Plus Size and Big & Tall Clothing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435905 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Plus Size and Big & Tall Clothing Market Size

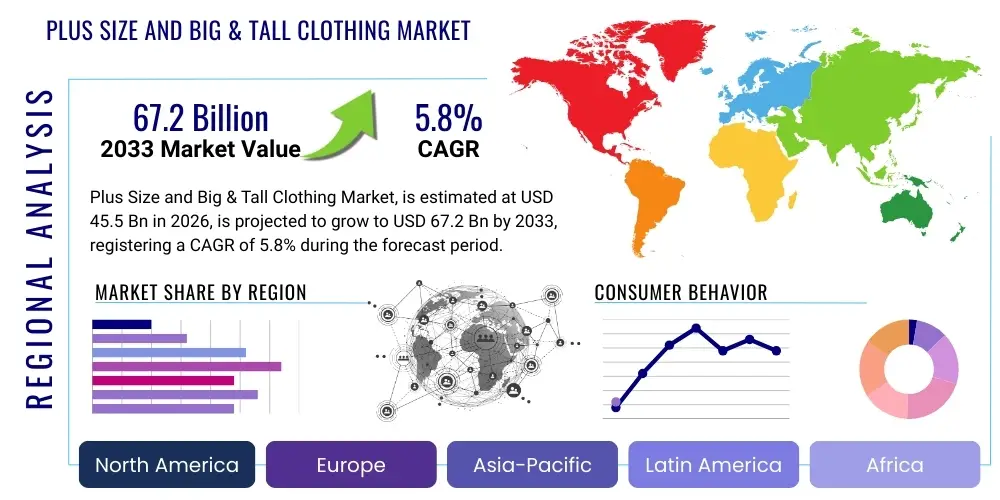

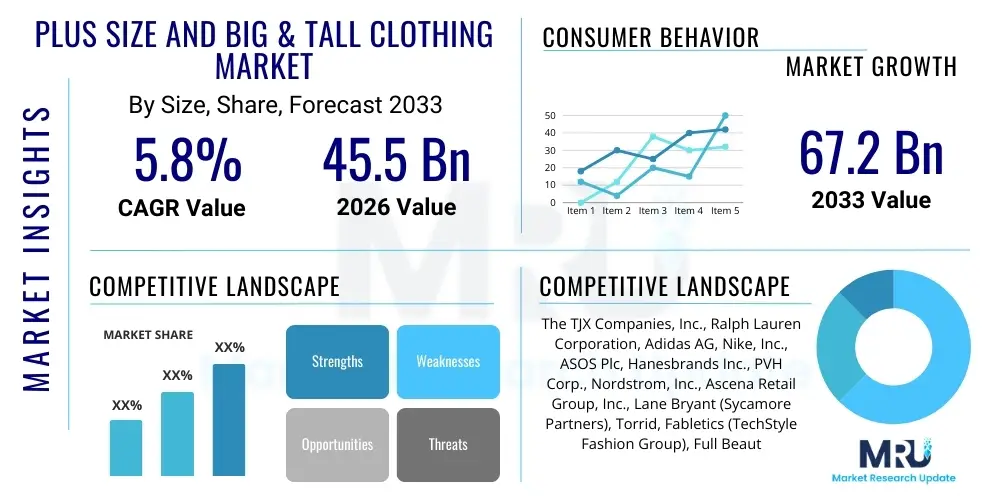

The Plus Size and Big & Tall Clothing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 67.2 Billion by the end of the forecast period in 2033.

Plus Size and Big & Tall Clothing Market introduction

The Plus Size and Big & Tall Clothing Market encompasses apparel specifically designed and tailored for individuals whose body measurements fall outside the traditional standardized size charts, typically defined as sizes 14 and above for women and XL/XLT and above for men. This segment addresses a critical need for inclusive sizing, offering a vast array of fashion-forward, functional, and comfortable garments including formal wear, casual attire, activewear, and intimate apparel. Historically underserved, this consumer group is gaining significant attention from major retailers and specialized brands due to increased body positivity movements, shifting societal norms regarding aesthetic ideals, and robust purchasing power demonstrated by this demographic. The market is evolving rapidly, moving away from purely functional designs to trend-driven collections that match mainstream fashion cycles, thereby driving consumer engagement and increasing average transaction values.

The core applications of Plus Size and Big & Tall apparel span across daily wear, professional settings, and specialized recreational activities. Demand is primarily driven by demographic shifts, increasing rates of obesity globally, and, crucially, enhanced consumer awareness regarding available options and sizing equality. Furthermore, the accessibility provided by e-commerce platforms has drastically reduced the stigma associated with shopping in specialized physical stores, allowing consumers discreet access to diverse inventories and specialized fittings. Product innovation is focusing on advanced fabric technologies that offer stretch, breathability, and better drape, ensuring superior fit and comfort, which are paramount concerns for this consumer base. Successful brands are those that leverage accurate data analytics to understand unique fit requirements, leading to reduced return rates and enhanced customer loyalty within this highly specific niche.

Key benefits derived from the expansion of this market include increased inclusivity within the retail landscape, a higher degree of self-expression for consumers, and substantial economic growth opportunities for companies prioritizing size diversity. Driving factors include the influence of social media figures promoting body acceptance, targeted marketing campaigns that recognize the diversity of body shapes, and technological advancements such as 3D body scanning and virtual try-ons that personalize the shopping experience. The convergence of fashion and technology is central to minimizing the friction points historically associated with finding well-fitting, stylish apparel in larger sizes, positioning the market for sustained, robust growth throughout the forecast period.

Plus Size and Big & Tall Clothing Market Executive Summary

The Plus Size and Big & Tall Clothing Market is characterized by accelerating business trends focused on vertical integration and direct-to-consumer (DTC) models, allowing brands specialized in inclusive sizing to control brand messaging, inventory, and consumer data more effectively. A major shift is the increased participation of mainstream luxury and fast-fashion retailers in launching dedicated extended-size lines, signaling market validation and heightened competition. Investment is heavily directed toward developing sophisticated digital tools for precise fit and virtual styling, addressing the challenge of consistency across varied garment types. Sustainability and ethical sourcing are also becoming significant business considerations, with plus-size consumers increasingly demanding transparent supply chains and durable, high-quality materials, pushing brands away from fast fashion models that often prioritize low cost over longevity.

Regionally, North America maintains the largest market share due to high consumer awareness, established distribution channels, and favorable cultural shifts promoting body positivity. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, driven by rapidly increasing disposable incomes, westernization of fashion trends, and a large, untapped population base in countries like China and India experiencing significant demographic shifts towards larger body sizes. Europe follows North America, with strong market performance anchored by sophisticated European brands focusing on premium quality and sustainable fashion practices within the plus-size segment. Emerging markets in Latin America and MEA are beginning to recognize the economic necessity of serving this niche, primarily through e-commerce penetration which bypasses historical retail infrastructure limitations.

Segment trends reveal that the Women’s Plus Size clothing segment dominates the market in terms of sheer volume and variety, particularly driven by strong performance in the casual wear and activewear categories, reflecting the athleisure trend. Conversely, the Men’s Big & Tall segment is experiencing rapid value growth, fueled by higher price points for specialized formal wear and outdoor apparel. By distribution channel, the e-commerce segment is paramount, facilitating discreet shopping, detailed sizing guides, and efficient returns, thus drastically lowering the barrier to entry for both consumers and emerging brands. Product type segmentation shows increasing demand for specialized categories like lingerie, swimwear, and technical outdoor gear, indicating a maturing market where consumers expect size inclusivity across all facets of their wardrobe, not just basic essentials.

AI Impact Analysis on Plus Size and Big & Tall Clothing Market

User inquiries regarding AI's impact on the Plus Size and Big & Tall Clothing Market commonly revolve around how technology can solve the persistent problem of fit and sizing consistency, which historically leads to high return rates. Users frequently ask about the capabilities of AI-driven tools to personalize recommendations, especially across diverse body shapes (e.g., apple, pear, hourglass in plus sizes), and whether AI can help designers create patterns that accommodate complex fit challenges inherent in larger sizing categories. A core concern is the ethical use of AI in collecting and analyzing sensitive body metric data, balancing personalization with privacy. Expectations are high that AI will optimize inventory management, reducing overstock in less popular sizes while ensuring adequate supply of high-demand items, thereby tackling inventory inefficiency common in specialized retail.

AI is set to revolutionize the supply chain and consumer experience by providing unprecedented accuracy in sizing. Machine learning algorithms analyze vast datasets of body scans, purchase history, and feedback data to predict optimal sizing recommendations, dramatically improving the customer journey and reducing the environmental impact of high returns. In design, Generative AI is assisting pattern makers in optimizing grading rules for complex garments, ensuring that a size 24 garment maintains the intended aesthetic and structure of its smaller counterpart, a task historically challenging for human designers. Furthermore, AI-powered chatbots and virtual assistants provide 24/7 personalized styling advice tailored to specific body types and fashion preferences, bridging the gap often left by traditional retail associates who may lack specialized knowledge in plus-size styling.

The integration of AI extends deeply into operational efficiency. Predictive analytics informed by machine learning forecasts demand for specific size ranges in different regions, minimizing wasted production and maximizing profitability for retailers. This level of optimization is critical for specialized markets like Plus Size and Big & Tall, where size distribution is highly heterogeneous. AI also drives dynamic pricing strategies based on real-time inventory levels and regional demand, ensuring competitive pricing. Ultimately, the adoption of AI is transitioning this market from one grappling with standardized sizing limitations to a hyper-personalized ecosystem where optimal fit and style are accessible to every customer, regardless of their dimensions.

- AI-Powered Sizing Algorithms: Utilization of machine learning for highly accurate, personalized size recommendations, significantly lowering return rates.

- Generative Design for Grading: AI assists in creating complex pattern grading rules that maintain garment integrity and fit aesthetics across extreme size variances.

- Predictive Inventory Management: Machine learning forecasts specific size demands regionally to optimize stock levels and reduce costly overstocking or stockouts.

- Virtual Try-On (VTO) Enhancement: AI integration improves the realism and accuracy of VTO tools tailored specifically for diverse plus-size body morphologies.

- Personalized Styling and Chatbots: AI-driven assistants provide customized outfit recommendations based on body shape, occasion, and inventory availability.

- Supply Chain Optimization: Leveraging AI for demand sensing and routing efficiencies to handle the specialized logistics required for diverse and bulky product lines.

DRO & Impact Forces Of Plus Size and Big & Tall Clothing Market

The Plus Size and Big & Tall Clothing Market is influenced by a powerful combination of consumer-driven momentum (Drivers), operational complexities (Restraints), and expanding technological integration (Opportunities), all synthesized by strong Impact Forces. The primary driver is the accelerating body positivity movement across social media and mainstream media, which has destigmatized larger sizes and amplified consumer demand for stylish, accessible options. This cultural shift is coupled with undeniable demographic realities, specifically the rising prevalence of obesity globally, which naturally increases the size of the target market. Retailers are recognizing the immense and previously untapped purchasing power of this loyal consumer base, pushing for expanded offerings.

However, significant restraints temper this growth trajectory. The most critical operational challenge remains the high complexity of pattern grading and achieving consistent fit across diverse body shapes within the plus-size category, leading to higher manufacturing costs and potentially discouraging fast-fashion entry. Furthermore, lingering societal biases sometimes result in a lack of retail space commitment or limited investment in sophisticated design talent dedicated to this niche. Supply chain management is also complicated by the need to manage a broader range of stock-keeping units (SKUs) compared to standard-size apparel, increasing warehousing and logistics expenses. These operational hurdles require significant strategic investment to overcome effectively.

Opportunities for growth are abundant, particularly through technological adoption. The expansion of e-commerce allows niche brands to reach a global audience without the prerequisite of physical retail presence. Innovations in 3D body scanning and virtual fitting technologies promise to solve the consistency problem, providing a highly tailored customer experience. Strategic partnerships between specialized plus-size retailers and mainstream brands (collaborations) are key opportunities to introduce high-fashion aesthetics to the extended size market. The market’s Impact Forces are driven primarily by consumer advocacy and high brand loyalty, meaning positive reputation and strong social media engagement translate directly into sustained revenue streams. Brands that effectively address the emotional needs and fit requirements of this demographic are poised for superior market performance and differentiation.

Segmentation Analysis

The segmentation of the Plus Size and Big & Tall Clothing Market is complex, relying heavily on gender, product type, distribution channel, and application, reflecting the highly diverse nature of consumer needs within this niche. This detailed breakdown allows brands to strategically target specific sub-demographics with precision, moving beyond a one-size-fits-all approach to extended sizing. The overarching goal of segmentation is to recognize that a size 20 consumer has unique needs distinct from a size 14, and men's tall sizing presents challenges separate from men's broad sizing. Effective segmentation is critical for optimizing inventory, design pipelines, and marketing spend, ensuring maximum relevance to the end-user.

By Product Type, the market is segmented into essentials, formal wear, casual wear, activewear, and intimate apparel. While casual wear and essentials account for the largest volume due to frequency of purchase, specialized categories like activewear (driven by fitness inclusivity) and formal wear (addressing professional and special occasion needs) are experiencing the fastest value growth. Gender segmentation differentiates between Women’s Plus Size, which is a mature and highly competitive segment, and Men’s Big & Tall, which is currently undergoing rapid expansion and modernization. The distribution segmentation highlights the dominance of online retail, which provides superior inventory depth and discretion, alongside the importance of specialized brick-and-mortar stores for high-touch services like fitting and personalization.

Geographical segmentation remains crucial for operational logistics and market penetration, as sizing standards and cultural acceptance of larger sizes vary significantly between regions like North America, Europe, and developing APAC economies. The precise understanding of these segmented markets enables manufacturers to tailor their supply chain strategies, from sourcing appropriate materials (e.g., higher quality stretch fabrics) to localized marketing campaigns that resonate with regional body image standards and fashion preferences. This granular approach ensures that expansion efforts yield sustainable market share gains rather than generalized retail presence.

- By Gender:

- Women’s Plus Size

- Men’s Big & Tall

- Unisex/Gender-Neutral Extended Sizes

- By Product Type:

- Casual Wear (Tops, Bottoms, Denim)

- Formal Wear (Suits, Dresses, Blazers)

- Activewear and Sportswear

- Intimate Apparel and Sleepwear

- Outerwear and Specialized Apparel

- By Application:

- Daily Wear

- Work/Professional Wear

- Special Occasion Wear

- Sport/Fitness Activities

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Department Stores, Specialty Stores, Supermarkets)

Value Chain Analysis For Plus Size and Big & Tall Clothing Market

The Value Chain for the Plus Size and Big & Tall Clothing Market begins with the highly specialized Upstream Analysis, focusing on raw material procurement, fabric innovation, and initial design conceptualization. Unlike standard apparel, this segment requires greater quantities of specialized fabrics—often those with enhanced stretch, durability, and better draping characteristics (like modal, spandex blends, and technical knits)—to ensure optimal fit and comfort for larger dimensions. Sourcing must also factor in the higher material consumption per garment, necessitating robust relationships with suppliers capable of providing high-quality, sustainable materials at scale. Design and pattern making are arguably the most critical upstream steps, requiring expert knowledge in fit science, sophisticated 3D body mapping, and precise grading rules that account for complex body variations beyond simple circumference scaling, influencing manufacturing feasibility and cost.

The Midstream component involves manufacturing and production, where specialized machinery and skilled labor are necessary to handle larger fabric cuts and maintain pattern integrity during assembly. Quality control is paramount in this stage, as poor stitching or inconsistent sizing leads directly to high return rates. Downstream Analysis encompasses distribution and retail. The primary distribution channel is rapidly shifting towards Direct-to-Consumer (DTC) e-commerce, offering brands unparalleled control over sizing information presentation and customer service. Indirect channels, such as wholesale agreements with large department stores, remain relevant but often require rigorous inventory management agreements to ensure adequate floor space and accurate sizing displays.

Direct Distribution, via brand-specific e-commerce sites and flagship stores, allows for richer data collection on consumer fit preferences, enabling continuous improvement in design and sizing algorithms—a competitive advantage. Indirect Distribution, through third-party platforms like Amazon or Zalando, offers broader market reach but dilutes brand control over the fitting experience. Efficient logistics and warehouse management are essential downstream, as larger garments and diverse SKUs require greater physical space and handling complexity. Ultimately, a successful value chain prioritizes advanced pattern technology upstream, ethical and sustainable manufacturing midstream, and a frictionless, information-rich shopping experience downstream to address the unique pain points of the Plus Size and Big & Tall consumer.

Plus Size and Big & Tall Clothing Market Potential Customers

The core potential customers for the Plus Size and Big & Tall Clothing Market are individuals requiring clothing that accommodates non-standard body dimensions, typically identified as women wearing size 14 (US) and above, and men requiring sizes 2XL/XLT and above. This demographic is highly diverse but unified by the need for apparel that offers both functional fit and current fashion aesthetics, a need historically neglected by mainstream retailers. End-users are primarily segmented demographically, including working professionals who require high-quality formal wear, active individuals seeking performance-driven athletic apparel, and younger, fashion-conscious consumers who demand trend-relevant casual wear. Their purchasing decisions are heavily influenced by inclusivity messaging, brand authenticity, and the perceived quality and durability of the garments.

Beyond the primary demographic, secondary potential customers include institutions and organizations that require uniforms for employees who fall within these extended sizing categories, such as healthcare workers, airline staff, and corporate teams. Furthermore, the market also serves customers seeking specialized fit solutions due to medical conditions or recent lifestyle changes (e.g., post-maternity or weight fluctuation). These buyers are often characterized by high brand loyalty once they find a reliable fit, contrasting sharply with the general apparel market where brand switching is more common. This loyalty stems from the difficulty and emotional investment involved in finding satisfactory clothing, making the perceived value of a reliable fit extremely high.

The evolving customer base is also defined by their digital fluency. They are highly engaged online, actively seeking reviews, contributing to community discussions about sizing consistency, and leveraging social media to discover new, inclusive brands. They are demanding consumers who prioritize sustainability, ethical production, and transparency in sizing charts. Retailers aiming to capture these potential buyers must therefore invest heavily in digital infrastructure, including detailed measurement guides, diverse model representation, and responsive customer service that understands the nuances of extended sizing. The focus must shift from simply providing larger clothes to offering meticulously designed, confidence-boosting garments that recognize the full spectrum of body diversity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 67.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The TJX Companies, Inc., Ralph Lauren Corporation, Adidas AG, Nike, Inc., ASOS Plc, Hanesbrands Inc., PVH Corp., Nordstrom, Inc., Ascena Retail Group, Inc., Lane Bryant (Sycamore Partners), Torrid, Fabletics (TechStyle Fashion Group), Full Beauty Brands, Casual Male Retail Group (Destination XL Group, Inc.), Avenue Stores, Universal Standard, Dia & Co., Boohoo Group Plc, Lindex, Marks & Spencer. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plus Size and Big & Tall Clothing Market Key Technology Landscape

The technological landscape supporting the Plus Size and Big & Tall Clothing Market is rapidly evolving, driven by the imperative to solve the perennial challenges of accurate fit and consistent sizing. A cornerstone of this evolution is the deployment of advanced 3D body scanning and body mapping technologies. These tools capture precise anatomical data, allowing designers to create highly accurate virtual avatars that reflect the real diversity of body shapes within the extended size segment. This data is critical for refining pattern grading software, moving beyond simplistic linear scaling to complex non-linear adjustments that maintain the structural integrity and aesthetic flow of the garment across all sizes. The integration of 3D scanning into fitting processes minimizes the need for multiple physical samples, reducing production costs and time-to-market, which is particularly beneficial given the niche nature of the segment.

Furthermore, the growth of the market is heavily reliant on e-commerce optimization, spearheaded by sophisticated Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These technologies power recommendation engines that not only suggest style based on purchase history but, more importantly, predict the optimal size and fit based on aggregated user data and feedback loops, substantially lowering the return rate often associated with online apparel purchases in this category. Virtual Try-On (VTO) solutions, which utilize Augmented Reality (AR) or sophisticated photorealistic rendering, are becoming increasingly common. These VTO tools, when customized for plus-size body metrics, allow consumers to visualize how a garment will drape and fit before purchase, providing confidence and replacing the physical fitting room experience which can sometimes be intimidating for this consumer group.

Innovation also spans material science and sustainable manufacturing practices. There is a heightened demand for specialized technical fabrics that offer features like four-way stretch, moisture-wicking properties, and sustainable compositions (e.g., recycled polyester, organic cotton blends) designed to accommodate the functional requirements of larger body mass and active lifestyles. On the manufacturing side, advancements in automated cutting and sewing technologies are being adapted to efficiently handle the larger and often more intricate fabric pieces required for plus-size garments. This technological infusion, from initial design optimization via 3D software to final customer delivery supported by predictive analytics, is essential for mainstream adoption and profitable scaling within the Plus Size and Big & Tall Clothing sector.

Regional Highlights

- North America: This region holds the largest market share, driven by high consumer spending, advanced e-commerce infrastructure, and a robust body positivity movement institutionalized through media and social advocacy. The US market, in particular, is highly competitive with major retailers and specialized DTC brands heavily investing in extended sizing. The market is mature, with a strong focus on high-quality activewear and workwear catering to the Big & Tall male demographic. Strategic initiatives often center around size-inclusive marketing and technological integration, particularly virtual fitting solutions, to maintain market dominance.

- Europe: Europe represents the second-largest market, characterized by strong consumer demand for sustainable and ethically sourced plus-size apparel. Western European countries like the UK and Germany lead in market maturity, emphasizing high-fashion and design-led clothing for larger sizes, moving beyond basic essentials. Regulatory environments increasingly favor size inclusivity. However, the market remains somewhat fragmented due to varying national sizing standards, posing a challenge that technological standardization efforts are attempting to address. Growth is steady, focused on premiumization and brand authenticity.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising disposable incomes, evolving dietary habits leading to increased average body sizes, and explosive growth in mobile commerce. While the cultural acceptance of larger sizes varies significantly, the sheer population size of countries like China and India presents massive, largely untapped market potential. The current focus is on building localized supply chains, adapting global fashion trends to regional preferences, and overcoming logistical complexities associated with penetrating diverse geographical markets. E-commerce platforms are the primary driver of market access.

- Latin America (LATAM): The LATAM market is in an emergent phase, with growth driven by increasing urbanization and the expansion of international retail chains. Brazil and Mexico are key markets showing high awareness and demand for stylish extended sizes. Economic volatility remains a restraint, but local manufacturers are increasingly responding to consumer demand, particularly in fast-fashion segments. The adoption of online retail is accelerating market accessibility, allowing consumers in less urbanized areas to access previously unavailable products.

- Middle East and Africa (MEA): This region exhibits nascent growth, concentrated primarily in the GCC countries due to higher disposable incomes and exposure to international fashion trends. The market is primarily served by imports and focused on luxury or conservative plus-size fashion. Challenges include cultural considerations regarding modesty requirements and the necessity of establishing dedicated supply chain networks for this specialized product category. E-commerce is crucial for early market penetration, especially in securing international brands' presence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plus Size and Big & Tall Clothing Market.- The TJX Companies, Inc.

- Ralph Lauren Corporation

- Adidas AG

- Nike, Inc.

- ASOS Plc

- Hanesbrands Inc.

- PVH Corp.

- Nordstrom, Inc.

- Ascena Retail Group, Inc.

- Lane Bryant (Sycamore Partners)

- Torrid Holdings Inc.

- Fabletics (TechStyle Fashion Group)

- Full Beauty Brands

- Casual Male Retail Group (Destination XL Group, Inc.)

- Avenue Stores

- Universal Standard

- Dia & Co.

- Boohoo Group Plc

- Lindex

- Marks & Spencer Group plc

- Fashion Nova, LLC (NovaCURVE)

- J.C. Penney Company, Inc.

Frequently Asked Questions

Analyze common user questions about the Plus Size and Big & Tall Clothing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Plus Size and Big & Tall Clothing Market globally?

Market growth is fundamentally driven by the accelerating body positivity and inclusivity movements, combined with rising global obesity rates which naturally expand the target consumer base. Enhanced accessibility through e-commerce and improved fashion offerings are key secondary drivers making stylish options more available and reducing shopping stigma.

How is technology addressing the primary challenge of fit and sizing consistency in plus-size apparel?

Technology addresses fit challenges through the deployment of 3D body scanning and mapping for superior pattern design, alongside AI-powered recommendation engines that offer personalized size suggestions online. This reduces return rates and improves customer satisfaction by providing a more reliable fit prediction.

Which distribution channel dominates the sales of Plus Size and Big & Tall Clothing?

The Online Retail segment, encompassing specialized brand websites and large e-commerce marketplaces, dominates sales. This channel provides the necessary inventory depth, discretion, detailed sizing information, and efficient return processes crucial for serving the geographically dispersed and niche requirements of this consumer group.

What are the primary operational restraints facing manufacturers in the Big & Tall market segment?

Manufacturers face significant operational restraints primarily related to the technical complexity of pattern grading (achieving consistent fit across diverse extended body shapes), higher material consumption per unit, and the logistical challenges associated with managing a vast number of diverse, large-sized Stock Keeping Units (SKUs).

Which regional market shows the strongest future potential for the Plus Size and Big & Tall market?

The Asia Pacific (APAC) region is projected to exhibit the highest future growth potential (CAGR). This is due to rapid economic development leading to increased disposable incomes, urbanization, and a large, previously underserved consumer population that is increasingly adopting western fashion and e-commerce shopping habits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager