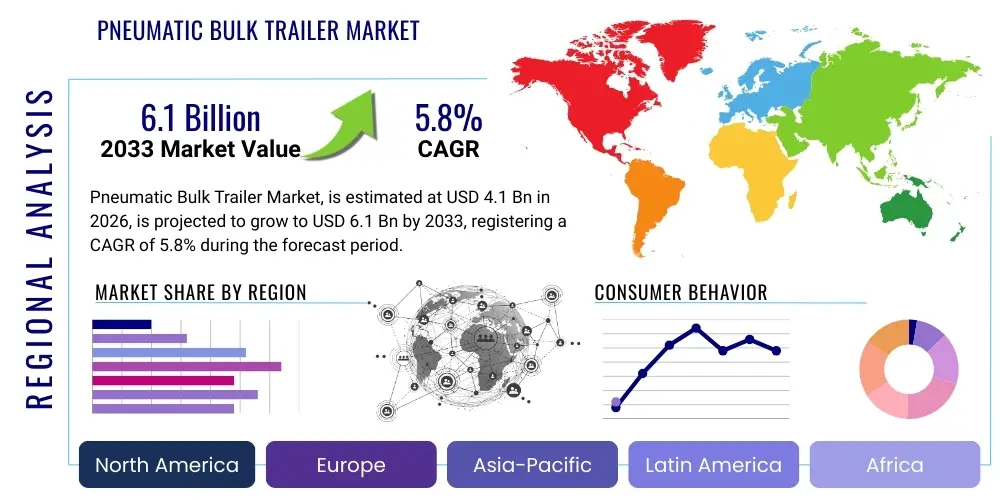

Pneumatic Bulk Trailer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436291 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Pneumatic Bulk Trailer Market Size

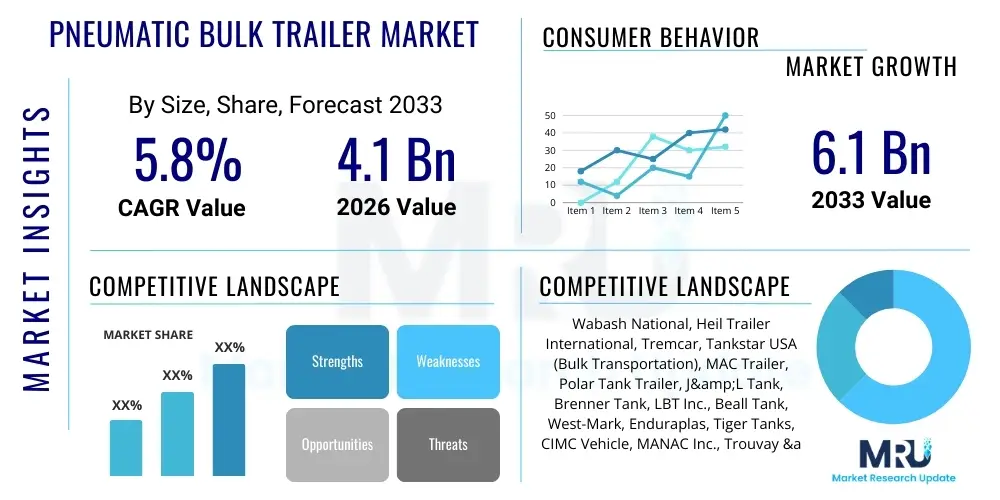

The Pneumatic Bulk Trailer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by accelerated infrastructure development across emerging economies, coupled with stringent regulatory standards demanding efficient and contamination-free transport of powdered and granular materials. The inherent advantages of pneumatic trailers, particularly their sealed system which minimizes material loss and environmental exposure, solidify their position as essential assets in industrial logistics chains worldwide.

Market expansion is also intrinsically linked to the performance of key end-use sectors, including construction, agriculture, and chemicals. The global surge in cement and aggregate production, necessitated by urbanization and public works projects, directly translates into increased demand for high-capacity pneumatic trailers. Furthermore, technological advancements focused on reducing the tare weight of these trailers through the integration of high-strength aluminum alloys and composite materials are enhancing operational efficiency, allowing for greater payload capacity per trip, thereby making the investment more attractive for logistics providers operating under tight profit margins and escalating fuel costs. This operational optimization drives fleet modernization and replacement cycles.

Pneumatic Bulk Trailer Market introduction

Pneumatic Bulk Trailers, often referred to as 'tankers' or 'dry bulk tanks,' are specialized semi-trailers designed for the efficient, safe, and contamination-controlled transportation of fine-grained or powdered materials such as cement, flour, plastics pellets, sand, fly ash, and certain chemical compounds. These trailers utilize compressed air (pneumatic pressure) for both loading and unloading operations, which is fundamentally advantageous over mechanical handling systems because it allows for direct transfer into silos or storage containers without intermediate steps, significantly reducing labor requirements and minimizing the risk of material degradation or atmospheric exposure. The typical construction involves a cylindrical or conical pressure vessel mounted on a chassis, fabricated predominantly from carbon steel or aluminum, with the latter gaining prominence due to its substantial weight reduction benefits.

The primary applications of these sophisticated transportation units span across vital industrial sectors. In the construction industry, pneumatic trailers are indispensable for delivering cement, lime, and aggregates to batching plants. The agricultural sector relies heavily on them for the bulk transport of grains, feeds, and fertilizers, ensuring high throughput during harvest seasons. The chemical and plastics industries use specialized, often stainless steel, versions for sensitive materials like resins and polyethylene pellets, where maintaining purity and integrity is paramount. Key benefits driving market adoption include superior unloading speed, reduced material spillage, dust control capabilities which comply with environmental regulations, and the ability to handle products that are highly abrasive or prone to moisture absorption without compromising quality.

Major driving factors sustaining the market's growth momentum include the ongoing globalization of supply chains, necessitating long-distance bulk transport solutions, and the accelerating pace of urbanization, particularly in developing nations, which fuels the demand for basic construction materials. Regulatory shifts favoring cleaner transportation methods and tighter control over hazardous dust emissions are also pushing logistics companies toward sealed, pneumatic systems. Furthermore, continuous innovations in trailer design, focusing on aerodynamics, increased capacity, and enhanced durability to withstand harsh operating conditions, are broadening the market scope and applicability across diverse industrial environments globally.

Pneumatic Bulk Trailer Market Executive Summary

The Pneumatic Bulk Trailer Market is experiencing dynamic shifts, characterized by strong business trends centered on lightweighting technologies and enhanced safety features. Key manufacturers are focusing heavily on integrating high-strength aluminum and advanced composite materials into tank construction to maximize payload efficiency, addressing the perennial industry challenge of increasing operational profitability under restrictive weight limits. Digital integration, particularly the adoption of telematics and smart pressure monitoring systems, is moving from a niche offering to a standard expectation, improving fleet management, predictive maintenance scheduling, and cargo integrity monitoring throughout transit. Sustainability is also a core business driver, with a rising demand for trailers optimized for fuel efficiency and reduced carbon footprint through aerodynamic design modifications and reduced rolling resistance tires.

Regionally, Asia Pacific (APAC) stands out as the epicenter of growth, largely propelled by massive government investment in infrastructure, encompassing road networks, housing, and industrial parks, particularly in China, India, and Southeast Asian nations. North America and Europe, representing mature markets, show consistent demand, primarily driven by fleet replacement cycles and the adoption of high-specification, specialized trailers (e.g., pressurized sanitary trailers for food grade materials). The Middle East and Africa (MEA) region demonstrates significant potential, directly correlating with large-scale energy and construction projects that require continuous bulk material supply, though market volatility remains a regional constraint.

Segment-wise, the high-capacity trailer segment (exceeding 1,500 cubic feet) dominates the market share due to its efficiency in long-haul operations, especially in commodities like cement and plastics. The aluminum trailer segment is projected to exhibit the fastest growth CAGR, surpassing traditional steel models due to compelling lifetime operational savings, despite a higher initial procurement cost. Application trends indicate robust growth in the construction and mining sectors, although the food and beverage segment is increasingly demanding specialized, smaller-capacity stainless steel units, driven by stringent sanitary and quality control regulations, offering high-margin opportunities for specialized manufacturers.

AI Impact Analysis on Pneumatic Bulk Trailer Market

User inquiries regarding AI's impact on the Pneumatic Bulk Trailer Market overwhelmingly center on optimizing the complex logistics involved in dry bulk transport, maximizing equipment uptime, and enhancing safety protocols during high-pressure operations. Common questions revolve around the feasibility of using AI-driven predictive analytics to anticipate component failure (especially in compressors and seals), the deployment of machine learning algorithms for real-time optimal route planning considering factors like weight, road grade, and traffic, and the potential for automating complex loading and unloading sequences to minimize human error and downtime. There is also significant user interest in how AI can integrate sensor data from advanced telematics systems to provide deep operational insights that extend beyond simple GPS tracking, transforming raw data into actionable intelligence for fleet managers and safety officers.

The primary influence of Artificial Intelligence in this sector will manifest through the enhancement of operational resilience and efficiency. AI algorithms are instrumental in analyzing historical maintenance data, ambient conditions, and operational metrics (such as fill/discharge pressure cycles and vibration analysis) to establish highly accurate predictive maintenance schedules for critical pneumatic system components. This transition from reactive or time-based maintenance to condition-based maintenance drastically reduces unexpected breakdowns, maximizing trailer utilization rates. Furthermore, advanced AI-powered route optimization services consider material density and dynamic fuel prices alongside traditional variables, providing logistics firms with micro-optimization opportunities that compound into substantial annual savings, thereby improving the overall economic viability of pneumatic bulk hauling.

- AI-driven Predictive Maintenance: Analyzing sensor data (vibration, temperature, pressure) to forecast failure points in compressors, blowers, and valves, minimizing costly unscheduled downtime.

- Dynamic Route and Load Optimization: Machine learning algorithms processing real-time traffic, weather, and road condition data to ensure the shortest, safest, and most fuel-efficient route for specific dry bulk commodities.

- Enhanced Safety Monitoring: Using computer vision and AI analytics during loading/unloading to ensure compliance with high-pressure safety procedures and identifying potential hazards or breaches in real-time.

- Automated Data Logging and Reporting: Streamlining regulatory compliance and operational reporting by autonomously collecting, classifying, and reporting key performance indicators (KPIs) regarding cargo integrity and delivery times.

- Optimized Pressure Control: AI systems dynamically adjusting discharge pressure based on material type, silo capacity, and line resistance, ensuring faster and safer unloading while preventing material compaction or damage.

DRO & Impact Forces Of Pneumatic Bulk Trailer Market

The Pneumatic Bulk Trailer Market is shaped by a confluence of accelerating drivers (D), persistent restraints (R), significant opportunities (O), and influential market impact forces. The core driver is the robust expansion of global infrastructure and construction activities, particularly in emerging economies, which necessitates the steady, large-volume transport of materials like cement and construction chemicals. Simultaneously, stringent industrial regulations requiring dust minimization and contamination control are compelling industries, especially food processing and chemicals, to transition from conventional material handling to sealed pneumatic systems, boosting demand. However, the high initial capital expenditure associated with specialized pneumatic trailers and related infrastructure, coupled with the reliance on highly skilled labor for complex maintenance of the pressure systems, acts as a primary restraint, particularly affecting smaller regional logistics providers. Opportunities reside in the development and adoption of smart, connected trailers utilizing IoT and telematics, alongside the shift towards sustainable, lightweight materials that enhance operational efficiency and align with global sustainability goals.

Market growth is strongly driven by the increasing automation within logistics processes. As manufacturers strive for just-in-time delivery and reduced operational lead times, the fast, efficient, and direct transfer capability offered by pneumatic systems becomes an indispensable competitive advantage. Furthermore, the diversification of materials transported, including specialized chemicals, pulverized coal, and specific food ingredients, continues to broaden the application base beyond traditional construction materials. Regulatory pressures, especially concerning driver safety and vehicle emissions, indirectly favor manufacturers who invest in modern, aerodynamic, and maintenance-friendly trailer designs. Conversely, the market faces headwinds from volatility in raw material prices, particularly steel and aluminum, which directly impacts the manufacturing cost and, consequently, the final procurement price for end-users, leading to delayed investment decisions in some cycles.

The key impact forces dictating market evolution include intense competition among established global manufacturers and regional specialists, driving continuous innovation in capacity optimization and structural design. Technological advances, particularly in digital integration, exert a strong positive influence, reshaping expectations around real-time monitoring and operational transparency. Economic factors, such as fluctuating fuel costs and global interest rate changes affecting financing options for fleet acquisition, significantly impact demand elasticity. Finally, environmental and legislative forces—mandating better road safety standards, lower noise pollution, and strict material containment protocols—compel rapid adaptation in trailer design and maintenance practices, ensuring that only compliant, modern equipment remains commercially viable. These interwoven forces determine the speed and direction of market penetration across different geographies.

Segmentation Analysis

The Pneumatic Bulk Trailer Market is segmented based on critical operational characteristics including Material Type, Capacity, and Application, providing a structured view of diverse market needs and purchasing behaviors across various industrial sectors. The segmentation by Material Type, primarily Aluminum and Steel (Carbon and Stainless), reflects the trade-off between tare weight efficiency, corrosion resistance, and initial cost, driving distinct demand patterns across regional markets and specific cargo requirements. The Capacity segmentation highlights the predominant move toward larger volumes for efficiency in bulk commodities like cement, contrasting with smaller, specialized units required for high-value or highly sensitive materials in chemical transport.

Analyzing these segments reveals that manufacturers are increasingly focusing R&D efforts on aluminum-based solutions due to the compelling economic case for maximizing payload. While steel remains dominant in specific heavy-duty or abrasive applications, the lightweight segment is rapidly capturing market share in regions with strict maximum weight limits. The application segment analysis clearly delineates market resilience, showing construction and infrastructure to be the foundational pillars of demand, while the specialized requirements of the food and beverage industry and the chemical sector present high-growth, high-specification opportunities, demanding greater specialization in interior linings, sanitary fittings, and pressure controls, distinguishing them from standard utility trailers.

- By Material Type:

- Aluminum Trailers

- Steel Trailers (Carbon Steel, Stainless Steel)

- By Capacity:

- Small Capacity (Below 1,000 Cubic Feet)

- Medium Capacity (1,000 to 1,500 Cubic Feet)

- High Capacity (Above 1,500 Cubic Feet)

- By Application:

- Construction (Cement, Fly Ash, Sand)

- Chemicals and Plastics (Resins, Pellets, Powders)

- Food and Beverage (Flour, Sugar, Grains)

- Mining and Minerals (Lime, Ore Concentrate)

- Agriculture (Feed, Fertilizer)

Value Chain Analysis For Pneumatic Bulk Trailer Market

The value chain for the Pneumatic Bulk Trailer Market begins with the upstream suppliers responsible for providing essential raw materials and specialized components. This phase includes the sourcing of high-grade steel (both carbon and stainless), various aluminum alloys (critical for lightweight designs), and specialized components such as compressors, blowers, axles, landing gear, and advanced sealing systems. Key upstream dynamics include maintaining stable raw material pricing and securing reliable supply chains for specialized pneumatic equipment, as component quality directly impacts the trailer's operational lifespan, safety, and efficiency. Manufacturers often integrate vertically for basic chassis fabrication but rely heavily on specialized pneumatic system vendors (like those producing rotary lobe blowers or high-efficiency air filters) to ensure optimal functionality for specific commodities.

The middle segment of the value chain is occupied by the trailer manufacturers, who undertake design, fabrication, assembly, and rigorous testing, ensuring compliance with international safety and transport regulations (such as DOT standards in the US or relevant European directives). Differentiation at this stage is achieved through innovative engineering, quality control, customization capabilities, and the integration of advanced technologies like telematics. Downstream activities involve distribution channels, which include direct sales to large fleet operators, sales through regional dealerships, and specialized leasing companies. Direct distribution often dominates transactions with major construction firms or global logistics providers, while dealerships cater to smaller, regional carriers, offering localized maintenance and support services.

The final stage of the value chain encompasses end-users—large-scale industrial operators in construction, agriculture, and chemicals—and the crucial post-sales support infrastructure. Post-sales services, including warranty provision, spare parts availability, scheduled maintenance, and refurbishment services, are vital components that drive customer retention and operational longevity. The trend towards indirect distribution via specialized leasing and rental companies is growing, allowing end-users to manage capital expenditure more efficiently while still accessing modern, well-maintained equipment. The efficiency of the entire chain is increasingly dependent on streamlined communication between component suppliers, manufacturers, and end-users regarding performance feedback and technological requirements.

Pneumatic Bulk Trailer Market Potential Customers

The primary purchasers and end-users of Pneumatic Bulk Trailers are large-scale logistics and transportation companies that specialize in dry bulk commodities, along with the industrial firms that generate or consume these materials in large volumes. The construction sector remains the largest consumer, primarily demanding high-capacity trailers for cement, lime, and fly ash transport necessary for infrastructure and building projects. These customers prioritize robustness, high cubic volume capacity, and reliability under constant, heavy use. Another significant customer base includes major chemical and plastics manufacturers, who require highly specialized, contamination-resistant stainless steel or lined aluminum trailers to transport sensitive materials like plastic resins, PVC powders, and chemical intermediates, valuing cargo integrity and cleanability above sheer capacity.

The agriculture and food processing industries represent a rapidly expanding customer segment, driven by the need for sanitary transport of grains, flours, sugars, and animal feed. These users require trailers that meet stringent food safety standards (e.g., FDA requirements), necessitating smooth internal surfaces, easy sanitation access, and specific air filtration systems to prevent microbial contamination. Logistics firms dedicated to serving these sectors often seek medium-capacity trailers optimized for quick turnaround and regulatory compliance. Furthermore, mining operations and power generation facilities also constitute steady customer bases, requiring specialized trailers for moving pulverized coal, mineral ores, and various by-products like gypsum or slag.

Purchasing decisions among these diverse end-users are influenced by several factors: overall operational lifetime cost, payload optimization allowed by lightweight design, adherence to regional environmental and safety regulations, and the availability of responsive post-sales service and spare parts. Large corporations tend to purchase directly from manufacturers, often demanding extensive customization, whereas smaller, independent carriers frequently rely on equipment financing and leasing services provided by dealers or third-party leasing firms. The adoption of smart, telematics-equipped trailers is increasingly becoming a deciding factor, especially for potential customers focused on integrating their transport assets into modern, data-driven supply chain management systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wabash National, Heil Trailer International, Tremcar, Tankstar USA (Bulk Transportation), MAC Trailer, Polar Tank Trailer, J&L Tank, Brenner Tank, LBT Inc., Beall Tank, West-Mark, Enduraplas, Tiger Tanks, CIMC Vehicle, MANAC Inc., Trouvay & Cauvin, Kässbohrer, Spitzer Silo. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pneumatic Bulk Trailer Market Key Technology Landscape

The technological evolution within the Pneumatic Bulk Trailer Market is centered around three core areas: material science innovation for weight reduction, sophisticated pneumatic system optimization for enhanced speed and efficiency, and digital integration for improved safety and fleet management. The shift towards advanced high-strength aluminum alloys and, increasingly, carbon fiber reinforced polymer (CFRP) composites for non-pressure bearing structures is paramount. These lightweighting strategies directly translate to higher legal payloads, offering substantial competitive advantages to operators. Furthermore, modern trailers incorporate optimized internal baffling and conical design elements to ensure complete and rapid material discharge, minimizing residual product and cleanout time, which are critical operational cost factors.

Pneumatic system technology is advancing through the implementation of highly efficient, low-noise blowers and specialized fluidizing devices. Manufacturers are focusing on variable speed drives and smart pressure control systems that dynamically adjust air flow based on material characteristics (e.g., density, particle size, moisture content) and discharge line length. This optimization minimizes energy consumption and prevents material compaction or damage during the transfer process. Another critical technological advancement is the use of specialized internal linings and treatments, particularly in stainless steel tanks, designed to prevent corrosion and adhesion when transporting abrasive or chemically aggressive substances, thereby extending the trailer's service life and maintaining cargo purity, especially crucial for sensitive chemical and food-grade applications.

Digital technology, led by the integration of Internet of Things (IoT) sensors and advanced telematics platforms, is transforming trailer utilization. Modern pneumatic trailers are equipped with sensors to monitor tire pressure, brake health, tank pressure, temperature, and residual material levels in real-time. This connectivity allows for comprehensive remote diagnostics, predictive maintenance alerts, and seamless integration with Enterprise Resource Planning (ERP) systems used by logistics firms. Furthermore, sophisticated electronic stability control (ESC) and advanced braking systems (ABS) are standard safety technologies, enhancing vehicle control under dynamic loading conditions and contributing to overall road safety, which is a key requirement driven by regulatory bodies worldwide.

Regional Highlights

The global Pneumatic Bulk Trailer Market demonstrates distinct growth characteristics across major geographical regions, influenced by varying infrastructure maturity, economic development, and regulatory frameworks. North America (NA), comprising the United States and Canada, represents a mature, high-value market characterized by stringent safety regulations and a strong demand for high-capacity, lightweight aluminum trailers. Fleet replacement cycles are the primary demand driver, alongside increasing investment in specialized trailers for the petrochemical and food industries. The North American market is also a leader in adopting advanced telematics and smart trailer technologies, driven by large corporate logistics operators seeking optimized operational efficiency and superior regulatory compliance tracking.

Asia Pacific (APAC) is unequivocally the fastest-growing region globally, fueled by aggressive urbanization, massive government expenditure on infrastructure (roads, railways, and industrial construction), and rapid industrialization in countries like China, India, and Indonesia. This sustained growth translates into exponential demand for cement, chemicals, and plastics transport. While cost-effectiveness and durability often favor steel trailers in certain segments, the rising focus on operational efficiency and environmental protection is gradually increasing the adoption of aluminum trailers. Regional manufacturing bases are expanding rapidly, leading to highly competitive local markets, although quality standards and technological integration often lag behind Western counterparts.

Europe represents a highly consolidated and technologically advanced market, where demand is characterized by strict environmental legislation (favoring low-emission transport) and regulations governing maximum dimensions and weights. European manufacturers excel in producing highly customized, multi-axle, and often smaller-capacity pneumatic tankers optimized for complex urban and narrow road networks. Demand is steady, driven by the replacement of aging fleets and the continued growth of high-value chemical and food-grade material transport. Latin America and the Middle East & Africa (MEA) present emerging market opportunities, heavily dependent on commodity price stability and the execution pace of large-scale infrastructure and energy projects, requiring robust, often higher-axle load trailers capable of operating reliably in challenging terrain and climatic conditions.

- Asia Pacific (APAC): Dominant growth region driven by large-scale infrastructure projects in China, India, and Southeast Asia; increasing adoption of cement and chemical transport technologies.

- North America: Mature market focusing on fleet modernization, lightweight aluminum design adoption, and high integration of IoT/Telematics for regulatory compliance and operational optimization.

- Europe: Characterized by stringent environmental and safety standards; strong demand for specialized, high-specification trailers for food and chemical transport; focus on aerodynamic efficiency.

- Middle East & Africa (MEA): Growth tied to oil and gas infrastructure, construction mega-projects, and bulk material transport across difficult operating environments.

- Latin America: Market stability linked to economic recovery and commodity export volumes, driving steady demand for trailers used in mining and agriculture.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pneumatic Bulk Trailer Market.- Wabash National Corporation

- Heil Trailer International Co.

- Tremcar Inc.

- Tankstar USA (Bulk Transportation)

- MAC Trailer Manufacturing, Inc.

- Polar Tank Trailer, LLC

- J&L Tank Inc.

- Brenner Tank, LLC

- LBT Inc.

- Beall Tank Wash & Trailer Sales

- West-Mark

- Enduraplas

- Tiger Tanks (India)

- CIMC Vehicle Group Co., Ltd.

- MANAC Inc.

- Kässbohrer Transport Technik GmbH

- Spitzer Silo-Fahrzeugwerke GmbH

- Trouvay & Cauvin Group

- Crossroads Trailer

- Advance Engineered Products Group (AEPG)

Frequently Asked Questions

Analyze common user questions about the Pneumatic Bulk Trailer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift from steel to aluminum pneumatic bulk trailers?

The primary driver is the necessity for weight reduction (lightweighting) to maximize payload capacity, especially crucial in regions with strict highway weight limits. Aluminum offers significant weight savings compared to steel, resulting in lower operational costs per trip, improved fuel efficiency, and reduced wear and tear on truck components, leading to a superior total cost of ownership over the trailer's lifespan.

How do technological advancements like IoT and telematics impact the profitability of pneumatic fleet operations?

IoT and telematics integration significantly boost profitability by enabling real-time monitoring of key operational parameters, including tire pressure, braking system health, and internal tank pressure. This data facilitates highly accurate predictive maintenance, minimizes unexpected downtime, optimizes routing based on real-time conditions, and ensures full compliance with regulatory reporting requirements, translating directly into higher fleet utilization rates and lower emergency repair costs.

Which application segment currently holds the largest market share and why?

The Construction application segment, specifically the transport of cement, fly ash, and dry aggregates, holds the largest market share. This dominance is due to the massive, consistent demand generated by global urbanization and infrastructure projects, requiring high-capacity, robust pneumatic trailers designed for continuous high-volume material transfer, forming the backbone of industrial supply chains.

What are the primary operational challenges pneumatic bulk trailer operators face globally?

Key operational challenges include managing high initial capital expenditure for specialized equipment, mitigating the risk of material compaction or bridging during unloading (requiring specific technical skills), and navigating complex, varying regional weight and safety regulations. Additionally, high volatility in fuel prices and securing skilled technicians for specialized pneumatic system maintenance present ongoing economic hurdles for fleet managers.

How are environmental regulations influencing the design and adoption of new pneumatic trailers?

Environmental regulations demand that new trailer designs minimize dust emissions during loading and unloading, necessitating highly efficient sealing systems and filtration technologies. Furthermore, regulations focusing on vehicle emissions and fuel efficiency are accelerating the adoption of lightweight materials and aerodynamic designs, as lighter trailers contribute directly to lower fuel consumption and a reduced carbon footprint, aligning transport assets with global sustainability goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager