trenchless repair methods, which rely heavily on accurate camera diagnostics, also fuels demand. Furthermore, technological advancements, such as the incorporation of HD imaging, enhanced battery life, digital reporting software, and wireless connectivity (Wi-Fi/Bluetooth), increase the efficiency and ease of use for plumbing professionals, making these tools indispensable parts of modern maintenance and inspection protocols. The shift towards preventative inspection models rather than reactive repair is a crucial long-term growth catalyst for this specialized diagnostic equipment market.

Plumbing Camera Market Executive Summary

The global Plumbing Camera Market is experiencing robust growth driven by accelerating infrastructure renewal projects worldwide and significant technological integration that enhances diagnostic capabilities. Current business trends indicate a strong move toward professional-grade, high-definition (HD) systems that offer superior image clarity and sophisticated reporting software, enabling service providers to deliver more detailed and verifiable inspection reports. Furthermore, the convergence of plumbing cameras with other technologies, such as sonar locators and simultaneous lateral inspection (SLI) systems, allows contractors to offer comprehensive mapping and diagnostic packages. Manufacturers are focusing heavily on developing lightweight, modular, and battery-operated units, specifically catering to the needs of independent plumbing contractors who prioritize portability and rapid deployment.

Regional trends reveal that North America and Europe remain the largest and most mature markets, primarily due to aging infrastructure, high labor costs necessitating efficient NDT methods, and stringent governmental regulations mandating regular pipeline assessments. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market, propelled by rapid urbanization, massive investment in new utility network development, and increasing adoption of modern plumbing practices in countries like China and India. Latin America and the Middle East & Africa (MEA) show steady growth potential, linked to large-scale construction booms and ongoing efforts to upgrade existing water and sewer networks to meet expanding urban populations.

Segment trends underscore the dominance of the self-leveling camera segment, which provides operators with consistently upright images regardless of the camera head's orientation inside the pipe, significantly improving inspection quality. The application segment sees the municipal sector contributing the highest revenue, given the extensive network of public sewers and water lines requiring continuous monitoring and rehabilitation. The growing popularity of wireless connectivity and integrated reporting features is shaping product development across all segments, ensuring that data capture and analysis are seamlessly integrated into the operational workflow. This integration of software solutions transforms the traditional inspection process into a digital diagnostic service, enhancing operational efficiency for end-users across residential and commercial sectors.

AI Impact Analysis on Plumbing Camera Market

Analysis of common user questions regarding the integration of Artificial Intelligence (AI) in the Plumbing Camera Market reveals a primary focus on automation, efficiency, and predictive maintenance capabilities. Users frequently ask: "Can AI automatically detect and classify defects like cracks or root intrusions?" "How will AI reduce the time spent on manual video review?" and "Will AI integration make these systems too expensive for small contractors?" The prevalent user expectation centers on leveraging AI/Machine Learning (ML) algorithms for automated defect recognition, which would dramatically reduce post-inspection processing time and minimize human error in identifying critical pipe anomalies. There is also significant interest in using AI for predictive modeling—analyzing recurring defect patterns across networks to anticipate future failures and optimize maintenance schedules. However, concerns persist regarding the initial cost barrier, the necessity for substantial, high-quality training data, and the need for simplified, user-friendly interfaces suitable for non-technical plumbing professionals.

The practical application of AI in this domain centers on transforming raw video footage into actionable, structured data. AI models are trained on thousands of hours of inspection videos to recognize specific pipe conditions (e.g., collapsed pipes, offsets, heavy scaling, blockages, or infiltration). This automation capability accelerates the generation of condition assessment reports, moving away from time-consuming manual annotation. Furthermore, AI-powered systems can provide automatic severity scoring based on recognized defects, prioritizing necessary repairs and ensuring compliance with standardized industry coding protocols like the NASSCO Pipeline Assessment Certification Program (PACP) in North America, thus significantly enhancing the standardization and reliability of inspection data.

Beyond defect recognition, AI's influence extends to operational logistics. Machine learning is being utilized to optimize the navigation path of robotic crawlers within complex sewer networks, minimizing inspection time and reducing the likelihood of the equipment getting stuck. In the future, AI is expected to enable real-time augmented reality overlays on live video feeds, providing inspectors with instant contextual information, historical data related to the specific pipe segment being examined, and recommended courses of action. This integration shifts the market focus from merely collecting visual data to providing intelligent diagnostic and predictive solutions, potentially creating a new class of subscription-based, AI-enhanced inspection services.

- AI-driven Automated Defect Recognition (ADR) enhances inspection speed and accuracy.

- Predictive maintenance analytics use historical data to forecast pipeline failure points.

- Machine Learning (ML) algorithms streamline compliance reporting (e.g., NASSCO PACP scoring).

- Optimization of robotic crawler navigation paths reduces operational costs and inspection time.

- Integration with geospatial information systems (GIS) for intelligent mapping and location correlation.

- Development of cloud-based platforms for centralized data processing and collaborative analysis powered by ML.

DRO & Impact Forces Of Plumbing Camera Market

The dynamics of the Plumbing Camera Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the critical Impact Forces shaping its trajectory. A primary driver is the accelerating global need for pipeline inspection and maintenance, necessitated by vast, deteriorating urban infrastructure, particularly in established economies across North America and Western Europe. This demographic reality, coupled with increasingly stringent environmental regulations designed to prevent leaks and overflows, creates sustained demand for accurate, non-destructive diagnostic tools. The secondary key driver is the technological maturation of the equipment itself, with advancements such as high-definition imaging, longer battery life, self-leveling technology, and seamless Wi-Fi integration making the tools more efficient and accessible to a wider professional user base, including small independent contractors.

Conversely, significant restraints hinder market expansion. The high initial capital investment required for professional-grade inspection systems, particularly for robotic crawlers utilized in mainline inspections, often creates an adoption barrier for smaller enterprises or emerging municipal authorities with constrained budgets. Furthermore, operational challenges such as the requirement for specialized training to effectively operate and interpret data from complex systems, coupled with the difficulty of maintaining consistent performance in harsh environments (e.g., highly corrosive pipes or extreme temperatures), can limit equipment lifespan and operational efficiency. The necessity for continuous software updates and maintenance to keep pace with evolving reporting standards also presents a long-term cost burden.

Despite these restraints, substantial opportunities exist, primarily focused on emerging markets and technological diversification. The rapid urbanization and infrastructure development in the APAC and MEA regions present lucrative avenues for market entry. Technologically, the integration of 3D modeling and laser profiling capabilities into camera systems offers a significant opportunity for detailed structural analysis beyond basic visual inspection, catering to high-value industrial and engineering applications. The growing trend towards utility system digitalization and the proliferation of IoT sensors provides a platform for plumbing cameras to become integral data collection nodes within smart infrastructure frameworks. The overarching impact forces—aging infrastructure combined with digital innovation—strongly favor sustained market expansion, pushing suppliers to focus on offering customizable, scalable, and data-centric solutions.

Segmentation Analysis

The Plumbing Camera Market is comprehensively segmented based on product type, application, and end-user, reflecting the diverse requirements of the plumbing inspection industry. Analyzing these segments provides crucial insights into where technological investment and market growth are most concentrated. The market structure emphasizes the specialized nature of the equipment, ranging from highly portable, handheld units designed for short-range residential drain inspections to robust, truck-mounted robotic systems capable of navigating kilometers of large-diameter municipal pipelines. Understanding these differentiations is vital for manufacturers tailoring their product portfolios and for market participants seeking strategic positioning across various customer groups, optimizing their offerings based on depth, pipe diameter suitability, and required data output features (e.g., video, sonar, or laser profiling).

Segmentation by product type typically separates the market into Push Rod Cameras and Robotic Crawlers, defining the primary method of maneuverability and scale of application. Push Rod systems dominate the residential and commercial in-house plumbing segment due to their affordability and flexibility for small to medium-diameter pipes. Conversely, Robotic Crawlers are essential for industrial and municipal inspections, offering long-distance travel, steering capabilities, and the capacity to carry sophisticated sensors. Segmentation by application highlights the distinct needs of the residential, commercial, industrial, and municipal sectors, with municipal water and wastewater management historically being the largest revenue generator due to the sheer volume and critical nature of public infrastructure requiring mandated preventative inspection cycles and structural assessment.

Further segmentation by end-user, including Plumbers & Contractors, Utility Companies, and Industrial Inspection Firms, illustrates the purchasing power and feature preferences within the market. Plumbers and small contractors favor rugged, easy-to-use, mid-range push systems that provide quick return on investment, prioritizing durability and clear visual feedback. Utility companies and large industrial firms, however, demand high-specification robotic systems with advanced digital integration, cloud storage capacity, and adherence to strict data compliance standards. The interaction between these segments defines the competitive landscape, pushing innovation towards systems that bridge the gap between high performance and operational simplicity, ensuring accessibility across the entire professional spectrum.

- By Product Type:

- Push Rod Cameras

- Robotic Crawler Cameras

- Reel Systems

- By Pipe Diameter:

- Small Pipes (Less than 4 inches)

- Medium Pipes (4 to 10 inches)

- Large Pipes (Greater than 10 inches)

- By Application:

- Residential Inspection

- Commercial Building Maintenance

- Industrial Pipeline Assessment

- Municipal Water and Wastewater Management

- By End-User:

- Plumbers and Contractors

- Utility and Public Works Companies

- Home and Property Inspectors

- Oil & Gas and Chemical Industries

Value Chain Analysis For Plumbing Camera Market

The value chain for the Plumbing Camera Market begins with upstream activities focused on the sourcing and manufacturing of highly specialized components, which include high-resolution CMOS/CCD sensors, robust fiber optic cables, specialized lighting elements (typically LEDs), durable self-leveling mechanisms, and proprietary control software. Key upstream suppliers are manufacturers of electronic components, specialized plastics, and ruggedized housing materials capable of resisting corrosive sewer environments. Manufacturing processes are complex, requiring precision assembly to integrate optics, electronics, and mechanical components into waterproof and durable camera heads and control units. Quality control at this stage is critical, ensuring reliability and longevity, which are paramount demands from end-users operating in harsh field conditions.

The midstream segment involves the core activities of system integration, branding, marketing, and distribution. Major Original Equipment Manufacturers (OEMs) design, assemble, and test the complete camera systems, often investing heavily in proprietary software for data logging, reporting, and cloud integration (AEO/GEO optimization necessitates robust digital reporting capabilities). Distribution channels are bifurcated: direct sales channels handle large, complex municipal or industrial systems requiring substantial technical support and customization, while indirect channels utilize established networks of specialized plumbing supply distributors, tool rental companies, and e-commerce platforms to reach the vast network of small to medium-sized plumbing contractors. The choice of channel depends largely on the complexity and price point of the specific camera model.

Downstream analysis focuses on the end-users—the professional application of the equipment, post-sale service, and subsequent data utilization. Direct customers (plumbers, municipal teams) purchase or lease the equipment to provide diagnostic services. A crucial downstream component is after-sales support, including calibration, repair, training services, and continuous software updates. The data generated—video footage, defect codes, and geospatial coordinates—then flows into client reports, infrastructure management systems, or municipal databases, completing the value cycle. The growing emphasis on data processing (e.g., using AI for defect recognition) places significant value on the software element, moving the market focus beyond hardware sales to holistic data solutions and long-term service agreements.

Plumbing Camera Market Potential Customers

The primary potential customers in the Plumbing Camera Market are professional service providers who rely on non-destructive methods to maintain and manage subsurface infrastructure. This expansive customer base can be broadly categorized into professional plumbers and drain cleaning contractors, large-scale utility and public works departments, and specialized industrial inspection firms. Professional plumbers represent a significant volume buyer base, often requiring portable, durable, and reliable push-rod cameras for routine residential and light commercial work, such as locating blockages, finding lost items, and performing pre-purchase inspections for home buyers. Their purchasing decisions are highly influenced by system reliability, ease of operation, and the ability to quickly generate client-friendly reports, ensuring rapid return on investment and enhancing service transparency.

Utility companies and municipal departments constitute the largest revenue stream, demanding sophisticated, high-performance robotic crawlers. These customers manage vast, complex networks of sewer, storm, and water lines, often requiring continuous assessment programs mandated by governmental bodies (e.g., EPA regulations). Their requirements focus on systems capable of long-distance navigation, laser profiling for structural measurements, compatibility with GIS mapping systems, and integration with standardized defect coding software (like NASSCO PACP). The procurement process in this segment is typically characterized by large, multi-year tenders and contracts, prioritizing long-term service agreements and robust technical support from suppliers.

The third major segment involves industrial inspection firms, including those serving the oil & gas, chemical processing, and mining sectors. These customers require highly specialized, ruggedized cameras designed to withstand extreme conditions, such as high heat, pressure, or explosive environments (ATEX certified). Their applications often involve inspecting smaller, inaccessible process piping or hazardous chemical lines where downtime is immensely costly. This segment values precision, specialized sensor integration (e.g., thermal imaging), and systems designed for highly technical, specialized diagnostic reporting. Furthermore, property managers, insurance adjusters, and civil engineering consultants also represent crucial secondary end-users, utilizing inspection data to validate repair work or assess damage claims, underscoring the broad reliance on accurate, verifiable visual evidence provided by these diagnostic tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RIDGID, Vivax-Metrotech, General Pipe Cleaners, Rothenberger, CUES Inc., Hathorn Corporation, MyTana Manufacturing, Insight Vision Cameras, Spartan Tool, Rausch Electronics, Envirosight, ProBuilt Professional Lighting, Forbest International, Minicam Group, Extech Instruments, Aries Industries, Sewerin, Subsite Electronics, Wohler, Zimmerschied. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plumbing Camera Market Key Technology Landscape

The technological landscape of the Plumbing Camera Market is rapidly evolving, driven primarily by the need for enhanced image quality, improved data integration, and increased operational efficiency in challenging environments. High-Definition (HD) and increasingly 4K imaging sensors represent a core technology trend, moving beyond traditional standard-definition analog output. This shift provides inspectors with significantly clearer, higher-resolution video footage, which is crucial for accurately identifying hairline cracks, subtle structural defects, and fine root intrusion details. Furthermore, advancements in specialized LED lighting technology, including adjustable intensity and color temperature controls, ensure optimal illumination within dark and reflective pipe interiors, guaranteeing consistent image quality regardless of environmental variability. This focus on visual data integrity is paramount for defensible diagnostic reports and planning costly repair strategies.

Another crucial technological development is the integration of advanced localization and mapping features. Self-leveling technology ensures the camera image remains upright, facilitating easier navigation and clearer reporting, while integrated Sonar and Radio Frequency (RF) locators allow operators to precisely pinpoint the camera head's position and depth above ground. This capability is essential for minimizing excavation during repair and accurately linking inspection data to geospatial information systems (GIS). Modern systems utilize wireless data transmission (Wi-Fi and 5G connectivity) to stream real-time video and data directly to rugged tablets or cloud storage platforms, enabling remote monitoring, instant reporting, and collaborative analysis among field teams and office engineering staff, transforming data flow efficiency.

Beyond imaging and localization, the market is capitalizing on robust materials science and battery technology. Camera heads are being constructed from durable, corrosion-resistant materials like stainless steel and sapphire lenses to withstand aggressive sewer gases and abrasive solids. Long-life lithium-ion batteries are standardizing operational times, allowing for full-day inspection cycles without frequent recharging. Crucially, the rise of digital reporting software conforming to industry standards like PACP (Pipeline Assessment Certification Program) and MACP (Manhole Assessment Certification Program) requires camera systems to generate structured metadata alongside video, enabling seamless export to sophisticated asset management platforms. The convergence of high-quality hardware with intelligent, compliance-driven software defines the competitive edge in the contemporary plumbing camera market.

Regional Highlights

- North America: This region holds a dominant share of the global market, characterized by extensive, aging municipal water and wastewater infrastructure across the United States and Canada. Growth is driven by mandatory preventative maintenance protocols, high adoption rates of advanced robotic crawlers and AI-enabled reporting software, and a strong presence of key market players who continually innovate. The prevalence of trenchless repair methods, such as Cured-In-Place Pipe (CIPP) lining, relies heavily on pre- and post-inspection using advanced camera systems. Furthermore, high labor costs incentivize the use of efficient, time-saving NDT diagnostic tools, maintaining North America's position as a technology leader and major revenue contributor. The residential market is highly digitized, with plumbers utilizing Wi-Fi enabled cameras for real-time customer transparency.

- Europe: The European market demonstrates mature demand, particularly in countries like Germany, the UK, and France, where environmental legislation regarding sewer overflow and leakage prevention is extremely strict. European market growth is supported by continuous investment in urban renewal projects and rehabilitation of historic infrastructure. The emphasis here is often on modular systems that can be adapted for highly varied pipe materials and dimensions, prevalent in older city centers. Scandinavian countries are leaders in adopting specialized inspection technologies, including those focused on water main inspection rather than just sewage. Regulatory adherence to European standards for equipment safety and environmental impact is a critical market driver, promoting high-quality, long-lasting equipment.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by unprecedented rates of urbanization and massive government investment in new infrastructure projects, especially in China, India, and Southeast Asian nations. While the initial market preference was for cost-effective, basic models, there is a swift transition toward mid-range and high-end systems as infrastructure quality requirements increase. The sheer scale of utility network expansion, coupled with growing awareness of water conservation and pollution control, ensures a high long-term demand for diagnostic tools. Opportunities abound for manufacturers offering scalable, locally supported solutions tailored to large-scale municipal bids and rapidly developing construction industries.

- Latin America: Market development in Latin America is tied to large metropolitan infrastructure upgrades and the expansion of sanitation services. Brazil and Mexico are the primary centers of demand. The market generally favors cost-efficiency, but there is increasing recognition of the long-term benefits of NDT technology for preventing catastrophic failures. Political stability and economic investment are key factors influencing the pace of infrastructure spending and, consequently, the demand for sophisticated plumbing cameras. Distribution relies heavily on strong local partnerships to provide necessary technical training and maintenance support.

- Middle East and Africa (MEA): Growth in the MEA region is driven primarily by large-scale construction projects in the Gulf Cooperation Council (GCC) countries and ongoing efforts in South Africa and the UAE to modernize water and wastewater treatment facilities. Investment in smart city projects necessitates reliable sub-surface assessment tools. The market demand is bifurcated, with high-specification robotic systems required for new, large-diameter installations and more basic systems utilized for rehabilitation projects in older areas. Extreme climate conditions necessitate highly durable, temperature-resistant equipment, posing unique technical challenges for product design and deployment in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plumbing Camera Market.- RIDGID (Emerson Electric Co.)

- Vivax-Metrotech Corp.

- General Pipe Cleaners (General Wire Spring Co.)

- Rothenberger GmbH

- CUES Inc.

- Hathorn Corporation

- MyTana Manufacturing

- Insight Vision Cameras

- Spartan Tool LLC

- Rausch Electronics USA, LLC

- Envirosight LLC

- ProBuilt Professional Lighting, LLC

- Forbest International Trading, LLC

- Minicam Group

- Extech Instruments (FLIR Systems)

- Aries Industries, Inc.

- Subsite Electronics (Ditch Witch)

- Wohler USA Inc.

- Sewerin GmbH

- Zimmerschied GmbH

Frequently Asked Questions

Analyze common user questions about the Plumbing Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Plumbing Camera Market between 2026 and 2033?

The Plumbing Camera Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 8.5% over the forecast period, reflecting robust demand driven by aging infrastructure and technological advancements in non-destructive testing.

How is Artificial Intelligence (AI) influencing the effectiveness of plumbing cameras?

AI significantly enhances effectiveness through Automated Defect Recognition (ADR), which allows systems to instantly identify, classify, and score defects (like cracks or offsets) in real-time or post-inspection, minimizing human error and accelerating report generation compliant with industry standards like NASSCO PACP.

Which segment, Push Rod or Robotic Crawler, dominates the market in terms of revenue?

The Robotic Crawler segment typically dominates in terms of revenue due to the high cost of the units and their necessity for large-scale municipal and industrial pipeline inspections, although Push Rod systems lead in unit volume sales due to widespread use by residential contractors.

What are the primary restraints affecting the adoption of advanced plumbing camera systems?

The key restraints include the high initial capital investment required for professional-grade robotic and HD systems, along with the necessity for specialized training and ongoing maintenance to ensure optimal performance in harsh sewer environments.

Which geographic region is expected to experience the fastest market growth during the forecast period?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by rapid urbanization, substantial governmental investment in new utility infrastructure, and the increasing adoption of modern pipe assessment technologies across expanding economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager