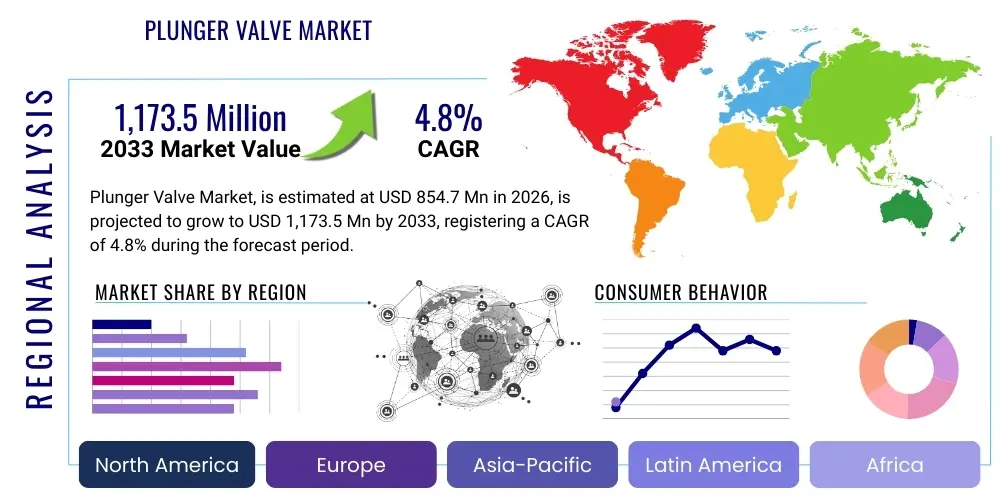

Plunger Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438900 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Plunger Valve Market Size

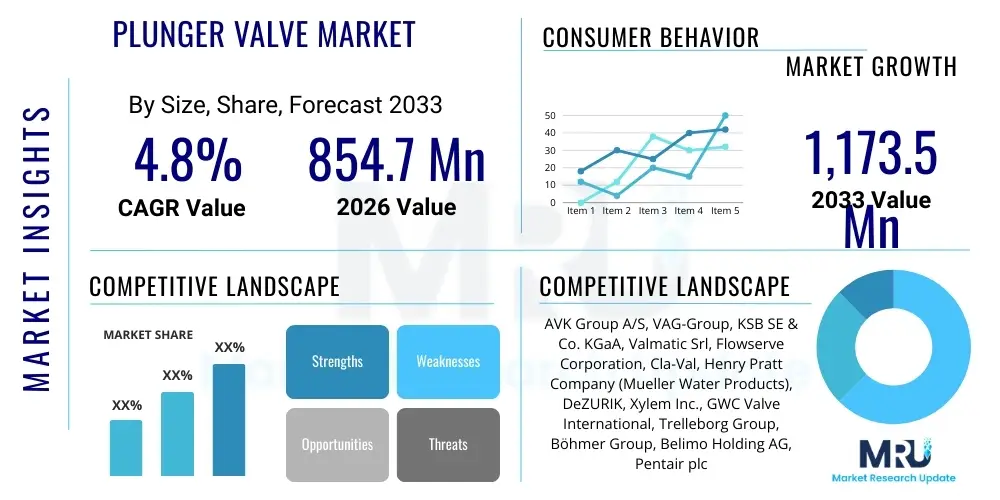

The Plunger Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 854.7 million in 2026 and is projected to reach USD 1,173.5 million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global demand for precise fluid control mechanisms, particularly within large-scale water distribution networks, hydropower generation facilities, and highly pressurized industrial systems. The market expansion is also contingent upon the necessary replacement and upgrade of aging water infrastructure across developed economies, which mandates robust, low-maintenance flow regulation components like the Plunger Valve.

Plunger Valve Market introduction

The Plunger Valve, often referred to as a Needle Valve or Cylindrical Valve, is a specialized type of control valve designed primarily for regulating or isolating the flow of fluids in pressurized pipelines, offering superior performance in high head loss applications. Its core mechanism utilizes a cylindrical plug (plunger) that moves axially within the valve body, regulating flow by altering the annular opening area. This design minimizes cavitation and vibration, leading to extended service life and highly precise flow modulation compared to traditional butterfly or globe valves, especially in demanding environments such as hydro-electric power plants and urban water supply systems.

Major applications of plunger valves span across municipal water treatment and distribution, where they are critical for pressure reduction and flow regulation; hydropower generation, where they manage turbine bypass flow and reservoir discharge; and various industrial processes requiring precise control over liquids, slurries, or gases. The inherent benefits of these valves include exceptional sealing capabilities, low head loss when fully open, and anti-cavitation characteristics, which significantly reduce maintenance costs and operational downtime. Key driving factors propelling market demand include rapid urbanization leading to expanded water infrastructure projects, stringent governmental regulations mandating efficient water management technologies, and increasing investments in renewable energy infrastructure, particularly hydropower facilities globally.

The complexity of modern infrastructure demands components capable of continuous, reliable operation under harsh conditions. Plunger valves meet this requirement by offering smooth, guided movement and balanced pressure distribution across the seating area, preventing wear and tear associated with high-velocity flows. Furthermore, advancements in materials science, particularly the development of corrosion-resistant alloys and advanced elastomers for seals, have enhanced the longevity and applicability of these valves in highly aggressive fluid mediums. The global trend towards smart water networks, necessitating automated and remote-controlled valve operation, further solidifies the position of plunger valves as indispensable components in critical fluid control loops.

Plunger Valve Market Executive Summary

The global Plunger Valve Market is characterized by steady technological advancements focusing on smart integration and anti-cavitation design, driven primarily by infrastructure renewal cycles and heightened requirements for water security. Business trends indicate a strong emphasis on lifecycle cost reduction, prompting manufacturers to invest in material durability and modular design for ease of maintenance. Key industry players are increasingly engaging in strategic partnerships with engineering, procurement, and construction (EPC) firms involved in large-scale utility and dam projects, aiming to secure long-term supply contracts. Furthermore, the convergence of operational technology (OT) and information technology (IT) is facilitating the integration of sensors and actuators, enabling remote diagnostics and predictive maintenance, thereby defining new competitive advantages within the market landscape.

Regionally, the market dynamics show significant divergence. Asia Pacific (APAC) dominates in terms of new installations, fueled by extensive government-led initiatives in China and India aimed at expanding water treatment and power generation capacity to support burgeoning populations and industrial growth. North America and Europe, conversely, represent mature markets where growth is concentrated in the replacement segment, driven by the necessity to upgrade decades-old water transmission lines and comply with increasingly strict environmental discharge regulations. Latin America and the Middle East & Africa (MEA) are emerging as high-potential regions, buoyed by significant investments in desalination plants and inter-basin water transfer projects requiring robust flow control solutions.

Segment trends highlight the critical role of the Water Management application segment, which accounts for the largest market share due to the universal necessity of municipal water infrastructure. Within the operational segment, electrically or hydraulically actuated plunger valves are exhibiting the highest growth rate, displacing manually operated counterparts, as utility providers seek automation for enhanced efficiency and safety. The increasing adoption of high-pressure plunger valves, typically utilized in hydropower and large industrial cooling systems, underscores the specialized nature of demand, emphasizing precision control under extreme operating parameters. Material segmentation reveals a continuous shift toward stainless steel and exotic alloys, replacing traditional cast iron, particularly in areas susceptible to corrosion or high abrasive content, thereby improving valve reliability and operational lifespan.

AI Impact Analysis on Plunger Valve Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Plunger Valve Market predominantly revolve around optimizing operational efficiency, enhancing predictive maintenance protocols, and refining design processes. Users frequently inquire: "How can AI algorithms predict valve failure before it occurs?", "What role does machine learning play in optimizing flow control based on real-time network conditions?", and "Can AI improve the anti-cavitation design of future plunger valves?". The analysis of these queries indicates key themes centered on maximizing asset utilization, minimizing unplanned downtime, and transitioning from reactive maintenance to prescriptive strategies. Users expect AI to deliver highly granular insights into valve performance parameters, such as vibration, pressure differentials, and acoustic emissions, facilitating proactive intervention.

The integration of AI and Machine Learning (ML) is fundamentally transforming the lifecycle management of plunger valves, particularly in large, complex pipeline networks. By analyzing massive datasets collected through Industrial Internet of Things (IIoT) sensors integrated into smart valves, ML models can identify subtle anomalies and patterns indicative of imminent mechanical degradation, seal failure, or internal erosion. This capability moves the market towards Condition-Based Monitoring (CBM) and away from scheduled maintenance, drastically reducing overall operational expenditures (OpEx) for asset owners. Furthermore, AI-driven diagnostics are streamlining root cause analysis, allowing maintenance teams to address underlying systemic issues rather than merely treating symptoms, leading to greater long-term reliability.

Beyond maintenance, AI is also influencing the design and engineering phases. Computational Fluid Dynamics (CFD) simulations, augmented by AI, allow engineers to rapidly test and optimize complex valve geometries to achieve superior hydraulic performance, minimizing turbulence and maximizing anti-cavitation properties under varied load conditions. AI algorithms can process optimization parameters far more effectively than traditional methods, speeding up the innovation cycle for next-generation plunger valves. In supply chain management, AI optimizes inventory levels for spare parts based on predicted usage and failure rates across the installed base, ensuring that critical components are available when needed, thereby improving service delivery and customer satisfaction.

- AI-driven Predictive Maintenance: Utilizing ML models to analyze sensor data (vibration, temperature, acoustic signals) for anomaly detection and forecasting potential mechanical failures in valve components (plunger, seals, actuators).

- Optimized Fluid Dynamics: Applying AI-enhanced Computational Fluid Dynamics (CFD) to iterate and optimize plunger valve geometries for superior anti-cavitation and flow efficiency, reducing pressure loss.

- Real-time Flow Optimization: Implementing control systems using AI to dynamically adjust valve positioning in response to network demand fluctuations, maintaining optimal pressure and flow velocity across large distribution systems.

- Automated Supply Chain Management: Using predictive analytics to forecast demand for plunger valve spare parts, optimizing inventory holding costs and improving fulfillment rates.

- Digital Twin Creation: Developing high-fidelity digital models of installed plunger valves to simulate operational stress, test upgrades, and train maintenance personnel virtually, leading to enhanced reliability planning.

DRO & Impact Forces Of Plunger Valve Market

The dynamics of the Plunger Valve Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), alongside influential impact forces that shape investment and technological priorities. The primary driving force is the global imperative for enhanced water resource management and the necessity for reliable, high-capacity fluid control in critical infrastructure, particularly in high-head applications like dam outlet works and turbine bypass lines. Coupled with this is the continuous public and private investment in renovating aging water and power infrastructure, especially across North America and Europe, which necessitates replacing outdated control mechanisms with advanced plunger valves capable of precision flow regulation and extended operational lifecycles. Furthermore, the increasing adoption of automated and remote-controlled fluid systems is driving demand for advanced actuation and smart monitoring capabilities integrated into these valves.

Conversely, significant restraints hinder market growth. The high initial capital expenditure associated with purchasing and installing specialized, high-pressure plunger valves remains a barrier, particularly for municipal bodies and smaller industrial operators facing budgetary constraints. Technical complexity, requiring specialized knowledge for installation, calibration, and maintenance, presents another hurdle, especially in developing regions where skilled labor is scarce. Furthermore, the inherent longevity and robustness of existing installed valves sometimes defer replacement cycles, leading to prolonged market stagnation in certain mature segments. Regulatory hurdles pertaining to certification standards and localized content requirements also add layers of complexity and cost for international manufacturers operating across diverse geographic regions.

Opportunities for expansion are abundant, centered around the rapid expansion of hydropower infrastructure in emerging economies in Asia and Africa, where new dam construction projects require large-diameter, high-performance valves for discharge control. The market is also poised to benefit significantly from the proliferation of smart water management initiatives, driving demand for intelligent plunger valves equipped with IoT sensors and remote telemetry units (RTUs). Technological breakthroughs in developing composite materials that offer superior resistance to corrosion and abrasion, while simultaneously reducing the valve's overall weight and cost, present a substantial commercial opportunity. The overarching impact forces include intense regulatory pressure favoring water efficiency and safety, substantial shifts in material costs (e.g., steel, nickel), and the competitive environment driven by differentiated product offerings focused on minimizing cavitation and maximizing hydraulic efficiency under extreme operating conditions.

Segmentation Analysis

The Plunger Valve Market is highly segmented based on critical technical and operational parameters, including size, material composition, actuation method, and end-use application, providing a nuanced view of demand patterns across diverse industrial landscapes. Understanding these segments is crucial for strategic market positioning, as requirements vary drastically between, for example, a high-head hydro facility demanding large-diameter, highly specialized valves and a municipal water system needing medium-sized valves focused on pressure stability and energy efficiency. Segmentation by size often correlates directly with the specific throughput requirements, influencing material choice and required pressure rating, with large-diameter valves (DN 600 and above) representing a high-value, low-volume segment predominantly serving utility applications.

The material segment is differentiated by the fluid medium handled and the operational environment, with Cast Iron being historically dominant but increasingly being supplanted by Ductile Iron and Stainless Steel for improved corrosion resistance and mechanical strength. Stainless steel and specialized alloys command a premium and are mandatory in applications involving corrosive chemicals or seawater (e.g., desalination plants). Segmentation by actuation method—manual, electric, pneumatic, and hydraulic—reflects the evolution toward automation, with electrically and hydraulically actuated valves witnessing accelerated adoption due to their suitability for remote operation and integration into Supervisory Control and Data Acquisition (SCADA) systems. This shift is integral to realizing the efficiencies targeted by smart infrastructure projects globally.

The application segment remains the most influential driver of market revenue, clearly defined by the utility of the valve within various industries. The Water Management segment (including irrigation, distribution, and treatment) is the largest consumer due to the volume and necessity of these infrastructure projects. The Power Generation segment, particularly hydropower, utilizes highly sophisticated plunger valves for crucial flow control functions such as turbine inlet control, bypass, and reservoir discharge. The Industrial segment, encompassing petrochemical, oil & gas, and manufacturing, requires smaller, robust valves for process control and specialized chemical handling. This detailed segmentation allows manufacturers to tailor their product offerings, R&D investments, and sales channels effectively to meet the specific compliance and performance requirements of each specialized end-use segment.

- By Type:

- Needle Plunger Valve

- Radial Plunger Valve

- Self-Actuating Plunger Valve

- By Size:

- Small (Up to DN 200)

- Medium (DN 200 – DN 600)

- Large (Above DN 600)

- By Material:

- Cast Iron

- Ductile Iron

- Stainless Steel

- Others (e.g., Bronze, Exotic Alloys)

- By Actuation Method:

- Manual

- Electric

- Hydraulic

- Pneumatic

- By End-Use Application:

- Water Management (Distribution, Irrigation, Sewage)

- Power Generation (Hydropower, Thermal Power)

- Industrial Applications (Oil & Gas, Chemical, Mining)

Value Chain Analysis For Plunger Valve Market

The value chain of the Plunger Valve Market begins with the highly specialized Upstream activities focused on raw material procurement, dominated by the sourcing of high-grade ferrous and non-ferrous metals, including various grades of stainless steel, ductile iron, and specialized alloys necessary for valve bodies, plungers, and seatings. Critical components also involve precision machining of complex internal mechanisms and procurement of high-performance sealing materials (elastomers and plastics) designed to withstand high pressure and chemical exposure. Manufacturers rely heavily on certified foundries and material suppliers who adhere to strict industry standards (like ISO and ASME) to ensure the durability and reliability of the final product, as material failure is unacceptable in critical utility applications. Efficient inventory management and securing stable supply contracts for these volatile commodities are key competitive factors at this stage.

The subsequent Midstream phase involves the core manufacturing processes, which include precision casting or forging, highly complex CNC machining of the internal flow path components to minimize surface roughness and friction, assembly, and rigorous testing. Given the high-pressure and anti-cavitation requirements of plunger valves, manufacturing complexity is significantly higher than for standard isolation valves. Quality control is paramount, involving hydrostatic testing, non-destructive examination (NDE), and performance validation tests (e.g., flow curve analysis) to ensure compliance with specific project specifications and hydraulic requirements. Manufacturers often invest heavily in specialized automation and robotics to ensure repeatability and precision in the machining of plungers and internal guiding systems, which directly impacts the valve’s efficiency and operational lifespan.

The Downstream segment, encompassing distribution and end-user engagement, typically utilizes a hybrid distribution channel structure. For large-scale infrastructure projects (e.g., dam outlets, municipal water transfer lines), direct sales and distribution through established Engineering, Procurement, and Construction (EPC) contractors are the primary route, requiring specialized technical sales teams and direct engagement with utility engineers. Conversely, smaller valves and replacement components often move through Indirect channels, utilizing regional industrial distributors and value-added resellers who provide localized inventory, installation services, and post-sale support. Aftermarket services, including maintenance contracts, provision of specialized spare parts, and system upgrades, represent a significant long-term revenue stream, emphasizing the critical importance of a robust, localized service network to support the installed base globally.

Plunger Valve Market Potential Customers

Potential customers for Plunger Valves are predominantly large-scale asset owners and operators requiring highly reliable and precise flow control mechanisms for critical infrastructure, where failure is both costly and potentially hazardous. The largest category of buyers comprises Municipal and Governmental Water Authorities globally. These entities utilize plunger valves extensively in water transmission mains, distribution networks, reservoirs, and pumping stations for functions such as pressure regulating, surge protection, and reservoir inlet/outlet control. Given the sheer scale and long operational life required for municipal assets, these customers prioritize valves offering maximal durability, minimal maintenance requirements, and stringent adherence to international quality standards for potable water contact.

The second major group includes Power Generation Companies, specifically those operating Hydropower Plants. In hydro facilities, plunger valves are indispensable for managing discharge from reservoirs, controlling turbine bypass systems (especially during shutdown or low-demand periods), and regulating downstream flow to prevent erosion and stabilize pressure. These applications demand the largest and most technically sophisticated plunger valves, often custom-engineered to handle extremely high pressure heads and large flow rates while effectively mitigating the risk of destructive cavitation, making performance and longevity the critical purchasing criteria. Investment decisions in this segment are typically tied to long-term government energy policies and infrastructure development financing.

Furthermore, Industrial End-Users, including organizations in the petrochemical, mining, and large-scale manufacturing sectors, constitute a specialized customer base. In the mining industry, for instance, plunger valves are used for controlling abrasive slurries or high-pressure dewatering systems. In the oil and gas sector, particularly within refined product pipelines and high-pressure injection systems, these valves offer superior throttling capabilities compared to alternatives. While these industrial buyers may require smaller volumes than utilities, they often demand valves constructed from specialized materials to handle highly corrosive or erosive media, focusing on specific certifications and material traceability to ensure operational compliance and safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 854.7 Million |

| Market Forecast in 2033 | USD 1,173.5 Million |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AVK Group A/S, VAG-Group, KSB SE & Co. KGaA, Valmatic Srl, Flowserve Corporation, Cla-Val, Henry Pratt Company (Mueller Water Products), DeZURIK, Xylem Inc., GWC Valve International, Trelleborg Group, Böhmer Group, Belimo Holding AG, Pentair plc, Neles Corporation (Valmet), Watts Water Technologies, Inc., Crane Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plunger Valve Market Key Technology Landscape

The contemporary technological landscape of the Plunger Valve Market is highly focused on integrating advanced material science with digital control capabilities to enhance performance, reliability, and ease of operation. A primary technological focus is on the development and application of advanced anti-cavitation trims and internal geometries. Cavitation—the formation and implosion of vapor bubbles—is the leading cause of material erosion and premature failure in high-head applications. Modern plunger valves employ specialized cage designs, multi-stage pressure reduction mechanisms, and geometrically optimized plungers (often derived from extensive Computational Fluid Dynamics simulations) that manage energy dissipation gradually, ensuring that pressure reduction occurs smoothly and away from critical sealing surfaces. This sophisticated hydraulic design is crucial for extending the operational lifespan in demanding hydropower and municipal pressure reduction applications.

The second critical area is the adoption of Smart Valve Technology, leveraging the Industrial Internet of Things (IIoT) to transform traditional mechanical components into connected assets. Modern plunger valves are frequently equipped with integrated sensors that monitor operational parameters such as position, vibration, acoustic emissions, and differential pressure in real time. This sensor data is transmitted via secure networks to centralized SCADA or asset performance management (APM) systems, enabling remote diagnostics, real-time control adjustments, and the implementation of predictive maintenance protocols. This technological shift not only enhances operational efficiency by optimizing flow control dynamically but also minimizes the need for manual inspections, significantly reducing labor costs and safety risks associated with accessing critical pipeline installations.

Furthermore, material innovation continues to drive the market forward. The trend involves moving away from standard cast iron toward high-strength ductile iron with advanced protective coatings (e.g., epoxy lining) and increasingly, the use of duplex or super duplex stainless steel alloys. These materials offer superior resistance to aggressive chemicals, chlorides (critical for desalination and seawater applications), and abrasive particles found in raw water or mining slurries. Complementing this are advancements in seal technology, utilizing high-performance elastomers and polymer composites that maintain integrity under extreme temperatures and pressures for extended periods, reducing the frequency of seal replacement, which is often a major maintenance item for utility operators.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand structure and technological adoption within the Plunger Valve Market, driven by varying infrastructure needs, regulatory environments, and economic development stages. North America is characterized by a high volume of replacement and modernization projects. Aging infrastructure across the U.S. and Canada necessitates significant investment in upgrading water transmission lines and power facilities built decades ago. The focus here is on integrating smart monitoring capabilities (IIoT) and specifying high-reliability, low-maintenance valves to minimize lifecycle costs. Compliance with stringent drinking water quality and environmental regulations also mandates the use of certified materials and highly efficient flow control systems, sustaining stable demand for specialized, medium-to-large sized plunger valves.

Europe represents a highly mature market characterized by strict environmental regulations and a strong emphasis on sustainability and energy efficiency. Demand is largely driven by adherence to the Water Framework Directive and ongoing efforts to optimize existing networks. Central and Western European nations prioritize valves with proven anti-cavitation performance and those compatible with complex automation systems (hydraulic and electric actuation) for remote operation in decentralized networks. Germany, the UK, and France are key consumers, often demanding European-standard compliant valves. Eastern Europe, while also focusing on modernization, is witnessing new construction projects spurred by EU funding, creating a dual market for both replacement and new installations.

The Asia Pacific (APAC) region is the fastest-growing market globally, primarily driven by massive infrastructure expansion in countries like China, India, and Southeast Asian nations. Rapid urbanization and industrialization require unprecedented investments in new dams, hydropower stations, and large-scale municipal water transfer schemes. This region demands large-diameter plunger valves for high-volume, high-head applications. While cost-competitiveness is a significant factor, the growing emphasis on long-term reliability due to the critical nature of these projects is driving a shift towards international quality standards. The sheer number of new pipeline kilometers being laid annually makes APAC the epicenter for new valve installations, often procured directly through competitive bidding processes managed by government agencies or state-owned enterprises.

- North America (US, Canada): Dominance in replacement market, high adoption of smart valve technology, focus on reducing non-revenue water (NRW) through precise pressure management.

- Europe (Germany, UK, France): High regulatory compliance standards, strong demand for energy-efficient valves, substantial market share in hydraulic and electric actuation for network optimization.

- Asia Pacific (China, India, Australia): Highest volume growth due to rapid infrastructure construction (hydropower, water treatment), significant governmental investment in large-scale utility projects.

- Latin America (Brazil, Mexico): Emerging market driven by necessary water infrastructure expansion; sensitivity to import costs, increasing adoption of international standard valves in key economic centers.

- Middle East & Africa (MEA): Growth centered around desalination plants, large inter-basin transfer projects, and industrial expansion (oil & gas, mining), requiring highly corrosion-resistant materials (stainless steel).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plunger Valve Market.- AVK Group A/S

- VAG-Group

- KSB SE & Co. KGaA

- Valmatic Srl

- Flowserve Corporation

- Cla-Val

- Henry Pratt Company (Mueller Water Products)

- DeZURIK

- Xylem Inc.

- GWC Valve International

- Trelleborg Group

- Böhmer Group

- Belimo Holding AG

- Pentair plc

- Neles Corporation (Valmet)

- Watts Water Technologies, Inc.

- Crane Co.

- Bermad CS

- Orbinox Valve Industries

- Rotork plc

Frequently Asked Questions

Analyze common user questions about the Plunger Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a Plunger Valve over other throttling valves?

The primary technical advantage is the superior capability of the plunger valve to handle high differential pressures and minimize cavitation. Its cylindrical plunger and streamlined flow path ensure gradual pressure reduction by altering the annular opening, which significantly reduces vibration and noise, leading to longer service life compared to traditional butterfly or globe valves in severe throttling applications like reservoir discharge.

How does the integration of IoT and smart technology affect the operational lifespan of plunger valves?

IoT integration enhances the operational lifespan by enabling continuous, real-time condition monitoring. Sensors track vibration, pressure, and position data, feeding into predictive maintenance algorithms. This allows asset owners to identify minor mechanical anomalies and schedule intervention before major wear or failure occurs, preventing catastrophic damage and optimizing the valve's usage within its designed operating parameters.

Which End-Use Application segment holds the largest share in the Plunger Valve Market globally?

The Water Management segment, encompassing municipal water distribution, treatment, and irrigation, holds the largest market share. This dominance is driven by the universal need for reliable pressure and flow regulation in urban water networks and the global scale of replacement and expansion projects necessary to serve growing populations.

What are the key materials used for manufacturing high-pressure plunger valves, and why are they preferred?

Key materials include Ductile Iron with specialized epoxy coatings and various grades of Stainless Steel (especially duplex and super duplex). These materials are preferred for their high mechanical strength, excellent fatigue resistance under cyclic pressure loads, and superior corrosion resistance, essential for maintaining integrity in harsh, high-pressure, and often corrosive water infrastructure environments.

What is the projected growth trajectory for the Plunger Valve Market in the Asia Pacific (APAC) region?

The APAC region is projected to exhibit the highest growth rate due to accelerated urbanization and monumental government investments in infrastructure, particularly in hydropower generation and large-scale water conveyance projects in China and India. This requires substantial volumes of new valve installations, driving the regional market expansion significantly throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager